Global Food Sterilization Equipment Market By Process(Batch Sterilization, Continuous Sterilization), By Technology(Steam, Heat, Radiation, Chemical, Filtration, Others), By Application(Spices, Seasonings, and Herbs, Meat, Poultry & Seafood, Dairy Products, Fruits & Vegetables, Juices & Beverages, Grains, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 54241

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

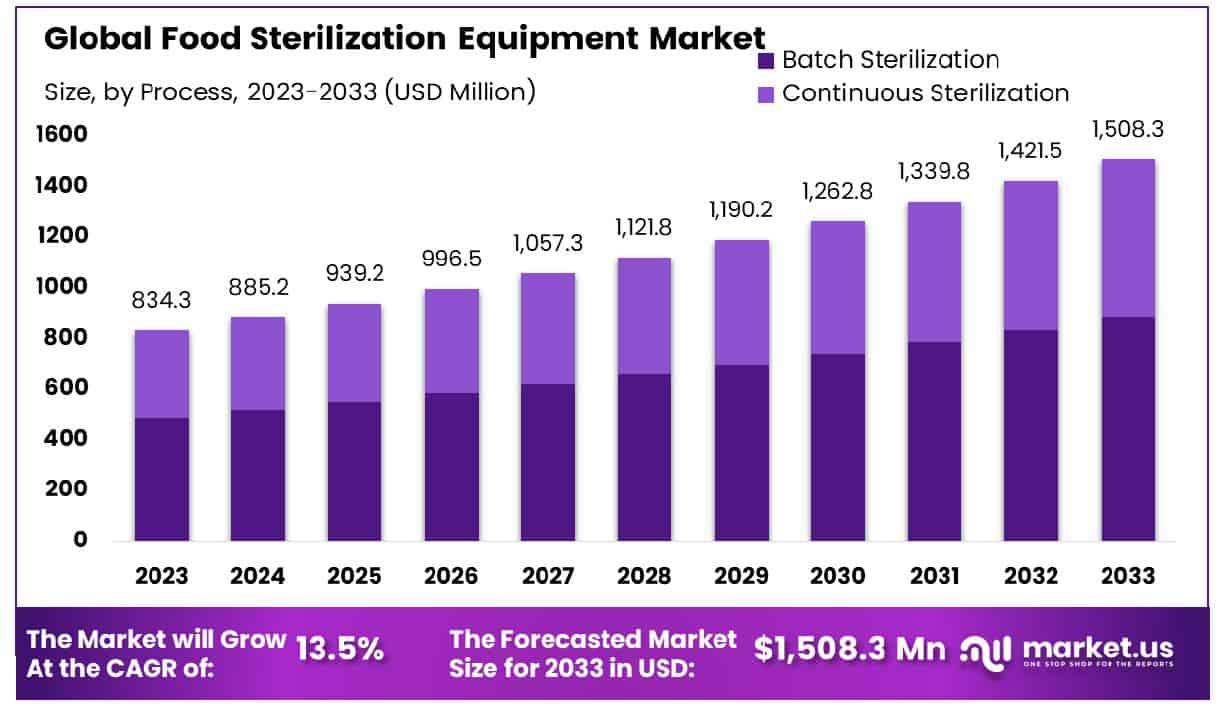

The Global Food Sterilization Equipment Market size is expected to be worth around USD 1,508.3 Million by 2033, From USD 834.3 Million by 2023, growing at a CAGR of 6.10% during the forecast period from 2024 to 2033.

The Food Sterilization Equipment Market encompasses advanced technological solutions designed to ensure food safety by effectively eliminating, reducing, or preventing the growth of pathogenic microorganisms and extending product shelf life. This market is integral to the food processing industry, catering to the stringent regulatory standards and consumer demand for high-quality, safe food products.

It includes diverse technologies such as heat, chemicals, radiation, and filtration. The strategic importance of sterilization equipment is recognized by industry leaders, including Product Managers, as it directly impacts product safety, brand reputation, and operational efficiency. Investments in this market are driven by the pursuit of innovation, efficiency, and compliance with global food safety regulations.

The market for food sterilization equipment is undergoing a significant transformation, influenced by an array of socio-economic factors and technological advancements. The escalating concern over food security, as highlighted by the increase in very low food security rates from 3.3% in 2001 to 5.1% in 2022, underscores an urgent need for robust food sterilization solutions.

This trend, marked by a statistically significant rise in food insecurity levels over the years, signals a growing demand for food safety measures that can mitigate risks and ensure the provision of safe, consumable products to the market. Furthermore, the World Bank’s proactive stance in committing $45 billion to combat food insecurity, thereby aiming to benefit 335 million people, reflects a global acknowledgment of the crisis and the pivotal role that food sterilization plays in this context.

In this environment, the food sterilization equipment market is poised for growth, driven by the imperative to address food safety concerns and regulatory compliance. Manufacturers and stakeholders are increasingly investing in innovative sterilization technologies that promise efficiency, reliability, and compliance with stringent food safety standards.

These technological advancements, coupled with a heightened awareness of foodborne illness risks, are propelling the market forward. As such, the deployment of food sterilization equipment becomes a critical component in the broader strategy to combat food insecurity, underscoring its significance in ensuring public health and safety.

Key Takeaways

- Market Growth: Global Food Sterilization Equipment Market size is expected to be worth around USD 1,508.3 Million by 2033, From USD 834.3 Million by 2023, growing at a CAGR of 6.10% during the forecast period from 2024 to 2033.

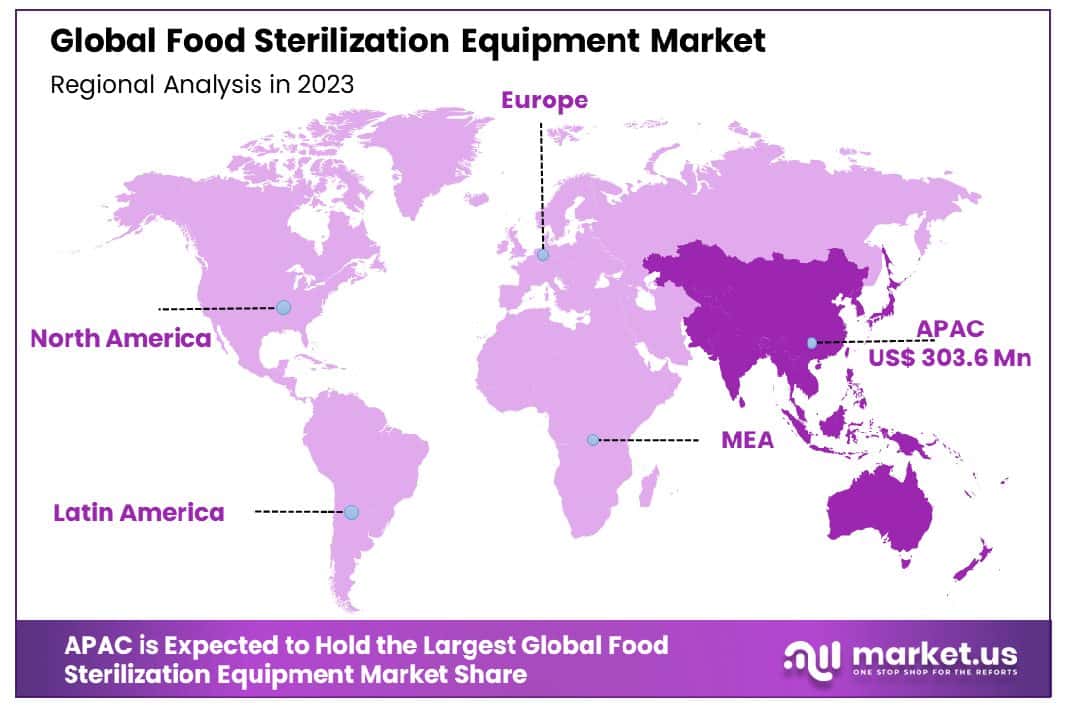

- Regional Dominance: Asia-Pacific dominates the food sterilization equipment market, capturing a substantial 36.4% share.

- segmentation Insights:

- By Process: Batch sterilization dominates the food sterilization equipment market, holding a substantial 58.6% market share.

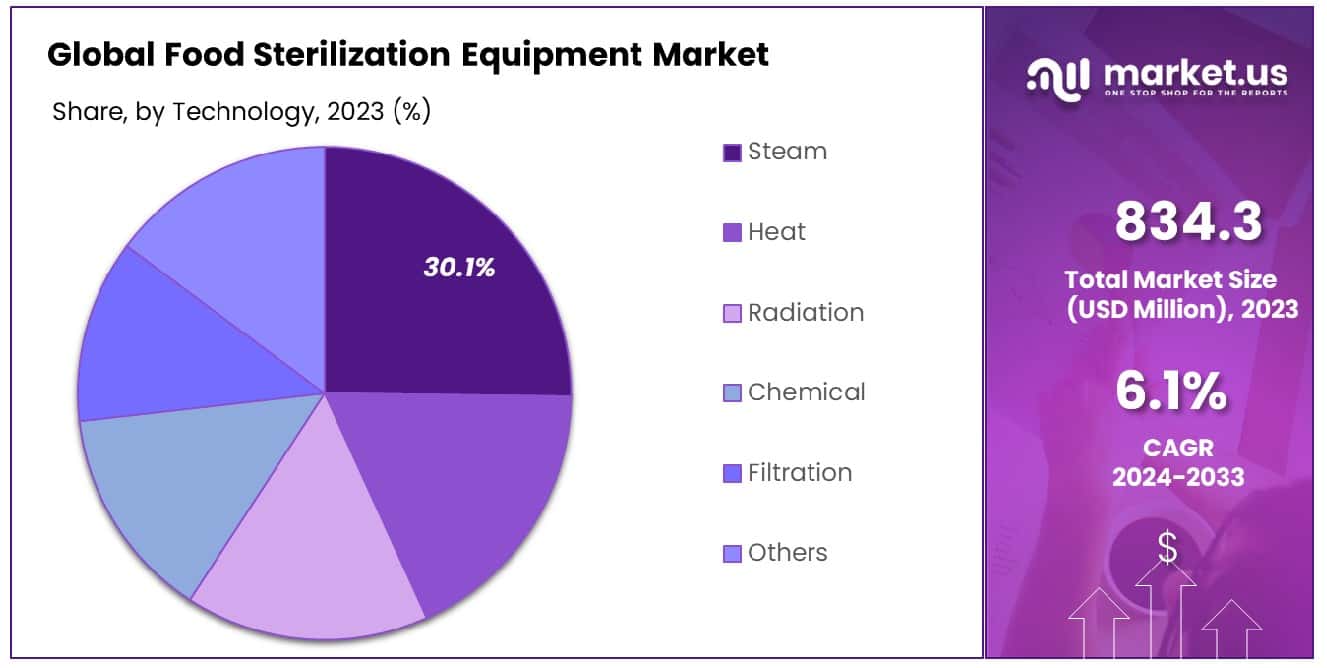

- By Technology: Steam technology leads in sterilization methods, accounting for 30.1% of the market share.

- By Application: Spices, seasonings, and herbs represent the largest application area, with a 25.2% market share.

- Growth Opportunities: The global food sterilization equipment market is expanding, driven by emerging market demands and technological innovations. Key growth opportunities include advanced sterilization methods catering to safety and sustainability, and integrating IoT for enhanced efficiency.

Driving Factors

Rising Global Concern Over Food Safety and Regulations

The increasing awareness of foodborne illnesses and the implementation of stringent food safety regulations worldwide are significant drivers for the food sterilization equipment market. Governments and regulatory bodies are enforcing strict food safety standards to prevent contamination and ensure the provision of safe food to consumers. This regulatory landscape compels food producers and processors to adopt effective sterilization solutions, thereby driving the demand for food sterilization equipment.

Technological Advancements in Sterilization Processes

The market is witnessing rapid technological evolution, with innovations aimed at enhancing efficiency, reducing processing times, and minimizing energy consumption. Advanced technologies such as ultraviolet (UV) radiation, pulsed electric fields (PEF), and high-pressure processing (HPP) are gaining traction. These technologies offer benefits such as lower energy costs, reduced processing times, and the ability to maintain the nutritional and sensory qualities of food products, thereby appealing to food manufacturers and boosting market growth.

Increasing Consumer Demand for Packaged and Processed Foods

The global rise in consumer demand for convenience foods, including packaged and processed products, has necessitated the adoption of effective sterilization methods to ensure food safety and extend shelf life. The shift towards ready-to-eat meals, coupled with the growing consumer awareness of food hygiene and safety, has bolstered the need for advanced food sterilization equipment across the food processing industry.

Restraining Factors

High Initial Investment Costs

The adoption of advanced food sterilization technologies often entails substantial initial capital investment, which can be a deterrent for small and medium-sized enterprises (SMEs). This financial barrier not only limits market entry but also restricts the ability of these entities to upgrade to more efficient, modern systems. The cost associated with procuring, installing, and maintaining sophisticated sterilization equipment can strain the operational budgets of smaller players, potentially impeding the broader adoption of these essential technologies.

Stringent Regulatory Standards

While regulatory frameworks are pivotal in ensuring food safety and public health, they can also serve as a restraint. The complexity and stringent nature of food safety regulations vary significantly across regions, making compliance a challenging and often resource-intensive endeavor. Manufacturers of food sterilization equipment must navigate these diverse and evolving regulations to develop solutions that are not only effective but also compliant. This regulatory landscape can slow down innovation, limit market access, and increase the time and cost associated with bringing new technologies to the market.

By Process Analysis

Batch sterilization leads, claiming 58.6% market share in food sterilization equipment.

In 2023, the Food Sterilization Equipment Market was prominently segmented by process into two main categories: Batch Sterilization and Continuous Sterilization. Batch Sterilization held a dominant market position within this segmentation, capturing more than a 58.6% share. This significant market share underscores the widespread adoption and reliance on Batch Sterilization techniques across various food processing industries.

Batch Sterilization’s dominance can be attributed to its flexibility and efficacy in managing diverse food products, allowing for the careful control of sterilization parameters to suit specific product requirements. This process is particularly suited for small to medium production volumes, where the precise control of temperature, pressure, and time is critical for ensuring product safety without compromising nutritional value or sensory qualities.

Continuous Sterilization, while offering advantages in terms of higher throughput and efficiency for large-scale production, faced limitations in adoption due to its requirement for uniform product characteristics and the higher initial capital investment. This has led to Continuous Sterilization capturing a smaller portion of the market in comparison to Batch Sterilization.

The growth of the Batch Sterilization segment is further fueled by technological advancements that enhance process control, energy efficiency, and safety, making it an increasingly attractive option for food processors aiming to meet stringent food safety standards. Moreover, the ongoing development of more sophisticated and versatile batch sterilization equipment is anticipated to support this segment’s sustained growth and prominence in the Food Sterilization Equipment Market.

By Technology Analysis

Steam technology is preferred, holding 30.1% of the food sterilization market share.

In 2023, the Food Sterilization Equipment Market was characterized by various technology segments, including Steam, Heat, Radiation, Chemical, Filtration, and Others. Among these, Steam held a dominant market position in the By Technology segment, capturing more than a 30.1% share. This prominence can be attributed to its widespread acceptance and efficacy in ensuring the microbial safety of food products, along with its environmental sustainability compared to alternative methods.

The Heat segment followed, leveraging its capacity for rapid, uniform heating and cooling processes to ensure food safety without compromising nutritional value or taste. Radiation, a method known for its ability to penetrate deep into products, thereby extending shelf life and maintaining food quality, secured a notable position as well. The Chemical segment, employing substances such as ozone and chlorine dioxide for food sterilization, offered solutions for specific applications where traditional methods might fall short.

Filtration, particularly valued in beverage production for its effectiveness in removing microorganisms without altering the chemical composition of the product, represented another key technology segment. The Others category, encompassing emerging technologies and bespoke solutions tailored to unique requirements of the food processing industry, also held a significant share.

The distribution of market shares across these segments reflects the diverse requirements of the food sterilization industry, driven by factors such as regulatory compliance, consumer demand for safety and quality, and advancements in food processing technologies. The continued evolution of these technologies is expected to further shape the dynamics of the Food Sterilization Equipment Market, offering enhanced solutions for food safety and preservation.

By Application Analysis

Spices, seasonings, and herbs are top applications, with a 25.2% market share.

In 2023, the Food Sterilization Equipment Market witnessed a significant delineation in its application segments, notably with Spices, Seasonings, and Herbs emerging as the preeminent category. Capturing more than a 30.1% share, this segment underscored its dominant market position, accentuating the growing demand for sterilized culinary ingredients which are crucial for ensuring food safety and extending shelf life. Following closely, Meat, Poultry & Seafood; Dairy Products; Fruits & Vegetables; Juices & Beverages; Grains; and Other segments delineated the market’s diverse application landscape.

The predominance of Spices Seasonings, and Herbs can be attributed to heightened consumer awareness regarding the health benefits of natural and organic seasonings coupled with escalating concerns over foodborne illnesses that can be mitigated through effective sterilization processes. This trend is further bolstered by the global culinary industry’s expanding palate, necessitating a vast array of sterilized spices and herbs to meet consumer demand for diverse and safe food experiences.

Meanwhile, the Meat, Poultry & Seafood segment, holding a significant market share, reflected the stringent regulatory standards necessitating advanced sterilization solutions to ensure pathogen-free products, thereby fostering consumer trust and industry compliance. Dairy Products, Fruits & Vegetables, and Juices & Beverages segments also illustrated considerable growth, driven by the increasing consumer preference for minimally processed and preservative-free foods. Grains and Other application segments showcased steady growth, underpinned by the escalating global food trade requiring robust sterilization to maintain food quality and safety standards across borders.

Key Market Segments

By Process

- Batch Sterilization

- Continuous Sterilization

By Technology

- Steam

- Heat

- Radiation

- Chemical

- Filtration

- Others

By Application

- Spices, Seasonings, and Herbs

- Meat, Poultry & Seafood

- Dairy Products

- Fruits & Vegetables

- Juices & Beverages

- Grains

- Others

Growth Opportunities

Expansion into Emerging Markets

The global food sterilization equipment market is poised for significant growth, particularly in emerging markets. Factors contributing to this expansion include rising food safety concerns, stringent government regulations regarding food processing and preservation, and the growing demand for non-thermal processing technologies. Emerging economies, with their rapidly expanding middle-class populations, are increasingly demanding processed and packaged foods that meet high safety standards.

This shift presents a substantial opportunity for manufacturers and suppliers of food sterilization equipment to penetrate these markets. Additionally, the adoption of advanced sterilization technologies, such as ultraviolet (UV) light, pulsed electric fields (PEF), and high-pressure processing (HPP), can cater to the evolving preferences for minimal processing with maximal nutrient retention. The market’s growth in these regions can be attributed to these factors, alongside investments in food processing infrastructure and technology transfer initiatives.

Technological Innovations in Sterilization Processes

Technological innovation represents another pivotal growth opportunity within the food sterilization equipment market. The increasing consumer inclination towards food products that are free from additives and preservatives yet have an extended shelf life is driving demand for innovative sterilization solutions. Technologies such as HPP, PEF, and UV light not only offer the advantage of preserving the food’s nutritional and sensory qualities but also significantly reduce the energy consumption and environmental impact associated with traditional sterilization methods.

These innovations are likely to foster a more sustainable approach to food sterilization, aligning with global sustainability goals and consumer expectations. Moreover, integrating these technologies with Internet of Things (IoT) capabilities for real-time monitoring and optimization of sterilization processes can enhance operational efficiency and compliance with regulatory standards. Consequently, companies that invest in R&D to innovate and improve the efficiency and effectiveness of sterilization technologies are well-positioned to capitalize on these growth opportunities.

Latest Trends

Surge in Demand for Organic and Clean-Label Foods

In 2023, the global food sterilization equipment market is witnessing a significant trend towards the consumption of organic and clean-label foods. This consumer-driven movement is compelling food manufacturers to adopt sterilization methods that align with the ethos of natural and minimally processed foods. Sterilization techniques that preserve the food’s integrity, nutritional value, and taste without the use of chemicals are increasingly favored. High-pressure processing (HPP), for example, has emerged as a preferred method for extending shelf life and ensuring safety without altering the food’s natural state.

This trend is not only reshaping consumer expectations but also the strategic focus of companies within the food processing industry. Manufacturers are now investing in equipment that can cater to the clean-label trend, thus driving innovation and differentiation in the market. The adaptation to these consumer preferences can be seen as a response to the growing awareness and demand for transparency in food production processes and ingredients.

Integration of IoT and Blockchain in Sterilization Processes

The integration of the Internet of Things (IoT) and blockchain technology into food sterilization processes marks a transformative trend in the industry. In 2023, these technologies are increasingly being leveraged to enhance transparency, traceability, and efficiency in the food supply chain. IoT devices enable real-time monitoring and control of sterilization conditions, ensuring optimal performance and compliance with food safety standards. Blockchain, on the other hand, offers an immutable ledger for recording and verifying every step of the food’s journey from farm to table, including sterilization data.

This integration not only improves operational efficiencies but also builds consumer trust by providing transparent and verifiable information on food safety practices. The adoption of these technologies is indicative of a broader shift towards digitalization and smart manufacturing in the food industry. As companies invest in these advanced technologies, the food sterilization equipment market is set to evolve, offering new capabilities and setting new standards in food safety and quality assurance. This trend underscores the industry’s commitment to adopting innovative solutions to meet the complex demands of modern food processing and distribution.

Regional Analysis

The Asia-Pacific region commands a significant 36.4% market share in the global food sterilization equipment sector.

The Food Sterilization Equipment Market demonstrates significant regional diversification across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America is characterized by its robust food safety standards and the presence of leading food processing companies, driving the demand for advanced sterilization solutions. Europe’s market is bolstered by stringent EU regulations on food hygiene and safety, fostering the adoption of state-of-the-art sterilization technologies.

The Asia Pacific region, accounting for the dominant share of 36.4%, showcases rapid growth due to increasing food safety awareness, expanding food processing sectors, and rising export demands, particularly from countries like China and India. This region’s growth is underpinned by its expanding middle-class population and urbanization, which escalate the need for processed and sterilized food products.

The Middle East & Africa region is witnessing a gradual uptake in food sterilization equipment, propelled by the growing focus on food safety and shelf-life extension amidst varying climatic conditions. Latin America’s market is emerging, driven by advancements in food processing techniques and regulatory efforts to meet global food safety standards.

Collectively, these regional markets contribute to a composite landscape of the global Food Sterilization Equipment Market, with Asia-Pacific leading the charge due to its significant market share, burgeoning food industry, and increasing emphasis on food safety protocols. This trend underscores the global shift towards ensuring food safety and quality, fostering technological advancements and investments in the food sterilization equipment sector.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Food Sterilization Equipment Market in 2023, several key players have emerged as pivotal contributors shaping industry dynamics. Among these, JBT Corporation stands out prominently, exemplifying a commitment to innovation and technological advancement. With a robust portfolio of sterilization solutions tailored to meet diverse industry demands, JBT Corporation has positioned itself as a frontrunner in the market.

Bühler Group, renowned for its cutting-edge processing technologies, continues to assert its influence in the Food Sterilization Equipment Market. Leveraging a blend of expertise and forward-thinking strategies, Bühler Group remains at the forefront of driving efficiency and quality in food sterilization processes.

Alfa Laval AB, a stalwart in the field of heat transfer, separation, and fluid handling, brings unparalleled expertise to the table. Their comprehensive range of sterilization equipment underscores a commitment to excellence, offering customers innovative solutions that prioritize food safety and integrity.

SPX FLOW, Inc. has established a formidable presence in the market, characterized by a relentless pursuit of excellence and customer satisfaction. With a focus on delivering state-of-the-art sterilization solutions, SPX FLOW, Inc. continues to play a pivotal role in shaping industry standards and best practices.

These key players, alongside other industry stalwarts such as Surdry S.L., Allpax Products, LLC, and De Lama S.p.A., collectively drive innovation, efficiency, and reliability in the global Food Sterilization Equipment Market. Their unwavering dedication to quality and customer-centric approaches ensures sustained growth and competitiveness in an increasingly dynamic marketplace.

Market Key Players

- JBT Corporation

- Bühler Group

- Alfa Laval AB

- SPX FLOW, Inc.

- Surdry S.L.

- Allpax Products, LLC

- De Lama S.p.A.

- Steriflow SAS

- Ventilex USA, Inc.

- Sun Sterifaab Pvt. Ltd.

- Steritech Group, Inc.

- Barriquand Technologies Thermiques

Recent Development

- In March 2024, Fermilab researchers are developing a prototype electron beam accelerator for medical device sterilization, aiming to replace ethylene oxide and cobalt-60 with safer and more efficient technology.

- In February 2024, ProMach acquires Zacmi, expanding its filling, seaming, and pasteurization technology for the pet food industry, strengthening its global position in process and filling solutions.

Report Scope

Report Features Description Market Value (2023) USD 834.3 Million Forecast Revenue (2033) USD 1,508.3 Million CAGR (2024-2033) 6.10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process(Batch Sterilization, Continuous Sterilization), By Technology(Steam, Heat, Radiation, Chemical, Filtration, Others), By Application(Spices, Seasonings, and Herbs, Meat, Poultry & Seafood, Dairy Products, Fruits & Vegetables, Juices & Beverages, Grains, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape JBT Corporation, Bühler Group, Alfa Laval AB, SPX FLOW, Inc., Surdry S.L., Allpax Products, LLC, De Lama S.p.A., Steriflow SAS, Ventilex USA, Inc., Sun Sterifaab Pvt. Ltd., Steritech Group, Inc., Barriquand Technologies Thermiques Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Food Sterilization Equipment Market in 2023?The Food Sterilization Equipment Market size is USD 834.3 Million in 2023.

What is the projected CAGR at which the Food Sterilization Equipment Market is expected to grow at?The Food Sterilization Equipment Market is expected to grow at a CAGR of 6.10% (2024-2033).

List the segments encompassed in this report on the Food Sterilization Equipment Market?Market.US has segmented the Food Sterilization Equipment Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Process(Batch Sterilization, Continuous Sterilization), By Technology(Steam, Heat, Radiation, Chemical, Filtration, Others), By Application(Spices, Seasonings, and Herbs, Meat, Poultry & Seafood, Dairy Products, Fruits & Vegetables, Juices & Beverages, Grains, Others)

List the key industry players of the Food Sterilization Equipment Market?JBT Corporation, Bühler Group, Alfa Laval AB, SPX FLOW, Inc., Surdry S.L., Allpax Products, LLC, De Lama S.p.A., Steriflow SAS, Ventilex USA, Inc., Sun Sterifaab Pvt. Ltd., Steritech Group, Inc., Barriquand Technologies Thermiques

Name the key areas of business for Food Sterilization Equipment Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Food Sterilization Equipment Market.

Food Sterilization Equipment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Food Sterilization Equipment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- JBT Corporation

- Bühler Group

- Alfa Laval AB

- SPX FLOW, Inc.

- Surdry S.L.

- Allpax Products, LLC

- De Lama S.p.A.

- Steriflow SAS

- Ventilex USA, Inc.

- Sun Sterifaab Pvt. Ltd.

- Steritech Group, Inc.

- Barriquand Technologies Thermiques