Global Food Processing Blades Market Size, Share, And Business Benefits By Product (Straight, Curved, Circular), By Material (Stainless Steel, High-carbon Steel, Carbide, Ceramic, Plastic, Others), By Application (Slicing, Grinding, Dicing, Skinning, Peeling, Cutting/Portioning, Others), By End-use (Proteins, Fruits, Vegetables, Nuts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155362

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

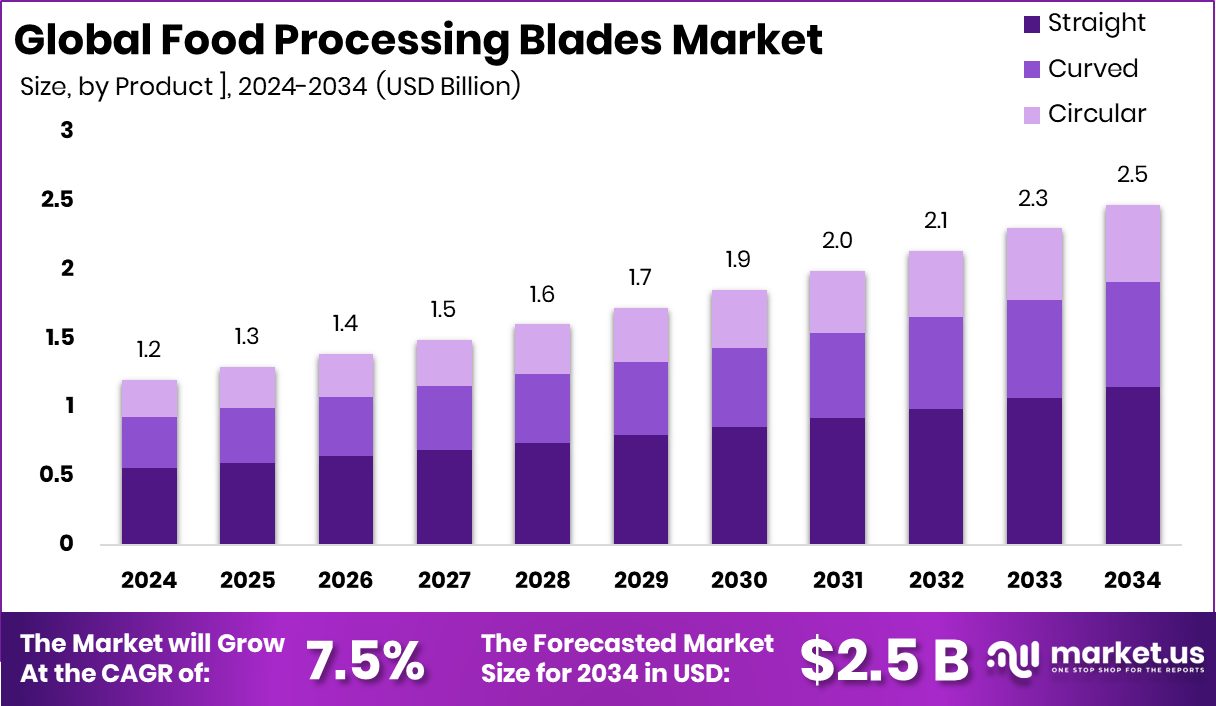

The Global Food Processing Blades Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034. Rising automation in food plants drives Asia Pacific USD 0.5 Bn blade sales.

Food processing blades are specialized cutting tools designed for slicing, dicing, chopping, and shaping various food products during manufacturing. They are made from high-grade stainless steel or other food-safe materials to ensure hygiene, durability, and precision. These blades are widely used in meat processing, bakery production, vegetable and fruit cutting, and cheese manufacturing, where sharpness and resistance to corrosion are crucial for consistent product quality and safety. SLICE launches $54 nipper designed for precision cutting in pro and hobby use.

The food processing blades market refers to the global trade, production, and use of these blades across different food manufacturing sectors. It encompasses the demand from industrial-scale facilities, mid-sized processors, and specialized kitchens, covering both standard and custom blade designs. Growth is driven by the rising focus on automation, efficiency, and consistent food quality, alongside stricter hygiene and safety standards in the food industry. Silo obtains $32M funding to aid financial management in food supply chains.

Increasing automation in food production is a key driver, as modern processing lines require high-performance blades to maintain speed and precision. AM 4 AM secures €1.3M to expand metal powder manufacturing capacity. Additionally, the push for standardized food sizes and shapes in retail packaging is creating more demand for specialized cutting tools.

The demand for food processing blades is rising with the growth of ready-to-eat meals, frozen foods, and packaged fresh produce. Consumers’ preference for visually appealing, uniform food products is pushing processors to invest in sharper, longer-lasting blades. Ohio’s proposed budget trims $120 million from the H2Ohio initiative.

Key Takeaways

- The Global Food Processing Blades Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.2 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034.

- Straight blades hold 46.3% of the Food Processing Blades Market, valued for precision and versatile cutting.

- Stainless steel accounts for 39.1% of the Food Processing Blades Market, driven by durability and hygiene requirements.

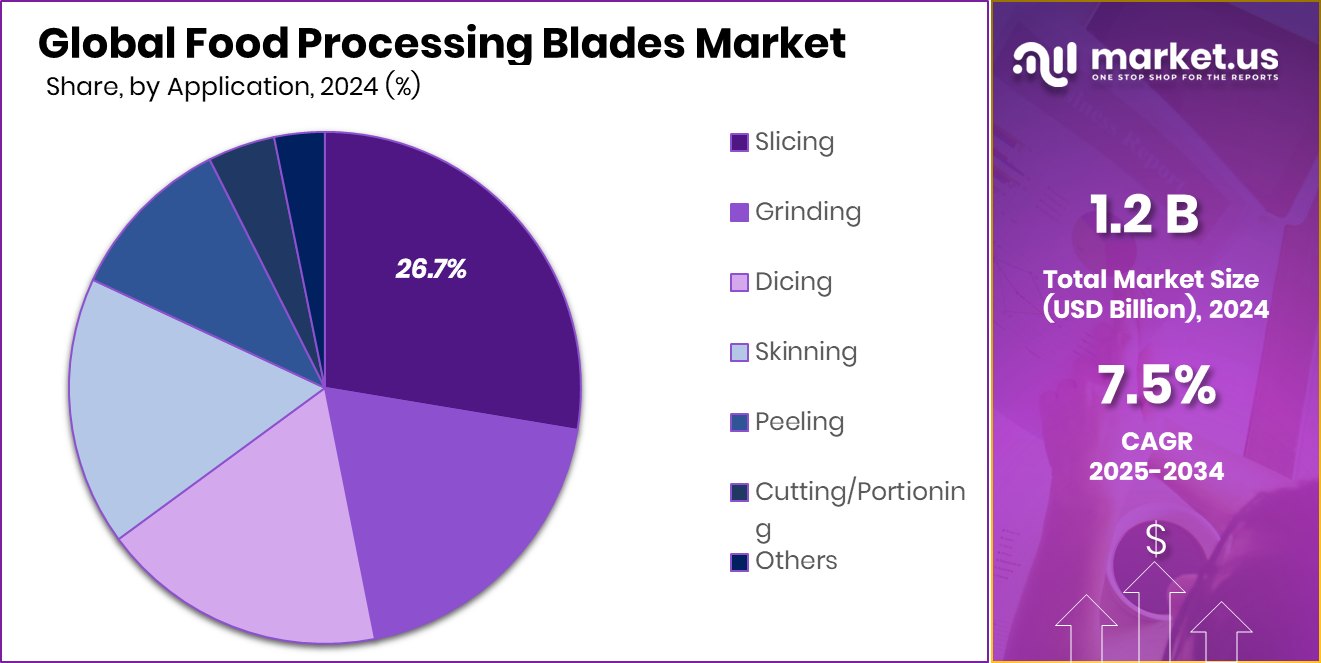

- Slicing applications capture 26.7% of the Food Processing Blades Market, supported by rising packaged food production demand.

- Protein processing dominates 56.9% of the Food Processing Blades Market, reflecting growing global consumption of meat and seafood products.

- Strong demand for packaged food boosts the Asia Pacific’s 42.80% market growth.

By Product Analysis

Straight blades hold a 46.3% share in the Food Processing Blades Market.

In 2024, Straight held a dominant market position in the By Product segment of the Food Processing Blades Market, with a 46.3% share. This leadership reflects the widespread adoption of straight blades across various food processing applications, particularly in slicing, chopping, and portioning, where precision and uniformity are critical.

Their simple yet efficient design allows for smooth, consistent cuts, making them ideal for high-speed production lines handling meat, vegetables, bakery items, and processed cheese. The popularity of straight blades is also driven by their ease of sharpening and maintenance, which helps processors reduce downtime and operational costs.

The strong market share is further supported by the rising demand for packaged and ready-to-cook foods, which require consistent sizing for both visual appeal and cooking efficiency. In industrial facilities, straight blades are often preferred for their adaptability to different machinery and food types, ensuring versatility in production.

Additionally, the use of high-quality stainless steel and advanced manufacturing processes has enhanced blade durability, improving performance in continuous operations. With global food production increasingly moving toward automation and standardization, the demand for straight blades is expected to remain strong, reinforcing their position as the preferred choice in precision food cutting solutions.

By Material Analysis

Stainless steel leads with a 39.1% share in the Food Processing Blades Market.

In 2024, Stainless Steel held a dominant market position in the By Product segment of the Food Processing Blades Market, with a 39.1% share. This strong presence is attributed to stainless steel’s superior combination of durability, corrosion resistance, and food safety compliance, making it the preferred material for a wide range of cutting applications in the food industry.

Its ability to maintain sharpness over prolonged use ensures consistent cutting quality, which is vital for high-volume production lines. Stainless steel blades are widely used in processing meat, seafood, fruits, vegetables, bakery products, and dairy items, where hygiene standards are stringent and exposure to moisture and acids is common.

The material’s ease of cleaning and resistance to bacterial growth further strengthen its adoption, as processors prioritize compliance with global food safety regulations. Technological advancements in steel treatment and blade manufacturing have enhanced hardness and edge retention, reducing replacement frequency and lowering operational costs.

Moreover, stainless steel’s versatility allows it to be adapted for both manual tools and automated machinery. With the growing demand for precision cutting in packaged and processed foods, coupled with the need for reliable, long-lasting equipment, stainless steel remains the material of choice for manufacturers aiming for efficiency and quality in food processing operations.

By Application Analysis

Slicing applications capture a 26.7% share in the Food Processing Blades Market.

In 2024, Slicing held a dominant market position in the By Application segment of the Food Processing Blades Market, with a 49.2% share. This leading position is driven by the extensive use of slicing blades in processing meat, poultry, seafood, bakery products, fruits, and vegetables, where precision thickness and uniformity are critical for product quality and presentation.

Slicing blades play a central role in both industrial-scale facilities and mid-sized processing units, enabling high-speed operations without compromising cut consistency. Their efficiency in producing evenly sliced products also supports portion control, reducing waste and improving yield—key priorities for food manufacturers aiming to optimize costs.

The dominance of slicing applications is further fueled by the rising consumption of ready-to-eat meals, pre-packaged deli items, and frozen foods, all of which require standardized slicing for consumer convenience and retail appeal. Technological improvements in blade design, such as sharper edges and wear-resistant coatings, have enhanced durability, reducing maintenance intervals and increasing productivity.

Additionally, the growing adoption of automated slicing equipment in food processing plants has amplified the demand for high-performance slicing blades. With increasing emphasis on visual appeal, precision, and operational efficiency, slicing continues to be the most influential application area in the food processing blades market.

By End-use Analysis

Protein processing dominates with a 56.9% share in the Food Processing Blades Market.

In 2024, Proteins held a dominant market position in the by-end-use segment of the Food Processing Blades Market, with a 56.9% share. This strong lead is primarily due to the extensive use of processing blades in the meat, poultry, and seafood industries, where precision cutting, portioning, and deboning are essential for maintaining product quality and meeting strict hygiene standards.

Protein processing requires blades capable of delivering clean, consistent cuts to preserve texture, minimize product loss, and enhance presentation, especially for retail-ready packaging. The increasing global demand for processed protein products, driven by rising urbanization, busy lifestyles, and the growth of foodservice sectors, has significantly contributed to this segment’s dominance.

High-performance blades in protein processing are designed to withstand continuous operation in demanding environments, resisting wear from contact with bones and dense muscle tissue. The use of advanced stainless steel and specialized coatings improves edge retention and corrosion resistance, reducing downtime for maintenance.

Additionally, the surge in frozen and ready-to-cook protein products has increased the need for blades that can handle both fresh and frozen cuts with precision. With automation expanding in meat and seafood processing plants worldwide, the demand for reliable, high-efficiency blades in protein applications is expected to remain strong and steadily grow.

Key Market Segments

By Product

- Straight

- Curved

- Circular

By Material

- Stainless Steel

- High-carbon Steel

- Carbide

- Ceramic

- Plastic

- Others

By Application

- Slicing

- Grinding

- Dicing

- Skinning

- Peeling

- Cutting/Portioning

- Others

By End-use

- Proteins

- Fruits

- Vegetables

- Nuts

- Others

Driving Factors

Rising Automation in Food Processing Boosts Blade Demand

The biggest driving factor for the Food Processing Blades Market is the growing use of automation in food manufacturing. Modern processing plants are shifting from manual cutting to high-speed automated machines to meet the rising demand for packaged, ready-to-eat, and processed foods. These automated systems require sharp, durable, and precise blades to maintain consistent quality and reduce waste.

As production volumes increase, companies are investing in advanced blades made from high-grade materials like stainless steel, which can handle continuous operation without frequent replacements. This not only improves efficiency but also cuts downtime. With the global food industry focusing on speed, accuracy, and hygiene, automation is directly fueling the demand for high-performance food processing blades.

Restraining Factors

High Maintenance and Replacement Costs Limit Adoption

One key restraining factor for the Food Processing Blades Market is the high cost of maintenance and frequent replacements. Food processing blades operate under heavy workloads, cutting through dense materials like meat, frozen products, and fibrous vegetables, which causes wear and dulling over time. To maintain hygiene and cutting precision, these blades must be regularly sharpened or replaced, leading to ongoing expenses for manufacturers.

In addition, downtime during blade maintenance can slow production, impacting efficiency and profitability. Smaller processing facilities, in particular, may find it challenging to invest in high-quality blades and bear the recurring costs. This financial burden can slow adoption, especially in regions with lower profit margins in the food processing sector.

Growth Opportunity

Advanced Blade Materials Creating New Market Potential

A major growth opportunity in the Food Processing Blades Market lies in developing advanced blade materials and coatings that improve durability, sharpness, and hygiene. Innovations such as titanium-coated edges, ceramic-infused steel, and specialized non-stick coatings can significantly extend a blade’s lifespan while maintaining cutting precision. These technologies reduce the frequency of sharpening and replacements, lowering operational downtime and costs for food processors.

Additionally, advanced materials can better resist corrosion and bacterial buildup, meeting stricter food safety regulations. As automation in food processing grows, the demand for high-performance, low-maintenance blades will increase. Manufacturers investing in innovative blade designs and premium materials can tap into this rising need, gaining a competitive edge in both developed and emerging markets.

Latest Trends

Integration of Smart Technology in Blade Manufacturing

A key trend in the Food Processing Blades Market is the integration of smart technology into blade design and manufacturing. Producers are adopting advanced manufacturing techniques like precision laser cutting, CNC machining, and automated grinding to create blades with consistent sharpness and accuracy. Some manufacturers are also exploring embedded sensors that can monitor blade wear and performance in real time, helping processors plan maintenance before issues arise.

This smart approach not only improves cutting quality but also extends blade life and reduces unexpected downtime. With the food industry increasingly focusing on efficiency, safety, and automation, the use of technology-driven manufacturing processes is becoming a standard, setting new benchmarks for quality and reliability in food processing blades.

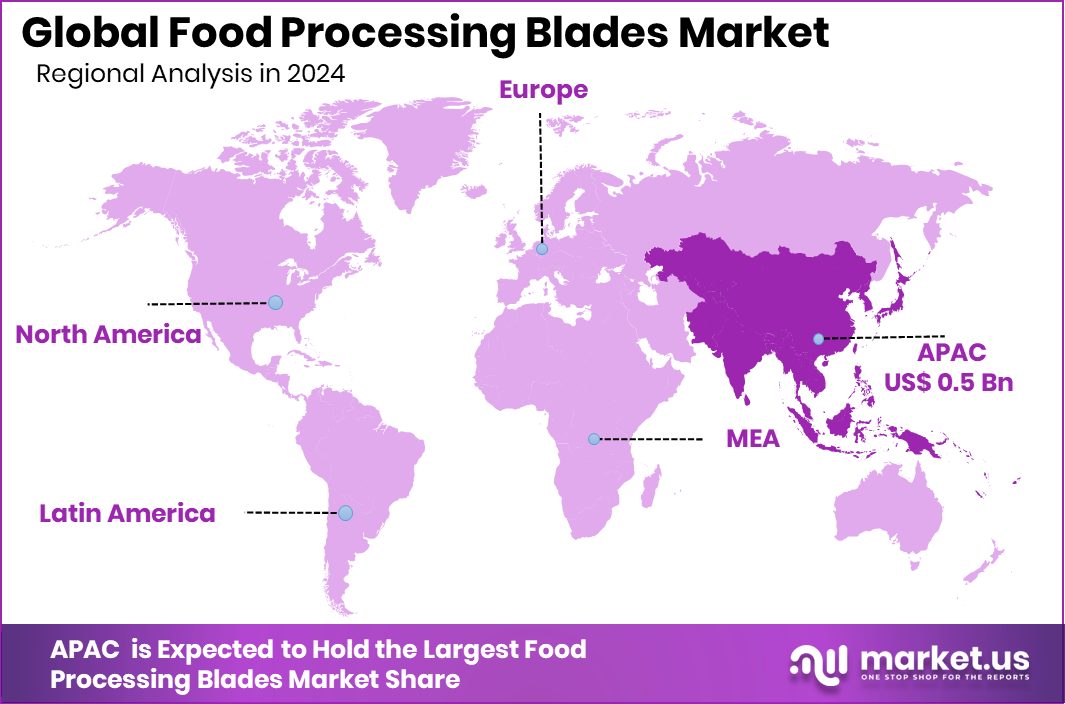

Regional Analysis

Asia Pacific holds a 42.80% share, valued at USD 0.5 Bn.

In 2024, Asia Pacific emerged as the leading region in the Food Processing Blades Market, capturing a dominant 42.80% share, valued at USD 0.5 billion. This strong position is driven by the region’s rapidly expanding food processing industry, supported by rising urbanization, growing populations, and increasing consumption of packaged and ready-to-eat products.

Countries such as China, India, Japan, and Australia are witnessing significant investments in food manufacturing infrastructure, with automation playing a central role in improving efficiency and meeting strict hygiene standards. The surge in demand for processed meat, seafood, bakery, and fresh produce has boosted the adoption of high-performance blades capable of delivering precision and durability. Government initiatives to strengthen food safety compliance have further encouraged manufacturers to upgrade cutting equipment, favoring stainless steel and advanced coated blades.

North America and Europe maintain steady demand, driven by well-established processing industries and technological advancements, while Latin America and the Middle East & Africa are gradually expanding their market presence through investments in modern food production facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Simonds International continues to leverage its long-standing expertise in industrial cutting tools, offering high-performance blades that cater to large-scale food production while emphasizing durability and operational efficiency.

Urschel Laboratories, Inc., recognized for its specialized cutting equipment, maintains its market strength by integrating advanced blade designs into its processing machines, ensuring uniform slicing, dicing, and shredding for high-volume operations.

Dexter Russell, with its deep roots in professional-grade cutlery, holds a strong position in supplying stainless steel blades known for their sharpness, hygiene, and ergonomic handling, making them a preferred choice in both industrial and commercial kitchens.

M.K. Morse LLC brings its metallurgical expertise into the food sector, producing robust blades with enhanced wear resistance, well-suited for demanding applications like protein processing and frozen food cutting.

Fortifi Food Processing Solutions is strategically expanding its footprint by offering integrated processing systems where blades are engineered for precision, longevity, and compatibility with automated production lines.

Top Key Players in the Market

- Simonds International

- Urschel Laboratories, Inc.

- Dexter Russell

- M.K. Morse LLC

- Fortifi Food Processing Solutions

- Grote Company

- Wilbur Curtis

- Jarvis India

- Hallde

- Talsabell S.A.

Recent Developments

- In November 2024, Urschel showcased cutting-edge equipment at the Interpom trade show in Kortrijk, Belgium. Among the featured innovations were the Comitrol Processor Model 3640A, featuring variable frequency drives for improved speed control; the E TranSlicer Cutter with a conveyor discharge for seamless tote loading; the DiversaCut 2110A Dicer for precision and high capacity; the TranSlicer 2520 Cutter with a user-friendly Human‑Machine Interface; and the versatile CC‑DL Shredder.

- In October 2024, Morse introduced a spring-loaded pin-drive arbor for hole saws. This new design lets professionals switch hole saws in seconds—no more aligning pins or worrying about the saw getting stuck. It brings both accuracy and ease to drilling tasks.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Straight, Curved, Circular), By Material (Stainless Steel, High-carbon Steel, Carbide, Ceramic, Plastic, Others), By Application (Slicing, Grinding, Dicing, Skinning, Peeling, Cutting/Portioning, Others), By End-use (Proteins, Fruits, Vegetables, Nuts, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Simonds International, Urschel Laboratories, Inc., Dexter Russell, M.K. Morse LLC, Fortifi Food Processing Solutions, Grote Company, Wilbur Curtis, Jarvis India, Hallde, Talsabell S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Processing Blades MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Food Processing Blades MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Simonds International

- Urschel Laboratories, Inc.

- Dexter Russell

- M.K. Morse LLC

- Fortifi Food Processing Solutions

- Grote Company

- Wilbur Curtis

- Jarvis India

- Hallde

- Talsabell S.A.