Global Flywheel Energy Storage Systems Market Size, Share, And Business Benefits By Rims Type (Carbon Fiber, Composites, Solid Steel), By Component (Flywheel Rotor, Motor-Generator, Magnetic Bearings, Others), By Application (UPS, Distributed Energy Generation, Transport, Data Centres, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154729

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

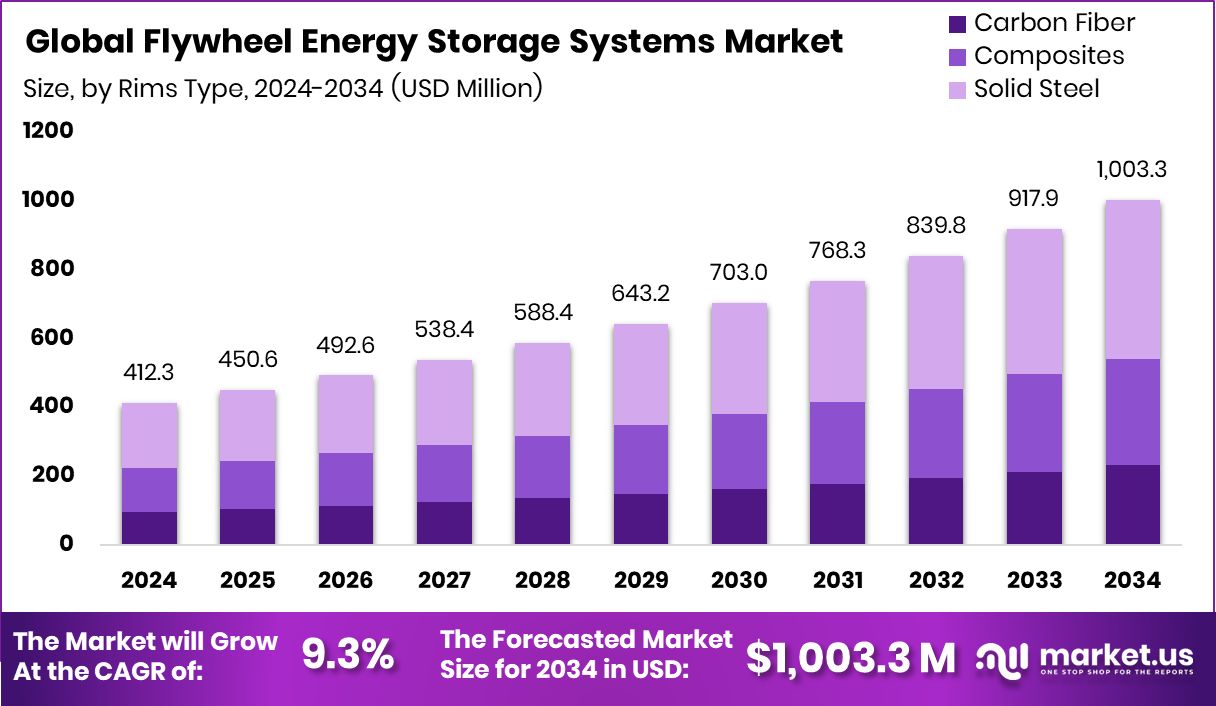

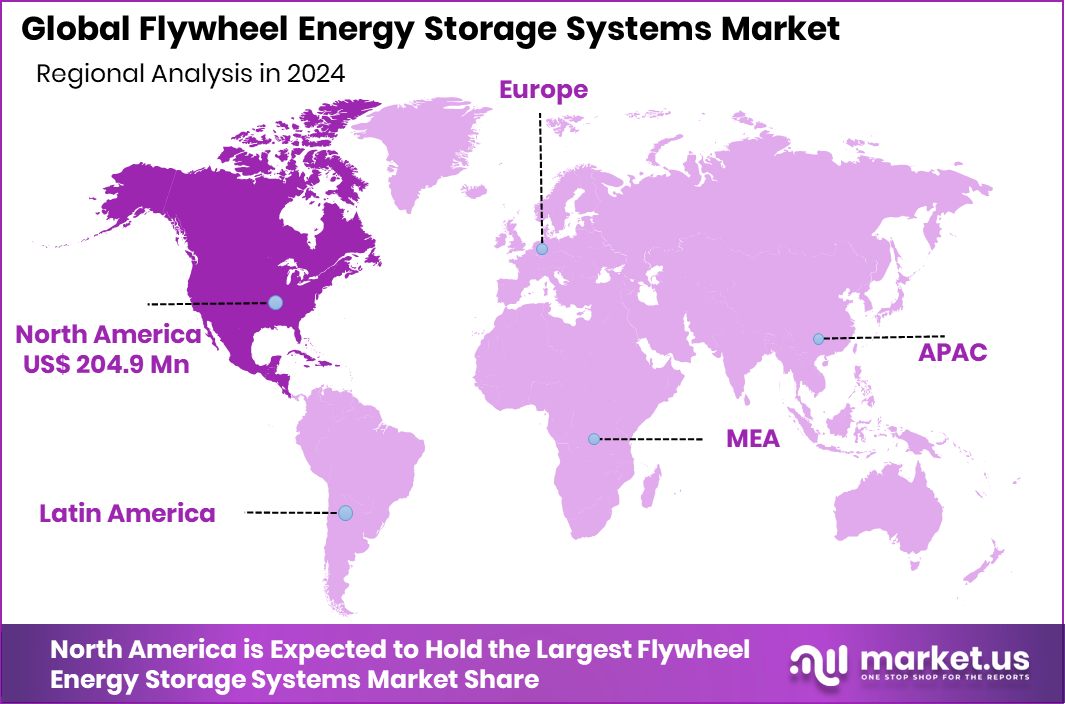

The Global Flywheel Energy Storage Systems Market is expected to be worth around USD 1,003.3 million by 2034, up from USD 412.3 million in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034. North America’s USD 204.9 Mn strong grid modernization investments supported the wide adoption of flywheel energy storage systems.

Flywheel Energy Storage Systems (FESS) are mechanical devices that store energy in the form of kinetic energy using a rotating mass. When electricity is supplied, the flywheel spins at very high speeds, storing energy that can later be converted back to electrical power when needed. These systems offer fast response times, high cycle life, and low maintenance, making them ideal for short-duration energy storage applications such as grid frequency regulation, UPS systems, and renewable energy balancing.

The growth of the flywheel energy storage systems market is being driven by the global shift toward cleaner and more reliable energy solutions. As renewable energy sources like solar and wind continue to expand, the need for rapid-response storage technologies has increased. Flywheel systems are well-suited to address this demand due to their ability to instantly deliver or absorb power, helping stabilize electrical grids during fluctuations.

Demand for FESS is also rising in sectors where power quality and reliability are critical, such as data centers, hospitals, and industrial plants. These sectors require backup power solutions that activate instantly without delay. The high-speed operation and instant energy discharge of flywheels offer a dependable solution, especially in areas with frequent grid disturbances or unstable power supply. According to an industry report, Chakratec secured $4.4 million in funding to support its flywheel storage technology for DC fast charging applications.

Opportunities are emerging with the integration of flywheel systems in hybrid energy storage setups and smart grid infrastructure. Governments and utilities are exploring modular, scalable energy storage technologies to support decentralization and improve grid resilience.

Key Takeaways

- The Global Flywheel Energy Storage Systems Market is expected to be worth around USD 1,003.3 million by 2034, up from USD 412.3 million in 2024, and is projected to grow at a CAGR of 9.3% from 2025 to 2034.

- In the Flywheel Energy Storage Systems Market, solid steel rims held a dominant 46.7% share.

- Flywheel rotors accounted for 49.2%, making them the leading component in system construction.

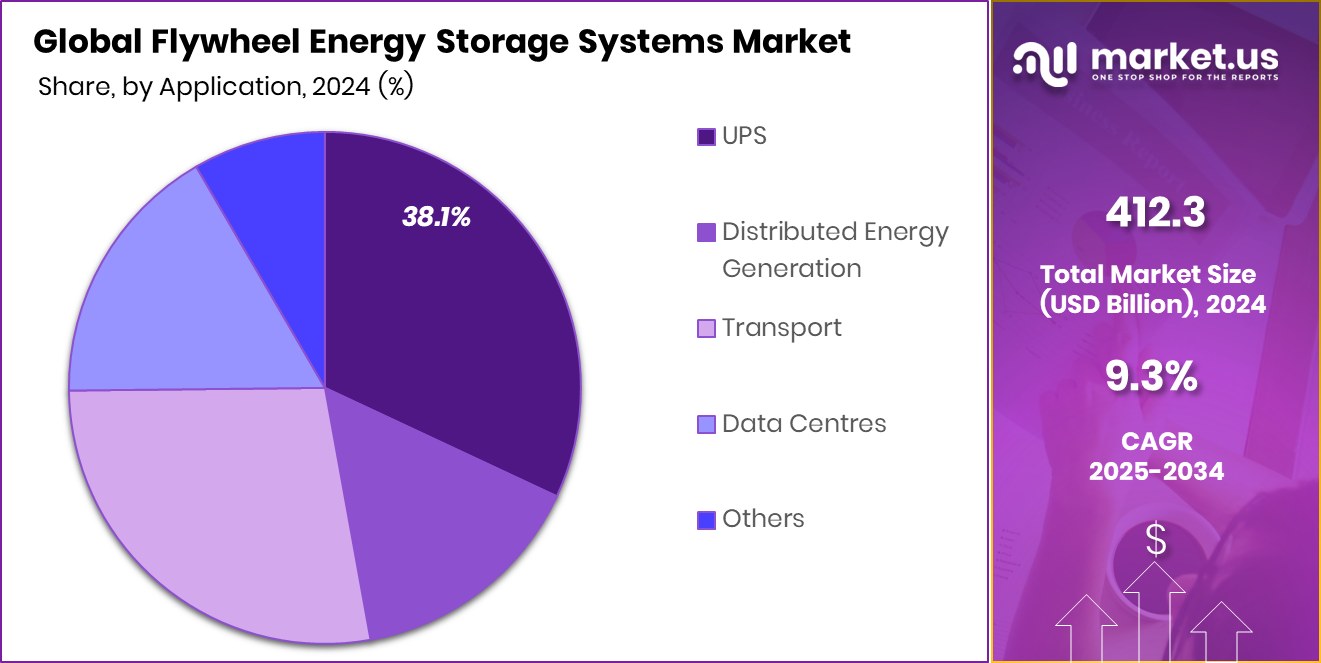

- UPS applications led demand, capturing a strong 38.1% share in the global market usage.

- The North American demand was driven by power backup needs across 49.70% share, critical infrastructure sectors.

By Rims Type Analysis

Solid steel rims dominate the Flywheel Energy Storage Systems Market at 46.7%.

In 2024, Solid Steel held a dominant market position in the By Rims Type segment of the Flywheel Energy Storage Systems Market, with a 46.7% share. This dominance can be attributed to the material’s high strength, durability, and cost-effectiveness in high-speed rotational applications. Solid steel rims are widely preferred in industrial and grid-scale flywheel systems due to their ability to withstand mechanical stress and deliver consistent performance over extended cycles.

The strong adoption of solid steel rims is also driven by their compatibility with conventional manufacturing processes and ease of maintenance, offering a practical solution for utility-scale deployments. Moreover, their lower susceptibility to wear and environmental degradation supports long-term operation, reducing replacement and servicing costs for operators. This makes them an economically viable option for regions seeking stable, short-duration energy storage.

In addition, the structural simplicity of solid steel contributes to higher energy storage efficiency and safer operation, which are essential in applications such as frequency regulation and backup power. As energy infrastructure continues to modernize with a focus on stability and resilience, the solid steel segment is expected to maintain its leadership in rim-type preferences across key end-use sectors.

By Component Analysis

The flywheel rotor holds a 49.2% share in component-wise market segmentation.

In 2024, Flywheel Rotor held a dominant market position in the By Component segment of the Flywheel Energy Storage Systems Market, with a 49.2% share. This leading position reflects the rotor’s central role in energy storage and discharge operations within the system. The flywheel rotor is the core component responsible for storing kinetic energy, and its performance directly influences the system’s overall efficiency, speed, and reliability.

The market preference for advanced rotors is also supported by the need for components that can sustain high mechanical stress and rotational velocities without compromising safety or lifespan. Flywheel rotors designed using robust materials and precision engineering ensure high energy density, making them essential for both utility and industrial-scale storage systems. The ability to provide rapid charge and discharge cycles with minimal energy loss further enhances their value in dynamic energy environments.

As energy grids and industrial facilities increasingly prioritize resilience and fast-response storage technologies, investment in flywheel rotor development and deployment has remained strong. The 49.2% market share in 2024 underscores the rotor’s pivotal importance and its continued leadership within the component landscape of this growing market.

By Application Analysis

UPS applications lead the Flywheel Energy Storage Systems Market with 38.1%.

In 2024, UPS held a dominant market position in the By Application segment of the Flywheel Energy Storage Systems Market, with a 38.1% share. This leading share reflects the growing reliance on flywheel-based Uninterruptible Power Supply (UPS) systems across sectors requiring instant backup power and power quality assurance. Flywheel energy storage systems offer a rapid response time, long operational life, and minimal maintenance compared to traditional battery-based UPS systems, making them a preferred choice in critical infrastructure environments.

Industries such as data centers, healthcare facilities, and manufacturing plants prioritize continuous power availability, where even a brief interruption can lead to substantial operational and financial losses. The flywheel UPS systems, due to their mechanical nature, eliminate many of the limitations associated with chemical-based storage, such as degradation and limited cycling capability. This has encouraged greater adoption in facilities seeking high reliability and efficient short-term backup solutions.

The 38.1% market share captured by the UPS application segment in 2024 also signifies the increasing trend of integrating fast-response storage with sensitive electrical systems to mitigate grid fluctuations. As the demand for uninterrupted operations and high power quality continues to rise, the UPS segment is expected to remain a key driver of flywheel energy storage deployment.

Key Market Segments

By Rims Type

- Carbon Fiber

- Composites

- Solid Steel

By Component

- Flywheel Rotor

- Motor-Generator

- Magnetic Bearings

- Others

By Application

- UPS

- Distributed Energy Generation

- Transport

- Data Centres

- Others

Driving Factors

Growing Demand for Fast and Reliable Power Backup

One of the key driving factors for the Flywheel Energy Storage Systems Market is the increasing demand for fast and reliable power backup. Industries such as data centers, hospitals, and manufacturing plants cannot afford power interruptions, even for a few seconds. Flywheel systems provide an instant power supply when the main power source fails, ensuring smooth and uninterrupted operations.

Unlike traditional batteries, flywheels react quickly and have a much longer life cycle. This makes them ideal for use in environments that require frequent and short bursts of backup power. As businesses continue to modernize their operations and rely more on automation and digital infrastructure, the demand for high-speed energy backup solutions like flywheel systems is growing rapidly.

Restraining Factors

High Initial Cost of System Installation

A major restraining factor for the Flywheel Energy Storage Systems Market is the high initial cost of installation. Although flywheel systems offer long-term benefits like low maintenance and longer lifespan, the upfront investment required for advanced materials, precision engineering, and safety components can be very expensive. This becomes a major concern for small businesses and facilities with limited budgets.

The cost of designing and manufacturing high-speed rotors, control systems, and protective housing also adds to the overall system price. As a result, many potential users hesitate to adopt this technology, especially when compared to lower-cost alternatives like chemical batteries. This cost barrier slows down market growth, especially in cost-sensitive regions and emerging markets.

Growth Opportunity

Integration with Smart Grids and Microgrids Worldwide

A key growth opportunity for the Flywheel Energy Storage Systems Market lies in its integration with smart grids and microgrids across the globe. As power systems modernize, there is a rising need for fast-response energy storage to balance supply and demand in real time. Flywheel systems are highly suitable for this because they can quickly release or absorb power, helping maintain grid stability.

In microgrids—especially in remote or off-grid areas—flywheels offer a clean, efficient way to support renewable energy sources like solar and wind. Their long service life and low maintenance make them ideal for such distributed energy setups. As governments and utilities invest in smarter, decentralized power systems, the demand for flywheel technology is expected to rise significantly.

Latest Trends

Use of Advanced Composite Materials in Rotors

One of the latest trends in the Flywheel Energy Storage Systems Market is the growing use of advanced composite materials in the construction of flywheel rotors. Traditionally, rotors were made using solid steel, but now many manufacturers are shifting to carbon fiber and other lightweight composites. These materials allow the flywheel to spin at much higher speeds without increasing the weight, which helps store more energy efficiently.

They also reduce wear and improve safety by handling mechanical stress better. Although these composites are more expensive, they offer better performance and longer life. This trend reflects the industry’s focus on improving energy density, reducing system size, and enhancing overall efficiency in energy storage applications across multiple sectors.

Regional Analysis

In 2024, North America led the market with a 49.70% share, reaching USD 204.9 Mn.

In 2024, North America emerged as the dominant region in the Flywheel Energy Storage Systems Market, capturing a substantial 49.70% market share, which translated to a value of approximately USD 204.9 million. The region’s leadership position is driven by strong demand for uninterrupted power supply solutions across data centers, healthcare, and industrial sectors. North America’s mature energy infrastructure, coupled with ongoing investments in grid stability and clean energy integration, continues to support the widespread adoption of flywheel technology.

Europe followed as a significant contributor, supported by energy transition initiatives and the need for grid-balancing solutions in renewable-heavy networks. Asia Pacific is witnessing gradual growth due to urbanization and emerging power infrastructure in countries focused on improving energy reliability.

Meanwhile, Latin America and the Middle East & Africa regions show moderate uptake, primarily influenced by industrial development and early-stage adoption of modern energy storage solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bc New Energy (Tianjin) Co., Ltd. (BNE) has made significant strides in large-scale grid deployment, exemplified by its involvement in China’s first 30 MW grid-level flywheel energy storage facility, which was commissioned in 2024. This milestone underscores BNE’s capability in supporting utility-scale energy requirements and contributes to the expansion of flywheel technology in rapidly growing power markets.

Beacon Power, LLC, remains a proven player in utility-scale frequency regulation services, operating two 20 MW facilities in New York and Pennsylvania. These installations mobilize hundreds of flywheels to inject or absorb power instantaneously, stabilizing grid frequency. The company’s operational history includes millions of active runtime hours, highlighting the reliability and grid-level relevance of its modular flywheel systems.

Energiestro continues advancing flywheel solutions, placing emphasis on technology applications across distributed energy and industrial segments. Though specific figures are not disclosed, the company is recognized among the core group of innovators driving industry-wide deployment and expanding product portfolios.

Top Key Players in the Market

- Amber Kinetics, Inc.

- Bc New Energy (Tianjin) Co., Ltd. (BNE)

- Beacon Power, LLC

- Energiestro

- Kinetic Traction Systems, Inc.

- Langley Holdings plc

- Dumarey Group

- Stornetic GmbH

- VYCON, Inc.

Recent Developments

- In October 2024, Amber Kinetics introduced a new containerized flywheel energy storage system designed for above-ground deployment. The system was unveiled at the Miramar Airshow in San Diego and is slated for testing in the Rapid Integration and Commercialization Unit (RICU) at Marine Corps Air Station Miramar in the first half of 2025. It will later be installed at the Viejas project site. This containerized design enables easier site deployment and modular scalability for diverse energy applications.

- In September 2024, BNE served as the technology provider for China’s first large-scale grid‑connected flywheel storage plant in Shanxi Province’s Changzhi City. The Dinglun facility delivers 30 MW of capacity using 120 high‑speed magnetic levitation flywheel units, grouped into arrays and connected to the 110 kV grid. This milestone marks a significant step in deploying utility-grade flywheel applications for frequency regulation and grid stability.

Report Scope

Report Features Description Market Value (2024) USD 412.3 Million Forecast Revenue (2034) USD 1,003.3 Million CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rims Type (Carbon Fiber, Composites, Solid Steel), By Component (Flywheel Rotor, Motor-Generator, Magnetic Bearings, Others), By Application (UPS, Distributed Energy Generation, Transport, Data Centres, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amber Kinetics, Inc., Bc New Energy (Tianjin) Co., Ltd. (BNE), Beacon Power, LLC, Energiestro, Kinetic Traction Systems, Inc., Langley Holdings plc, Dumarey Group, Stornetic GmbH, VYCON, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flywheel Energy Storage Systems MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Flywheel Energy Storage Systems MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amber Kinetics, Inc.

- Bc New Energy (Tianjin) Co., Ltd. (BNE)

- Beacon Power, LLC

- Energiestro

- Kinetic Traction Systems, Inc.

- Langley Holdings plc

- Dumarey Group

- Stornetic GmbH

- VYCON, Inc.