Global Flue Gas Desulfurization (FGD) System Market Size, Share, And Industry Analysis Report By Type (Wet FGD Systems, Limestone, Seawater, Dry and Semi-dry FGD Systems), By Process (Wet Limestone Based, Dry Sorbent Injection, Sea Water Based), By Installation (Brownfield, Greenfield), By End-use (Power Generation, Chemical, Iron and Steel, Cement Manufacturing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175631

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

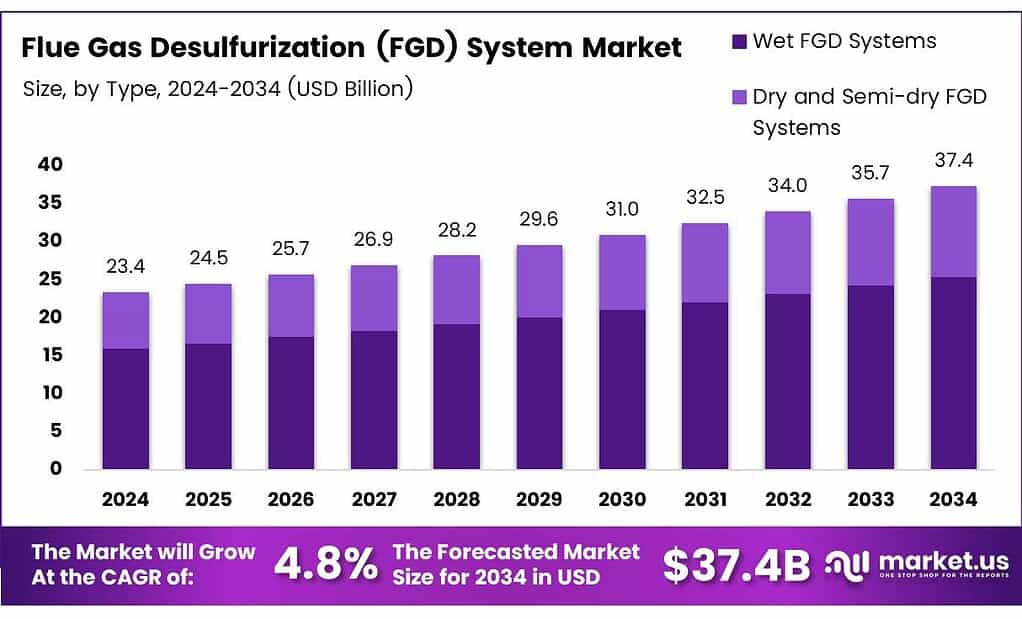

The Global Flue Gas Desulfurization (FGD) System Market size is expected to be worth around USD 37.4 billion by 2034, from USD 23.4 billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The Flue Gas Desulfurization (FGD) System Market represents a critical segment of global air pollution control, driven by rising emission standards and the continued reliance on coal-based power generation across emerging economies. The market focuses on systems designed to remove sulfur dioxide from industrial exhaust streams, ensuring compliance with tightening environmental regulations worldwide.

The industry is advancing as governments invest in sustainable infrastructure and stricter air-quality enforcement. Power utilities, cement producers, chemical manufacturers, and metal processors increasingly adopt wet and dry FGD systems to maintain operational continuity. This shift provides steady growth prospects, especially across Asia-Pacific and North America, where regulatory frameworks are becoming more stringent.

- FGD plants deliver strong performance that strengthens their market relevance. Modern FGD units operate at capacities up to 1,050 MW, manage inlet SO₂ concentrations as high as 80,000 mg/Nm³, and achieve 99% SO₂ removal efficiency, confirming their reliability and compliance value. The limestone-gypsum wet scrubbing process removes nearly 95% of SO₂ and captures almost all HCl, while converting calcium carbonate into usable gypsum, reinforcing operational efficiency and environmental performance.

The FGD System itself plays a central role in reducing harmful emissions by integrating scrubbing, reagent-based absorption, and by-product recovery. Wet limestone–gypsum systems remain the preferred technology due to proven efficiency, operational stability, and reduced lifecycle cost. These systems also offer added benefits, including co-pollutant removal and commercial-grade gypsum generation for construction and agricultural applications.

Moreover, market opportunities are widening as industries modernize aging Air Quality Control Systems (AQCS). Demand for high-capacity FGD installations is rising across developing economies, supported by government initiatives to curb SO₂ pollution. Investment trends further reveal a preference for flexible retrofitting solutions that allow large coal-fired plants to achieve compliance without major structural redesign.

Key Takeaways

- The Global Flue Gas Desulfurization (FGD) System Market is projected to reach USD 37.4 billion by 2034, growing from USD 23.4 billion in 2024, at a CAGR of 4.8% during 2025 to 2034.

- Wet FGD Systems dominate the market by type with a 71.2% share.

- By process, Wet Limestone-Based systems lead with 56.7% share in 2025.

- Brownfield installations hold the largest installation share at 62.3%.

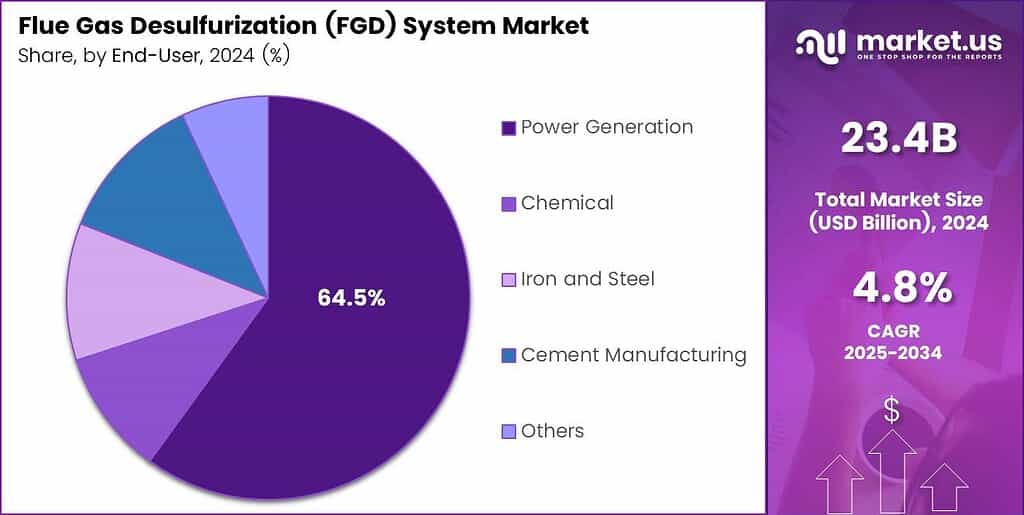

- In end-use, Power Generation remains dominant with a 64.5% share.

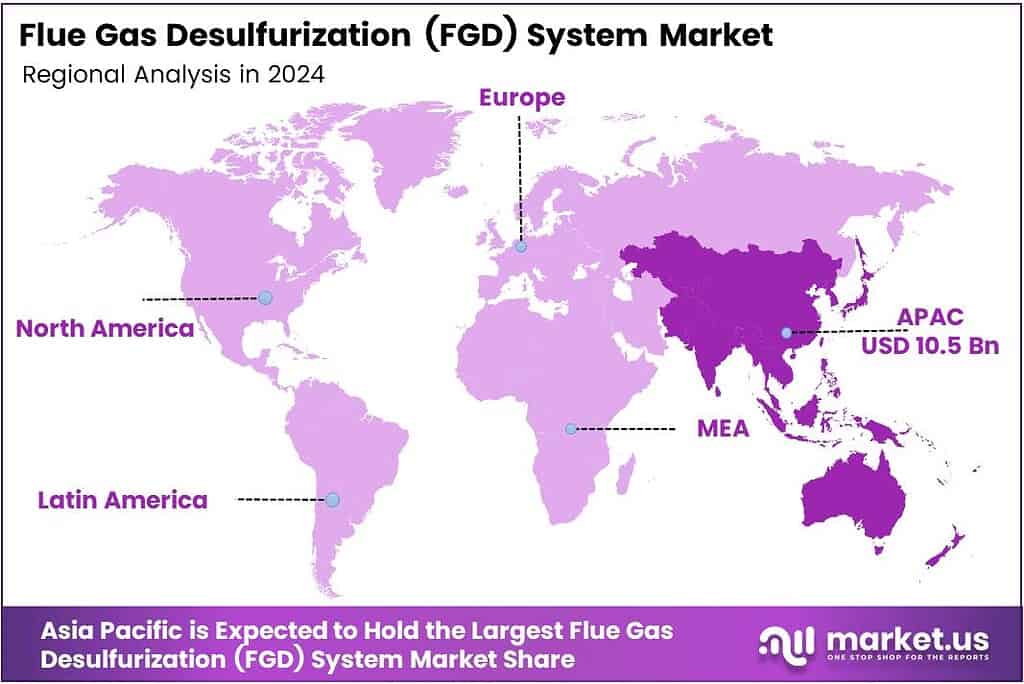

- Asia Pacific leads regional demand with 45.1% market share, valued at USD 10.5 billion.

By Type Analysis

Wet FGD Systems dominate the segment with 71.2% due to their high removal efficiency and wide adoption.

In 2025, Wet FGD Systems held a dominant market position in the By Type Analysis segment of the Flue Gas Desulfurization (FGD) System Market, with a 71.2% share. Their ability to achieve high sulfur dioxide (SO₂) removal rates continues to attract large power plants and industrial operators. These systems support strict environmental regulations, making them the preferred option for regions with tough emission norms.

Dry and Semi-dry FGD Systems form the second key sub-segment in this category, offering flexibility for medium-sized installations. These systems appeal to industries seeking lower water consumption and simpler installation processes. Their cost-effective operation makes them suitable for plants with moderate sulfur content in fuel.

Though they do not match the high removal efficiency of wet systems, their adaptability keeps them relevant across emerging markets. They are increasingly adopted in regions prioritizing reduced water usage, especially areas facing resource constraints. Furthermore, their compact design allows faster deployment, supporting industrial expansion needs.

By Process Analysis

Wet limestone-based systems dominate the segment with 56.7% owing to their reliability and economic operation.

In 2025, Wet Limestone-Based systems held a dominant market position in the By Process Analysis segment of the Flue Gas Desulfurization (FGD) System Market, with a 56.7% share. Their effectiveness in removing SO₂ at comparatively low operational costs positions them as a standard choice for large coal-fired plants. The easy availability of limestone further reduces lifecycle expenses, supporting broad adoption across developed and developing regions.

Dry Sorbent Injection systems continue to serve industries requiring flexible and rapid SO₂ reduction. Their advantage lies in lower upfront costs and simpler retrofitting, enabling quick compliance with emission norms. These systems are suitable for smaller or older installations aiming to achieve moderate SO₂ removal without extensive structural changes.

Sea water-based systems represent another important sub-segment, leveraging natural alkalinity in coastal regions. Their chemical-free operation supports sustainable environmental practices, attracting industries near marine locations. These systems offer lower reagent costs and environmentally compatible discharge, making them ideal for power plants adjacent to coastlines.

By Installation Analysis

Brownfield installations dominate with 62.3%, driven by retrofit demand across aging industrial facilities.

In 2025, Brownfield installations held a dominant market position in the By Installation Analysis segment of the Flue Gas Desulfurization (FGD) System Market, with a 62.3% share. The rise in retrofitting projects across aging thermal power plants significantly fuels this dominance. Many existing facilities face tightening emission norms, prompting operators to integrate FGD systems for compliance.

Brownfield installations allow plants to continue operations while upgrading environmental performance. Additionally, cost savings achieved through partial reuse of infrastructure further boost adoption. Their relevance grows as governments prioritize emission control in older industrial clusters.

Greenfield installations form the second sub-segment, driven by new power projects and industrial expansion. These systems allow companies to incorporate the latest FGD technologies from the beginning, ensuring efficiency and regulatory alignment. Greenfield projects typically offer higher design flexibility, enabling optimized equipment layout and performance. Demand increases in regions investing in new coal or industrial capacity.

By End Use Analysis

Power Generation dominates with 64.5% due to strict emission norms and continual upgrades across thermal plants.

In 2025, Power Generation held a dominant market position in the By End Use Analysis segment of the Flue Gas Desulfurization (FGD) System Market, with a 64.5% share. Thermal power plants require large-scale SO₂ reduction systems to meet tightening global emission standards. Their high energy output demands robust FGD technologies, leading to consistent installations and retrofits.

The Chemical sector also relies on FGD systems to manage emissions from various production processes. Many chemical plants generate sulfur-rich exhaust, requiring efficient desulfurization solutions. Adoption increases as companies aim to modernize facilities and enhance environmental performance through reliable emission control systems.

The Iron and Steel industry represents another essential sub-segment, with smelting and processing units producing significant SO₂ emissions. FGD systems support these facilities in maintaining regulatory compliance. Their use helps protect worker safety and surrounding communities while improving sustainability credentials.

The Cement Manufacturing sector uses FGD systems to manage emissions produced during clinker production. Operators adopt these systems to align with industrial emission limits and reduce environmental impact. Growing demand for cleaner construction materials also encourages manufacturers to improve pollution control infrastructure.

Key Market Segments

By Type

- Wet FGD Systems

- Limestone

- Seawater

- Others

- Dry and Semi-dry FGD Systems

By Process

- Wet Limestone-Based

- Dry Sorbent Injection

- Sea Water Based

By Installation

- Brownfield

- Greenfield

By End-use

- Power Generation

- Chemical

- Iron and Steel

- Cement Manufacturing

- Others

Emerging Trends

Rising Preference for Advanced and Energy-Efficient FGD Technologies Shapes Market Trends

A major trend shaping the FGD market is the shift toward more efficient and lower-energy systems. Industries are preferring technologies that reduce water use, waste generation, and chemical consumption. Semi-dry sorbent injection systems and newer wet scrubber designs are gaining traction due to their improved performance.

- Digital monitoring and automation are also becoming common. Plants are adopting real-time emission tracking, automated pH control, and predictive maintenance solutions. EPA documents commonly describe DSI ranges where plants see roughly 50–70% SO₂ control, depending on configuration and sorbent use.

The integration of FGD systems with broader environmental equipment, such as NOx control and particulate removal systems. This integrated approach helps industries meet multiple emission norms using a single optimized system. Sustainability trends are also influencing purchasing decisions.

Drivers

Stringent Environmental Regulations Boost the Demand for FGD Systems

Stricter global air-quality laws are one of the strongest forces driving the adoption of FGD systems. Governments across major economies are pushing industries to cut sulfur dioxide (SO₂) emissions, especially from coal-based power plants, metallurgical units, and chemical facilities.

- Industries are also adopting FGD systems to maintain sustainability goals. Many large power utilities are upgrading old plants with wet or dry scrubbers to meet regulatory deadlines. India’s largest power producer, NTPC, was described as having spent about $4 billion fitting roughly 11% of plants with FGD, while advancing work for another 50%.

The rising awareness about health effects linked to SO₂ emissions. Countries are prioritizing public-health protection by enforcing emission caps and continuous monitoring systems. This indirectly supports a steady demand for efficient FGD units. As compliance becomes mandatory, companies invest in reliable FGD technologies to avoid penalties and ensure smooth operations.

Restraints

High Installation and Operating Costs Limit Wider FGD Adoption

One of the biggest barriers for the FGD market is the high upfront cost required to set up scrubbing units. Power plants and industrial facilities often face financial challenges when installing large-scale systems, especially in older plants where structural modifications are needed. This makes smaller companies delay adoption despite regulatory pressure.

- Operating costs also act as a restraint. Wet FGD systems require continuous water supply, grinding units, chemical inputs, and regular maintenance. It also described 11% of plants near populated cities moving to a case-by-case approach, while only the remaining 10%, those closest to major cities, must install FGD.

The disposal of by-products such as sludge or gypsum. Although gypsum can be reused in construction, not all regions have strong recycling networks. This increases handling and storage costs, discouraging industries from opting for FGD units. In some countries, weak enforcement of pollution norms further slows adoption. Industries may postpone compliance if penalties are low or regulations are inconsistently implemented.

Growth Factors

Growing Transition Toward Cleaner Industrial Operations Creates New FGD Opportunities

The move toward cleaner industrial processes is opening strong growth avenues for the FGD market. Many developing countries are expanding power generation capacity, and new plants are increasingly designed with advanced emission-control systems. This creates a consistent demand pipeline for wet and semi-dry FGD technologies.

Retrofitting older plants provides another major opportunity. As governments tighten emission limits, existing coal-based power stations must upgrade their setups. This generates significant market potential for engineering services, revamping projects, and turnkey FGD solutions.

The increasing global use of flue-gas-derived gypsum in cement and construction materials is also encouraging industries to adopt FGD systems. When by-products can be monetized, the economic justification for adopting desulfurization technologies becomes stronger.

Regional Analysis

Asia Pacific Dominates the Flue Gas Desulfurization (FGD) System Market with a Market Share of 45.1%, Valued at USD 10.5 Billion

Asia Pacific leads the global FGD system market, holding a substantial 45.1% share and reaching a valuation of USD 10.5 billion, driven by rapid industrial growth and expanding coal-based power generation. Strong environmental regulations in countries like China and India further support the adoption of FGD technologies. Government-led emission control mandates continue to push utilities and industries toward upgrading their flue gas treatment infrastructure.

North America maintains a strong presence in the FGD market, supported by stringent air quality standards and active investment in emission-reduction systems. The U.S. Clean Air Act continues to drive modernization of flue gas treatment installations across older coal-fired plants. The region also benefits from early technology adoption and a steady shift toward retrofitting environmentally compliant systems.

Europe demonstrates consistent market demand, driven by strict EU emission directives and accelerated decarbonization policies. Countries across Western and Central Europe continue to invest in FGD technologies to meet sulfur dioxide (SO₂) reduction targets. The transition toward greener energy sources has also created a parallel need for upgrading existing thermal plants until full renewable integration is achieved.

The Middle East and Africa show steady growth supported by expanding industrial sectors and rising adoption of emission control technologies. Oil- and gas-dependent economies are increasingly integrating FGD systems into refining and petrochemical facilities to align with global environmental standards. Infrastructure development and modernization of thermal power assets further contribute to market expansion across key nations in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Babcock and Wilcox Enterprises Inc. continues to be viewed as a practical retrofit partner in 2025, especially where aging coal and industrial boilers still need SO₂ compliance without full plant redesign. Its value proposition stays strongest in end-to-end delivery—engineering, equipment, and long-term service helping operators reduce downtime risk and control lifecycle costs.

Mitsubishi Heavy Industries, Ltd. remains a benchmark supplier for large-scale wet limestone FGD projects, particularly for high-capacity power units that demand high removal efficiency and reliable operation at scale. In 2025, its edge is tied to deep process know-how, proven reference designs, and strong execution capability for complex EPC-style deliveries.

Andritz AG is increasingly positioned as an integration and optimization player, combining process equipment, automation, and plant services to improve FGD performance under tighter operating budgets. Customers typically look to Andritz for modernization packages and upgrades that stabilize absorber operation, improve reagent utilization, and support data-driven maintenance.

Thermax Limited is seen as a strong contender in cost-sensitive and mixed-fuel industrial markets in 2025, where compliance deadlines meet space and capex limits. Its advantage often lies in localized manufacturing, faster project turnaround, and the ability to bundle FGD with boilers, energy efficiency, and broader air pollution control solutions for a single-vendor approach.

Top Key Players in the Market

- Babcock and Wilcox Enterprises Inc.

- Mitsubishi Heavy Industries, Ltd.

- Andritz AG

- Thermax Limited

- Doosan Lentjes GmbH

- Ducon Technologies Inc.

- Marsulex Environmental Technologies

- Rafako S.A.

Recent Developments

- In 2025, Babcock & Wilcox will focus on enhancing FGD technologies for integration with carbon capture and high-efficiency emissions control. They emphasized upgrades to existing wet FGD systems to improve SO2 removal, reduce power consumption, and enable the use of lower-cost reagents while maintaining high system reliability.

- In 2025, Mitsubishi Heavy Industries continues to advance FGD systems for air pollution prevention, with a strong emphasis on high SO2 removal efficiency and integration with other emissions controls. They detailed their wet limestone, gypsum, and seawater FGD processes.

Report Scope

Report Features Description Market Value (2024) USD 23.4 Billion Forecast Revenue (2034) USD 37.4 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Wet FGD Systems, Limestone, Seawater, Others, Dry and Semi-dry FGD Systems), By Process (Wet Limestone Based, Dry Sorbent Injection, Sea Water Based), By Installation (Brownfield, Greenfield), By End-use (Power Generation, Chemical, Iron and Steel, Cement Manufacturing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Babcock and Wilcox Enterprises Inc., Mitsubishi Heavy Industries, Ltd., Andritz AG, Thermax Limited, Doosan Lentjes GmbH, Ducon Technologies Inc., Marsulex Environmental Technologies, Rafako S.A. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Flue Gas Desulfurization (FGD) System MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Flue Gas Desulfurization (FGD) System MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Babcock and Wilcox Enterprises Inc.

- Mitsubishi Heavy Industries, Ltd.

- Andritz AG

- Thermax Limited

- Doosan Lentjes GmbH

- Ducon Technologies Inc.

- Marsulex Environmental Technologies

- Rafako S.A.