Global Flow Meter Market By Product(Differential Pressure (DP), Positive Displacement (PD), Magnetic, Ultrasonic, Turbine, Others), By Type(Electric, Solar, Battery Powered), By Application, Water & Wastewater, Oil and Gas, Chemicals, Power Generation, Pulp and Paper, Food and Beverages, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119709

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

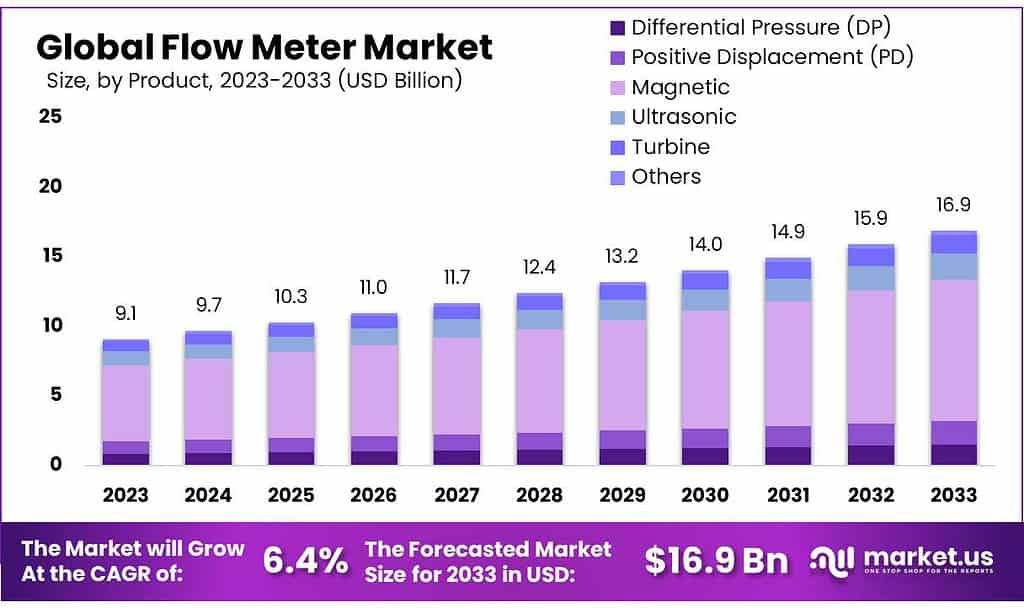

The global Flow Meter Market size is expected to be worth around USD 16.9 billion by 2033, from USD 9.1 billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The flow meter market encompasses the global industry focused on the production, distribution, and innovation of devices used to measure the flow rate of liquids, gases, or slurries through pipes and channels.

Flow meters are essential tools across various industries, including water and wastewater management, oil and gas, chemical processing, pharmaceuticals, and food and beverage production, where precise measurement of flow is critical for operational efficiency, safety, and compliance with regulatory standards.

The market is driven by advancements in technology and increasing demand for accurate and reliable flow measurement solutions. Innovations in flow meter technologies, such as ultrasonic, magnetic, and Coriolis flow meters, have enhanced measurement accuracy, reliability, and versatility. These technologies cater to the diverse needs of industries by offering solutions that can handle a wide range of flow rates, temperatures, and fluid characteristics.

Key growth factors for the flow meter market include the rising need for efficient water and wastewater management systems, driven by global water scarcity and stringent environmental regulations. In the oil and gas industry, the demand for accurate flow measurement is crucial for optimizing production processes, reducing wastage, and ensuring safety. Similarly, the chemical and pharmaceutical industries rely on precise flow measurements to maintain product quality and comply with stringent manufacturing standards.

Key Takeaways

- Market Growth: Global Flow Meter Market to reach USD 16.9 billion by 2033, growing at 6.4% CAGR from 2023 to 2033.

- Product Dominance: Magnetic flow meters hold over 60.1% market share in 2023.

- Power Preferences: Battery-powered flow meters dominate with over 45.2% market share in 2023.

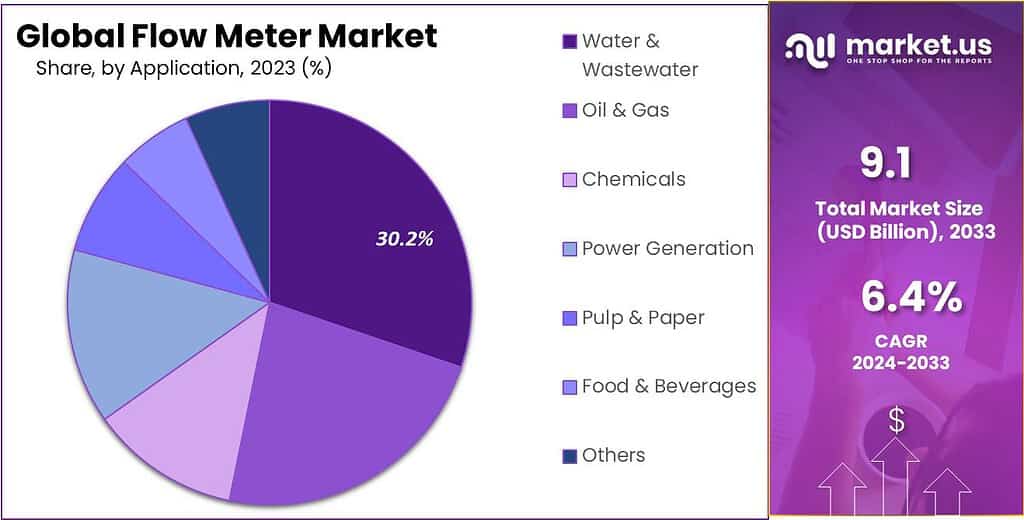

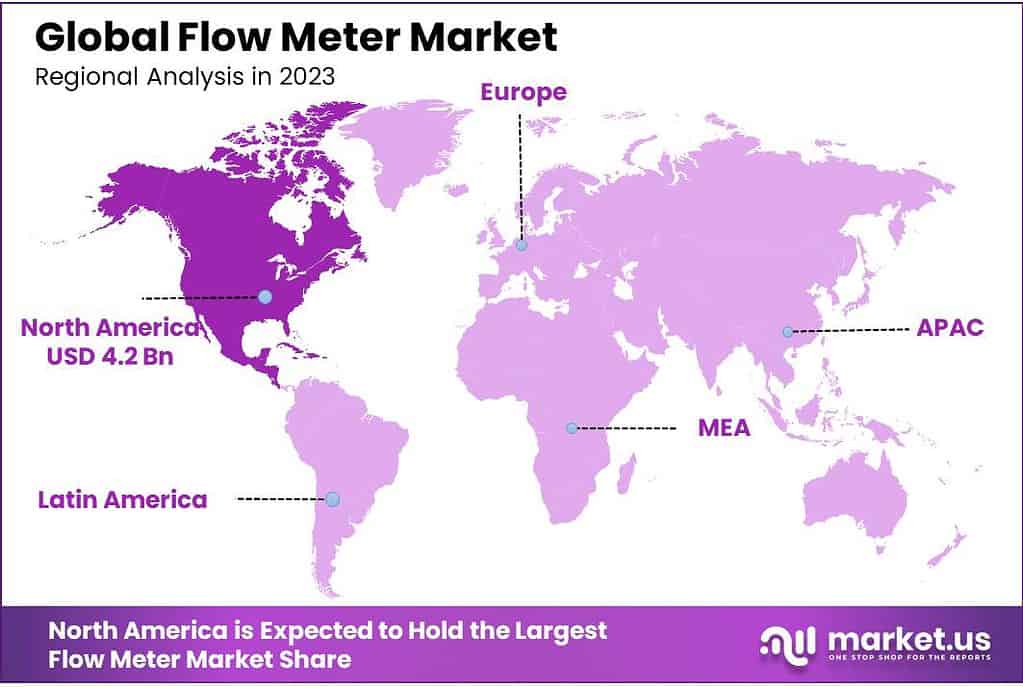

- Application Importance: Water & Wastewater segment holds over 30.2% market share in 2023.Regional Leadership: North America leads adoption with 46.4% global share in 2023, driven by the U.S.

By Product

In 2023, Magnetic flow meters held a dominant market position, capturing more than a 60.1% share. This dominance is attributed to their high accuracy and reliability in measuring the flow of conductive fluids. Magnetic flow meters are widely used in industries like water and wastewater management, and chemical, and food and beverage processing due to their non-intrusive nature and ability to handle a wide range of flow rates and fluid types.

Differential Pressure (DP) Flow Meters: These flow meters are essential in various industrial applications for their ability to measure the flow rate by monitoring the pressure drop across a restriction in the flow path. They are preferred in industries where cost-effectiveness and simplicity are crucial. DP flow meters are commonly used in oil and gas, petrochemical, and power generation sectors.

Positive Displacement (PD) Flow Meters: PD flow meters are known for their precision in measuring the flow of high-viscosity fluids. They are widely used in applications requiring high accuracy, such as the pharmaceutical and chemical industries. These meters capture the flow by dividing it into fixed, measurable increments, ensuring precise volumetric flow measurement.

Ultrasonic Flow Meters: Ultrasonic flow meters use sound waves to measure the velocity of a fluid. They are highly favored for their non-invasive nature and ability to measure both conductive and non-conductive fluids. These meters are extensively used in industries like water and wastewater, oil and gas, and chemical processing due to their accuracy and low maintenance requirements.

Turbine Flow Meters: Turbine flow meters measure the flow rate by detecting the rotational speed of a turbine within the flow stream. They are valued for their accuracy and reliability in measuring clean, low-viscosity fluids. These meters are commonly used in water distribution, oil and gas, and chemical processing industries.

By Type

In 2023, Battery Powered flow meters held a dominant market position, capturing more than a 45.2% share. These flow meters are highly valued for their portability and ease of use in remote and challenging environments where power availability is limited. They are widely used in applications such as irrigation, water distribution, and field operations in the oil and gas industry due to their ability to operate independently of external power sources.

Electric Flow Meters: Electric flow meters are known for their high accuracy and reliability. They are commonly used in industrial applications where a consistent power supply is available. These meters are essential in sectors like chemical processing, pharmaceuticals, and food and beverage industries, where precise flow measurement is critical for maintaining product quality and process efficiency.

Solar Flow Meters: Solar flow meters are gaining popularity due to their sustainable energy source and low operational costs. These meters are particularly useful in remote areas and environmental monitoring applications. They are extensively used in agriculture for irrigation management and in water treatment facilities, where harnessing solar energy helps reduce operational expenses and environmental impact.

By Application

In 2023, Water & Wastewater held a dominant market position, capturing more than a 30.2% share. This segment’s growth is driven by the increasing need for efficient water management systems and stringent environmental regulations. Flow meters in this application ensure accurate measurement of water usage and waste discharge, crucial for compliance and resource management. They are extensively used in municipal water supply, wastewater treatment plants, and irrigation systems.

Oil & Gas: The oil and gas industry relies heavily on flow meters for accurate measurement of liquid and gas flow in pipelines and processing facilities. These meters are essential for monitoring production, ensuring safety, and optimizing operations. They are used in applications such as upstream exploration, midstream transportation, and downstream refining.

Chemicals: In the chemical industry, flow meters are critical for maintaining precise control over the flow of various chemicals and fluids. This ensures consistent product quality and safety. They are used in processes such as chemical synthesis, mixing, and batching, where accurate flow measurement is crucial.

Power Generation: Flow meters in the power generation sector are used to measure the flow of steam, water, and other fluids. They play a vital role in maintaining the efficient and safe operation of power plants. These meters are essential in applications like boiler feedwater monitoring, cooling water systems, and fuel flow measurement.

Pulp & Paper: The pulp and paper industry uses flow meters to measure the flow of raw materials and chemicals used in paper production. Accurate flow measurement helps optimize the production process and ensure product quality. These meters are used in processes such as pulp production, chemical dosing, and water management.

Food & Beverages: Flow meters are widely used in the food and beverage industry to measure the flow of liquids, gases, and slurries. They ensure accurate ingredient mixing, dosing, and quality control. Applications include beverage production, dairy processing, and brewing.

Market Key Segments

By Product

- Differential Pressure (DP)

- Positive Displacement (PD)

- Magnetic

- Ultrasonic

- Turbine

- Others

By Type

- Electric

- Solar

- Battery Powered

By Application

- Water & Wastewater

- Oil & Gas

- Chemicals

- Power Generation

- Pulp & Paper

- Food & Beverages

- Others

Drivers

Increasing Demand for Accurate Water and Wastewater Management

One of the major drivers for the flow meter market is the escalating demand for accurate water and wastewater management. This demand is fueled by several critical factors, including the global scarcity of water resources, stringent regulatory requirements, and the need for sustainable water usage and conservation practices. As water becomes an increasingly valuable resource, the necessity for precise measurement and monitoring of water flow in various applications has grown significantly.

Water scarcity is a pressing global issue, with many regions facing severe shortages and the challenge of managing limited water supplies effectively. According to the United Nations, nearly 2 billion people live in countries experiencing high water stress, and this number is expected to increase due to population growth and climate change. Accurate flow meters play a crucial role in addressing this challenge by providing reliable data on water usage and distribution, enabling more efficient management of water resources. Flow meters help in monitoring water consumption, detecting leaks, and optimizing the distribution network, thereby reducing water wastage and ensuring sustainable usage.

Regulatory bodies worldwide have implemented stringent standards and regulations to ensure the efficient use and conservation of water resources. For instance, the European Union’s Water Framework Directive mandates member states to achieve good qualitative and quantitative status of all water bodies. Similarly, the U.S. Environmental Protection Agency (EPA) enforces regulations under the Clean Water Act to control water pollution and promote water conservation. Flow meters are essential tools in complying with these regulations, as they provide accurate measurements required for reporting and monitoring compliance with water usage and discharge limits. This regulatory pressure compels industries and municipalities to adopt advanced flow measurement technologies to meet compliance requirements.

In addition to regulatory compliance, the drive toward sustainability has encouraged industries and municipalities to adopt advanced water management practices. Companies are increasingly recognizing the importance of sustainable operations, which include minimizing water usage and maximizing efficiency. Flow meters enable real-time monitoring and control of water flow, allowing businesses to implement effective water conservation strategies. For example, industries can optimize their water-intensive processes by accurately measuring water consumption and identifying areas for improvement.

Technological advancements in flow meter technologies have further propelled their adoption in water and wastewater management. Modern flow meters, such as ultrasonic, magnetic, and Coriolis meters, offer high accuracy, reliability, and versatility, making them suitable for a wide range of water-related applications. These technologies provide non-intrusive measurement solutions that are ideal for handling various types of fluids, including clean water, wastewater, and slurries. The integration of digital technologies and IoT capabilities in flow meters has enhanced their functionality, enabling remote monitoring, data logging, and advanced analytics. These features provide valuable insights into water usage patterns, system performance, and potential issues, facilitating proactive maintenance and optimization.

The increasing focus on smart water management solutions is also driving the demand for flow meters. Smart water management systems leverage advanced sensors, data analytics, and communication technologies to enhance the efficiency and reliability of water infrastructure. Flow meters are integral components of these systems, providing the necessary data for monitoring and controlling water flow in real time. Smart water management solutions help utilities and industries reduce operational costs, improve service delivery, and enhance the overall resilience of water systems.

Restraints

High Initial Costs and Maintenance Requirements

One of the significant restraints for the flow meter market is the high initial costs and ongoing maintenance requirements associated with these devices. This challenge is particularly pronounced in industries where large-scale deployment of flow meters is essential, such as water and wastewater management, oil and gas, chemical processing, and power generation. The substantial capital investment required for advanced flow meter technologies and the costs related to their upkeep can deter potential users, especially small and medium-sized enterprises (SMEs) and budget-constrained municipal utilities.

High Initial Costs: Advanced flow meters, such as ultrasonic, Coriolis, and electromagnetic meters, often come with a hefty price tag due to their sophisticated technology and high precision. These devices incorporate cutting-edge components and sensors that enhance measurement accuracy, reliability, and functionality. For instance, Coriolis flow meters, known for their exceptional accuracy and ability to measure mass flow, density, and temperature, are significantly more expensive than traditional mechanical meters. Similarly, ultrasonic flow meters, which offer non-intrusive measurement and are ideal for a variety of fluids, also command higher prices due to their advanced transducers and signal processing capabilities.

The high cost of these flow meters can be a barrier for many organizations, particularly those operating on tight budgets. Small businesses and municipal utilities may find it challenging to justify the upfront expenditure, especially when the perceived benefits do not immediately outweigh the costs. This financial hurdle can slow down the adoption of advanced flow meters, limiting market growth despite the availability of superior technology.

Maintenance and Calibration Requirements: Flow meters, like any other precision instrument, require regular maintenance and calibration to ensure their accuracy and longevity. Maintenance activities can include cleaning, inspection, and part replacements, which can be both time-consuming and costly. Calibration is crucial for maintaining measurement accuracy, especially in industries where precise flow measurement is critical for process control, quality assurance, and regulatory compliance.

The need for periodic calibration and maintenance adds to the total cost of ownership of flow meters. For example, magnetic flow meters, while highly reliable, may require periodic checks to ensure that the electrodes and liner are free from deposits that could affect performance. Similarly, ultrasonic flow meters may need regular inspection of their transducers to maintain signal clarity and measurement accuracy.

Specialized Expertise and Training: Operating and maintaining advanced flow meters often require specialized knowledge and training. Technicians must be familiar with the specific requirements of different types of flow meters, understand calibration procedures, and be capable of troubleshooting issues that may arise. This need for skilled personnel adds another layer of cost and complexity, as companies may need to invest in training programs or hire specialized staff.

Impact on Market Dynamics: The high initial costs and maintenance requirements can significantly impact market dynamics by influencing purchasing decisions. Industries and organizations may opt for less expensive, albeit less accurate, flow measurement solutions to avoid the higher upfront and ongoing costs associated with advanced flow meters. This preference for cost-effective alternatives can limit the market penetration of high-end flow meters, affecting overall market growth.

Additionally, the reluctance to invest in advanced flow meters may hinder technological advancements and innovation in the market. Manufacturers may face challenges in justifying the development of new technologies if the demand for high-cost flow meters remains constrained due to financial barriers

Opportunity

Integration of IoT and Digital Technologies

One major opportunity for the flow meter market lies in the integration of the Internet of Things (IoT) and digital technologies. This trend is transforming traditional flow measurement systems into smart, interconnected devices that offer enhanced functionalities, real-time data analytics, and improved operational efficiencies. The adoption of IoT and digital solutions in flow meters is poised to significantly drive market growth by catering to the increasing demand for automation and smart monitoring in various industries.

Enhanced Data Collection and Analysis: IoT-enabled flow meters can collect vast amounts of data from various flow measurement points and transmit this information in real time to centralized monitoring systems. This capability allows for continuous monitoring and analysis of flow parameters, enabling quick identification of anomalies, leaks, or inefficiencies in the system. For instance, industries such as water and wastewater management can greatly benefit from real-time monitoring of water distribution networks, helping to reduce water loss and optimize resource allocation.

Predictive Maintenance and Reduced Downtime: The integration of IoT with flow meters facilitates predictive maintenance by providing insights into the health and performance of the equipment. IoT sensors can monitor critical parameters such as flow rate, pressure, and temperature, alerting operators to potential issues before they lead to equipment failure. This predictive capability reduces unexpected downtime, extends the lifespan of flow meters, and lowers maintenance costs. In sectors like oil and gas, where equipment reliability is crucial, predictive maintenance enabled by IoT can significantly enhance operational efficiency and safety.

Improved Accuracy and Precision: Digital technologies, combined with IoT, enhance the accuracy and precision of flow measurement. Advanced algorithms and data analytics can process the data collected by IoT sensors to correct any discrepancies and improve measurement reliability. This increased accuracy is particularly valuable in industries such as pharmaceuticals and food and beverage, where precise flow measurement is essential for maintaining product quality and compliance with regulatory standards.

Scalability and Flexibility: IoT-enabled flow meters offer scalability and flexibility, allowing industries to easily expand their monitoring capabilities as needed. These systems can be integrated with existing industrial infrastructure, enabling seamless upgrades and expansion without significant overhauls. This adaptability makes IoT solutions attractive to industries looking to enhance their flow measurement systems without incurring substantial costs.

Energy Efficiency and Sustainability: IoT integration promotes energy efficiency by enabling more precise control over flow systems, leading to optimized energy usage. For example, in HVAC systems, IoT-enabled flow meters can adjust flow rates based on real-time demand, reducing energy consumption and enhancing system efficiency. This capability supports sustainability initiatives by lowering the carbon footprint and operational costs associated with energy use.

Regulatory Compliance and Reporting: Digital flow meters equipped with IoT can automate the collection and reporting of data required for regulatory compliance. This automation simplifies compliance processes and ensures accurate reporting of flow rates, emissions, and other critical parameters. Industries such as chemicals and water treatment, which are subject to stringent regulatory requirements, can greatly benefit from the streamlined compliance facilitated by IoT-enabled flow meters.

Enhanced Customer Experience: For manufacturers and service providers, IoT-enabled flow meters offer the opportunity to enhance customer experience through advanced features such as remote monitoring, troubleshooting, and support. Customers can access real-time data and analytics through user-friendly interfaces, enabling better decision-making and system management. This improved customer engagement can lead to increased satisfaction and loyalty, driving further market adoption.

Trends

Increasing Adoption of Smart Flow Meters

One of the major trends in the flow meter market is the increasing adoption of smart flow meters. These advanced devices are equipped with digital technologies and IoT capabilities, enabling real-time data collection, remote monitoring, and enhanced analytics. This trend is driven by the growing demand for automation, precision, and efficiency across various industries, including water and wastewater management, oil and gas, chemicals, and food and beverage.

Real-Time Data Collection and Monitoring: Smart flow meters are designed to provide continuous, real-time data on flow rates, pressure, and temperature. This capability allows operators to monitor processes closely, identify issues promptly, and make informed decisions to optimize operations. For example, in the water and wastewater industry, smart flow meters help utilities monitor water distribution networks, detect leaks, and manage water resources more efficiently.

Enhanced Accuracy and Precision: Smart flow meters leverage advanced digital technologies to enhance measurement accuracy and precision. These devices often include features such as automatic calibration, self-diagnostics, and error detection, which reduce the likelihood of measurement inaccuracies. This increased precision is particularly beneficial in industries where precise flow measurement is critical for maintaining product quality and compliance with regulatory standards, such as pharmaceuticals and food and beverage.

Remote Monitoring and Control: One of the key advantages of smart flow meters is their ability to support remote monitoring and control through IoT connectivity. This feature enables operators to access flow data from any location, using digital dashboards and mobile applications. Remote monitoring capabilities are especially valuable in industries with widespread or hard-to-reach installations, such as oil and gas pipelines and remote water treatment facilities.

Predictive Maintenance and Reduced Downtime: Smart flow meters are equipped with predictive maintenance features that use real-time data and analytics to predict equipment failures and maintenance needs. By identifying potential issues before they lead to breakdowns, these devices help reduce unexpected downtime and maintenance costs. This capability is crucial for industries like power generation and chemical processing, where equipment reliability and uptime are essential for continuous operations.

Energy Efficiency and Sustainability: The integration of smart technologies in flow meters promotes energy efficiency by enabling precise control over flow systems. Smart flow meters can adjust flow rates based on real-time demand, reducing energy consumption and improving overall system efficiency. This trend aligns with the growing emphasis on sustainability and environmental responsibility, helping industries lower their carbon footprint and operational costs.

Enhanced Data Analytics and Insights: Smart flow meters provide advanced data analytics capabilities, allowing operators to gain deeper insights into flow patterns, system performance, and operational efficiency. These insights facilitate better decision-making and process optimization, leading to improved productivity and cost savings. In sectors such as chemicals and pharmaceuticals, advanced analytics help maintain process consistency and product quality.

Regulatory Compliance and Reporting: Smart flow meters simplify regulatory compliance by automating data collection and reporting processes. These devices can generate accurate, real-time reports on flow rates, emissions, and other critical parameters required for regulatory compliance. This automation reduces the administrative burden on industries and ensures timely and accurate reporting to regulatory authorities.

Integration with Smart Infrastructure: The trend towards smart infrastructure and Industry 4.0 is further driving the adoption of smart flow meters. These devices can seamlessly integrate with other smart systems, such as SCADA (Supervisory Control and Data Acquisition) and MES (Manufacturing Execution Systems), enhancing overall operational efficiency and connectivity. This integration supports the development of smart factories and intelligent water networks, contributing to the digital transformation of industries.

Regional Analysis

North America stands out as the leader in adoption, commanding a significant global share of 46.4% in 2023. Driving this momentum is the United States, where there is a growing demand for more reliable and efficient flow measurement solutions. Concerns surrounding outdated measurement practices and the escalating challenges associated with traditional methods serve as catalysts for this surge in adoption.

Industries and communities across North America are increasingly prioritizing the importance of accurate flow measurement technologies, directing investments toward innovative solutions. Stakeholders recognize the numerous benefits, such as improved accuracy, cost-effectiveness, and reduced environmental impact, driving significant capital into these transformative technologies.

The region benefits from a well-established infrastructure within the energy sector, supported by a network of skilled professionals and technology providers. This supportive ecosystem facilitates the seamless development and integration of advanced flow measurement solutions, with industry leaders actively promoting their widespread adoption. Additionally, many prominent flow meter manufacturers are based in North America, contributing to ongoing research, innovation, and the expansion of a diverse range of cutting-edge products within the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The flow meter market is characterized by the presence of several key players driving innovation and competition. Prominent companies such as Siemens AG, Emerson Electric Co., and ABB Ltd. stand out as leaders in the global flow meter landscape, leveraging their extensive expertise and technological capabilities to offer a diverse range of advanced flow measurement solutions.

Market Key Players

- Siemens

- Azbil Group

- Emerson Electric Corporation

- General Electric

- Honeywell International Inc.

- Hitachi High-Tech Corporation

- Schneider Electric SE

- Endress+Hausar AG

- Krohne Messtechnik Gmbh

- Yokogawa Electric Corporation

- ABB Ltd.

- Badger Meter Inc.

- HÖNTZSCH GMBH & CO. KG

- Em-Tec GmbH

- Ennovacion Instruments

Recent Developments

In 2023, Siemens witnessed steady growth in sales of its flow meter products, with notable increases observed across various regions, including North America, Europe, and Asia-Pacific.

In 2023, Azbil Group experienced robust growth in sales of its flow meter offerings, particularly in regions such as Asia-Pacific and Europe, where there was a growing demand for advanced measurement solutions in industries like petrochemicals, food and beverage, and pharmaceuticals.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Bn Forecast Revenue (2033) US$ 16.9 BN CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Differential Pressure (DP), Positive Displacement (PD), Magnetic, Ultrasonic, Turbine, Others), By Type(Electric, Solar, Battery Powered), By Application, Water & Wastewater, Oil and Gas, Chemicals, Power Generation, Pulp and Paper, Food and Beverages, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Siemens, Azbil Group, Emerson Electric Corporation, General Electric, Honeywell International Inc., Hitachi High-Tech Corporation, Schneider Electric SE, Endress+Hausar AG, Krohne Messtechnik Gmbh, Yokogawa Electric Corporation, ABB Ltd., Badger Meter Inc., HÖNTZSCH GMBH & CO. KG, Em-Tec GmbH, Ennovacion Instruments Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Flow Meter Market?Flow Meter Market size is expected to be worth around USD 16.9 billion by 2033, from USD 9.1 billion in 2023

What CAGR is projected for the Flow Meter Market?The Flow Meter Market is expected to grow at 6.4% CAGR (2023-2033).Name the major industry players in the Flow Meter Market?Siemens, Azbil Group, Emerson Electric Corporation, General Electric, Honeywell International Inc., Hitachi High-Tech Corporation, Schneider Electric SE, Endress+Hausar AG, Krohne Messtechnik Gmbh, Yokogawa Electric Corporation, ABB Ltd., Badger Meter Inc., HÖNTZSCH GMBH & CO. KG, Em-Tec GmbH, Ennovacion Instruments

-

-

- Siemens

- Azbil Group

- Emerson Electric Corporation

- General Electric

- Honeywell International Inc.

- Hitachi High-Tech Corporation

- Schneider Electric SE

- Endress+Hausar AG

- Krohne Messtechnik Gmbh

- Yokogawa Electric Corporation

- ABB Ltd.

- Badger Meter Inc.

- HÖNTZSCH GMBH & CO. KG

- Em-Tec GmbH

- Ennovacion Instruments