Flow Cytometry Market by Product Type (Instrument, Kit and Reagent), By Technology (Cell-Based Cytometry and Bead-Based Cytometry), By End-User (Hospitals and Clinics, Academic and Research Institutes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Aug 2024

- Report ID: 28460

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

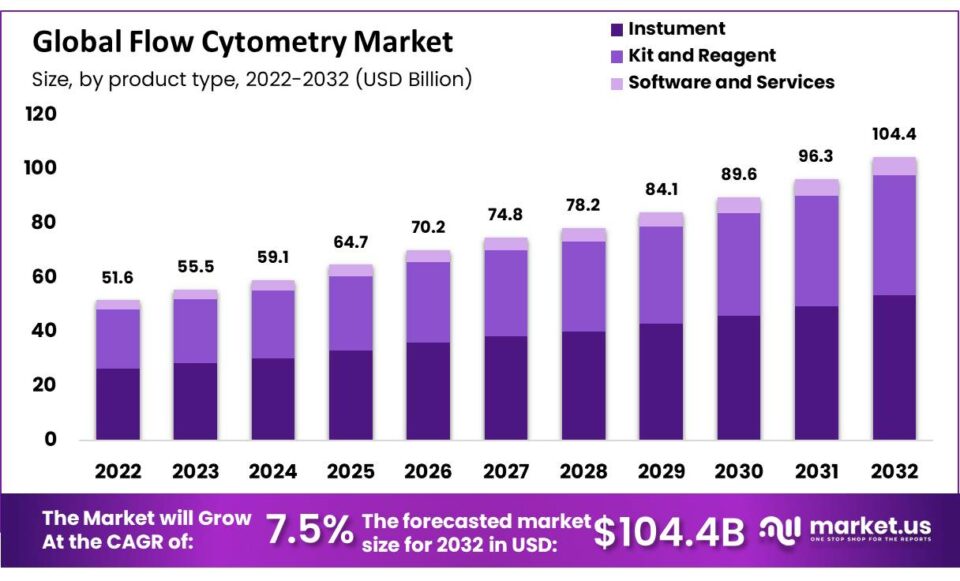

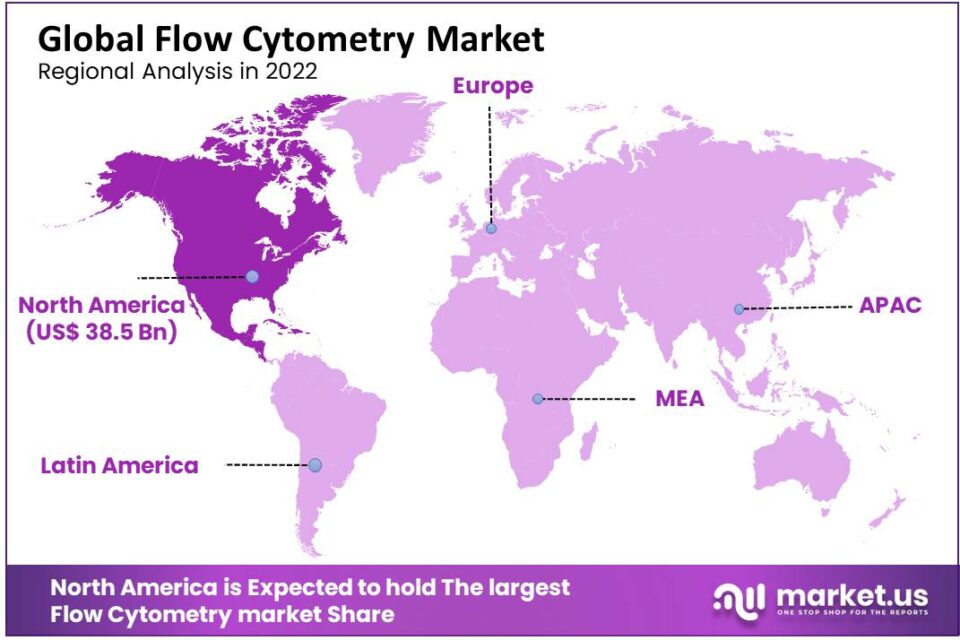

The Global Flow Cytometry Market Size is expected to be worth around USD 104.4 Billion by 2032 from USD 51.6 Billion in 2022, growing at a CAGR of 7.5% during the forecast period from 2022 to 2032. North America held a dominant market position, capturing more than a 40.7% share and holds US$ 38.5 Billion market value for the year.

Flow cytometry is a dynamic technique employed extensively in both clinical diagnostics and research, distinguishing itself through its ability to analyze multiple parameters of single cells rapidly. This capability makes it invaluable for applications in immunology, cancer research, and infectious disease monitoring.

The market is poised for significant growth, driven by the rising incidence of diseases such as cancer and HIV, alongside the expanding use of flow cytometry in research settings. The integration of advanced technologies, including artificial intelligence for enhanced data analysis, is expected to further augment this growth.

However, the market faces challenges such as the high costs associated with flow cytometry equipment and reagents, and a general lack of awareness about the technique among potential end-users. Moreover, the development and validation of flow cytometry assays are complicated by the absence of standardized materials and guidelines, which could restrain market expansion.

On the other hand, opportunities abound with the increasing adoption of flow cytometry in drug discovery and diagnostics, driven by its precise analytical capabilities. Additionally, the push towards personalized medicine is likely to increase the demand for flow cytometry as it allows for detailed cellular analysis.

Geographically, North America leads the market, benefiting from a well-established healthcare infrastructure and substantial investments in research and development. The region’s market dominance is supported by ongoing advancements in biotechnology and an increase in public-private partnerships.

While the flow cytometry market faces certain hurdles, its critical role in modern medicine and research, combined with technological advancements, presents substantial opportunities for growth and expansion across various applications and regions

Key Takeaways

- The global flow cytometry market is expected to reach USD 104.4 billion by 2032.

- The flow cytometry market is growing at a CAGR of 7.5%.

- The instrument segment held 37% of the market share in 2022.

- North America dominated the market with a 40.7% revenue share in 2022.

- Europe held a 32% revenue share in 2022.

- Asia-Pacific is expected to have the highest CAGR.

- The increase in the geriatric population is driving market growth.

- Technological advances in chronic disease treatment are boosting the market.

- Cost-effectiveness is increasing demand for flow cytometry devices.

- Stem cell research and clinical trials contribute to market growth.

- Hospitals and clinics are the dominant end-users of flow cytometry.

- The instrument segment is the most dominant product type in the market.

Type Analysis

The flow cytometry market is categorized into four primary segments: software and services, instruments, kits, and reagents. Instruments are the most profitable segment within this market, showing substantial growth. Reagents, particularly, have seen increased adoption due to their critical role in clinical trials and various research applications, which enhances the market’s scope.

Reagents and consumables are poised to become the dominant segment. Their importance in flow cytometry analysis is underscored by their ability to offer cost-effectiveness, enhanced accuracy, and easy delivery of results, paving the way for new development opportunities. The introduction of compact, high-throughput cytometers is anticipated due to their affordability and user-friendliness.

Software and services are also vital, providing tools for controlling and analyzing data from cytometers. This software is crucial in both research and clinical settings for fast and advanced data analysis, aiding in disease detection and monitoring across various medical fields such as oncology, virology, and immunology. The expanding variety of available software options is expected to drive further demand in this segment.

Technology

The flow cytometry market is divided into two main technological segments: cell-based flow cytometry and bead-based cytometry. During the forecast period, the cell-based flow cytometry segment is expected to experience the highest growth rate. This growth is primarily driven by increased recognition of the benefits associated with cell-based research, alongside heightened interest in early-stage research endeavors. Furthermore, technological advancements are anticipated to further bolster this segment. Enhancements in software, instrumentation, algorithms, affinity reagents, and labeling techniques are set to enhance the adoption of cell-based flow cytometry methods.

On the other hand, the bead-based flow cytometry segment is also poised for significant expansion. This method excels in the measurement of various intracellular soluble proteins, including growth factors, cytokines, chemokines, and phosphorylated proteins. Bead-based flow cytometry is regarded as the optimal tool for conducting multiplex bead-based assays, which are critical in the research, diagnosis, and treatment of immune-related disorders. The versatility and efficacy of this approach suggest a promising potential for growth, especially in applications requiring detailed analysis of multiple biomarkers simultaneously.

End-User Analysis

The Flow Cytometry market caters to various end users, including hospitals and clinics, academic and research institutes, pharmaceutical, and biotechnological companies. Among these, hospitals and clinics emerge as the most dominant segment. This prominence is attributed to the extensive application of flow cytometry in cell science and molecular diagnostics, where it is crucial for analyzing cell characteristics such as type, lineage, and development stage, alongside detecting biomarkers using specific antibodies.

The hospital and clinic segment is poised for significant growth during the forecast period, driven by increased research and development activities utilizing flow cytometry. This method is pivotal in diagnosing and treating conditions like immunodeficiency disorders and cancer, underlining its vital role in clinical settings. As the demand for cost-effective disease management continues to rise, particularly for chronic illnesses and cancer, the reliance on diagnostic tests employing flow cytometry is expected to surge.

Moreover, clinical testing laboratories are projected to witness the fastest growth rate in the coming years. This growth is fueled by the escalating need for precise diagnostics, which, in turn, enhances the management and treatment outcomes of severe health conditions. The broader adoption of flow cytometry for analyzing cancer and other persistent diseases is anticipated to further boost the demand for diagnostic tests in these laboratories, supporting the overall expansion of the flow cytometry market in the healthcare sector.

Key Market Segments

Based On Product Type

- Instrument

- Kit and Reagent

- Software and Services

Based on Technology

- Cell-based Cytometry

- Bead-based Cytometry

Based on End-User

- Hospitals and Clinics

- Academic and Research Institutes

- Pharmaceutical

- Biotechnology Companies

- Others

Drivers

Technological Advancement in Flow Cytometry Instruments

Technological advancements are significantly driving the expansion of the flow cytometry market. This growth is fueled by the widespread adoption of flow cytometry across various research and diagnostic applications. The technology is increasingly utilized in diverse fields such as cytogenetics, proteomics, and marine biology, enhancing its market share.

Prominent industry players are intensifying their research and development efforts. These endeavors focus on crafting advanced analytical reagents and multicolor assays, which in turn propel market growth. Additionally, the market is benefiting from the rising incidence of chronic and infectious diseases worldwide. Such medical conditions necessitate the use of flow cytometry techniques for precise analysis, making this technology indispensable in modern diagnostics.

Another pivotal factor contributing to market growth is the surge in research and development investments within the biotechnology sector. Innovations such as microfluidic flow cytometry are being developed to support point-of-care testing. This advancement simplifies the diagnostic process, allowing for quicker and more efficient patient care.

Collectively, these technological innovations and increased application scope are key drivers propelling the flow cytometry market forward, marking it as a critical tool in both research settings and clinical diagnostics.

Restraints

High Product Cost

The flow cytometry market faces significant restraints due to high equipment costs. Pharmaceutical companies, major research institutions, and clinical laboratories often need multiple devices to conduct simultaneous projects, which escalates initial purchasing and maintenance expenses. For example, a standard flow cytometer can cost anywhere from $40,000 to over $100,000, according to a government healthcare report.

Additionally, academic and research laboratories frequently encounter financial barriers that prevent them from acquiring such costly tools. Maintenance fees and various indirect costs further compound the overall expense involved. A study by a leading health organization highlighted that maintenance alone could account for approximately 20% of the total cost of ownership over the device’s lifespan.

For instance, the need for regular calibration and servicing, along with the necessity for specialized training for operators, adds to indirect costs, making the technology less accessible. Consequently, these financial challenges are anticipated to constrain the growth of the flow cytometry market, particularly in resource-limited settings. According to recent industry analysis by a reputable pharmaceutical news portal, this cost factor is among the top barriers to the adoption of advanced cytometric techniques in emerging research markets.

Opportunity

Rise in Adaption of Flow Cytometry Approach Academic And Research

The adoption of flow cytometry in the academic and research sectors presents significant growth opportunities, especially within emerging economies such as China, India, Brazil, and South Africa. According to a World Health Organization report, the increasing geriatric population, coupled with rising per capita incomes and high patient volumes, is driving the need for enhanced healthcare infrastructure in these regions. For example, the government initiatives to bolster healthcare facilities are expected to fuel the demand for flow cytometry technologies.

Studies indicate that awareness among the general public about advanced diagnostic methods is also growing, thereby contributing to the expansion of the flow cytometry market. Furthermore, significant investments are being channeled into healthcare from both public and private sectors, creating a fertile environment for the adoption of flow cytometry techniques. A press release by the Ministry of Health in Brazil highlighted an allocation increase of 20% in healthcare funding for 2024, aimed at incorporating advanced technologies like flow cytometry in clinical settings.

This strategic focus on healthcare enhancement in developing countries illustrates a promising trend for stakeholders in the flow cytometry market. The integration of such technologies is pivotal in advancing patient care standards, making this a lucrative opportunity for market growth and technological advancement in flow cytometry applications.

Trends

Rising Demand for Flow Cytometry in Clinical Diagnostics

Flow cytometry has become indispensable in the fight against cancer and HIV/AIDS. It offers a precise analysis of cellular functions and markers, facilitating early diagnosis and monitoring of disease progression. According to the World Health Organization, there were about 20 million new cancer cases globally in 2022, underscoring the critical need for effective diagnostic tools like flow cytometry.

Technological advancements have also expanded the applications of flow cytometry. For instance, in May 2023, Becton, Dickinson, and Company introduced a novel cell sorting device that significantly enhances cellular analysis capabilities. This is part of a broader trend where key market players are continuously innovating to improve the accuracy, efficiency, and cost-effectiveness of flow cytometry technologies.

Moreover, the sector is seeing significant investments, such as Pfizer Inc.’s USD 120 million funding in 2021, aimed at bolstering biotechnology and clinical research, further integrating flow cytometry into drug development processes

Regional Analysis

In 2022, North America held a dominant market position, capturing more than a 40.7% share and holds US$ 38.5 Billion market value for the year.

The flow cytometry market in North America, primarily led by the United States, is poised to dominate growth. This leadership stems from extensive adoption of advanced flow cytometry solutions, coupled with a robust healthcare infrastructure and high healthcare expenditure. The U.S. market benefits from significant research and development activities and a focus on innovative product development, which together drive market expansion.

Additionally, the rising prevalence of cancer in the region fuels the demand for sophisticated flow cytometry solutions, supporting further market growth. The presence of major pharmaceutical companies and comprehensive research undertaken by academic institutions also contribute to this trend.

Conversely, the Asia-Pacific region is expected to emerge as a leader in the flow cytometry market during the forecast period. This shift is likely due to the increasing outsourcing of research activities to contract research organizations within the region. Moreover, a surge in chronic diseases like HIV and cancer, alongside a growing demand for advanced healthcare facilities, is set to accelerate market growth in Asia-Pacific.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic field of flow cytometry, emerging key players are actively pursuing strategic approaches to expand their global reach. Prominent companies such as Sysmex Corporation, Luminex Corporation, Sartorius AG, Danaher Corporation, and Becton Dickinson and Company, along with others like BioLegend, Inc., bioMérieux SA, Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Danaher, and Enzo Life Sciences, Inc., are intensifying their research and development efforts through expanded facilities.

Moreover, these players are engaging in investments, mergers, and acquisitions to innovate and enhance their product portfolios. For example, BD Life Sciences has notably advanced its position in India by establishing a center of excellence in flow cytometry in collaboration with Vellore Christian Clinical School.

The flow cytometry market is highly competitive, with numerous local and regional players challenging established brands that boast extensive distribution networks. To maintain a competitive edge and leadership in the market, companies are increasingly focusing on launching new products and forming strategic partnerships. This competitive environment drives continuous innovation and expansion across the industry.

Market Key Players

- Danaher Corp.

- Becton, Dickinson, and Company (BD)

- Sysmex Corp.

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Stratedigm, Inc.

- DiaSorin SPA

- Other Key Player

Recent Development

- In July 2024: Launch of Diagnostic Innovation Centers, Danaher announced the establishment of two new Clinical Laboratory Improvement Amendments (CLIA) and College of American Pathologists (CAP)-certified labs through its subsidiary, DH Diagnostics LLC. These labs aim to streamline the development and commercialization of companion and complementary diagnostics, focusing on speeding up pharma translational research and precision medicine development. These labs integrate technologies and assays from multiple Danaher subsidiaries, enhancing their capacity to bring precise treatments to market more rapidly.

- In July 2024: Agilent Technologies announced its acquisition of BIOVECTRA Inc., a Canadian-based Contract Development and Manufacturing Organization (CDMO), for $925 million. This acquisition is aimed at expanding Agilent’s biopharma solutions and accelerating drug development and manufacturing. BIOVECTRA is known for its expertise in biologics, including mRNA and pDNA technologies, which complements Agilent’s offerings.

- In June 2024: BD announced its acquisition of Edwards Lifesciences’ Critical Care product group for $4.2 billion. This strategic move is aimed at expanding BD’s smart connected care solutions and advancing its position in the market for advanced monitoring technologies. The acquisition includes a portfolio of AI-enabled clinical decision tools and monitoring technologies, which are expected to enhance BD’s offerings in patient care.

Report Scope

Report Features Description Market Value (2022) USD 51.6 Billion Forecast Revenue (2032) USD 104.4 Billion CAGR (2023-2032) 7.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instrument, Kit and Reagent, Software, and Services); By Technology (Cell-Based Cytometry and Bead-Based Cytometry); By End-User (Hospitals and Clinics, Academic and Research Institutes, Pharmaceutical and Biotechnology Companies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Danaher Corp., Becton, Dickinson, and Company, Sysmex Corp., Agilent Technologies, Inc., Apogee Flow Systems Ltd., Bio-Rad Laboratories, Inc, Thermo Fisher Scientific, Inc., Stratedigm, Inc., DiaSorin SPA, Other Key Player Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

• Danaher Corporation • Dickinson and Company • Luminex Corporation • Agilent Technologies, Inc. • Miltenyi Biotec • Sysmex Corporation • Stratedigm, Inc. • Apogee Flow Systems Ltd. • Sony Biotechnology, Inc. • Thermo Fisher Scientific, Inc. • Other Key Players