Global Floating Solar Panels Market By Product Type(Tracking Floating Solar Panels, Stationary Floating Solar Panels), By Technology(Thin Film, Monocrystalline, Polycrystalline, Others), By Capacity(Below 2 MW, 2 MW - 3 MW, 3 MW - 5 MW, 5 MW - 15 MW, Above 15 MW), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119637

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

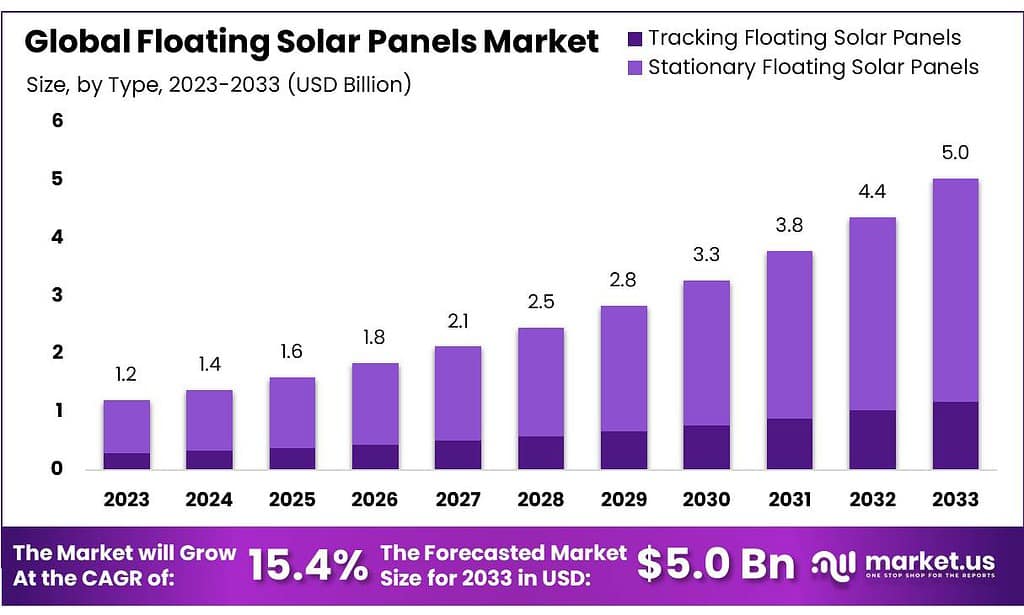

The global Floating Solar Panels Market size is expected to be worth around USD 5.0 billion by 2033, from USD 1.2 billion in 2023, growing at a CAGR of 15.4% during the forecast period from 2023 to 2033.

The Floating Solar Panels Market refers to the industry involved in the deployment and management of solar photovoltaic panels installed on water bodies such as lakes, reservoirs, and ponds. These floating solar panels, also known as photovoltaics, are mounted on buoyant structures that allow them to float on the surface of the water.

This innovative approach to solar energy generation offers several advantages over traditional land-based solar systems, including efficient use of space, reduced land acquisition costs, and enhanced energy efficiency due to the cooling effect of water, which can increase the panels’ performance.

Floating solar panels are particularly advantageous in regions with limited land availability or where land costs are prohibitively high. They are also beneficial for reducing water evaporation from reservoirs and can improve the water quality by inhibiting algae growth. The market for floating solar panels is growing rapidly, driven by the increasing demand for renewable energy sources, technological advancements, and supportive government policies aimed at promoting sustainable energy solutions.

Recent developments in this market include advancements in floating solar technology, such as improved buoyancy structures and anchoring systems, which enhance the stability and efficiency of the panels.

Additionally, collaborations between energy companies and water utilities are becoming more common, facilitating the integration of floating solar systems with existing water infrastructure. The market is also witnessing increased investments and large-scale project deployments, particularly in countries like China, Japan, and India, which are leading the adoption of floating solar technology.

Key Takeaways

- Market Size: Expected to reach USD 5.0 billion by 2033 from USD 1.2 billion in 2023, with a CAGR of 15.4%.

- Product Types: Stationary panels, holding over 76.5% market share, offer simplicity and cost-effectiveness; tracking panels optimize energy capture by up to 25%.

- Technology Dominance: Thin film technology, capturing over 50.2% market share, favored for lightweight and cost-effectiveness.

- Capacity Preference: Above 15 MW capacity dominates with over 71.1% market share, favored for utility-scale projects.

- Regional Analysis: Asia Pacific leads with 68.5% market share, driven by technological advancements and increasing demand for renewable energy.

By Product Type

In 2023, Stationary Floating Solar Panels held a dominant market position, capturing more than a 76.5% share. These panels are designed to remain fixed in position on the water surface, offering a cost-effective and simple solution for solar energy generation.

Their straightforward installation and minimal maintenance requirements make them particularly attractive for large-scale deployments on calm water bodies like reservoirs and lakes. The widespread adoption of stationary floating solar panels is driven by their stability and ease of integration into existing water infrastructure, making them a preferred choice for utility-scale projects.

Tracking Floating Solar Panels accounted for the remaining market share, increasingly recognized for their enhanced energy efficiency. These panels use sophisticated tracking systems to follow the sun’s trajectory throughout the day, optimizing the angle of incidence and maximizing energy capture by up to 25% compared to stationary panels.

The adoption of tracking floating solar panels is gaining momentum, especially in regions with high solar irradiance, where maximizing energy output is critical. Although they involve higher initial costs and more complex technology, their ability to significantly boost energy generation makes them an appealing option for innovative solar projects aiming for higher efficiency and return on investment.

By Technology

In 2023, Thin Film technology held a dominant market position, capturing more than a 50.2% share. This dominance is attributed to the lightweight nature and flexibility of thin film solar panels, which make them ideal for installation on water bodies where weight and adaptability are crucial. Thin film panels are also known for their relatively low production costs and ability to perform well under diffused light conditions, making them a cost-effective choice for floating solar installations.

Monocrystalline floating solar panels accounted for a significant portion of the market, recognized for their high efficiency and longevity. These panels are made from single-crystal silicon, which allows for higher energy conversion rates compared to other technologies. Monocrystalline panels are preferred for projects where space efficiency is paramount, as they can generate more power per square meter than other types of solar panels.

Polycrystalline panels also held a notable market share, valued for their balance of performance and cost-effectiveness. Made from silicon crystals, polycrystalline panels offer a good compromise between efficiency and affordability, making them a popular choice for various floating solar projects. Their lower production costs compared to monocrystalline panels make them attractive for large-scale installations where budget constraints are a consideration.

By Capacity

In 2023, Above 15 MW capacity, floating solar panels held a dominant market position, capturing more than a 71.1% share. This segment’s dominance is driven by the increasing number of large-scale projects aimed at maximizing energy output from available water surfaces. These high-capacity installations are particularly favored by utilities and large energy companies looking to significantly boost their renewable energy portfolios. The economies of scale achieved in projects above 15 MW make them cost-effective, despite the higher initial investment, and allow for substantial contributions to regional and national renewable energy targets.

The 5 MW – 15 MW segment also showed significant market presence, being popular for mid-sized installations on reservoirs and industrial water bodies. These projects offer a balance between scale and manageability, making them suitable for both utility companies and large industrial players looking to augment their power supply with sustainable options.

3 MW – 5 MW capacity floating solar panels are gaining traction, especially in regions with limited water surface area but high energy demand. These installations are often utilized by municipalities and smaller utilities, providing a reliable source of renewable energy while optimizing space usage on smaller reservoirs and water treatment facilities.

The 2 MW – 3 MW segment is expanding, with applications in smaller-scale utility projects and private sector initiatives. These systems are ideal for entities looking to integrate renewable energy into their operations without the need for extensive water surfaces, making them attractive for smaller industrial facilities and agricultural applications.

Below 2 MW capacity, floating solar panels are commonly used in niche applications, such as small lakes, ponds, and water retention areas. These systems are popular among small businesses and local governments aiming to enhance their sustainability efforts with minimal investment and space requirements. Despite their smaller scale, these installations play a crucial role in demonstrating the viability and benefits of floating solar technology to a broader audience.

Market Key Segments

By Product Type

- Tracking Floating Solar Panels

- Stationary Floating Solar Panels

By Technology

- Thin Film

- Monocrystalline

- Polycrystalline

- Others

By Capacity

- Below 2 MW

- 2 MW – 3 MW

- 3 MW – 5 MW

- 5 MW – 15 MW

- Above 15 MW

Drivers

Increasing Demand for Renewable Energy and Efficient Land Use

One of the major drivers for the floating solar panels market is the increasing demand for renewable energy combined with the efficient use of available land and water resources. As the global push towards sustainable energy sources intensifies, floating solar panels, or photovoltaics, offer an innovative solution to several challenges associated with traditional land-based solar installations. This trend is driven by a combination of factors including the scarcity of suitable land for solar farms, the desire to enhance energy efficiency, and the global commitment to reducing carbon emissions.

Firstly, the scarcity of suitable land for large-scale solar installations is a significant issue, especially in densely populated or geographically constrained regions. Floating solar panels provide a viable alternative by utilizing underutilized water bodies such as reservoirs, lakes, and ponds.

This approach not only conserves valuable land resources but also allows for the dual use of water surfaces for energy generation and other purposes, such as water storage and fishing. Countries with limited land availability, like Japan and Singapore, have been early adopters of floating solar technology, leveraging their extensive water surfaces to expand renewable energy capacity without compromising land use.

The enhanced energy efficiency of floating solar panels is another critical factor driving their adoption. Floating solar systems benefit from the cooling effect of water, which reduces the operating temperature of the solar panels. This cooling effect can significantly improve the panels’ efficiency and energy output, as high temperatures typically reduce the performance of photovoltaic cells. Studies have shown that floating solar panels can generate up to 15% more electricity compared to their land-based counterparts, making them a more efficient option for solar power generation.

Additionally, floating solar panels help mitigate water evaporation from reservoirs and lakes, contributing to water conservation efforts. This is particularly beneficial in arid regions where water scarcity is a major concern. By covering a portion of the water’s surface, floating solar panels reduce the amount of sunlight hitting the water directly, thereby lowering the rate of evaporation. This dual benefit of energy generation and water conservation enhances the appeal of floating solar projects, particularly in water-stressed areas.

The global commitment to reducing carbon emissions and combating climate change is also a powerful driver for the floating solar panels market. Governments and organizations worldwide are setting ambitious renewable energy targets and implementing supportive policies to encourage the adoption of clean energy technologies.

Floating solar panels, with their ability to generate significant amounts of renewable energy without competing for land resources, align well with these policy goals. Incentives such as subsidies, tax breaks, and favorable regulatory frameworks are further promoting the deployment of floating solar projects.

Moreover, technological advancements and cost reductions in solar panel manufacturing and floating platform design are making floating solar projects more economically viable. Innovations in materials and construction techniques are enhancing the durability and stability of floating solar systems, making them suitable for a wide range of water environments, from calm reservoirs to more challenging offshore conditions. These technological improvements are reducing the overall cost of floating solar installations, making them an attractive option for both public and private sector investments.

Restraints

High Initial Costs and Technical Challenges

A significant restraint in the floating solar panels market is the high initial costs and technical challenges associated with the installation and maintenance of these systems. While floating solar technology offers numerous benefits, the upfront expenses and complexities involved can pose substantial barriers to widespread adoption, particularly in regions with limited financial resources or technical expertise.

The initial costs of floating solar panels are generally higher than those of traditional land-based solar installations. This is primarily due to the specialized equipment and materials required for floating systems, including buoyant platforms, mooring systems, and anchoring mechanisms. These components must be designed to withstand water currents, wind forces, and potential variations in water levels, which adds to their complexity and cost. Additionally, the installation process often involves more intricate logistics and engineering expertise, further increasing the overall expenses.

One of the main technical challenges is ensuring the stability and durability of the floating platforms. These structures must be robust enough to support the weight of the solar panels and withstand environmental conditions such as waves, strong winds, and fluctuating water levels. Designing and constructing such resilient platforms require advanced materials and engineering solutions, which contribute to higher costs. Moreover, the mooring and anchoring systems must be carefully designed to prevent the platforms from drifting or tilting, which could affect the performance and safety of the solar panels.

Maintenance and operational challenges also play a significant role in restraining the growth of the floating solar panels market. Accessing floating solar installations for routine maintenance or repairs can be more complicated and costly compared to land-based systems.

Maintenance tasks, such as cleaning the panels and inspecting the electrical components, often require specialized equipment and procedures to ensure safety and efficiency. The potential for biofouling, where aquatic organisms attach to the submerged parts of the floating structure, adds another layer of maintenance complexity, requiring regular cleaning and preventive measures.

Environmental considerations present additional challenges. While floating solar panels can help reduce water evaporation and inhibit algae growth, they can also impact aquatic ecosystems if not properly managed. The shading effect of the panels may alter the light penetration in the water, potentially affecting the growth of aquatic plants and the behavior of fish and other marine life. Environmental impact assessments and mitigation strategies are essential to address these concerns, which can add to the project’s complexity and cost.

Financing challenges also impact the adoption of floating solar technology. The higher initial investment required for these systems can be a deterrent for investors and project developers, especially in regions with limited access to capital or where financial incentives for renewable energy projects are insufficient. Securing financing for floating solar projects often requires demonstrating their long-term economic viability and environmental benefits, which can be challenging given the relatively new and evolving nature of the technology.

Opportunity

Integration with Hydropower and Water Management Systems

A major opportunity in the floating solar panels market is the integration of hydropower and water management systems, which can enhance the efficiency and sustainability of energy production and water resource management. This synergy between floating solar and existing hydropower infrastructure presents a unique advantage, offering multiple benefits that can drive significant growth in the market.

Firstly, the co-location of floating solar panels with hydropower plants allows for the efficient use of existing water bodies and infrastructure. Hydropower reservoirs provide vast, stable water surfaces ideal for deploying floating solar arrays. By utilizing these surfaces, floating solar installations can generate additional renewable energy without requiring new land, thereby maximizing the utility of existing assets and reducing the environmental impact associated with land-based solar farms.

One of the key benefits of integrating floating solar with hydropower is the complementary nature of their energy generation profiles. Hydropower plants typically generate more electricity during the rainy season when water flow is abundant, while solar power is more effective during dry, sunny periods. This complementary generation pattern can help balance the overall energy output, ensuring a more stable and reliable power supply throughout the year. By combining these two renewable energy sources, utilities can enhance grid stability and reduce dependence on fossil fuels.

Moreover, the integration of floating solar with hydropower can improve the overall efficiency of the energy system. During periods of low solar output, such as cloudy days or nighttime, hydropower can compensate by increasing electricity generation. Conversely, during peak sunlight hours, the solar output can reduce the need for hydropower generation, allowing more water to be conserved in the reservoir for future use. This dynamic synergy optimizes the use of available resources, leading to more efficient and sustainable energy production.

The co-location of floating solar panels on hydropower reservoirs also provides opportunities for enhanced water management. The shade provided by the solar panels can reduce water evaporation from the reservoirs, which is particularly beneficial in arid regions where water scarcity is a concern. By conserving water resources, floating solar installations can contribute to more sustainable water management practices, supporting agricultural activities, drinking water supply, and ecological conservation.

Additionally, the combined infrastructure can streamline operations and maintenance activities. Hydropower facilities typically have established access routes, maintenance crews, and security measures, which can be leveraged to support floating solar installations. This shared infrastructure can reduce the operational costs and logistical complexities associated with maintaining separate energy generation systems, making the combined setup more cost-effective and manageable.

The potential for floating solar and hydropower integration is being recognized and pursued globally. For instance, countries like China and Brazil are leading the way with pilot projects and large-scale installations that combine these technologies. In China, the Longyangxia Dam Solar-Hydro Project is a notable example, where floating solar panels have been deployed on the reservoir of a large hydropower plant, creating a hybrid renewable energy system that enhances overall efficiency and sustainability.

Moreover, international organizations and governments are increasingly supporting such integrated projects through favorable policies, funding, and incentives. These initiatives aim to promote the adoption of renewable energy technologies and achieve climate goals, providing a conducive environment for the growth of the floating solar market.

Trends

Technological Advancements and Innovations in Floating Solar Solutions

A major trend in the floating solar panels market is the rapid technological advancements and innovations in floating solar solutions, which are significantly enhancing the efficiency, durability, and scalability of these systems. This trend is driven by the increasing demand for renewable energy and the need to optimize the performance and reliability of floating solar installations.

One of the key areas of innovation is in the development of advanced materials and designs for floating platforms. Researchers and manufacturers are focusing on creating more robust and lightweight materials that can withstand harsh environmental conditions such as strong winds, waves, and fluctuating water levels. For instance, the use of high-density polyethylene (HDPE) and other durable polymers in the construction of floating platforms has become increasingly common. These materials offer excellent buoyancy, UV resistance, and long-term durability, making them ideal for floating solar applications.

Another significant advancement is in the design of tracking systems for floating solar panels. Tracking systems allow solar panels to follow the sun’s movement throughout the day, maximizing energy capture and improving overall efficiency. Recent innovations include the development of dual-axis tracking systems, which can adjust the panels’ orientation both vertically and horizontally, significantly increasing their energy output compared to fixed-position panels. These advanced tracking systems are particularly beneficial for floating solar installations, as the water’s surface allows for smooth and unobstructed movement of the panels.

In addition to tracking systems, there have been notable advancements in anchoring and mooring technologies. Effective anchoring and mooring are crucial for maintaining the stability and positioning of floating solar platforms. Innovations such as dynamic mooring systems, which can adjust to changes in water levels and environmental conditions, are being developed to enhance the reliability and safety of floating solar installations. These systems use advanced materials and engineering techniques to ensure that the floating platforms remain securely anchored even in challenging conditions.

The integration of smart technologies and IoT (Internet of Things) is also transforming the floating solar market. Smart monitoring systems equipped with sensors and IoT devices are being implemented to provide real-time data on the performance and condition of floating solar installations. These systems can monitor various parameters such as power output, panel temperature, and structural integrity, enabling proactive maintenance and optimizing system performance. The use of artificial intelligence (AI) and machine learning algorithms further enhances the ability to predict potential issues and optimize energy generation.

Furthermore, the trend toward hybrid renewable energy systems is gaining momentum. Floating solar panels are increasingly being integrated with other renewable energy sources such as hydropower, wind, and energy storage systems to create hybrid solutions that offer enhanced efficiency and reliability.

For example, combining floating solar with hydropower allows for the complementary use of resources, optimizing energy production and providing a more stable power supply. These hybrid systems are particularly advantageous in regions with variable weather conditions, as they can balance the fluctuations in energy generation from different sources.

The push for large-scale deployment of floating solar farms is also driving innovation. Large floating solar projects, such as those being developed in China, India, and Southeast Asia, are encouraging manufacturers and developers to create scalable and cost-effective solutions. Innovations in modular designs and streamlined installation processes are making it easier to deploy and expand floating solar installations on a large scale, reducing costs and improving feasibility.

Regional Analysis

The Asia Pacific region has emerged as a dominant force in the global floating solar panels market, securing a significant market share of 68.5%. This notable growth is primarily driven by the escalating demand for floating solar panels, fueled by their extensive use in critical sectors such as energy generation, particularly in regions with limited land availability.

The robust expansion of end-use industries and substantial advancements in technology are pivotal factors propelling the growth of the floating solar panels market in the Asia Pacific region. Countries such as China, Japan, South Korea, India, and Singapore are witnessing remarkable progress in floating solar panel research, development, and deployment, thus playing a central role in driving market expansion.

The energy generation, agriculture, and water management sectors, in particular, are instrumental in accelerating the adoption of floating solar panels across various applications, thereby significantly bolstering the market in the region.

In North America, the floating solar panels market has experienced notable growth, driven by the region’s overall technological innovation and commitment to sustainable practices. The increasing demand for efficient and eco-friendly energy solutions is primarily propelled by industries such as power generation, agriculture, and water conservation. This trend underscores the region’s emphasis on embracing renewable energy technologies and environmentally friendly practices across diverse sectors.

Europe is poised for substantial growth in the floating solar panels market, fueled by the rising demand from various industries, including energy generation, agriculture, and water management applications. The progress of the European market is further supported by the region’s dedication to sustainability and the increasing adoption of green practices, particularly in the energy and water sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

An analysis of key players in the Floating Solar Panels market reveals a competitive landscape characterized by innovation and strategic partnerships. Leading companies have emerged as prominent contributors to market growth, leveraging their expertise and resources to drive technological advancements and market penetration.

Market Key Players

- Kyocera Corporation

- Ciel & Terre International

- SPG Solar, Inc.

- Lanco Solar Energy Pvt. Ltd.

- Solaris Synergy Ltd.

- Sharp Corporation

- Floating Power Plant A/S

- BayWa r.e. Renewable Energy GmbH

- Ciel & Terre USA

- Trina Solar Limited

- SPG Energy Group

- Ocean Sun AS

Recent Developments

In 2023, Kyocera Corporation demonstrated its commitment to advancing floating solar panel technology by announcing partnerships with leading industry players and investing in research and development efforts aimed at enhancing product efficiency and durability.

In 2023, SPG Solar, Inc. intensified its efforts to bolster the floating solar panel market by announcing key partnerships and expanding its presence in emerging markets.

Report Scope

Report Features Description Market Value (2022) USD 1.2 Bn Forecast Revenue (2032) USD 5.0 Bn CAGR (2023-2032) 15.4% Base Year for Estimation 2022 Historic Period 2017-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Tracking Floating Solar Panels, Stationary Floating Solar Panels), By Technology(Thin Film, Monocrystalline, Polycrystalline, Others), By Capacity(Below 2 MW, 2 MW – 3 MW, 3 MW – 5 MW, 5 MW – 15 MW, Above 15 MW) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Kyocera Corporation, Ciel & Terre International, SPG Solar, Inc., Lanco Solar Energy Pvt. Ltd., Solaris Synergy Ltd., Sharp Corporation, Floating Power Plant A/S, BayWa r.e. Renewable Energy GmbH, Ciel & Terre USA, Trina Solar Limited, SPG Energy Group, Ocean Sun AS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Floating Solar Panels Market?Floating Solar Panels Market size is expected to be worth around USD 5.0 billion by 2033, from USD 1.2 billion in 2023

What CAGR is projected for the Floating Solar Panels Market?The Floating Solar Panels Market is expected to grow at 15.4% CAGR (2023-2033).Name the major industry players in the Floating Solar Panels Market?Kyocera Corporation, Ciel & Terre International, SPG Solar, Inc., Lanco Solar Energy Pvt. Ltd., Solaris Synergy Ltd., Sharp Corporation, Floating Power Plant A/S, BayWa r.e. Renewable Energy GmbH, Ciel & Terre USA, Trina Solar Limited, SPG Energy Group, Ocean Sun AS

Floating Solar Panels MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Floating Solar Panels MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Kyocera Corporation

- Ciel & Terre International

- SPG Solar, Inc.

- Lanco Solar Energy Pvt. Ltd.

- Solaris Synergy Ltd.

- Sharp Corporation

- Floating Power Plant A/S

- BayWa r.e. Renewable Energy GmbH

- Ciel & Terre USA

- Trina Solar Limited

- SPG Energy Group

- Ocean Sun AS