Global Floating Power Plant Market By Power Source [Non-renewable (Gas Turbines, IC Engines) Renewable (Solar and Wind)] By Power Rating (Low-power FPP, Medium-power FPP and High-power FPP) By Type (Ships, Barges and Others (Platforms. Etc.)), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 53891

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

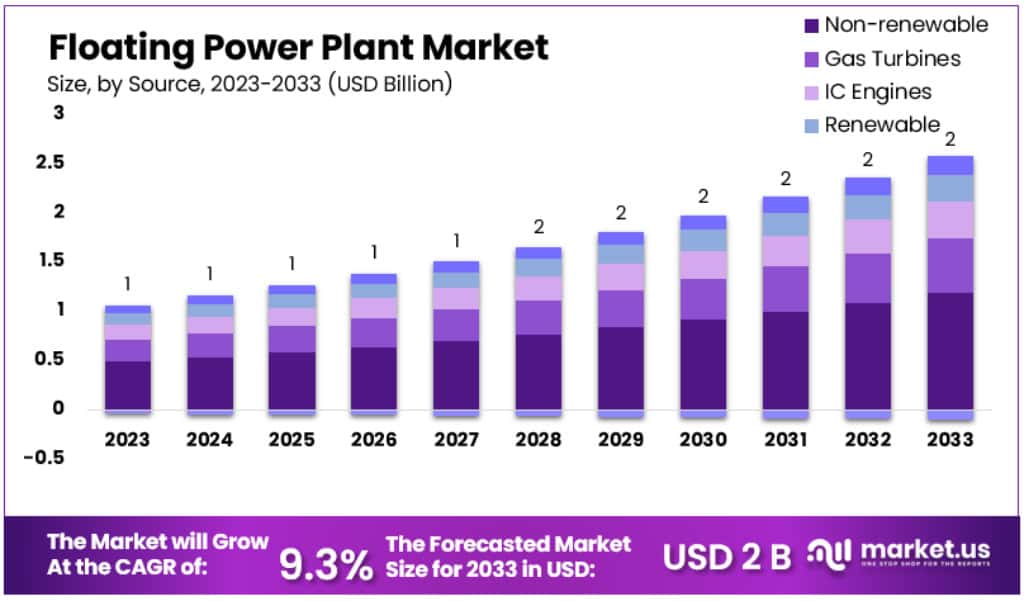

The Global Floating Power Plant Market size is expected to be worth around USD 2 Billion by 2033, from USD 1 Billion in 2023, growing at a CAGR of 9.3% during the forecast period from 2024 to 2033.

China is emerging as a key player in the floating power plant market, driven by the presence of major FPPs developers and a growing need for continuous power supply. The country’s commitment to solar energy, highlighted by the deployment of solar-operated floating power plants, is enhancing its energy infrastructure. Notably, in March 2019, the CECEP of China and France’s Ciel & Terre launched a significant floating solar power project in Anhui province. This project, featuring LONGi Solar’s technology and Ciel & Terre’s floats, marks a major step in advancing floatovoltaic technology.

Moreover, increasing global awareness of floating power plants benefits, such as rapid power delivery to infrastructure-limited regions, ease of relocation, minimal land requirements, and reliable power during disasters, is expected to fuel market growth. Stringent environmental regulations are also prompting greater adoption of floating power plants. Compared to traditional land-based power generation, floating power plants have a lower environmental impact and their growing use of renewable energy sources further enhances their market appeal.

Key Takeaways

- The Global Floating Power Plant Market is expected to reach USD 2 Billion by 2033.

- It had a market size of USD 1 Billion in 2023.

- The market is projected to grow at a CAGR of 9.3% from 2024 to 2033.

- In 2023, non-renewable sources held over 50% market share.

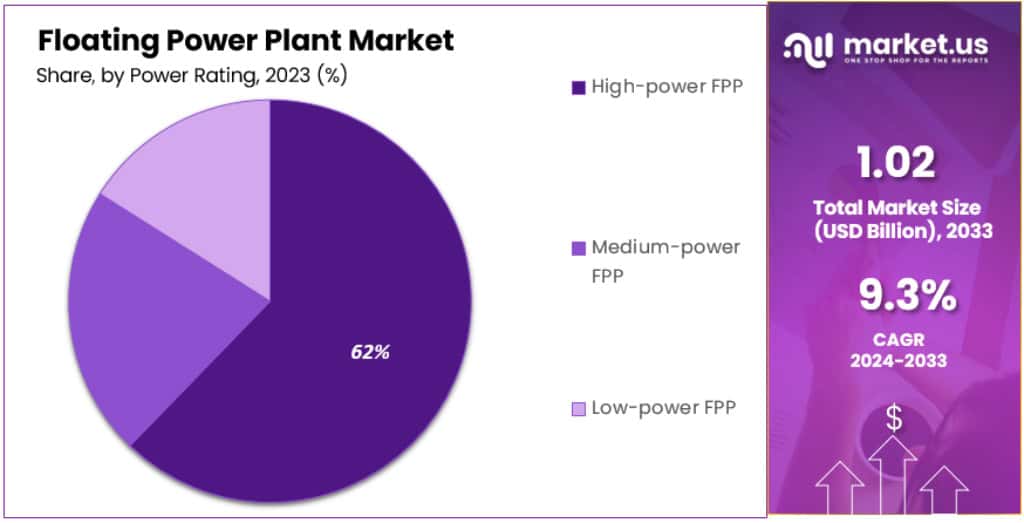

- High-power floating power plants captured over 66% of the market.

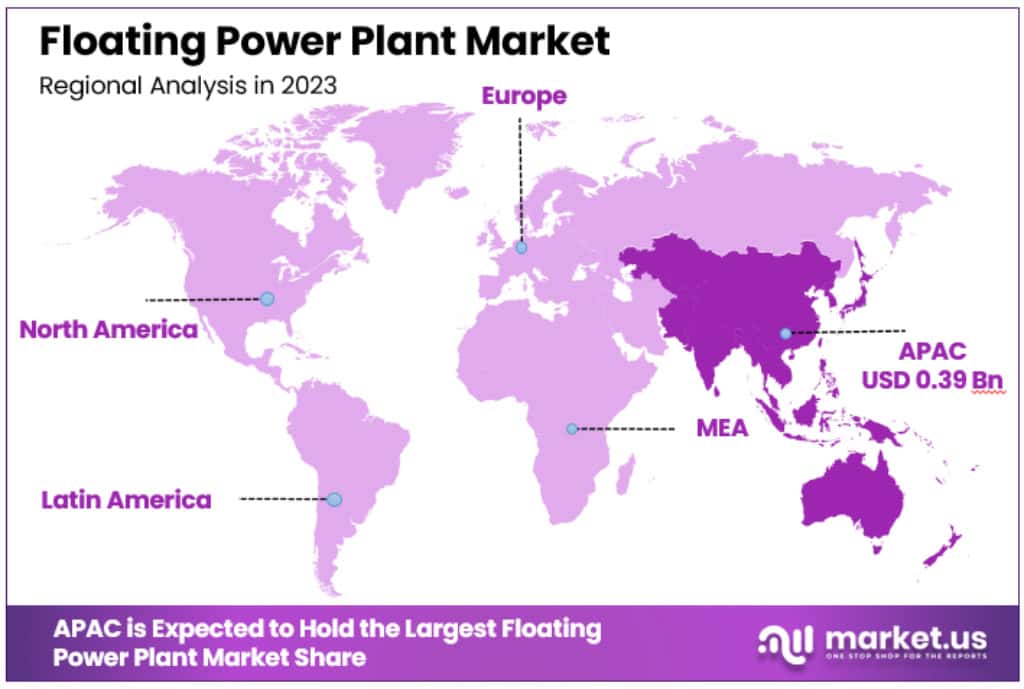

- The Asia Pacific region dominated the market with a 38% share, with USD 0.39 Billion in 2023.

Power Source Analysis

In 2023, the non-renewable segment held a dominant position in the Floating Power Plant (FPP) market, capturing over 50% of the total share. This dominance is primarily due to the high power density, reliability, and cost-effectiveness of gas turbines and internal combustion (IC) engine-based floating power plants. Leading manufacturers are focusing on enhancing the power output capacity of floating gas turbines, contributing to the segment’s growth. For instance, Siemens has developed the SGT-8000H-class industrial gas turbines, capable of producing 140 MW for their FPP facilities. The company has also expanded its seafloat turbine range to include large-scale gas turbines that can provide up to 1.2 GW of power. Offshore power plants are increasingly being supplied with natural gas from ships, supplemented by additional platforms equipped to convert liquid fuel into gas.

The renewable segment, including solar and wind power sources, is projected to grow at the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is supported by favorable environmental policies promoting the use of clean fuels for power generation. The scarcity of wind sites and the extensive land requirements for solar installations are driving the demand for renewable floating power plants.

Power Rating Analysis

In 2023, the high-power floating power plants segment maintained a dominant market position, capturing over 66% of the market share. This segment’s strong performance is largely due to substantial power demands in South Asian economies, including China, India, Singapore, and Malaysia. The high-power FPPs, typically used for large-scale power generation, have been crucial in meeting the growing energy needs fueled by continuous population growth and rapid infrastructure development in key industries such as healthcare, manufacturing, and construction.

However, the medium-power floating power plant segment, which encompasses plants with a capacity between 20.1 Megawatt to 100 Megawatt, is projected to experience growth over the forecast period. This growth is driven by the increasing number of renewable energy-based floating power plants projects.

A notable development in this segment was the announcement in January 2020 by the Electricity Generating Authority of Thailand and B.Grimm Power of an Engineering, Procurement, and Construction (EPC) contract for a hybrid hydro and solar energy floating power plant at the EGAT dam. This project, valued at USD ~25 million, is set to utilize 45 Megawatt capacity crystalline solar panels alongside the existing hydropower of Sirindhorn dam. The use of an HDPE plastic floating platform for this project highlights its eco-friendly and aquatic life-friendly nature. Initiatives like this are expected to encourage the construction of more medium-power floating power plants.

The low-power FPP segment, while smaller in comparison, also plays a crucial role, particularly in regions with limited power needs or where smaller-scale and agile power solutions are preferred. The diversity in power rating segments of FPPs ensures a comprehensive approach to meeting varied power demands across different geographical and industrial landscapes.

Key Market Segments

By Power Source

- Non-renewable

-

- IC Engines

-

- Gas Turbines

- Renewable

- Wind

-

- Solar

By Power Rating

- Low-power FPP

- Medium-power FPP

- High-power FPP

By Type

- Ships

- Barges

- Others (Platforms. Etc.)

Drivers

- Surge in Demand for Green Energy: There’s a growing global shift towards sustainable energy sources. FPPs align well with this trend, offering a green energy solution by harnessing renewable resources like solar, wind, and tidal energy. The market is further propelled by government incentives and policy support for green energy adoption.

- Technological Advancements: Innovations in floating platform technologies enhance the efficiency, reliability, and economic viability of FPPs. Improved designs, materials, mooring systems, and the incorporation of digital technologies like IoT are key drivers in market growth.

- High Energy Demand in End-use Industries: Industries such as manufacturing, technology, and heavy industry are transitioning towards cleaner energy sources. FPPs, with their ability to be installed near these energy-intensive sectors, are increasingly in demand.

Restraints

- High Initial Capital Cost and Regulatory Challenges: The substantial upfront investment required for FPPs, coupled with complex regulatory and permitting processes, poses significant challenges. These factors can deter potential investors and delay project timelines.

- Dependency on Weather Conditions: The intermittent nature of renewable energy sources, dependent on conditions like wind speed and solar irradiation, can impact grid stability and reliability of power supply from FPPs.

Opportunities

- Thin-film Flexible FPP Solutions: New companies are introducing innovative thin-film flexible FPP systems that adapt to wave motions and catch solar energy from various angles. These solutions are more compact, eco-friendly, and suitable for a variety of locations.

- Increasing Investments in Renewable Energy: With the rise in global awareness and commitment to reducing carbon footprints, there’s a surge in investments in renewable energy sectors, providing ample opportunities for the growth of FPPs.

Challenges

- Weather-related Instabilities: Rough weather conditions like cyclones or tsunamis can destabilize floating structures, posing a significant challenge to the durability and reliability of FPPs.

Trends

- Rising Global Energy Consumption: The increasing demand for energy due to rapid industrialization and changes in lifestyle has led to a higher consumption rate, fueling the growth of the FPP market. For instance, the International Energy Agency reported a 4% increase in electricity demand, reaching 1,000 TWh in April 2021.

- Growth in Renewable Energy Installations: The renewable segment, particularly solar and wind installations, is expected to dominate the FPP market. For example, the global offshore wind installation reached 28,308 MW in 2019, up from 23,629 MW in 2018.

Regional Analysis

In 2023, the Asia Pacific region dominated the Floating Power Plant market, holding a significant 38% share with a market value of USD 0.39 billion. This leading position is largely attributed to the lack of power infrastructure and the high adoption rate of renewable energy sources in rapidly developing economies such as China and India. The region’s market is expanding at the fastest CAGR, driven by an increasing number of renewable energy-based FPP projects and major market players investing in the area. However, challenges like higher installation and maintenance costs of sea-based plants may slightly hinder growth.

Europe, holding the second-largest market share, is expected to continue its strong performance. Countries in Europe are heavily investing in FPPs, aligning with the European Union’s targets for cleaner energy generation. Notable developments include Total S.A’s acquisition of an 80% share in the UK’s floating wind project Erebus, which is expected to have a 96 MW capacity. The demand for FPPs in Europe is anticipated to rise at a CAGR of ~9% during the forecast period, with key countries like Italy, the United Kingdom, and Germany focusing on installing new power plants to reduce reliance on fossil fuels and minimize environmental impact. For instance, in April 2022, Germany’s BayWa r.e. AG announced the operation of a new floating solar power plant on a quarry lake.

North America, particularly the United States and Canada, is also expected to show significant growth. The U.S. market alone is valued at US$ ~500 million in 2023, with a strong focus on developing LNG-based power ships and well-established nuclear and solar farms. The region’s growth is propelled by stringent regulatory reforms focusing on cleaner power generation.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

In the Floating Power Plant (FPP) market, key industry participants are increasingly focusing on local production to reduce emissions, lower logistics costs, and support local employment. This approach not only minimizes environmental impact but also enhances economic benefits in the production regions. The adaptability, mobility, and versatility of FPPs make them a less risky investment, appealing to operators in this sector.

Leading players are actively engaging in strategic partnerships, which allow them to pool expertise across different segments of the FPP supply chain. This collaboration reduces overall project costs and fosters innovative solutions. Notable companies in the market are investing in research and development to advance FPP technologies. Their focus areas include enhancing energy conversion efficiency, refining platform designs, improving mooring systems, and integrating energy storage technologies. Such innovations provide these companies with a competitive edge.

The market is characterized by various strategic moves such as mergers, acquisitions, and portfolio expansions, as companies aim to maintain and grow their market presence. These strategies, along with a strong focus on product quality and standards, are key to increasing revenue in this competitive landscape.

Key players like MAN Diesel & Turbo, Karadeniz Holding A.Ş., and Ciel & Terre International, among others, are making significant investments in research and development. This investment is crucial for fostering market demand and staying ahead in an increasingly competitive and evolving market. Manufacturing locally is a strategic approach employed by these companies to offer cost-effective products to their clients and expand their market share.

Market Key Players

- Kawasaki Heavy Industries Ltd.

- Ciel & Terre International

- Wärtsilä

- Floating Power Plant A/S

- Siemens Gas and Power GmbH & Co.

- Kyocera Corporation

- Waller Marine Inc.

- Karadeniz Holding A.S.

- Siemens AG

- General Electric

- Iberdrola, S.A

- Caterpillar Inc.

- MAN Diesel and Turbo SE

- Mitsubishi Corporation

- Principle Power, Inc.

- STX Corporation

- Other companies

Recent Developments

- April 2023: Wärtsilä, along with partners Hoegh LNG, IFE, University of South-East Norway, Sustainable Energy, and BASF SE, secured approximately EUR 5.9 million in funding from the Norwegian Government for floating power plant initiatives.

- April 2023: Wärtsilä renewed its Operation & Maintenance agreement with Gera Amazonas, a Brazil-based independent energy producer, reinforcing its commitment to reliable energy provision in Brazil.

- September 2023: Principle Power revealed the fourth generation of its Wind Float concept, designed to lower industrialization costs and adapt to various regional supply chain capabilities and port characteristics.

- April 2022: BayWa r.e. AG in Germany declared the commencement of a new floating solar power plant on a quarry lake. This development is aimed at reducing Germany’s reliance on Russian fossil fuels.

- May 2021: GE researchers, under the ARPA-E’s ATLANTIS program, revealed an ongoing US$ 4 million project to develop advanced controls for a 12 MW Floating Offshore Wind Turbine. This project, in collaboration with Glosten and PelaStar, aims to innovate in the floating wind turbine domain.

- May 2021: Adani Green Energy Ltd. (AGEL) acquired SB Energy India from SoftBank Group (SBG) and Bharti Group. This acquisition significantly bolsters AGEL’s renewable energy portfolio, adding 4,954 MW.

- September 2021: Linxon introduced a pioneering floating substation technology designed to reduce the carbon footprint of the electrical grid while supporting renewable electricity production.

- August 2021: Falck Renewables SpA and BlueFloat Energy announced a joint initiative to develop floating offshore wind farms along the Italian coast, marking a significant step in Italy’s renewable energy sector.

Report Scope

Report Features Description Market Value (2023) USD 1 Billion Forecast Revenue (2033) USD 2 Billion CAGR (2024-2033) 9.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Source [Non-renewable (Gas Turbines, IC Engines) Renewable (Solar and Wind)] By Power Rating (Low-power FPP, Medium-power FPP and High-power FPP) By Type (Ships, Barges and Others (Platforms. Etc.)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kawasaki Heavy Industries Ltd., Ciel & Terre International, Wärtsilä, Floating Power Plant A/S, Siemens Gas and Power GmbH & Co., Kyocera Corporation, Waller Marine Inc., Karadeniz Holding A.S., Siemens AG, General Electric, Iberdrola, S.A, Caterpillar Inc., MAN Diesel and Turbo SE, Mitsubishi Corporation, Principle Power, Inc., STX Corporation. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Floating Power Plant Market in 2023?The Floating Power Plant Market size was USD 1 Billion in 2023.

What is the projected CAGR at which the Floating Power Plant Market is expected to grow at?The Floating Power Plant Market is expected to grow at a CAGR of 9.3% (2024-2033).

List the key industry players of the Floating Power Plant Market?Kawasaki Heavy Industries Ltd., Ciel & Terre International, Wärtsilä, Floating Power Plant A/S, Siemens Gas and Power GmbH & Co., Kyocera Corporation, Waller Marine Inc., Karadeniz Holding A.S., Siemens AG, General Electric, Iberdrola, S.A, Caterpillar Inc., MAN Diesel and Turbo SE, Mitsubishi Corporation, Principle Power, Inc., STX Corporation and Other Key Players are engaged in the Floating Power Plant market

Floating Power Plant MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Floating Power Plant MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Kawasaki Heavy Industries Ltd.

- Ciel & Terre International

- Wärtsilä

- Floating Power Plant A/S

- Siemens Gas and Power GmbH & Co.

- Kyocera Corporation

- Waller Marine Inc.

- Karadeniz Holding A.S.

- Siemens AG

- General Electric

- Iberdrola, S.A

- Caterpillar Inc.

- MAN Diesel and Turbo SE

- Mitsubishi Corporation

- Principle Power, Inc.

- STX Corporation

- Other companies