Global Flip Flops Market Report By Material Type (PVC, EVA, Rubber), By Design Type (Printed Flip Flops, Classic Flip Flops, Fashion-forward Flip Flops, Ergonomic and Supportive Flip Flops), By End-User (Male, Female), By Distribution Channel (Online Platform, Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 12439

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

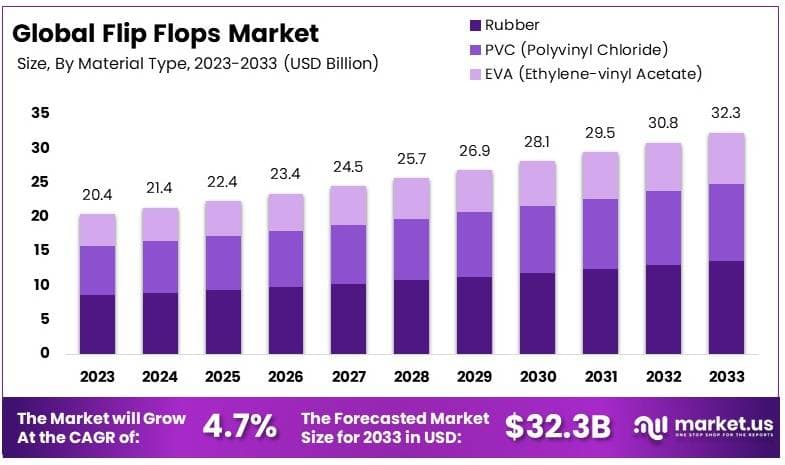

The Global Flip Flops Market size is expected to be worth around USD 32.3 Billion by 2033, from USD 20.4 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Flip flops are simple, open-toed sandals with a flat sole, typically held on the foot by a Y-shaped strap that goes between the first and second toes. They are lightweight, easy to wear, and often used in casual settings or warm weather. Their design offers comfort and convenience, making them a popular choice for people of all ages.

The flip flops market refers to the global industry focused on the production, distribution, and sale of flip flops. This market includes various brands, ranging from low-cost to high-end designer flip flops. It is driven by factors such as fashion trends, consumer preferences for comfortable footwear, and the demand for casual, everyday shoes. The market covers both offline and online retail channels.

The growth of the flip flops market can be attributed to several factors. Rising demand for comfortable and affordable footwear has increased the consumption of flip flops globally. Additionally, fashion brands have started introducing innovative designs and sustainable materials, which have also contributed to market expansion. The growing trend of casual dressing in workplaces has further fueled demand for flip flops.

The demand for flip flops is largely driven by their versatility and comfort. Consumers seek footwear that is not only functional but also fashionable. The demand is higher during warmer seasons and in regions with tropical climates. E-commerce platforms have also contributed to increased sales, as online platforms offer a wide range of options, styles, and price points.

There are several opportunities for growth in the flip flops market. Companies that focus on sustainability by using recyclable or biodegradable materials have a chance to capture a significant share of the market. Additionally, expansion into emerging markets, particularly in Asia and Latin America, presents potential due to growing disposable incomes and increasing awareness of global fashion trends.

Notably, over 1 billion flip-flops are produced annually, contributing significantly to plastic pollution. To address this, there have been substantial efforts to develop biodegradable plastics, such as algae-based flip-flops. This trend is further supported by rising consumer awareness of environmental issues and a preference for sustainable products.

For instance, the University of California, San Diego, has developed flip-flops made from algae oil, which are designed to break down in approximately 18 weeks under composting conditions. This shift towards sustainable materials highlights the growing importance of innovation in reducing environmental impact.

Additionally, the demand for comfortable, casual footwear, particularly in leisure and tourism, is contributing to market expansion. Government policies, such as the U.S. National Travel and Tourism Strategy that aims to welcome 90 million international visitors by 2027, are expected to boost demand for beachwear and casual footwear, including flip-flops.

The rise in tourism, particularly beach tourism, also plays a crucial role in increasing demand for flip-flops. Government initiatives aimed at boosting tourism are expected to create opportunities for market expansion. For example, the U.S. National Travel and Tourism Strategy is projected to increase demand for casual footwear among international tourists.

Additionally, the surge in e-commerce and online search trends, such as the 53% increase in flip-flop searches in the U.K. during summer 2020, underscores the opportunity for brands to capture consumer interest through online channels.

Key Takeaways

- Flip Flops Market was valued at USD 20.4 Billion in 2023, and is expected to reach USD 32.3 Billion by 2033, with a CAGR of 4.7%.

- In 2023, Rubber material dominates the market with 42% due to its durability and flexibility in flip-flop production.

- In 2023, Female end-users lead with 67%, highlighting the demand for fashionable and comfortable footwear among women.

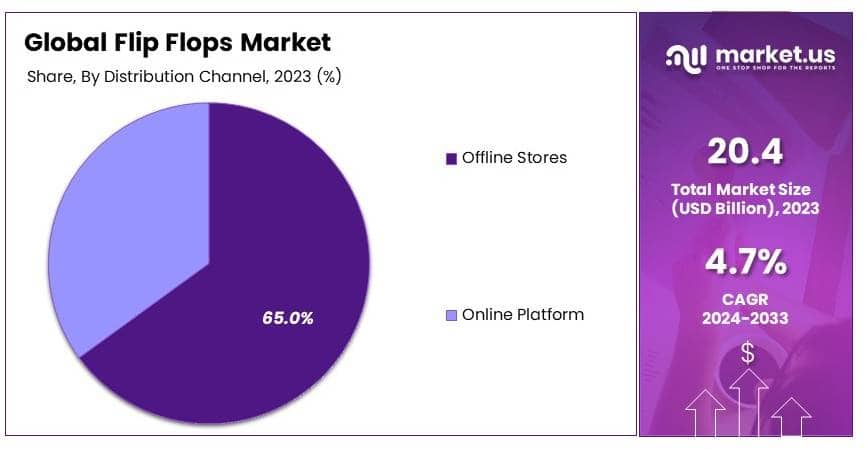

- In 2023, Offline distribution accounts for 65%, emphasizing customer preference for in-store purchase experiences.

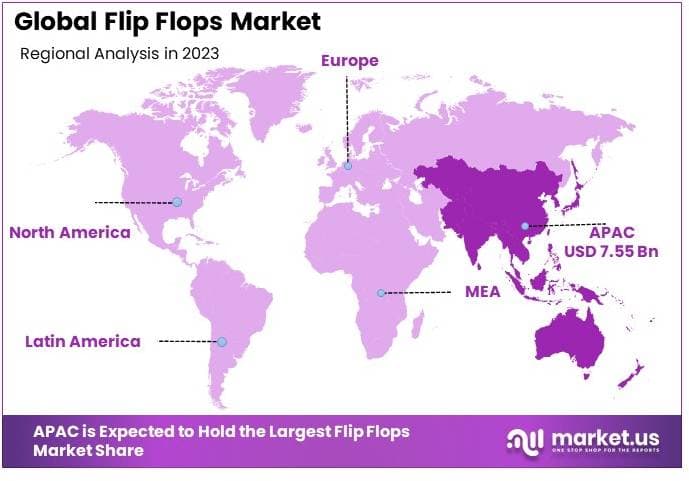

- In 2023, Asia-Pacific dominates with 37% market share, driven by high population and increasing disposable incomes.

Type Analysis

Rubber dominates with 42% due to its durability and cost-effectiveness.

The Flip Flops Market, segmented by material type, showcases Rubber as the dominant sub-segment, holding a significant 42% market share. This predominance can be attributed to the material’s inherent attributes such as durability, flexibility, and water resistance, which make it highly suitable for prolonged and versatile usage.

Rubber flip flops are favored for their longevity and economic value, which resonate well with consumers seeking affordable yet reliable footwear options.

Beyond its primary advantages, the production of rubber flip flops is relatively less complex and resource-intensive compared to alternatives like PVC and EVA (Ethylene-vinyl Acetate), contributing to its larger market share. Manufacturers benefit from the lower cost of raw materials and simplified production processes, enabling them to offer competitive pricing in the global market.

Additionally, the environmental impact of rubber, when sourced sustainably, is comparatively lower than synthetic alternatives, aligning with the growing consumer preference for eco-friendly products. This trend is bolstered by innovations in recycling processes and the introduction of organic and natural rubber materials, which further enhance the market appeal of rubber flip flops.

In contrast, other materials such as Polyvinyl Chloride and EVA, though significant, hold smaller shares of the market. PVC, known for its moldability and vivid color options, caters to a niche market that prioritizes style and aesthetic variety. Meanwhile, EVA stands out in the comfort segment due to its lightweight material and cushioning properties, appealing to consumers who prioritize ease and orthopedic support.

Each material type, while overshadowed by rubber in terms of market dominance, plays a critical role in diversifying the product offerings and catering to specific consumer needs, which collectively drive the growth of the flip flops market.

End-User Analysis

Female dominates with 67% due to comfort and style preferences.

In the segmentation by end-user, female consumers represent the largest market share at 67%, underscoring their significant influence in the flip flops industry. This segment’s dominance is largely driven by the diverse requirements female consumers place on footwear, including the need for a balance of comfort, style, and versatility.

Flip flops designed for women often incorporate a range of aesthetic elements such as color variety, embellishments, and design innovations that align with current fashion trends.

The preference among women for flip flops can also be linked to their applicability in various settings, from casual outings to beachwear and even certain formal occasions, provided the design and materials are appropriate.

This versatility has enabled a broader adoption of flip flops by female consumers, further supported by targeted marketing campaigns and the development of fashion-forward and ergonomic models that cater specifically to women’s health and style preferences.

While female consumers dominate this segment, male and unisex designs also contribute to market dynamics, offering growth opportunities through inclusive marketing and product innovations aimed at comfort and durability. These efforts ensure that the flip flops market remains inclusive, appealing to a broad consumer base and supporting overall market growth through diversified product offerings.

Distribution Channel Analysis

Offline dominates with 65% due to personalized shopping experiences.

Regarding the distribution channel, offline stores hold the majority share at 65%, illustrating the continued preference for physical retail experiences in the purchase of flip flops. This segment’s strength is largely due to the tactile nature of shopping for footwear, where consumers prefer to try on different styles and sizes for optimal fit and comfort before making a purchase.

Offline channels offer the advantage of immediate product availability and the ability to provide personalized services, which enhance consumer satisfaction and loyalty.

The offline retail landscape for flip flops is diverse, ranging from large department stores and specialized boutiques to seasonal vendors at beaches and tourist spots. These venues are strategically important for capturing impulse buys and catering to the immediate needs of consumers, particularly during peak travel seasons when flip flops are in high demand.

However, the role of online platforms cannot be underestimated, as they have been growing steadily, driven by the convenience of home shopping and a wider selection of products. The online segment is bolstered by the increasing integration of advanced technologies like virtual try-on and easy return policies, which are narrowing the gap between the convenience of online shopping and the assurance of traditional retail.

Key Market Segments

By Material Type

- PVC (Polyvinyl Chloride)

- EVA (Ethylene-vinyl Acetate)

- Rubber

By Design Type

- Printed Flip Flops

- Classic Flip Flops

- Fashion-forward Flip Flops

- Ergonomic and Supportive Flip Flops

By End-User

- Male

- Female

By Distribution Channel

- Online Platform

- Offline Stores

Driver

Increasing Seasonal Demand Drives Market Growth

The Flip Flops Market benefits significantly from the surge in seasonal demand, particularly during warmer months and holiday seasons. This heightened demand drives sales as consumers seek comfortable and stylish footwear suitable for summer activities and vacations.

Additionally, rising tourism activities contribute to the market’s expansion, with travelers opting for flip flops as their preferred choice of footwear due to their ease of use and versatility. Affordable pricing remains a crucial factor, making flip flops accessible to a broad consumer base and encouraging repeat purchases.

Furthermore, the growing casual fashion trend emphasizes the importance of relaxed and comfortable attire, positioning flip flops as a staple in casual wardrobes. These driving factors collectively enhance the market’s growth trajectory by aligning product offerings with consumer preferences and seasonal needs.

As more individuals prioritize comfort and style in their everyday footwear, the demand for flip flops continues to rise, reinforcing their position in the market. The combination of these elements creates a robust foundation for sustained market expansion, allowing manufacturers and retailers to capitalize on peak seasons and maintain consistent sales throughout the year.

Restraint

Limited Weather Suitability Restraints Market Growth

The Flip Flops Market faces challenges due to the limited weather suitability of the product, restricting its use primarily to warmer climates and seasons. This seasonal dependency limits year-round sales potential, as consumers are less likely to purchase flip flops during colder months or in regions with unpredictable weather patterns.

Additionally, the perception of low durability can deter consumers from investing in flip flops, as they may view them as less resilient compared to other types of footwear. High competition from alternative footwear options further restrains market growth, as consumers have a wide array of choices that may offer greater versatility or longevity.

Moreover, fluctuating raw material costs can impact profit margins, making it challenging for manufacturers to maintain competitive pricing without compromising quality. These restraining factors collectively hinder the market’s ability to achieve consistent growth, as they introduce barriers that limit consumer adoption and market penetration.

Addressing these challenges requires strategic initiatives, such as enhancing product durability, diversifying offerings to include seasonal variants, and optimizing supply chain efficiencies to manage cost fluctuations effectively.

Opportunity

Expansion in Emerging Markets Provides Opportunities

The Flip Flops Market is poised for significant growth through expansion into emerging markets, where rising disposable incomes and increasing urbanization present new consumer bases. As economies develop, more individuals have the financial means to purchase branded and higher-quality flip flops, driving demand.

Innovation in sustainable materials also offers substantial growth opportunities, as consumers become more environmentally conscious and seek eco-friendly footwear options. Brands that prioritize sustainability can differentiate themselves and attract a loyal customer base.

Additionally, customization and personalization trends enable companies to offer tailored products that meet individual consumer preferences, enhancing customer satisfaction and loyalty. The growth of e-commerce further amplifies these opportunities by providing platforms for reaching a global audience with lower overhead costs.

By leveraging these opportunities, market players can expand their reach, diversify their product lines, and tap into new revenue streams, thereby fostering long-term growth and competitiveness in the Flip Flops Market.

Challenge

Supply Chain Disruptions Challenge Market Growth

The Flip Flops Market encounters significant challenges due to supply chain disruptions, which can impede production and distribution processes. Factors such as geopolitical tensions, natural disasters, and pandemics can disrupt the steady flow of raw materials and finished products, leading to delays and increased costs.

Additionally, changing consumer preferences present a constant challenge, as brands must continuously adapt to evolving trends and demands to remain relevant. Regulatory compliance also poses hurdles, requiring companies to navigate complex legal landscapes and adhere to varying standards across different regions.

Intense market competition further exacerbates these challenges, as numerous brands vie for market share, necessitating constant innovation and strategic differentiation. These challenging factors collectively impact the market’s ability to maintain consistent growth and profitability.

To overcome these obstacles, companies must invest in resilient supply chain strategies, stay attuned to consumer trends, ensure compliance with regulations, and differentiate their offerings to sustain a competitive edge in the dynamic Flip Flops Market.

Growth Factors

Increased Disposable Income Is Growth Factors

The Flip Flops Market is experiencing robust growth driven by increased disposable income among consumers, enabling higher spending on non-essential items such as fashion footwear. As disposable incomes rise, individuals are more inclined to invest in quality and branded flip flops, seeking products that offer both style and comfort.

Urbanization further contributes to market growth by expanding the consumer base in metropolitan areas, where fashion trends and lifestyle preferences heavily influence purchasing decisions. Rising health consciousness also plays a role, as consumers opt for comfortable and ergonomic flip flops that support foot health during daily activities.

Additionally, the globalization of brands allows for greater market penetration, as international brands enter new regions and establish a presence, broadening consumer choices and fostering competitive pricing.

These growth factors collectively enhance the market’s expansion prospects, providing ample opportunities for brands to innovate, diversify their product lines, and cater to the evolving needs of a financially empowered and health-conscious consumer base.

Emerging Trends

Eco-Friendly Flip Flops Are Latest Trending Factor

Eco-friendly flip flops have emerged as the latest trending factor in the Flip Flops Market, reflecting a growing consumer preference for sustainable and environmentally responsible products. Manufacturers are increasingly utilizing recycled materials and eco-friendly production processes to cater to this demand, thereby reducing the environmental footprint of their products.

Technological integration, such as the incorporation of smart features, is also gaining traction, offering enhanced functionality and appealing to tech-savvy consumers. Influencer marketing platform plays a pivotal role in driving trends, as social media influencers promote eco-friendly and innovative flip flop designs to their followers, amplifying brand visibility and desirability.

Additionally, diverse design patterns and vibrant colors attract a broader audience, allowing consumers to express their individuality and style preferences through their footwear choices. These trending factors collectively enhance the market’s appeal, fostering increased consumer engagement and driving sales growth.

By aligning product offerings with current trends, brands can capitalize on the evolving market dynamics and maintain a competitive edge in the Flip Flops Market.

Regional Analysis

Asia-Pacific Dominates with 37% Market Share

Asia-Pacific leads the Flip Flops Market with a 37% market share was valued at USD 7.55 Bn, reflecting its strong position driven by a combination of high population density and warm climates. The region’s dominance is supported by high demand in countries like China, India, and Thailand, where flip-flops are favored due to their affordability, comfort, and everyday utility.

Key factors contributing to this large market share include the cost-effective production of flip flops in many Asia-Pacific countries, where manufacturers benefit from low labor costs and abundant raw materials. Additionally, the region’s vast distribution networks ensure that flip-flops are easily available, both in local markets and through growing online sales channels. The prevalence of outdoor and beach cultures in the region further enhances the demand for this casual footwear.

Regional dynamics such as economic growth and urbanization play a significant role in increasing disposable incomes, thereby boosting consumer spending on flip flops and other low-cost footwear. The flip flops market also benefits from a rapidly growing middle class, particularly in Southeast Asia, where consumers increasingly prioritize comfort and fashion in their everyday wear.

Regional Mentions:- North America: North America holds a solid position in the flip flops market, driven by summer tourism and outdoor activities. The focus on high-quality materials and branded products appeals to the region’s fashion-conscious consumers.

- Europe: Europe’s flip flop market is influenced by seasonal demand and vacation trends. The region emphasizes eco-friendly materials and sustainable practices, reflecting its focus on environmental responsibility.

- Middle East & Africa: The warm climate in the Middle East and Africa makes flip flops a practical choice, with growth driven by increasing urbanization and a rising middle class. The region is also seeing more affordable imports.

- Latin America: Latin America shows steady growth in the flip flops market, supported by its warm weather and vibrant beach culture. Demand is particularly strong in Brazil, where flip flops are a popular footwear choice year-round.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The flip flops market is highly competitive, with several leading players holding significant influence over global sales, innovation, and consumer preferences. Among the top companies, Havaianas, Skechers USA Inc., and Crocs Inc. stand out as key market drivers due to their strong brand recognition, strategic positioning, and expansive global reach.

Havaianas is a dominant player, widely recognized for its strong association with casual footwear. The brand has become synonymous with flip flops, offering a wide range of styles and vibrant designs that appeal to a broad consumer base. With a strong presence in Latin America and expanding influence in other regions, Havaianas benefits from a loyal customer following.

Skechers USA Inc. holds a significant market share through its broad product portfolio, offering affordable yet stylish flip flops. The company has leveraged its global presence and extensive distribution network, particularly in North America and Asia-Pacific, to capture a large portion of the market. Skechers focuses on comfort and value, which appeals to a wide range of customers, from budget-conscious buyers to fashion-forward consumers.

Crocs Inc. has made a strong impact with its distinctive, foam-based flip flops. The company’s innovative designs and material choices have allowed it to build a unique brand identity. Crocs’ focus on comfort, versatility, and bold aesthetics has resonated well with younger consumers and trendsetters. The company continues to expand its product line, which includes both functional and fashionable flip flops, positioning itself as a key influencer in the market.

Together, these companies drive significant innovation and growth in the global flip flops market, shaping trends and meeting evolving consumer demands.

Top Key Players in the Market

- Havaianas

- Skechers USA Inc.

- Crocs Inc.

- Deckers Brands

- C&J Clark International Limited

- Fat Face

- Adidas AG

- Kappa

- Nike, Inc.

- Tory Burch LLC

- Puma SE

- Reebok

- Under Armour Inc.

- VE Corporation

- Teva

- Rainbow Sandals

- Other Key Players

Recent Developments

- Relaxo Footwear Limited: October 2024 – Relaxo Footwear Limited, India’s largest footwear manufacturer, officially entered the Filipino market, introducing its iconic flip-flop range. The company, known for its durable, high-quality footwear at affordable prices, aims to cater to the Visayas and Mindanao regions, providing Filipino consumers with comfortable and long-lasting footwear.

- Nanyang: September 2024 – Nanyang, a renowned Thai footwear brand, launched a new line of sandals inspired by the famous “Moo Deng” school shoes to reinvigorate its market position. The Moo Deng sandals draw on the brand’s heritage and are aimed at appealing to a younger demographic while maintaining its commitment to affordability and durability.

- Bombas: September 2024 – Bombas, the popular comfort-focused clothing brand, introduced a new product, the Friday Slide, which emphasizes ease and relaxation. These slip-on sandals are designed for casual wear, offering comfort and style in line with the brand’s ethos of functionality and social good.

- DSI: April 2024 – DSI, a leading Sri Lankan footwear manufacturer, unveiled a premium line of flip-flops called “Islander,” catering to the upper segment of the market. This new range combines superior materials and innovative design aimed at providing both style and comfort.

Report Scope

Report Features Description Market Value (2023) USD 20.4 Billion Forecast Revenue (2033) USD 32.3 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (PVC, EVA, Rubber), By Design Type (Printed Flip Flops, Classic Flip Flops, Fashion-forward Flip Flops, Ergonomic and Supportive Flip Flops), By End-User (Male, Female), By Distribution Channel (Online Platform, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Havaianas, Skechers USA Inc., Crocs Inc, Deckers Brands, C&J Clark International Limited, Fat Face, Adidas AG, Kappa, Nike, Inc., Tory Burch LLC, Puma SE, Reebok, Under Armour Inc, VE Corporation, Teva, Rainbow Sandals, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Havaianas

- Skechers USA Inc.

- Crocs Inc.

- Deckers Brands

- C&J Clark International Limited

- Fat Face

- Adidas AG

- Kappa

- Nike, Inc.

- Tory Burch LLC

- Puma SE

- Reebok

- Under Armour Inc.

- VE Corporation

- Teva

- Rainbow Sandals

- Other Key Players