Global Flaxseeds Market Size, Share, Growth Analysis By Product (Ground Flax Seed, Whole Flax Seed), By Type (Brown, Golden), By End-User (Food, Pet Food, Dietary Supplements, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157956

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

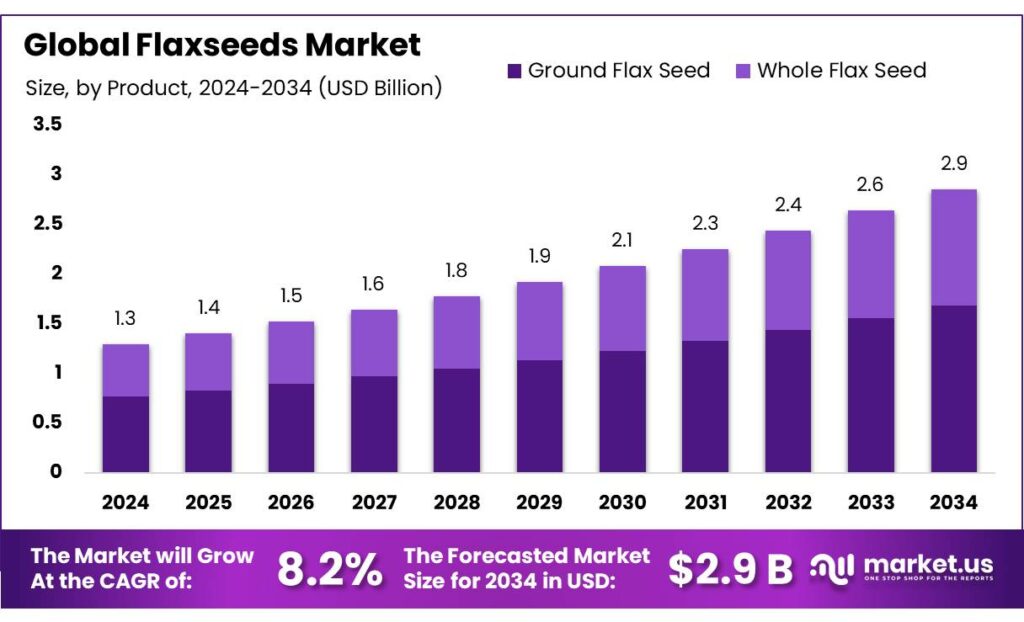

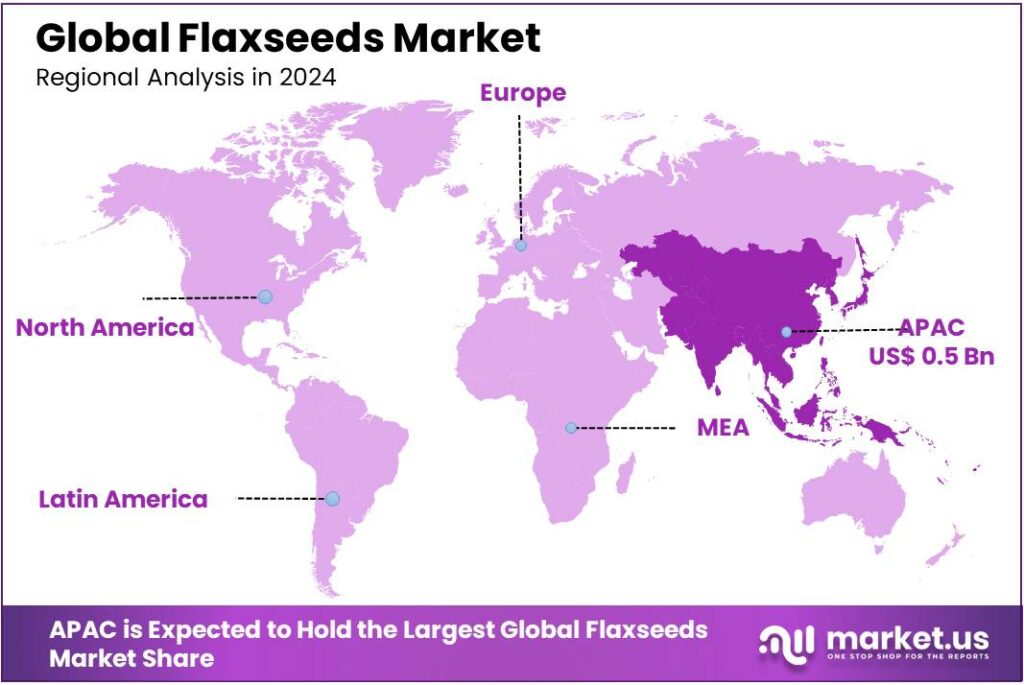

The Global Flaxseeds Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 41.20% share, holding USD 0.5 Billion in revenue.

Flaxseed, scientifically known as Linum usitatissimum, is a versatile crop cultivated primarily for its seeds, which are rich in omega-3 fatty acids, dietary fiber, and lignans. These nutritional benefits have positioned flaxseed as a valuable component in both food and industrial applications, including pharmaceuticals, cosmetics, and bio-based materials.

The demand for flaxseed is driven by its nutritional benefits, including high content of omega-3 fatty acids, lignans, and dietary fiber. These properties make it a valuable ingredient in functional foods, dietary supplements, and animal feed. The global market for flaxseed is expanding, with increasing awareness of its health benefits contributing to higher consumption rates. In India, the processed food sector, which includes flaxseed-based products, saw exports amounting to USD 10.09 billion in 2024–2025, indicating a growing market for such products.

India ranks fifth globally in linseed production, accounting for approximately 3.18% of the world’s output. Despite this, the country’s production is limited compared to leading producers like Russia, Kazakhstan, Canada, and China. In 2023, Kazakhstan’s flaxseed production saw a significant decline of 57%, dropping from 845,600 tons in 2022 to 361,700 tons, primarily due to adverse weather conditions and reduced cultivation areas. This decline presents an opportunity for India to enhance its production and export capabilities.

Additionally, the Ministry of Food Processing Industries (MoFPI) has approved the One District One Product (ODOP) scheme for 713 districts across 35 states and Union Territories, aiming to promote unique local products, which may include flaxseed-based products.

Key Takeaways

- Flaxseeds Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 8.2%.

- Ground Flax Seed held a dominant market position, capturing more than a 64.8% share.

- Golden flax seed held a dominant position in the global market, capturing more than a 53.5% share.

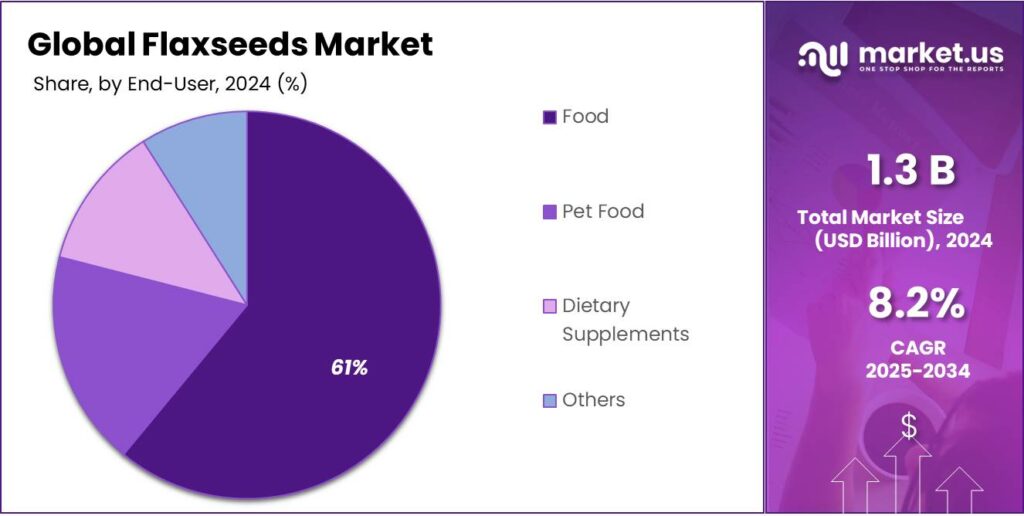

- Food industry emerged as the leading end-user of flaxseeds, capturing over 61.6% of the global market share.

- Asia Pacific region emerged as the dominant player in the global flaxseed market, capturing a significant 41.20% share, valued at approximately USD 0.5 billion.

By Product Analysis

Ground Flax Seed Leads the Market with 64.8% Share in 2024

In 2024, Ground Flax Seed held a dominant market position, capturing more than a 64.8% share, according to industry reports. This segment’s growth is driven by its widespread application in various industries, including food and beverages, animal feed, and nutraceuticals. The increasing consumer preference for plant-based and functional foods has further bolstered the demand for ground flax seeds.

By Type Analysis

Golden Flax Seed Leads with 53.5% Market Share in 2024

In 2024, Golden flax seed held a dominant position in the global market, capturing more than a 53.5% share. This segment’s popularity is attributed to its appealing light color and mild flavor, which make it a preferred choice for consumers seeking aesthetically pleasing and palatable options. Golden flax seeds are rich in essential nutrients such as omega-3 fatty acids, fiber, and antioxidants, aligning with the growing consumer demand for health-conscious and functional foods.

By End-User Analysis

Food Sector Dominates Flaxseed Market with 61.6% Share in 2024

In 2024, the food industry emerged as the leading end-user of flaxseeds, capturing over 61.6% of the global market share. This dominance underscores the growing consumer preference for functional foods that offer nutritional benefits. Flaxseeds, rich in omega-3 fatty acids, dietary fiber, and lignans, have become integral to various food products, including bakery items, cereals, smoothies, and energy bars. The increasing awareness of these health benefits has significantly contributed to the surge in demand within the food sector.

Key Market Segments

By Product

- Ground Flax Seed

- Whole Flax Seed

By Type

- Brown

- Golden

By End-User

- Food

- Pet Food

- Dietary Supplements

- Others

Emerging Trends

Surge in Organic Flaxseed Exports Driven by Government Initiatives

A notable trend in the flaxseed sector is the significant increase in organic flaxseed exports from India. This growth is largely attributed to strategic government initiatives aimed at promoting organic agriculture and facilitating export opportunities for farmers.

In fiscal year 2023-24, the Agricultural and Processed Food Products Export Development Authority (APEDA) issued 34,884 Certificates of Export (COE) for peanuts, with a total authorized quantity of 693,763.267 metric tonnes approved for export. While this data pertains to peanuts, it underscores the government’s commitment to supporting the export of agricultural products, including organic commodities like flaxseeds.

The Ministry of Food Processing Industries (MoFPI) has been instrumental in this growth through various schemes. The Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) and the Scheme for Creation of Backward and Forward Linkages provide financial assistance to farmers and processors for setting up infrastructure such as cold storage, processing units, and packaging facilities. These initiatives aim to reduce post-harvest losses and enhance the quality of organic flaxseeds, making them more competitive in international markets.

Furthermore, the government’s focus on organic certification and quality assurance has facilitated easier access to global markets. APEDA has recognized over 220 laboratories across India to provide testing services for a wide range of products, ensuring that organic flaxseeds meet international standards.

Drivers

Government Initiatives and Support for Flaxseed Cultivation

One of the most significant driving factors propelling the growth of flaxseed cultivation in India is the robust support and strategic initiatives provided by the government. Recognizing the importance of oilseeds like flaxseed in achieving self-sufficiency and enhancing nutritional security, the Indian government has implemented various schemes aimed at boosting production, improving seed quality, and facilitating market access for farmers.

Under the National Mission on Edible Oils – Oilseeds (NMEO-OS), the government has sanctioned a substantial outlay of ₹11,040 crore over a period of five years (2021–2026) to augment domestic oilseed production. This mission focuses on increasing the area under oilseed cultivation, enhancing productivity, and reducing dependence on imports. For flaxseed, this translates into increased support for research and development, distribution of high-quality seeds, and provision of financial assistance to farmers adopting best practices in cultivation.

Additionally, the Bharatiya Beej Sahakari Samiti Limited (BBSSL), established by the government, plays a pivotal role in ensuring the availability of certified and scientifically prepared seeds to farmers across the country. By connecting farmers with Primary Agricultural Credit Societies (PACS) and facilitating seed production through cooperatives, BBSSL aims to enhance seed quality and availability, thereby boosting flaxseed production.

Restraints

Climatic Vulnerabilities Affecting Flaxseed Production

A significant challenge hindering the growth of flaxseed cultivation in India is the country’s vulnerability to erratic weather patterns and climatic uncertainties. Flaxseeds, like many other crops, are highly sensitive to variations in temperature, rainfall, and humidity. These climatic factors can adversely impact seed quality and yield, making production less predictable and more susceptible to losses.

According to the Ministry of Agriculture and Farmers Welfare, approximately 76% of India’s oilseed cultivation area is rainfed, contributing to about 80% of the total oilseed production. This reliance on monsoon-dependent agriculture exposes crops like flaxseed to risks associated with delayed or insufficient rainfall, leading to reduced productivity and increased vulnerability to pests and diseases.

To address these challenges, the Indian government has implemented several initiatives aimed at enhancing the resilience of oilseed crops, including flaxseed. The National Mission on Edible Oils – Oilseeds (NMEO-OS) is one such program that focuses on increasing domestic oilseed production through improved agricultural practices and infrastructure development. This mission emphasizes the need for climate-resilient farming techniques and the adoption of technologies that can mitigate the impacts of adverse weather conditions.

Additionally, the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aims to provide irrigation solutions to areas facing water scarcity, thereby reducing dependence on monsoon rains. By improving water-use efficiency and ensuring timely irrigation, PMKSY seeks to stabilize crop production and enhance the resilience of farmers to climatic uncertainties.

Opportunity

Expanding Flaxseed Exports through Government Support

One of the most promising avenues for enhancing India’s flaxseed industry lies in expanding its export potential. The Indian government has recognized the importance of boosting agricultural exports, including flaxseeds, to achieve self-sufficiency and bolster the rural economy. Strategic initiatives and policy support are paving the way for Indian flaxseed to gain a stronger foothold in international markets.

In fiscal year 2023, India exported approximately 150 metric tonnes of organic chia seeds, a crop with similar market dynamics to flaxseed. This export volume underscores the potential for growth in the export of lesser-known oilseeds like flaxseed, especially when supported by government initiatives.

The Ministry of Commerce and Industry, through the Agricultural and Processed Food Products Export Development Authority (APEDA), has been instrumental in promoting the export of organic and niche agricultural products. APEDA’s efforts include facilitating certification processes, organizing international trade fairs, and providing market intelligence to exporters. These initiatives have been crucial in opening new markets for Indian agricultural products, including flaxseeds.

The government’s emphasis on organic farming and export promotion is also evident in its initiatives to support organic certification and export infrastructure. By encouraging farmers to adopt organic practices and facilitating access to international markets, the government is creating an environment conducive to the growth of flaxseed exports. This support is particularly beneficial for smallholder farmers who can tap into the premium markets for organic products.

Regional Insights

Asia Pacific Leads Flaxseed Market with 41.20% Share in 2024

In 2024, the Asia Pacific region emerged as the dominant player in the global flaxseed market, capturing a significant 41.20% share, valued at approximately USD 0.5 billion. This substantial market presence is driven by the region’s growing consumer awareness of health benefits associated with flaxseeds, coupled with rising disposable incomes and shifting dietary patterns toward plant-based foods in countries like China, India, and Japan.

Notably, China plays a pivotal role in this expansion, being one of the largest consumers and importers of flaxseeds in the region. The country’s increasing demand for plant-based omega-3 oils and dietary fiber contributes significantly to the market’s growth. Additionally, the government’s initiatives to promote healthy eating habits and sustainable agriculture practices further bolster the demand for flaxseed and its derivatives.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland (ADM) is a leading global agricultural processor and supplier of flaxseed products. The company offers a variety of flaxseed products, including whole seeds, ground flaxseed, and flaxseed oil, catering to the food and beverage, animal nutrition, and industrial sectors. ADM’s extensive global supply chain and commitment to sustainability position it as a key player in the flaxseeds market.

Cargill Incorporated is a multinational corporation that provides a wide range of agricultural products and services, including flaxseeds. The company supplies flaxseed to various industries, focusing on food applications such as bakery products and nutritional supplements. Cargill’s emphasis on innovation and quality assurance supports its strong presence in the flaxseeds market.

TA Foods Ltd. is a Canadian company specializing in the processing and supply of flaxseed and oilseed products. The company offers whole flaxseed, milled flax, cold-pressed flax oil, and defatted flax meal, serving both organic and conventional markets. TA Foods Ltd. is known for its high-quality products and commitment to food safety standards.

Top Key Players Outlook

- Archer Daniels Midland (ADM)

- Cargill Incorporated

- TA Foods Ltd.

- ORICHARDSON INTERNATIONAL LIMITED

- Johnson Seeds

- AgMotion, Inc.

- CanMar Foods Ltd.

- Simosis

- Bioriginal Food & Science Corp

Recent Industry Developments

In 2024, ADM processed approximately 62 million metric tons of oilseeds annually, including flaxseed, across its extensive network of over 270 plants and 420 crop procurement facilities worldwide.

In 2024 Richardson International Limited, processed approximately 35,000 metric tons of certified seed from over 100 Western Canadian growers, including flaxseed, through its Richardson Pioneer division

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Ground Flax Seed, Whole Flax Seed), By Type (Brown, Golden), By End-User (Food, Pet Food, Dietary Supplements, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd., ORICHARDSON INTERNATIONAL LIMITED, Johnson Seeds, AgMotion, Inc., CanMar Foods Ltd., Simosis, Bioriginal Food & Science Corp Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland (ADM)

- Cargill Incorporated

- TA Foods Ltd.

- ORICHARDSON INTERNATIONAL LIMITED

- Johnson Seeds

- AgMotion, Inc.

- CanMar Foods Ltd.

- Simosis

- Bioriginal Food & Science Corp