Global Flavor And Fragrance Market Size, Share, And Enhanced Productivity By Product Type (Flavors, Fragrances), By Form (Powder, Liquid, Others), By Source (Natural, Synthetic), By Application (Dairy, Bakery, Confectionery, Savory Snack, Meat, Beverage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174178

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

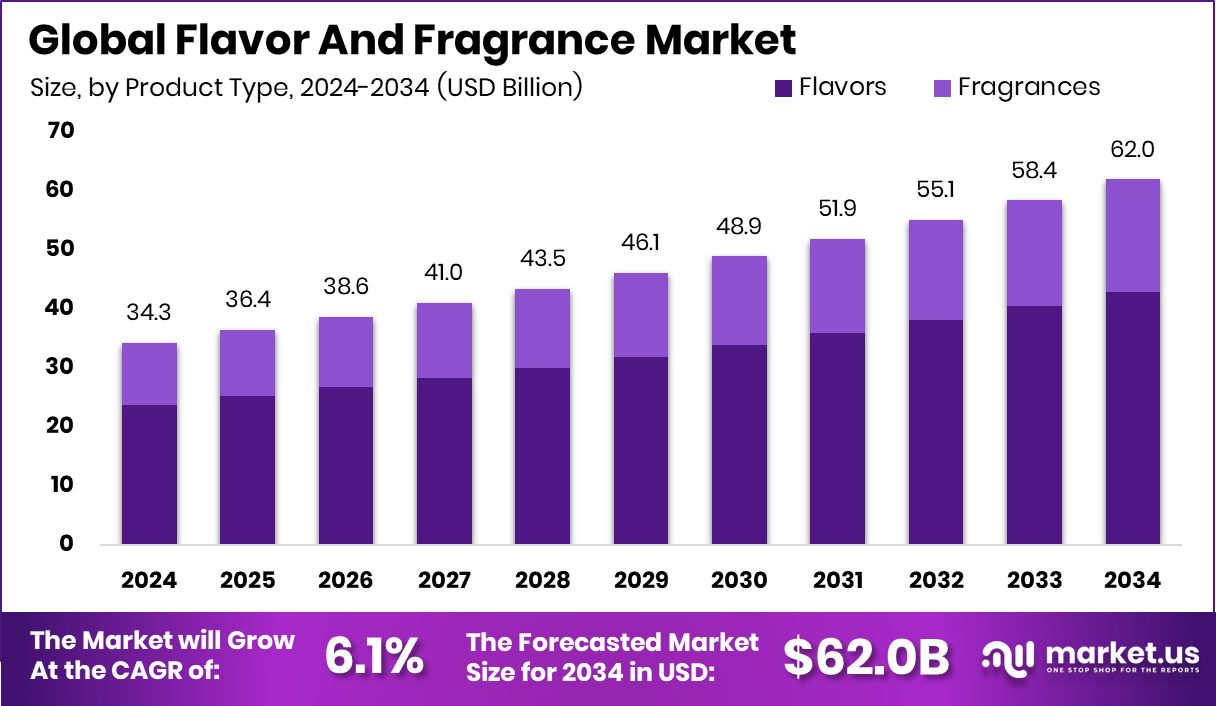

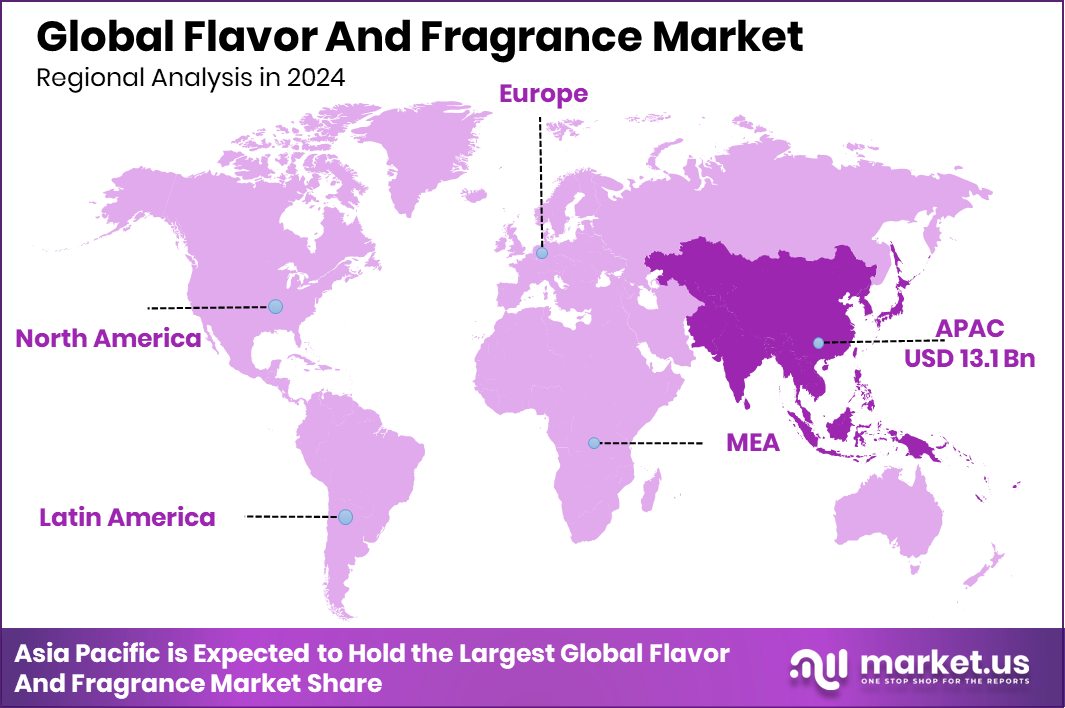

The Global Flavor And Fragrance Market is expected to be worth around USD 62.0 billion by 2034, up from USD 34.3 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Asia Pacific stands dominant at 38.4% share in the Flavor and Fragrance Market (USD 13.1 Bn).

Flavor and fragrance refer to ingredients that give food, beverages, personal care, and household products their taste and smell. Flavors focus on what people taste in products like sweets, snacks, drinks, and bakery items, while fragrances create pleasant scents in perfumes, soaps, cosmetics, and home care products. Together, they shape sensory experiences that influence consumer liking, brand recall, and repeat purchases. These ingredients are carefully designed to remain stable during processing, storage, and daily use, making them essential across everyday consumer goods.

The Flavor and Fragrance Market covers the development, production, and supply of these taste and scent solutions to manufacturers worldwide. It supports multiple industries, especially food, beverages, confectionery, bakery, cosmetics, and personal care. The market grows alongside packaged food consumption, lifestyle changes, and rising demand for differentiated products. As brands compete on experience rather than price alone, flavors and fragrances play a central role in product positioning and shelf appeal.

Growth in the market is strongly linked to innovation in food and confectionery. Recent funding activity highlights this momentum. Fireside Ventures led INR 20 crore funding in Oroos Confectionery, while Doughlicious secured $5 million to expand its product range. Luxury sweets brand Khoya Mithai raised over ₹6 crore in a pre-seed round, showing rising investment in premium taste-led offerings.

Demand drivers are reinforced by strong consumer interest in indulgent yet distinctive products. Canada’s Awake chocolate achieved $8 million in funding to scale its chocolate offerings, while confectionery startup Go Desi raised $5 million, led by Aavishkaar Capital, to grow traditional-flavor sweets. These developments show how taste, authenticityy and sensory appeal are directly linked to business expansion and market demand.

Opportunities ahead are widening as sustainability and premiumization gain importance. David closed a $75 million funding round to strengthen its food portfolio, while Mars launched a $250 million green investment fund alongside emissions reduction progress, signaling a cleaner production focus. Additionally, Indian sweets brand Khoya raised over ₹6 crore from Riga Foods and others, underlining opportunities for flavor innovation rooted in tradition but scaled for modern markets.

Key Takeaways

- The Global Flavor And Fragrance Market is expected to be worth around USD 62.0 billion by 2034, up from USD 34.3 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Flavors dominate the Flavor and Fragrance Market, holding 69.2% share due to food and adoption.

- Liquid form leads the Flavor and Fragrance Market with 63.8% share, supported by easy blending.

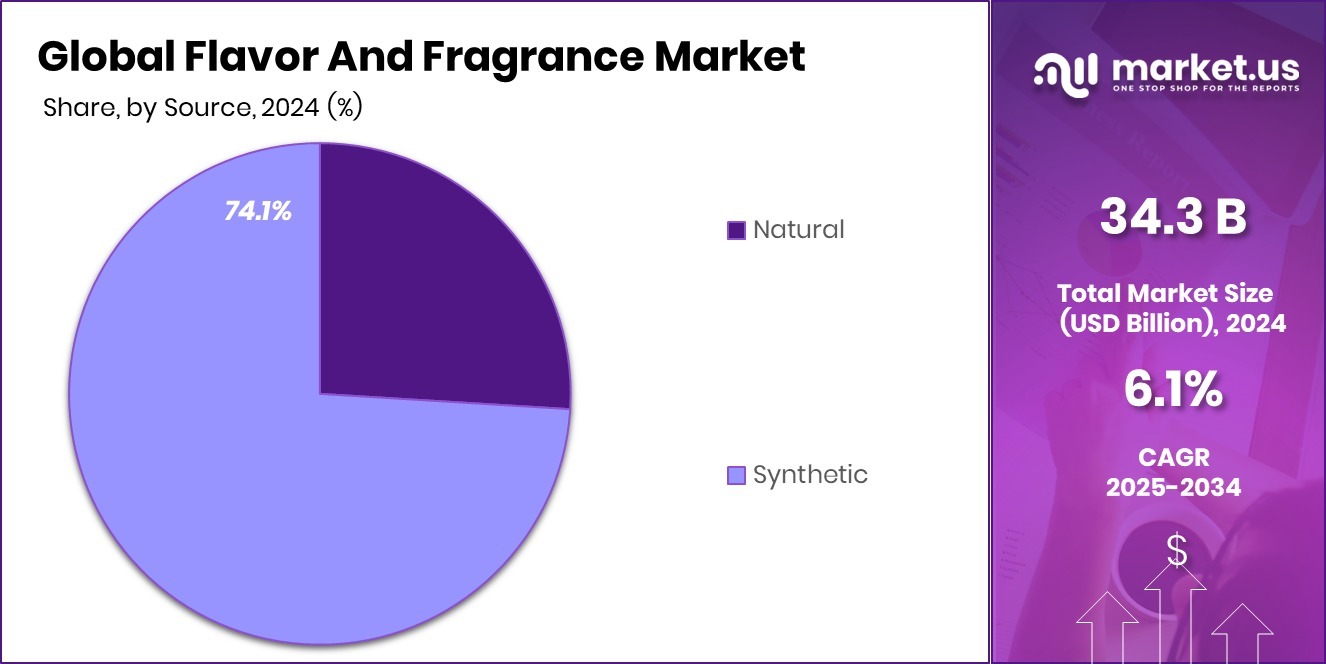

- Synthetic sources command the Flavor and Fragrance Market at 74.1% share, driven by cost efficiency.

- Bakery applications contribute 26.9% to the Flavor and Fragrance Market, fueled by consistent demand globally.

- Asia Pacific accounts for 38.4% of the flavor and fragrance market, reaching USD 13.1 Bn.

By Product Type Analysis

Flavor and Fragrance Market flavors dominate the product type with a 69.2% share.

In 2024, flavors dominated the Flavor and Fragrance Market by product type, holding 69.2% share, driven by rising demand for taste enhancement across food, beverage, and oral care products worldwide. Food manufacturers increasingly rely on flavor systems to maintain consistency, mask off-notes, and meet evolving consumer preferences for indulgent yet familiar profiles. Growth in packaged foods, ready-to-drink beverages, and confectionery directly supported higher flavor adoption.

Additionally, urban lifestyles and premiumization trends encouraged experimentation with ethnic, seasonal, and functional flavors. Regulatory clarity for approved flavoring substances further improved manufacturer confidence. Compared to fragrances, flavors benefit from higher consumption frequency and repeat purchasing cycles, ensuring steady volume demand. As brands compete on taste differentiation, flavors remain the core revenue driver globally today.

By Form Analysis

Flavor And Fragrance Market liquid form leads with 63.8% adoption worldwide.

In 2024, liquid formats led the Flavor and Fragrance Market by form, capturing 63.8% share due to superior solubility, faster dispersion, and ease of blending in industrial processes. Liquid flavors integrate smoothly into beverages, dairy, syrups, and bakery fillings, reducing processing time and formulation errors. Manufacturers prefer liquids for precise dosing, consistent sensory output, and compatibility with automated production lines. Growth in ready-to-use concentrates and emulsions further supported adoption.

Liquids also enable rapid flavor adjustments during product reformulation, which is critical amid sugar reduction and clean-label initiatives. Compared with powders, liquids show better stability in cold applications. These functional advantages continue to strengthen liquid dominance across food, beverage, and personal care manufacturing segments worldwide with scalable commercial demand growth trends.

By Source Analysis

Flavor and Fragrance Market: Synthetic sources account for 74.1% of industry demand.

In 2024, synthetic sources dominated the Flavor and Fragrance Market by source, accounting for 74.1% share, supported by cost efficiency, supply reliability, and consistent quality at scale. Synthetic ingredients offer stable pricing compared with natural alternatives affected by crop yields and climate variability. Large food and fragrance producers favor synthetics for standardized sensory profiles, longer shelf life, and predictable regulatory compliance.

Advances in aroma chemistry and molecular engineering improved performance while lowering production costs. Synthetics also support mass-market applications where affordability and volume matter most. Although natural and bio-based options are gaining attention, synthetics remain essential for meeting global demand efficiently. Their established infrastructure and technical familiarity continue to anchor sourcing strategies across mainstream flavor and fragrance formulations worldwide.

By Application Analysis

Flavor And Fragrance Market bakery applications hold a 26.9% share among uses.

In 2024, bakery emerged as a key application within the Flavor and Fragrance Market, representing 26.9% share, driven by high consumption of bread, cakes, pastries, and biscuits globally. Flavors play a critical role in enhancing freshness perception, masking ingredient variations, and supporting product consistency across batches. Growing demand for packaged bakery items, especially in urban markets, has increased reliance on flavor systems to maintain taste during shelf life.

Innovations in butter, vanilla, chocolate, and fruit profiles supported premium and artisanal positioning. Seasonal launches and indulgent offerings further boosted usage. Compared with other applications, the bakery benefits from frequent product launches and high-volume production, ensuring steady flavor demand. This makes the bakery a stable and attractive end-use segment for manufacturers globally today overall.

Key Market Segments

By Product Type

- Flavors

- Fragrances

By Form

- Powder

- Liquid

- Others

By Source

- Natural

- Synthetic

By Application

- Dairy

- Bakery

- Confectionery

- Savory Snack

- Meat

- Beverage

- Others

Driving Factors

Global Snack Expansion Accelerates Flavor Innovation Demand

The rising expansion of large snack and food brands is a key driving factor for the Flavor and Fragrance Market. As companies scale across borders, they need consistent taste and aroma profiles that work in different regions. This is clearly seen as Haldiram’s added two more investors after its $1 billion Temasek deal, with plans for global expansion.

Entering new markets means adapting flavors to local preferences while keeping brand identity intact. This increases demand for advanced flavor systems that offer stability, repeatability, and customization. Large food producers rely heavily on flavor expertise to manage shelf life, mass production, and regional taste shifts. As more traditional brands aim for international reach, flavor and fragrance solutions become essential tools for successful global product launches.

Restraining Factors

Rising Input Costs And Compliance Pressure Limit Growth

One major restraining factor in the Flavor and Fragrance Market is the rising cost pressure faced by emerging brands alongside regulatory and sourcing challenges. Startups often struggle to balance innovation with affordability. Beyond Snack, featured on Shark Tank India, raised $8.3 million in a Series A round, showing strong demand but also the need for capital to manage scale.

Similarly, fragrance brand Phool raised $8 million in Series A funding to support production and compliance needs. These funding rounds highlight that while demand exists, smaller players require significant investment to meet quality standards, ensure raw material availability, and follow safety norms. Cost-sensitive markets can slow the adoption of premium flavor and fragrance solutions, limiting faster market penetration.

Growth Opportunity

Natural Snack And Niche Fragrance Brands Create Opportunities

The growing success of natural food and niche fragrance brands presents a strong growth opportunity for the Flavor and Fragrance Market. Consumers increasingly seek clean tastes, authentic aromas, and differentiated sensory experiences. This trend is supported by funding momentum, as Quinn Natural Foods secured $10 million in a Series B round to expand its snack offerings.

At the same time, Fraganote raised $1 million in a pre-Series A round from Rukam Capital, signaling rising interest in modern, niche fragrance concepts. These brands depend heavily on customized flavors and distinctive scent profiles to stand out. As such, as companies scale, demand grows for tailored flavor and fragrance development, opening long-term opportunities for innovation-focused solution providers.

Latest Trends

Regional Brands And Celebrity Scents Redefine Preferences

Changing consumer preferences are shaping the latest trends in the Flavor and Fragrance Market. Regional snack brands are gaining ground, as seen in Pepsi losing share in India’s $2 billion salty snack market to local players, increasing demand for region-specific flavors. Local brands rely on familiar tastes and cultural relevance, pushing flavor customization. At the same time, lifestyle-driven fragrance trends are rising.

Courtney Cox’s fragrance brand Homecourt secured $8 million in funding, reflecting strong consumer interest in personal, home, and wellness-oriented scents. Together, these shifts show a move toward authenticity, local identity, and emotional connection, making flavor and fragrance development more creative, targeted, and experience-driven across food and personal care categories.

Regional Analysis

Asia Pacific leads the Flavor and fragrance market with 38.4% share valued at USD 13.1 billion in the region.

Asia Pacific stands as the dominating region in the Flavor and Fragrance Market, holding a 38.4% share and valued at USD 13.1 Bn, supported by strong food processing expansion, rising packaged food consumption, and rapid urbanization across major economies. High demand for flavored beverages, bakery products, and convenience foods continues to anchor regional leadership, while large-scale manufacturing capacity ensures a consistent supply.

North America follows with stable demand driven by mature food, beverage, and personal care industries, where product consistency and formulation efficiency remain critical priorities. Europe maintains a solid market presence, supported by long-established flavor houses and steady demand from bakery, dairy, and confectionery segments, emphasizing quality and formulation precision.

The Middle East & Africa region shows gradual market development, mainly supported by growing food imports, local food manufacturing growth, and expanding retail formats. Latin America contributes steadily, benefiting from rising consumption of processed foods and beverages, particularly in urban centers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Givaudan SA continues to set the benchmark in the global Flavor and Fragrance Market through its deep formulation expertise and application-driven innovation model. The company’s strength lies in combining sensory science with close customer collaboration, allowing it to support food, beverage, and personal care brands with tailored flavor and fragrance solutions. Its diversified application portfolio helps reduce dependency on any single end-use segment, while its strong customer relationships support long-term contract stability. Givaudan’s ongoing focus on reformulation, taste modulation, and aroma performance positions it well in a market increasingly shaped by product differentiation and consistency demands.

Symrise AG holds a strong strategic position in 2024, supported by its balanced presence across flavor, fragrance, and cosmetic ingredients. The company benefits from vertical integration in selected aroma molecules, enabling better cost control and supply reliability. Symrise’s application knowledge in beverages, savory products, and fine fragrances supports steady demand across both mass-market and premium segments. Its operational efficiency and focus on scalable solutions allow it to respond quickly to changing formulation needs, reinforcing its competitive standing in global customer portfolios.

Sensient Technologies Corporation maintains a differentiated position by combining flavors, fragrances, and color solutions under one technical platform. In 2024, Sensient’s strength lies in its regional manufacturing footprint and customization capability, particularly for food, beverage, and personal care customers. The company’s technical service model supports rapid formulation adjustments, making it a reliable partner for brands managing frequent product updates and regulatory shifts.

Top Key Players in the Market

- Givaudan SA

- Symrise AG

- Sensient Technologies Corporation

- T. Hasegawa Co., Ltd.

- International Flavors & Fragrances Inc.

- DSM-Firmenich AG

- ADM

- MANE

- Bell Flavors & Fragrances

- Takasago International Corporation

- Robertet Group

Recent Developments

- In December 2024, DSM-Firmenich unveiled “Mocha Mousse,” a new fragrance inspired by the PANTONE Color of the Year 2025, blending warm cocoa bean, salted peanut, and vanilla bean notes in both Eau de Parfum and Candle formats. This launch reflects creative scent development tied to cultural trends.

- In October 2024, Givaudan began construction of a new state-of-the-art production facility in Cikarang, Indonesia, strengthening its manufacturing for flavor and taste solutions in Southeast Asia. This site complements their existing local operations and supports regional growth in food and beverage flavor production.

- In March 2024, Symrise AG formed a joint venture with the Virchow Group to produce personal care ingredients from its portfolio in India under the name Vizag Care Ingredients Private Limited. Symrise holds the majority in this new company and will supply local and global customers with cosmetic and care raw materials.

Report Scope

Report Features Description Market Value (2024) USD 34.3 Billion Forecast Revenue (2034) USD 62.0 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flavors, Fragrances), By Form (Powder, Liquid, Others), By Source (Natural, Synthetic), By Application (Dairy, Bakery, Confectionery, Savory Snack, Meat, Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan SA, Symrise AG, Sensient Technologies Corporation, T. Hasegawa Co., Ltd., International Flavors & Fragrances Inc., DSM-Firmenich AG, ADM, MANE, Bell Flavors & Fragrances, Takasago International Corporation, Robertet Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flavor And Fragrance MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Flavor And Fragrance MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Givaudan SA

- Symrise AG

- Sensient Technologies Corporation

- T. Hasegawa Co., Ltd.

- International Flavors & Fragrances Inc.

- DSM-Firmenich AG

- ADM

- MANE

- Bell Flavors & Fragrances

- Takasago International Corporation

- Robertet Group