Global Fixed Length Seal Professional Survey Market By Type (9 Inches, 12 Inches, 15 Inches, 18 Inches), By Strength (Light Duty, Medium Duty, Heavy Duty), By Application (Transport and Logistics, Food and Beverage, Consumer Goods, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2025-2034

- Published date: Feb 2025

- Report ID: 139646

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

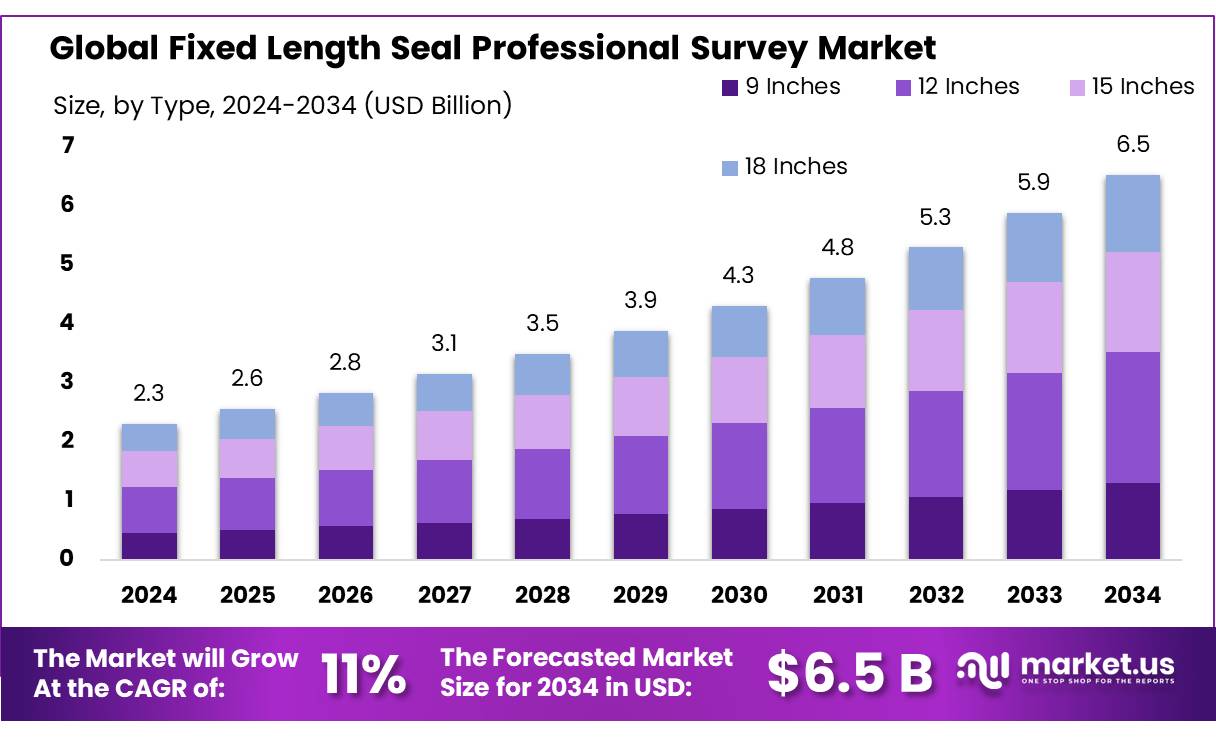

The Global Fixed Length Seal Professional Survey Market size is expected to be worth around USD 6.5 Bn by 2034, from USD 2.3 Bn in 2024, growing at a CAGR of 11.0% during the forecast period from 2025 to 2034.

The global fixed length seal professional survey market is a pivotal segment within the broader sealing technology industry, specializing in seals designed to be applied in specific, pre-determined lengths. These seals are primarily used in industries that require precise sealing for packaging, manufacturing, and logistical operations, particularly where uniformity and efficiency in sealing are essential. Fixed length seals are commonly utilized in applications such as pipe sealing, door sealing, and machinery sealing, offering high durability and performance across a range of sectors, including automotive, aerospace, food and beverage, and manufacturing.

Fixed Length Seal Professional Survey is currently characterized by a strong demand for custom sealing solutions that can provide greater reliability, ease of use, and enhanced durability. As global industries continue to focus on operational efficiency, cost-effective solutions, and sustainability, fixed length seals have gained prominence due to their ability to streamline production processes while ensuring a high standard of sealing.

The technological advancements. Innovations such as the development of seals with enhanced resistance to extreme temperatures, pressure, and chemical environments have spurred demand, particularly in specialized applications such as aerospace and industrial machinery. The growth of industries such as construction and automotive, along with the rising trend of automation, is further contributing to the increased usage of fixed length seals. These seals offer manufacturers a dependable solution that minimizes the risk of failures due to seal degradation, which can be critical in ensuring operational efficiency and safety.

Global fixed length seal market is poised for substantial growth. The increasing demand for customized and specialized sealing products tailored to specific applications will create significant opportunities for manufacturers to innovate and develop high-performance solutions. Furthermore, as industries move toward greener technologies and eco-friendly materials, there will be a growing emphasis on sustainable sealing options, opening new avenues for market growth.

Key Takeaways

- Fixed Length Seal Professional Survey Market size is expected to be worth around USD 6.5 Bn by 2034, from USD 2.3 Bn in 2024, growing at a CAGR of 11.0%.

- 12-inch fixed length seal segment held a dominant market position, capturing more than a 34.5% share.

- Medium Duty segment of the fixed length seal market held a dominant position, capturing more than a 46.4% share.

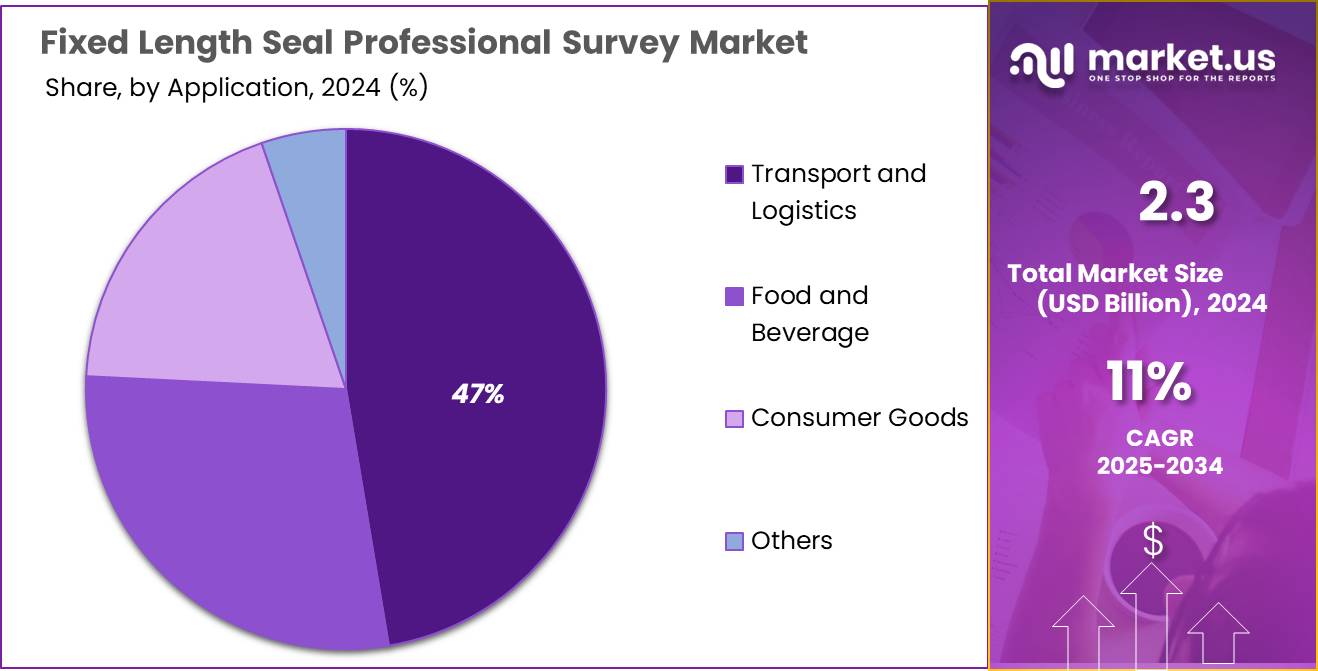

- Transport and Logistics segment held a dominant market position in the fixed length seal market, capturing more than a 47.5% share.

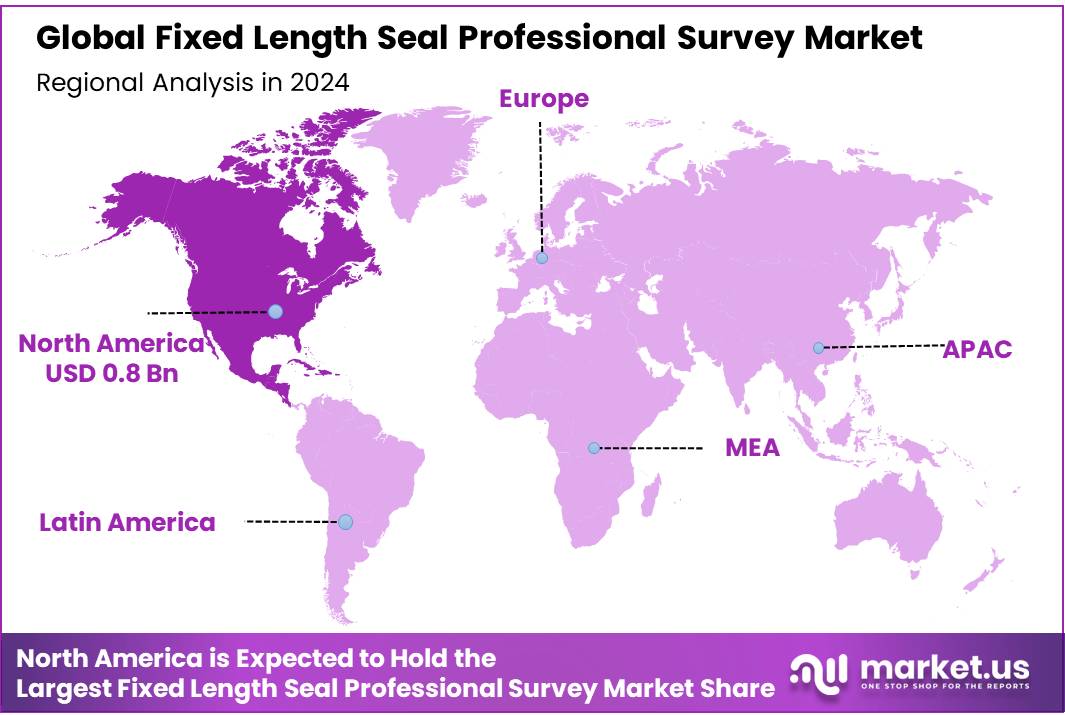

- North America holds a commanding position, dominating the market with a 35.5% share, translating to revenues of approximately $0.8 billion.

By Type

In 2024, the 12-inch fixed length seal segment held a dominant market position, capturing more than a 34.5% share. This size is particularly favored in industries where standardization of packaging is common, such as logistics and freight. Its popularity is attributed to the optimal balance it offers between security and flexibility, making it suitable for a wide range of applications including securing truck doors, trailers, and shipping containers.

The 9-inch seals, while smaller, are preferred in sectors that require tighter security measures for smaller closures. This segment has carved out a niche in securing smaller containers and boxes, particularly in the pharmaceutical and consumer electronics industries. Although smaller in market share compared to the 12-inch segment, its specific applications ensure steady demand.

Moving to the 15-inch and 18-inch seals, these larger sizes are designed for heavy-duty applications. The 15-inch seals are often used in industrial environments where larger scale sealing is necessary, such as in chemical drums or large-scale agricultural shipments. The 18-inch seals are the largest standard size commonly used in maritime shipping, securing cargo containers across long distances.

By Strength

In 2024, the Medium Duty segment of the fixed length seal market held a dominant position, capturing more than a 46.4% share. This segment’s popularity stems from its versatility and balance between strength and flexibility, making it ideal for a broad range of applications across various industries. Medium Duty seals are commonly used in the transportation and logistics sectors to secure truck trailers, railcars, and other medium-sized containers that require a reliable level of security without the robustness of heavy-duty alternatives.

Light Duty seals, although less robust than their medium and heavy counterparts, are essential in applications requiring a basic level of security. These seals are typically employed in sectors like retail and airlines for sealing duty-free trolleys or first aid kits. The Light Duty segment caters to needs where ease of removal without specialized tools is a priority, and while it holds a smaller share of the market, its importance in providing tamper-evident solutions cannot be understated.

Heavy Duty seals are designed for the most demanding applications. In 2024, they were primarily used in environments where the highest level of security is necessary, such as in shipping heavy machinery or within the chemical industry for securing large containers of hazardous materials.

By Application

In 2024, the Transport and Logistics segment held a dominant market position in the fixed length seal market, capturing more than a 47.5% share. This segment’s strong performance is driven by the critical need for secure transport of goods across both domestic and international routes. Fixed length seals are extensively used to secure truck trailers, shipping containers, and railcars, ensuring that cargo remains untouched from point of origin to destination, which is vital for maintaining the integrity and security of transported goods.

The Food and Beverage industry also relies heavily on fixed length seals to meet stringent safety and hygiene standards. These seals are used to secure food containers and transportation units, preventing tampering and contamination throughout the supply chain. While this segment does not match the scale of Transport and Logistics in terms of market share, its role is crucial in upholding consumer safety and trust in food products.

Consumer Goods is another significant application area for fixed length seals. In this sector, seals are used to protect products from theft and tampering during shipping and in retail environments. The use of seals helps manufacturers and retailers assure customers of product authenticity and safety.

Key Market Segments

By Type

- 9 Inches

- 12 Inches

- 15 Inches

- 18 Inches

By Strength

- Light Duty

- Medium Duty

- Heavy Duty

By Application

- Transport and Logistics

- Food and Beverage

- Consumer Goods

- Others

Drivers

Enhanced Regulatory Compliance in the Food and Beverage Industry

One of the major driving factors for the growth of the fixed length seal market is the enhanced regulatory compliance across the food and beverage industry. Governments and regulatory bodies worldwide have been tightening safety and hygiene standards to ensure food safety and prevent contamination. This regulatory pressure has significantly increased the adoption of fixed length seals as a means to secure food products during transportation and storage.

For instance, according to the Food and Drug Administration (FDA), there is a stringent set of guidelines that govern the packaging and transportation of food products in the United States. These guidelines are designed to ensure that food items are transported in a manner that prevents contamination and ensures consumer safety. The FDA’s Food Safety Modernization Act (FSMA), particularly the rule on Sanitary Transportation of Human and Animal Food, mandates the use of tamper-evident seals on food transporting vehicles to avoid any alteration or tampering of the contents during transit.

Similarly, the European Food Safety Authority (EFSA) imposes strict regulations on food hygiene and contact materials, requiring secure sealing solutions that comply with EU standards. The compliance with these regulations often necessitates the use of reliable and tamper-evident sealing mechanisms, like fixed length seals, across all stages of food production and distribution.

These regulatory frameworks are pivotal in driving the demand for fixed length seals in the food and beverage sector. As companies strive to comply with these regulations to avoid hefty fines and protect brand reputation, the demand for effective sealing solutions like fixed length seals intensifies. This is particularly evident in sectors involving the international trade of food products, where adherence to multiple regulatory standards is critical.

Restraints

Rising Costs of Raw Materials

One significant restraining factor impacting the fixed length seal market is the rising cost of raw materials. The production of fixed length seals often requires specific types of plastics and metals, which are susceptible to fluctuations in global commodity prices. Over the past few years, there has been a noticeable increase in the prices of these materials, largely due to supply chain disruptions and increased demand in other sectors.

For instance, the cost of polypropylene, a common plastic used in the manufacture of fixed length seals, has seen a steady rise. According to the Plastics Exchange Market Updates, the price of polypropylene in North America increased by approximately 15% over the last year. This increase is attributed to factors such as higher crude oil prices, which directly affect plastic production costs, and disruptions in supply chains due to geopolitical tensions and trade disputes.

Additionally, the cost of metal components, like stainless steel wires used in the seals, has also surged. Industry sources like Metal Bulletin have reported that the price of stainless steel increased by over 20% due to increased demand in the automotive and construction industries, compounded by limited supply due to production cutbacks during the global health crisis.

These rising costs are a major concern for manufacturers of fixed length seals, as they compress profit margins and increase production expenses. As these costs are often passed on to the consumers, it could potentially lead to reduced demand, especially in cost-sensitive markets. The increased production costs also restrain manufacturers’ ability to invest in new technologies or expand into new markets, further impacting the growth of the fixed length seal market.

Opportunity

Expansion into Emerging Markets

A significant growth opportunity for the fixed length seal market lies in the expansion into emerging markets, particularly in regions like Asia-Pacific and Africa. These areas are experiencing rapid industrialization and urbanization, leading to increased demand for secure transportation and logistics solutions.

Emerging markets present a fertile ground for the adoption of fixed length seals due to their growing food and beverage industries. For example, according to a report by the Food and Agriculture Organization (FAO), Asia is set to become one of the largest consumers of packaged food globally, with an expected growth rate of over 6% annually. This increase in packaged food consumption is directly correlated with the need for secure packaging solutions to ensure product safety and integrity during transport and storage.

Moreover, these regions are seeing significant government initiatives aimed at improving food safety standards. Countries like India and China have introduced stricter food safety laws in response to increasing concerns about food quality and safety. These laws mandate the use of effective sealing and packaging solutions to prevent contamination and ensure compliance with international food safety standards.

Additionally, as these markets develop, there is a rising trend towards modern retail formats, which require robust supply chains capable of handling large volumes of consumer goods securely. This shift is driving demand for fixed length seals in sectors ranging from pharmaceuticals to consumer electronics, where security and tamper evidence are critical.

The expansion into these rapidly developing markets offers a pathway for significant growth in the fixed length seal industry. Companies that can navigate the regulatory environments and cater to the specific needs of these regions are likely to see substantial gains in market share and revenue. This strategic focus not only taps into new customer bases but also diversifies business risks by reducing reliance on more saturated developed markets.

Trends

Eco-Friendly and Biodegradable Fixed Length Seals

One of the most significant trends in the fixed length seal market is the shift towards eco-friendly and biodegradable materials. As environmental concerns and regulations become more stringent globally, companies across various industries, including food and beverage, are seeking sustainable options for securing their goods while minimizing their ecological footprint.

The drive for sustainability is particularly evident in the food industry, where packaging not only needs to meet safety and hygiene standards but also align with consumer preferences for environmentally responsible products. According to a recent survey by the Food Industry Association, over 70% of consumers in the United States expressed a preference for sustainably packaged food products. This consumer demand is pushing food companies to adopt greener alternatives throughout their supply chains, including the seals used on transported goods.

In response, manufacturers of fixed length seals are developing products made from biodegradable materials such as polylactic acid (PLA) and other compostable compounds. These materials break down under certain conditions, reducing plastic waste and the environmental impact associated with the disposal of traditional seals. Furthermore, advancements in material science have enabled these biodegradable seals to maintain the strength and security features necessary for widespread industrial use.

Government initiatives also support this trend. For example, the European Union’s Circular Economy Action Plan encourages the use of sustainable materials in packaging and logistics. This policy framework not only promotes environmental sustainability but also opens up new markets for innovative fixed length seal products designed to comply with these regulations.

Regional Analysis

In the fixed length seal market, regional dynamics significantly vary, reflecting differing industrial activities and regulatory environments. North America holds a commanding position, dominating the market with a 35.5% share, translating to revenues of approximately $0.8 billion. This prominence is largely due to stringent regulatory standards and a robust logistics and transport sector, which demand high levels of security and tamper evidence in packaging solutions.

Europe follows closely, driven by rigorous EU regulations regarding product safety and environmental sustainability. These regulations have spurred innovation in fixed length seals, particularly those that are eco-friendly and capable of supporting the circular economy goals of the region. Europe’s advanced manufacturing and automotive sectors also contribute significantly to the demand for these seals.

The Asia Pacific region presents the most substantial growth opportunity due to its rapid industrialization and expanding manufacturing base, particularly in China and India. The increase in export-oriented production, coupled with growing domestic markets for consumer goods, is propelling the demand for fixed length seals.

The Middle East & Africa and Latin America are smaller markets but are experiencing gradual growth. In the Middle East & Africa, the growth is spurred by the expansion of the oil and gas sector, which requires high-security measures for transporting and storing resources. Latin America’s growth is driven by improvements in manufacturing capabilities and increasing trade activities within the region and with North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the fixed length seal market, several key players are shaping industry dynamics through innovation, geographic expansion, and strategic partnerships. Tyden Brooks, one of the leading manufacturers, is known for its broad range of security solutions tailored to various industries, including transport and logistics. Their commitment to quality and extensive distribution network have solidified their position in North America and Europe.

European-based companies like Unisto and Versapak Security Seals are also significant contributors to the market, with a strong focus on design and technological advancements in tamper-evident technologies. Unisto, for example, has pioneered reusable seals that align with sustainability trends in the market. On the other side of the globe, Mega Fortris and Cambridge Security Seals are aggressively expanding in the Asia Pacific region, leveraging growing demands in emerging economies.

In addition to traditional players, newer entrants like Innovic Seals are making notable strides with innovative product offerings and competitive pricing strategies. This dynamic competition encourages continual improvements in product quality and security features, addressing evolving customer needs across global markets.

Top Key Players

- Tyden Brooks

- Versa Pak Security Seals

- Unisto

- Acme Seals

- American Casting & Mfg. Corp

- Essentra

- Beloma Beira Logistics Management

- Mega Fortris

- Cambridge Security Seals

- Innovic Seals

- Versapak Security Seals

Recent Developments

In 2024, Unisto continued to strengthen its presence in the global fixed length seal market, particularly recognized for its innovative and security-focused sealing solutions.

In 2024, Versa Pak Security Seals continued to play a pivotal role in the fixed length seal market. This UK-based company has carved a niche by focusing on high-security and tamper-evident solutions tailored to a wide range of industries, including logistics and retail.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 6.5 Bn CAGR (2025-2034) 11% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (9 Inches, 12 Inches, 15 Inches, 18 Inches), By Strength (Light Duty, Medium Duty, Heavy Duty), By Application (Transport and Logistics, Food and Beverage, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tyden Brooks, Versa Pak Security Seals, Unisto, Acme Seals, American Casting & Mfg. Corp, Essentra, Beloma Beira Logistics Management, Mega Fortris, Cambridge Security Seals, Innovic Seals, Versapak Security Seals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fixed Length Seal Professional Survey MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Fixed Length Seal Professional Survey MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tyden Brooks

- Versa Pak Security Seals

- Unisto

- Acme Seals

- American Casting & Mfg. Corp

- Essentra

- Beloma Beira Logistics Management

- Mega Fortris

- Cambridge Security Seals

- Innovic Seals

- Versapak Security Seals