Global Financial Planning Software Market By Deployment Mode (Cloud-Based, On-Premise), By Application (Investment Planning, Personal Finance, Retirement Planning, Tax Planning, Other Applications), By End-User (Enterprises, Individuals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121154

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

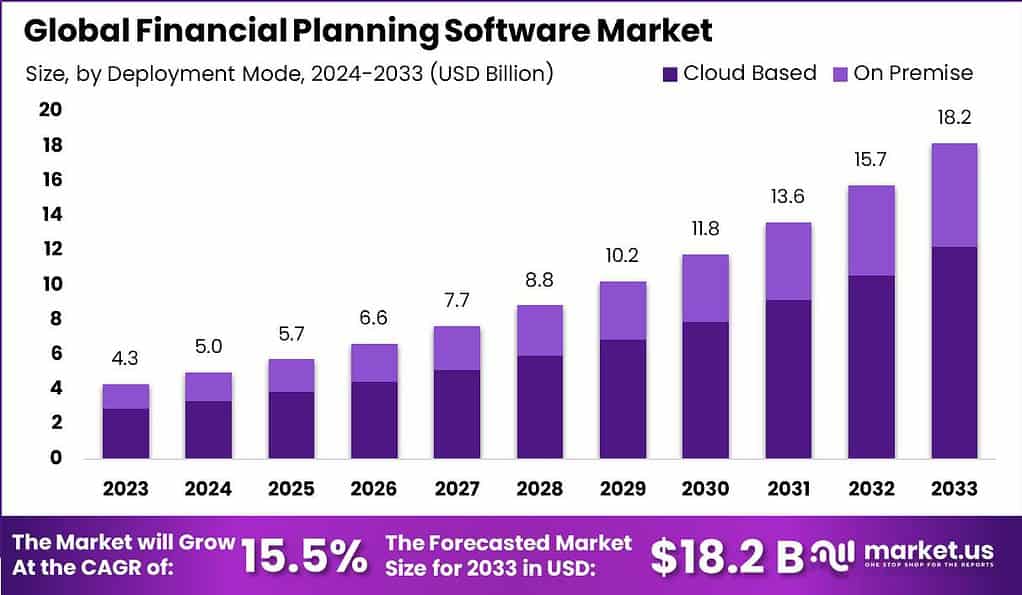

The Global Financial Planning Software Market size is expected to be worth around USD 18.2 Billion By 2033, from USD 4.3 Billion in 2023, growing at a CAGR of 15.5% during the forecast period from 2024 to 2033.

Financial planning software is a crucial tool for individuals and businesses to effectively manage their finances and develop comprehensive financial plans. This software is designed to streamline the process of budgeting, investment management, retirement planning, tax planning, and other financial tasks. It provides users with the necessary tools and features to analyze their financial situation, set financial goals, and make informed decisions about their money.

The financial planning software market has experienced significant growth and evolution in recent years. The increasing need for efficient financial management solutions has driven the demand for financial planning software across various sectors, including personal finance, wealth management, and corporate finance. One of the key drivers of the financial planning software market is the growing awareness among individuals and businesses about the importance of proactive financial planning.

Moreover, advancements in technology have played a crucial role in shaping the financial planning software market. The rise of cloud computing, mobile devices, and artificial intelligence has transformed the landscape of financial software solutions. Cloud-based financial planning software allows users to access their financial information from anywhere, collaborate with advisors or teams, and ensure data security. Mobile apps have made financial planning more convenient and accessible, empowering users to manage their finances on the go.

Artificial intelligence and machine learning have also made a significant impact on the financial planning software market. These technologies enable software platforms to analyze vast amounts of financial data, provide personalized recommendations, and automate routine tasks. AI-powered financial planning software can offer insights on investment opportunities, optimize portfolios, and even simulate different scenarios to predict future outcomes.

According to research conducted by Worldmetrics, the role of financial advisors in the United States remains significant, with approximately 64% of U.S. households being served by these professionals. Within the client base of financial advisors, 48% consists of individuals planning for retirement, particularly the Baby Boomer generation. However, it is worth noting that the proportion of Millennial clients is relatively lower, representing only 20% of the typical advisor’s clientele.

The preference for hiring a Certified Financial Planner (CFP) is evident among clients, as 63% of them express a preference for a financial advisor with this certification. This highlights the importance of professional qualifications and expertise in the eyes of consumers seeking financial advice.

The impact of financial advisory services on clients’ overall well-being is noteworthy. Research shows that 35% of Americans who work with a financial advisor are more likely to report feeling happy and content about their money situation. This highlights the positive influence that financial advisors can have on their clients’ financial outlook and emotional satisfaction.

Despite the presence of financial advisors, there is still a substantial demand for additional financial advice. Nearly 50% of consumers express the need for more financial guidance, suggesting a potential market opportunity for financial planning services.

In terms of client expectations, 82% of investors emphasize the importance of their financial advisor having access to up-to-date market data and analytic capabilities. This indicates the significance of staying informed and providing accurate and timely insights to clients to meet their evolving needs.

Trust is a critical factor in the financial services industry, and it appears that the majority of consumers have confidence in their financial services providers. A significant 79% of consumers express trust in their financial services provider, underscoring the importance of establishing and maintaining strong relationships built on trust and reliability.

However, there is room for improvement in terms of overall financial planning. Only 30% of Americans currently have a long-term financial plan that includes savings and investment goals. This highlights the need for increased awareness and education around financial planning to encourage more individuals to develop comprehensive strategies for their financial well-being.

Key Takeaways

- The Global financial planning software market size was valued at USD 4.3 billion in the year 2023 and is estimated to reach USD 18.1 billion in the year 2033 with a CAGR of 15.5% during the forecast period.

- Based on the deployment mode, the cloud-based segment has dominated the market with a share of 67.1% in the year 2023.

- Based on the application, the investment planning segment has dominated the market with a share of 28.4% in the year 2023.

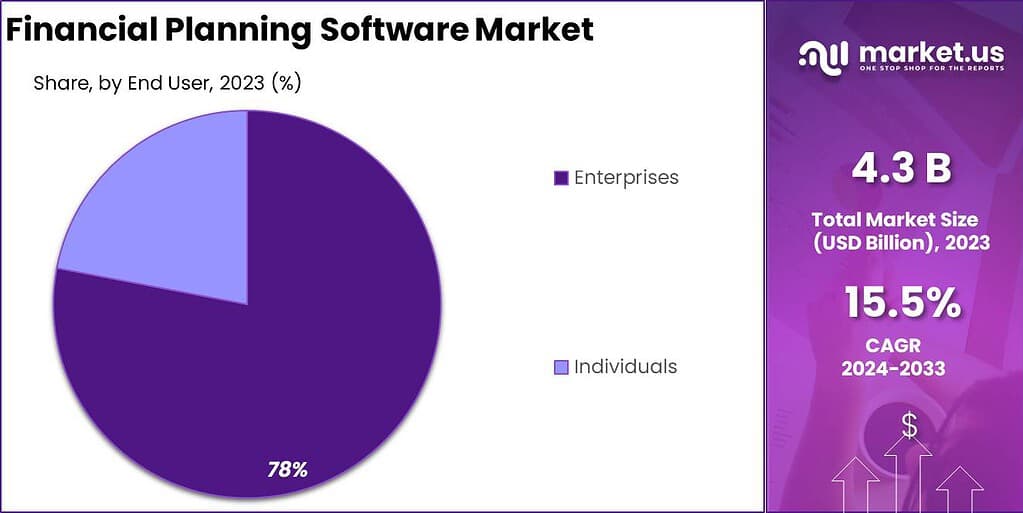

- Based on the end user, the enterprise segment mas dominated the market with a share of 78% in the year 2023

- In 2023, North America held a dominant market position in the financial planning software market, capturing more than a 37.5% share.

Deployment Mode Analysis

Based on the deployment mode, the market is segmented into Cloud-Based and On-Premise segments where the cloud-based segment has dominated the market with a share of 67.1% in the year 2023. This leadership can primarily be attributed to the flexibility, scalability, and cost-effectiveness that cloud-based solutions offer.

Financial institutions and businesses are increasingly adopting cloud-based platforms as they facilitate remote data access, real-time collaboration, and enhanced security with lower upfront costs. Moreover, the ability to integrate with other cloud services enhances operational efficiency, which is crucial for dynamic financial planning and analysis.

The preference for cloud-based deployment is further supported by the growing trend of digital transformation in the financial sector. As organizations strive to meet the changing demands of a digitally savvy customer base, cloud platforms offer an agile environment to deploy advanced analytics and machine learning models, which are integral to modern financial planning software. The ongoing enhancements in cloud security protocols have also assuaged previous concerns over data security, encouraging more financial planners to transition from traditional on-premise solutions.

On-Premise solutions, while still relevant, have seen slower growth compared to their cloud counterparts. This segment’s market share has been affected by the higher operational costs and the need for continuous maintenance and upgrades. On-premise systems often require significant initial investment in infrastructure and IT staff, which can be a deterrent for small to medium-sized enterprises.

However, they continue to hold appeal for organizations that require full control over their data and systems due to regulatory compliance or data sensitivity issues. Despite these advantages, the overall growth momentum strongly favors cloud-based solutions, reflecting a broader shift towards more flexible, scalable, and cost-efficient deployment modes in financial technologies.

Application Analysis

In 2023, the Investment Planning segment held a dominant market position within the Financial Planning Software market, capturing more than a 28.4% share. This segment leads due to its crucial role in assisting individuals and institutions in managing and growing their investment portfolios effectively. With the increasing complexity of financial markets and the variety of investment vehicles available, software that aids in investment planning has become indispensable.

These tools help users analyze market trends, assess risk, and allocate assets in a way that aligns with their financial goals and risk tolerance. The prominence of the Investment Planning segment is also driven by the rising financial awareness among consumers and the growing demand for personalized investment solutions. As investors become more sophisticated, there is a heightened need for software that not only tracks investments but also provides insights and recommendations tailored to individual financial situations.

Furthermore, the integration of technologies such as artificial intelligence and big data analytics in investment planning software has enhanced its capability to offer real-time, data-driven advice, making it more appealing to tech-savvy users. Despite the strong performance of the Investment Planning segment, other applications such as Personal Finance, Retirement Planning, Tax Planning, and other niche areas also contribute to the market’s diversity and growth.

Each of these segments addresses specific needs that are vital for comprehensive financial management, from budgeting and managing daily expenses in Personal Finance to preparing for long-term goals in Retirement Planning. However, the immediate and tangible benefits provided by investment planning tools ensure their leading position in the market, reflecting the ongoing prioritization of asset growth and management in personal and institutional finance strategies.

End User Analysis

In 2023, the Enterprises segment held a dominant market position in the Financial Planning Software Market, capturing more than a 78.0% share. This significant market share is primarily attributed to the widespread adoption of financial planning solutions among large and medium-sized enterprises. These organizations increasingly rely on sophisticated software to streamline their financial operations, enhance accuracy in financial reporting, and support strategic decision-making processes.

The adoption of these solutions enables enterprises to manage their financials more efficiently, fostering better resource allocation and financial stability. The leadership of the Enterprises segment can also be linked to the growing need for comprehensive financial oversight driven by increasing regulatory requirements and complex corporate structures.

Financial planning software offers features like budgeting, forecasting, cash flow analysis, and scenario planning, which are crucial for enterprises aiming to optimize their financial performance and ensure compliance with regulatory standards. Additionally, the integration of advanced technologies such as AI and machine learning has enhanced the functionality of financial planning software, making it more appealing to enterprise users.

These technologies help in predicting financial outcomes and identifying potential risks, thus providing enterprises with a competitive edge in strategic planning. Furthermore, the expanding availability of customized solutions tailored to the specific needs of businesses has propelled the adoption of financial planning software in the enterprise sector.

Providers of these software solutions are continuously enhancing their offerings to better serve the diverse requirements of different industries, which has further supported the segment’s growth. As financial landscapes become more dynamic and challenging, the reliance on effective financial planning tools within enterprises is expected to continue, suggesting a robust growth trajectory for this segment in the coming years.

Key Market Segments

By Deployment Mode

- Cloud-Based

- On-Premise

By Application

- Investment Planning

- Personal Finance

- Retirement Planning

- Tax Planning

- Other Applications

By End-User

- Enterprises

- Individuals

Driver

Increasing Demand for Digital Financial Solutions

The Financial Planning Software market is experiencing robust growth due to the increasing demand for digital financial management solutions. As businesses and individuals face more complex financial environments, there is a growing reliance on technology to manage financial tasks with greater accuracy and efficiency. This trend is further amplified by the global increase in financial regulations, which require detailed and transparent financial tracking and reporting.

Consequently, financial planning software is becoming essential for compliance, risk management, and strategic financial planning. The integration of advanced technologies like AI and analytics in this software enhances their appeal by providing deeper insights and predictive capabilities, thereby driving market growth.

Restraint

Concerns Over Data Security

Despite the advantages, the adoption of financial planning software is hindered by significant concerns over data security. Financial data involves sensitive personal and business information, making it a prime target for cyber threats. As financial planning software stores and processes large volumes of critical data, potential security breaches can lead to substantial financial losses and damage to reputation.

This vulnerability restricts some potential users from fully embracing these digital solutions, impacting the overall market expansion. Ensuring robust cybersecurity measures and complying with international data protection regulations remain pivotal for software providers to gain user trust and market acceptance.

Opportunity

Expansion into Emerging Markets

Emerging markets present lucrative opportunities for the expansion of the financial planning software industry. Countries in regions like Asia-Pacific are witnessing rapid economic growth, increased digitalization, and a rising middle class, which in turn boosts the demand for financial planning services.

Additionally, as financial literacy improves and awareness of the benefits of financial planning grows, there is an increased adoption of financial planning software among individuals and smaller enterprises. These factors combined offer a significant growth potential for market players willing to invest in these regions and tailor their offerings to meet local needs.

Challenge

Inaccuracy of Data Sources

One of the primary challenges faced by the financial planning software market is the inaccuracy of data sources. Reliable financial forecasting relies on precise and valid data. However, discrepancies in data accuracy can lead to flawed financial predictions and strategies. This issue is compounded in environments where data integration from multiple sources is necessary but challenging to standardize. Overcoming this hurdle is crucial for software providers to ensure the reliability of financial planning outcomes and maintain user confidence in their products.

Growth Factors

- Increasing demand for Advanced tools: Advanced tools are needed for effective asset management in light of the ever-complex financial landscape, which is fueled by the variety of investment possibilities, tax laws, and the intricacy of retirement planning. Software for financial planning offers thorough solutions for handling these difficult problems.

- Expanding fintech industry: The need for creative software solutions is being driven by the expanding fintech industry and the increasing use of digital financial services. These platforms use state-of-the-art technology such as machine learning and artificial intelligence to offer customized recommendations and optimize financial procedures.

- Increase in demand for customized financial planning products: The industry is expanding due to an increasing number of high-net-worth people (HNWI) who are looking for sophisticated financial planning products. To properly manage their significant assets and accomplish their financial objectives, HNWIs require customized solutions.

- Regulatory mandates and compliance requirements: To guarantee adherence to industry standards and reduce legal risks, financial institutions and consulting firms are investing in strong software solutions due to regulatory mandates and compliance requirements.

- Financial literacy and planning: A wider user base is being produced by people’s growing knowledge and emphasis on financial literacy and planning, as well as their move toward self-directed investing. Utilize software for financial planning.

Latest Trends

- User-friendly platforms and accessibility: The desire of consumers for user-friendly platforms and accessibility on mobile devices has resulted in a noticeable movement towards more intuitive user interfaces and seamless user experiences.

- Rising number of software companies: A rising number of software companies are combining elements like goal monitoring, debt management, and budgeting to give comprehensive solutions that cover a range of personal finance issues. This demonstrates the growing emphasis on holistic financial wellness.

- Integration of artificial intelligence (AI) and machine learning algorithms: Financial planning software is undergoing a revolution due to the integration of artificial intelligence (AI) and machine learning algorithms. This makes it possible to perform more precise risk assessments, provide predictive analytics, and provide individualized suggestions based on the tastes and actions of each user. Using Blockchain technology to improve data management and financial transaction security, transparency, and efficiency in planning software platforms is another new trend.

- ESG investment: Environmental, social, and governance (ESG) investing is gaining traction, pushing software suppliers to include ESG measurements and screening tools into their platforms to fulfill the growing demand for socially responsible investment solutions.

- Adaptable and modular software solutions: Growing consumer demand for software solutions that are adaptable and modular, enabling them to choose and pay for just the features and functionalities they require, making them more flexible and economical.

Regional Analysis

In 2023, North America held a dominant market position in the financial planning software market, capturing more than a 37.5% share. This leadership can primarily be attributed to the high concentration of financial technology pioneers and a robust financial sector in the region, particularly in the United States and Canada. These countries have seen substantial investments in digital transformation initiatives, which include the adoption of advanced financial planning tools to enhance decision-making and operational efficiencies in financial institutions.

The demand in North America is also driven by a strong regulatory framework that mandates stringent compliance and reporting standards. Financial institutions are leveraging software solutions to ensure compliance with evolving regulations while improving their service offerings. Furthermore, the increasing awareness among individuals regarding personal financial management, coupled with high internet penetration and the availability of sophisticated technology infrastructure, contributes to the growth of the market in this region.

Looking towards Europe, the market exhibits robust growth driven by the increasing adoption of cloud-based financial planning solutions among small and medium-sized enterprises (SMEs). Europe’s focus on enhancing data security and privacy, aligned with GDPR compliance, encourages financial planners to adopt reliable and secure software solutions. The European market is also benefiting from governmental initiatives aimed at promoting digital finance, which is poised to further propel the market growth across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the financial planning software market, the landscape is competitive and dynamic, with several key players dominating the industry. SS&C Technologies Holdings, Inc., a prominent player, offers comprehensive solutions that cater to a broad range of financial services, providing robust software that supports investment and fund management. Envestnet Inc. is another influential entity, known for integrating portfolio, practice management, and reporting tools into a unified platform that enhances advisor productivity.

Morningstar Inc. has carved a niche for itself by offering investment management solutions that are deeply integrated with financial planning capabilities, helping advisors deliver enriched advice based on robust analytics. InvestCloud Inc., designs tailored digital platforms that allow financial firms to upgrade their offerings, providing a personalized experience to their clients through advanced digital apps.

RightCapital Inc. distinguishes itself with user-friendly financial planning software that emphasizes quick financial assessments and actionable insights, making financial planning both accessible and comprehensive. Cheshire Software, Inc. focuses on providing detailed analytical tools and simulation models that appeal to advanced users needing deep and customizable functionalities.

Top Key Players in the Market

- SS&C Technologies Holdings, Inc.

- Envestnet Inc.

- Morningstar Inc.

- InvestCloud Inc.

- RightCapital Inc.

- Cheshire Software, Inc.

- Quicken

- Other Key Players

Recent Developments

- In August 2023, Tradeshift and HSBC announced their joint venture to launch a new business that focused on the development of finance solutions and financial services applications.

- In April 2023, Metapraxis Limited, launched the Budgeting Calculator, tailored to support enterprise Financial Planning and Analysis (FP&A) teams.

- January 2023: SS&C Technologies announced the acquisition of Tier1 Financial Solutions, a leading provider of client relationship management and integrated sales solutions in the financial services industry. This acquisition aims to enhance SS&C’s CRM capabilities.

- February 2023: Morningstar launched Morningstar Direct, a new version of its flagship investment analysis platform, with enhanced features for portfolio analytics and performance reporting.

- December 2023: Beacon Pointe, a leading RIA firm, acquired Joslin Capital, managing $775 million in assets, to expand its footprint and service offerings in the financial planning market.

Report Scope

Report Features Description Market Value (2023) USD 4.3 Bn Forecast Revenue (2033) USD 18.2 Bn CAGR (2024-2033) 15.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-Based, On-Premise), By Application (Investment Planning, Personal Finance, Retirement Planning, Tax Planning, Other Applications), By End-User (Enterprises, Individuals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape SS&C Technologies Holdings Inc., Envestnet Inc., Morningstar Inc., InvestCloud Inc., RightCapital Inc., Cheshire Software, Inc., Quicken, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Financial Planning Software Market?The Financial Planning Software Market refers to the sector encompassing software solutions designed to assist individuals, businesses, and financial advisors in managing various aspects of financial planning, including budgeting, investment management, retirement planning, and tax optimization.

How big is Financial Planning Software Market?The Global Financial Planning Software Market size is expected to be worth around USD 18.2 Billion By 2033, from USD 4.3 Billion in 2023, growing at a CAGR of 15.5% during the forecast period from 2024 to 2033.

What are the Key Drivers of Growth in the Financial Planning Software Market?Factors such as increasing demand for streamlined financial management processes, rising adoption of digital financial tools, and growing awareness among individuals regarding the importance of financial planning are driving the growth of the financial planning software market.

Which Regions are Witnessing Significant Adoption of Financial Planning Software?In 2023, North America held a dominant market position in the financial planning software market, capturing more than a 37.5% share.

What Are the Leading Players in the Financial Planning Software Market?Key players in the financial planning software market include companies such as SS&C Technologies Holdings Inc., Envestnet Inc., Morningstar Inc., InvestCloud Inc., RightCapital Inc., Cheshire Software, Inc., Quicken, Other Key Players

What Are the Emerging Trends in the Financial Planning Software Market?Emerging trends in the financial planning software market include the integration of artificial intelligence and machine learning capabilities, the rise of mobile-based financial planning applications, and the increasing emphasis on providing holistic financial wellness solutions.

Financial Planning Software MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Financial Planning Software MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SS&C Technologies Holdings, Inc.

- Envestnet Inc.

- Morningstar Inc.

- InvestCloud Inc.

- RightCapital Inc.

- Cheshire Software, Inc.

- Quicken

- Other Key Players