Global Fibrin Sealants Market by Type (Liquid, Patch, and Powder), by Application (General Surgery, Cardiovascular Surgery, Wound Management, Orthopedic Surgery, and Other Applications), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 104206

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

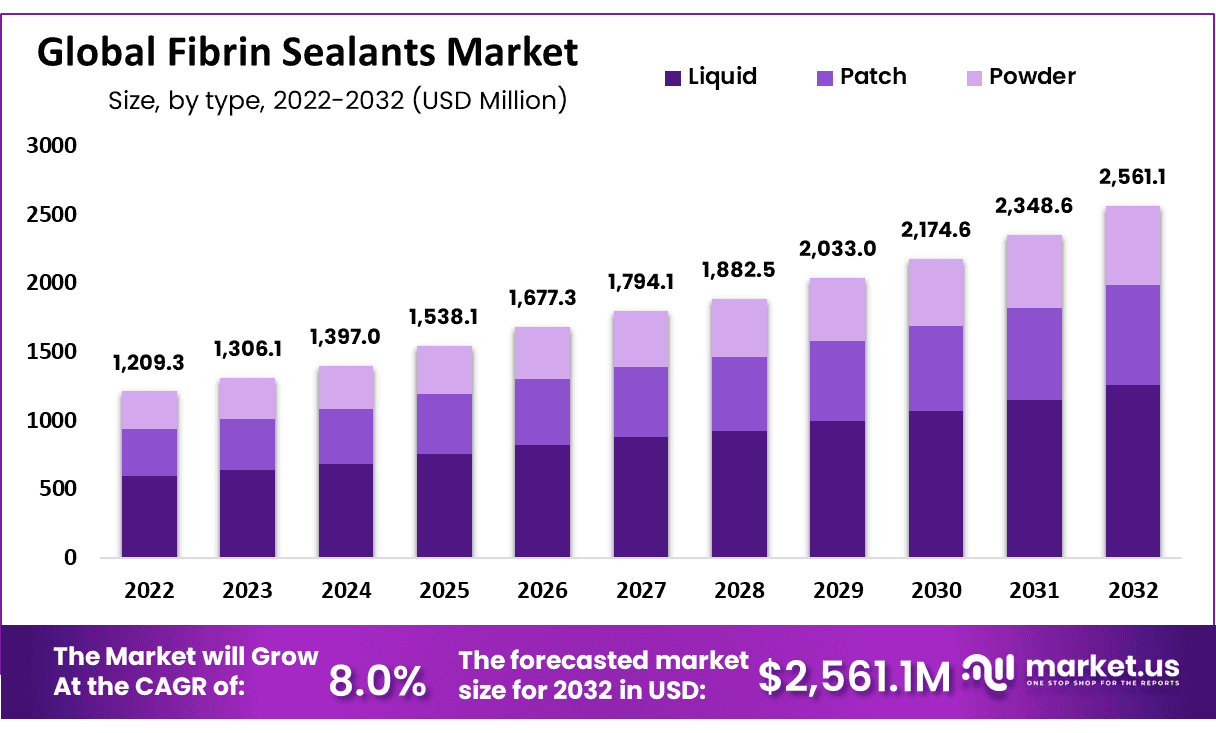

The Global Fibrin Sealants Market size is expected to be worth around USD 2,561.1 Million by 2032 from USD 1,306.1 Million in 2023, growing at a CAGR of 8.0% during the forecast period from 2023 to 2032.

Surgery bleeding is a common complication that can arise during surgery. Excess bleeding increases the risk of death and morbidity for those involved, necessitating using one of the popular fibrin sealants for hemostasis to stop bleeding after and during operations. Fibrin sealant comprises fibrinogen and thrombin, two essential elements in hemostasis during extreme bleeding.

The National Institutes of Health have classified fibrin sealants as individual human plasma liquids, bovine collagen, bovine thrombin, and human pooled blood; equine collagen patch; human pooled plasma liquids; oxidized and regenerated cellulose patches.

This market is expected to expand rapidly due to the rising use of hemostatic devices during surgical operations. Tissue sealant instruments will become even more sought-after due to an increasing prevalence of cardiovascular diseases and an escalating number of cardio surgeries. According to the American Heart Association (AHA), 15.5 million Americans suffered coronary heart disease in 2016.

Fibrin sealant patches are a two-component hemostatic solution. They contain fibrinogen and/or thrombin from human plasma embedded in an elastic composite patch made of collagen or cellulose, delivering both human fibrinogen and thrombin directly into the bleeding area without sufficient fibrinogen levels in the patient’s bloodstream.

Key Takeaways

- Fibrin Sealants Market size is expected to be worth around USD 2,561.1 Million by 2032 from USD 1,306.1 Million in 2023

- The market growing at a CAGR of 8.0% during the forecast period from 2023 to 2032.

- Fibrin sealants are used to manage bleeding during surgeries. Excessive bleeding can create complications during surgery and may even lead to death.

- Such products induce blood clotting at the site of bleeding, thus effectively stoopping the unnecessary blood flow.

- Liquid fibrin sealant patches are the largest contributor the Fibrin Sealants Market and the segment is predicted tofurther grow throughout the forecast.

- As far as application is concerned, cardiovascular surgery segment ranks first with a revenue share of 48%.

- Hospitals remain as the most dominant segment when classified by end users.

- Regionally, North America is a major contributor with a CAGR of 47.0%.

- Asia-Pacific market is projected to undergo a period of exponential growth with an expected CAGR of 6.9%.

By Type Analysis

Liquid Segment Dominates the Fibrin Sealants Market

The fibrin sealants market can be categorized into two main segments: liquid and patches. Among these segments, the liquid segment holds a prominent position due to its superior qualities compared to patches. Liquid solutions provide fast action and higher rational strength, resulting in advanced procedural outcomes. These advantages are expected to drive the growth of the liquid segment even further. Notably, one of the key benefits of using a fibrin sealant patch is its ability to achieve hemostasis within 3-4 minutes after application.

By Application Analysis

Cardiovascular Surgery Segment in Terms of Revenue Had Dominated the Market In 2022

Based on applications, the global fibrin sealants market is segmented into General Surgery, Cardiovascular Surgery, Orthopedic Surgery, Wound Management, Urological Surgeries, Ophthalmic Surgeries, and Transplant Surgery. Among these segments, the cardiovascular surgery segment, in terms of revenue, dominated the market in 2022 because of higher adoption in global markets.

Fibrin sealants will be more widely adopted because of the increasing number of orthopedic and cardiac surgical procedures. According to the fibrin sealants market research, the CAGR for cardiovascular and orthopedic surgery will be higher, the CAGR for cardiovascular and orthopedic surgery will be higher.

End-User Analysis

The Fibrin Sealant Market Share Will Be Overwhelmed by Hospitals

Based on the end users, the global fibrin sealants market can be separated into specialty clinics, hospitals, and Ambulatory Surgical Centers. The fibrin sealant market share will be overwhelmed by hospitals during the forecast period of 2023-2032. The hospital segment dominates because of an increasing number of CABG (coronary bypass grafting) and other cardiological surgeries in hospitals during the forecast period.

In the research by an agency, Healthcare Research, and Quality in the United States, percutaneous transluminal coronary surgery procedures grew by 20.0% between 2001 and 2011. This is expected to provide significant growth opportunities to the specialty clinics’ end-user segment between 2023-2032. because of the quieter demand for advanced healthcare facilities in developed and developing countries, the market shares of the other segment (ambulatory surgery centers and other care facilities) are predicted to be quieter.

Key Market Segments

By Type

- Liquid

- Patch

- Powder

By Application

- General Surgery

- Cardiovascular Surgery

- Wound Management

- Orthopedic Surgery

- Urological Surgeries

- Ophthalmic Surgeries

- Transplant Surgery

- Other Applications

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Other End-Users

Drivers

Patient Outcomes, Minimal Complications, And Lower Mortality Drives the Market

Hemostat adoption is expected to surge during the forecast period because of the increasing global prevalence of heart disease and complex surgical procedures such as cardiac surgery. According to a survey by the America Hospital Association, 17.2 million Americans required surgical procedures for therapeutic reasons. Fibrin sealants are expected to experience an uptick in demand over the forecast period due to their potential advantages, including improved patient outcomes, minimal complications, and lower mortality.

Fibrin sealants’ advantages over traditional methods like cautery and sutures could prompt increased adoption shortly. Recent product launches and technological developments within the fibrin sealants market should provide lucrative growth prospects for those performing minimally-invasive surgeries. By 2032, this will further accelerate the market’s expansion. Baxter introduced their new tissue prima syringe at the American Association of Gynecologic laparoscopists meeting in November 2018, making it eight times easier to push than its predecessor – making it ideal for use with Tisseel fibrin sealant products.

Restraints

Cases of Allergic Reactions Is Responsible for Restraining the Market

Fibrin sealant use may lead to allergic reactions, potentially leading to further surgical complications. Global fibrin sealing market growth is expected to be restricted due to reported allergic reactions to these patches and the relatively higher price point than traditional hemostatic products. Furthermore, there is the potential risk for transmission of viral or prion diseases through human plasma from pooled donors in this industry.

Opportunities

Increase in Patients Suffering from Blood-Related Disorders

Fibrin sealing agents are now widely operated in surgical practices such as dental surgery, neurosurgery (thoracic surgery), neurosurgery (plastic & reconstructive), and cardiovascular surgery to improve surgical outcomes. These contains a faster time to hemostasis, less blood loss, and fewer difficulties. Various electrosurgical instruments are available to analyze and seal vascular structures. Topical hemostatic agent fibrin sealants help control bleeding from surfaces or cavities which cannot withstand electrosurgery or suturing. The global fibrin sealing market is expected to expand due to increased patients suffering from blood-related disorders like hemophilia and more surgical procedures.

Impact of Macroeconomic Factors

The recent inflation has affected economies worldwide. Not only the costs are soaring but the purchasing power of customers has also been severely impacted. Further, cost-push inflation develops as a result of an upsurge in input costs. This impacts prices of goods and services. Seeing that the income is often unchanged without any considerable increase, customer behavior is greatly influenced. Customers tend to focus on the necessities, which hampers the market growth.

Latest Trends

Technological Advancements and Rising Product Approvals.

Fibrin sealants are used to rebuild the final stage of blood clotting by combining fibrinogen and thrombin at the wound site to form a cross-linked fibrin that stops bleeding. If standard surgical techniques fail to control bleeding, these products can be used as an adjunct. It’s important to consider hemostatic options for urgent or elective bleeding, as bones and soft tissues may be damaged or cut during orthopedic operations.

According to the Organization for Economic Co-operation and Development’s September 2022 update, coronary artery bypass surgery procedures were performed in France, Germany, and Canada at 17,149, 16,389, and 38,859, respectively, in 2020. This segment is predicted to grow because of increased cardiac surgeries.

Technological advancements and rising product approvals are fueling market growth. Key players also have partnerships and acquisitions underway. Takeda Pharmaceutical Company Limited bartered TachoSil Fibrin Sealant Patch in February 2021 to Corza Health Inc. In January 2020, Terumo Corporation released AQUABRID, an aortic surgery sealant, in Europe, the Middle East, and African Markets. AQUABRID reacts with the blood to form an elastic layer that sticks tightly to the tissue. These developments are expected to drive segment growth over the forecast period.

Regional Analysis

North America Held a Dominant Market Share of 47% In 2022

The Fibrin Sealants Market can be divided geographically into North America, Europe, Asia-Pacific, and South America. North America held a dominant market share of 47% in 2022 compared to other countries due to its developed healthcare infrastructure and higher prevalence of chronic diseases such as cardiovascular disease and orthopedic surgery; according to CDC estimates, one American dies from cardiovascular disease every 36 seconds – providing an enormous stimulus for this industry.

Asia-Pacific is expected to experience the fastest growth rate, rising at 6.9% CAGR over 2023-2032. Due to rising healthcare spending, demand for better care, and an aging population that poses greater risks of cardiovascular disease.

Key Regions

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Fibrin sealants are a highly competitive market, with only a few players holding the majority share. Baxter and Ethicon, both part of Johnson & Johnson Services Inc., held most of this share; however, Ethicon led in revenue. Baxter and Ethicon’s strong brand presence, established customer base, and presence across all regions account for this share. Ethicon’s share is expected to increase over the forecast period due to continuous product introductions, strategic partnerships, and their focus on penetration into emerging markets.

Market Key Players

Fragmentation is evident in the fibrin sealants market due to numerous local and regional players. Intense competition arises among market participants, especially from renowned brands with established reputations and extensive distribution networks. Companies employ diverse expansion strategies to maintain a competitive edge, including partnerships and product launches.

The following are some of the major players in the global fibrin sealants industry

- Baxter

- Pfizer Inc.

- Takeda Pharmaceutical Company

- Johnson & Johnson (Ethicon, Inc.)

- Grifols, S.A.

- CSL Limited

- Vivostat A/S

- Stryker

- Hermanus

- Asahi Kasei Corporation

- Other Key Players.

Recent Developments

- Baxter (February 2024): Baxter acquired Hemarini Pharmaceuticals in February 2024 to expand its portfolio in fibrin sealants. This acquisition aims to integrate Hemarini’s innovative hemostatic products, enhancing Baxter’s offerings in surgical care and improving bleeding control solutions.

- Pfizer Inc. (March 2024): Pfizer Inc. launched TachoSil Pro, an advanced fibrin sealant patch, in March 2024. This product offers enhanced adhesion and quicker hemostasis, making it suitable for various surgical procedures and providing reliable bleeding control.

- Takeda Pharmaceutical Company (January 2024): Takeda Pharmaceutical Company merged with BioSeal Technologies in January 2024. The merger combines Takeda’s pharmaceutical expertise with BioSeal’s fibrin sealant technologies, strengthening Takeda’s position in the hemostatic market.

- Johnson & Johnson (Ethicon, Inc.) (April 2024): Ethicon, Inc., a Johnson & Johnson company, acquired SurgiSeal Solutions in April 2024. This acquisition aims to enhance Ethicon’s fibrin sealant portfolio and improve its surgical bleeding control capabilities.

- Vivostat A/S (January 2024): Vivostat A/S merged with Hemostatic Innovations Inc. in January 2024. This merger aims to combine Vivostat’s autologous fibrin sealants with Hemostatic Innovations’ technologies, developing advanced hemostatic solutions for improved surgical outcomes.

Report Scope

Report Features Description Market Value (2023) USD 1,306.1 Million Forecast Revenue (2032) USD 2,561.1 Million CAGR (2023-2032) 8.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Liquid, Patch, and Powder By Application – General Surgery, Cardiovascular Surgery, Wound Management, Orthopedic Surgery, Urological Surgeries, Ophthalmic Surgeries, Transplant Surgery, Other Applications

By End-User – Hospitals, Specialty Clinics, Ambulatory Surgical Centers

Other End-Users

Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA. Competitive Landscape Baxter International Inc., Pfizer Inc., Takeda Pharmaceutical Company, Johnson & Johnson (Ethicon, Inc.), Grifols S.A., CSL Limited, Vivostat A/S, Stryker Corp, Hemarus Therapeutics Ltd. , Asahi Kasei Corporation and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are fibrin sealants?Fibrin sealants are biological adhesives used in surgery to stop bleeding and promote tissue healing.

How big is the Fibrin Sealants Market?The global Fibrin Sealants Market size was estimated at USD 1,209.3 Million in 2022 and is expected to reach USD 2,561.1 Million in 2032.

What is the Fibrin Sealants Market growth?The global Fibrin Sealants Market is expected to grow at a compound annual growth rate of 8.0 % From 2023 To 2032

Who are the key companies/players in the Fibrin Sealants Market?Some of the key players in the Fibrin Sealants Markets are Baxter, Pfizer Inc., Takeda Pharmaceutical Company, Johnson & Johnson (Ethicon, Inc.), Grifols, S.A., CSL Limited, Vivostat A/S, Stryker, Hermanus, Asahi Kasei Corporation, Other Key Players.

How do fibrin sealants work?Fibrin sealants mimic the body's natural clotting process, forming a stable blood clot to seal tissues and promote healing.

What are the main applications of fibrin sealants?Fibrin sealants are used in various surgical procedures, including cardiovascular, orthopedic, and general surgery.

What are the advantages of using fibrin sealants?Fibrin sealants reduce the risk of bleeding, infection, and inflammation, leading to faster recovery and better surgical outcomes.

Are there any risks associated with fibrin sealants?While generally safe, fibrin sealants can rarely cause allergic reactions or clotting issues. Patients should be screened for potential risks.

-

-

- Baxter

- Pfizer Inc.

- Takeda Pharmaceutical Company

- Johnson & Johnson (Ethicon, Inc.)

- Grifols, S.A.

- CSL Limited

- Vivostat A/S

- Stryker

- Hermanus

- Asahi Kasei Corporation

- Other Key Players.