Global Fiber Drums Market By Capacity (Below 25 Gallons, 25-50 Gallons, 50-75 Gallons, Above 75 Gallons), By Closure Type (Metal Closure, Plastic Closure, Fiber and Cardboard Closure), By End Use (Food and Beverage, Chemical, Pharmaceutical, Building and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133409

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

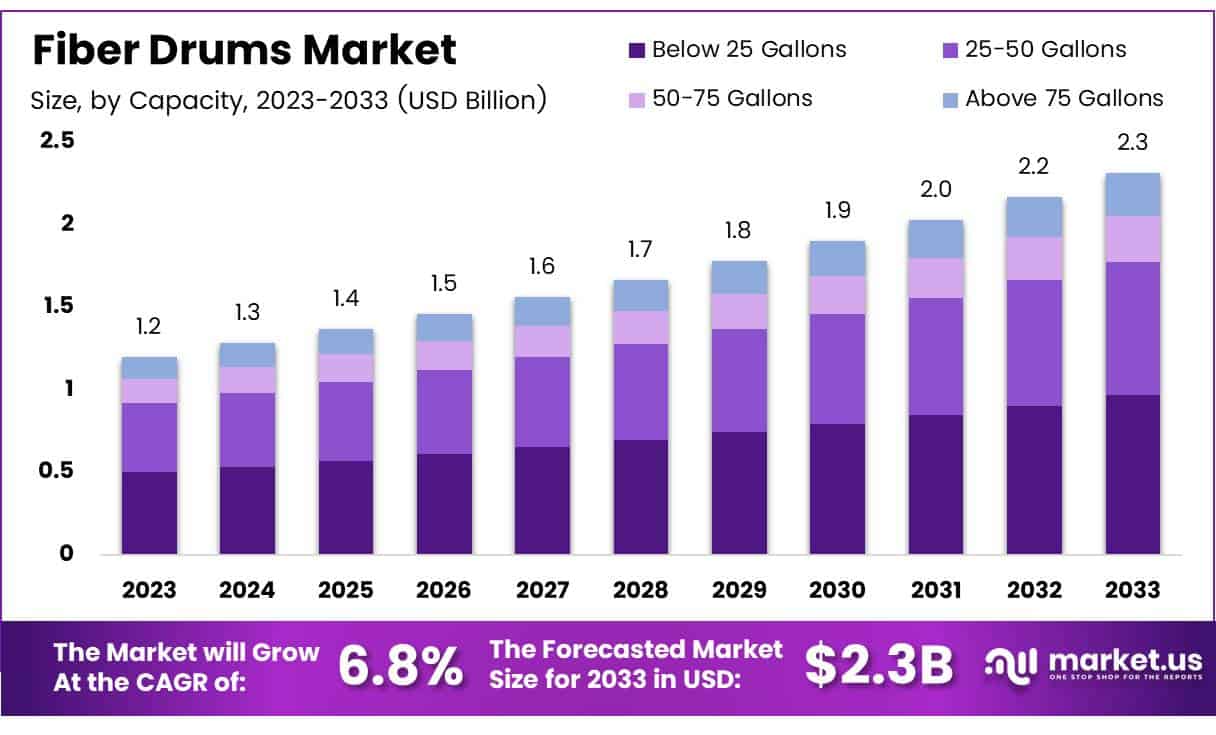

The Global Fiber Drums Market size is expected to be worth around USD 2.3 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Fiber drums are cylindrical containers crafted from fiberboard, designed for the transportation and storage of dry or solid products. These containers are prized for their lightweight, durability, and recyclability, making them a sustainable choice in packaging solutions.

They often feature removable lids and can be customized with linings, coatings, or barriers to accommodate a variety of substances including chemicals, pharmaceuticals, food ingredients, and other industrial goods.

The Fiber Drums Market refers to the global industry involved in the production, distribution, and sale of these fiberboard containers. This market caters to a wide array of sectors such as pharmaceuticals, chemicals, food and beverage, and other industrial applications where safe, cost-effective, and environmentally friendly packaging is paramount. The market is characterized by its commitment to sustainability and innovation in packaging solutions.

As industries continue to shift away from single-use plastics and other non-sustainable packaging options, fiber drums are becoming more popular due to their biodegradable nature and the ability to be reused and recycled. This shift is not only driven by consumer awareness and regulatory pressures but also by the substantial cost benefits these drums offer in terms of logistics and waste management.

Furthermore, the market is witnessing a surge in demand in emerging economies, where rapid industrialization and tightening environmental regulations are prompting companies to adopt more eco-friendly packaging methods.

The versatility and customization capability of fiber drums make them ideal for a broad range of applications, thus broadening their market reach and penetration in both developed and developing regions.

Government investments and regulatory frameworks play a crucial role in shaping the Fiber Drums Market. Various international and national agencies have implemented regulations that encourage or mandate the use of environmentally friendly packaging materials. These regulations often include standards for recyclability and minimum recycled content, which significantly favor the adoption of fiber drums.

In addition to regulatory support, some governments are providing financial incentives for companies that adopt sustainable practices, including tax rebates and grants for the development of green technologies in packaging. Such initiatives not only boost the market directly but also encourage continual innovations within the industry, ensuring that fiber drums remain competitive and effective against other packaging alternatives.

The importance of industry standards and capacity utilization is highlighted by a directive from perfect dossier, stating that fiberboard containers must be filled to not less than 95 percent of their maximum capacity, with contents evenly distributed.

This regulation ensures optimal use of space and materials, which enhances the sustainability profile of fiber drums by reducing the frequency and necessity of transportation, thereby decreasing carbon footprints associated with logistics.

Furthermore, the growth in global fiber production, as reported by textile exchange, from approximately 112 million tonnes in 2021 to 116 million tonnes in 2022, underscores a robust input market. This increase assures the Fiber Drums Market of a steady supply of raw materials, potentially stabilizing prices and improving supply chain reliability for manufacturers.

Additionally, the significant industry involvement, as noted by reusable packaging, with RIPA members generating approximately 90% of the gross industry sales of reconditioned containers, reflects a strong market dynamic of recycling and reconditioning. This not only enhances the environmental value proposition of fiber drums but also supports a circular economy model within the packaging industry.

Key Takeaways

- The Global Fiber Drums Market is projected to grow from USD 1.2 billion in 2023 to USD 2.3 billion by 2033, with a CAGR of 6.8%.

- In the capacity segment, Below 25 Gallons dominates with a 43% market share in 2023.

- Metal Closure leads the closure type segment with a 54.5% share in 2023, favored for its durability and security in high-requirement industries.

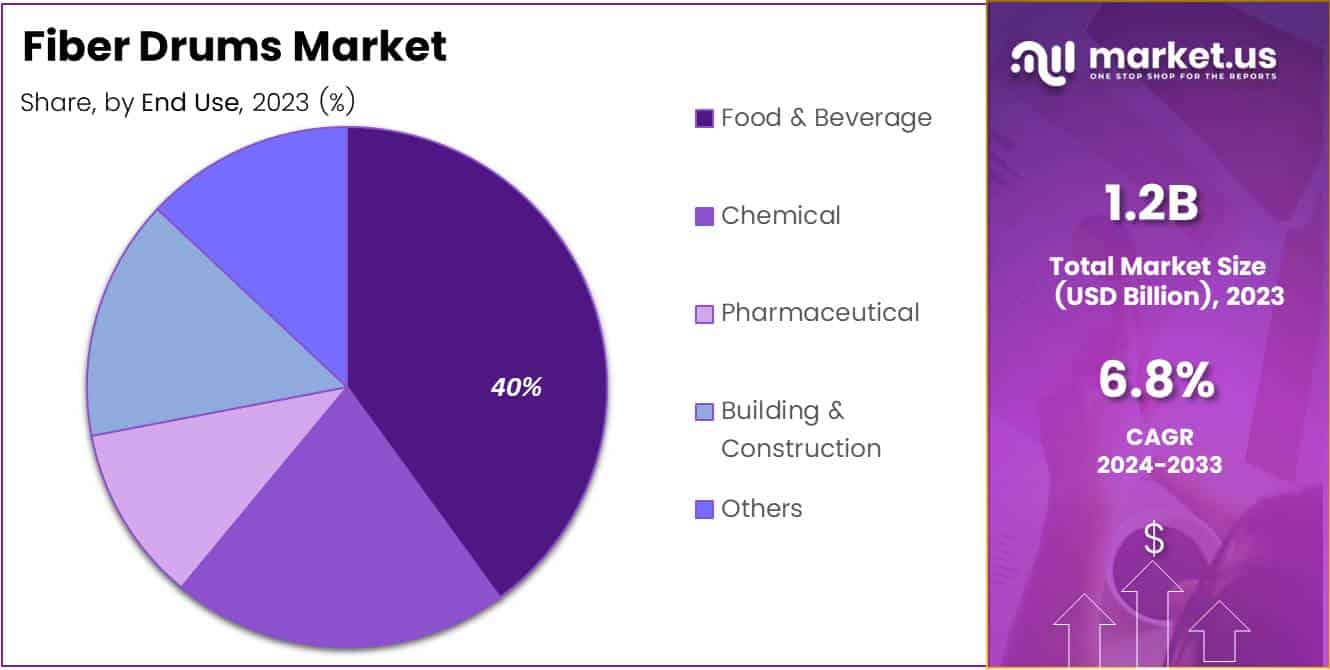

- The Food & Beverage sector is the largest end-user of fiber drums, holding a 40% market share in 2023, driven by demand for sustainable packaging.

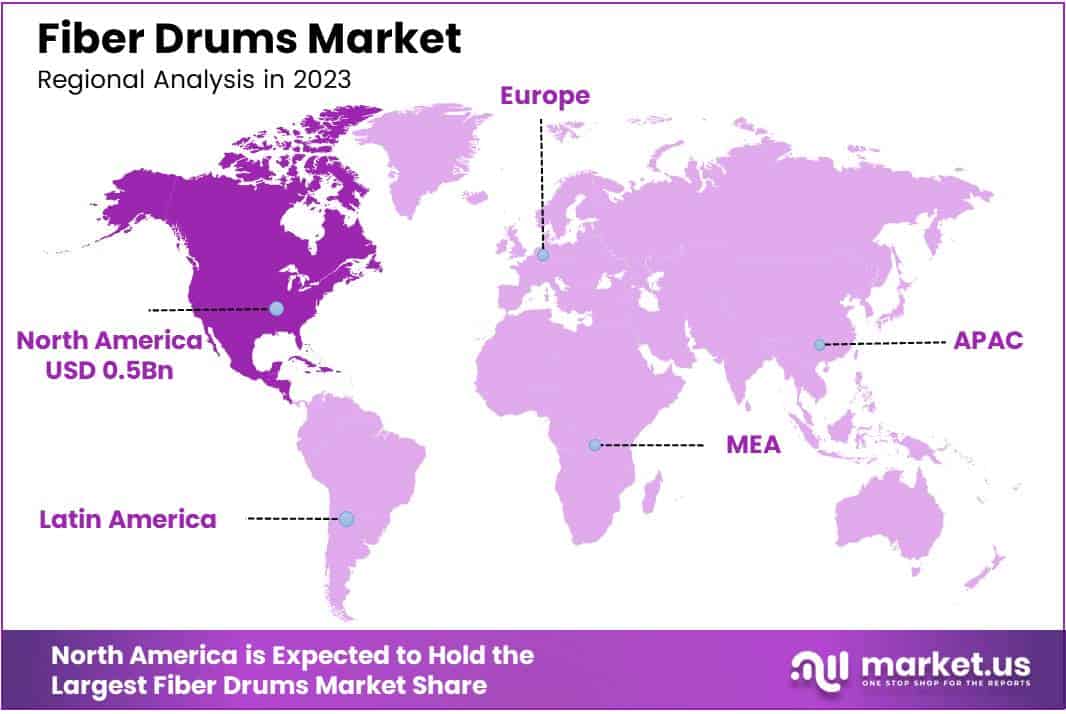

- North America is the leading region in the Fiber Drums Market, holding a 40% share valued at USD 0.5 billion, influenced by environmental regulations and a strong manufacturing sector.

Capacity Analysis

Below 25 Gallons Dominates Fiber Drums Market with 43% Share

In 2023, Below 25 Gallons held a dominant market position in the By Capacity Analysis segment of the Fiber Drums Market, with a 43% share. This segment’s substantial market share can be attributed to the widespread adoption of these smaller drums in various industries, including pharmaceuticals, food and beverages, and chemicals, where the need for compact and efficient packaging solutions is critical.

These drums are favored for their cost-effectiveness and suitability for storing smaller quantities of materials, which helps in reducing waste and improving material handling efficiency.

The 25-50 Gallons segment followed, leveraging its versatility across medium-scale operations, particularly in the chemicals and materials sectors. This segment benefits from the balance it offers between capacity and manageability, making it ideal for a wide range of applications without compromising on the transportation and storage costs.

Meanwhile, the 50-75 Gallons and Above 75 Gallons segments cater to niche markets requiring larger storage solutions. These segments are typically preferred in industries where bulk commodities are processed or shipped. However, their larger sizes often necessitate more significant logistical arrangements, slightly restraining their market penetration compared to smaller capacities.

Overall, the Fiber Drums Market is significantly shaped by the demand for efficient, scalable, and cost-effective packaging solutions, with smaller capacity drums leading the trend due to their practicality and ease of use in diverse industrial applications.

Closure Type Analysis

Metal Closure Leads with Over Half the Market Share in Fiber Drums Closures

In 2023, Metal Closure held a dominant market position in the By Closure Type Analysis segment of the Fiber Drums Market, with a 54.5% share. This prominent standing can be attributed to metal closures’ superior durability and security features, which are highly valued in industries requiring robust containment solutions, such as chemicals, pharmaceuticals, and food products.

Metal closures ensure an airtight seal, preserving the integrity of sensitive materials against external contaminants and variations in environmental conditions.

Conversely, Plastic Closure accounted for a significant portion of the market, favored for its cost-effectiveness and lighter weight, which reduces shipping costs. This type of closure is particularly popular in less regulated industries where extreme durability is not a primary concern.

Fiber/Cardboard Closure, while holding a smaller share of the market, is gaining traction due to its sustainability. As businesses move towards more eco-friendly packaging solutions, these closures are becoming preferred for their biodegradability and lower environmental impact, despite offering less protection compared to metal and plastic alternatives.

Together, these closure types cater to a diverse range of market needs, making the Fiber Drums Market versatile across various industrial applications.

End Use Analysis

Fiber Drums Market Dominated by Food & Beverage with 40% Share in 2023

In 2023, the Fiber Drums Market saw the Food & Beverage sector holding a dominant position in the By End Use Analysis segment, commanding a 40% market share.

This prominence is primarily attributed to the escalating demand for sustainable and cost-effective packaging solutions within the industry, driven by growing environmental concerns and stringent regulatory standards regarding packaging waste.

The Chemical sector also leveraged fiber drums extensively due to their safety, reliability, and compliance with handling regulations, contributing significantly to the market dynamics. Meanwhile, the Pharmaceutical industry’s utilization of fiber drums was motivated by the need for contamination-free and stable packaging for sensitive products, ensuring a steady demand within this segment.

Building & Construction and other sectors, such as agriculture and electronics, showed a diversified application of fiber drums, driven by their durability and ease of handling.

These sectors appreciated the fiber drums’ adaptability to various environmental conditions and their reusability, enhancing their appeal across a broad range of industrial applications. Overall, the diverse end-use spectrum of fiber drums underscores their versatility and essential role in modern industrial packaging solutions.

Key Market Segments

By Capacity

- Below 25 Gallons

- 25-50 Gallons

- 50-75 Gallons

- Above 75 Gallons

By Closure Type

- Metal Closure

- Plastic Closure

- Fiber/ Cardboard Closure

By End Use

- Food & Beverage

- Chemical

- Pharmaceutical

- Building & Construction

- Others

Drivers

Sustainability Spurs Fiber Drum Adoption

Fiber drums are gaining popularity in the market, primarily driven by their eco-friendly nature. As businesses and consumers increasingly prioritize sustainability, the demand for biodegradable packaging solutions is on the rise.

Fiber drums offer an excellent alternative to traditional plastic and metal packaging, aligning with global efforts to reduce environmental impact. Additionally, the booming e-commerce sector, characterized by the surge in online retail activities, necessitates robust and secure packaging options.

Fiber drums meet this demand effectively, especially for bulk products that require durable yet lightweight packaging. Moreover, cost-effectiveness remains a significant factor; compared to metal drums and plastic containers, fiber drums are more affordable, making them a preferred choice among cost-conscious industries. These attributes collectively make fiber drums a compelling option in today’s environmentally conscious and economically driven market landscape.

Restraints

Perceived Inadequacy for Heavy Loads Limits Use

Fiber drums, commonly used in various industries for packaging due to their lightweight and recyclability, face certain restraints that may impact their market growth. The primary challenge is the perception that they lack the necessary strength for transporting extremely heavy or abrasive materials, making them less favorable compared to more robust metal drums.

Additionally, their composition limits their effectiveness in extreme temperature conditions, which is a critical factor for sectors like food processing and pharmaceuticals where regulatory compliance and product integrity are paramount.

This perceived limitation in handling heavy loads and temperature-sensitive contents could restrict their adoption across industries that require stringent material handling solutions, potentially affecting the broader acceptance and utilization of fiber drums.

Growth Factors

Fiber Drums Tap into Expanding Emerging Markets

The fiber drums market is poised for growth, driven primarily by the rapid industrialization in emerging economies, especially in the Asia-Pacific region.

As these regions continue to develop, the demand for robust, cost-effective packaging solutions like fiber drums is expected to rise. These drums are highly valued in the pharmaceutical and healthcare sectors for their ability to safely transport bulk pharmaceuticals and chemicals, requiring stringent, hygienic packaging standards.

Moreover, the increasing emphasis on sustainability has elevated the importance of recycling and upcycling, propelling the demand for fiber drums made from recycled materials. This not only supports environmental sustainability but also offers companies a cost-efficient way to manage waste.

The convergence of these factors market expansion in developing countries, critical packaging needs in healthcare, and sustainability initiatives creates a fertile landscape for the growth of the fiber drums market, making it an attractive investment avenue for businesses looking to innovate and expand in global packaging solutions.

Emerging Trends

Smart Packaging Gains Popularity in Fiber Drums Market

Fiber drums are increasingly becoming a preferred choice in various industries, including food, chemicals, and pharmaceuticals, due to their capacity for bulk packaging, which allows businesses to store and transport large quantities efficiently. One of the key trends enhancing their appeal is the integration of smart packaging technologies.

These technologies include RFID tags, temperature sensors, and QR codes, which significantly improve supply chain transparency and product safety. Additionally, the shift towards lightweight packaging solutions is driving the adoption of fiber drums. They offer notable logistical advantages being easier to handle and more cost-effective to transport compared to heavier alternatives.

This blend of smart technology and practical design is positioning fiber drums as a pivotal solution in modern packaging strategies, catering to the growing demands of safety and efficiency in product handling and distribution.

Regional Analysis

North America Leads Fiber Drums Market with 40% Share, Valued at USD 0.5 Billion

The Fiber Drums Market exhibits varied performance across global regions, characterized by differing growth rates and market penetration.

Dominating the global landscape, North America holds a significant share of approximately 40%, with a market value of USD 0.5 billion. This region benefits from stringent environmental regulations and a robust manufacturing sector that increasingly prefers sustainable packaging solutions.

Regional Mentions:

Europe, the market is driven by a strong emphasis on recyclable and eco-friendly packaging materials, particularly within the chemicals and pharmaceuticals industries. European manufacturers and consumers show a growing preference for fiber drums due to their reusability and minimal environmental impact, supporting a steady growth trajectory in this region.

Asia Pacific region is witnessing rapid growth in the fiber drums market, fueled by expanding industrial activities and increasing international trade. The rise in manufacturing outputs in countries like China and India, coupled with heightened environmental awareness, is propelling the demand for fiber drums. This region’s market is expected to expand at the highest CAGR over the forecast period due to these factors.

Middle East & Africa and Latin America regions exhibit slower growth, primarily due to less stringent environmental regulations and a slower adoption rate of sustainable packaging solutions. However, these regions offer significant growth opportunities as markets mature and awareness of sustainable packaging increases among businesses and consumers alike.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Fiber Drums Market, several key players are shaping the industry’s landscape in 2023. Greif Inc. and Schutz Container Systems, Inc. remain prominent due to their comprehensive product offerings and widespread geographical presence, driving innovations in drum safety and sustainability.

Orlando Drum & Container Corporation and Milford Barrel Co Inc. stand out for their bespoke solutions tailored to niche market needs, enhancing customer satisfaction through specialized designs.

Berlin Packaging has made significant strides by integrating advanced manufacturing processes that reduce costs and improve the structural integrity of fiber drums. Similarly, the Fiber Drum Company focuses on eco-friendly designs, catering to industries looking to reduce their environmental footprint.

Mauser Group N.V. leverages its global network to ensure consistent supply and rapid deployment of their fiber drums in various markets. C.L Smith Company and Great Western Containers Inc. have focused on customer-centric strategies, offering enhanced customization options that allow clients to optimize storage and transportation conditions.

Sonoco Products Company continues to innovate in drum closure technology, which enhances the safety and reusability of their containers. Enviro-Pak, Inc., Industrial Container Services, Inc., and Three Rivers Packaging Inc. have concentrated their efforts on improving the durability and cost-effectiveness of their drums, aiming to offer superior alternatives to traditional packaging methods.

Patrick J. Kelly Drums and Fiberstar Drums Limited have carved out a niche by offering highly specialized drums for sectors like pharmaceuticals and food services, where stringent regulatory compliance is critical.

Top Key Players in the Market

- Grief Inc.

- Schutz Container Systems, Inc.

- Orlando Drum & Container Corporation

- Milford Barrel Co Inc.

- Berlin Packaging

- Fiber Drum Company

- Mauser Group N.V.

- C.L Smith Company

- Great Western Containers Inc.

- Sonoco Products Company

- Enviro-Pak, Inc.

- Industrial Container Services, Inc.

- Three Rivers Packaging Inc.

- Patrick J. Kelly Drums

- Fiberstar Drums Limited

Recent Developments

- In March 2024, William Say & Co. Ltd invested £850,000 to futureproof its London factory, enhancing production capabilities and integrating advanced sustainability technologies.

- In August 2024, Rödl & Partner advised SCHÜTZ on its strategic acquisition of a significant stake in Fibre Drum Sales, Inc., aiming to expand its market presence in North America.

- In January 2024, Novvia Group acquired the Packaging Distribution Division of JF Shelton Company, expanding its product offerings and distribution network across the United States.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 2.3 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (Below 25 Gallons, 25-50 Gallons, 50-75 Gallons, Above 75 Gallons), By Closure Type (Metal Closure, Plastic Closure, Fiber/ Cardboard Closure), By End Use (Food and Beverage, Chemical, Pharmaceutical, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Grief Inc., Schutz Container Systems, Inc., Orlando Drum & Container Corporation, Milford Barrel Co Inc., Berlin Packaging, Fiber Drum Company, Mauser Group N.V., C.L Smith Company, Great Western Containers Inc., Sonoco Products Company, Enviro-Pak, Inc., Industrial Container Services, Inc., Three Rivers Packaging Inc., Patrick J. Kelly Drums, Fiberstar Drums Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grief Inc.

- Schutz Container Systems, Inc.

- Orlando Drum & Container Corporation

- Milford Barrel Co Inc.

- Berlin Packaging

- Fiber Drum Company

- Mauser Group N.V.

- C.L Smith Company

- Great Western Containers Inc.

- Sonoco Products Company

- Enviro-Pak, Inc.

- Industrial Container Services, Inc.

- Three Rivers Packaging Inc.

- Patrick J. Kelly Drums

- Fiberstar Drums Limited