Ferritin Testing Market By Product Type (Reagent and Instrument & Kits), By Application (Anemia, Pregnancy, Lead Poisoning, Hemochromatosis, and Others), By End-user (Hospitals and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162861

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

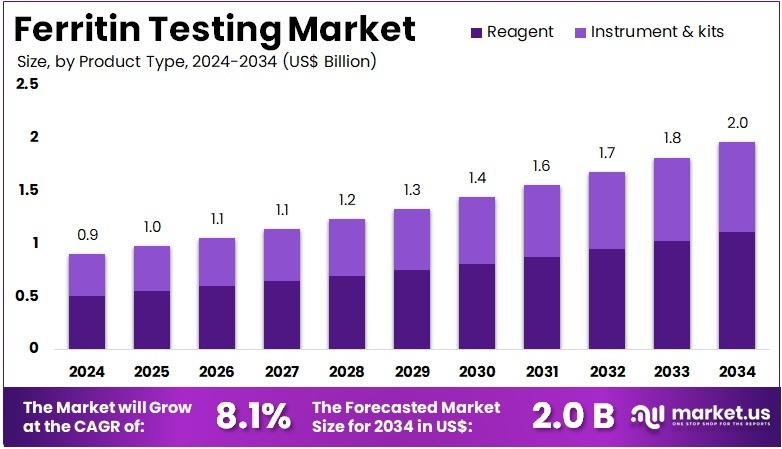

The Ferritin Testing Market Size is expected to be worth around US$ 2.0 billion by 2034 from US$ 0.9 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

Increasing prevalence of iron-related disorders drives the Ferritin Testing Market, as healthcare providers prioritize early detection of anemia and hemochromatosis. Clinicians employ ferritin assays to diagnose iron deficiency in patients with chronic fatigue, guiding targeted supplementation therapies. These tests support prenatal care by assessing maternal iron stores, reducing risks of adverse pregnancy outcomes.

Research institutions utilize ferritin testing to monitor iron metabolism in clinical trials for hematological disorders. In December 2024, the US Centers for Disease Control and Prevention reported that anemia affected nearly one in ten Americans aged two and older, underscoring the need for ferritin testing to address health disparities. This heightened clinical reliance fuels market growth by integrating ferritin assays into routine diagnostic protocols.

Growing demand for rapid diagnostics creates opportunities in the Ferritin Testing Market, as innovations enhance accessibility in diverse healthcare settings. Point-of-care ferritin tests enable swift iron status assessments in primary care, streamlining management of chronic kidney disease. These assays support nutritional screening in pediatric populations, identifying deficiencies in at-risk groups like adolescents.

Automated platforms improve throughput in hospital laboratories, facilitating large-scale public health surveys. In January 2025, bioMérieux acquired SpinChip Diagnostics, introducing microfluidic-based rapid immunoassay technology for whole-blood ferritin analysis in just 10 minutes. This advancement drives market expansion by enabling decentralized testing and improving patient care efficiency.

Rising regulatory focus on diagnostic standardization propels the Ferritin Testing Market, as updated guidelines necessitate advanced assay calibration. Ferritin tests aid in monitoring treatment efficacy for patients with iron overload disorders, ensuring precise therapeutic adjustments. These assays find applications in oncology, assessing iron status in cancer patients undergoing chemotherapy. Trends toward high-sensitivity immunoassays enhance accuracy in detecting subclinical deficiencies, supporting preventive care.

In 2024, the World Health Organization introduced updated ferritin reference thresholds for diagnosing iron deficiency and overload, requiring labs to adopt standardized, sensitive instruments. This regulatory shift drives demand for compliant diagnostic solutions, positioning the market for sustained growth through technological adaptation.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 billion, with a CAGR of 8.1%, and is expected to reach US$ 2.0 billion by the year 2034.

- The product type segment is divided into reagent and instrument & kits, with reagent taking the lead in 2023 with a market share of 56.4%.

- Considering application, the market is divided into anemia, pregnancy, lead poisoning, hemochromatosis, and others. Among these, anemia, pregnancy held a significant share of 37.9%.

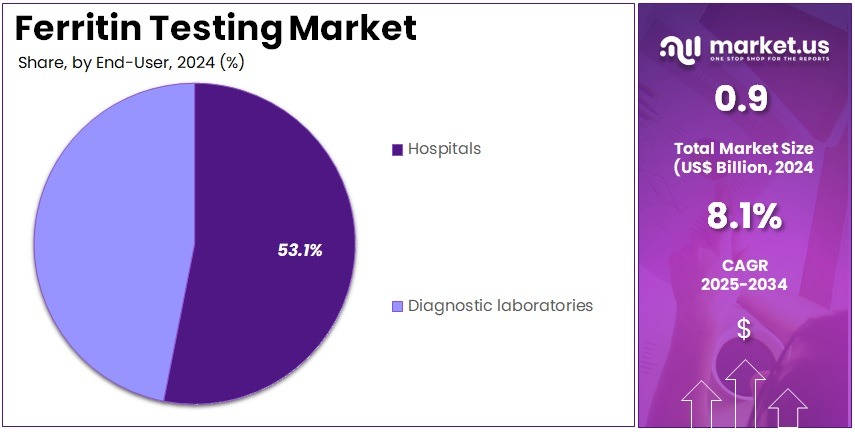

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and diagnostic laboratories. The hospitals sector stands out as the dominant player, holding the largest revenue share of 53.1% in the market.

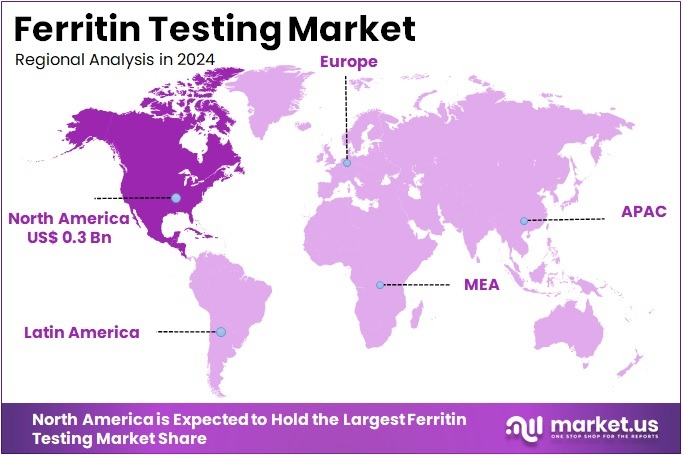

- North America led the market by securing a market share of 37.5% in 2023.

Product Type Analysis

Reagents hold 56.4% of the Ferritin Testing market and are expected to sustain their dominance due to their critical role in ensuring accuracy, sensitivity, and reproducibility of ferritin assays. Reagents are integral to various testing platforms, including ELISA, immunoturbidimetric, and chemiluminescent assays, enabling reliable quantification of ferritin levels in serum and plasma. The growing incidence of iron deficiency anemia and related disorders across developing economies drives high reagent consumption.

Laboratories and hospitals increasingly prefer high-quality, ready-to-use reagents for streamlined workflows and consistent results. Advances in reagent formulation, stability, and automation compatibility are projected to improve throughput and efficiency in ferritin testing. Additionally, the global expansion of clinical laboratories and preventive healthcare initiatives emphasizing anemia screening enhance reagent demand.

The shift toward automated analyzers that require reagent optimization further stimulates recurring sales. Research applications focusing on ferritin as an inflammation biomarker also contribute to market expansion. Reagents’ affordability, ease of standardization, and role in assay accuracy ensure their continued leadership. The ongoing introduction of advanced reagent kits compatible with multiple assay systems strengthens their position in both diagnostic and research environments.

Application Analysis

Anemia accounts for 37.9% of the application segment and is projected to drive strong growth owing to the high prevalence of iron deficiency worldwide. Ferritin testing serves as a primary diagnostic tool for evaluating iron stores and differentiating between types of anemia, ensuring appropriate treatment. The World Health Organization’s recommendation for routine anemia screening, particularly among women and children, enhances test adoption.

Early diagnosis of anemia in pregnant women prevents maternal and fetal complications, driving the complementary growth of the pregnancy segment, which holds 26.8%. Pregnant women often undergo regular ferritin monitoring to manage iron supplementation and prevent gestational anemia. Hospitals and diagnostic centers are expanding anemia and prenatal testing programs, increasing ferritin assay utilization.

Technological advancements in automated immunoassays and faster turnaround times improve clinical efficiency. Awareness campaigns promoting maternal health and nutritional monitoring further strengthen demand. The integration of ferritin testing into comprehensive prenatal and preventive health packages ensures consistent market growth. Collectively, anemia and pregnancy applications remain key growth drivers, supported by government screening initiatives and rising public health awareness.

End-User Analysis

Hospitals account for 53.1% of the end-user segment and are anticipated to maintain dominance due to their central role in patient diagnosis, monitoring, and preventive care. Hospitals conduct ferritin testing for diverse indications including anemia, chronic kidney disease, inflammation, and pregnancy-related evaluations. The increasing number of hospital-based diagnostic units equipped with automated analyzers enhances testing capacity and efficiency.

The rise in hospital admissions related to nutritional deficiencies and chronic disorders fuels consistent testing demand. Hospitals benefit from centralized procurement of reagents and instrument kits, ensuring standardized results and quality control. The expansion of tertiary care and maternal health programs increases ferritin test volumes in hospital laboratories. Integration of digital lab management systems improves data accuracy and reporting turnaround times.

Collaboration with government health initiatives for anemia screening and maternal care strengthens utilization. Hospitals also support research programs studying ferritin’s role as a biomarker for metabolic and inflammatory diseases. The focus on comprehensive diagnostic services, coupled with infrastructure modernization and increased patient awareness, is expected to reinforce hospital dominance. Continuous investments in laboratory automation and test standardization further consolidate hospitals as the leading end-users in the ferritin testing market.

Key Market Segments

By Product Type

- Reagent

- Instrument & Kits

By Application

- Anemia

- Pregnancy

- Lead Poisoning

- Hemochromatosis

- Others

By End-user

- Hospitals

- Diagnostic Laboratories

Drivers

Increasing Prevalence of Iron Deficiency Anemia is Driving the Market

The growing incidence of iron deficiency anemia has substantially advanced the ferritin testing market, as serum ferritin serves as a primary biomarker for assessing depleted iron stores in affected individuals. This condition, prevalent among women of reproductive age and children, manifests through fatigue and cognitive impairments, necessitating routine evaluations to guide supplementation and avert complications.

Ferritin assays, typically performed via immunoassays, provide quantitative insights into iron homeostasis, facilitating early interventions in primary care settings. This driver is amplified by nutritional deficiencies exacerbated by dietary patterns and socioeconomic factors, prompting healthcare systems to integrate ferritin profiling into anemia screening protocols.

Public health frameworks emphasize its diagnostic superiority over hemoglobin alone, enhancing adoption in diverse clinical contexts. The escalation in cases correlates with expanded laboratory capacities, where automated platforms streamline high-volume processing. The Centers for Disease Control and Prevention reported a 9.3% prevalence of anemia among individuals aged 2 years and older during August 2021–August 2023, with iron deficiency as a leading etiology. This figure, derived from the National Health and Nutrition Examination Survey, underscores the diagnostic imperative amid stable epidemiological trends.

Innovations in multiplex panels further augment utility, allowing concurrent assessment of transferrin saturation. Economically, widespread utilization mitigates hospitalization rates, justifying resource allocations for reagent supplies. Collaborative efforts with nutritional programs disseminate guidelines, promoting equitable access. This anemia burden not only sustains test demands but also reinforces ferritin’s centrality in hematologic surveillance.

Restraints

High Costs and Limited Reimbursement for Advanced Assays is Restraining the Market

The elevated financial demands of sophisticated ferritin testing methodologies and fragmented reimbursement mechanisms continue to hinder market accessibility, particularly in outpatient and low-resource environments. Immunoassay-based kits require premium reagents and calibration, often surpassing budgetary constraints for smaller facilities reliant on volume-based revenues. This restraint perpetuates selective utilization, confining advanced assays to tertiary centers while marginalizing point-of-care alternatives.

Jurisdictional variances in coverage, demanding evidentiary thresholds for routine applications, exacerbate adoption barriers and prolong payer negotiations. Developers shoulder validation expenses, deferring portfolio diversifications to subsidized niches. The resultant disparities inflate unmanaged case burdens, straining public health expenditures.

The Centers for Medicare & Medicaid Services indicated that Medicare Part B spending on clinical diagnostic laboratory tests totaled $7.9 billion in 2022, yet ferritin assays faced restrictive reimbursement adjustments under the Clinical Laboratory Fee Schedule. Such fiscal parameters highlight systemic constraints, as rate stabilizations from 2021–2023 limited expansions. Provider apprehensions arise from unrecouped outlays, favoring costlier but reimbursable alternatives. Advocacy for tiered models advances incrementally, impeded by outcome data deficiencies. These economic frictions not only curtail throughput but also impede the market’s preventive potential.

Opportunities

Government Initiatives for Anemia Reduction Programs is Creating Growth Opportunities

The proliferation of state-sponsored anemia abatement strategies has unlocked considerable avenues for ferritin testing, embedding diagnostics within comprehensive nutritional surveillance frameworks. These endeavors, targeting high-burden demographics through subsidized screenings, leverage ferritin as a sentinel indicator for intervention efficacy.

Opportunities emerge in procurement contracts for standardized kits, fortifying supply chains in community health outposts. Public-private alliances validate protocols, subsidizing deployments amid escalating caseloads. This integration addresses micronutrient gaps, positioning ferritin evaluations as prophylactics against developmental delays.

Fiscal commitments for universal access catalyze infrastructure enhancements, diversifying toward portable formats. The World Health Organization’s Anemia Mukt Bharat initiative screened over 10 million individuals in India by 2022, incorporating ferritin assessments to achieve a 32% prevalence reduction target among pregnant women. This scale exemplifies replicable models, with analogous programs projecting amplified reagent procurements.

Innovations in user-friendly interfaces broaden feasibility in field applications, mitigating logistical voids. As registries digitize, outcome analytics refine targeting, fostering performance-based revenues. These programmatic thrusts not only elevate volumes but also anchor the market in equitable health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are forcing developers in the ferritin testing market to delay automation upgrades for immunoassay platforms, focusing instead on maintaining antibody supplies amid tightening R&D budgets. Trade restrictions between the U.S. and China, along with shipping delays through the Suez Canal, are disrupting imports of calibration buffers, extending assay validation timelines and increasing certification costs for global lab networks. To address these challenges, some companies are partnering with buffer manufacturers in Nebraska, introducing validation protocols that accelerate FDA approvals and attract anemia-related research funding.

Growing diagnoses of iron deficiency are channeling WHO support into point-of-care ferritin testing, boosting adoption in primary care programs. Meanwhile, U.S. tariffs on imported medical devices and components are raising costs for Asian-sourced materials, reducing hospital profit margins and slowing international standardization efforts. In response, developers are leveraging federal innovation credits to establish synthesis facilities in Missouri, introducing chemiluminescent enhancements and improving precision in high-sensitivity calibrations.

Latest Trends

Launch of AnemoCheck Home Ferritin Test Kit is a Recent Trend

The commercialization of consumer-accessible ferritin self-testing solutions has delineated a noteworthy evolution in the ferritin testing landscape during 2025, prioritizing autonomy in iron status monitoring. AnemoCheck Home, a smartphone-paired capillary assay, delivers quantitative results within 15 minutes, circumventing laboratory dependencies for at-home validations. This trend embodies a transition to decentralized paradigms, accommodating frequent checks in chronic management without clinical visits.

Regulatory endorsements affirm analytical equivalence, hastening integrations with telehealth ecosystems. This accessibility aligns with wellness imperatives, empowering users to correlate levels with dietary adjustments. The platform’s algorithmic interpretations, synced via applications, facilitate provider consultations, enhancing adherence.

AnemoCheck Home received U.S. Food and Drug Administration clearance in 2023, with nationwide retail availability commencing in 2025 to support anemia self-screening. This rollout underscores viability in post-pandemic care, with validations confirming precision across demographic spectra. Subsequent adaptations target multiplexity, incorporating hemoglobin for holistic profiles. The advancement anticipates subscription models, optimizing longitudinal tracking. This self-reliant modality not only accelerates diagnostic tempo but also synchronizes with patient-centric evolutions.

Regional Analysis

North America is leading the Ferritin Testing Market

In 2024, North America commanded a 37.5% share of the global ferritin testing market, impelled by heightened emphasis on routine screening for iron deficiency anemia in primary care protocols, particularly among women of reproductive age and children, where elevated ferritin thresholds guide timely supplementation to avert cognitive impairments. Clinical laboratories broadened immunoassay capacities to handle increased referrals for hemochromatosis risk assessment in Caucasian demographics, utilizing high-throughput analyzers that deliver results in under 30 minutes, facilitating immediate therapeutic decisions in gastroenterology consultations.

The National Center for Health Statistics’ recent data underscored the prevalence, prompting expansions in point-of-care testing within pediatric clinics, where capillary-based assays mitigate venipuncture distress while supporting early intervention for growth faltering linked to low iron stores. Demographic patterns, such as higher rates among Hispanic populations due to dietary factors, correlated with community outreach programs funded by state health departments, enhancing diagnostic equity in border regions.

Innovations in multiplex configurations integrated ferritin with transferrin saturation metrics, streamlining evaluations for restless legs syndrome in neurology practices. These evolutions exemplified the region’s commitment to integrated metabolic screening paradigms. The National Center for Health Statistics reported that anemia affected 9.3% of individuals aged 2 years and older from August 2021 to August 2023, with females showing a higher prevalence of 13.0% compared to 5.5% in males.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National authorities in Asia Pacific project the ferritin testing sector to burgeon during the forecast period, as escalating anemia incidences in agrarian societies necessitate biomarker-driven diagnostics for maternal and pediatric cohorts. Officials in India and Vietnam disburse allocations for ELISA-based kits, arming rural dispensaries to quantify iron reserves in malnourished infants exposed to parasitic burdens. Laboratory consortia engage governmental institutes to calibrate spectrophotometric methods, anticipating accurate profiling of thalassemia trait carriers in coastal enclaves.

Regulatory councils in South Korea and Indonesia endorse subsidized point-of-care strips, enabling field medics to assess ferritin depletion during antenatal checkups without laboratory referrals. Administrative frameworks anticipate merging assay outputs with nutritional registries, expediting interventions for gestational hypoferremia in migrant enclaves.

Regional biochemists pioneer chemiluminescent variants, synchronizing with epidemiological cohorts to delineate ethnic disparities in storage depletion. These integrations forge a vigilant network for micronutrient stewardship. The World Health Organization estimated that anemia prevalence among women aged 15-49 years in South-East Asia stood at 53.1% in 2019, with figures persisting above 50% into 2022 amid stagnant mitigation efforts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent organizations in the iron metabolism diagnostics arena advance their portfolios by launching automated immunoassays that integrate AI for rapid ferritin quantification, enabling precise anemia management in outpatient settings. They pursue strategic acquisitions of regional lab networks to consolidate distribution channels, optimizing logistics and expanding access in fragmented markets. Enterprises forge collaborations with wellness programs to incorporate tests into preventive screening bundles, targeting high-risk groups like pregnant women and athletes.

Leaders invest in point-of-care adaptations for remote deployments, enhancing portability and reducing dependency on centralized facilities. They prioritize penetration into growth hubs across Latin America and Eastern Europe, aligning with national health campaigns to capture subsidized volumes. Moreover, they establish performance-based pricing tiers with clinics, leveraging outcome data to reinforce partnerships and diversify income sources.

Abbott Laboratories, founded in 1885 and headquartered in Chicago, Illinois, engineers a broad spectrum of diagnostics and medical devices that support global health initiatives through innovative testing solutions. The company deploys its Alinity platform for ferritin assays, providing streamlined workflows that integrate seamlessly with laboratory automation for efficient iron status evaluation.

Abbott allocates substantial resources to digital enhancements, focusing on connectivity features that facilitate remote monitoring and data-driven insights. CEO Robert B. Ford oversees a diversified enterprise spanning 160 countries, championing regulatory excellence and equitable access. The firm partners with public health entities to refine protocols, bolstering early intervention strategies. Abbott sustains its commanding presence by harmonizing technological advancements with collaborative frameworks to address evolving diagnostic demands.

Top Key Players in the Ferritin Testing Market

- Thermo Fisher Scientific Inc.

- Pointe Scientific, Inc

- Humankind Ventures Ltd

- Eurolyser Diagnostica GmbH

- CTK Biotech, Inc

- Cosmic Scientific Technologies

- Cortez Diagnostics Inc

- bioMrieux

- Aviva Systems Biology Corporation

- Abnova Corporation

Recent Developments

- In May 2025: Roche advanced its diagnostic portfolio with the release of the Elecsys PRO-C3 assay, designed for rapid liver fibrosis detection on its cobas analyzers. Delivering results in under 20 minutes, the test improves the clinical workflow for managing metabolic liver disease by complementing ferritin-based iron monitoring. This innovation strengthens Roche’s integrated diagnostic ecosystem and supports precision-based liver health assessment.

- In April 2025: QIAGEN announced plans to introduce a new generation of sample-preparation systems—QIA-symphony Connect, QIA-sprint Connect, and QIA-mini—by 2026. These systems aim to automate pre-analytical processing and improve consistency in biomarker testing, including ferritin assays. The expansion underscores QIAGEN’s focus on laboratory efficiency and its contribution to more standardized, high-throughput testing environments worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 billion Forecast Revenue (2034) US$ 2.0 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagent and Instrument & Kits), By Application (Anemia, Pregnancy, Lead Poisoning, Hemochromatosis, and Others), By End-user (Hospitals and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Pointe Scientific, Inc, Humankind Ventures Ltd, Eurolyser Diagnostica GmbH, CTK Biotech, Inc, Cosmic Scientific Technologies, Cortez Diagnostics Inc, bioMrieux, Aviva Systems Biology Corporation, Abnova Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Pointe Scientific, Inc

- Humankind Ventures Ltd

- Eurolyser Diagnostica GmbH

- CTK Biotech, Inc

- Cosmic Scientific Technologies

- Cortez Diagnostics Inc

- bioMrieux

- Aviva Systems Biology Corporation

- Abnova Corporation