Global Feather Clothing Market Size, Share, Growth Analysis By Product (Feather Jackets, Feather Vests, Feather Coats, Others), By Material (Duck Feathers, Synthetic Alternatives, Goose Feathers, Others), By Distribution Channel (Online Retail, Department Stores, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151916

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

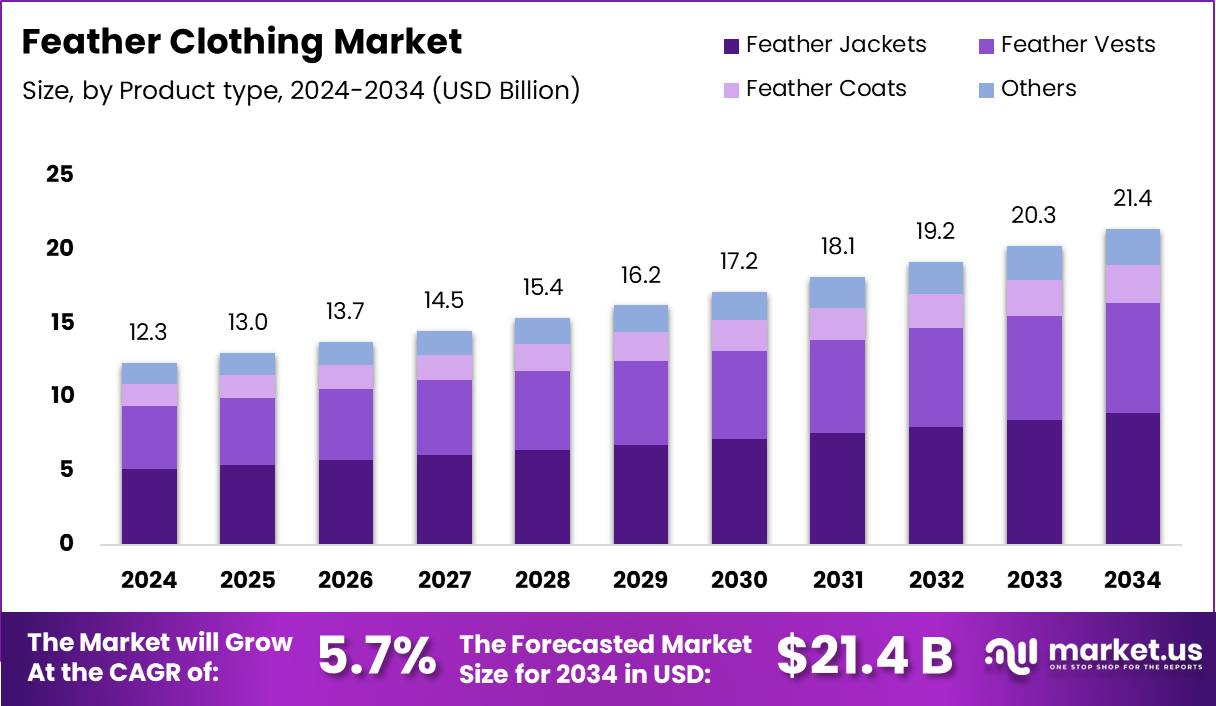

The Global Feather Clothing Market size is expected to be worth around USD 21.4 Billion by 2034, from USD 12.3 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Feather Clothing Market is a growing niche within the broader apparel industry, driven by consumer demand for lightweight, warm, and eco-conscious garments. Feather clothing, primarily filled with down from ducks and geese, is favored in luxury outerwear and winterwear. It combines functional insulation with premium aesthetics.

Feather clothing is increasingly adopted by high-end brands looking to blend performance with elegance. With sustainability in focus, many companies are turning to responsibly sourced or recycled down, positioning themselves competitively. The use of feather fill extends across jackets, parkas, fashion coats, and even accessories.

Notably, Taiqian, a key production hub, exports 160,000 tonnes of deep-processed down feather raw materials and 35 million pieces of down clothing and craft products annually, according to People. This highlights the global scale and industrial maturity of the market’s supply side.

The online fashion shift has further boosted feather clothing’s visibility. According to RetailBoss, 60% of luxury fashion sales are expected to occur online. This transition favors niche brands that leverage e-commerce to reach targeted consumers and premium shoppers worldwide.

Women’s feather outerwear presents significant market opportunities. As per TextilesResources, womenswear contributes nearly 53% of global fashion retail revenue, outperforming menswear (31%) and childrenswear (16%). Female consumers are often the first adopters of functional luxury trends like feather coats.

Additionally, global interest in outdoor and travel wear post-pandemic has driven demand for high-performance insulation apparel. Feather clothing, which delivers both warmth and style, is positioned to gain from this shift in consumer preference for versatile yet fashionable products.

Moreover, governments are encouraging sustainable textile practices. Incentives for recycling, animal welfare compliance, and cleaner production methods are pushing feather clothing manufacturers to innovate with ethical sourcing and green technologies.

China’s dominance in down processing, particularly in regions like Taiqian, is bolstered by strong infrastructure and export systems. This benefits global brands seeking large-scale production with reliable quality and volume capacity.

Technological advancements in feather blending, such as using feather with synthetic fills for durability, are opening new product categories. These include lightweight travel gear and hybrid jackets that appeal to younger, urban consumers.

In conclusion, the Feather Clothing Market stands at a promising juncture. Supported by e-commerce, sustainability trends, and robust export channels, it offers growth potential for both established fashion labels and emerging eco-friendly brands seeking to meet evolving global demands.

Key Takeaways

- The Global Feather Clothing Market is projected to grow from USD 12.3 Billion in 2024 to a significantly higher value by 2034, at a CAGR of 5.7%.

- Feather Jackets led the product type segment in 2024 with a 39.1% market share due to their functionality, fashion appeal, and weather versatility.

- Duck Feathers dominated the material type segment in 2024, capturing 36.7% of the market, owing to their ideal balance of insulation, weight, and cost.

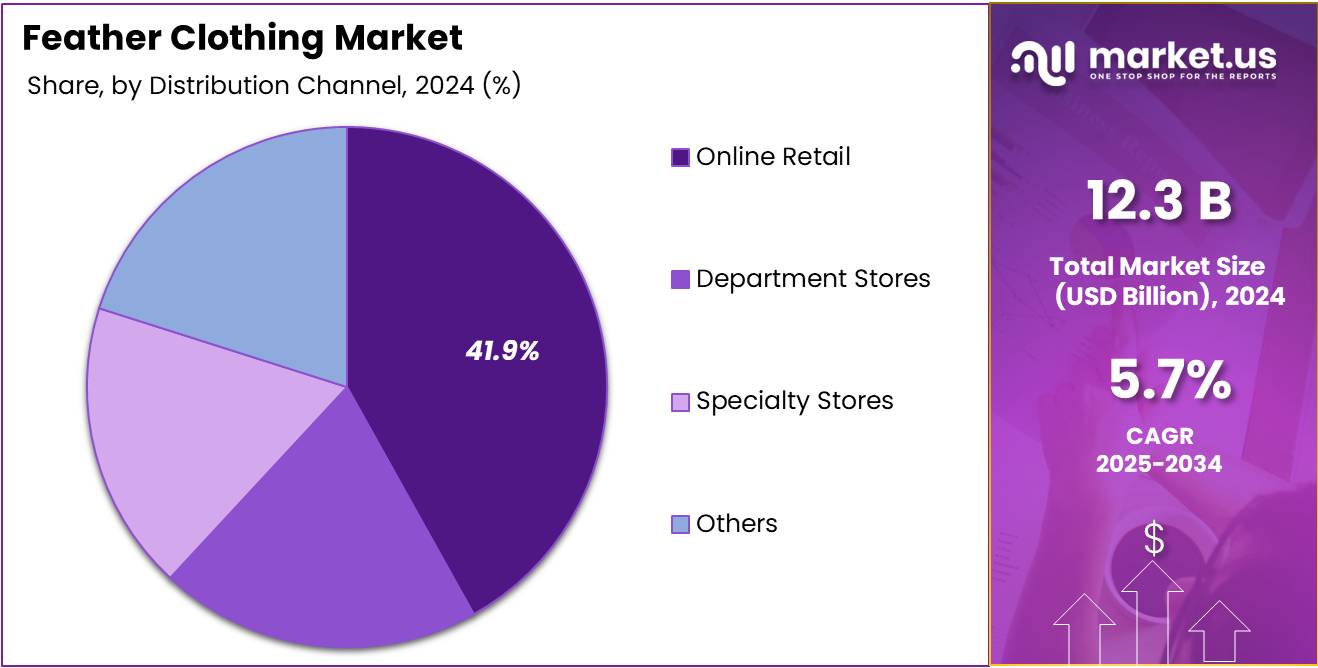

- Online Retail was the leading distribution channel in 2024 with a 41.9% share, driven by the rise of e-commerce and direct-to-consumer platforms.

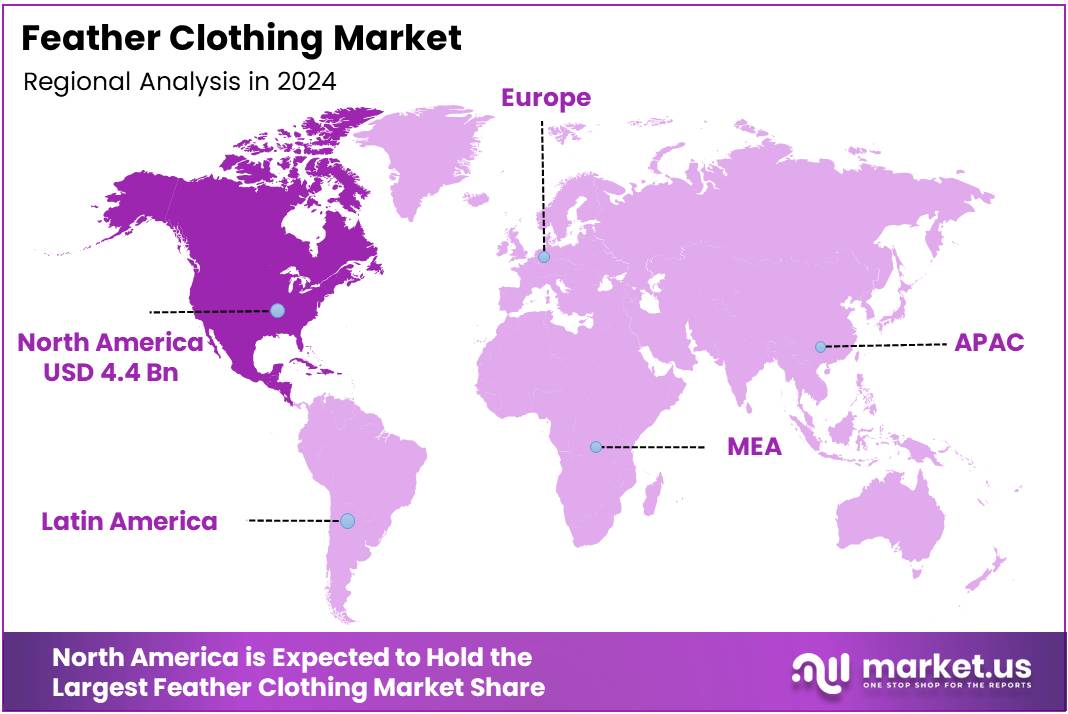

- North America held the largest regional market share at 36.4% in 2024, valued at USD 4.4 Billion, fueled by sustainable fashion demand, high spending power, and athleisure trends.

Product Type Analysis

Feather Jackets lead the market with 39.1% share, driven by their versatile appeal and seasonal demand.

In 2024, Feather Jackets held a dominant market position in the By Product Type Analysis segment of the Feather Clothing Market, with a 39.1% share. Their popularity stems from their functionality, fashionable designs, and adaptability across various weather conditions, making them the most sought-after product type globally.

Feather Vests followed, offering a lighter, more breathable option for consumers seeking layering garments. These products gained attention in milder climates, with market presence supported by athleisure trends and increased interest in casual outdoor wear.

Feather Coats occupied a more niche segment, typically aligned with luxury and high-end fashion. While they trail jackets in volume, they continue to attract consumers looking for premium winter wear with a focus on durability and warmth.

The Others category includes specialty products and hybrid styles. Though holding a smaller portion of the market, this segment reflects evolving consumer preferences and innovation in design. As fashion brands experiment with diverse silhouettes, this category shows potential for future growth in unique offerings.

Material Type Analysis

Duck Feathers dominate with 36.7% share due to balanced performance and accessibility.

In 2024, Duck Feathers held a dominant market position in the By Material Type Analysis segment of the Feather Clothing Market, with a 36.7% share. Their popularity is primarily attributed to their optimal balance between insulation, weight, and cost, making them a go-to choice for mass-market apparel.

Synthetic Alternatives emerged as a competitive option, especially among environmentally-conscious consumers. These materials gained momentum due to their cruelty-free appeal and performance improvements, although they remained slightly behind natural feather variants.

Goose Feathers retained their premium status within the market. Often used in high-end garments, they are prized for superior warmth and fluffiness. However, their higher cost and ethical concerns limited broader adoption.

The Others category, encompassing exotic blends or recycled materials, represented a small but growing niche. As sustainability takes center stage, this segment is gradually attracting attention from both brands and eco-conscious buyers.

Distribution Channel Analysis

Online Retail leads with 41.9% share, reflecting digital convenience and broad accessibility.

In 2024, Online Retail held a dominant market position in the By Distribution Channel Analysis segment of the Feather Clothing Market, with a 41.9% share. The rise in e-commerce platforms and direct-to-consumer models has empowered buyers to explore diverse feather clothing options from the comfort of their homes.

Department Stores continued to play a significant role, offering the advantage of physical product interaction. Their stable presence is maintained by consumers who value in-person purchases, especially in older demographics and urban regions.

Specialty Stores catered to niche customers seeking premium or customized feather apparel. With tailored services and curated collections, these outlets strengthened their relevance despite a relatively smaller footprint.

The Others category comprises local boutiques and multi-brand chains. Though this segment held a modest share, it contributes to the diversity of the retail landscape and serves consumers seeking alternative shopping experiences outside mainstream channels.

Key Market Segments

By Product

- Feather Jackets

- Feather Vests

- Feather Coats

- Others

By Material

- Duck Feathers

- Synthetic Alternatives

- Goose Feathers

- Others

By Distribution Channel

- Online Retail

- Department Stores

- Specialty Stores

- Others

Drivers

Expansion of Eco-Friendly and Cruelty-Free Feather Sourcing Drives Market Growth

Technological advancements have played a key role in transforming how feathers are processed. Modern techniques allow for better cleaning, dyeing, and preservation of feathers without compromising their quality. These innovations also help reduce waste, making feather garments more sustainable and appealing to eco-conscious buyers.

One of the strongest drivers of growth in the feather clothing market is the move toward eco-friendly and cruelty-free sourcing. Consumers today are more aware of animal welfare and environmental impact. As a result, brands that use ethically sourced feathers—often collected after natural molting or through regulated farms—are gaining popularity and customer trust.

The fashion industry’s shift toward luxury and premium garments is also boosting demand. Feather clothing, once considered niche, is now widely accepted in high fashion due to its unique texture and elegance. Premium brands are using feathers in jackets, gowns, and accessories, creating a sense of exclusivity that appeals to affluent consumers. This trend is expected to continue as designers push the boundaries of artistic expression using natural materials.

Restraints

High Production Costs Associated with Ethical Feather Harvesting Limit Market Expansion

Seasonal fluctuations in feather availability pose a significant challenge. Feathers, especially those used in high-end fashion, are often collected during specific times of the year. This limited supply impacts manufacturers’ ability to maintain consistent production and meet growing consumer demand.

Ethical feather harvesting adds to production costs. To ensure cruelty-free practices, companies must invest in humane sourcing, labor monitoring, and proper certifications. These additional layers of responsibility raise the cost of manufacturing, often translating into higher retail prices for end consumers.

Government regulations are another factor slowing the market’s momentum. Many countries have strict laws regarding the trade and use of animal-derived materials, including feathers. These laws, while beneficial for ethical practices, can restrict sourcing and increase compliance costs. As a result, some brands may hesitate to invest heavily in feather-based clothing lines due to these limitations.

Growth Factors

Collaborations Between Fashion Brands and Sustainable Feather Suppliers Open New Growth Paths

One promising opportunity in the feather clothing market lies in partnerships between fashion brands and sustainable feather suppliers. These collaborations help ensure ethical sourcing while maintaining quality. By aligning with eco-conscious values, brands can strengthen customer loyalty and build a positive image.

Feathers are now being integrated into outdoor and adventure gear, such as lightweight jackets and insulated wear. Their natural warmth and breathability make feathers an excellent choice for functional fashion. This expansion into performance-oriented apparel opens new market segments beyond traditional luxury fashion.

Additionally, research into synthetic alternatives that mimic the look and feel of feathers is gaining traction. These man-made materials offer similar softness and aesthetic appeal without involving animal products. As technology advances, synthetic feather alternatives could attract a broader customer base, including vegan and cruelty-free consumers, thereby widening the market potential.

Emerging Trends

Surge in Demand for Statement Feather Accessories in Runway Fashion Influences Market Trends

Feather accessories are making a strong comeback in runway shows. Designers are using dramatic feather accents in dresses, hats, and bags to create bold, eye-catching looks. This trend is influencing mainstream fashion, leading to more demand for statement feather pieces in retail stores.

Social media influencers are playing a major role in promoting feather-enhanced streetwear. Their reach and style influence encourage younger consumers to adopt feather elements in everyday fashion. This digital promotion has helped bring niche designs into the spotlight and made them more accessible to general audiences.

Feathers are also becoming popular in festival and event costumes. With their vibrant texture and unique appeal, they’re often used in creative, expressive outfits worn at music festivals, parades, and themed events. This seasonal but recurring demand supports steady market growth and keeps feather fashion culturally relevant.

Regional Analysis

North America Dominates the Feather Clothing Market with a Market Share of 36.4%, Valued at USD 4.4 Billion

North America leads the global feather clothing market, accounting for a dominant 36.4% of the total market share. The region’s market size stood at USD 4.4 billion, driven by increasing consumer demand for sustainable and luxury outerwear. Factors such as a well-established fashion industry, high purchasing power, and growing awareness of eco-friendly materials continue to support market expansion in this region. Additionally, the presence of premium fashion outlets and a trend toward athleisure contribute to the strong growth trajectory.

Europe Feather Clothing Market Trends

Europe follows closely behind, benefiting from a high affinity for luxury and seasonal apparel. The demand in this region is influenced by shifting fashion trends, colder climate zones, and the increasing popularity of winter sports apparel. Furthermore, heightened consumer consciousness around ethical sourcing and sustainable manufacturing practices has spurred demand for responsibly produced feather clothing.

Asia Pacific Feather Clothing Market Trends

The Asia Pacific region is witnessing significant growth in the feather clothing market, largely fueled by urbanization, rising disposable incomes, and evolving fashion preferences across emerging economies. Countries such as China, Japan, and South Korea are experiencing increased demand for premium and seasonal wear. The influence of Western fashion and growing e-commerce penetration are also playing a vital role in market expansion.

Middle East and Africa Feather Clothing Market Trends

In the Middle East and Africa, the feather clothing market is gradually growing, with demand largely driven by the region’s affluent consumer segments and tourism sector. While the climate in many areas does not necessitate heavy outerwear, cooler regions and international travel needs have sustained a niche demand. Premium retail developments and fashion-conscious consumers further contribute to the market presence.

Latin America Feather Clothing Market Trends

Latin America is seeing modest growth in the feather clothing segment, with rising fashion awareness and climatic diversity supporting demand across countries. Urban centers in regions with cooler climates are gradually adopting feather clothing for both functional and aesthetic use. Market growth is also being influenced by local fashion movements and increased access to international brands through online retail channels.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Feather Clothing Company Insights

In the 2024 global Feather Clothing Market, several key players have emerged as dominant forces, each contributing uniquely to the market’s evolution through innovation, branding, and sustainability efforts.

Canada Goose continues to lead the high-end segment of feather clothing, particularly with its premium down jackets. The brand’s focus on extreme weather performance and luxury appeal has helped maintain its strong market presence globally, especially in North America and Europe.

Moncler remains a pivotal player in the luxury fashion-meets-performance niche. Its collaborations with top designers and consistent expansion into Asian markets have bolstered its global footprint while reinforcing its identity as a high-fashion winterwear icon.

Patagonia distinguishes itself through its firm commitment to ethical sourcing and environmental responsibility. By using recycled down and promoting transparency in its supply chain, Patagonia attracts eco-conscious consumers while also setting a benchmark for sustainability in the industry.

The North Face, with its broad consumer base and versatile feather-based outerwear, continues to dominate the outdoor and adventure apparel sector. Its strategic use of technology and consistent product updates have kept it competitive in both performance and lifestyle markets.

Together, these companies are shaping the trajectory of the feather clothing market by addressing shifting consumer demands, including sustainability, fashion, and function. Their adaptability and brand strength will likely define the market landscape in the years ahead.

Top Key Players in the Market

- The North Face

- Eddie Bauer

- Arc’teryx

- Moncler

- Mountain Hardwear

- Columbia Sportswear

- Helly Hansen

- Marmot

- Patagonia

- Mammut

- Canada Goose

- Rab

- Fjällräven

- Craghoppers

- Jack Wolfskin

Recent Developments

- In date August 2024, Chanel acquired a 25% stake in the independent, high-end watchmaking brand MB&F, marking a strategic move into avant-garde horology.

This investment strengthens Chanel’s position in the luxury watch segment and aligns with its long-term vision for innovation in craftsmanship. - In date February 2025, Fin Feather Fur Outfitters acquired MVD Sports and Specialties, a move aimed at expanding its market share in outdoor gear and sporting goods.

The acquisition brings in a broader customer base and enhances product offerings across key regions. - In date March 2025, DBL Group officially acquired Glory Textile & Apparels Limited, reinforcing its vertical integration in the textile and apparel industry.

This acquisition is expected to boost DBL Group’s production capacity and global competitiveness.

Report Scope

Report Features Description Market Value (2024) USD 12.3 Billion Forecast Revenue (2034) USD 21.4 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Feather Jackets, Feather Vests, Feather Coats, Others), By Material (Duck Feathers, Synthetic Alternatives, Goose Feathers, Others), By Distribution Channel (Online Retail, Department Stores, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The North Face, Eddie Bauer, Arc’teryx, Moncler, Mountain Hardwear, Columbia Sportswear, Helly Hansen, Marmot, Patagonia, Mammut, Canada Goose, Rab, Fjällräven, Craghoppers, Jack Wolfskin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The North Face

- Eddie Bauer

- Arc'teryx

- Moncler

- Mountain Hardwear

- Columbia Sportswear

- Helly Hansen

- Marmot

- Patagonia

- Mammut

- Canada Goose

- Rab

- Fjällräven

- Craghoppers

- Jack Wolfskin