Global Failure Analysis Equipment Market Size, Share, Growth Analysis By Equipment Type (Scanning Electron Microscope, Focused Ion Beam System, Dual-beam Systems, Transmission Electron Microscope), By Technology (Broad Ion Milling Technology, Reactive Ion Etching Technology, Chemical Mechanical Planarization Technology, Focused Ion Beam Technology, Secondary Ion Mass Spectroscopy Technology, Energy Dispersive X-ray Spectroscopy Technology), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152410

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

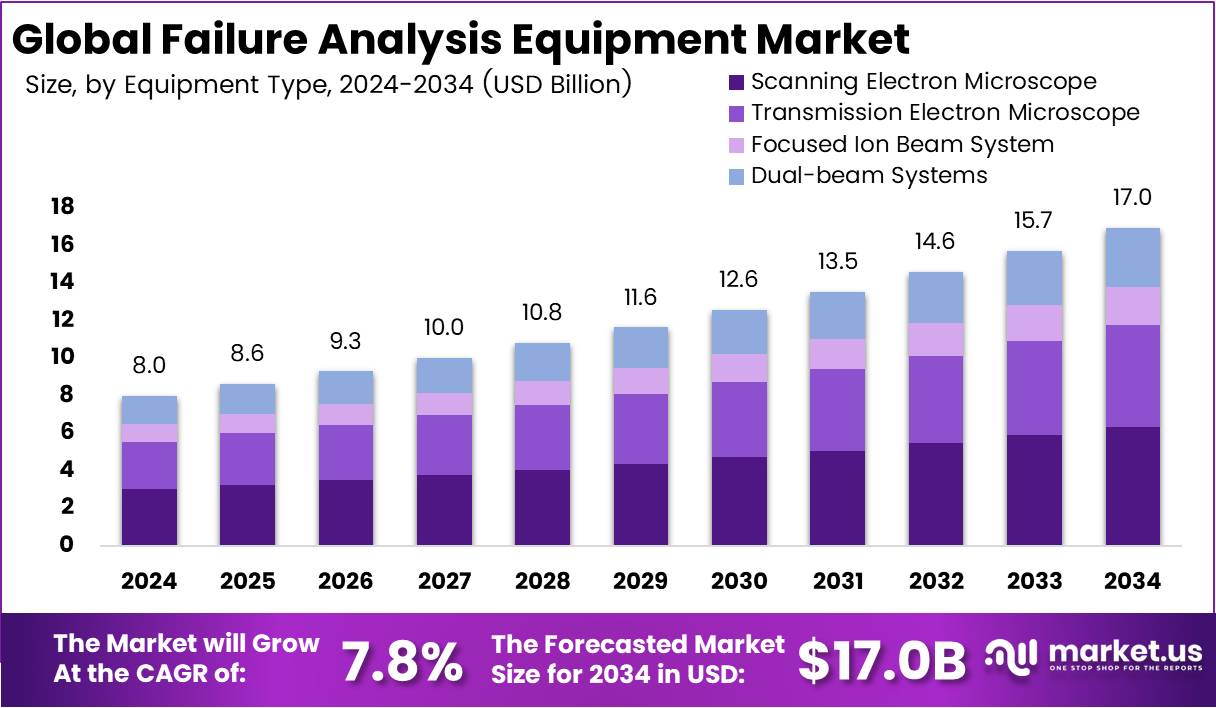

The Global Failure Analysis Equipment Market size is expected to be worth around USD 17.0 Billion by 2034, from USD 8.0 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The Failure Analysis Equipment Market refers to a segment of precision tools and systems used to detect, isolate, and resolve faults or defects in materials, semiconductors, electronics, and industrial components. This market enables engineers and manufacturers to maintain product quality, improve performance, and reduce downtime by examining root causes of failure using tools like Scanning Electron Microscopes (SEM), Focused Ion Beams (FIB), and Transmission Electron Microscopes (TEM).

Failure analysis equipment plays a pivotal role in the semiconductor and electronics manufacturing industry, where micro-level inspection is critical. With miniaturization trends accelerating, manufacturers increasingly rely on precise failure analysis tools to meet strict performance and safety standards. As a result, demand for advanced tools with real-time imaging and data processing is rising.

Growing adoption of 3D-ICs has further driven the market. According to Academia.edu, a novel repair architecture for Through-Silicon-Vias (TSVs) interconnection technology leads to 100% reparability even when the failure rate is 30%, significantly enhancing yield. This trend encourages further innovation in chip packaging and reliability testing.

In recent years, governments have boosted investments in microelectronics and defense R&D, spurring growth. Countries like the U.S., China, and Germany are allocating funding to semiconductor innovation and quality assurance infrastructure, including failure analysis systems. These initiatives contribute to the expansion of advanced material testing capabilities.

The shift toward electric vehicles (EVs), AI, and IoT technologies also widens market opportunities. Failure analysis ensures high reliability in power electronics, battery systems, and sensors. With the global EV push gaining momentum, manufacturers are increasing their focus on testing systems that enable defect-free, long-life components.

Moreover, regulatory compliance with standards like ISO/IEC 17025 and RoHS necessitates robust failure analysis processes. Compliance enhances brand credibility, reduces recalls, and ensures safer consumer products, prompting industries to invest in quality control technologies.

Adoption of nano-scale testing tools and integration of AI in failure analysis software offers massive potential. AI helps in pattern recognition, predictive diagnostics, and faster fault detection, reducing inspection time and costs while enhancing precision.

The market is also witnessing regional expansion, particularly in Asia-Pacific, due to electronics manufacturing dominance in countries like China, Taiwan, and South Korea. This geographical advantage makes it a hotspot for both production and deployment of failure analysis equipment.

In addition, rising demand from aerospace and medical devices industries for critical component testing strengthens the need for multi-technique inspection solutions. These industries require failure analysis to avoid catastrophic failures and meet strict regulatory oversight.

Universities and R&D institutions are also driving demand, as failure analysis supports advanced materials research and innovation. It ensures repeatability, scientific validation, and breakthrough development in nanotechnology, optics, and energy storage fields.

Key Takeaways

- The global Failure Analysis Equipment Market is projected to grow from USD 8.0 Billion in 2024 to USD 17.0 Billion by 2034, registering a CAGR of 7.8% during 2025–2034.

- In 2024, Scanning Electron Microscope (SEM) led the equipment type segment with a 37.5% market share due to its high-resolution imaging capabilities.

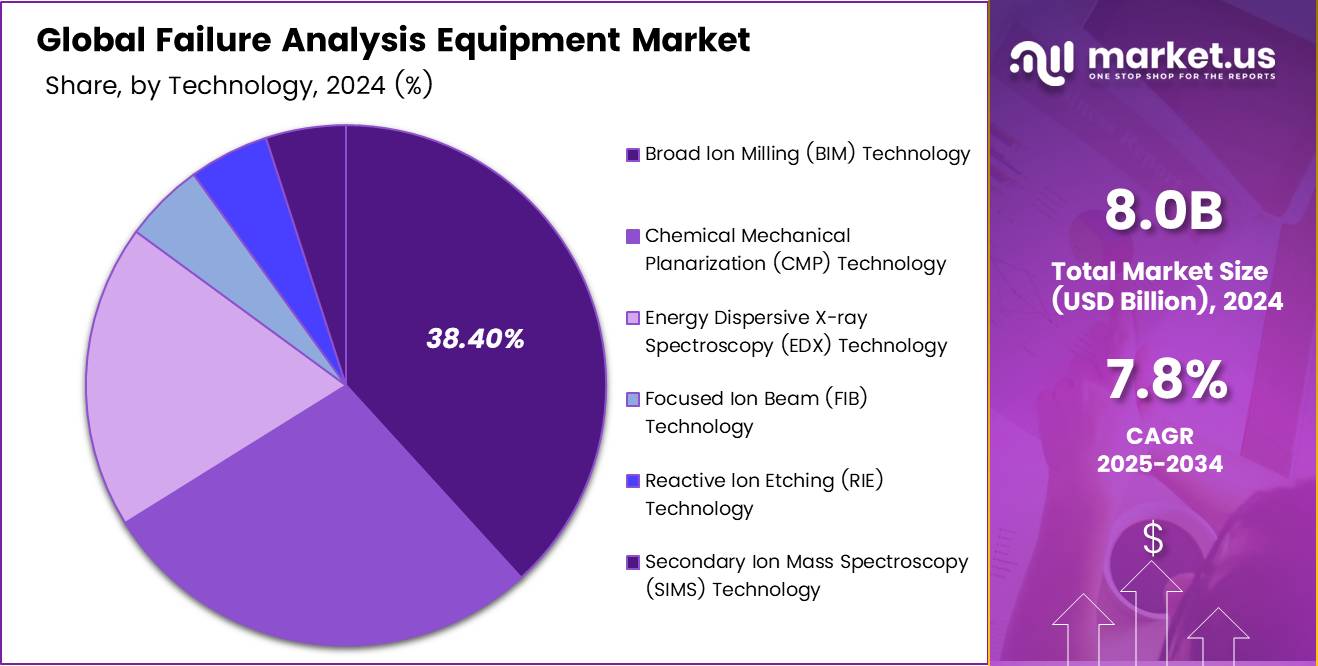

- In 2024, Broad Ion Milling (BIM) Technology dominated the technology segment with a 38.4% share, favored for precision sample preparation.

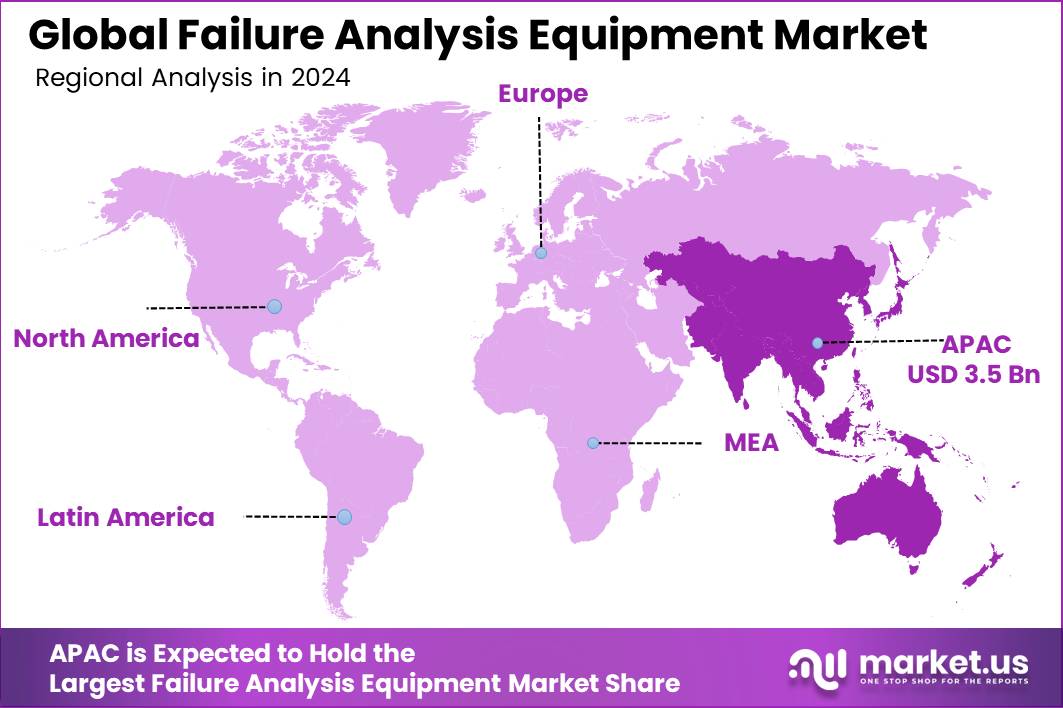

- Asia Pacific led the market in 2024, accounting for 43.8% of the global share and valued at USD 3.5 Billion, driven by strong semiconductor and electronics industries.

Equipment Type Analysis

Scanning Electron Microscope dominates with 37.5% due to its precision and widespread application in microstructure analysis.

In 2024, Scanning Electron Microscope (SEM) held a dominant market position in the By Equipment Type Analysis segment of the Failure Analysis Equipment Market, with a 37.5% share. Its high-resolution imaging and ability to analyze surface structures at the microscale have made it an essential tool across industries like semiconductors, materials science, and electronics manufacturing.

Focused Ion Beam (FIB) Systems followed SEMs in adoption, with their capability to mill and modify samples at the nanometer level. These systems are widely used for cross-sectioning and circuit editing, making them indispensable in failure localization and defect analysis processes.

Dual-beam Systems, which combine the capabilities of SEM and FIB in a single setup, are gaining ground for their versatility. These systems enable simultaneous imaging and material modification, enhancing turnaround time and accuracy in complex failure investigations.

Transmission Electron Microscopes (TEMs), though highly sophisticated, are typically reserved for advanced applications requiring atomic-level resolution. They are primarily used in R\&D and academic settings, offering deep insights but at higher operational costs and technical requirements.

Technology Analysis

Broad Ion Milling (BIM) Technology dominates with 38.4% due to its effectiveness in preparing precise cross-sections for microscopic evaluation.

In 2024, Broad Ion Milling (BIM) Technology held a dominant market position in the By Technology Analysis segment of the Failure Analysis Equipment Market, with a 38.4% share. BIM remains the preferred method for preparing high-quality cross-sectional samples without mechanical damage, particularly in the semiconductor and electronics industries.

Reactive Ion Etching (RIE) Technology remains vital in applications requiring selective material removal. Its anisotropic etching capabilities support complex circuit and material layer analysis, especially in integrated device manufacturing.

Chemical Mechanical Planarization (CMP) Technology is used to achieve uniform surface flatness. While its role is more niche, it remains crucial in achieving defect-free surfaces in semiconductor wafers prior to analysis.

Focused Ion Beam (FIB) Technology, though already discussed in equipment terms, also stands as a key standalone technology in the precision etching and modification of materials.

Secondary Ion Mass Spectroscopy (SIMS) Technology provides detailed elemental composition analysis, making it valuable in failure cause identification, especially in contamination analysis.

Energy Dispersive X-ray Spectroscopy (EDX) Technology supports quick elemental detection during SEM imaging, enhancing real-time decision-making in failure evaluation processes.

Key Market Segments

By Equipment Type

- Scanning Electron Microscope

- Focused Ion Beam System

- Dual-beam Systems

- Transmission Electron Microscope

By Technology

- Broad Ion Milling (BIM) Technology

- Reactive Ion Etching (RIE) Technology

- Chemical Mechanical Planarization (CMP) Technology

- Focused Ion Beam (FIB) Technology

- Secondary Ion Mass Spectroscopy (SIMS) Technology

- Energy Dispersive X-ray Spectroscopy (EDX) Technology

Drivers

Surge in Advanced Semiconductor Manufacturing Processes Drives Market Growth

Advanced semiconductor manufacturing processes are driving a major shift in the failure analysis equipment market. As chips become smaller and more powerful, even the slightest defect can lead to system failure. This demands extremely precise inspection tools, pushing the need for high-end failure analysis solutions.

The aerospace and defense sectors are also demanding accurate, high-resolution inspection methods. With safety-critical components, any flaw must be caught during development or production. This is fueling the adoption of sophisticated failure analysis systems, especially in military-grade electronics.

In the automotive industry, the rise in electronic components for safety systems—such as ADAS and autonomous tech—is making failure analysis essential. These systems must perform flawlessly under all conditions, increasing reliance on precision testing and imaging tools.

Material science labs, both academic and commercial, are increasing their research funding. As a result, demand for analytical tools that can study materials at micro and nano levels is growing. This pushes the use of Transmission Electron Microscopes (TEMs), SEMs, and FIB systems.

Restraints

High Initial Capital Investment and Operational Costs Restrain Market Adoption

Failure analysis equipment often involves substantial upfront investment. Technologies like SEMs and FIB systems can cost hundreds of thousands of dollars, which restricts access for small- and medium-scale enterprises.

Operational costs further add to the burden. These machines require clean room environments, regular calibration, and consumables like ion sources and detector materials, making ongoing expenses high.

There’s also a shortage of trained personnel who can operate and interpret data from these complex systems. Lack of skilled technicians slows down adoption across emerging economies and mid-tier industries.

Integrating new equipment with older infrastructure presents technical hurdles. Many companies face challenges in upgrading legacy systems to work with today’s digitally connected tools. This limits system compatibility and efficiency.

Moreover, regular maintenance and stringent calibration protocols required for high-precision analysis mean extended downtime and additional resources—factors that can discourage investment.

Growth Factors

Adoption of AI and Machine Learning in Failure Analysis Opens New Growth Avenues

The integration of AI and machine learning into failure analysis equipment is transforming the market. These technologies can rapidly analyze patterns, detect anomalies, and predict failures—greatly improving efficiency and reducing human error.

There’s also growing demand for portable and miniaturized failure analysis tools. With engineers working on-site or in the field, compact equipment that still offers high accuracy is gaining popularity.

Emerging economies are heavily investing in electronics and telecom infrastructure. Countries in Asia Pacific, Latin America, and Africa are expanding their industrial capabilities, creating a strong demand for affordable and scalable failure analysis solutions.

The shift toward green energy, especially in battery technologies and solar materials, is opening new application areas. R\&D in lithium-ion batteries, for example, requires deep structural analysis—boosting demand for advanced microscopes and testing systems.

Emerging Trends

Shift Toward Non-Destructive Testing (NDT) Techniques Shapes Market Trends

Non-destructive testing is becoming a top trend in the failure analysis market. Industries now prefer testing methods that preserve the sample’s structure while still identifying internal faults, especially in expensive or critical components.

Cloud-based data management is also changing how failure analysis is conducted. Data from testing equipment can now be stored, analyzed, and shared securely across global teams—making the process faster and more collaborative.

3D imaging and tomography are increasingly used in microelectronics. These technologies provide detailed visualizations of internal structures without sectioning the sample, enhancing analysis accuracy.

Lastly, automation and robotics are being integrated into inspection systems. These upgrades improve repeatability, reduce manual labor, and enable high-throughput testing, making them ideal for modern, large-scale manufacturing environments.

Regional Analysis

Asia Pacific Dominates the Failure Analysis Equipment Market with a Market Share of 43.8%, Valued at USD 3.5 Billion

Asia Pacific leads the global failure analysis equipment market due to the strong presence of semiconductor manufacturing hubs, particularly in countries like China, Japan, South Korea, and Taiwan. The region’s dominance is supported by heavy investments in electronics, automotive innovation, and materials research. The market in Asia Pacific reached a value of USD 3.5 Billion in 2024, accounting for a leading 43.8% of the global share. Rapid industrialization, R&D activities, and a strong ecosystem of advanced laboratories are driving consistent regional growth.

North America Failure Analysis Equipment Market Trends

North America maintains a significant position in the market, driven by advanced aerospace, defense, and semiconductor industries. The U.S. plays a key role, benefiting from technological innovation and robust R\&D spending by both government and private sectors. Increasing demand for nanotechnology-based analysis and quality control in high-performance electronics further strengthens the region’s market share.

Europe Failure Analysis Equipment Market Trends

Europe’s failure analysis equipment market is fueled by its strong focus on quality assurance in automotive and industrial engineering. Countries like Germany and France are at the forefront of integrating advanced materials analysis tools into manufacturing and research environments. Sustainability-led technological upgrades and smart factory adoption are key contributing factors in the region.

Middle East and Africa Failure Analysis Equipment Market Trends

The Middle East and Africa region is gradually embracing failure analysis technologies, primarily in sectors like oil & gas, energy, and defense. While the market share is relatively smaller, investments in infrastructure development and localized R\&D facilities are expected to support long-term growth in high-end inspection equipment.

Latin America Failure Analysis Equipment Market Trends

Latin America shows emerging potential in the failure analysis space, with growing adoption in industrial, academic, and electronics applications. Countries like Brazil and Mexico are witnessing gradual uptake due to increased awareness of quality standards and material testing requirements in evolving manufacturing sectors.

Regional Mentions:

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Failure Analysis Equipment Company Insights

In 2024, the global Failure Analysis Equipment Market is significantly influenced by the innovation and strategic moves of its key players. These companies are strengthening their market positions through product development, technological integration, and global expansion strategies.

Jeol Ltd. continues to lead in electron optics technologies, especially in scanning and transmission electron microscopes. The company’s strong R&D foundation and collaborations with academic institutions help it stay ahead in high-resolution failure analysis solutions.

A&D Company Ltd. maintains a strong foothold in precision measurement instruments. Its emphasis on user-friendly interface designs and automation integration supports growing demand across semiconductor and aerospace applications.

Bruker has expanded its analytical instrumentation portfolio with advanced spectroscopy and microscopy systems. Its consistent innovation in nanomechanical testing and microanalysis tools makes it a preferred partner in material science research.

EAG (Evans Analytical Group) Inc. plays a critical role as a service provider specializing in surface analysis, microscopy, and materials characterization. EAG’s ability to deliver rapid, in-depth analytical insights supports manufacturers in reducing downtime and improving reliability across electronic components.

These companies collectively contribute to driving technological evolution in failure analysis tools, supporting industries such as semiconductors, automotive, and aerospace in addressing micro-level defects and ensuring high product reliability. Their combined market strategies, focus on precision diagnostics, and adoption of AI-integrated systems are expected to shape the growth trajectory of the Failure Analysis Equipment Market through 2024 and beyond.

Top Key Players in the Market

- Jeol Ltd.

- A&D Company Ltd.

- Bruker

- EAG (Evans Analytical Group) Inc.

- Eurofins Scientific

- Exponent Inc.

- Hitachi High-Technologies Corporation

- HORIBA, Ltd.

- Intertek Group PLC

- Leica Microsystems GmbH

- Motion X Corp.

- Oxford Instruments

- Semilab

- Tescan Orsay Holding, A.S.

- TESTiLABS

Recent Developments

- In Sep 2023, the U.S. National Science Foundation unveiled 24 research and education projects, allocating a total of $45.6 million to accelerate innovations in semiconductor technologies. This initiative, backed by the CHIPS and Science Act of 2022, also emphasizes workforce development in advanced manufacturing sectors.

- In Mar 2024, Binghamton University received $1 million in funding aimed at supporting the advanced chip manufacturing industry. The program is expected to train over 100 students annually, preparing them for high-demand roles in semiconductor production.

- In March 2025, Hamamatsu Photonics Korea successfully completed a new manufacturing facility to enhance production capabilities. The new factory is specifically designed to support the increasing demand for semiconductor failure analysis equipment globally.

Report Scope

Report Features Description Market Value (2024) USD 8.0 Billion Forecast Revenue (2034) USD 17.0 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Scanning Electron Microscope, Focused Ion Beam System, Dual-beam Systems, Transmission Electron Microscope), By Technology (Broad Ion Milling Technology, Reactive Ion Etching Technology, Chemical Mechanical Planarization Technology, Focused Ion Beam Technology, Secondary Ion Mass Spectroscopy Technology, Energy Dispersive X-ray Spectroscopy Technology) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Jeol Ltd., A&D Company Ltd., Bruker, EAG (Evans Analytical Group) Inc., Eurofins Scientific, Exponent Inc., Hitachi High-Technologies Corporation, HORIBA, Ltd., Intertek Group PLC, Leica Microsystems GmbH, Motion X Corp., Oxford Instruments, Semilab, Tescan Orsay Holding, A.S., TESTiLABS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Failure Analysis Equipment MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Failure Analysis Equipment MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Jeol Ltd.

- A&D Company Ltd.

- Bruker

- EAG (Evans Analytical Group) Inc.

- Eurofins Scientific

- Exponent Inc.

- Hitachi High-Technologies Corporation

- HORIBA, Ltd.

- Intertek Group PLC

- Leica Microsystems GmbH

- Motion X Corp.

- Oxford Instruments

- Semilab

- Tescan Orsay Holding, A.S.

- TESTiLABS