Global Facial Cleansing Balm Market By Gender (Women, Men), By Age Group, Teenagers, Young Adults, Mature Adults), By Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Pharmacies and Drugstores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140716

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

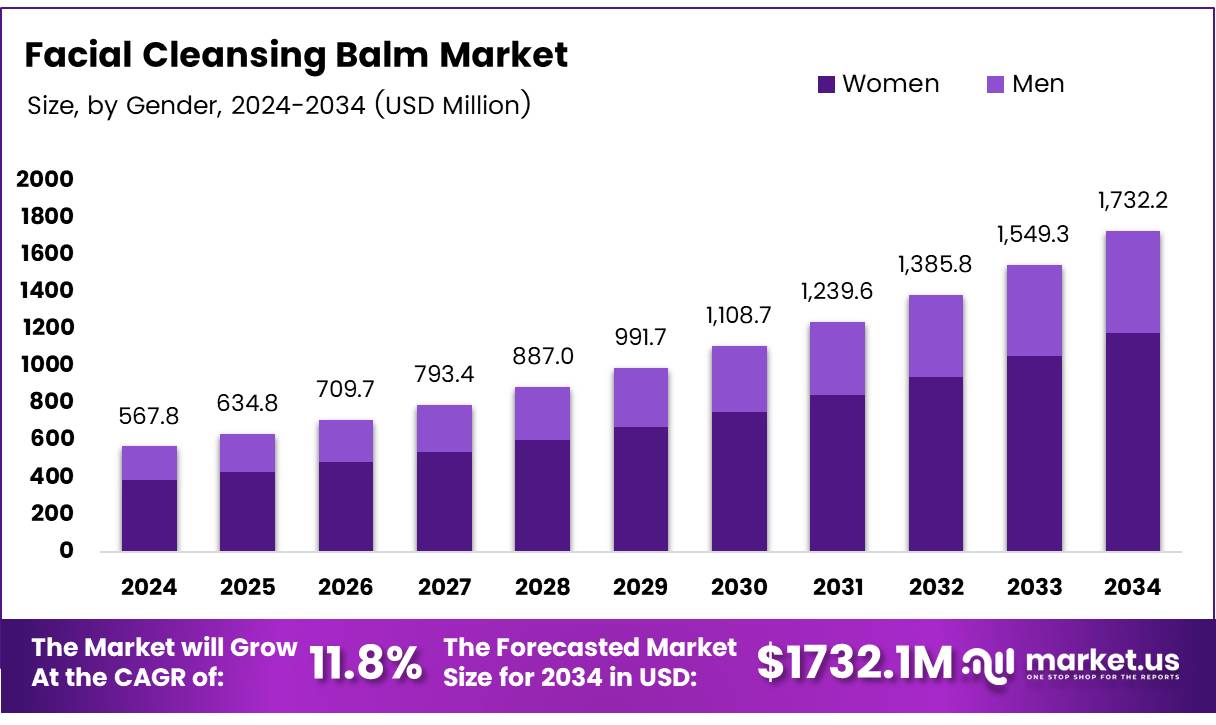

The Global Facial Cleansing Balm Market size is expected to be worth around USD 1732.2 Million by 2034, from USD 567.8 Million in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034.

Facial cleansing balms are an essential component in the daily skincare routine of consumers worldwide. These products, which are primarily formulated with oils and butters, have gained immense popularity due to their ability to effectively remove makeup, dirt, and impurities while also nourishing the skin.

In recent years, the market for facial cleansing balms has seen notable growth, driven by consumer demand for gentle yet effective skincare solutions. This trend is particularly evident among consumers who prioritize natural and non-irritating ingredients.

As a result, facial cleansing balms are increasingly being incorporated into both high-end and mass-market skincare lines. Their appeal lies in their versatility, as they are suitable for all skin types and are often marketed as a more sustainable and skin-friendly alternative to traditional foaming cleansers.

According to Recent Study, in 2023, facial cleansers were the most profitable segment of the U.S. skincare market, with approximately 247 million units of facial cleanser sold across multi-outlets. This indicates the growing importance of facial cleansers within the broader skincare industry.

Additionally, research published by iJord highlights the clinical benefits of face cleansers, with regular use resulting in significant reductions in acne (43.58%), acne spots (44.85%), and post-inflammatory hyperpigmentation (PIH) (46.06%), demonstrating their effectiveness in improving skin health. Furthermore, Mintel reports that 92% of British women use facial cleansers, reflecting their widespread adoption across diverse demographics.

The market for facial cleansing balms is poised for continued growth, driven by the increasing awareness of skincare and the growing preference for gentle yet effective products.

Opportunities exist for brands to capitalize on the demand for clean beauty and natural formulations. With an increasing number of consumers seeking products that are free from harmful chemicals, the market is witnessing a shift toward plant-based ingredients, which offer both efficacy and sustainability.

Governments in various regions have also begun to invest in the wellness and beauty sector, with a focus on promoting local manufacturing and innovation in skincare products.

For example, regulations around product formulations, packaging, and safety standards are becoming more stringent, creating both challenges and opportunities for companies in the facial cleansing balm market. Regulatory frameworks are encouraging brands to focus on transparency and product safety, which will help build consumer trust.

Key Takeaways

- The global facial cleansing balm market is projected to reach USD 1,732.2 million by 2034, growing at a CAGR of 11.8% from 2025 to 2034.

- Women accounted for 67.3% of the facial cleansing balm market share in 2024, driven by demand for multi-functional skincare products.

- Adults aged 31-50 represented 40% of the facial cleansing balm market share in 2024, with a focus on anti-aging and skin hydration.

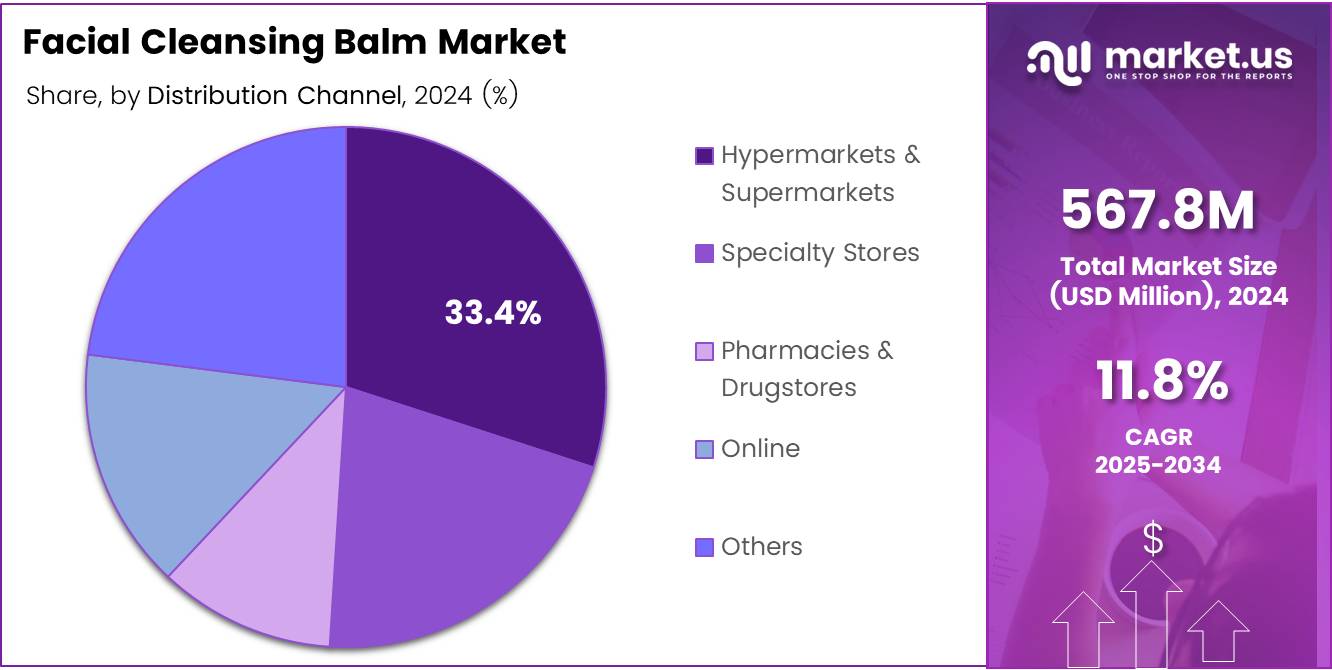

- Hypermarkets and supermarkets led the distribution channel segment with 33.4% market share in 2024.

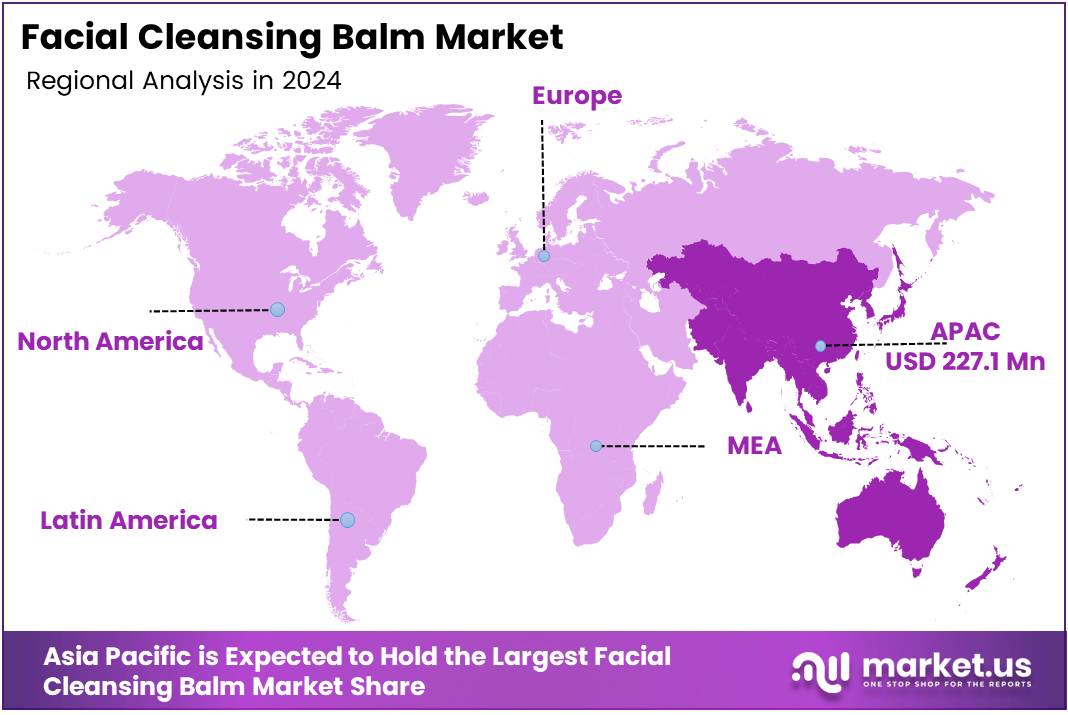

- Asia Pacific holds the largest regional market share at 40%, valued at USD 227.1 million, due to the strong skincare focus in Japan, South Korea, and China.

Gender Analysis

Women Lead the Facial Cleansing Balm Market with 67.3% Share in 2024, Driven by Preference for Skincare Routine

In 2024, women held a dominant position in the facial cleansing balm market, accounting for 67.3% of the total market share. This significant share is primarily attributed to the growing preference for multi-functional skincare products that offer convenience and efficacy.

Women have increasingly embraced facial cleansing balms as part of their daily skincare routine due to their gentle yet effective formulation, which is ideal for removing makeup, dirt, and excess oils. The rising awareness around skin health, coupled with an increased focus on natural ingredients, further propels the demand for these products among female consumers.

As a result, key brands have expanded their product lines to cater to this demographic, offering a range of formulations designed to meet various skin types and concerns. On the other hand, the male segment, while showing growth, captured a smaller portion of the market. Men’s skincare habits have evolved, but the facial cleansing balm category remains relatively niche compared to other products such as facial washes and moisturizers.

Despite this, the male segment is projected to experience steady growth as more men adopt comprehensive skincare routines. Nonetheless, women continue to lead, with their substantial contribution to the market’s overall growth.

Age Group Analysis

Adults (Ages 31-50) Hold 40% Share of Facial Cleansing Balm Market in 2024, Driven by Growing Skincare Awareness

In 2024, adults aged 31-50 dominated the By Age Group Analysis segment of the facial cleansing balm market, holding a 40% share. This demographic has shown a strong preference for high-quality skincare products that cater to the need for anti-aging benefits, skin hydration, and gentle cleansing.

As individuals in this age group become more conscious of skin health, there has been a notable shift towards using products that not only cleanse but also nourish and protect the skin from environmental stressors. The increasing availability of formulations targeting specific skin concerns, such as fine lines and wrinkles, has further contributed to the growth in this segment.

Teenagers (ages 13-19) represented a smaller portion of the market, primarily driven by concerns related to acne and oil control. Although their skincare routines are becoming more sophisticated, they continue to favor products with targeted functions like acne treatment, which limits their share in the facial cleansing balm market.

Young adults (ages 20-30) also contributed to market growth, driven by a preference for versatile skincare solutions. However, their share remains smaller than the 31-50 age group, as they are more likely to use cleansers with stronger exfoliation properties.

Mature adults (51 and above) accounted for a smaller share, as this group continues to prioritize anti-aging treatments over cleansing products, though there is a growing trend towards inclusive skincare solutions.

Distribution Channel Analysis

Hypermarkets & Supermarkets Capture 33.4% Share of Facial Cleansing Balm Market in 2024, Driven by Convenient Shopping Experience

In 2024, hypermarkets and supermarkets held the largest share in the By Distribution Channel Analysis segment of the facial cleansing balm market, accounting for 33.4% of the total market share.

This dominance is largely due to the convenience and accessibility these retail outlets offer, allowing consumers to purchase a wide variety of skincare products, including facial cleansing balms, during routine grocery shopping.

Hypermarkets and supermarkets are particularly attractive to consumers seeking convenience, a broad product selection, and competitive pricing, making them the preferred choice for mass-market skincare products.

Specialty stores, which focus on skincare and beauty products, held a significant but smaller share of the market. These stores cater to consumers who seek premium, high-quality products and often provide a more curated selection of facial cleansing balms. The in-store experience, with knowledgeable staff and personalized recommendations, contributes to the growth of this segment.

Pharmacies and drugstores also represent a key distribution channel, appealing to customers looking for trusted, medically-oriented skincare solutions. Online channels are experiencing rapid growth, driven by the convenience of home delivery and a broader range of product options. The shift towards e-commerce is expected to continue expanding, with many consumers opting for the convenience and variety offered by online retailers.

Key Market Segments

By Gender

- Women

- Men

By Age Group

- Adults (Ages 31-50)

- Teenagers (Ages 13-19)

- Young Adults (Ages 20-30)

- Mature Adults (Age 51 & Above)

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Pharmacies & Drugstores

- Online

- Others

Drivers

Rising Skin Care Awareness Drives Market Demand for Facial Cleansing Balms

The growing awareness surrounding skincare routines is significantly driving the demand for facial cleansing balms. As consumers increasingly recognize the importance of maintaining healthy skin, they are turning to products that effectively cleanse without compromising skin integrity.

Facial cleansing balms, particularly oil-based ones, have become a preferred choice due to their gentle yet efficient makeup removal and ability to eliminate impurities without stripping the skin of its natural oils. This shift in consumer preference is also being fueled by the broader growth of the beauty and personal care industry, which is seeing higher product adoption across all age groups.

Additionally, there is a marked increase in demand for natural and organic skincare products, with many consumers opting for cleansing balms that contain organic ingredients, further aligning with the growing trend for safer and more sustainable beauty solutions. Consequently, these factors are contributing to the accelerated growth of the facial cleansing balm market, as they cater to a more informed and health-conscious consumer base.

Restraints

Higher Price and Complex Application Limitations Restrain Facial Cleansing Balm Market Growth

One of the primary factors limiting the growth of the facial cleansing balm market is the higher price point compared to traditional cleansers. Cleansing balms are often positioned as premium products, which can deter budget-conscious consumers from adopting them, especially in price-sensitive markets. This price barrier can be a challenge for widespread acceptance, as consumers may opt for more affordable alternatives like foaming or gel cleansers.

Additionally, the application process for facial cleansing balms, which involves massaging the balm into the skin and transforming it into an oil before rinsing, can be perceived as more complex and time-consuming compared to simpler, more convenient methods offered by traditional cleansers. Some users may find this process inconvenient, particularly in fast-paced lifestyles where ease and speed are prioritized.

These factors, including the perceived inconvenience of the application process and the higher cost, could potentially limit the broader adoption of facial cleansing balms, especially in regions where consumers are more price-sensitive or where convenience is a top priority in skincare routines.

Growth Factors

Expansion into Emerging Markets and Strategic Partnerships Offer Significant Growth Opportunities

The facial cleansing balm market holds considerable growth potential through expansion into emerging markets such as Asia-Pacific, Latin America, and the Middle East. These regions are experiencing an increase in disposable income and a growing interest in beauty and personal care, presenting untapped revenue streams for cleansing balm brands.

Additionally, forming strategic partnerships with established skincare brands can significantly enhance market visibility and product credibility. Collaborating with trusted names in the industry can drive consumer trust and boost sales, especially in competitive markets.

Another growth opportunity lies in the development of eco-friendly packaging solutions. As sustainability becomes a key priority for consumers, offering environmentally conscious packaging can appeal to eco-aware individuals, differentiating brands in a crowded marketplace.

Furthermore, the trend toward personalized skincare products provides an opportunity for companies to introduce customizable facial cleansing balms tailored to specific skin types or concerns. This level of customization could increase consumer engagement and loyalty, as personalized products cater to the growing demand for skincare that addresses unique individual needs.

Overall, leveraging these growth opportunities can position brands for long-term success in the facial cleansing balm market.

Emerging Trends

Clean Beauty Movement and Minimalist Routines Fuel Growth in Facial Cleansing Balm Market

Several key trends are driving the growth of the facial cleansing balm market. The clean beauty movement is one of the most prominent factors, with consumers increasingly seeking non-toxic, cruelty-free, and transparent beauty products. This shift in consumer preference is particularly favorable for natural cleansing balms, which are often formulated with safe, organic ingredients.

Additionally, the rise of minimalist skincare routines is contributing to the market’s expansion. Facial cleansing balms are aligning with this trend due to their multipurpose nature, offering a single product that can cleanse, remove makeup, and nourish the skin, thus simplifying skincare regimens.

Another significant trend is the growing consumer focus on sustainability. Many buyers now prioritize products that are produced with ethical practices and minimal environmental impact, making eco-friendly cleansing balms an attractive option. This includes packaging made from recyclable or biodegradable materials, further appealing to environmentally conscious consumers.

Finally, there is a heightened focus on dermatologically tested and hypoallergenic products. As consumers become more cautious about skin safety, they are gravitating toward products that have been clinically tested to ensure they are gentle and suitable for sensitive skin.

These trends are shaping the landscape of the facial cleansing balm market, as they respond to the evolving needs of consumers who seek safer, simpler, and more sustainable beauty solutions.

Regional Analysis

Asia Pacific Leads Facial Cleansing Balm Market with 40% Share and USD 227.1 Million Driven by Growing Skincare Trends and Rising Disposable Income

The facial cleansing balm market is witnessing significant growth across various global regions, driven by increasing consumer demand for skincare products that offer convenience, effective cleansing, and hydration.

Asia Pacific is the dominant region, holding a substantial market share of approximately 40%, valued at USD 227.1 million. This can be attributed to the increasing focus on skincare in countries such as Japan, South Korea, and China, where the beauty and personal care market is well-established and growing rapidly.

The rising adoption of multi-step skincare routines, coupled with a growing preference for natural and organic ingredients, has further bolstered the demand for cleansing balms in the region. Moreover, Asia Pacific’s burgeoning middle-class population and increasing disposable income have contributed to the overall market growth.

Regional Mentions:

North America follows as a significant market for facial cleansing balms, accounting for a notable share. The U.S. market is driven by a high awareness of skincare benefits, coupled with a preference for premium and innovative beauty products. Additionally, the rising trend toward dermatologically-tested products and a growing inclination towards vegan and cruelty-free beauty solutions support the increasing demand for facial cleansing balms in this region.

Europe is also witnessing robust growth, supported by a well-established skincare industry and the rising consumer inclination toward anti-aging and sensitive skin care solutions. The demand is particularly high in countries like Germany, the UK, and France, where consumer trends are moving towards holistic beauty regimens.

In Latin America, the market is experiencing moderate growth, with Brazil and Mexico being the key markets. Increasing awareness of skincare routines and a preference for natural ingredients are pivotal drivers.

The Middle East & Africa remains a relatively smaller segment, with slow but steady growth as consumer demand for luxury skincare products rises, particularly in the UAE and Saudi Arabia.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global facial cleansing balm market remains highly competitive, with several major players dominating both product innovation and market share. Key companies such as Charlotte Tilbury, Procter & Gamble, Shiseido, and L’Oréal Group are leveraging their established brand equity, extensive distribution channels, and strong R&D capabilities to maintain dominance.

Charlotte Tilbury, known for its luxury positioning, continues to capture a niche market with high-performance, visually appealing products. Its focus on premium formulations and effective skincare solutions aligns with the growing consumer demand for multi-functional, indulgent skincare experiences.

Procter & Gamble and Unilever, giants in the consumer goods industry, benefit from their vast global reach and high-volume production capabilities. Both companies offer a range of cleansing balm options under well-established brands like Olay and Dove. Their market strategy focuses on affordability, accessibility, and product innovation, making them formidable players in the mass-market segment.

Japanese beauty giant Shiseido and Kao Corporation are capitalizing on their heritage in skincare technology and ingredients. Both companies emphasize the use of advanced, skin-friendly formulas, with a strong focus on gentle, yet effective, cleansing solutions, appealing to health-conscious consumers globally.

L’Oréal Group continues to set trends with its ability to quickly introduce cutting-edge formulations backed by rigorous scientific research. Brands under L’Oréal, such as Lancôme and Garnier, offer a wide range of facial cleansing balms designed for various skin types, ensuring broad consumer appeal.

Lastly, e.l.f. Cosmetics and L’Occitane Groupe offer diverse pricing strategies, catering to both affordable luxury and mid-range markets, attracting younger, ingredient-conscious consumers.

Top Key Players in the Market

- Charlotte Tilbury

- Procter & Gamble

- Shiseido Company, Limited

- Amorepacific

- Estee Lauder Companies, Inc.

- L’Oréal Group

- Kao Corporation

- Unilever

- e.l.f. Cosmetics

- L’Occitane Groupe S.A.

Recent Developments

- In April 2024, L’Occitane divested its ownership of Grown Alchemist, two years after acquiring the clean beauty brand, signaling a strategic shift in its portfolio. This move aligns with L’Occitane’s ongoing realignment toward core brands.

- In November 2024, Clean Skin Club successfully closed a $32 million investment round, led by Astō Consumer Partners with additional co-investment from Amberstone. This funding will support the brand’s growth and innovation in the premium skincare market.

- In April 2024, the incubator Slate Brands expanded its portfolio with the acquisition of Frontman, a Gen Z-focused men’s acne brand. The acquisition positions Slate Brands to tap into the rapidly growing market for men’s skincare solutions.

- In July 2024, SkinInspired raised $1.5 million in a funding round led by Unilever Ventures, which will aid the brand’s efforts to expand its clean and sustainable skincare product offerings. This investment reinforces SkinInspired’s commitment to innovation in the beauty sector.

- In July 2024, American Exchange Group acquired Indie Lee, a leading clean beauty brand known for its plant-based skincare products. The acquisition enhances American Exchange Group’s position in the premium, sustainable beauty market.

- In February 2024, Stockholm-based Mantle secured over €2.8 million in funding to accelerate its clean skincare expansion. The investment will enable Mantle to further scale its product offerings and reach within the European market.

Report Scope

Report Features Description Market Value (2024) USD 567.8 Million Forecast Revenue (2034) USD 1732.2 Million CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Gender (Women, Men), By Age Group, Teenagers, Young Adults, Mature Adults), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Pharmacies & Drugstores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Charlotte Tilbury, Procter & Gamble, Shiseido Company, Limited, Amorepacific, Estee Lauder Companies, Inc., L’Oréal Group, Kao Corporation, Unilever, e.l.f. Cosmetics, L’Occitane Groupe S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Facial Cleansing Balm MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Facial Cleansing Balm MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Charlotte Tilbury

- Procter & Gamble

- Shiseido Company, Limited

- Amorepacific

- Estee Lauder Companies, Inc.

- L'Oréal Group

- Kao Corporation

- Unilever

- e.l.f. Cosmetics

- L'Occitane Groupe S.A.