Global Fabry Disease Market By Treatment Type (Enzyme Replacement Therapy, Substrate Reduction Therapy, Chaperone Therapy and Gene Therapy), By Diagnosis Method (Genetic Testing, Enzyme Activity Assay, Biopsy and Imaging Techniques), By Disease Severity (Moderate, Mild, Severe and Asymptomatic), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176173

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

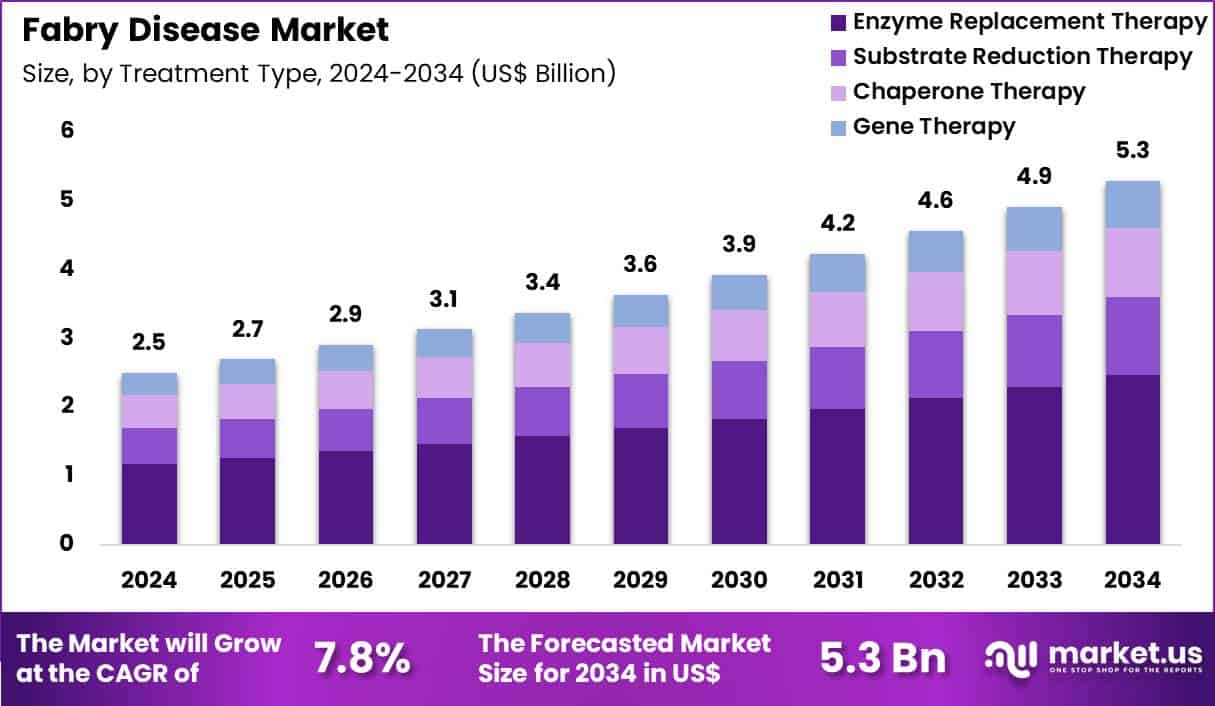

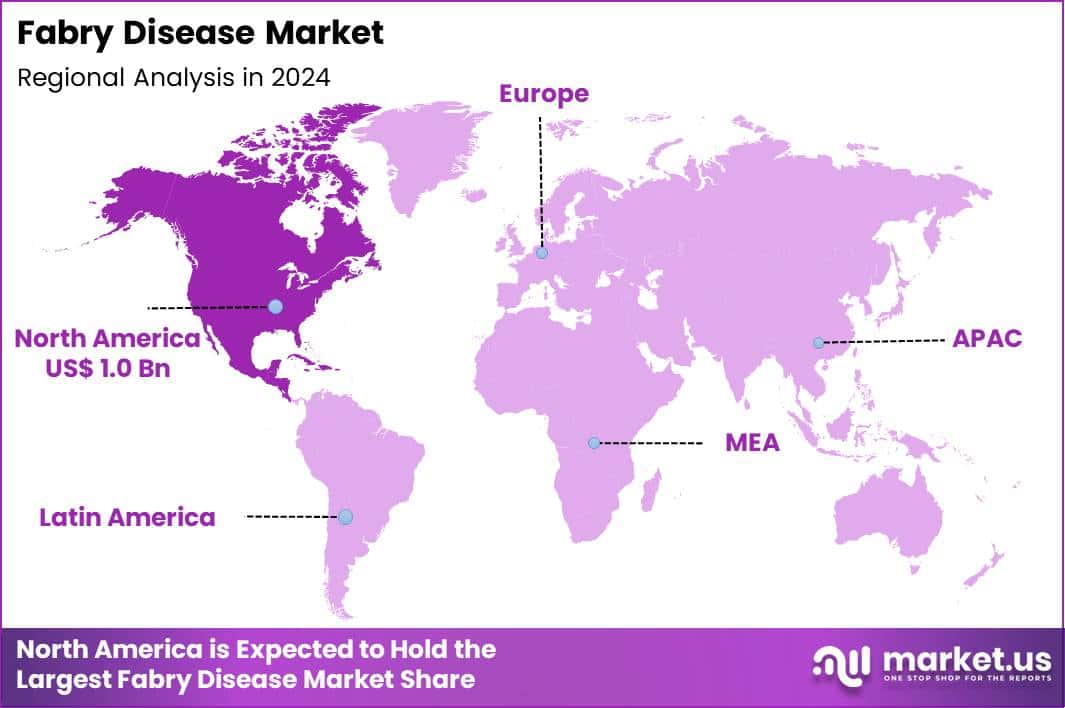

Global Fabry Disease Market size is expected to be worth around US$ 5.3 Billion by 2034 from US$ 2.5 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 1.0 Billion.

Increasing awareness of lysosomal storage disorders and improved diagnostic capabilities drive the Fabry Disease market as healthcare providers identify more patients with this X-linked genetic condition characterized by alpha-galactosidase A deficiency. Clinicians increasingly prescribe enzyme replacement therapies to address glycosphingolipid accumulation, alleviating neuropathic pain, renal dysfunction, and cardiac complications in affected individuals.

These treatments support symptom management in pediatric cases, where early intervention prevents progressive organ damage and enhances quality of life. Gene therapies target the underlying GLA gene mutation, offering potential long-term correction for severe manifestations including cerebrovascular events and hearing loss.

Oral chaperone therapies stabilize misfolded enzymes, providing convenient options for patients with amenable mutations to improve cardiac and renal function. Supportive applications include substrate reduction therapies that inhibit lipid synthesis, complementing primary treatments to mitigate gastrointestinal symptoms and fatigue.

Pharmaceutical companies pursue opportunities to develop next-generation gene editing tools that achieve durable enzyme expression, expanding curative potential for newly diagnosed cases and reducing lifelong treatment burdens. Developers advance combination regimens that integrate enzyme replacement with anti-inflammatory agents, broadening efficacy in managing multi-organ involvement and preventing hypertrophic cardiomyopathy.

These innovations facilitate personalized dosing protocols based on genetic profiling, optimizing outcomes in heterogeneous patient populations. Opportunities emerge in biomarker-driven monitoring systems that track disease progression, enabling timely therapeutic adjustments. Companies invest in patient registries and real-world evidence platforms to accelerate regulatory approvals for novel modalities.

Recent trends emphasize viral vector optimizations for safer gene delivery and oral formulations with enhanced bioavailability, positioning the market for sustained growth in addressing unmet needs across symptomatic and preventive care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.5 Billion, with a CAGR of 7.8%, and is expected to reach US$ 5.3 Billion by the year 2034.

- The treatment type segment is divided into enzyme replacement therapy, substrate reduction therapy, chaperone therapy and gene therapy, with enzyme replacement therapy taking the lead with a market share of 46.7%.

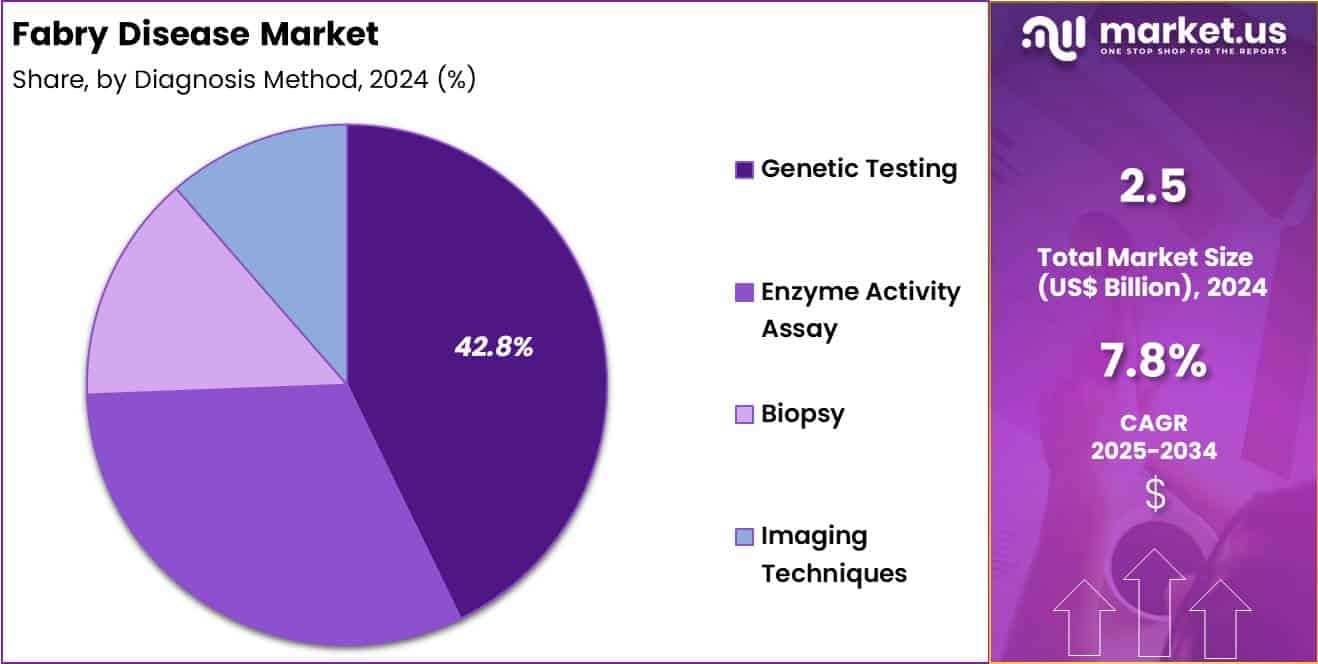

- Considering diagnosis method, the market is divided into genetic testing, enzyme activity assay, biopsy and imaging techniques. Among these, genetic testing held a significant share of 42.8%.

- Furthermore, concerning the disease severity segment, the market is segregated into moderate, mild, severe and asymptomatic. The moderate sector stands out as the dominant player, holding the largest revenue share of 39.5% in the market.

- North America led the market by securing a market share of 41.1%.

Treatment Type Analysis

Enzyme replacement therapy contributed 46.7% of growth within treatment type and led the Fabry disease market due to its established role in addressing the underlying enzyme deficiency. Clinicians rely on enzyme replacement therapy to reduce globotriaosylceramide accumulation and slow organ damage progression.

Long-term clinical evidence supports its effectiveness in preserving renal and cardiac function, which strengthens physician confidence. Patients diagnosed at early or moderate stages often initiate therapy promptly to delay irreversible complications. Regular infusion schedules increase treatment continuity and overall therapy utilization.

Growth further accelerates as diagnosis rates improve and patient registries expand globally. Reimbursement coverage across developed healthcare systems supports sustained uptake. Treatment guidelines recommend enzyme replacement therapy as a standard of care, reinforcing consistent prescribing patterns.

Expansion of infusion centers improves access for patients. Lifecycle management strategies by manufacturers sustain therapy adherence. The segment is expected to remain dominant as clinicians prioritize disease-modifying treatment with long-term outcome benefits.

Diagnosis Method Analysis

Genetic testing accounted for 42.8% of growth within diagnosis method and dominated the Fabry disease market due to its accuracy in confirming pathogenic mutations. Physicians prefer genetic testing to differentiate Fabry disease from clinically similar lysosomal storage disorders.

Family screening programs rely heavily on genetic confirmation to identify affected relatives and carriers. Earlier diagnosis enables timely treatment initiation, which improves long-term patient outcomes. Expanding awareness among nephrologists and cardiologists increases test ordering frequency.

Advances in sequencing technology reduce turnaround time and testing costs, which supports broader adoption. National rare disease initiatives promote genetic diagnostics as a standard practice. Integration of genetic counseling strengthens testing pathways. Pediatric screening programs further expand testing volumes. Precision medicine strategies reinforce reliance on genetic data for treatment planning. The segment is projected to grow steadily as early and accurate diagnosis becomes central to Fabry disease management.

Disease Severity Analysis

Moderate disease severity generated 39.5% of growth within disease severity and emerged as the dominant segment due to higher diagnosis rates at this stage. Patients with moderate symptoms often present with renal, cardiac, or neurological manifestations that prompt clinical investigation.

Physicians prioritize treatment initiation at this stage to prevent progression to severe organ damage. Symptom visibility drives healthcare engagement and diagnostic follow-up. Moderate patients frequently qualify for disease-specific therapies, increasing treatment penetration.

Ongoing monitoring programs focus on patients with measurable disease progression, which sustains healthcare utilization. Clinical trial enrollment often targets moderate severity populations, increasing treatment exposure.

Patient advocacy efforts encourage proactive management before irreversible damage occurs. Treatment adherence remains higher among moderate patients due to preserved functional status. The segment is anticipated to maintain dominance as early intervention strategies emphasize managing disease progression at moderate stages.

Key Market Segments

By Treatment Type

- Enzyme Replacement Therapy

- Substrate Reduction Therapy

- Chaperone Therapy

- Gene Therapy

By Diagnosis Method

- Genetic Testing

- Enzyme Activity Assay

- Biopsy

- Imaging Techniques

By Disease Severity

- Moderate

- Mild

- Severe

- Asymptomatic

Drivers

Increasing sales of approved therapies is driving the market.

The robust growth in sales of established treatments for Fabry disease reflects expanding patient access and heightened clinical adoption worldwide. This upward trajectory is fueled by improved diagnostic rates and greater physician awareness of the condition’s manifestations. Sanofi reported Fabrazyme net sales of 1,047 million euros in 2024, marking a 9.1% increase at constant exchange rates from the prior year.

Such financial performance indicates sustained demand for enzyme replacement therapies in managing lysosomal storage deficiencies. Amicus Therapeutics achieved Galafold net product sales of 458.1 million dollars in 2024, representing an 18% year-over-year rise. These figures highlight the market’s response to effective oral chaperone options for amenable mutations.

Healthcare systems are increasingly incorporating these therapies into standard protocols for symptomatic relief. The correlation between sales growth and expanded reimbursement policies further accelerates utilization. Key pharmaceutical entities continue to invest in marketing to support this momentum. Overall, rising revenues underscore the foundational role of current treatments in market progression.

Restraints

High cost of enzyme replacement therapies is restraining the market.

The substantial pricing of enzyme replacement therapies for Fabry disease poses a barrier to equitable access in various healthcare environments. Manufacturing complexities and biologic production requirements contribute to elevated per-patient expenses. Patients frequently encounter challenges with insurance coverage, leading to restricted therapeutic initiation.

Regulatory frameworks demand rigorous post-marketing surveillance, adding to overall cost structures. In public sectors, fiscal constraints prioritize other chronic conditions over rare disease interventions. Providers may select watchful waiting approaches to defer high-expenditure treatments.

This restraint diminishes potential market volume in economically diverse regions. Collaborative pricing negotiations aim to temper these effects progressively. Despite efficacy, financial hurdles limit comprehensive patient reach. Mitigating affordability remains key to resolving this market constraint.

Opportunities

Launch of pegunigalsidase alfa is creating growth opportunities.

The introduction of pegunigalsidase alfa expands therapeutic choices for Fabry disease management in adult populations. This pegylated enzyme variant offers potential advantages in dosing frequency and immunogenicity profiles. Protalix BioTherapeutics generated 29.3 million dollars from Elfabrio sales to Chiesi in 2024.

Such revenue demonstrates early commercial traction following regulatory approvals in key jurisdictions. Partnerships with global distributors facilitate broader geographic availability and compliance. The product’s positioning addresses unmet needs in patients with prior treatment intolerances.

Government orphan drug designations support accelerated pathways and incentives. Key organizations are conducting post-approval studies to validate long-term benefits. This opportunity enables diversification within the lysosomal storage disorder segment. Strategic integrations into care guidelines can enhance adoption rates.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the Fabry disease market through public healthcare budgets, reimbursement scrutiny, and funding for rare disease programs that executives review closely. Inflation and higher interest rates pressure payer negotiations and stretch timelines for therapy access in some regions.

Geopolitical instability disrupts global supply chains for biologics, enzymes, and specialty raw materials, increasing manufacturing and distribution complexity. Current US tariffs on imported inputs and specialized equipment raise production costs for therapy developers and contract manufacturers, tightening margins.

These challenges can slow market expansion and intensify pricing discussions with payers. On the positive side, trade pressure supports domestic manufacturing, supply chain redundancy, and investment in local biologics capacity. Strong policy support for orphan drugs and unmet medical need sustains long term demand. With continued innovation and strategic partnerships, the market remains positioned for steady and resilient growth.

Latest Trends

Advancement in gene therapy pipelines is a recent trend in the market.

In 2024, alignments with regulatory bodies have propelled gene therapy candidates toward potential accelerated approvals for Fabry disease. These investigational approaches aim to provide durable enzyme expression through vector-mediated delivery. Sangamo Therapeutics secured FDA consensus on using estimated glomerular filtration rate slope as a surrogate endpoint in October 2024.

This milestone facilitates biologics license application submission in the latter half of 2025. Clinical datasets emphasize multi-organ benefits beyond traditional replacement methods. Industry investments focus on optimizing vector designs for enhanced safety. The trend incorporates real-world evidence to support broader indications.

Collaborative trials refine administration protocols for diverse patient cohorts. These evolutions target root-cause correction in genetic deficiencies. Overall, gene therapy progress heralds transformative shifts in treatment paradigms.

Regional Analysis

North America is leading the Fabry Disease Market

North America commands a 41.1% share of the global Fabry Disease market, showcasing vigorous growth in 2024 propelled by accelerated development of gene therapies and enhanced patient support programs for managing this inherited lysosomal storage disorder. Key firms like Sanofi Genzyme and uniQure have advanced investigational treatments, such as next-generation vectors that aim to restore alpha-galactosidase A activity, addressing cardiac and renal complications more effectively.

The region’s sophisticated clinical trial ecosystem has enabled swift progression of pipeline candidates, with multiple Phase I/II studies recruiting participants to evaluate long-term efficacy in diverse patient cohorts. Advocacy groups, including the National Fabry Disease Foundation, have intensified educational efforts to promote newborn screening, leading to earlier diagnoses and intervention.

Investments in precision medicine have integrated genomic profiling into standard care, allowing for mutation-specific approaches that improve therapeutic outcomes. Cooperative ventures between biotech enterprises and academic centers have generated pivotal data on substrate reduction strategies, influencing treatment guidelines.

Additionally, expanded reimbursement models from payers have reduced financial barriers, encouraging higher utilization of approved therapies. The U.S. FDA granted orphan drug designations to two gene therapies for Fabry disease in 2024, highlighting intensified innovation in rare genetic treatments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts forecast considerable expansion in the rare lysosomal disorder sector across Asia Pacific over the forecast period, because policymakers enhance reimbursement frameworks to cover advanced enzyme replacements and chaperone molecules. Companies in South Korea and Singapore innovate localized formulations that target specific mutations, while specialists in Malaysia refine diagnostic protocols to identify cases earlier in high-prevalence communities.

Hospitals in the Philippines equip facilities with infusion centers, enabling consistent administration of biologics for symptom management. Funders in Vietnam back registries that track progression, informing tailored regimens for cardiovascular and neuropathic manifestations. Officials in Indonesia harmonize import regulations for orphan products, allowing faster entry of international options into public health systems.

Clinicians in Thailand conduct workshops that train providers on monitoring tools, optimizing adherence among affected families. Enterprises in India establish manufacturing sites for biosimilars, lowering costs and broadening distribution to remote areas. China’s National Medical Products Administration authorized 55 medicines for rare diseases in 2024, boosting availability of specialized interventions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the Fabry Disease market expand growth by advancing next-generation therapies such as oral chaperones, novel enzyme replacement regimens, and gene therapy candidates that address underlying genetic causes and extend patient choice. They allocate substantial resources toward global clinical programs and regulatory filings to secure approvals and broaden label claims across major geographies, strengthening competitive positions.

Firms also pursue strategic alliances and licensing agreements that accelerate access to complementary technologies and share development risk, especially for complex biologics. Expanding sales and medical education efforts in emerging healthcare systems amplifies uptake where diagnosis rates and treatment awareness are rising.

Sanofi SA operates as a major diversified pharmaceutical company with a robust rare disease franchise, including established enzyme replacement options and ongoing innovation initiatives that align commercial reach with unmet clinical needs. The company sustains momentum through disciplined investment in R&D, global distribution scale, and structured engagement with clinicians and payers to drive long-term adoption.

Top Key Players

- Sanofi

- Takeda Pharmaceutical Company

- Amicus Therapeutics

- Pfizer Inc.

- Eli Lilly and Company

- Johnson & Johnson

- Novartis AG

- Protalix BioTherapeutics

- Freeline Therapeutics

- Idorsia Pharmaceuticals

Recent Developments

- In February 2025, Amicus Therapeutics shared new scientific findings from its migalastat development programs at the 21st Annual WORLD Symposium 2025. The company contributed both oral presentations and poster sessions, highlighting ongoing progress in Fabry disease research.

- In October 2024, Amicus Therapeutics entered into a licensing arrangement with Teva Pharmaceuticals, bringing resolution to patent litigation related to Teva’s ANDA for a generic version of GALAFOLD. Under the agreement terms, Teva is permitted to commercialize its generic product in the US starting in January 2037, following the expiration of the relevant patent protections.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 Billion Forecast Revenue (2034) US$ 5.3 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Enzyme Replacement Therapy, Substrate Reduction Therapy, Chaperone Therapy and Gene Therapy), By Diagnosis Method (Genetic Testing, Enzyme Activity Assay, Biopsy and Imaging Techniques), By Disease Severity (Moderate, Mild, Severe and Asymptomatic) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sanofi, Takeda Pharmaceutical Company, Amicus Therapeutics, Pfizer Inc., Eli Lilly and Company, Johnson & Johnson, Novartis AG, Protalix BioTherapeutics, Freeline Therapeutics, Idorsia Pharmaceuticals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sanofi

- Takeda Pharmaceutical Company

- Amicus Therapeutics

- Pfizer Inc.

- Eli Lilly and Company

- Johnson & Johnson

- Novartis AG

- Protalix BioTherapeutics

- Freeline Therapeutics

- Idorsia Pharmaceuticals