Global Extractable and Leachable Testing Services Market Analysis By Product Type (Container Closure Systems, Single-use Systems, Drug Delivery Systems, Others), By Application (Orally Inhaled and Nasal Drug Products (OINDP), Parenteral Drug Products, Ophthalmic) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156050

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

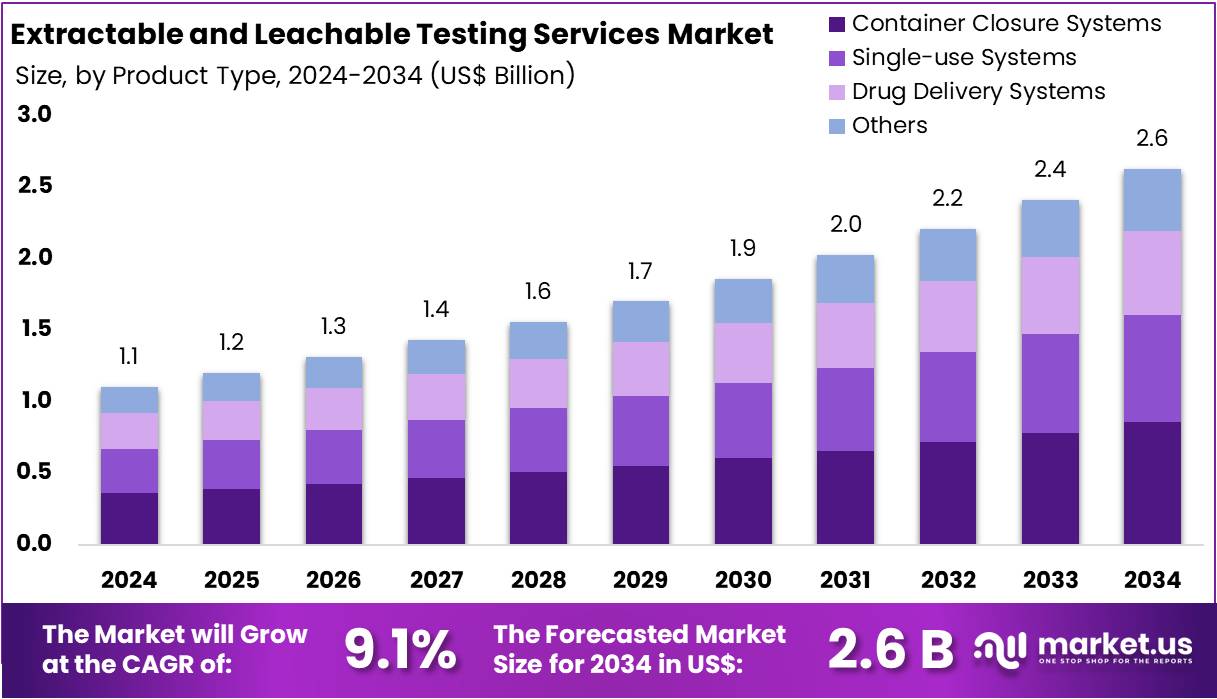

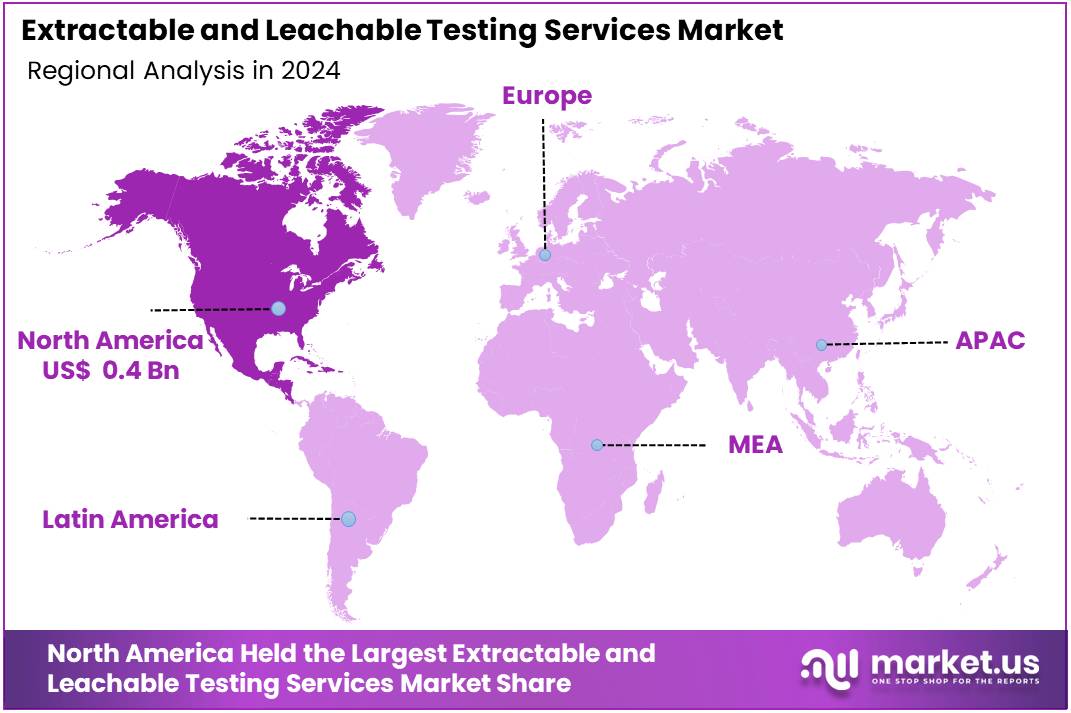

The Global Extractable and Leachable Testing Services Market size is expected to be worth around US$ 2.6 Billion by 2034, from US$ 1.1 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 44.6% share and holds US$ 0.4 Billion market value for the year.

Regulatory Drivers and Market Expansion

Extractable and Leachable (E&L) testing services are essential in pharmaceuticals, biologics, and medical devices. These tests identify chemical substances that may migrate from packaging, containers, or delivery systems into products. Extractables are detected under aggressive conditions, while leachables are substances migrating during normal use. According to regulatory agencies such as the U.S. FDA and the EMA, strict oversight is vital for patient safety and product quality. As compliance expectations grow, the demand for reliable E&L services is steadily rising.

The U.S. FDA’s Center for Drug Evaluation and Research (CDER) approved 50 novel drugs in 2024. Of these approvals, 66% used at least one expedited program, 52% targeted rare diseases, and 48% were first-in-class. This high share of innovative and complex medicines increases the need for robust E&L testing to ensure compatibility between advanced drug formulations and packaging systems. For example, sterile injectables and device-enabled therapies require detailed chemical risk assessments before regulatory acceptance.

In Europe, the EMA recommended 114 medicines for marketing authorisation in 2024. Of these, 46 contained a new active substance. Early-access activity also expanded, with PRIME eligibility requests rising to 58, reflecting a 12% year-over-year increase. Out of these, 56 recommendations were issued with a 27% acceptance rate. As more innovative drugs enter the pipeline, regulators increasingly expect in-depth E&L data to verify that packaging and delivery systems do not compromise patient safety or drug stability.

The vaccine market has also contributed to the expansion of E&L services. The WHO’s 2024 Global Vaccine Market Report covered 88 vaccine products supplied by 116 manufacturers across 207 countries. According to the report, diverse formulations, containers, closures, and cold-chain devices must all be assessed for leachables during storage and distribution. For instance, the testing of polymeric components in vials and stoppers ensures that vaccines remain stable throughout their shelf life, driving demand for broader E&L evaluations.

Global regulatory capacity building has reinforced compliance expectations. WHO’s Department of Regulation and Prequalification reports that over 1,500 products have been prequalified across medicines, vaccines, diagnostics, and devices. Furthermore, 58 national regulatory authorities have achieved maturity level 3 or 4, and the WHO-Listed Authority framework now includes 36 agencies. As more regulators reach advanced maturity levels, E&L testing requirements are being enforced more consistently across global markets, encouraging manufacturers to conduct early and comprehensive studies.

Industry Trends and Emerging Testing Needs

The rapid proliferation of medical devices is another factor supporting E&L testing growth. According to WHO, nearly 2 million types of medical devices exist worldwide, grouped into more than 7,000 categories. Many of these devices, such as syringes, infusion pumps, or polymer-based catheters, are in direct contact with drugs or patients. For example, device–drug combinations and administration systems often require chemical characterization studies to meet regulatory expectations, further expanding E&L testing demand.

Quality vigilance is emerging as a strong driver for testing services. WHO estimates that at least 1 in 10 medicines in low- and middle-income countries are substandard or falsified. This quality gap imposes an annual economic burden of approximately US$ 30.5 billion. To mitigate risks, regulators and procurement agencies now demand robust chemistry data, including detailed E&L assessments. According to studies, these requirements help demonstrate product quality, reduce safety risks, and strengthen confidence in global pharmaceutical supply chains.

Recent impurity alerts are tightening expectations for proactive testing. For instance, the U.S. FDA has warned manufacturers about benzene contamination risks in categories such as hand sanitizers, acne products containing benzoyl peroxide, and aerosol-based formulations. Several recalls have been linked to inactive ingredients, propellants, or degradation pathways. In response, the FDA has reminded firms of their obligations under CGMP and ICH limits. These alerts are reinforcing the need for earlier and more comprehensive E&L studies across raw materials, packaging, and device components.

Taken together, the growing volume of novel drug approvals, the expanding vaccine pipeline, stronger regulatory systems, the vast medical device landscape, and stricter impurity vigilance are collectively reshaping the E&L testing market. According to industry studies, sponsors are increasingly focused on generating regulator-ready evidence that packaging, delivery systems, and raw materials do not compromise safety, quality, or efficacy. The market for E&L testing services is therefore expected to expand consistently, supported by innovation-driven pipelines and rising global quality standards.

Key Takeaways

- The Global Extractable and Leachable Testing Services Market is projected to reach US$ 2.6 Billion by 2034, growing from US$ 1.1 Billion in 2024.

- A robust CAGR of 9.1% is expected for the market during 2025–2034, driven by increasing regulatory compliance and safety standards across pharmaceutical industries.

- In 2024, Container Closure Systems led the product type segment, capturing over 32.5% share, reflecting their critical role in drug safety assurance.

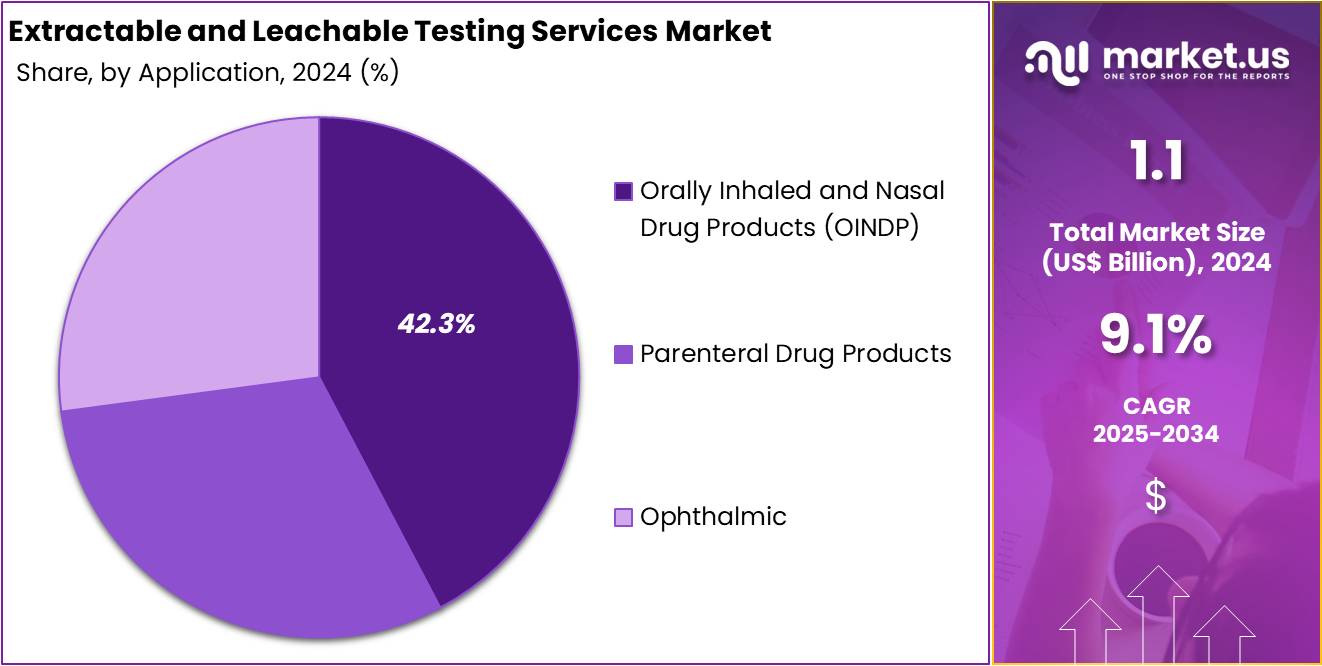

- Orally Inhaled and Nasal Drug Products (OINDP) dominated the application segment in 2024, accounting for more than 42.3% of the global market share.

- North America maintained market leadership in 2024, capturing over 44.6% share with a value of US$ 0.4 Billion, driven by advanced healthcare infrastructure.

Product Type Analysis

In 2024, the Container Closure Systems Section held a dominant market position in the Product Type Segment of the Extractable and Leachable Testing Services Market, and captured more than a 32.5% share. This segment maintained leadership due to its essential role in securing pharmaceutical packaging. The growth was supported by rising concerns over contamination and product stability. Industry experts indicated that strict regulations governing packaging safety encouraged wider testing adoption. Primary packaging, including vials, stoppers, and bottles, was the focus of extensive evaluations.

The Single-use Systems segment also held a significant market portion. Analysts noted that the adoption of disposable bioprocessing equipment was increasing steadily. These systems were favored for minimizing contamination risks and improving efficiency. However, higher risk of leachables in plastics raised safety concerns, driving demand for testing services. With biopharmaceutical manufacturing on the rise, experts observed consistent growth potential. The reliance on disposable equipment highlighted the importance of comprehensive testing protocols to ensure compliance and patient safety.

The Drug Delivery Systems segment showed steady expansion. This category included pre-filled syringes, inhalers, and auto-injectors. Experts emphasized that rising demand for self-administered devices created greater testing requirements. Growing use of biologics and innovative drug delivery formats added to the need for safety checks. Meanwhile, the Others segment recorded a modest share but remained important. It included diagnostic consumables and medical devices. Market observers suggested that the segment could gain momentum with the growing use of polymer-based healthcare components worldwide.

Application Analysis

In 2024, the Orally Inhaled and Nasal Drug Products (OINDP) section held a dominant market position in the application segment of the Extractable and Leachable Testing Services Market and captured more than a 42.3% share. This leadership is linked to the growing use of inhalers and nasal sprays in respiratory diseases. Rising asthma and COPD cases have strengthened the need for strict testing. Ensuring drug safety through reliable extractables and leachables testing remains a critical requirement in this segment.

The Parenteral Drug Products segment emerged as the second largest contributor to the market. Its growth was influenced by rising demand for sterile injectables used in biologics, vaccines, and advanced therapies. The sensitivity of parenteral formulations to leachable impurities increased reliance on extensive testing protocols. Regulatory focus on drug purity and safety has been a driving factor. The segment is projected to remain stable, with ongoing demand fueled by biologic developments and injectable-based treatment innovations.

The Ophthalmic Products segment recorded consistent growth in recent years. This progress is associated with higher adoption of eye drops and advanced ocular delivery systems for conditions like glaucoma, dry eye, and post-surgical recovery. Stringent regulatory standards require safety testing for all ophthalmic products, leading to steady demand. Although its share is smaller compared to OINDP and parenteral drugs, the ophthalmic category is positioned for sustainable expansion. Continuous developments in drug delivery formats are expected to reinforce its contribution to the overall market.

Key Market Segments

By Product Type

- Container Closure Systems

- Single-use Systems

- Drug Delivery Systems

- Others

By Application

- Orally Inhaled and Nasal Drug Products (OINDP)

- Parenteral Drug Products

- Ophthalmic

Drivers

Expansion of Pharma and Biotech Industries Driving E&L Testing Services

The expansion of the pharmaceutical and biotechnology industries is a key driver for extractable and leachable (E&L) testing services. The market is witnessing a surge in biologics, injectable drugs, and advanced combination therapies. These products demand higher safety standards due to their direct interaction with patients. As drug delivery systems evolve, the risks of harmful chemical interactions from packaging or device materials increase. This rising complexity drives pharmaceutical companies to invest in robust E&L testing to meet stringent safety and quality requirements.

Regulatory authorities across the globe emphasize patient safety through strict compliance measures. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate thorough E&L evaluations for drug packaging and delivery systems. Manufacturers are compelled to conduct comprehensive studies to ensure that no harmful substances migrate into products. These requirements create consistent demand for specialized testing services. Hence, regulatory pressure continues to fuel market adoption and expansion of E&L testing solutions.

The biotechnology sector’s rapid growth further accelerates the need for advanced testing. Biologics and injectable therapies are highly sensitive to contamination, making leachable compounds a critical concern. Any failure in packaging integrity can impact efficacy and patient health outcomes. As companies innovate with novel delivery devices and complex formulations, the need for reliable E&L testing rises. This trend ensures continued reliance on specialized service providers who can deliver accurate and regulatory-compliant results. Thus, industry expansion and innovation strongly drive the testing services market.

Restraints

Complexity and High Costs of E&L Testing as a Restraint

The complexity of extractable and leachable (E&L) testing is a major restraint for the market. These studies demand the identification of a wide range of contaminants that can migrate from packaging or manufacturing materials into drugs or medical devices. Each test requires advanced instrumentation such as mass spectrometry and chromatography. The high level of technical expertise needed adds to operational challenges. This complexity makes it difficult for companies without strong analytical capabilities to manage testing independently.

Another restraint comes from the costs involved in conducting E&L studies. Sophisticated laboratory equipment, skilled professionals, and multiple testing phases increase overall expenses. Smaller pharmaceutical or biotech firms may find it financially difficult to allocate budgets for such detailed testing. Delays and repeated evaluations further raise costs. This restricts broader adoption of E&L testing services, especially among startups and mid-sized firms, slowing market expansion in regions with limited resources.

Project timelines also extend due to the detailed processes required. Comprehensive E&L testing includes study design, sample preparation, analytical testing, and data interpretation. Each phase is time-intensive and subject to strict regulatory standards. Delays in completing these assessments can slow product development cycles. This becomes a significant bottleneck for companies aiming for faster regulatory approval. As a result, the length and complexity of E&L studies remain a limiting factor in market growth despite increasing demand.

Opportunities

Advancements in Analytical Technologies Driving Growth in E&L Testing Services

Advancements in analytical technologies present a significant opportunity for extractable and leachable (E&L) testing services. The adoption of high-resolution mass spectrometry, advanced chromatography methods, and improved data-driven modeling techniques is reshaping the industry. These technologies allow laboratories to detect even trace levels of potential contaminants with greater precision and reliability. As pharmaceutical and medical device companies face stricter global regulations, demand for such highly sensitive and efficient testing solutions continues to rise, making E&L testing services more attractive and indispensable.

The use of advanced tools also improves testing speed and accuracy. High-resolution instruments can process complex samples more efficiently, while chromatography innovations provide better separation and identification of compounds. Data-driven modeling further reduces uncertainty by predicting material behaviors under different conditions. This leads to faster validation cycles for new drugs and devices. Companies adopting these advanced solutions gain a competitive advantage, as regulatory bodies prefer validated, precise, and transparent testing processes in ensuring patient safety and compliance.

Moreover, these innovations open new opportunities for service providers to expand offerings. They can now deliver integrated testing solutions that combine chemical characterization, risk assessment, and regulatory documentation. With increasing biologics, injectables, and combination products in development, the need for comprehensive and rapid testing is critical. E&L service providers leveraging modern analytical tools can cater to this growing demand. This creates a strong market opportunity to build long-term partnerships with pharmaceutical and medical device companies seeking reliable and cutting-edge compliance solutions.

Trends

Diversification of E&L Testing Applications

Extractable and leachable (E&L) testing services are no longer limited to the pharmaceutical sector. Increasing regulatory oversight and consumer awareness are driving their adoption across medical devices, food packaging, and cosmetics. Regulators demand assurance that materials in contact with drugs, food, or skin remain safe over time. This has created new opportunities for testing laboratories. As industries expand, ensuring compliance with global safety standards has become essential, positioning E&L testing as a critical enabler of market access.

The medical device industry is a key area of expansion for E&L testing. Devices such as catheters, infusion systems, and implants often use polymers and elastomers. These materials can release harmful substances under real-world conditions. As a result, regulatory agencies like the FDA and EMA emphasize detailed leachables studies to ensure patient safety. This trend is fueling greater demand for specialized analytical techniques. Testing providers now focus on advanced methods to detect trace chemicals at lower thresholds with higher accuracy.

Beyond healthcare, food packaging and cosmetics also contribute to this trend. Consumers are increasingly concerned about chemical migration from packaging or cosmetic containers into consumable products. Authorities such as the European Food Safety Authority (EFSA) enforce strict migration limits to protect consumers. Cosmetics safety regulations in the EU also highlight the role of leachables monitoring. This wider application scope strengthens the long-term growth outlook of E&L testing services. It signals a shift from niche pharmaceutical testing toward a multi-industry compliance and safety solution.

Regional Analysis

North America held a dominant market position, capturing more than a 44.6% share and holds US$ 0.4 Billion market value for the year. This strong performance is closely linked to strict regulations and advanced healthcare infrastructure. Agencies like the FDA, Health Canada, and USP enforce comprehensive testing standards. Pharmaceutical and device makers are required to follow detailed E&L testing guidelines. These regulations ensure product safety, drive testing demand, and maintain the region’s leadership in the global E&L services market.

The presence of leading pharmaceutical and biotechnology companies is another major driver of North America’s dominance. Firms such as Pfizer, Johnson & Johnson, and Amgen invest heavily in research and development. Their innovative drug pipelines require extensive analytical testing to meet approval standards. As these companies are based in the region, service providers are well positioned to collaborate with them. This close proximity strengthens partnerships, accelerates projects, and creates consistent demand for extractable and leachable (E&L) testing services.

North America also benefits from advanced laboratory capabilities and skilled professionals. Specialized expertise in chromatography, mass spectrometry, and toxicology supports accurate E&L testing. The healthcare system in the region is known for its strong infrastructure and rapid adoption of cutting-edge tools. Moreover, the growing use of biologics, biosimilars, and combination therapies increases testing complexity. As a result, the demand for highly precise evaluations of potential extractables and leachables continues to rise across pharmaceutical and medical device manufacturing facilities.

The increasing demand for biologics and parenteral drugs further boosts the market. Injectable treatments, monoclonal antibodies, and cell and gene therapies are particularly sensitive to contamination risks. Ensuring the safety of these products requires strict testing. With North America being a global hub for biologics production, the reliance on E&L services is strong. This trend highlights the region’s importance in safeguarding patient health while ensuring that innovative therapies meet all required regulatory and quality standards.

Collaborations and public-private partnerships also contribute to market growth in North America. Government funding in biomedical research indirectly raises the need for advanced testing solutions. The continuous push for innovation, combined with a culture of strong compliance, supports this dominance. As biologics and complex therapies become more common, the importance of E&L testing grows further. With these factors, North America is expected to sustain its leading role in the extractable and leachable testing services market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The extractable and leachable (E&L) testing services market is highly competitive and driven by global players with strong technological capabilities and regulatory expertise. Eurofins Scientific stands out with its global network of laboratories and advanced analytical solutions. Its robust portfolio in pharmaceutical testing, combined with consistent investments in infrastructure and acquisitions, ensures a strong presence across North America, Europe, and Asia-Pacific. Eurofins’ ability to meet regulatory compliance while offering a broad range of E&L testing services gives it a clear competitive edge in the market.

Intertek Group plc also holds a strong position in the market. The company provides wide-ranging laboratory services, including E&L testing, with strict adherence to FDA, EMA, and USP guidelines. Intertek is recognized for its high-quality assurance and adoption of advanced analytical techniques. This enables it to cater to leading pharmaceutical and medical device companies. Its diversified service portfolio beyond E&L testing creates opportunities for cross-selling, helping the company deepen client relationships and expand its role in compliance-driven markets.

SGS Société Générale de Surveillance SA is another major competitor in the E&L testing market. The company offers testing, inspection, and certification services with a global reach. SGS leverages its regulatory expertise and innovation in analytical methods to deliver accurate and reproducible results. It plays an important role in compliance testing for pharmaceutical packaging and medical devices. With its focus on technical excellence and reliability, SGS continues to strengthen its reputation as a trusted partner for companies seeking high standards in E&L analytical solutions worldwide.

WuXi AppTec and Merck KGaA are also influential players. WuXi AppTec leads in Asia with integrated platforms that support drug development and E&L analysis. Its collaborations with global biopharma companies strengthen its market footprint. Merck KGaA leverages its expertise in life sciences and chemical solutions, offering high-quality E&L services backed by advanced instrumentation. Beyond these, smaller regional providers also compete effectively. Their specialized services, flexibility, and competitive pricing attract mid-sized pharmaceutical firms. This mix of global giants and niche providers keeps the market dynamic and highly competitive.

Market Key Players

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc

- Wickham Micro Limited

- Pacific Biolabs

- Boston Analytical

- Sotera Health

Recent Developments

- In September 2024: Eurofins expanded its BioPharma Product Testing capabilities through the strategic acquisition of Infinity Laboratories, Inc., a company operating eight laboratories across the United States with expertise in microbiology, chemistry, sterilization, and package testing—services complementary to extractables and leachables testing. The integration of package testing competencies is expected to reinforce Eurofins’ E&L offering, particularly regarding material and packaging assessments.

- In August 2024: Intertek introduced an enhanced version of its ToxClear platform. The upgrade constitutes a significant digital innovation, aimed at elevating the transparency, efficiency, and traceability of testing processes and toxicology data workflows. Although not exclusively tied to extractable and leachable testing, the ToxClear platform’s enhancement underscores Intertek’s broader commitment to digital transformation in testing and laboratory services. Enhanced digital platforms like this could plausibly integrate or complement E&L service offerings in future, improving data management, regulatory compliance, and traceability.

- In December 2024: WuXi AppTec inaugurated a state‑of‑the‑art testing laboratory at the Life Science Center Gräfelfing near Munich, Germany. The laboratory provides extractables and leachables testing for medical products, enabling compliance with regulatory requirements for safety approvals. The facility is strategically situated to leverage the neighboring biotech and biopharma ecosystem in Martinsried.

Report Scope

Report Features Description Market Value (2024) US$ 1.1 Billion Forecast Revenue (2034) US$ 2.6 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Container Closure Systems, Single-use Systems, Drug Delivery Systems, Others), By Application (Orally Inhaled and Nasal Drug Products (OINDP), Parenteral Drug Products, Ophthalmic) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Eurofins Scientific, Intertek Group plc, SGS Société Générale de Surveillance SA, WuXi AppTec, Merck KGaA, West Pharmaceutical Services, Inc, Wickham Micro Limited, Pacific Biolabs, Boston Analytical, Sotera Health, and Other. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Extractable and Leachable Testing Services MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Extractable and Leachable Testing Services MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc

- Wickham Micro Limited

- Pacific Biolabs

- Boston Analytical

- Sotera Health