Extracorporeal Shock Wave Lithotripsy Market By Product Type (Electrohydraulic, Electromagnetic, and Piezoelectric), By Application (Pancreatic Stone, Kidney Stone, and Others), By End-user (Hospitals, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155601

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

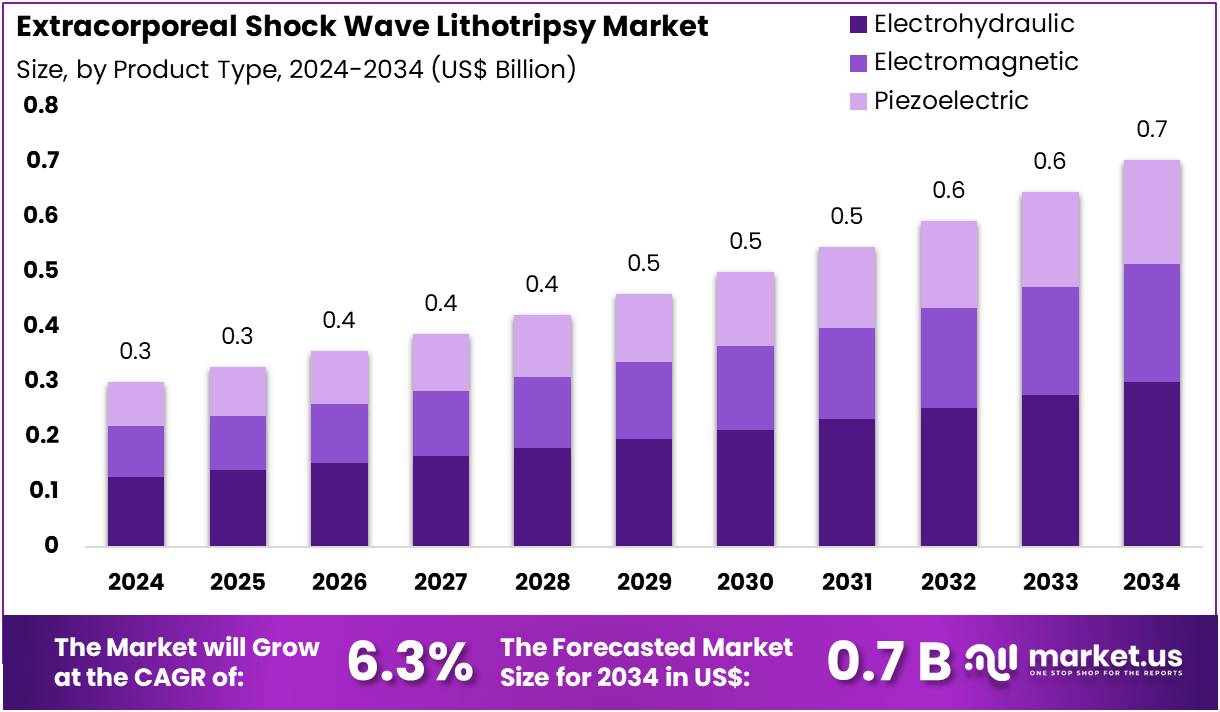

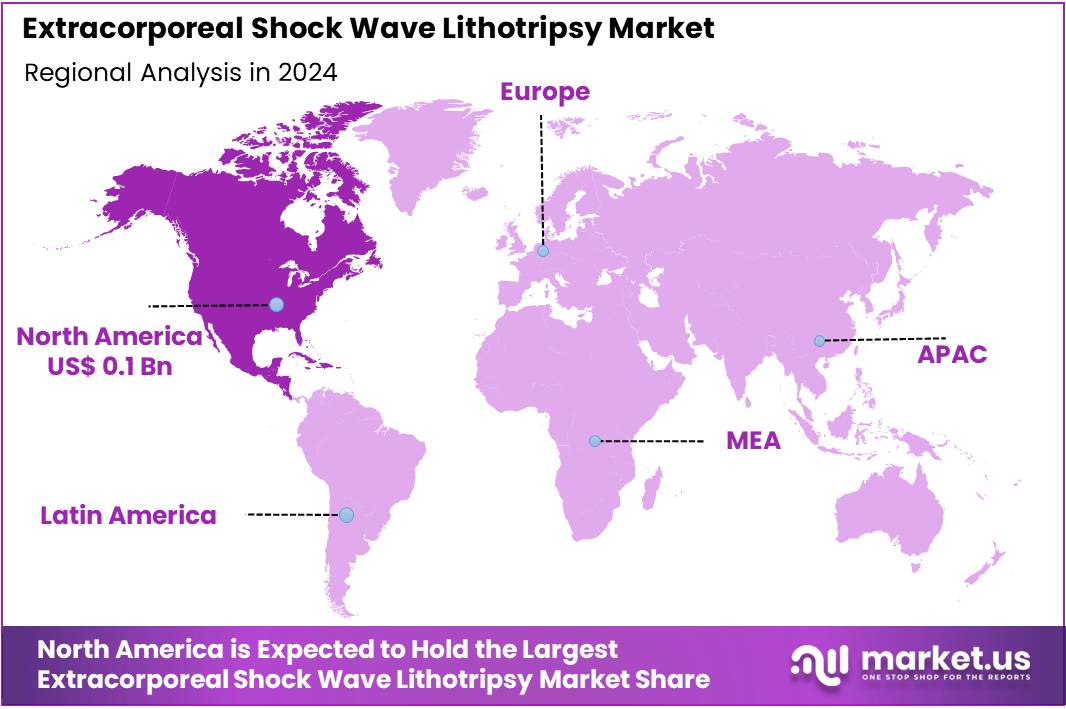

The Extracorporeal Shock Wave Lithotripsy Market Size is expected to be worth around US$ 0.7 billion by 2034 from US$ 0.3 billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.3% share and holds US$ 0.1 Billion market value for the year.

The extracorporeal shock wave lithotripsy (ESWL) market is experiencing significant growth, primarily driven by a growing preference for minimally invasive procedures and the increasing global prevalence of kidney stones. Patients and healthcare providers alike are seeking less invasive alternatives to traditional surgery, making ESWL a highly attractive treatment option.

The high prevalence of kidney stone disorder in developed nations is a major catalyst for this market. For instance, the National Kidney Foundation estimates that in 2024, more than half a million people will visit emergency rooms in the United States for kidney stone-related issues alone. This widespread and recurring health problem underscores the continuous demand for effective treatment methods like ESWL.

The rising global burden of kidney and ureter stones is a critical factor driving the need for ESWL devices. According to the World Health Organization (WHO), the global prevalence of kidney stone disease has steadily increased, affecting a substantial portion of the population. This has created an enormous health and economic burden worldwide, prompting a growing demand for cost-effective and efficient procedures. The Agency for Healthcare Research and Quality (AHRQ) has also documented the significant economic impact of urinary stones, with medical expenditures exceeding US$4.5 billion annually in the United States. This economic pressure further incentivizes the adoption of procedures like ESWL that can reduce hospital stays and associated costs.

The market is also shaped by continuous product innovation and strategic organizational initiatives. The introduction of new ESWL technologies, such as the one implemented at BHR University Hospitals in the United Kingdom in February 2023, directly addresses the need to reduce patient waiting lists and enhance the overall patient experience. This focus on improving clinical workflows and outcomes is a major trend.

Furthermore, the Centers for Disease Control and Prevention (CDC) highlights that lifestyle and dietary risk factors, such as high-sodium diets and obesity, contribute to a rising incidence of kidney stones. This trend points to a sustained and growing patient population that requires the advanced, non-invasive treatment options that the ESWL market provides. While ESWL has some limitations, its benefits in a landscape of rising prevalence and a preference for minimally invasive care position it for continued market expansion.

Key Takeaways

- In 2024, the market for extracorporeal shock wave lithotripsy generated a revenue of US$ 0.3 billion, with a CAGR of 6.3%, and is expected to reach US$ 0.7 billion by the year 2034.

- The product type segment is divided into electrohydraulic, electromagnetic, and piezoelectric, with electrohydraulic taking the lead in 2023 with a market share of 42.6%.

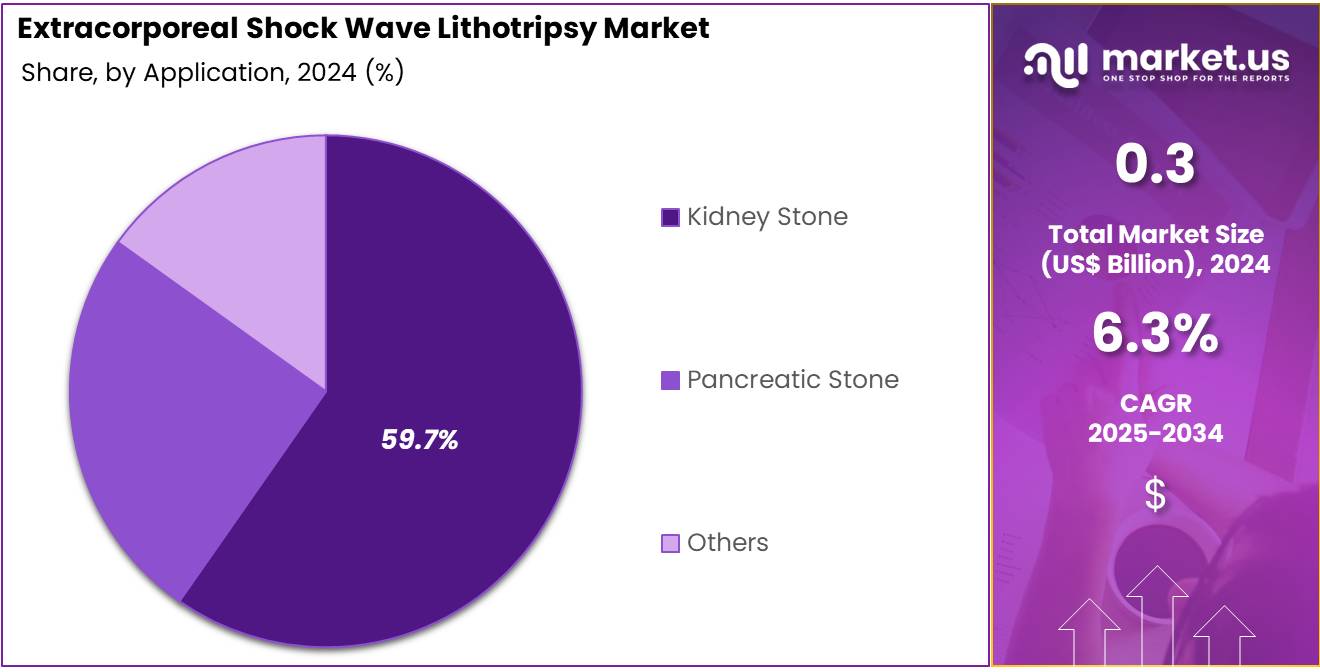

- Considering application, the market is divided into pancreatic stone, kidney stone, and others. Among these, kidney stone held a significant share of 59.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 61.3% in the extracorporeal shock wave lithotripsy market.

- North America led the market by securing a market share of 43.3% in 2023.

Product Type Analysis

Electrohydraulic shock wave lithotripsy systems hold 42.6% of the market share. This growth is expected to continue as electrohydraulic systems are among the most widely used for extracorporeal shock wave lithotripsy (ESWL) procedures due to their effectiveness and reliability. These systems generate high-energy shock waves, which can efficiently break down kidney stones and other calculi. The increasing prevalence of kidney stones, particularly among older adults, is a significant factor driving the demand for electrohydraulic lithotripsy systems.

As healthcare providers seek minimally invasive treatment options that are both effective and have fewer side effects compared to traditional surgical procedures, the adoption of electrohydraulic lithotripsy systems is likely to grow. Additionally, advancements in technology that improve precision, reduce pain during treatment, and enhance the patient experience are anticipated to further fuel the market growth of electrohydraulic systems.

Application Analysis

Kidney stones represent 59.7% of the application segment in the extracorporeal shock wave lithotripsy market. The demand for lithotripsy procedures for kidney stone treatment is expected to continue rising as kidney stones remain one of the most common urological conditions, affecting millions of individuals worldwide. The increasing incidence of kidney stones, particularly due to rising rates of obesity, diabetes, and high-sodium diets, is driving demand for ESWL procedures. Shock wave lithotripsy, especially when used to treat kidney stones, is highly preferred due to its non-invasive nature and effective results.

As the population ages and lifestyle-related diseases contribute to the growing number of kidney stone cases, the market for shock wave lithotripsy treatments is projected to grow significantly. Furthermore, the preference for non-invasive treatments that allow for quicker recovery times will continue to boost the adoption of ESWL for kidney stone management.

End-User Analysis

Hospitals account for 61.3% of the end-user segment in the extracorporeal shock wave lithotripsy market. This dominance is expected to persist as hospitals are the primary setting for complex medical treatments, including shock wave lithotripsy. Hospitals have the necessary infrastructure, medical personnel, and diagnostic tools to offer shock wave lithotripsy services, which are often required for patients with larger or more complex kidney stones. The adoption of lithotripsy in hospitals is also driven by the demand for effective, non-invasive treatments for kidney stones, which can otherwise require invasive surgery.

As healthcare facilities continue to invest in advanced technologies for treating conditions like kidney stones, the need for high-quality lithotripsy devices is expected to grow. Additionally, the integration of shock wave lithotripsy devices with imaging technologies, such as ultrasound and X-ray, for better targeting of stones is likely to enhance the capabilities of hospitals in treating stone-related conditions, driving the continued demand for ESWL systems in hospital settings.

Key Market Segments

By Product Type

- Electrohydraulic

- Electromagnetic

- Piezoelectric

By Application

- Pancreatic Stone

- Kidney Stone

- Others

By End-User

- Hospitals

- Clinics

- Others

Drivers

The rising prevalence of chronic diseases is driving the market

The extracorporeal shock wave lithotripsy (ESWL) market is experiencing a significant uplift due to the increasing global burden of chronic diseases, particularly diabetes and obesity, which are major risk factors for kidney stone formation. The global shift toward aging populations also elevates the incidence of these conditions, necessitating effective and non-invasive treatments.

According to the International Diabetes Federation (IDF) Diabetes Atlas 2022, approximately 537 million adults globally were living with diabetes in 2021, and this number is projected to rise to 643 million by 2030, representing a massive and growing patient population. This trend is a key driver for kidney stone formation, as the condition is more prevalent in diabetic individuals.

Furthermore, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) states that the lifetime prevalence of kidney stones in the US is 11.2% in men and 6.1% in women, with the risk increasing in those with obesity and metabolic disorders. A 2022 cost-utility analysis in the British Journal of Urology International found that while alternative treatments like ureteroscopy may have a higher initial stone-free rate, the ESWL pathway is less costly, with a mean cost difference of £809 (Approx $1,097.30) per patient. The procedure’s ability to be performed in an outpatient setting further reduces healthcare costs, making it a compelling first-line treatment for a broad patient population.

Restraints

The potential for complications and alternative treatments is restraining the market

A significant restraint on the ESWL market is the potential for kidney damage and other complications, coupled with the growing availability of alternative, more effective treatments for certain stone types. While ESWL is a non-invasive procedure, it is not without risks. Potential side effects can include pain, bruising, and, in rare cases, chronic hypertension or kidney damage. The success of the procedure is also highly dependent on stone size and location, with less favorable outcomes for larger stones.

Furthermore, the development of alternative treatments, such as ureteroscopy (URS) and percutaneous nephrolithotomy (PCNL), offers higher success rates for complex cases. For example, a 2023 study published in The Journal of Urology found that URS had a higher stone-free rate compared to ESWL, particularly for larger or lower-pole stones. This evidence-based shift in clinical practice is directing urologists toward these alternatives, especially for patients with a higher risk of ESWL failure. As a result, the market faces a continuous challenge to demonstrate the clinical superiority and cost-effectiveness of ESWL, particularly as competing technologies become more advanced and accessible.

Opportunities

The high success rate and non-invasive nature are creating growth opportunities

The extracorporeal shock wave lithotripsy (ESWL) market is presented with significant opportunities due to its high success rate, non-invasive nature, and demonstrated efficacy for a wide range of stone types. ESWL offers a compelling alternative to more invasive surgical procedures, as it typically requires no incision, minimal anesthesia, and allows for a quick return to daily activities. This patient-friendly profile makes it a preferred choice for many patients and clinicians.

A January 2024 study published in the African Journal of Urology highlighted a notable success rate for ESWL monotherapy in treating bladder stones, achieving a 93.1% success rate after a single session and 100% after two sessions. The study concluded that ESWL should receive greater consideration from urologists, further boosting its adoption. Furthermore, the procedure’s ability to be performed in an outpatient setting significantly reduces healthcare costs and increases patient convenience. This high level of efficacy, coupled with its non-invasive and cost-effective nature, solidifies ESWL as a first-line treatment for a broad patient population, creating a sustained and reliable demand for the technology.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical influences are significantly shaping the operational environment for manufacturers and suppliers in the extracorporeal shock wave lithotripsy (ESWL) sector. The global rise in inflation has driven up the cost of essential raw materials, specialized components, and high-performance power supplies that are critical to the production of advanced lithotripters. Data from the US Census Bureau’s 2024 manufacturing report revealed a 1.1% increase in the Producer Price Index for “Total Manufacturing Industries” compared to the previous year, reflecting the growing costs across the production chain, from shock wave generators to control units.

Concurrently, geopolitical instability in key manufacturing regions is causing disruptions in global supply chains, leading to increased volatility and the potential for component shortages. A 2024 report on the semiconductor industry indicated that US investments in wafer fabrication are expected to rise, capturing 28% of global capital expenditure between 2024 and 2032, a notable increase from previous years. To manage these challenges, companies in the ESWL market are focusing on enhancing operational efficiency and diversifying their supplier networks, which provides a more resilient and stable manufacturing environment.

Additionally, the US tariff policies are adding complexity to the supply chain for medical instruments and components. New tariffs on imported diagnostic and therapeutic devices have raised the cost of these essential products. According to a 2025 analysis of US tariffs from the Harmonized Tariff Schedule, certain medical devices face duties of 25% or higher, depending on their classification and country of origin. This increase in cost is impacting manufacturers’ profitability and leading to higher prices for hospitals and surgical centers.

A 2024 report from the American Hospital Association (AHA) showed that the US imported over $75 billion worth of medical devices and supplies that year, making the healthcare sector especially vulnerable to such disruptions. However, these tariffs offer a competitive edge to US-based manufacturers, who are exempt from these additional duties. As a result, some healthcare providers are turning to domestically produced goods to ensure more reliable supply chains and predictable costs. This trend is encouraging investment in local manufacturing, enabling companies to bypass tariff-related costs and reinforcing the long-term stability of the market.

Trends

The development of compact and portable ESWL systems is a recent trend

A significant trend observed in 2024 and 2025 is the development and adoption of more compact, portable, and affordable ESWL systems, which are broadening the treatment’s accessibility. Historically, ESWL machines were large, expensive, and confined to hospital operating rooms. However, recent technological advancements have led to the creation of smaller, mobile units that can be easily transported and used in outpatient clinics or ambulatory surgical centers. This shift is in line with the broader trend toward decentralized healthcare and a focus on cost-effective, patient-centric care models.

A 2024 press release from Siemens Healthineers announced the launch of a new compact lithotripter designed for multi-functional use, highlighting its suitability for smaller spaces and its enhanced user interface. This is a clear indicator of the industry’s direction. The portability of these new systems allows providers to offer the procedure in a wider range of settings, reducing hospital overhead and increasing patient convenience. As a result, this trend is expanding the market beyond large hospitals and into a network of accessible outpatient clinics.

Regional Analysis

North America is leading the Extracorporeal Shock Wave Lithotripsy Market

The extracorporeal shock wave lithotripsy (ESWL) market in North America commanded a 43.3% share of global revenue in 2024, a position driven by the high prevalence of kidney stones and a preference for minimally invasive procedures. The significant burden of urolithiasis is a key growth catalyst. A research study published in the Journal of the American Urological Association in January 2024 revealed that among US adults aged 20 and older, 9.9% reported a history of kidney stones. This translates to an estimated 23.7 million individuals and indicates a substantial patient population requiring treatment.

Additionally, a 2024 report by the CDC highlighted that the number of emergency room visits for kidney stones exceeded 500,000 annually, underscoring the acute need for effective and rapid treatment options. The continuous advancements in lithotripsy technology, which offer improved efficacy and patient outcomes, also contribute to market expansion. The availability of advanced, minimally invasive alternatives to surgery, as noted in a Cleveland Clinic research article in April 2024, enhances the treatment portfolios of hospitals and provides patients with better solutions, thereby fueling market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific extracorporeal shock wave lithotripsy market is projected to experience the fastest growth during the forecast period. This growth is a result of a large and expanding population, increasing healthcare spending, and a rising prevalence of kidney stone disease driven by changing lifestyles and dietary habits. According to a systematic review published in ResearchGate in September 2023, the pooled prevalence of urolithiasis in China was 8.1%, with the total number of incident cases continuing to rise. This indicates a significant and growing patient pool that requires effective treatment.

Similarly, India’s high prevalence of urolithiasis, estimated to affect approximately 12% of the population, also drives demand for advanced lithotripsy devices. The market’s expansion is further supported by an increasing number of hospitals and specialized urology centers, which are making these procedures more accessible. Moreover, the growth of medical tourism in the region, where patients seek high-quality and cost-effective healthcare services, is anticipated to contribute to the increasing demand for extracorporeal shock wave lithotripsy devices and procedures.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the lithotripsy market are employing a three-pronged growth strategy that focuses on product innovation, geographical expansion, and strategic partnerships. Manufacturers are dedicating resources to research and development to engineer systems with more effective shockwave delivery and enhanced imaging capabilities, which directly improves treatment success rates and patient outcomes. They are also extending their commercial presence into developing regions, where a growing patient population with kidney stones and improving healthcare infrastructure present significant market opportunities.

By forging strong relationships with hospitals and integrated healthcare systems, these companies facilitate the adoption of their technology and reinforce their competitive standing. This approach underscores a commitment to delivering advanced medical solutions along with robust support for healthcare professionals and their patients.

Dornier MedTech, a subsidiary of Advanced MedTech based in Munich, Germany, holds a foundational position in the urology sector. The company is credited with originating the method of extracorporeal shock wave lithotripsy, a non-invasive procedure for kidney stone treatment. Dornier continues to enhance clinical results by expanding its broad range of urological products, which includes lithotripters, lasers, and other related consumables. Emphasizing innovation with a focus on customer needs, the company persistently develops its digital urology platforms to offer comprehensive care to medical communities and patients globally.

Recent Developments

- In May 2024: Dornier Medtech, in collaboration with leading urologists, launched Urogpt, an innovative AI-powered tool designed to assist patients with kidney stones. This development underscores Dornier’s dedication to integrating digital solutions that enhance patient care. Urogpt offers patients personalized, real-time advice and practical insights, ensuring they receive immediate clarity and support in managing their condition.

- In February 2024: the Urology Department at INHS Asvini unveiled a state-of-the-art extracorporeal shock wave lithotripsy (ESWL) machine. This advanced machine provides a non-invasive method for breaking down kidney stones, marking a major step forward in improving both treatment efficacy and patient care at the hospital.

Top Key Players in the Extracorporeal Shock Wave Lithotripsy Market

- Storz Medical AG

- Dornier MedTech

- EMS Electro Medical Systems

- Olympus Corporation

- Boston Scientific Corporation

- Cook Medical

- Sonic Healthcare

- MTS Medical

- Zhongshan Sinolinks Medical Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Report Scope

Report Features Description Market Value (2024) US$ 0.3 billion Forecast Revenue (2034) US$ 1.7 billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electrohydraulic, Electromagnetic, and Piezoelectric), By Application (Pancreatic Stone, Kidney Stone, and Others), By End-user (Hospitals, Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Storz Medical AG, Dornier MedTech, EMS Electro Medical Systems, Olympus Corporation, Boston Scientific Corporation, Cook Medical, Sonic Healthcare, MTS Medical, Zhongshan Sinolinks Medical Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Extracorporeal Shock Wave Lithotripsy MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Extracorporeal Shock Wave Lithotripsy MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Storz Medical AG

- Dornier MedTech

- EMS Electro Medical Systems

- Olympus Corporation

- Boston Scientific Corporation

- Cook Medical

- Sonic Healthcare

- MTS Medical

- Zhongshan Sinolinks Medical Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.