Global Exhaust Gas Recirculation (EGR) Coolers Market Size, Share, Growth Analysis By Material (Aluminum, Stainless Steel), By Type (Tube Exhaust Gas Recirculation (EGR) Coolers, Finned Exhaust Gas Recirculation (EGR) Coolers), By Fuel Type (Diesel, Petrol), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161310

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Material Analysis

- By Type Analysis

- By Fuel Type Analysis

- By Vehicle Type Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Exhaust Gas Recirculation (EGR) Coolers Company Insights

- Recent Developments

- Report Scope

Report Overview

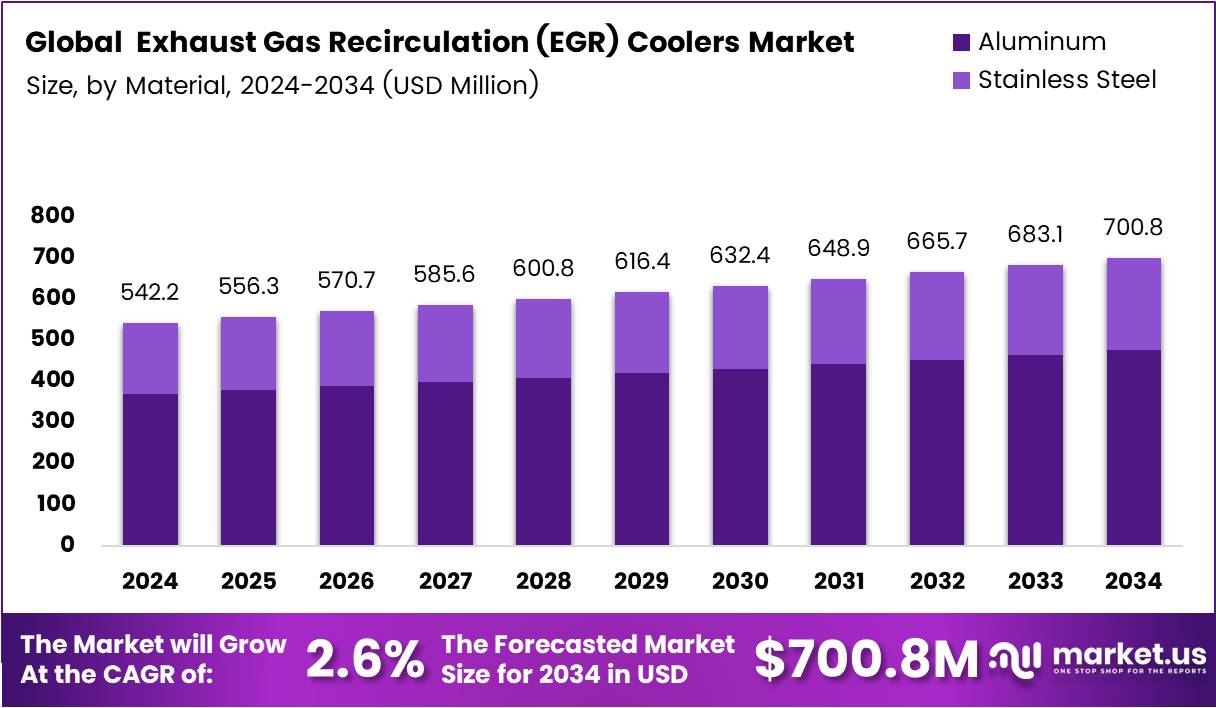

The Global Exhaust Gas Recirculation (EGR) Coolers Market size is expected to be worth around USD 700.8 Million by 2034, from USD 542.1 Million in 2024, growing at a CAGR of 2.6% during the forecast period from 2025 to 2034.

The Exhaust Gas Recirculation (EGR) Coolers market plays a crucial role in reducing nitrogen oxide emissions from diesel and gasoline engines. EGR coolers help recirculate a portion of exhaust gases back into the engine, lowering combustion temperature and improving efficiency. Thus, they remain vital in meeting global emission standards.

Moreover, the market growth is driven by the rising demand for fuel-efficient and low-emission vehicles across commercial and passenger segments. As automakers focus on compliance with Euro 6 and EPA Tier 4 regulations, the integration of advanced EGR systems becomes essential. This trend strongly supports continuous innovation among EGR cooler manufacturers.

Additionally, the growing adoption of hybrid and alternative fuel engines creates opportunities for EGR cooler upgrades. Manufacturers are investing in high-performance materials like stainless steel and aluminum to enhance durability and thermal efficiency. Consequently, such innovations are strengthening product reliability while reducing maintenance costs for fleet operators.

Furthermore, several governments are tightening emission norms, prompting OEMs to adopt efficient exhaust after-treatment technologies. Policies in Europe, North America, and Asia-Pacific are mandating reductions in NOx and CO₂ levels, directly boosting EGR system installation rates. Hence, regulatory alignment continues to serve as a primary market accelerator worldwide.

At the same time, infrastructure investments and industrial vehicle production are surging, notably in emerging economies. These factors collectively fuel higher consumption of diesel-powered trucks and off-road vehicles. Thus, the expanding logistics and construction sectors further reinforce the long-term demand for EGR coolers globally.

In addition, the aftermarket segment is witnessing steady revenue due to the aging vehicle fleet. Replacement demand, particularly in heavy-duty applications, is encouraging component suppliers to expand regional distribution networks. This steady aftermarket performance ensures consistent growth even amid fluctuating OEM sales volumes.

According to the European Automobile Manufacturers’ Association (ACEA), in H1-2025, 93.6% of new EU trucks were diesel compared to 3.6% electrically chargeable. This sustained dominance of diesel engines highlights ongoing reliance on EGR systems for emission control, affirming their critical role in future automotive sustainability and compliance strategies.

Key Takeaways

- The Exhaust Gas Recirculation (EGR) Coolers market is projected to reach USD 700.8 Million by 2034, growing from USD 542.1 Million in 2024 at a CAGR of 2.6%.

- Aluminum dominates the Material segment with a 68.4% share, favored for lightweight design and superior heat dissipation.

- Tube EGR Coolers lead the Type segment with a 59.2% share, driven by design simplicity and emission control efficiency.

- Diesel vehicles account for a 78.8% share in the Fuel Type segment, owing to high NOx emissions and regulatory compliance needs.

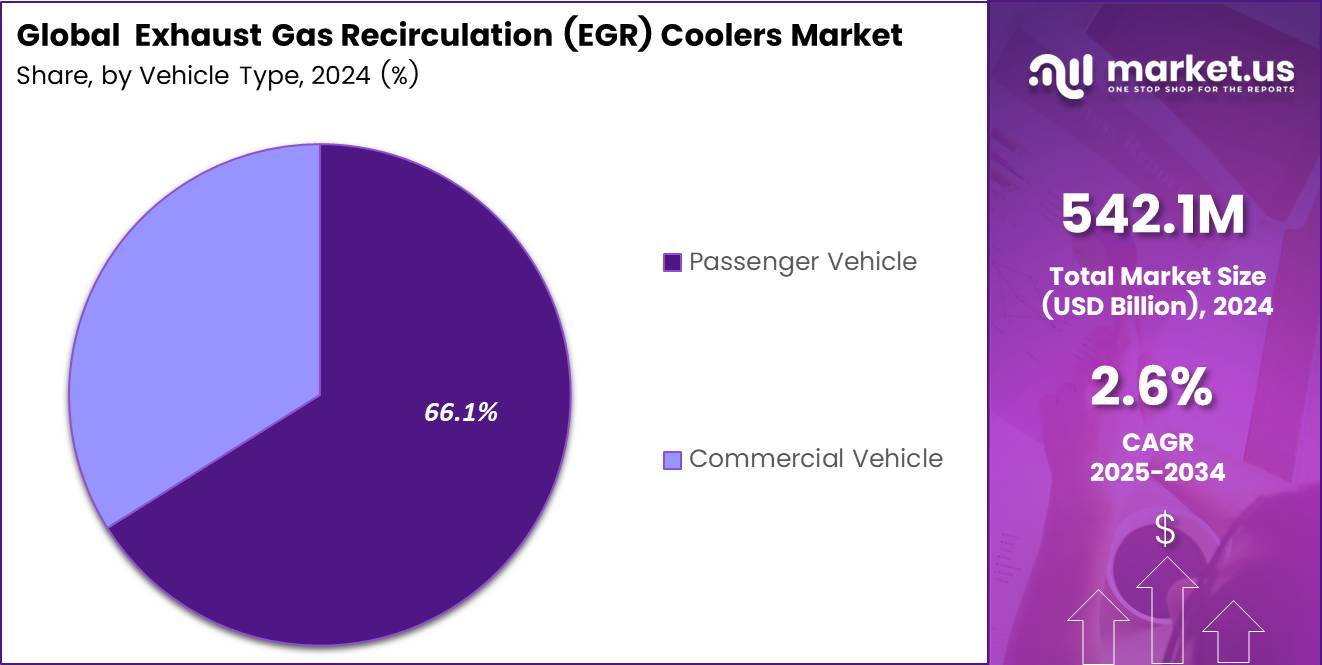

- Passenger Vehicles hold a 66.1% share under Vehicle Type, supported by emission norms in Europe and Asia-Pacific.

- OEMs dominate the Sales Channel with an 82.3% share, ensuring compatibility, precision, and warranty-backed reliability.

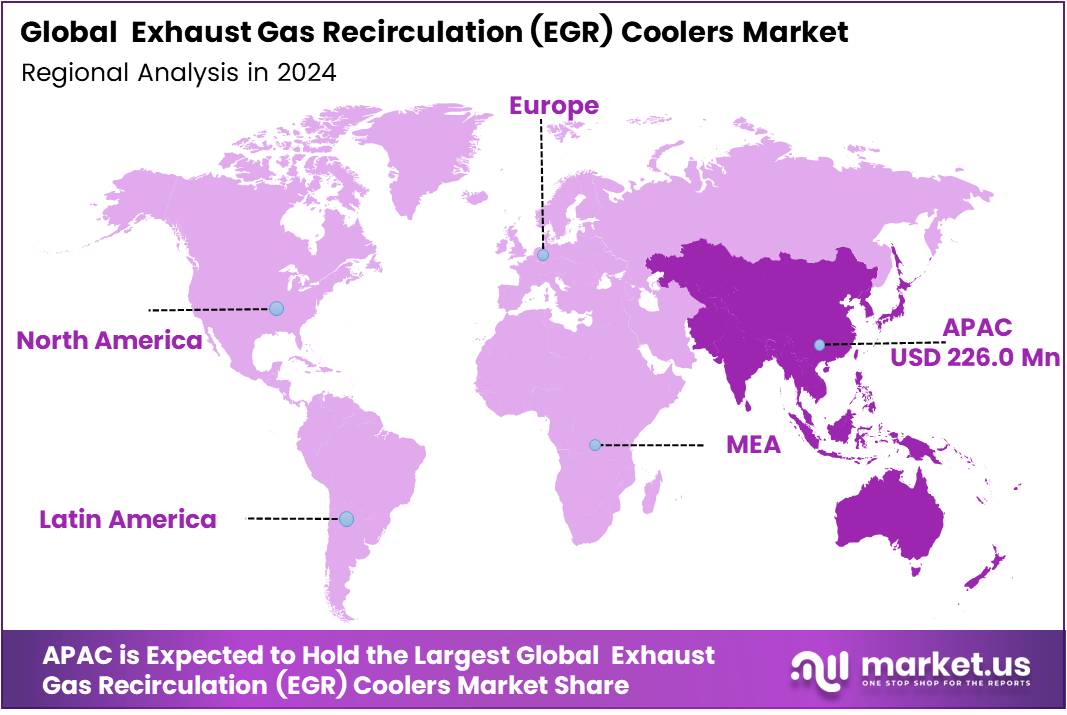

- Asia Pacific leads globally with a 41.7% market share, valued at USD 226.0 Million, fueled by stringent emission rules and automotive expansion.

By Material Analysis

Aluminum dominates with 68.4% due to its lightweight properties and high thermal conductivity.

In 2024, Aluminum held a dominant market position in the By Material segment of the Exhaust Gas Recirculation (EGR) Coolers Market, with a 68.4% share. Aluminum is preferred for its ability to dissipate heat efficiently, reduce overall engine weight, and improve fuel economy.

The increasing demand for lightweight automotive components in modern vehicle design continues to strengthen the adoption of aluminum-based EGR coolers, supporting stricter emission regulations and improved engine efficiency across global markets.

Stainless Steel is also witnessing steady demand owing to its superior durability, corrosion resistance, and strength at high temperatures. It remains a favorable material for heavy-duty and commercial applications where long service life and reliability are prioritized over weight.

Manufacturers are combining stainless steel’s endurance with advanced manufacturing technologies to deliver performance consistency, especially in diesel-powered engines exposed to extreme operating conditions.

By Type Analysis

Tube Exhaust Gas Recirculation (EGR) Coolers dominate with 59.2% due to their efficient heat transfer capability and proven design reliability.

In 2024, Tube Exhaust Gas Recirculation (EGR) Coolers held a dominant market position in the By Type segment of the Exhaust Gas Recirculation (EGR) Coolers Market, with a 59.2% share. The design’s simplicity, coupled with easy integration into various vehicle configurations, makes tube-type EGR coolers highly attractive for automotive OEMs.

Their effectiveness in controlling nitrogen oxide (NOx) emissions and maintaining stable exhaust gas temperatures supports their extensive use in both passenger and commercial vehicles.

Finned Exhaust Gas Recirculation (EGR) Coolers are gradually gaining traction due to their enhanced heat exchange surface area and compact size. These coolers are ideal for modern engines that demand compact yet efficient thermal management systems. Manufacturers are focusing on design improvements and cost optimization to increase adoption across mid-range vehicles, especially where space efficiency and performance balance are critical.

By Fuel Type Analysis

Diesel dominates with 78.8% owing to its significant application in heavy-duty vehicles and emission regulation compliance.

In 2024, Diesel held a dominant market position in the By Fuel Type segment of the Exhaust Gas Recirculation (EGR) Coolers Market, with a 78.8% share. Diesel engines inherently produce higher NOx levels, necessitating the integration of EGR coolers for emissions control. Increasing adoption of stringent emission standards worldwide has accelerated the implementation of efficient EGR systems in diesel vehicles, boosting this segment’s growth substantially.

The Petrol segment, although smaller, continues to expand gradually due to rising awareness about emission control in gasoline-powered vehicles. Automakers are introducing EGR technology in petrol engines to improve fuel combustion and reduce CO₂ output. This trend is anticipated to grow further as environmental norms tighten globally, fostering innovation and technological advancements in petrol-compatible EGR cooler designs.

By Vehicle Type Analysis

Passenger Vehicle dominates with 66.1% due to rising production volumes and focus on emission reduction.

In 2024, Passenger Vehicle held a dominant market position in the By Vehicle Type segment of the Exhaust Gas Recirculation (EGR) Coolers Market, with a 66.1% share. Growing demand for fuel-efficient and environmentally friendly passenger cars drives the adoption of EGR coolers. Stringent emission norms across Europe and Asia-Pacific have compelled automakers to implement advanced exhaust systems, including high-performance EGR coolers, in small and mid-sized vehicles.

Commercial Vehicle applications remain crucial due to the continued reliance on diesel engines for logistics and heavy transport operations. This segment benefits from EGR coolers that enhance durability and thermal stability under extended use. Fleet owners and manufacturers increasingly favor durable cooling solutions that meet long-term performance and compliance needs, reinforcing the importance of EGR systems in commercial fleets.

By Sales Channel Analysis

OEM dominates with 82.3% owing to direct integration and stringent quality standards in vehicle manufacturing.

In 2024, OEM held a dominant market position in the By Sales Channel segment of the Exhaust Gas Recirculation (EGR) Coolers Market, with a 82.3% share. Automakers prefer sourcing EGR coolers directly from original equipment manufacturers to ensure design compatibility and compliance with emission regulations. The OEM dominance is further supported by the demand for precision-engineered systems and warranty-backed reliability, making them the primary distribution channel globally.

The Aftermarket segment continues to grow as vehicle owners seek replacement and performance upgrades for aging fleets. Increasing vehicle age and the need for cost-effective repair solutions have encouraged aftermarket suppliers to expand their offerings. Competitive pricing and availability of advanced retrofitted EGR coolers contribute to this segment’s steady rise, particularly in developing markets.

Key Market Segments

By Material

- Aluminum

- Stainless Steel

By Type

- Tube Exhaust Gas Recirculation (EGR) Coolers

- Finned Exhaust Gas Recirculation (EGR) Coolers

By Fuel Type

- Diesel

- Petrol

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing Adoption of Emission Control Regulations Across Commercial and Passenger Vehicles Drives Market Growth

The Exhaust Gas Recirculation (EGR) Coolers market is witnessing strong growth as governments across the world introduce strict emission control laws. These regulations are pushing automakers to integrate efficient EGR systems to reduce nitrogen oxide (NOx) emissions in both passenger and commercial vehicles. As compliance becomes mandatory, the demand for high-performance EGR coolers continues to rise across various vehicle categories.

The growing use of diesel engines in heavy-duty trucks, buses, and off-highway machinery also supports market growth. Diesel engines emit higher NOx levels, making EGR coolers essential for meeting emission standards. The construction and mining industries, which rely heavily on such engines, are contributing significantly to market expansion.

In addition, hybrid and advanced combustion engines are increasingly using EGR systems to improve efficiency and lower emissions. Automakers are combining EGR with turbocharging and hybrid technologies, creating new opportunities for EGR cooler manufacturers.

Technological innovations in EGR cooler design, such as improved materials and better heat transfer efficiency, are enhancing product performance. These advancements are helping automakers achieve greater thermal efficiency, reduce energy loss, and extend component lifespan, further fueling market growth.

Restraints

Rising Preference for Electric Vehicles Reducing Dependence on EGR Systems

While the EGR Coolers market shows promise, it faces challenges due to changing automotive trends. One major restraint is the growing shift toward electric vehicles (EVs), which do not require EGR systems since they produce no exhaust gases. As EV adoption accelerates, the long-term demand for EGR coolers may decline, especially in the passenger car segment.

EGR coolers also face issues related to high maintenance costs and frequent failures under harsh operating conditions. Heavy-duty vehicles and industrial engines often expose coolers to extreme heat and soot buildup, which can cause clogging and efficiency loss. This increases downtime and maintenance expenses for fleet operators.

Retrofitting EGR systems to older or existing engine platforms adds further complexity. The process often requires engine redesign and calibration, which increases costs for manufacturers and end users.

Moreover, meeting strict testing and validation requirements for new EGR cooler designs extends development timelines. Manufacturers must invest heavily in R&D and quality testing to ensure reliability, which raises overall production costs and limits rapid market growth.

Growth Factors

Expansion of Low-Temperature EGR Coolers for Next-Generation Turbocharged Engines Creates Growth Opportunities

The EGR Coolers market is set to gain new opportunities from the growing use of low-temperature EGR systems in modern turbocharged and downsized engines. These coolers help improve fuel efficiency and meet tighter emission standards, making them a key focus area for future engine technologies.

Rising aftermarket demand also offers a strong growth avenue. As global vehicle fleets age, the need for replacement EGR coolers is increasing, especially in commercial and heavy-duty vehicles. This trend is particularly visible in developing regions, where older diesel vehicles remain in operation.

Emerging applications in agricultural and construction machinery further support market expansion. These industries rely on high-power diesel engines that must comply with updated emission norms, creating consistent demand for durable and efficient EGR cooling solutions.

Additionally, collaborations between OEMs and Tier-1 suppliers are driving innovation in lightweight materials such as aluminum and composite alloys. These partnerships aim to reduce system weight while maintaining thermal strength, improving vehicle efficiency and boosting the long-term growth potential of the EGR cooler market.

Emerging Trends

Shift Toward Stainless Steel and Aluminum-Based EGR Coolers for Durability and Weight Reduction

One of the most notable trends in the EGR Coolers market is the increasing use of stainless steel and aluminum materials. These metals provide higher corrosion resistance, better heat dissipation, and lower weight, making them ideal for modern engines that demand both efficiency and durability.

Manufacturers are also focusing on compact and high-performance EGR systems designed for downsized engines. As automakers reduce engine size to improve fuel economy, EGR components must deliver equal or greater performance in smaller packages, leading to innovative design solutions.

Advanced computational fluid dynamics (CFD) and simulation tools are now widely used to optimize EGR cooler designs. These technologies allow engineers to analyze fluid flow, temperature distribution, and material performance before production, reducing development time and improving reliability.

Another key trend is the integration of EGR coolers with selective catalytic reduction (SCR) and diesel particulate filter (DPF) systems. Combining these technologies enhances overall emission control efficiency and helps manufacturers meet global emission standards, driving sustained interest in integrated exhaust management solutions.

Regional Analysis

Asia Pacific Dominates the Exhaust Gas Recirculation (EGR) Coolers Market with a Market Share of 41.7%, Valued at USD 226.0 Million

The Asia Pacific region leads the global Exhaust Gas Recirculation (EGR) Coolers market with a dominant market share of 41.7%, valued at USD 226.0 Million. This growth is driven by the rapid expansion of the automotive and commercial vehicle industries across major economies such as China, India, and Japan.

Stringent emission regulations, coupled with rising demand for fuel-efficient vehicles, are further boosting the adoption of EGR coolers. Additionally, government initiatives promoting cleaner transportation and sustainable manufacturing practices are strengthening regional market growth.

North America Exhaust Gas Recirculation (EGR) Coolers Market Trends

North America holds a strong position in the global EGR coolers market, supported by a well-developed automotive sector and strict emission norms enforced by the Environmental Protection Agency (EPA). The region’s focus on enhancing vehicle performance and reducing nitrogen oxide emissions is driving consistent demand for advanced EGR cooling systems. Furthermore, technological advancements in engine efficiency and increasing production of heavy-duty vehicles are key factors contributing to market expansion across the U.S. and Canada.

Europe Exhaust Gas Recirculation (EGR) Coolers Market Trends

Europe remains a key market for EGR coolers, influenced by stringent Euro emission standards and strong environmental regulations. The adoption of advanced emission control systems in passenger and commercial vehicles continues to rise as manufacturers strive to meet carbon reduction targets. Countries like Germany, France, and the U.K. are at the forefront of integrating efficient EGR technologies, further supported by a robust automotive manufacturing base and continuous investments in R&D.

Middle East and Africa Exhaust Gas Recirculation (EGR) Coolers Market Trends

The Middle East and Africa EGR coolers market is experiencing moderate growth, driven by the modernization of transportation fleets and the gradual enforcement of emission standards. Increased investments in infrastructure and the automotive industry, particularly in Gulf countries and South Africa, are promoting the adoption of emission control technologies. As regional governments emphasize sustainability and reduced carbon emissions, the demand for reliable EGR cooling systems is expected to rise steadily.

Latin America Exhaust Gas Recirculation (EGR) Coolers Market Trends

In Latin America, the EGR coolers market is witnessing steady development, supported by growing vehicle production and the enforcement of stricter emission policies in countries like Brazil and Mexico. Expanding automotive manufacturing capabilities and rising awareness regarding vehicle emissions are propelling demand for efficient cooling technologies. The region’s ongoing shift toward cleaner and more sustainable automotive systems is anticipated to create new growth opportunities for EGR cooler manufacturers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Exhaust Gas Recirculation (EGR) Coolers Company Insights

The global Exhaust Gas Recirculation (EGR) Coolers market in 2024 is witnessing steady growth driven by stringent emission norms, technological advancements, and increasing adoption of efficient thermal management systems in both passenger and commercial vehicles. Among the leading players, several companies stand out for their innovation, strategic positioning, and market influence.

BorgWarner Inc. remains a dominant force in the EGR coolers market, leveraging its strong R&D capabilities and global presence. The company’s focus on lightweight materials and high-performance cooling technologies aligns well with the automotive industry’s shift toward cleaner and more efficient engines.

Friedrich Boysen GmbH & Co KG continues to strengthen its position through its expertise in exhaust aftertreatment systems. Its EGR coolers are recognized for durability and efficiency, and the company’s partnerships with major OEMs enhance its competitiveness in both European and international markets.

Mahle Group plays a vital role in shaping the EGR cooler landscape with its broad portfolio of thermal management products. Its emphasis on sustainable manufacturing and advanced heat exchanger designs helps reduce emissions and improve overall engine efficiency, securing its place among key global suppliers.

Delphi Automotive LLP (now operating as part of Aptiv) maintains a steady footprint through innovative cooling solutions integrated into advanced powertrain systems. Its ongoing developments in electronic and thermal technologies position it to benefit from the increasing electrification and hybridization of vehicles worldwide.

Collectively, these players are driving the evolution of EGR cooler technologies toward greater efficiency, reliability, and environmental compliance.

Top Key Players in the Market

- BorgWarner Inc.

- Friedrich Boysen Gmbh & Co KG

- Mahle Group

- Delphi Automotive LLP

- Senior Flexonics

- Denso Corporation

- Others

Recent Developments

- In May 2025, BorgWarner extended four EGR system contracts—covering coolers, valves, and modules—with a major North American OEM, strengthening its foothold in emissions control technology and ensuring continued supply partnerships across diesel engine platforms.

- In May 2025, Senior PLC secured new contracts to supply fluid conveyance assemblies for EGR coolers to a heavy-duty truck OEM, expanding its role in the commercial vehicle emissions ecosystem and supporting cleaner combustion technologies.

- In August 2025, BMW issued a warranty-extension bulletin for its N47T diesel EGR cooler and intake manifold, addressing reliability improvements and extending service coverage to enhance consumer trust and compliance with updated emission standards.

- In August 2025, a class-action lawsuit settlement was reached involving the Ram 1500 EcoDiesel EGR cooler, resolving claims related to thermal failure risks and establishing compensation and warranty-repair terms for affected vehicle owners.

Report Scope

Report Features Description Market Value (2024) USD 542.1 Million Forecast Revenue (2034) USD 700.8 Million CAGR (2025-2034) 2.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Aluminum, Stainless Steel), By Type (Tube Exhaust Gas Recirculation (EGR) Coolers, Finned Exhaust Gas Recirculation (EGR) Coolers), By Fuel Type (Diesel, Petrol), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BorgWarner Inc., Friedrich Boysen Gmbh & Co KG, Mahle Group, Delphi Automotive LLP, Senior Flexonics, Denso Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Exhaust Gas Recirculation (EGR) Coolers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Exhaust Gas Recirculation (EGR) Coolers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BorgWarner Inc.

- Friedrich Boysen Gmbh & Co KG

- Mahle Group

- Delphi Automotive LLP

- Senior Flexonics

- Denso Corporation

- Others