Global Excipients Market By Type (Organic and Inorganic), By Product (Polymers, Alcohols, Sugars, Minerals, Gelatin, and Other Products), Functionality, By Formulation, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 103601

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

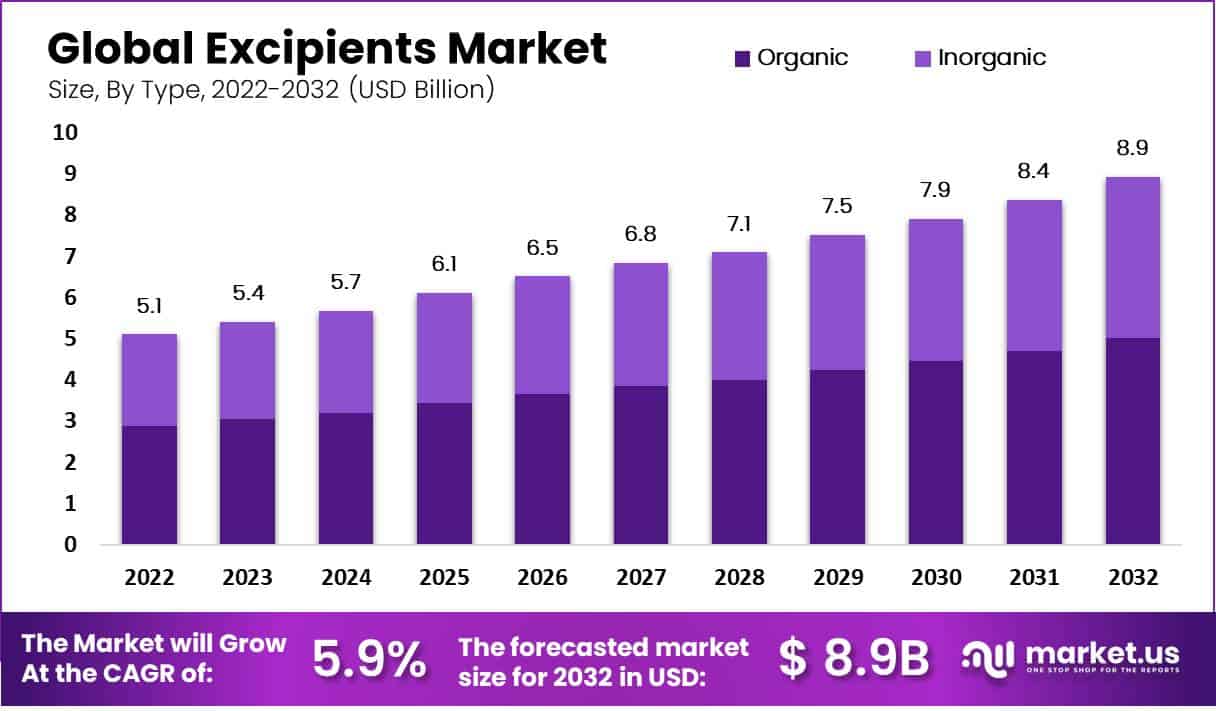

In 2022, The Global Excipients Market size accounted for USD 5.1 billion. This market is estimated to reach USD 8.9 billion in 2032 at a CAGR of 5.9% between 2023 and 2032.

The main drivers of revenue growth are anticipated to be an increase in the use of generic medications and a rise in demand for multifunctional excipients. The pharmaceutical industry has increased its use of excipients in recent years due to the fact that they provide greater functionality and a competitive advantage when it comes to drug formulations.

*Actual Numbers Might Vary In The Final Report

The market has seen a significant boost due to the ongoing research and discovery process of near-ideal or ideal substances that can be utilized in drug formulations. The fact that pharmaceutical companies have developed more sophisticated excipients, which play a greater role in drug delivery, is another factor contributing to global growth.

To improve the stability and acceptance of oncological medicines, there is an increasing demand for novel substances. The market is likely to grow as a result. Patent expiration of blockbuster medicines is expected also to boost the market.

Key Takeaways

- In 2022, the Excipients market was valued at USD 5.1 billion.

- The Excipients market is estimated to reach USD 8.9 billion in 2032.

- The CAGR between 2023 and 2032 is projected to be 5.9%.

- The main drivers of revenue growth are the increased use of generic medications and a rise in demand for multifunctional excipients.

- The pharmaceutical industry has increased its use of excipients due to their greater functionality and competitive advantage in drug formulations.

- Ongoing research and the discovery of ideal substances for drug formulations have boosted the market.

- Pharmaceutical companies have developed more sophisticated excipients that play a greater role in drug delivery.

- There is an increasing demand for novel substances to improve the stability and acceptance of oncological medicines.

- Patent expiration of blockbuster medicines is expected to boost the market.

- The demand for pharmaceuticals and nutraceuticals is rising due to population growth and the increasing incidence of chronic diseases.

- The need for specialized excipients for enhanced drug formulations is increasing.

- The demand for cost-effective excipients for generic drug production is growing.

- Emerging markets like India and China are driving demand for excipients.

- The excipients market faces challenges like stringent regulations, high costs, limited raw material availability, and limited innovation.

Driving Factors

- Increasing demand for pharmaceuticals and nutraceuticals: Demand for pharmaceuticals and nutraceuticals is rising as a result of the expanding population and the rising incidence of chronic diseases, which in turn is boosting the demand for excipients.

- Growing demand for advanced drug formulations: The increasing demand for enhanced drug formulations, which need the usage of specialized excipients, is being driven by the need for targeted therapies and better drug delivery methods.

- Demand for generics is increasing: As the demand for generic drugs increases, so does the need for excipients that are cost-effective and can be used to produce generic drugs.

- Growing demand from emerging markets: Excipients are in high demand due to the growing demand for pharmaceuticals and nutraceuticals from emerging markets, such as India and China.

Restraining Factors

The global excipients market also faces several restraining factors, including Stringent regulations, high cost, Lack of availability of raw materials, and Limited Innovation.

- Stringent regulations: The excipients market is heavily regulated, and the regulatory bodies impose strict rules and regulations on the use of excipients, which can lead to delays in product approvals and increased costs.

- High cost: The cost of excipients can be high, which can increase the overall cost of drug development and manufacturing.

- Lack of availability of raw materials: The availability of raw materials used in the production of excipients can be a constraint, which can lead to supply chain disruptions and affect the production of drugs.

- Limited Innovation: The excipient market is relatively mature, and there is limited innovation in terms of new excipient products or technologies, which can limit the market’s growth.

By Type Analysis

The Organic Segment Accounted for the Largest Revenue Share in Excipients Market in 2022.

The global excipients industry is divided into two types: organic and inorganic. The organic segment is anticipated to dominate revenue during the forecasted period. A growing market for chemicals produced from organic sources has led to an increase in the usage of organic excipients in the pharmaceutical sector.

They are more beneficial than inorganic ones in a variety of ways, including better bioavailability and solubility. The biocompatibility and low toxicity of organic excipients are projected to increase demand during the following few years significantly. The segment of inorganic excipients is expected to have the fastest revenue CAGR over the forecast period.

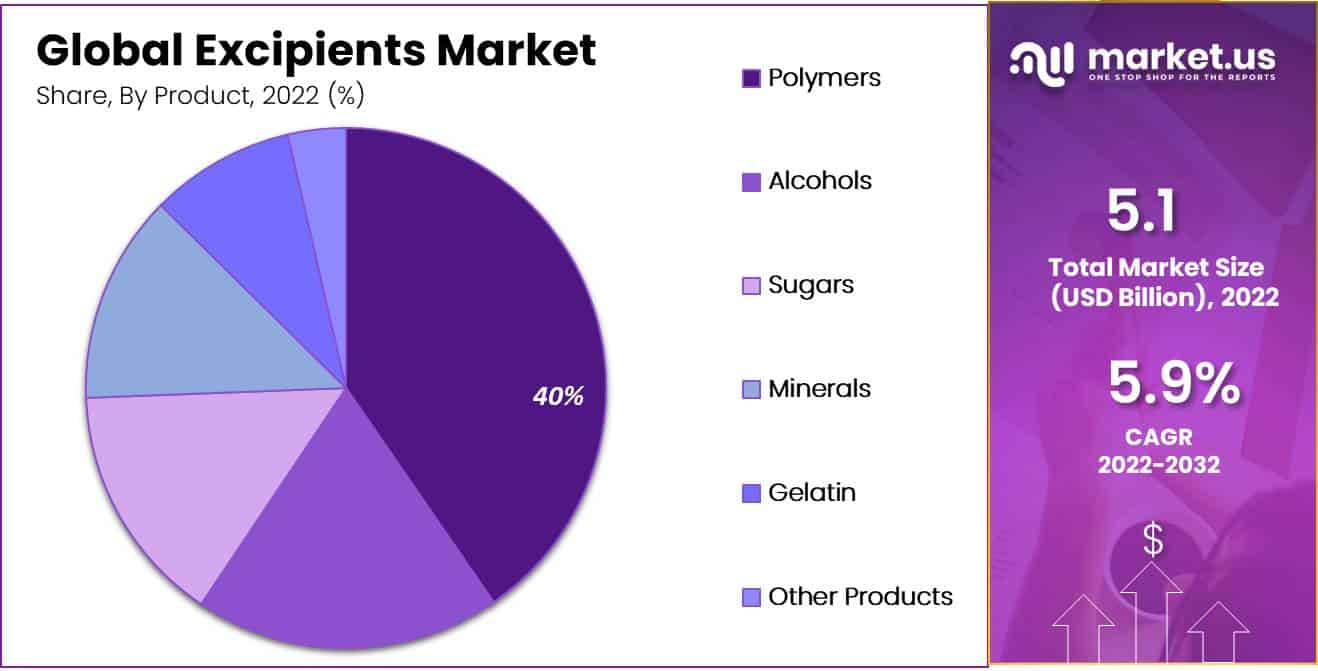

By Product Analysis

The Polymers Segment Accounted for the Largest Revenue Share in Excipients Market in 2022.

Based on products, the market is divided into polymers, alcohols, sugars, minerals, gelatin, and other products. In terms of revenue and volume, polymers, which include microcrystalline cellulose, pregelatinized sugar, and starch, have emerged as the most important product category. it accounted for almost 40% of all pharmaceutical formulations and over 44% of revenue.

This segment is expected to grow due to the increasing use of various dosage forms, such as tablets, capsules, and suspensions. The high use of polymers in pharmaceutical R&D is due to their multiple functions. Polymers are ideal for formulations that allow controlled/sustained releases and can help deliver drugs directly to target sites.

By Functionality Analysis

The Fillers and Diluents Segment Accounted for the Largest Revenue Share in Excipients Market in 2022.

The global excipients industry is divided into functional segments, including fillers and diluents, binders, disintegrants coatings, flavoring agents, and others. In 2022, the fillers and diluents segment will account for the largest revenue share. Excipients, fillers, and diluents can be added to drugs to enhance their flow and bulk.

They are employed in the production of tablets and capsules to ensure that the medicine is uniformly dispersed throughout the dosage form and to guarantee that they are of the proper size and shape. The availability of generic drugs on the market and the rising demand for low-cost and efficient drug manufacturing processes are both driving this market segment’s revenue growth. The segment of binders is expected to have the fastest revenue growth during the forecast period.

By Formulation Analysis

Tablets dominate the market for excipients among the various formulations.

Based on formulation, the market is further segmented into tablets, capsules, topical, parenteral, and other formulations. Tablets dominate the market for excipients among the various formulations. Excipients can be used to enhance the stability, bioavailability, and effectiveness of tablets, which are widely used in dosage forms. Tablet and capsule formulations commonly use excipients like binders and disintegrants. They also include lubricants and coatings.

Excipients are also used in topical formulations, which is a major contributor to the market. Topical formulations use excipients to improve the texture, stability, and effectiveness. These excipients are used in lotions, creams, and gels. Topical formulations commonly use excipients like emulsifiers and thickeners. Excipients are also used in parenteral formulations such as injectables. In order to increase their bioavailability, solubility, and stability, excipients can be used in parenteral formulas. Parenteral formulations commonly use excipients like buffers, tonicity, and preservatives.

By End-User Analysis

The pharmaceutical end-user segment dominates the excipients market due to the high demand for excipients in the development of various drug formulations.

The pharmaceutical end-user segment dominated the excipients market due to the increased demand for excipients in the development of different drug formulations. Excipients are also used in various dosage forms, such as tablets, capsules, and injectables. Nutraceuticals, which are products that are derived from foods and have medical properties, are often used to prevent and promote disease. Excipients are used in various industries, including food and beverages, cosmetics as well as agriculture.

Key Market Segments

Based on Type

- Organic

- Inorganic

Based on Product

- Polymers

- Alcohols

- Sugars

- Minerals

- Gelatin

- Other Products

Based on Functionality

- Fillers & Diluents

- Binders

- Disintegrants

- Coatings

- Flavoring Agents

- Other Functionalities

Based on Formulation

- Tablets

- Capsules

- Topical

- Parenteral

- Other Formulations

Based on End-User

- Pharmaceutical

- Nutraceutical

- Other End-Users

Growth Opportunity

Excipients are a market that offers many opportunities for innovation and growth. This is due to the growing demand for excipients that can enhance the safety, efficacy, and stability of pharmaceuticals. The excipients industry offers several key opportunities.

Innovation in Excipient Formulation: The need for innovative excipient formulations is growing. These include formulas that address specific formulation challenges such as increasing the bioavailability and stability of sensitive drug molecules or reducing the risks of drug-drug interaction. Excipient manufacturers have a great opportunity to create new formulations that satisfy these needs.

Demand for Plant-based Excipients is Growing: Plant-based excipients are becoming more popular because people consider they are safe and more natural than synthetic excipients. The opportunity to create new plant-based excipients that are efficient and secure for use in pharmaceutical products is offered by this.

Latest Trends

- Growing Demand for Specialty Excipients: There is an increasing need for specialty excipients that can help with certain formulation challenges such as increasing bioavailability, promoting medication stability, and reducing the risk of drug interactions. This trend is driving the creation of new excipient formulations that can satisfy these requirements.

- Increasing Popularity of Natural and Plant-based Excipients: The popularity of plant-based and natural excipients is on the rise. These excipients are viewed as safer and environmentally friendly than synthetic ones. This trend drives the development of natural excipients as well as the reformulation of existing products with more natural ingredients.

- Excipients Using Nanotechnology: Nanotechnology is increasingly being used, largely due to the promise of improved drug delivery. This trend drives the development of nanotechnology-based formulations for excipients, which can enhance drug bioavailability and stability, as well as reduce toxicity.

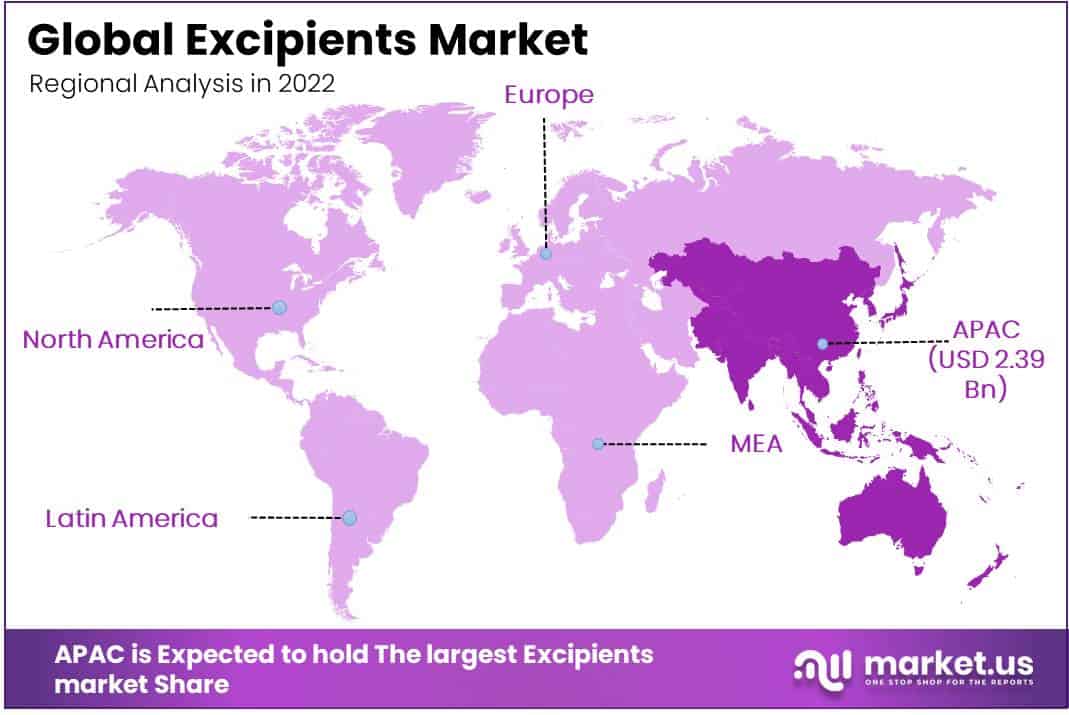

Regional Analysis

Asia Pacific accounted for the Largest Revenue Share in Excipients Market in 2022.

In 2022, The market in Asia Pacific accounted for the largest revenue share. This growth is largely due to the increasing investment in healthcare and the rising pharmaceutical demand. China, as well as India, are playing an important role in driving this growth. Growing elderly populations and the prevalence of chronic illnesses in the area are driving the growth in revenue of the market.

North America is Expected as Fastest Growing Region in Projected Period in Excipients Market.

North America is projected to have the fastest CAGR in revenue during the forecast period due to the rising demand for generics and biologics in the area. Increased emphasis on sustainable and affordable manufacturing methods is driving the growth of excipients in this region. Rising investments in R&D and the presence of major pharmaceutical companies in the area are also driving revenue growth in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The excipients industry is highly competitive, driven by innovations, and a number of key players are vying to gain market share. These companies are focusing on strategic partnerships, mergers and acquisitions, and product innovation to increase their market share. These companies also invest in R&D to create new excipient formulas that meet specific requirements, enhance safety, efficacy, and stability, and can be tailored to specific needs.

The excipients industry is dominated in terms of market shares by a small number of prominent players. Excipients are also characterized as a market with a number of regional and local players. This is especially true in emerging markets like Asia and Latin America. These players provide low-cost excipients, and they focus on customizing solutions to meet local customer requirements.

Market Key Players

- Avantor, Inc.

- DuPont de Nemours, Inc.

- Associated British Foods plc.

- Ashland Global Holding Inc.

- Evonik Industries AG

- Roquette Freres

- Kerry Group

- DFE Pharma

- Ingredion

- BASF SE

- Other Key Players

Recent Developments

- In 2021– Ashland Global Holdings Inc. purchased the personal-care business of Schulke & Mayr GmbH on 30 April 2021 to enhance its position in both the pharmaceutical and personal-care industries.

- In 2020– Avantor acquired Ritter GmbH on 10 June 2020. Ritter is a producer of bioprocessing and consumables. This acquisition will allow Avantor to expand its product and service portfolio for the biopharmaceutical sector.

Report Scope

Report Features Description Market Value (2022) USD 5.10 Billion Forecast Revenue (2032) USD 8.92 Billion CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Based on Type(Organic, Inorganic, Based on Product, Polymers, Alcohols, Sugars, Minerals, Gelatin, Other Products) Based on Functionality(Fillers & Diluents, Binders, Disintegrants, Coatings, Flavoring Agents, Other Functionalities) Based on Formulation(Tablets, Capsules, Topical, Parenteral, Other Formulations) Based on End-User(Pharmaceutical, Nutraceutical, Other End-Users) Segments Covered By Type, By Product, By Functionality, By Formulation, By End-User. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Avantor, Inc., DuPont de Nemours, Inc., Associated British Foods plc., Ashland Global Holding Inc., Evonik Industries AG, Roquette Freres, Kerry Group, DFE Pharma, Ingredion, BASF SE, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Frequently Asked Questions (FAQ)

What is the value of the global Excipients Market?In 2022, the global Excipients Market was valued at USD 5.1 billion.

What will be the market size for Excipients Market in 2032?In 2032, the Excipients Market will reach USD 8.9 billion.

What CAGR is projected for the Excipients Market?The Excipients Market is expected to grow at 5.9% CAGR (2023-2032).

List the segments encompassed in this report on the Excipients Market?Market.US has segmented the Excipients Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Organic and Inorganic. By Product, the market has been further divided into Polymers, Alcohols, Sugars, Minerals, Gelatin and Other Products.

Which segment dominate the Excipients industry?With respect to the Excipients industry, vendors can expect to leverage greater prospective business opportunities through the Polymers segment, as this dominate this industry.

Name the major industry players in the Excipients Market.Avantor, Inc., DuPont de Nemours, Inc., Associated British Foods plc., Ashland Global Holding Inc., Evonik Industries AG, Roquette Freres and Other Key Players are the main vendors in this market.

-

-

- Avantor, Inc.

- DuPont de Nemours, Inc.

- Associated British Foods plc.

- Ashland Global Holding Inc.

- Evonik Industries AG

- Roquette Freres

- Kerry Group

- DFE Pharma

- Ingredion

- BASF SE

- Other Key Players