Global Excimer and Femtosecond Ophthalmic Lasers Market Analysis By Product Type (Excimer lasers, Femtosecond lasers), By Application (Refractive surgery (Photorefractive Keratectomy (PRK), LASIK, Astigmatic Keratotomy, Femtosecond Lenticule Extraction (FLEx), Small Incision Lenticule Extraction (SMILE), Others), Cataract surgery, Others), By End-User (Hospitals, Ophthalmology clinics, Ambulatory surgical centres) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167019

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

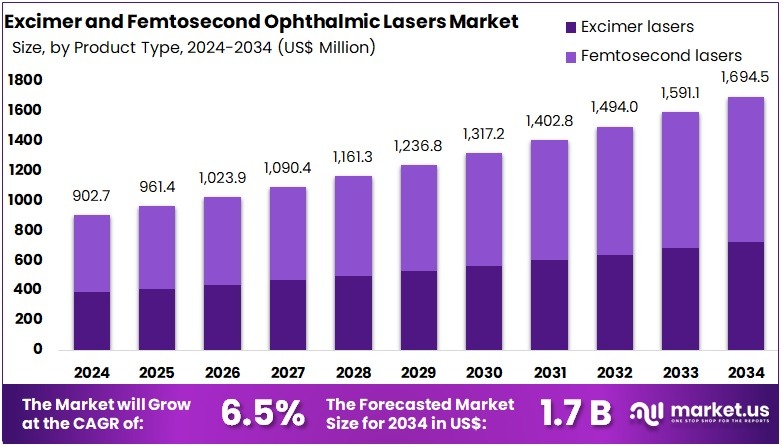

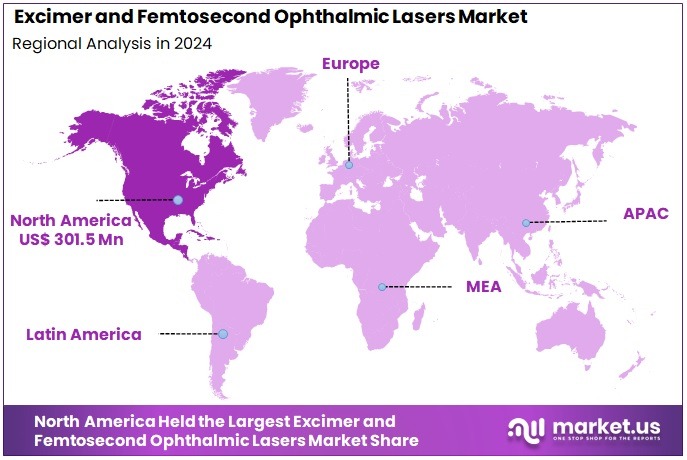

The Global Excimer and Femtosecond Ophthalmic Lasers Market size is expected to be worth around US$ 1694.5 Million by 2034, from US$ 902.7 Million in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 33.4% share and holds US$ 301.5 Million market value for the year.

The excimer and femtosecond ophthalmic lasers market has been expanding as eye-care providers adopt technologies that enhance surgical accuracy and patient outcomes. These systems support refractive and cataract procedures and are widely used in hospitals and specialty clinics. According to global clinical trends, demand has been rising as patients seek minimally invasive options and faster recovery, which strengthens the uptake of laser-assisted interventions.

A strong demand base has emerged due to widespread vision impairment that affects populations worldwide. Before presenting numerical data, it is important to understand that limited access to eye care and delayed treatment contribute to preventable vision loss. According to the World Health Organization, 2.2 billion people experience near or distance vision impairment, and 1 billion of these cases are unaddressed. These unmet needs increase the requirement for excimer and femtosecond laser systems.

The rising global incidence of myopia adds further momentum to market growth. Increasing indoor lifestyles, reduced outdoor exposure, and educational pressure have contributed to this trend. Study findings cited by WHO project that myopia prevalence will rise sharply from 22–27% in 2000–2010 to 50–52% by 2050. For example, the National Eye Institute reported a 66% rise in U.S. myopia prevalence, increasing from 25% to 41.6% between 1971–1972 and 1999–2004.

Lifestyle behaviour among younger age groups further reinforces this growth. Digital device exposure has become a major concern, with children spending longer hours on screens for education and entertainment. According to a large meta-analysis highlighted by The Guardian, each additional hour of screen time increases myopia risk. This behavioural trend expands the future pool of refractive surgery candidates, strengthening demand for excimer laser systems in private refractive centers.

Cataract Burden, Technology Progress, and Policy Support

The increasing burden of cataract is shaping the need for advanced surgical tools such as femtosecond lasers. Aging populations, limited early screening, and uneven access to surgical services contribute to global cataract-related impairment. Study by leading researchers shows that cataract continues to dominate global blindness patterns, with 17 million people blind and 83.5 million visually impaired from cataract in 2020. These figures highlight the need for more precise and efficient surgical technologies.

Regulatory support has played a significant role in strengthening market confidence. Before listing specific data, it is essential to note that approvals act as a signal of safety and effectiveness for surgeons and hospitals. For instance, the U.S. FDA has granted premarket approvals for systems such as the WAVELIGHT EX500, MEL90, STAR S4 IR, and the Kremer Laser System. These approvals cover the correction of myopia and mixed astigmatism in adults, which encourages broader adoption.

Economic structures within healthcare systems further influence technology expansion. Providers often differentiate their services by offering premium surgical options that improve visual quality and reduce spectacle dependence. For example, advanced procedures such as laser refractive surgery and femtosecond-assisted cataract surgery are frequently funded out-of-pocket. This financial model supports investment in excimer and femtosecond platforms in high-volume hospitals and specialized centers.

Policy directives and national eye-health strategies continue to encourage infrastructure development. Before adding numerical perspectives, it is important to emphasize that governments are prioritizing avoidable blindness reduction as part of public-health planning. According to WHO recommendations, integrating eye care into universal health coverage is essential to meet rising surgical needs. As tertiary eye-care centers expand, investment naturally shifts toward precision-driven technologies, leading to sustained demand for excimer and femtosecond laser systems.

Key Takeaways

- The global Excimer and Femtosecond Ophthalmic Lasers Market is projected to reach about US$ 1,694.5 million by 2034, rising from US$ 902.7 million in 2024 at a 6.5% CAGR.

- Femtosecond lasers were reported to dominate the 2024 product landscape, accounting for over 57.3% of total revenue due to their precision and broad clinical adoption.

- Refractive surgery emerged as the leading application area in 2024, securing more than 71.1% share as demand for vision correction procedures continued increasing globally.

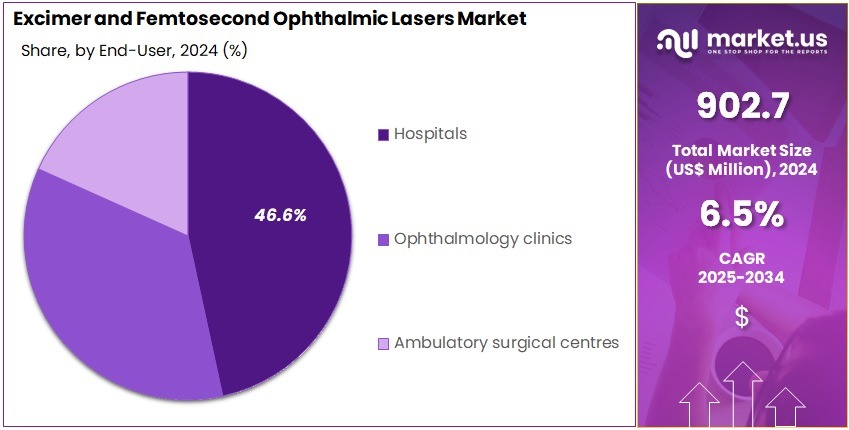

- Hospitals were identified as the primary end-user category in 2024, contributing over 46.6% share owing to advanced infrastructure and higher surgical procedure volumes.

- North America maintained the largest regional presence in 2024, representing more than 33.4% share and generating approximately US$ 301.5 million in market value.

Product Type Analysis

In 2024, the Femtosecond lasers held a dominant market position in the Product Type Segment of the Excimer and Femtosecond Ophthalmic Lasers Market, and captured more than a 57.3% share. Their demand was driven by high precision. These systems enabled accurate corneal flap creation. They reduced thermal damage. Their efficiency improved surgical outcomes. Surgeons increased adoption for LASIK and cataract care. Growth was supported by the shift toward minimally invasive procedures. Clinical advantages strengthened overall market penetration.

Excimer lasers maintained a stable role in refractive surgery across global practices. Their use in corneal reshaping remained essential for PRK and LASIK procedures. Steady procedural volumes supported consistent demand. Advances in beam stability improved ablation control. These improvements ensured predictable outcomes for vision correction. Clinics continued to adopt excimer systems for established refractive methods. Growth remained moderate but the technology held value due to proven performance. Its presence supported overall market continuity.

The market showed balanced adoption across both laser categories. Femtosecond systems advanced precision standards and supported rapid healing in refractive care. Excimer platforms continued to deliver consistent corneal reshaping outcomes. Together, these technologies sustained demand for modern ophthalmic surgery. Clinical confidence increased as improvements enhanced safety and accuracy. Their combined use strengthened overall procedural efficiency across global eye centers. The segment benefited from steady technological progress and rising surgical volumes.

Application Analysis

In 2024, the ‘Refractive surgery’ held a dominant market position in the Application Segment of the Excimer and Femtosecond Ophthalmic Lasers Market, and captured more than a 71.1% share. The segment showed strong demand due to rising volumes of vision correction procedures. Growth was supported by improvements in laser accuracy and safety. PRK, LASIK, SMILE, and other methods gained acceptance. Short recovery time also encouraged adoption. Patient preference for permanent correction strengthened the segment’s lead.

Femtosecond use in cataract surgery showed steady growth. The demand was driven by the need for precise capsulotomy and improved lens fragmentation. Adoption increased as aging populations sought better outcomes. Surgeons valued predictable results and reduced complication risks. The technology enhanced consistency in complex cases. Market expansion was supported by broader access to advanced ophthalmic care. The segment benefited from continuous improvements in laser platforms and rising awareness of premium cataract procedures.

Other applications showed gradual expansion. Therapeutic corneal treatments gained attention due to improving diagnostic tools. Procedures for presbyopia advanced as clinical evidence strengthened. Growth was supported by better imaging systems and refined ablation profiles. The segment benefited from wider adoption of personalized treatments. Uptake increased as patients sought targeted solutions. Market momentum remained positive due to ongoing technology upgrades. Steady improvements in outcomes encouraged broader interest across emerging ophthalmic indications.

End-User Analysis

In 2024, the ‘Hospitals’ held a dominant market position in the End-User Segment of the Excimer and Femtosecond Ophthalmic Lasers Market, and captured more than a 46.6% share. This segment remained strong due to advanced clinical infrastructure. Hospitals managed a high volume of refractive procedures. Skilled ophthalmologists supported consistent outcomes. Strong procurement capacity increased the installation of laser systems. The broad availability of specialised care also strengthened patient preference. These factors reinforced the leading role of hospitals in this market.

Ophthalmology clinics recorded a steady contribution to the market. Their growth was supported by rising demand for outpatient refractive surgeries. Clinics offered shorter waiting times. They also delivered focused and specialised care. Compact laser systems encouraged adoption in smaller facilities. The increase in standalone refractive centres added momentum. Patient preference for convenient services remained strong. These elements supported gradual expansion. The segment is expected to maintain a stable trajectory as clinical modernisation continues across developing regions.

Ambulatory surgical centres showed a smaller yet expanding market share. Their growth was influenced by cost-efficient surgical models. Shorter procedure times improved patient throughput. Reduced hospital stays made ASCs attractive for refractive treatments. Adoption of ophthalmic laser systems increased due to lower operational costs. The shift toward minimally invasive vision correction strengthened this segment. Outpatient care trends encouraged broader acceptance. These drivers positioned ASCs for progressive growth. The overall market benefited from rising demand for efficient refractive solutions.

Key Market Segments

By Product Type

- Excimer lasers

- Femtosecond lasers

By Application

- Refractive surgery

- Photorefractive Keratectomy (PRK)

- LASIK

- Astigmatic Keratotomy

- Femtosecond Lenticule Extraction (FLEx)

- Small Incision Lenticule Extraction (SMILE)

- Others

- Cataract surgery

- Others

By End-User

- Hospitals

- Ophthalmology clinics

- Ambulatory surgical centres

Drivers

Escalating Burden Of Uncorrected Refractive Error And Myopia

The growing burden of uncorrected refractive error has been recognized as a central factor that strengthens demand for excimer and femtosecond ophthalmic laser systems. Large segments of the global population continue to experience distance- and near-vision impairment that could be corrected through refractive solutions. This unmet need has been associated with rising interest in advanced laser-based procedures. The expansion of the candidate pool for refractive correction has, therefore, supported steady adoption of laser platforms across both developed and emerging healthcare markets.

The escalation of myopia worldwide has also reinforced this driver. Persistent increases in childhood and adolescent myopia have been linked to long-term dependence on corrective devices. As more individuals progress to higher degrees of refractive error, the preference for surgical correction grows. Higher surgical acceptance rates have, in turn, stimulated continuous investment in precision laser technologies. This trend is expected to sustain market growth, as clinics seek reliable systems to meet expanding procedural volumes.

According to global assessments, only an estimated 36% of people with distance-vision impairment caused by refractive error currently receive spectacles. It has been noted that more than 800 million people continue to experience near-vision impairment that could be corrected with basic intervention. These figures highlight a significant gap in accessible care. For example, this gap has created favorable conditions for refractive surgery providers, as laser-based treatments offer long-term correction when conventional solutions are limited or underutilized.

Study by BioMed Central reported that myopia prevalence reached approximately 96.5% in a specific cohort of children and adolescents, while uncorrected refractive error affected nearly 8.9% of participants. For instance, such findings indicate that younger populations are entering adulthood with persistent visual deficits. As these patients seek durable correction options, excimer and femtosecond laser procedures are increasingly selected. This pattern supports continuous adoption of advanced laser platforms to address high refractive case loads in ophthalmic practices.

Restraints

Cost-Intensity And Adoption Limitations Tied To High-Precision Laser Platforms And Infrastructure

The market has been hindered by the high capital intensity linked to advanced excimer and femtosecond laser systems. The adoption of these platforms requires expensive hardware, controlled clinical environments, and specialized workflow integration. The overall investment includes equipment acquisition, installation, and adherence to strict operational standards. This level of financial commitment limits accessibility for many providers. The growth of the market has therefore been constrained in regions where budget flexibility is low and healthcare infrastructure remains underdeveloped.

Additional pressures arise from the recurring costs associated with system maintenance and consumables. These obligations increase the operational burden on clinics and demand steady patient volumes to maintain profitability. The financial threshold for break-even performance becomes challenging for smaller practices. As a result, the technology is often prioritized by high-volume centers only. This condition restricts broader adoption. The market expansion is therefore slowed because smaller facilities cannot justify such continuous expenditures.

According to multiple clinical assessments, femtosecond-laser-assisted refractive surgery has been described as safe and efficient, yet its implementation requires advanced infrastructure and skilled personnel. Study by several ophthalmic research groups indicates that trained technicians, precision calibration systems, and controlled procedural environments are essential to ensure consistent outcomes. These requirements increase operational complexity. For example, clinical teams must undergo specialized training and regular certifications, which raise costs further and limit accessibility for emerging ophthalmic facilities.

For instance, evidence published in 2022 emphasized that although femtosecond platforms reduce complication risks, they necessitate sophisticated workflow alignment, including maintenance protocols and procedural optimization. Such infrastructure-heavy demands create disparities between high-resource and low-resource settings. The need for high procedure volumes to justify investment continues to deter smaller providers. As a result, market penetration of premium laser systems remains uneven. These structural limitations act as a significant restraint and influence overall technology adoption patterns worldwide.

Opportunities

Integration Of Artificial Intelligence In Refractive Surgery Planning And Laser-Vision-Correction Workflows

The integration of artificial intelligence into refractive-surgery planning is creating a clear opportunity for excimer and femtosecond ophthalmic-laser manufacturers. The adoption of AI-enabled workflows is improving precision, standardising decisions and enhancing predictability across complex cases. The growth of this trend indicates that laser platforms with embedded algorithmic modules are likely to achieve stronger clinical acceptance. The opportunity is further reinforced as surgical centres prioritise technologies that support faster assessments and more reliable outcomes for laser vision correction procedures.

The expansion of AI across surgical-planning pathways is enabling value creation for both laser-system vendors and clinical providers. The opportunity emerges as AI supports accurate patient selection, optimised energy-delivery planning and improved postoperative forecasting. These improvements strengthen clinical confidence and can increase procedural throughput. The market shift suggests that integrated AI capabilities may become a key differentiator within excimer and femtosecond systems, supporting premium pricing models, additional service revenues and long-term upgrade pathways for installed laser platforms.

According to a 2025 narrative review, AI has been assessed across 33 key studies, including 16 focused on laser-vision-correction applications. Study findings showed that AI contributed to surgical planning, screening and postoperative prediction. These advancements suggest that excimer and femtosecond systems fitted with AI-based analytical tools may achieve stronger competitive positioning. For example, enhanced topography interpretation and personalised ablation-profile generation can improve the consistency of refractive outcomes, thereby supporting the transition toward data-driven refractive-surgery ecosystems.

Further acceleration is supported by evidence from another 2025 article, which reported that AI applications rapidly process corneal topography, biometry and previous outcomes to optimise treatment planning. For instance, automated interpretation of multidimensional data reduces planning time and lowers the risk of manual variability. The implication is that laser-system suppliers can embed AI-driven modules to strengthen workflow efficiency. This integration is expected to expand differentiation opportunities, reinforce clinical adoption and widen recurring-revenue models through software-enabled upgrades and service offerings.

Trends

Transition Toward Femtosecond-Laser Platforms And Precision Workflows In Refractive And Cataract Surgery

The excimer and femtosecond ophthalmic lasers market is experiencing a clear shift toward high-precision surgical ecosystems. The transition toward femtosecond-laser platforms is being driven by the need for more accurate, safer, and repeatable outcomes in refractive and cataract procedures. This shift has been supported by the adoption of precision workflows that minimize tissue disruption and improve postoperative recovery. The growth of these platforms can be attributed to the increased demand for minimally invasive procedures and the rising expectations of both surgeons and patients for predictable visual results.

Workflow integration is strengthening this trend. Modern surgical systems increasingly combine femtosecond lasers for flap creation or lenticule extraction with excimer lasers for surface ablation. This blended approach allows clinics to optimize different stages of surgery and achieve highly customized refractive corrections. The advancement of such hybrid workflows has improved surgical efficiency and broadened the range of treatable refractive errors. The ongoing enhancement of platform interoperability has further accelerated the shift toward combined-laser approaches in ophthalmic practices worldwide.

According to a 2025 review on Wiley Online Library, femtosecond-laser technology has been described as “revolutionising refractive surgery with unparalleled precision and safety.” This assessment reinforces the growing preference for femtosecond systems as the core technology in advanced refractive procedures. Study findings emphasize that precision, consistency, and reduced complication rates have strengthened adoption across high-volume ophthalmic centers. For instance, the expanding clinical evidence base has increased practitioner confidence and encouraged investment in upgraded laser platforms.

Demographic changes are also reinforcing market expansion. According to The Guardian’s summary of a British Journal of Ophthalmology study, about 36 percent of children and teens were myopic globally in 2023, and nearly 40 percent may be affected by 2050. For example, the rising prevalence of refractive errors among younger patients is increasing the long-term demand for corrective interventions. This growth trajectory supports higher utilization of excimer and femtosecond systems, as clinics prepare for larger, younger patient pools requiring precise refractive correction.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 33.4% share and holding a market value of US$ 301.5 million for the year. Strong clinical infrastructure supported this lead. High demand for refractive correction procedures also contributed. Advanced diagnostic technologies improved adoption rates. Consistent investments in ophthalmic innovation strengthened regional growth. Favorable patient awareness further increased procedure volumes. These conditions created a stable environment for excimer and femtosecond laser expansion.

Europe showed steady progress with increasing use of laser-assisted cataract procedures. Aging demographics supported a higher demand for precision-based vision correction. Awareness of minimally invasive treatments also improved uptake. Asia Pacific grew at a faster pace. Rising procedure volumes in China and India strengthened market expansion. Better healthcare access supported this trend. Medical tourism in Southeast Asia added more momentum. Latin America showed moderate gains, mainly in urban centers with higher investment capacity.

The Middle East and Africa region demonstrated early-stage but improving adoption. Growth was concentrated in the Gulf countries due to stronger spending. Expanding specialty clinics increased awareness of advanced eye-care technologies. However, overall penetration remained lower than other regions. North America retained its lead due to stronger technology integration, skilled clinical professionals, and higher patient acceptance of refractive procedures. Continuous upgrades in laser systems also reinforced the region’s position and supported sustained demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Carl Zeiss AG holds a strong position in the excimer and femtosecond lasers market. The company benefits from an integrated product ecosystem that links diagnostics, planning tools, and advanced laser systems. Its excimer and femtosecond platforms support a wide range of corneal procedures. Strong global distribution and consistent regulatory approvals have enhanced its market presence. Growth has been driven by rising demand for minimally invasive refractive techniques. Premium clinics continue to select Zeiss systems to achieve predictable outcomes and stable workflow performance.

Alcon Inc. maintains broad market visibility through its high-speed excimer systems and integrated refractive suites. The company offers advanced eye-tracking features and optimized ablation profiles that support personalized LASIK procedures. Its large installed base contributes to stable recurring revenue from service and consumables. Global distribution strength improves product availability across key regions. Growth has been supported by the rising adoption of refractive surgeries. Alcon benefits from strong surgeon familiarity, which reinforces loyalty and drives continuous demand for its refractive platforms worldwide.

SCHWIND eye-tech-solutions GmbH operates as a specialist in high-precision refractive lasers. The company offers advanced excimer and femtosecond platforms that support fast, touch-free surface treatments. High-frequency pulse rates and multi-dimensional tracking systems enhance treatment accuracy. SCHWIND has gained traction in Europe, the Middle East, and parts of Asia. Its focus on customized ablation profiles supports complex case management. Market growth for SCHWIND has been sustained by increasing preference for surface ablation techniques. Its innovation-driven approach continues to attract premium refractive centers.

Bausch + Lomb Surgical, Ziemer Ophthalmic Systems AG, iVis Technologies, and Innova Medical contribute additional competition in this market. Bausch + Lomb provides integrated cataract and refractive solutions that appeal to multi-specialty centers. Ziemer offers compact, low-energy femtosecond systems with strong mobility benefits. iVis Technologies focuses on highly customized no-touch procedures that enhance precision. Innova Medical strengthens market distribution and service support. Combined, these companies widen technology access and stimulate competitive pricing. Their offerings support market expansion across both developed and emerging surgical environments.

Market Key Players

- Carl Zeiss AG

- Alcon Inc.

- SCHWIND eye‑tech‑solutions GmbH

- Bausch + Lomb Surgical

- iVis Technologies, Inc.

- Ziemer Ophthalmic Systems AG

- Innova Medical

Recent Developments

- In July 2024: Alcon announced WaveLight Plus, described as its “next-generation” refractive technology based on the WaveLight laser platform. The system uses 3D ray-tracing measurements of the entire optical system to design a fully personalized LASIK treatment, and was introduced to the market in Australia and New Zealand at the AUSCRS congress. This development enhances the WaveLight excimer/femtosecond refractive suite by enabling more individualized ablation profiles for corneal laser vision correction.

- In January 2024: The U.S. FDA approved the ZEISS VISUMAX 800 femtosecond laser with SMILE pro software for the surgical treatment of myopia and myopic astigmatism. This marked the commercial introduction of the latest-generation ZEISS femtosecond laser in the U.S., offering faster lenticule creation (sub-10 seconds) and workflow enhancements such as CentraLign centration aid and OcuLign cyclotorsion adjustment, specifically targeting small-incision lenticule extraction procedures.

- On 8 January 2024: Bausch + Lomb announced that the U.S. FDA approved the TENEO Excimer Laser Platform for LASIK vision-correction surgery in myopia and myopic astigmatism. The platform is positioned as a compact, high-speed excimer system for corneal refractive surgery and is reported as the first new excimer laser platform to receive U.S. approval in nearly two decades, significantly expanding the company’s surgical laser portfolio in refractive ophthalmology.

- In 2024: SCHWIND introduced CENTRAX as a “product upgrade” used in conjunction with SCHWIND ATOS femtosecond laser systems. CENTRAX is described as an intelligent centration and active eye-tracking solution, improving centration accuracy and eye-tracking performance during femtosecond procedures such as SmartSight lenticule extraction and FemtoLASIK flap creation.

Report Scope

Report Features Description Market Value (2024) US$ 902.7 Million Forecast Revenue (2034) US$ 1694.5 Million CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Excimer lasers, Femtosecond lasers), By Application (Refractive surgery (Photorefractive Keratectomy (PRK), LASIK, Astigmatic Keratotomy, Femtosecond Lenticule Extraction (FLEx), Small Incision Lenticule Extraction (SMILE), Others), Cataract surgery, Others), By End-User (Hospitals, Ophthalmology clinics, Ambulatory surgical centres) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Carl Zeiss AG, Alcon Inc., SCHWIND eye‑tech‑solutions GmbH, Bausch + Lomb Surgical, iVis Technologies, Inc., Ziemer Ophthalmic Systems AG, Innova Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Excimer and Femtosecond Ophthalmic Lasers MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Excimer and Femtosecond Ophthalmic Lasers MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Carl Zeiss AG

- Alcon Inc.

- SCHWIND eye‑tech‑solutions GmbH

- Bausch + Lomb Surgical

- iVis Technologies, Inc.

- Ziemer Ophthalmic Systems AG

- Innova Medical