Global EV Charging Management Software Platform Market Size, Share, Growth Analysis Report By Functionality (Charging Station Management, Billing and Payment Management, Energy Management, Other Functionalities), By Charging Infrastructure Type (Public Charging Stations, Private Charging Stations), By Charging Type (Level 1 Charging, Level 2 Charging, Level 3 Charging), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132698

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

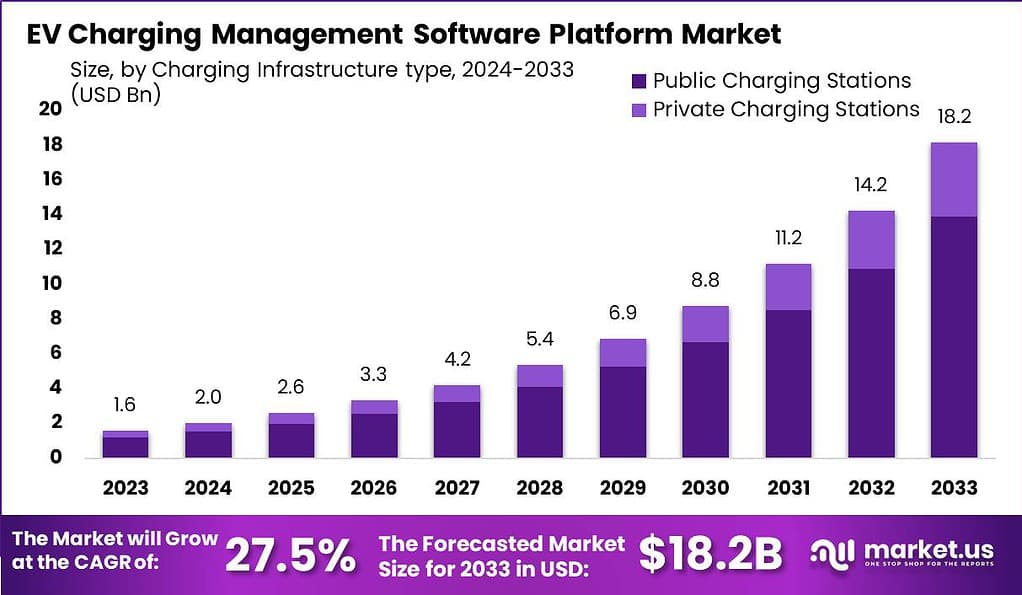

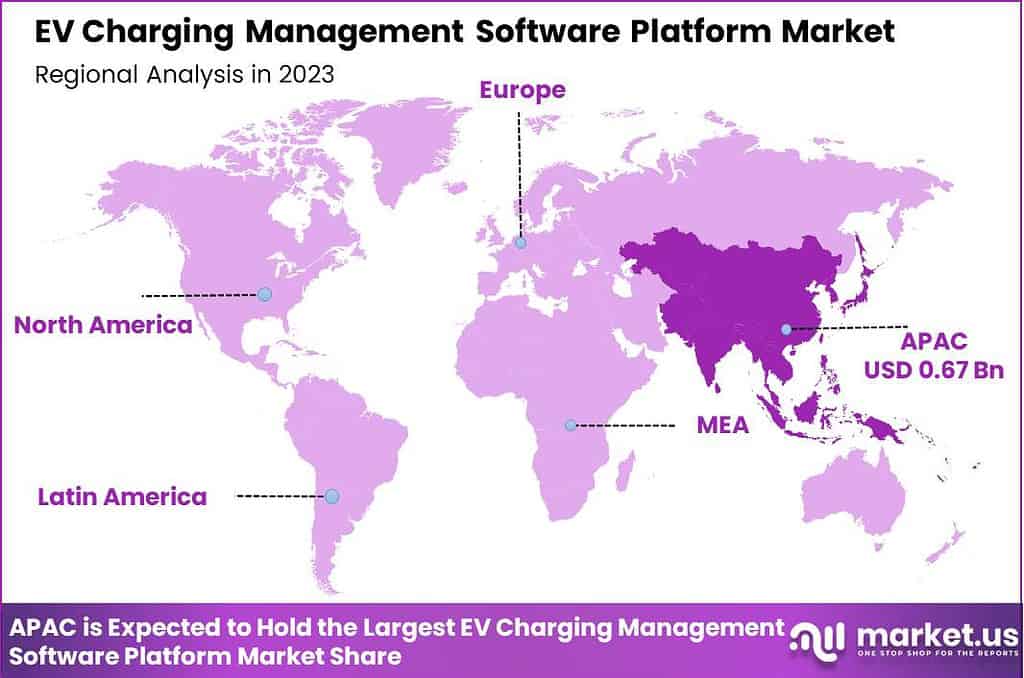

The Global EV Charging Management Software Platform Market size is expected to be worth around USD 18.2 Billion By 2033, from USD 1.6 Billion in 2023, growing at a CAGR of 27.5% during the forecast period from 2024 to 2033. In 2023, Asia-Pacific dominated the EV Charging Management Software Platform market, capturing over 42.1% of the market share and generating revenues of USD 0.67 billion.

An EV Charging Management Software Platform is a sophisticated system designed to streamline the operations of electric vehicle (EV) charging stations. This software assists in managing the distribution of power, overseeing transactions, and optimizing the use of charging infrastructure. It often includes features like real-time monitoring, user authentication, billing integration, and energy management.

The market for EV Charging Management Software Platforms is growing rapidly, fueled by the increase in EV adoption worldwide. As more people and businesses opt for electric vehicles to reduce carbon footprints, the demand for efficient and scalable charging solutions rises. This market growth is driven by the expansion of EV infrastructure and the need for better management systems to accommodate increasing numbers of EVs on the road.

The demand for EV Charging Management Software Platforms is primarily driven by the need for efficient operation and management of the growing number of EV charging stations. This is further supported by the shift towards sustainable transportation solutions. The market opportunities are expanding, particularly with the integration of charging systems with renewable energy, which aligns with global sustainability goals.

Innovations in software that facilitate optimized energy usage and reduced operational costs are also key factors creating new opportunities in this market. Key drivers for the EV Charging Management Software Platform market include the global push towards sustainable transportation, government incentives for EV infrastructure development, and technological innovations in EV charging systems.

For instance, In January 2023, AMPECO, a leading EV charging software company, announced it secured USD 16 million through a venture capital investment. This followed a successful USD 13 million Series A funding round led by BMW i Ventures Inc. With these funds, AMPECO outlined plans to expand its operations in the U.S., focusing on empowering large-scale EV charging providers with complete control over their business operations.

The increasing consumer preference for electric vehicles over traditional fuel vehicles due to environmental concerns also significantly contributes to the market’s growth. Technological advancements are central to the evolution of the EV Charging Management Software Platform market. These platforms are increasingly leveraging AI and machine learning to improve charging efficiency and manage energy distribution smartly.

Furthermore, the advent of 5G technology is expected to enhance the connectivity and operational efficiency of these platforms, enabling faster communication and better management of the charging infrastructure. Such advancements not only improve the functionality of charging stations but also enhance user experiences by reducing charging times and offering flexible payment solutions.

Key Takeaways

- The Global EV Charging Management Software Platform Market is expected to reach approximately USD 18.2 billion by 2033, up from USD 1.6 billion in 2023, growing at a CAGR of 27.5% from 2024 to 2033.

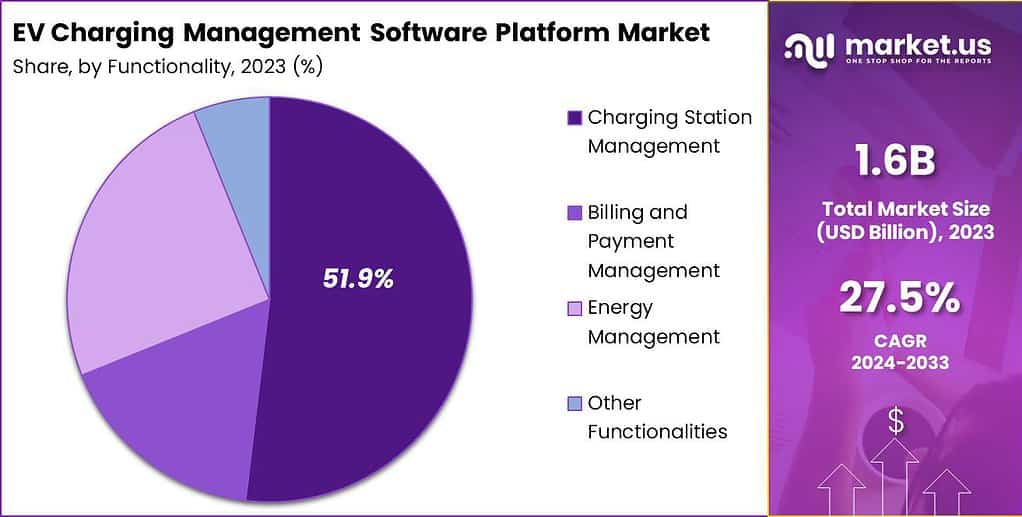

- In 2023, the Charging Station Management segment held a dominant position in the market, capturing over 51.9% of the market share within the EV Charging Management Software Platform space.

- The Public Charging Stations segment also led the market in 2023, holding more than 76.5% of the market share in the EV Charging Management Software Platform market.

- In 2023, the Level 2 Charging segment captured more than 53.4% of the market share, making it the dominant segment within the EV Charging Management Software Platform market.

- Asia-Pacific held the largest market share in 2023, with over 42.1% of the global market share, generating revenues of USD 0.67 billion.

Functionality Analysis

In 2023, the Charging Station Management segment held a dominant market position, capturing more than a 51.9% share. This segment is crucial because it directly addresses the operational needs of EV charging stations, which are expanding rapidly due to the global increase in electric vehicle usage.

Charging Station Management systems provide the backbone for efficient operations, ensuring that all aspects of the EV charging process, from station activation and maintenance to monitoring and reporting, are managed effectively.

The importance of this segment stems from its ability to enhance user experience and operational efficiency. As the number of EVs continues to rise, the demand for more robust and user-friendly charging stations grows. Charging Station Management systems cater to this need by enabling station operators to manage their networks seamlessly, thereby reducing downtime and improving service reliability.

Moreover, these systems are integral in facilitating the smart integration of charging stations with the grid, which is vital for balancing energy demands and supply. Technological advancements in IoT and cloud-based technologies have further propelled the growth of the Charging Station Management segment. These technologies allow for real-time data collection and analysis, leading to more informed decision-making and better resource allocation.

Additionally, the integration of renewable energy sources with charging stations is becoming more prevalent, which these management systems can facilitate by optimizing energy consumption according to availability and cost. Looking ahead, the Charging Station Management segment is expected to continue its growth trajectory, supported by ongoing innovations and the increasing global push towards electric mobility.

The development of more sophisticated management solutions, coupled with the expansion of EV infrastructure, promises to keep this segment at the forefront of the EV charging management software platform market. This ongoing evolution will likely open new avenues for market expansion and offer enhanced services that meet the growing complexities of charging network management.

Charging Infrastructure Type Analysis

In 2023, the Public Charging Stations segment held a dominant market position, capturing more than a 76.5% share. This significant market share reflects the critical role of public charging infrastructure in supporting the widespread adoption of electric vehicles (EVs).

Public charging stations are essential for providing access to charging facilities for EV drivers who may not have the ability to charge at home, particularly in urban and densely populated areas. They are also pivotal during long-distance travel, providing necessary pit stops where drivers can recharge their vehicles.

The expansion of this segment is primarily driven by government policies aimed at reducing carbon emissions, which promote the development and installation of public EV charging stations. Additionally, as EV technology advances, there is a growing expectation for more accessible and faster charging solutions, which public stations are uniquely positioned to provide. These stations often feature higher capacity chargers, such as Level 3 chargers, which offer rapid charging speeds that are attractive to consumers.

Technological innovations are continuously enhancing the efficiency and capabilities of public charging stations. Smart charging technologies, which allow for the integration of renewable energy sources and the optimization of energy consumption based on real-time data, are becoming more prevalent.

Furthermore, advancements in payment and billing systems integrated into these platforms enhance the convenience and user experience, making public charging more appealing. Looking forward, the Public Charging Stations segment is expected to maintain its growth momentum, driven by increasing investments from both public and private sectors.

As cities around the world push towards greener transportation options, the need for well-managed, widely accessible public charging infrastructure will continue to grow. This demand is likely to spur further innovations in charging technology and management software, ensuring that the infrastructure not only expands but also becomes more integrated and user-friendly for EV drivers.

Charging Type Analysis

In 2023, the Level 2 Charging segment held a dominant market position, capturing more than a 53.4% share. This segment’s prominence is primarily due to its balance of speed and accessibility, making it highly suitable for a variety of settings including residential, workplace, and some public locations.

Level 2 chargers provide a faster charging solution compared to Level 1 chargers, yet they do not require the high infrastructure and energy demands associated with Level 3 chargers, making them a versatile and economical option for many users and businesses. The growth of the Level 2 Charging segment is supported by the expanding infrastructure of electric vehicles and the need for a quicker, more efficient charging solution that can be easily integrated into existing electrical systems.

Level 2 chargers can fully charge an electric vehicle overnight, which is ideal for home and office settings. Technological enhancements have also made Level 2 chargers more dynamic, with features such as smart scheduling to take advantage of lower electricity rates during off-peak hours, and integration with renewable energy sources like solar panels.

Level 2 charging stations are particularly noted for their convenience. They strike an optimal balance between charging speed and energy costs, which appeals to EV owners who need a more practical solution for daily use. This type of charging station is also increasingly found in commercial properties, supporting employees and customers alike, which further drives market growth.

As the electric vehicle market continues to grow, the demand for Level 2 charging solutions is expected to rise, not only in residential and commercial settings but also in new developments such as multi-unit dwellings and community charging hubs. The ongoing developments in smart grid technology and the increasing focus on sustainable living are likely to enhance the capabilities and popularity of Level 2 charging solutions, securing their position as a cornerstone of the EV charging infrastructure.

Key Market Segments

By Functionality

- Charging Station Management

- Billing and Payment Management

- Energy Management

- Other Functionalities

By Charging Infrastructure Type

- Public Charging Stations

- Private Charging Stations

By Charging Type

- Level 1 Charging

- Level 2 Charging

- Level 3 Charging

Driver

Increasing Adoption of Electric Vehicles (EVs)

The rapid rise in the adoption of electric vehicles (EVs) worldwide serves as a critical driver for the growth of EV Charging Management Software Platforms. Governments, industries, and consumers alike are pushing for clean transportation, leading to a surge in demand for EVs.

This transition is driven by a mix of regulations aimed at reducing carbon emissions, incentives like tax rebates, and advances in battery technology that make EVs more affordable and accessible. As EV ownership rises, the need for effective management of charging infrastructure becomes imperative. EV Charging Management Software Platforms provide a holistic approach to managing charging stations, optimizing their operations, and reducing downtime.

Restraint

High Initial Cost and Complex Implementation

One of the main restraints holding back the widespread adoption of EV Charging Management Software Platforms is the high initial investment required for infrastructure development and software integration. Deploying such platforms entails not only acquiring and setting up physical charging stations but also investing in compatible software solutions and networking equipment to ensure connectivity and reliability.

This initial financial burden can be daunting for small and mid-sized businesses, municipalities, and other organizations, creating a barrier to entry. Also, the implementation process can be complex, involving coordination among multiple stakeholders such as software vendors, utility companies, and hardware manufacturers. Compatibility and interoperability issues may arise, leading to delays, higher-than-expected costs, or limited functionality of existing systems.

Opportunity

Integration with Renewable Energy Sources

As the world shifts towards clean and sustainable energy, combining EV charging solutions with renewable energy systems such as solar and wind power creates a compelling case for reducing carbon footprints. This integration enables efficient energy management, minimizing grid dependency and operational costs.

Through the use of advanced algorithms, these platforms can optimize charging based on renewable energy availability, creating “green charging” options for EV owners. Such a feature appeals to environmentally conscious consumers, boosting the overall attractiveness of EV adoption.

By leveraging renewable sources, charging platforms can offer dynamic pricing based on energy availability, providing cost savings to end-users. This opportunity also extends to smart grid integration, where EV charging can contribute to grid stabilization and demand response programs, unlocking additional revenue streams for stakeholders.

Challenge

Lack of Interoperability Across EV Charging Networks

One of the key challenges facing EV Charging Management Software platforms is the lack of interoperability between various charging networks and stations. As electric vehicles (EVs) become more mainstream, the number of charging stations is growing rapidly.

However, these stations often use different hardware, software, and payment systems, which leads to significant compatibility issues. For users, this fragmentation means they might encounter difficulties when trying to locate and use charging stations, especially if they rely on specific apps or payment methods tied to particular networks. This inconsistency can cause inconvenience and confusion for EV owners.

Emerging Trends

The electric vehicle (EV) landscape is rapidly evolving, and charging management software platforms are at the forefront of this transformation. A significant trend is the integration of renewable energy sources, such as solar and wind, into charging infrastructures. This approach not only reduces carbon footprints but also promotes sustainable energy consumption.

Another notable development is the advancement of smart charging technologies. These systems enable dynamic adjustments of charging rates based on real-time grid conditions and energy prices, ensuring efficient energy use and cost savings for users.

The rise of bidirectional charging, or vehicle-to-grid (V2G) technology, is also reshaping the industry. This innovation allows EVs to not only draw power from the grid but also supply energy back during high-demand periods. Such capabilities transform EVs into mobile energy storage units, enhancing grid stability and offering potential financial incentives to vehicle owners.

Also, the adoption of open protocols like the Open Charge Point Protocol (OCPP) is promoting interoperability among different charging networks and hardware. This standardization ensures that various charging stations and management systems can communicate seamlessly, providing users with a more cohesive and user-friendly charging experience.

Business Benefits

Implementing EV charging management software offers numerous advantages for businesses operating charging networks. One of the benefits is that these platforms provide real-time monitoring and control of charging stations, allowing operators to swiftly address issues, manage energy consumption, and ensure optimal performance across the network.

Enhanced customer satisfaction is also a key benefit. User-friendly interfaces, mobile applications, and seamless payment options improve the charging experience for EV owners. Features like real-time station availability updates and reservation systems ensure that customers can plan their charging sessions conveniently, fostering repeat usage.

Moreover, these platforms facilitate scalability and future-proofing. As the demand for EV charging grows, businesses can easily expand their networks, integrate new technologies, and adapt to evolving industry standards without overhauling existing systems. This flexibility ensures that businesses remain competitive and responsive to market changes.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the EV Charging Management Software Platform Market, capturing more than a 42.1% share with revenues reaching USD 0.67 billion. This region leads due to its rapid adoption of electric vehicles driven by strong governmental initiatives aimed at reducing carbon emissions and promoting sustainable transportation solutions.

Countries like China, Japan and South Korea have implemented aggressive policies to boost EV infrastructure, which fuels the demand for robust charging management software to handle the complexities of large-scale charging networks. The region’s dominance is also linked to its increasing adoption of smart city initiatives and energy-efficient solutions, where EV charging platforms are crucial.

The growth in Asia-Pacific is also supported by significant investments from both public and private sectors in developing advanced EV charging infrastructure. The region is home to some of the world’s leading technology firms that are pioneering innovations in EV charging systems, making it a hotbed for advanced management solutions that cater to a diverse range of charging technologies and protocols.

Additionally, the increasing urbanization in Asia-Pacific countries has led to a higher density of EV ownership in urban areas, necessitating the development of more sophisticated EV charging networks. Management software plays a crucial role in optimizing charger use to prevent grid overload during peak times, enhancing the user experience through features like real-time status updates and remote control operations.

These factors collectively position Asia-Pacific as a leader in the EV Charging Management Software Platform Market, with continued growth expected as more regions commit to electrifying their transportation systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

Latin America

- Brazil

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Key Player Analysis

The EV Charging Management Software Platform market is highly competitive, with several key players driving innovation and growth across the sector.

Shell plc has made substantial strides in the EV charging sector through its New Energies division. Shell aims to bridge the gap between traditional fueling and modern charging needs by integrating sophisticated software platforms that manage a vast network of charging stations. Their software solutions focus on enhancing user experience and operational efficiency, making EV charging as convenient as refueling at a gas station.

ABB Group is renowned for its robust engineering and pioneering technology in the power and automation sectors. In the EV charging market, ABB offers a range of management software solutions tailored for different scales of charging infrastructure, from private homes to public charging networks.

ChargePoint, Inc. specializes exclusively in electric vehicle charging solutions, making them a standout in the industry. Their comprehensive software platform covers everything from station management and power management to user engagement and analytics.

Top Key Players in the Market

- Shell plc

- ABB Group

- ChargePoint, Inc.

- EV Connect Inc.

- EVBox

- Blink Charging Co.

- Enel Group

- Chargefox

- Driivz Ltd.

- TelioEV

- Other Key Players

Recent Developments

- In February 2024, FreeWire launched its latest solution, ‘Boost Power Pro’, marking a new era in EV charging and energy management. The solution is designed to improve the efficiency and accessibility of EV charging infrastructure.

- In April 2024, SolarEdge acquired Wevo Energy, a software startup specializing in EV charging optimization and management for sites with large numbers of EV chargers, such as apartment buildings and workplace car parks.

- In September 2024, Siemens announced plans to carve out its eMobility division and merge it with Heliox, a specialist in fast DC charging solutions. This strategic move aims to enhance Siemens’ position in the rapidly evolving EV charging market.

- In October 2024, Nissan invested in ChargeScape, a company providing software and technology to optimize EV battery charging. This investment allows Nissan to offer ChargeScape’s services to its EV drivers across the United States and Canada.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Bn Forecast Revenue (2033) USD 18.2 Bn CAGR (2024-2033) 27.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Functionality (Charging Station Management, Billing and Payment Management, Energy Management, Other Functionalities), By Charging Infrastructure Type (Public Charging Stations, Private Charging Stations), By Charging Type (Level 1 Charging, Level 2 Charging, Level 3 Charging) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Shell plc, ABB Group, ChargePoint, Inc., EV Connect Inc., EVBox, Blink Charging Co., Enel Group, Chargefox, Driivz Ltd., TelioEV, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  EV Charging Management Software Platform MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

EV Charging Management Software Platform MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Shell plc

- ABB Group

- ChargePoint, Inc.

- EV Connect Inc.

- EVBox

- Blink Charging Co.

- Enel Group

- Chargefox

- Driivz Ltd.

- TelioEV

- Other Key Players