Global Eubiotics Market By Product Product-Probiotics(Lactobacilli, Bifidobacterum, Streptococcus, Others)Prebiotics(Fructo-oligosaccharides (FOS), Inulin, Galacto-Oligosaccharides (GOS), Mannan-Oligosaccharides (MOS), Others)Organic Acids,Phytogenic,Enzymes,Form-(Liquid, Solid) Application-(Gut Health, Immunity, Yield, Others)End-use-(Cattle Feed, Poultry Feed, Swine Feed,and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 59591

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

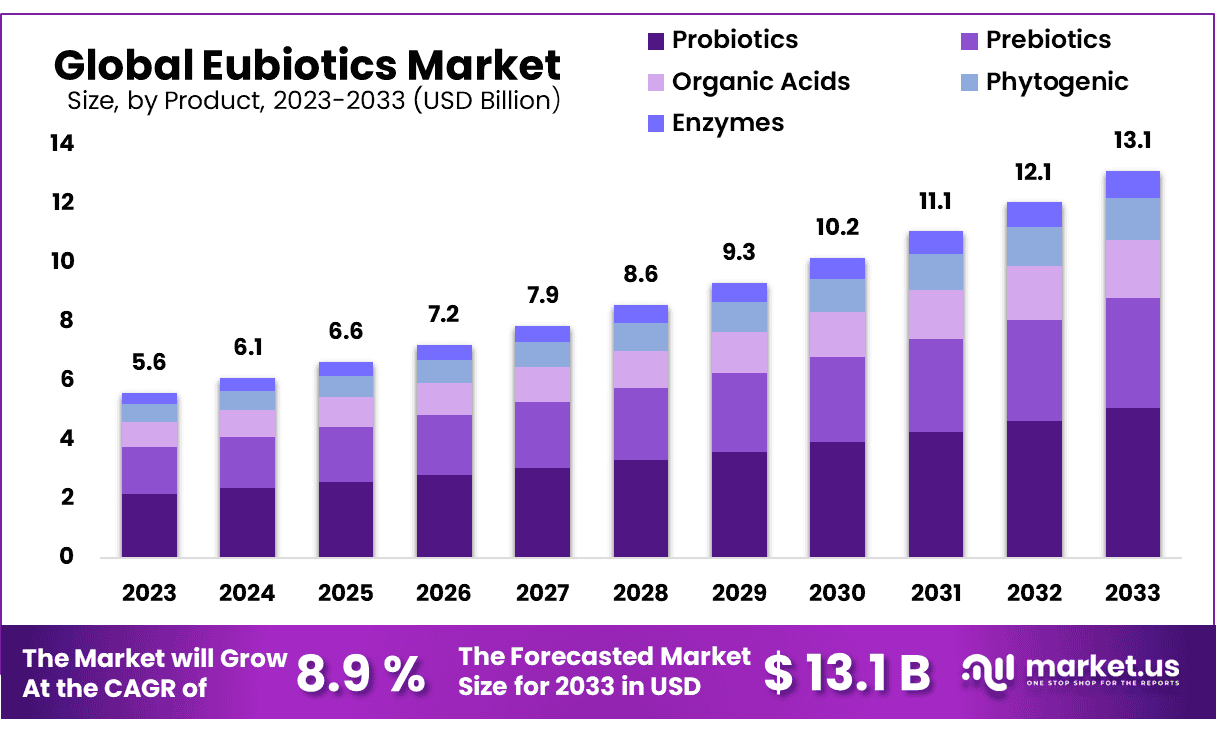

The Global Eubiotics Market size is expected to be worth around USD 31.1 Billion by 2033 from USD 5.6 Billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2023 to 2033.

Favorable regulatory situations, such as banning the use of antibiotics or increasing meat consumption worldwide, are expected to drive demand. With long-standing, and well-established players enjoying significant market share, the market is highly competitive.

In order to produce affordable and cost-effective products, companies invest heavily in R&D. Lack of sufficient players in many countries, particularly in the Middle East, opens up ample opportunities for new players to enter the market and establish a strong foothold.

Probiotics and prebiotics are important parts of the value chain in the nutraceuticals market. India and China, both developing countries, are well-positioned in this market due to their technological advancements, low labor costs, and the abundance of raw materials from upscale production. Key players from developing economies are working together to create an efficient manufacturing process and a strong supply network for low-cost product manufacturing. This allows them to offer products at comparatively lower prices.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size & Growth: The Eubiotics Market size is expected to be worth around USD 31.1 Billion by 2033 from USD 5.6 Billion in 2023, growing at a CAGR of 8.9%

- Product Analysis: The Probiotics market dominated with a large revenue share of more than 38.6% in 2023.

- Application Analysis: The segment for Gut Health had the largest percentage of market shares, which was 36.3% in 2023.

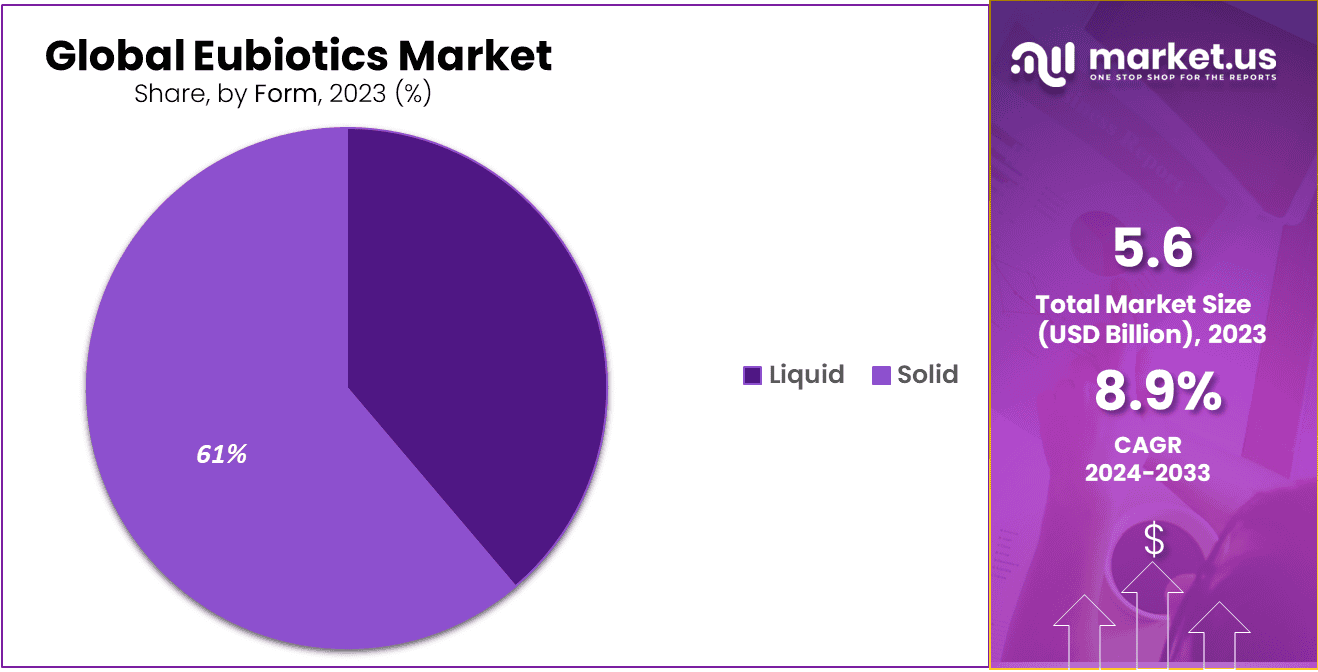

- Form Analysis: Solid was the dominant segment by 61.2% in 2023.

- End-Use Analysis: The market was dominated by the poultry segment is 35.8% in 2023.

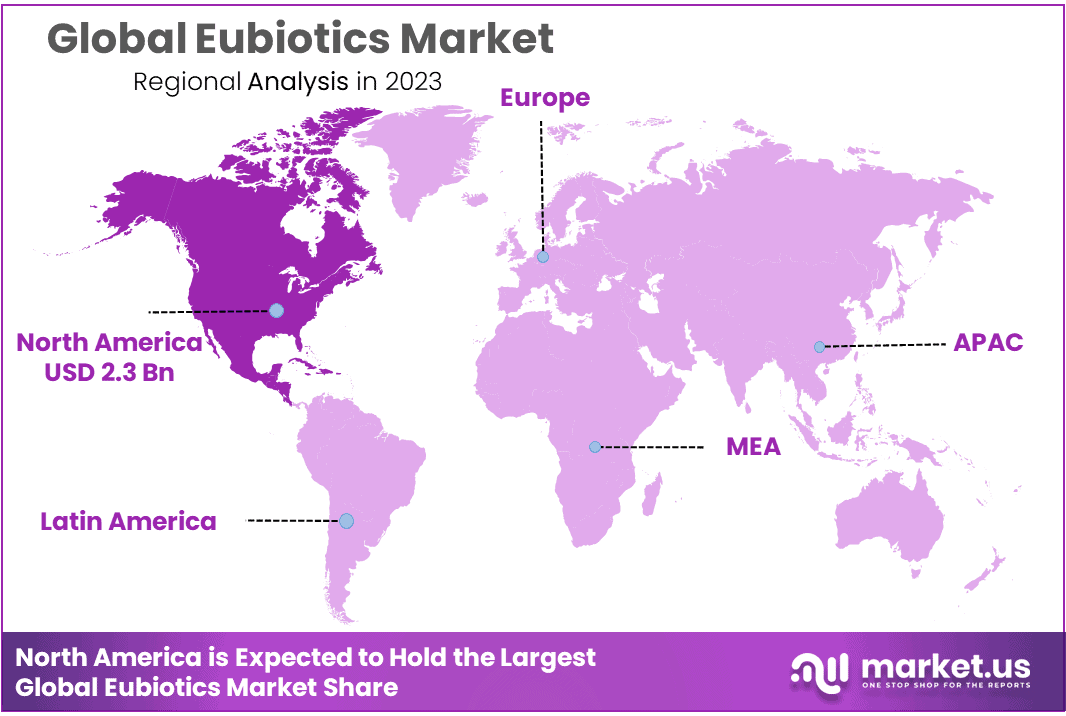

- Regional Analysis: North America held a dominant position in the global market, accounting for 41.8% in 2023 and holding a USD 2.3 Billion value for the Eubiotics Market

- Consumer demand for sustainable animal feed: With consumers demanding animal products produced sustainably becoming ever more prevalent, Eubiotics can help to minimize environmental impacts through reduced need for antibiotics and synthetic feed additives in animal production.

- Development of new eubiotics with improved efficacy: Researchers are consistently developing more efficacious eubiotics. This will have an immediate positive impact on animal health and productivity, which will in turn drive market expansion for these products.

Product Analysis

The Probiotics market dominated with a large revenue share of more than 38.6% in 2023. This is due to increasing awareness about the use of probiotics as animal feed and ongoing R&D efforts to create efficient products. eubiotics industry demand is expected to increase due to the numerous uses probiotics have in animal applications, including immune development and maintenance of gut health.

Additionally, organic acids were second in the global market share. These acids are used for forage and as grain preservatives in animal nutrition. These acids inhibit the growth of mold and bacterial pathogens. They also help to improve feed utilization. They can be used in aquaculture, poultry, and pig farming. Organic acids can be used to improve feed quality and hygiene. These attributes are expected to drive organic acid segment growth in the forecast period.

Propionic acids saw high growth in both demand and consumption. The majority of propionic acids produced are used as preservatives for food for human consumption, as well as for animal feed. They are most effective as a feed additive and growth promoter for food animals, particularly poultry and pig.

Application Analysis

Based on the application, the market for Eubiotics is divided into Gut Health, Immunity, Yield as well as others. The segment for Gut Health had the largest percentage of market shares, which was 36.3% in 2023.

Gut health applications held a significant market share. Its high market share can be attributed to the increasing prevalence of gut problems in animals and an increased desire for preventive healthcare. Eubiotic products increase intestinal microbiota production, which in turn improves digestion and the immune system. Gut health is possible with products such as essential oils, prebiotics, organic acids, and others.

These products can be used in combination or as an individual to obtain better results. Eubiotics are used in domestic animals to increase performance and improve health. The product’s effectiveness is dependent on its antimicrobial and gut flora effects. Gut health enhancers include fructo-oligosaccharide, mannan-oligosaccharide, beta-glucan, probiotics, and prebiotics.

Eubiotics improve the immune system of animals. While the immune system only accounts for a small percentage of total nutritional needs in an animal, activating it is a major challenge that has a significant effect on nutrition status. Low immunity levels can make animals more vulnerable to viruses, infections, and bacteria that could lead to death. Therefore, it is crucial to boost and develop immunity in both growing and newborn animals.

Form Analysis

Segmentation of the Eubiotics Market according to Form and Function, comprises Liquid as well as Solid. Solid was the dominant segment by 61.2% in 2023. The benefits of this segment, including greater protection from exposure to moisture and light are the reason for this substantial percentage. Solid forms include flakes beads, and cross-linked beads. In the process of making of feed, the beadlet technique effectively shields active components from mechanical stress, thereby increasing their bioavailability and stability.

The liquid form is increasing in recognition among feed formulators due to its contribution to better health and improved performance of animals in greater quantities when compared to solid forms as well as comes at a lower cost. Additionally the liquid version for these ingredients is sought-after due to their capacity to decrease enteric pathogens, gastric pH and also their value for money.

End Use Analysis

The market was dominated by the poultry segment is 35.8% in 2023. This high market share can be attributed to the increasing consumption and demand for poultry, duck, turkey, as well as boilers. Because of its low price, low-fat content, and fewer religious & cultural restrictions, chicken meat is popular.

The growing demand for pork has forced pork producers to produce high-quality, disease-free meat products that can be consumed by humans. The demand for feed additives has increased. Eubiotic ingredients can be used as dietary supplements or additives in swine food. They are known to improve the health and growth of animals, their gut health, and their reproductive health. They also help to improve animal health and decrease the animals’ mortality rates.

Due to the increased demand for meat and other dairy products, there will be a rise in demand for eubiotics. There is a rising demand for dairy products, such as milk, butter, and cheese. This has led to the need for large-scale improvement in the efficiency of dairy farms and the use of high-quality nutritive feed. The bovine feed should contain eubiotic ingredients to increase productivity and milk production. The demand for animal feed will rise due to increased beef consumption.

Key Market Segment

Product

Probiotics

- Lactobacilli

- Bifidobacterum

- Streptococcus

- Others

Prebiotics

- Fructo-oligosaccharides (FOS)

- Inulin

- Galacto-Oligosaccharides (GOS)

- Mannan-Oligosaccharides (MOS)

- Others

Organic Acids

Phytogenic

Enzymes

Form

- Liquid

- Solid

Application

- Gut Health

- Immunity

- Yield

- Others

End-use

- Cattle Feed

- Poultry Feed

- Swine Feed

- Aquatic Feed

- Others

Driving Factors

Rising Demand for Animal Products

Eubiotics are being driven by rising global demand for meat and dairy products, including meat. They play an essential part in improving animal performance, improving feed efficiency and improving overall health – factors which directly support meeting rising consumer expectations for high-quality animal-derived goods.

Trending Factors

A shift toward Natural Growth Promoters

One notable trend in the Eubiotics Market is its move away from antibiotic-based growth promoters towards natural alternatives like probiotics, prebiotics, organic acids and essential oils as reliable and sustainable growth promoters to support animal well-being and support animal growth and well-being.

Restraints Factors

Regulatory Challenges

A significant restraint in the Eubiotics Market is the evolving regulatory landscape surrounding feed additives. Stringent regulations and varying approval processes across regions pose challenges for market players in introducing new eubiotic products, impacting market growth.

Opportunities

Expanding Aquaculture Industry

One exciting opportunity lies within the expanding aquaculture sector. Eubiotics have proven beneficial in aquafeed formulations to promote gut health in fish and shrimp species; their incorporation can increase productivity while supporting sustainability efforts in aquaculture operations.

Regional Analysis

North America held a dominant position in the global market, accounting for 41.8% in 2023 and holding a USD 2.3 Billion value for the Eubiotics Market. This is due to increasing demand for processed foods, such as meat, and increasing livestock production. Italy, France, Germany, and other countries have witnessed a sharp rise in meat consumption in recent years. This has encouraged producers to source high-quality, disease-free animal products.

The region of North America can see a significant rise in product demand because of rising animal product demand and the fast-growing animal feed industry. The U.S. and Mexico are experiencing a rising demand for meat and other products. This has increased awareness of animal health and has helped to increase the use of animal feed products.

The Asia Pacific is one of the fastest-growing markets in the world. The increasing consumption of meat and meat products has led to a greater need for animal health and hygiene. This has prompted the demand to feed additives. The region’s demand for animal feed and supplements is being driven by the rising consumption of beef and pork in Japan, China, and India.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Due to the many players operating in the market, fragmentation has been called for. The majority of market share is held by market leaders, small-scale manufacturers, traders, and operators on local or national markets. Manufacturers are focused on improving their product ranges in order to be more competitive than other market players. These factors include supply chain, distribution channel, and technology.

Маrkеt Кеу Рlауеrѕ

- DSM

- Novus International, Inc.

- UAS Laboratories

- Lallemand, Inc.

- Calpis Co., Ltd.

- Advanced BioNutrition Corp

- BENEO

- BEHN MEYER

- Lesaffre Group

- Kemin Industries, Inc.

- DuPont de Nemours, Inc.

- Novozymes

- Associated British Foods plc

- Chr. Hansen Holding A/S

- Evonik Industries AG

Recent Development

- Innovations in Eubiotic Products: Research and development initiatives may have led to the creation of novel eubiotic products with enhanced formulations and efficacy, including probiotics, prebiotics, organic acids and essential oils that could address specific challenges related to animal nutrition.

- Expanding Eubiotics Use in Aquaculture: Due to the growing significance of aquaculture, recent trends include further integration of eubiotics into aquafeed formulations. Companies might explore new strategies that improve gut health and overall performance of fish and shrimp farming operations.

- Regulatory Updates and Compliance: Feed additive regulation changes have had a direct impact on this industry. Recent developments may include updates in regulations governing eubiotics; companies in this market may need to adapt or navigate through evolving regulatory environments in order to stay profitable.

- Market Players and Partnerships: Recent market developments could involve strategic moves by key market players, including partnerships, collaborations, mergers, or acquisitions. Such initiatives might aim to strengthen product portfolios, expand market presence or leverage complementary capabilities.

Report Scope

Report Features Description Market Value (2023) USD 5.6 Billion Forecast Revenue (2033) USD 31.1 Billion CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product-Probiotics(Lactobacilli, Bifidobacterum, Streptococcus, Others)Prebiotics(Fructo-oligosaccharides (FOS), Inulin, Galacto-Oligosaccharides (GOS), Mannan-Oligosaccharides (MOS), Others)Organic

Acids,Phytogenic,Enzymes,Form-(Liquid, Solid) Application-(Gut Health, Immunity, Yield, Others)End-use-(Cattle Feed, Poultry Feed, Swine Feed, Aquatic Feed, Others)Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape DSM, Novus International, Inc., UAS Laboratories, Lallemand, Inc., Calpis Co., Ltd., Advanced BioNutrition Corp, BENEO, BEHN MEYER, Lesaffre Group, Kemin Industries, Inc., DuPont de Nemours, Inc., Novozymes, Associated British Foods plc, Chr. Hansen Holding A/S, Evonik Industries AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are eubiotics in the context of animal nutrition?Eubiotics refer to substances, including probiotics, prebiotics, organic acids, and essential oils, used in animal nutrition to promote a balanced microbial environment in the gastrointestinal tract, enhancing overall health and performance.

How big is the Eubiotics Market?The global Eubiotics Market size was estimated at USD 5.6 Billion in 2023 and is expected to reach USD 31.1 Billion in 2033.

What is the Eubiotics Market growth?The global Eubiotics Market is expected to grow at a compound annual growth rate of 8.9%. From 2023 To 2033

Who are the key companies/players in the Eubiotics Market?Some of the key players in the Eubiotics Markets are DSM, Novus International, Inc., UAS Laboratories, Lallemand, Inc., Calpis Co., Ltd., Advanced BioNutrition Corp, BENEO, BEHN MEYER, Lesaffre Group, Kemin Industries, Inc., DuPont de Nemours, Inc., Novozymes, Associated British Foods plc, Chr. Hansen Holding A/S, Evonik Industries AG

How do eubiotics benefit animals in agriculture?Eubiotics contribute to improved animal performance by supporting digestion, nutrient absorption, and immune function. They are often used as alternatives to traditional growth promoters in livestock and aquaculture.

What is driving the demand for eubiotics in animal feed?The rising global demand for animal products, coupled with a shift towards sustainable and natural growth promoters, is driving the demand for eubiotics in animal feed to enhance feed efficiency and promote animal well-being.

Are there regulatory challenges associated with eubiotics?Yes, the Eubiotics Market faces regulatory challenges related to the approval and use of feed additives. Stringent regulations and varying approval processes across regions can impact the introduction of new eubiotic products.

-

-

- DSM

- Novus International, Inc.

- UAS Laboratories

- Lallemand, Inc.

- Calpis Co., Ltd.

- Advanced BioNutrition Corp

- BENEO

- BEHN MEYER

- Lesaffre Group

- Kemin Industries, Inc.

- DuPont de Nemours, Inc.

- Novozymes

- Associated British Foods plc

- Chr. Hansen Holding A/S

- Evonik Industries AG