Global Ethylbenzene Market By Purity(Upto 99%, Above 99%), By Form(Liquid, Solid), By Application(Gasoline, Diethylbenzene, Natural Gas, Paint, Asphalt and Naphtha, Others), By End User Industry(Packaging, Electronics, Construction, Automotive, Agriculture, Others), By Distribution Channel(Direct Sales, Indirect Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122376

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

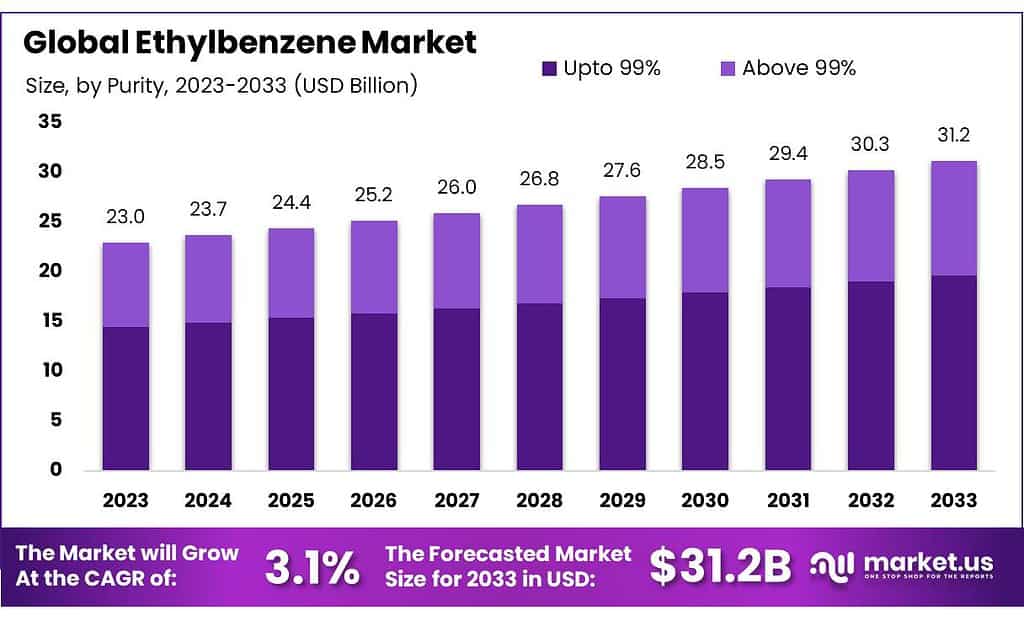

The global Ethylbenzene Market size is expected to be worth around USD 31.2 billion by 2033, from USD 23.0 billion in 2023, growing at a CAGR of 3.1% during the forecast period from 2023 to 2033.

Ethylbenzene is an organic compound characterized by the chemical formula C8H10. It is a colorless, flammable liquid with a distinct, sweet-smelling aroma, commonly associated with paints, inks, and varnishes. This compound is primarily used as an intermediate in the production of styrene, a precursor to polystyrene, a widely used plastic, and rubber—the production of styrene accounts for the majority of ethylbenzene usage globally.

In the industrial sector, ethylbenzene is produced through the alkylation of benzene with ethylene, typically in the presence of a catalyst such as aluminum chloride or zeolite. This process yields a high-purity product that is essential for the subsequent production of high-quality polystyrene products.

The market for ethylbenzene is largely driven by its demand in the manufacture of polystyrene and other styrene derivatives. These materials are pivotal in various applications including packaging, insulation, automotive components, and consumer electronics, highlighting the compound’s importance in modern manufacturing and industry. The demand for ethylbenzene is closely tied to economic conditions, as its end-use products are linked to consumer goods and construction activities.

However, ethylbenzene poses environmental and health risks. It is categorized as a volatile organic compound (VOC), contributing to air pollution and the formation of ground-level ozone, a key component of urban smog. Additionally, exposure to ethylbenzene can cause respiratory issues, and irritation of the eyes, skin, and throat, and long-term exposure has been linked to more severe health impacts.

Regulatory frameworks aimed at reducing VOC emissions influence the ethylbenzene market. Innovations in production technology that minimize environmental impact without compromising the material properties required by end-users are critical for the sustained growth of the ethylbenzene market. As such, the industry continues to seek methods to reduce its environmental footprint while meeting the growing global demand for its derivatives.

Key Takeaways

- Market Size and Growth: Ethylbenzene market expected to grow from USD 23.0 billion in 2023 to USD 31.2 billion by 2033, at a CAGR of 3.1%.

- Purity Segmentation: In 2023, ethylbenzene with up to 99% purity held over 63.2% market share, favored for cost-effectiveness in industrial applications.

- Form Preferences: Liquid ethylbenzene dominated with over 45.1% market share due to ease of handling in chemical processes.

- Key End-User Industries: Automotive sector led with over 56.2% market share, using ethylbenzene in synthetic rubber and plastics.

- Distribution Channels: Indirect sales dominated with over 61.2% market share, facilitating widespread accessibility across industries.

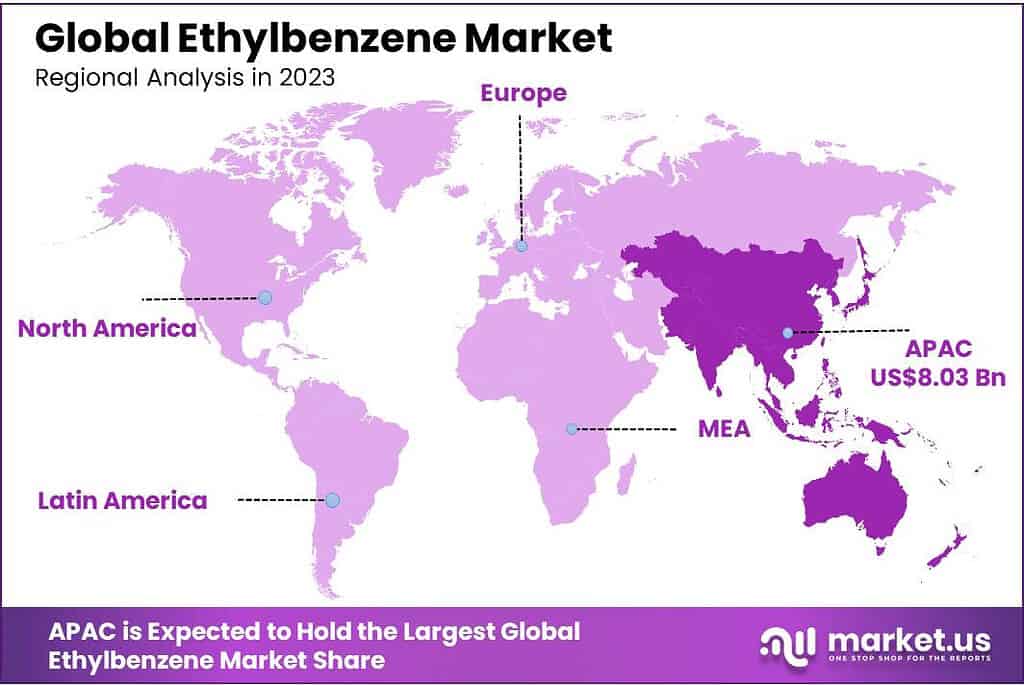

- Regional Insights: Asia Pacific holds the largest market share (34.9%) due to extensive adoption in petrochemicals and plastics manufacturing.

By Purity

In 2023, ethylbenzene with a purity of up to 99% held a dominant market position, capturing more than a 63.2% share. This segment’s prominence is attributed to its broad application in the production of various chemical products where extremely high purity is not a critical requirement.

Ethylbenzene with up to 99% purity is extensively used in industries such as synthetic rubbers and adhesives, where it serves as a key solvent and intermediate compound. Its cost-effectiveness compared to higher purity grades makes it a preferred choice for manufacturers looking to balance quality with production costs.

On the other hand, ethylbenzene with a purity above 99% caters to more specialized applications that demand higher quality and performance standards. This segment is critical in the production of polystyrene and other high-performance plastics, where even minor impurities can significantly affect the properties of the final product. Although this higher purity category has a smaller market share, it commands a premium price and is essential for applications requiring stringent compliance with health, safety, and environmental regulations.

By Form

In 2023, Liquid ethylbenzene held a dominant market position, capturing more than a 45.1% share. This form is preferred due to its versatility and ease of use in industrial applications such as the production of styrene, where it is a key solvent. The liquid form allows for straightforward handling and integration into various chemical processes, making it essential in sectors like plastics and synthetic rubber manufacturing.

Solid ethylbenzene, while less common, serves specific needs in areas where liquid forms may pose storage or safety challenges. It is used in certain niche applications that require precise dosing and where powder form can offer advantages in terms of stability and dispersion. Although it has a smaller market share compared to its liquid counterpart, solid ethylbenzene is crucial for specialized applications that benefit from its unique properties.

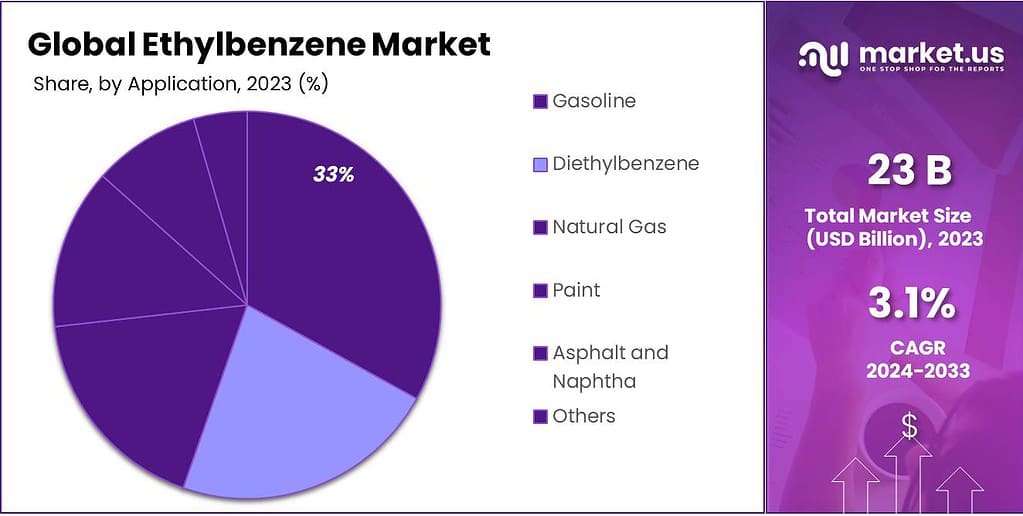

By Application

By End User Industry

In 2023, the Automotive sector held a dominant market position in the ethylbenzene market, capturing more than a 56.2% share. Ethylbenzene is crucial in this industry primarily for the production of synthetic rubbers and plastics used in vehicle manufacturing. Its applications range from tire components to dashboard panels, highlighting its essential role in enhancing durability and performance in automotive materials.

The Packaging industry also utilizes ethylbenzene, especially in the production of polystyrene which is used for manufacturing protective packaging, containers, and insulation materials. This application capitalizes on the lightweight and insulative properties of polystyrene, making ethylbenzene important for sustainable and efficient packaging solutions.

In Electronics, ethylbenzene is used to produce parts like casings and insulation materials. Its role in forming polymers that meet the high standards for safety and performance in electronics underpins its steady demand in this sector.

The Construction industry benefits from ethylbenzene through its use in making construction materials like insulation panels and sealants. These applications leverage the chemical’s properties to enhance energy efficiency and durability in building projects.

For the Automotive industry, ethylbenzene’s role extends to components such as hoses and gaskets, further solidifying its integral use in producing both functional and aesthetic vehicle parts.

Agriculture uses ethylbenzene-derived products for making containers and films used in agricultural operations, demonstrating its versatility and utility in various supportive roles.

By Distribution Channel

In 2023, Indirect Sales held a dominant market position in the ethylbenzene market, capturing more than a 61.2% share. This channel’s success is largely due to its extensive network of distributors and resellers, which facilitates broader access to ethylbenzene across various industries globally.

The availability of indirect sales allows manufacturers to efficiently reach a diverse customer base, from large industrial clients to smaller, specialized firms, ensuring widespread distribution and accessibility.

Direct Sales also play a significant role in the ethylbenzene market, providing a direct connection between manufacturers and large consumers.

This distribution channel is particularly valued by companies seeking precise formulations and customized chemical delivery schedules, which are critical for maintaining production efficiencies and meeting specific industry standards. Direct sales are appreciated for their ability to offer tailored services and quicker response times, ensuring that client needs are directly addressed with a high level of customer service.

Key Market Segments

By Purity

- Upto 99%

- Above 99%

By Form

- Liquid

- Solid

By Application

- Gasoline

- Diethylbenzene

- Natural Gas

- Paint

- Asphalt and Naphtha

- Others

By End User Industry

- Packaging

- Electronics

- Construction

- Automotive

- Agriculture

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Drivers

Growing Demand for Polystyrene and Expanded Polystyrene Products

A major driver propelling the ethylbenzene market is the increasing demand for polystyrene and expanded polystyrene (EPS) products. Ethylbenzene is a primary raw material in the production of styrene, which is subsequently polymerized to create polystyrene. This versatile plastic is widely used in various applications ranging from packaging materials to insulation in the building and construction industry. Its lightweight, insulating properties and ease of molding make it ideal for producing a wide array of products, including disposable containers, protective packaging, and insulation panels.

The surge in demand for polystyrene is closely linked to the global growth in the packaging industry, which is driven by the expanding e-commerce sector and the increasing consumption of packaged foods. As online shopping continues to grow, so does the need for effective and efficient packaging solutions that protect goods during shipping. Polystyrene, with its excellent cushioning and insulation properties, is one of the preferred materials for packaging solutions, particularly for fragile items and food products that require temperature control.

Additionally, the building and construction sector contributes significantly to the demand for ethylbenzene through its use in manufacturing EPS. EPS is extensively used as an insulation material in walls, roofs, and floors, contributing to energy efficiency in buildings. With the increasing focus on sustainable and energy-efficient building practices, the use of EPS in construction is expected to rise, further boosting the demand for ethylbenzene.

Furthermore, the automotive industry utilizes polystyrene and its derivatives for various applications, including parts of the interior body of vehicles, such as knobs, instrument panels, and energy-absorbing door panels. As the automotive industry continues to recover and grow, especially with an increasing emphasis on lightweight materials to enhance fuel efficiency, the demand for polystyrene products is likely to increase.

However, the market faces challenges, such as environmental concerns associated with the production and disposal of polystyrene products, which are often not biodegradable. These environmental impacts are prompting research into and development of more sustainable alternatives. Nonetheless, the current applications and innovations in recycling technologies are mitigating some of these impacts, maintaining the demand for ethylbenzene.

Restraints

Environmental and Health Concerns Associated with Ethylbenzene

A significant restraint on the growth of the ethylbenzene market is the environmental and health concerns associated with its production and use. Ethylbenzene is classified as a volatile organic compound (VOC), and its emissions can contribute to air pollution and the formation of ground-level ozone. These environmental impacts are particularly concerning in urban and industrial areas where the concentration of VOCs can lead to significant air quality issues, affecting not only the environment but also public health.

Health concerns related to ethylbenzene exposure are substantial. Short-term exposure to ethylbenzene can irritate the eyes, skin, and respiratory tract, while long-term exposure has been linked to more severe health effects such as neurological issues and kidney damage. Furthermore, the International Agency for Research on Cancer (IARC) has classified ethylbenzene as a possible human carcinogen, which raises serious concerns about its safety in occupational settings and among the general population.

These health and environmental risks have led to stringent regulatory measures aimed at controlling ethylbenzene emissions. Regulations such as the U.S. Environmental Protection Agency’s (EPA) National Emission Standards for Hazardous Air Pollutants (NESHAP) are designed to limit VOC emissions from industrial operations, including those involving ethylbenzene. Such regulations necessitate significant investment from industries to install control technologies and monitor emissions, which can be a costly process.

Additionally, the public’s growing environmental awareness and demand for safer, greener products are pushing companies to look for alternatives to ethylbenzene. This shift is particularly evident in the packaging and construction industries, where there is a move towards using materials that are less harmful to the environment and human health. The development and adoption of such alternatives could potentially reduce the demand for ethylbenzene, posing a long-term challenge to its market.

Despite these challenges, the ethylbenzene industry continues to implement improvements in production technologies to reduce harmful emissions and improve safety. Innovations in chemical processing, better containment methods, and advancements in recycling and waste management practices are all efforts aimed at mitigating the environmental and health impacts of ethylbenzene use.

Opportunity

Expansion into Emerging Markets with Growing Industrial Sectors

A major opportunity for the ethylbenzene market lies in its expansion into emerging markets, particularly those with rapidly growing industrial sectors such as Asia, Africa, and South America. These regions are experiencing significant economic growth, urbanization, and industrialization, which are driving demand for a wide range of products including plastics, synthetic rubbers, and other ethylbenzene-derived materials.

As these economies continue to develop, there is an increasing need for durable and cost-effective materials in construction, automotive manufacturing, and consumer goods. Ethylbenzene, as a precursor to styrene, which is used extensively in the production of polystyrene and other styrenic polymers, is positioned to meet this rising demand. The versatility of these polymers in various applications—from packaging solutions that require lightweight and protective materials to insulation products in the construction industry—highlights the potential for ethylbenzene market growth in these regions.

Moreover, many emerging markets are still in the early stages of establishing comprehensive environmental regulations, which might initially lower the barriers to setting up chemical manufacturing facilities that produce or use ethylbenzene. However, this also presents an opportunity for ethylbenzene producers to lead by example, implementing and promoting sustainable practices and advanced emission control technologies that could set industry standards and positively influence local regulations.

Additionally, the expansion into these new markets could stimulate local economies by creating jobs, fostering technological advancements, and encouraging the development of local ancillary industries related to chemical manufacturing and environmental management. By doing so, ethylbenzene producers can not only capitalize on new market opportunities but also contribute to the sustainable development of these regions.

This strategic expansion requires careful consideration of local market dynamics, potential regulatory changes, and environmental impacts. Building strong relationships with local partners, understanding the specific needs and challenges of these markets, and investing in community relations and sustainable practices will be key to successful and responsible market penetration.

Trends

Increasing Focus on Sustainable and Environmentally Friendly Alternatives

A significant trend shaping the ethylbenzene market is the increasing focus on developing sustainable and environmentally friendly alternatives. As global awareness of environmental issues grows, industries are seeking greener solutions that minimize ecological impact. Ethylbenzene, traditionally used in the production of polystyrene and other plastics, is under scrutiny due to its volatile organic compound (VOC) emissions and potential health risks.

In response, researchers and companies are investing in technologies and processes that either reduce the environmental footprint of ethylbenzene production or develop alternative materials that can fulfill the same roles without the associated environmental and health concerns. For example, advancements in catalyst technology have made it possible to produce ethylbenzene and styrene with fewer emissions and lower energy consumption. Moreover, the recycling of polystyrene has become a key focus area, aiming to reduce waste and promote a circular economy where ethylbenzene-based products are reused rather than disposed of.

Additionally, the push for biodegradable and renewable materials is gaining momentum. Bio-based alternatives to traditional ethylbenzene-derived products are being developed, using natural raw materials that can decompose naturally without leaving harmful residues. These materials are particularly appealing in industries such as packaging, where single-use products are prevalent.

This trend towards sustainability is not just driven by regulatory pressure and environmental activism but also by consumer preferences. More consumers are demanding environmentally responsible products, prompting companies to revise their product lines and manufacturing processes to cater to this market demand.

While these developments pose challenges to the traditional ethylbenzene market, they also open up new opportunities for innovation and differentiation. Companies that lead in sustainability efforts and introduce eco-friendly products can capture a significant competitive advantage, especially in markets that are highly regulated and in regions with environmentally conscious consumers.

Regional Analysis

In the Ethylbenzene Market, the Asia Pacific region stands out as a key player, holding a leading market share of 34.9%. Analysts project the market to reach a value of USD 8.03 Billion by the end of the forecast period. This growth is fueled by extensive adoption across critical sectors such as petrochemicals, plastics manufacturing, and construction.

Key economies in the region, including China, India, Japan, and South Korea, play pivotal roles in this upward trend. These countries demonstrate a significant rise in Ethylbenzene usage, driven by increasing demand for raw materials in various industries, including petrochemicals and construction. Additionally, the region’s emphasis on sustainable practices and stringent regulatory frameworks further enhances its position in the global Ethylbenzene market.

In North America, the Ethylbenzene market is experiencing steady expansion. This growth is driven by rising demand from industries utilizing Ethylbenzene for the production of styrene, a key component in plastics manufacturing and automotive applications. The region’s robust industrial base and advancements in chemical processing technologies contribute significantly to the adoption of Ethylbenzene solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Ethylbenzene Market, several key players contribute significantly to shaping the industry landscape. Cepsa, a prominent player, leverages its extensive experience in petrochemicals and refining to maintain a robust position. JXTG Nippon Oil & Energy Corporation, another major player, brings expertise from its diversified operations in energy and chemicals. ISU Chemical, known for its specialization in aromatic hydrocarbons, including Ethylbenzene, plays a pivotal role in the market with its innovative production capabilities.

Qatar Petroleum, a global leader in the energy sector, contributes to the Ethylbenzene market through its substantial production capacities and strategic investments. Deten Quimica S.A., based in Spain, stands out with its focus on sustainable chemical solutions, adding to the market’s diversity. Chevron Phillips Chemical Company, known for its integrated petrochemical operations, including Ethylbenzene production, strengthens market dynamics with its global reach and technological advancements.

Honeywell International Inc. brings advanced technologies to Ethylbenzene production, enhancing efficiency and sustainability. Jingtung Petrochemical Corp., Ltd, based in Taiwan, contributes significantly to the Asian market with its production capabilities and strategic partnerships. SASOL, a key player from South Africa, plays a crucial role in global supply chains with its extensive chemical manufacturing expertise. Huntsman International LLC, known for its innovation in chemical solutions, including Ethylbenzene derivatives, drives market growth with its diverse product portfolio.

Reliance Industries Limited, a major player from India, contributes to the Ethylbenzene market through its integrated petrochemical operations. PT Unggul Indah Cahaya Tbk, based in Indonesia, adds regional diversity with its production capacities. S.B.K HOLDING, focusing on chemicals and petrochemicals, including Ethylbenzene, contributes to market dynamics with its strategic initiatives. Indian Oil Corporation Ltd, a significant player in the energy sector, extends its influence into petrochemicals, including Ethylbenzene production.

Market Key Players

- Cepsa

- JXTG Nippon Oil & Energy Corporation

- ISU Chemical

- Qatar Petroleum

- Deten Quimica S.A.

- Chevron Phillips Chemical Company

- Honeywell International Inc

- Jingtung Petrochemical Corp., Ltd

- SASOL

- Huntsman International LLC.

- Reliance Industries Limited

- PT Unggul Indah Cahaya Tbk

- S.B.K HOLDING

- Indian Oil Corporation Ltd

- Desmet Ballestra

- Farabi Petrochemicals Co

Recent Development

In January 2023, Cepsa enhanced its Ethylbenzene production capacity by 10%, aiming to meet growing market demand.

In January 2023 JXTG Nippon Oil & Energy Corporation, the company announced a 15% increase in Ethylbenzene production capacity, aiming to meet rising global demand.

Report Scope

Report Features Description Market Value (2023) US$ 23.0 Bn Forecast Revenue (2033) US$ 31.2 Bn CAGR (2024-2033) 3.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity(Upto 99%, Above 99%), By Form(Liquid, Solid), By Application(Gasoline, Diethylbenzene, Natural Gas, Paint, Asphalt and Naphtha, Others), By End User Industry(Packaging, Electronics, Construction, Automotive, Agriculture, Others), By Distribution Channel(Direct Sales, Indirect Sales) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Cepsa, JXTG Nippon Oil & Energy Corporation, ISU Chemical, Qatar Petroleum, Deten Quimica S.A., Chevron Phillips Chemical Company, Honeywell International Inc, Jingtung Petrochemical Corp., Ltd, SASOL, Huntsman International LLC., Reliance Industries Limited, PT Unggul Indah Cahaya Tbk, S.B.K HOLDING, Indian Oil Corporation Ltd, Desmet Ballestra, Farabi Petrochemicals Co Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Ethylbenzene Market?Ethylbenzene Market size is expected to be worth around USD 31.2 billion by 2033, from USD 23.0 billion in 2023

What is the CAGR for the Ethylbenzene Market?The Ethylbenzene Market is expected to grow at a CAGR of 3.1% during 2024-2033.Name the major industry players in the Ethylbenzene Market?Cepsa, JXTG Nippon Oil & Energy Corporation, ISU Chemical, Qatar Petroleum, Deten Quimica S.A., Chevron Phillips Chemical Company, Honeywell International Inc, Jingtung Petrochemical Corp., Ltd, SASOL, Huntsman International LLC., Reliance Industries Limited, PT Unggul Indah Cahaya Tbk, S.B.K HOLDING, Indian Oil Corporation Ltd, Desmet Ballestra, Farabi Petrochemicals Co

-

-

- Cepsa

- JXTG Nippon Oil & Energy Corporation

- ISU Chemical

- Qatar Petroleum

- Deten Quimica S.A.

- Chevron Phillips Chemical Company

- Honeywell International Inc

- Jingtung Petrochemical Corp., Ltd

- SASOL

- Huntsman International LLC.

- Reliance Industries Limited

- PT Unggul Indah Cahaya Tbk

- S.B.K HOLDING

- Indian Oil Corporation Ltd

- Desmet Ballestra

- Farabi Petrochemicals Co