Global Esports Event Insurance Market Size, Share and Analysis Report By Coverage Type (Event Cancellation Insurance, Prize Pool Insurance, Non-Appearance Insurance, Equipment & Asset Insurance, Others), By Event Size (Major Tournaments, Minor Leagues, Local LAN Events, Online Competitions), By End-User (Tournament Organizers, Esports Teams, Venue Operators), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177208

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- U.S. Esports Event Insurance Market Size

- Coverage Type Analysis

- Event Size Analysis

- End-User Analysis

- Trends and Disruptions Impacting Customers

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

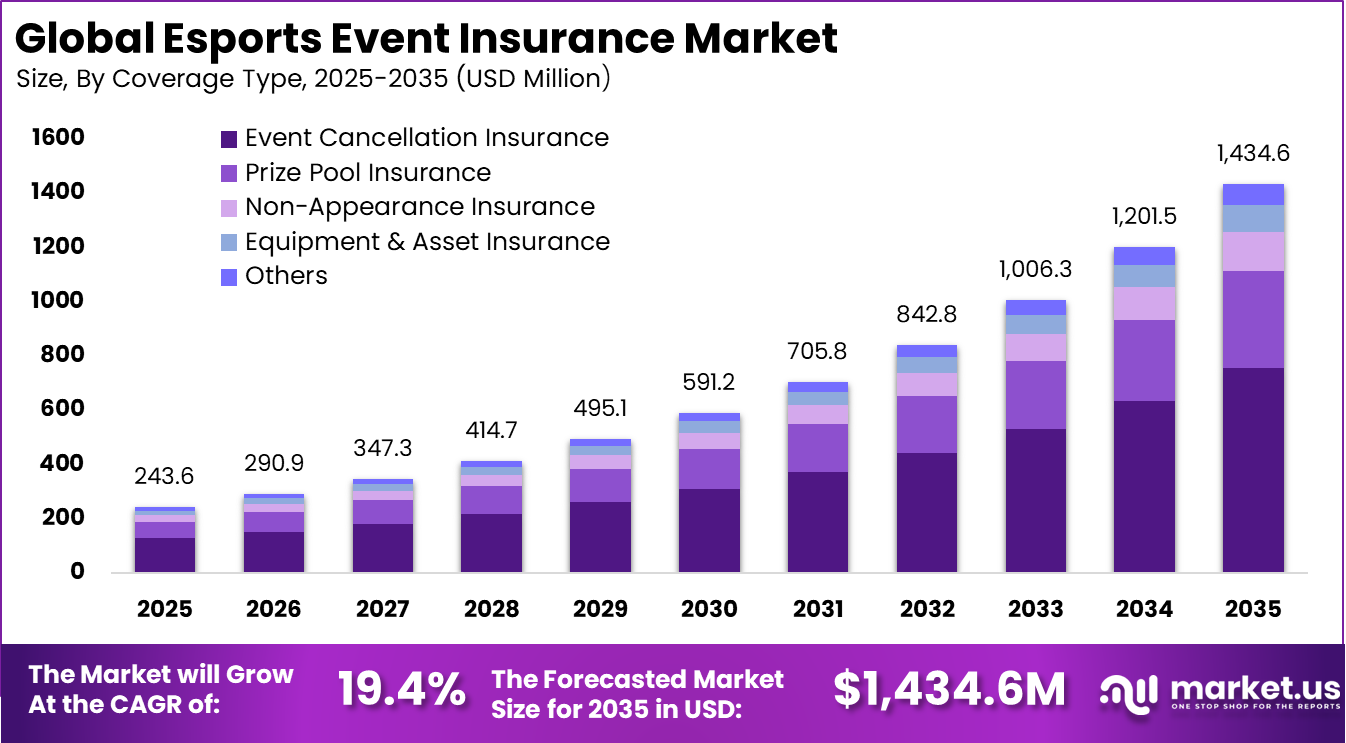

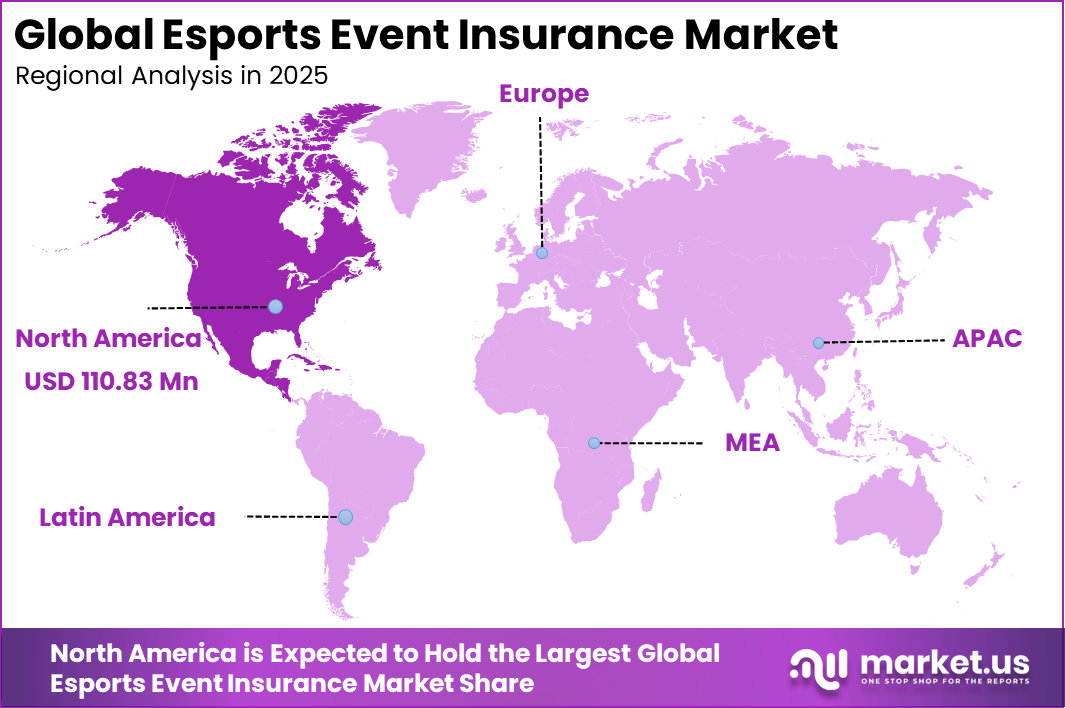

The Global Esports Event Insurance Market size is expected to be worth around USD 1,434.6 million by 2035, from USD 243.6 million in 2025, growing at a CAGR of 19.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 45.5% share, holding USD 110.83 million in revenue.

The Esports Event Insurance Market refers to specialized insurance coverage designed to protect organizers, venues, sponsors, and participants involved in esports tournaments and live gaming events. These policies address risks related to event cancellation, technical failure, equipment damage, liability claims, and participant related incidents. Esports events combine live audiences, digital platforms, and high value equipment, which creates a unique risk profile compared to traditional sports events.

Coverage in this market typically supports both physical and virtual event formats, including arena based tournaments and online competitions. As esports events grow in scale and production complexity, financial exposure increases across multiple dimensions. Industry observations indicate that large esports events can involve hundreds of players, thousands of spectators, and significant broadcast infrastructure, increasing potential loss impact.

Demand for esports event insurance is increasing among professional tournament organizers and venue operators. These entities manage multiple events each year and require consistent risk transfer mechanisms. Industry data suggests that more than 60% of large esports events now involve third party vendors and international participants, increasing contractual risk. Insurance is often required to satisfy partner and venue agreements.

Media and intellectual property risks play a central role in the esports ecosystem. Sponsorships account for more than 35% of global esports revenue, making insurance essential to protect against contract breaches and IP infringement. Incidents such as unintended display of competing sponsor brands can trigger financial penalties and reputational damage for teams and organizers.

Cyber liability is an increasing concern as the esports user base continues to expand. With an estimated 924.9 million users expected by 2030, the risk of streaming outages, cyberattacks, and data breaches has become a primary exposure for event organizers and platforms. Insurance coverage is being used to mitigate losses from service disruptions and digital security incidents.

For instance, in September 2025, Willis Towers Watson expanded its sports group with new global risk tools for esports organizers, focusing on prize indemnity and production risks. This follows regional broker acquisitions, boosting middle-market tournament coverage.

Key Takeaway

- By coverage type, event cancellation insurance led the Esports Event Insurance Market with a 52.7% share, reflecting high exposure to schedule disruptions and venue related risks.

- By event size, major tournaments accounted for 61.9% of total coverage demand, supported by larger budgets, higher audience reach, and greater financial stakes.

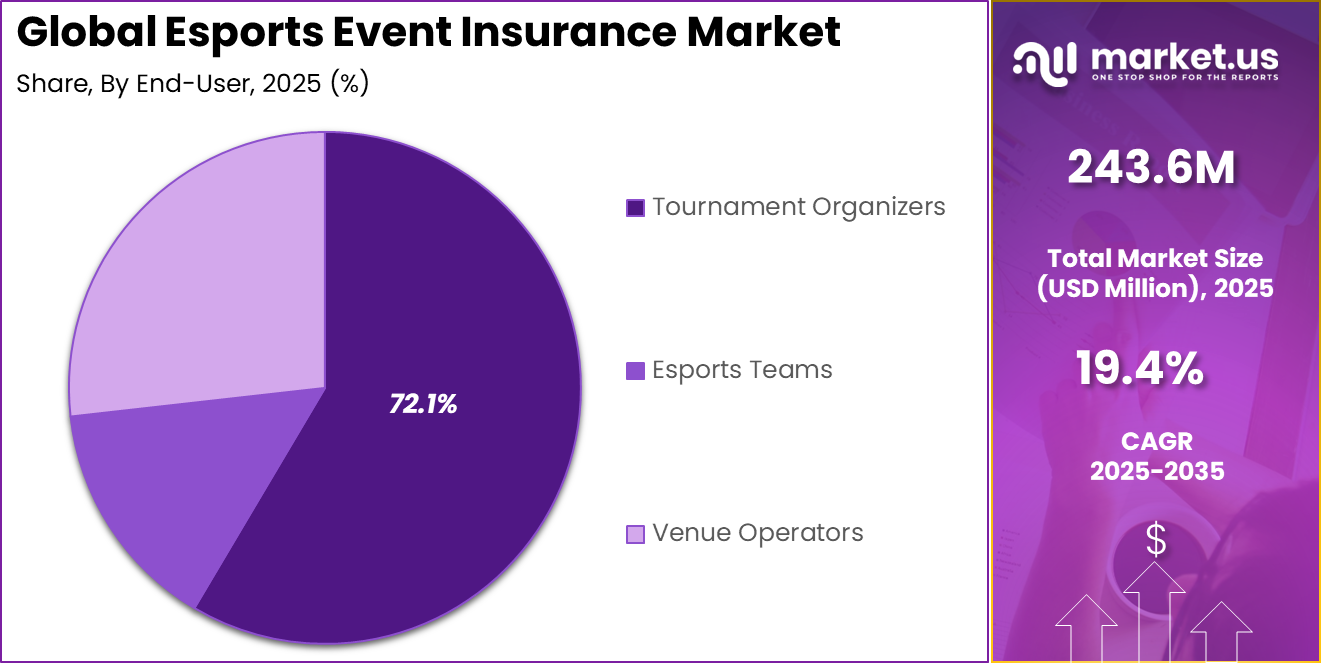

- By end user, tournament organizers represented the largest buyer group, holding a 72.1% share due to direct responsibility for event execution and risk management.

- Regionally, North America dominated the market with a 45.5% share, supported by a well developed esports ecosystem.

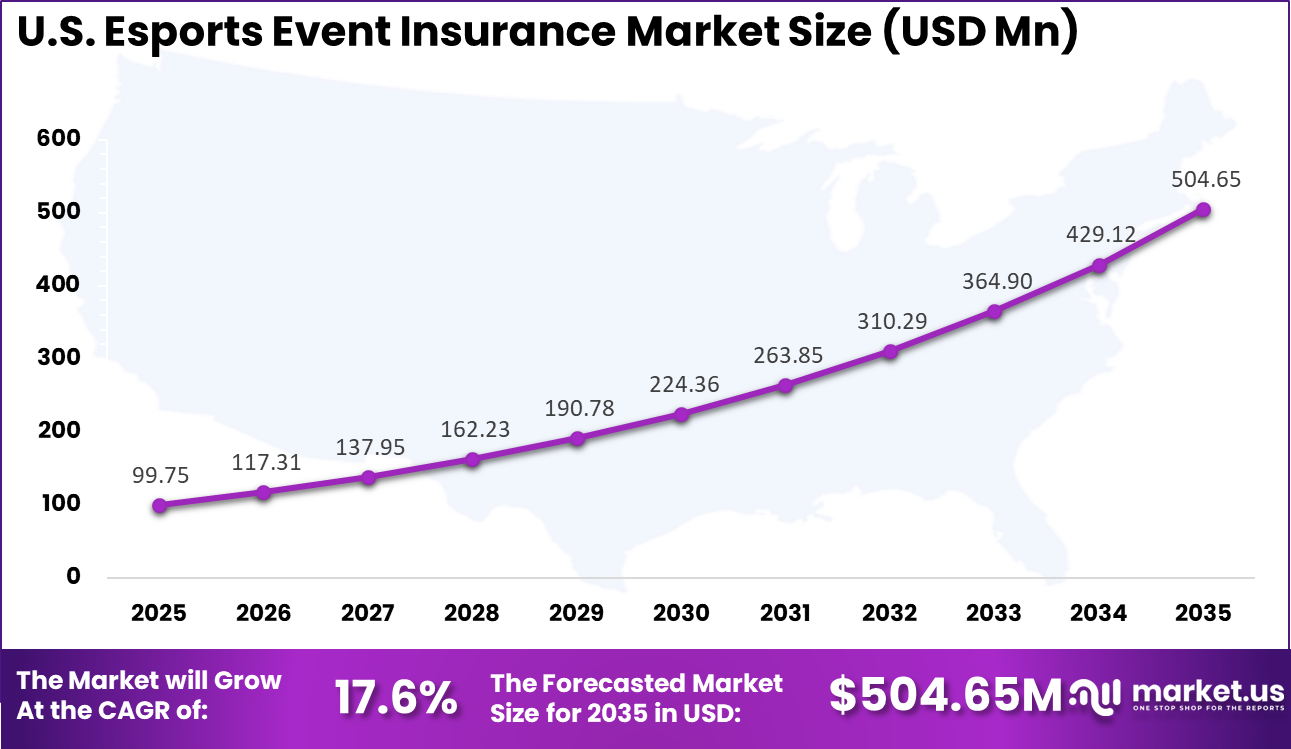

- In the US, the Esports Event Insurance Market reached USD 99.75 million and recorded a CAGR of 17.6%, driven by increasing frequency of large scale competitive events.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rapid growth in global esports tournaments and live events +5.3% North America, Europe Short to medium term Increasing prize pools and commercial sponsorship exposure +4.4% North America, Asia Pacific Medium term Rising risk of event cancellation, technical failures, and cyber incidents +3.8% Global Short term Expansion of hybrid online and offline esports events +3.2% Global Medium term Growing professionalization of esports event management +2.7% North America, Europe Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High premium sensitivity among small tournament organizers -3.1% Global Short to medium term Limited insurance awareness within emerging esports markets -2.6% Asia Pacific, Latin America Medium term Difficulty in underwriting digital and cyber-related event risks -2.2% Global Medium term Volatility in esports event scheduling and attendance -1.8% Global Short term Inconsistent regulatory recognition of esports events -1.5% Europe Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Specialized event insurance providers High Medium North America, Europe Niche but fast-growing premiums Large commercial insurers Medium Low to Medium Global Portfolio diversification Esports event organizers and leagues High Medium Global Risk transfer and continuity Private equity firms Medium Medium North America, Europe Consolidation of niche insurance Venture capital investors Low to Medium High North America Limited to insurtech tools Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Digital policy issuance and online underwriting platforms +3.9% Faster event coverage North America, Europe Short term Real-time risk monitoring for technical and cyber events +3.2% Loss prevention Global Medium term Predictive analytics for event disruption and attendance risk +2.7% Pricing accuracy North America Medium term Automated claims processing and settlement systems +2.3% Faster payouts Global Medium to long term Integration with event management and ticketing platforms +1.9% Embedded insurance North America Long term U.S. Esports Event Insurance Market Size

The market for Esports Event Insurance within the U.S. is growing tremendously and is currently valued at USD 99.75 million, the market has a projected CAGR of 17.6%. The market grows fast due to booming tournaments, packed arenas, and massive online audiences that crank up financial stakes.

Organizers face cyber attacks, tech glitches, weather disruptions, and player injuries that threaten big sponsorships and prizes, so they snap up coverage like cancellation policies. Strong regulations and tech-savvy insurers offer tailored plans, while rising awareness after past flops pushes more events to protect venues, streams, and crowds.

For instance, in June 2023, Marsh launched tailored personal accident insurance for esports teams, covering disabilities from degenerative diseases for players up to age 23. This innovation underscores U.S.-based Marsh’s dominance in specialized esports coverage, addressing unique health risks in competitive gaming.

In 2025, North America held a dominant market position in the Global Esports Event Insurance Market, capturing more than a 45.5% share, holding USD 110.83 million in revenue. This dominance is due to the strong concentration of large scale esports tournaments, advanced digital infrastructure, and high awareness of risk management among event organisers.

The region benefits from mature insurance practices, clear contractual norms, and frequent live and hybrid esports events. Strong sponsor participation and higher financial exposure further push organisers to secure insurance coverage.

For instance, in September 2024, AIG’s specialty division acquired eSportsInsurance, enhancing its offerings for amateur and youth esports events nationwide. This strategic move bolsters North American leadership by providing tailored liability, event cancellation, and risk management solutions for the rapidly expanding esports sector.

Coverage Type Analysis

In 2025, Event cancellation insurance accounts for 52.7% of overall adoption in the Esports Event Insurance Market. This dominance reflects the high sensitivity of esports events to disruptions such as technical failures, venue issues, and last minute participant withdrawals. Financial exposure from ticket refunds and sponsorship obligations makes cancellation coverage a priority.

The importance of cancellation insurance has increased as esports events grow in scale and complexity. Live broadcasts, online streaming commitments, and global audiences amplify the impact of cancellations. Coverage helps protect revenue streams and contractual commitments.

Event organizers also face uncertainty related to external factors that can interrupt schedules. Insurance coverage provides financial stability during unforeseen disruptions. These factors sustain strong demand for event cancellation insurance.

For Instance, in September 2025, Chubb highlighted flexible event cancellation policies for high-stakes gatherings. Drawing from cases like weather-hit swims or band tours, they cover irrecoverable costs in esports setups. This supports rising demand for cancellation protection amid bigger prize pools and live streams.

Event Size Analysis

In 2025, the Major tournaments represent 61.9% of total event size coverage. Large scale events involve significant investment in venues, production, marketing, and prize pools. The financial stakes are higher, increasing the need for comprehensive insurance protection. Major tournaments also attract global audiences and sponsors.

Any disruption can result in reputational and financial damage. Insurance coverage mitigates these risks and supports event continuity planning. The complexity of organizing large tournaments further drives insurance adoption. Multiple stakeholders and vendors increase operational risk. This maintains the dominance of major tournaments within this segment.

For instance, in June 2025, Miller Insurance expanded esports coverage for major tournaments. They focus on risks in large events like League of Legends finals, offering prize indemnity and cyber protection. This aids growth as organizers of big prize events seek financial safeguards against outages or attacks.

End-User Analysis

In 2025, Tournament organizers account for 72.1% of total end user demand in the Esports Event Insurance Market. These entities are directly responsible for event execution and financial outcomes. Insurance coverage is essential to manage liability and operational risk. Organizers face exposure related to venue contracts, participant agreements, and broadcast rights.

Insurance helps protect against losses arising from cancellations or disruptions. This is critical for maintaining business sustainability. As esports events professionalize, organizers increasingly adopt formal risk management practices. Insurance is integrated into event planning processes. This reinforces strong demand from tournament organizers.

For Instance, in November 2025, Zurich Insurance renewed sponsorship for a major PGA event, extending to esports organizers. They offer cancellation solutions for tournament hosts facing venue or player issues. This bolsters end-user growth as organizers prioritize reliable partners for complex events.

Trends and Disruptions Impacting Customers

The esports event insurance market is gaining importance as the global esports industry expands in audience and revenue. The overall esports audience is estimated at around 640 million people worldwide in 2026, reflecting deep engagement across competitive gaming communities. This scale of participation and viewership translates to large prize pools and sizable investments in events, equipment, and digital infrastructure, which increases the financial and operational risks that organizers face.

Risk categories in the esports event insurance landscape are wider than those in traditional sports due to technology and connectivity demands. Traditional risks such as venue liability and participant injury remain relevant, but digital threats now influence coverage requirements. Cybersecurity incidents, data breaches, and online broadcast interruptions are increasingly part of policy considerations for insurers working with esports organizers.

Disruptions in esports events can result in substantial financial losses when tournaments are postponed or cancelled due to unforeseen circumstances. Event cancellation and postponement insurance helps to reimburse non-refundable expenses and lost revenues, reducing the financial shock to organizers and stakeholders. This form of coverage is part of broader event insurance markets that are seeing accelerated adoption among event planners across industries due to rising unpredictability in global gatherings.

Emerging Trends Analysis

An emerging trend in the esports event insurance market is increased focus on cyber and technology risk coverage. Protection against data breaches, distributed denial of service attacks, and streaming interruptions is becoming more prominent. These risks are central to esports operations and influence coverage design.

Another trend is growing integration of insurance into event planning processes. Organizers increasingly include insurance review during early planning stages alongside venue selection and sponsorship agreements. This proactive approach improves risk assessment and reduces last minute exposure. Insurance is becoming embedded in standard event governance.

Growth Factors Analysis

One of the key growth factors for the esports event insurance market is the continued rise in live and hybrid esports events. In person tournaments combined with online participation increase audience reach but also expand risk exposure. Greater complexity drives demand for structured risk transfer solutions.

Another growth factor is increasing involvement of corporate sponsors and media partners. These stakeholders often require formal insurance coverage to protect investments and brand reputation. Contractual insurance requirements reinforce consistent demand as esports events mature commercially.

Opportunity Analysis

A significant opportunity in the esports event insurance market lies in customized and modular coverage offerings. Policies tailored to esports specific risks such as cyber incidents, streaming failure, or player no shows improve relevance and adoption. Modular designs allow organizers to select coverage based on event size and format. This flexibility supports wider uptake across different event scales.

Another opportunity is the global expansion of esports events into new regions. As tournaments are hosted across diverse geographies, exposure to regulatory, logistical, and operational risks increases. Insurance solutions that address cross border events and hybrid online offline formats can support international growth of esports competitions.

Challenge Analysis

A major challenge for the esports event insurance market is accurately defining coverage triggers for digital disruptions. Determining when a technical issue qualifies as an insured event can be complex. Ambiguity around causation such as whether an outage is internal or external may lead to disputes. Clear policy language is essential to maintain trust.

Another challenge is rapid evolution of esports formats and platforms. New game titles, tournament structures, and broadcast technologies can change risk profiles quickly. Insurance products must adapt continuously to remain aligned with industry practices. Keeping pace with innovation is an ongoing challenge.

Key Market Segments

By Coverage Type

- Event Cancellation Insurance

- Prize Pool Insurance

- Non-Appearance Insurance

- Equipment & Asset Insurance

- Others

By Event Size

- Major Tournaments

- Minor Leagues

- Local LAN Events

- Online Competitions

By End-User

- Tournament Organizers

- Esports Teams

- Venue Operators

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global commercial and specialty insurers such as Allianz, Chubb, and AIG hold strong positions in the esports event insurance market. Their coverage typically includes event cancellation, public liability, equipment damage, and cyber-related risks. These insurers apply underwriting models aligned with large-scale digital events and live audience exposure. Zurich Insurance Group and AXA XL add capacity for international tournaments.

The specialty and Lloyd’s market plays a critical role through Lloyd’s of London, Beazley, and Markel. These players offer flexible and bespoke policies for event disruption, technology failure, and prize indemnity. Hiscox supports coverage for smaller and mid-sized esports organizers. Their expertise in emerging risk and digital business models strengthens confidence among event hosts.

Insurance brokers and advisory firms such as Marsh, Aon, and Willis Towers Watson play a key role in structuring and placing esports event insurance programs. Berkshire Hathaway, Liberty Mutual, and Travelers expand underwriting options. Other insurers enhance regional access and customization, supporting stable growth of esports event insurance worldwide.

Top Key Players in the Market

- Lloyd’s of London

- Allianz

- Chubb

- AIG

- Zurich Insurance Group

- AXA XL

- Marsh

- Aon

- Willis Towers Watson

- Berkshire Hathaway

- Liberty Mutual

- Travelers

- Hiscox

- Beazley

- Markel

- Others

Recent Developments

- In November 2025, Chubb launched an AI-powered optimization engine within Chubb Studio, enabling personalized embedded insurance offerings at the point of sale for digital partners. This innovation boosts customer engagement and revenue for gaming platforms and esports organizers seeking real-time, tailored event coverage amid rising cyber and liability risks.

- In September 2025, Lloyd’s of London hosted a multinational insurance coverage event at its historic venue, exploring cyber and war risks relevant to global esports tournaments. The session highlighted tailored policies for virtual events, reinforcing Lloyd’s leadership in underwriting complex gaming exposures.

Report Scope

Report Features Description Market Value (2025) USD 243.6 Mn Forecast Revenue (2035) USD 1,434.6 Mn CAGR(2026-2035) 19.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Event Cancellation Insurance, Prize Pool Insurance, Non-Appearance Insurance, Equipment & Asset Insurance, Others), By Event Size (Major Tournaments, Minor Leagues, Local LAN Events, Online Competitions), By End-User (Tournament Organizers, Esports Teams, Venue Operators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lloyd’s of London, Allianz, Chubb, AIG, Zurich Insurance Group, AXA XL, Marsh, Aon, Willis Towers Watson, Berkshire Hathaway, Liberty Mutual, Travelers, Hiscox, Beazley, Markel, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Esports Event Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Esports Event Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Lloyd's of London

- Allianz

- Chubb

- AIG

- Zurich Insurance Group

- AXA XL

- Marsh

- Aon

- Willis Towers Watson

- Berkshire Hathaway

- Liberty Mutual

- Travelers

- Hiscox

- Beazley

- Markel

- Others