Global ERP Software Market Size, Share Analysis Report By Deployment (Cloud and On-premises), By Function (Finance, Supply Chain, HR, and Other Functions), By Enterprise Size (Small Enterprises, Large Enterprises, and Medium Enterprises), By Industry Verticals (Retail, Aerospace & Defense, BFSI, Manufacturing & Services, Government, Telecom, and Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: May 2025

- Report ID: 32270

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Deployment Mode Analysis

- By Business Function Analysis

- Enterprise Size Analysis

- End-Use Industry

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Latest Trends

- Geopolitical and Recession Impact Analysis:

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

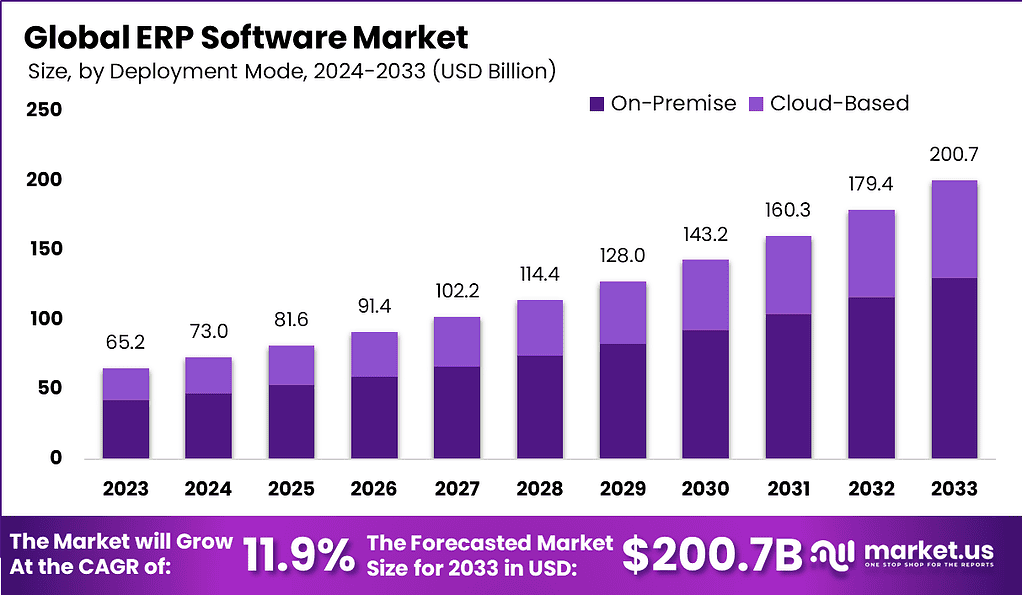

The Global ERP Software Market size is expected to be worth around USD 200.7 Billion by 2033 from USD 65.2 Billion in 2023, growing at a CAGR of 11.9% during the forecast period 2023 to 2032.

Enterprise Resource Planning (ERP) software is a suite of integrated applications designed to streamline and automate core business processes across various departments within an organization. These processes typically include finance, human resources, supply chain, manufacturing, and customer relationship management. By consolidating data into a unified system, ERP software facilitates real-time information sharing and decision-making, thereby enhancing operational efficiency and accuracy.

The ERP software market has been experiencing significant growth, Key driving factors for the ERP market include the need for improved business process efficiency, regulatory compliance, and the ability to make data-driven decisions. Organizations are increasingly seeking ERP solutions that offer scalability, flexibility, and the capability to integrate emerging technologies, enabling them to respond swiftly to market changes and customer demands.

Demand for ERP systems is particularly strong in sectors such as manufacturing, healthcare, retail, and finance, where complex operations and regulatory requirements necessitate robust management tools. The shift towards remote work and the globalization of supply chains have further amplified the need for ERP solutions that can provide real-time visibility and control over dispersed operations.

According to FounderJar, the value of ERP implementations is widely recognized by enterprises, with over 95% of organizations reporting process improvements post-deployment. Only 9% stated they did not achieve a return on investment, indicating a high overall success rate. Furthermore, 80% of organizations noted that ERP’s centralized data capabilities enabled the co-creation of new applications, reflecting its transformative role in enterprise innovation.

ERP systems also deliver measurable cost efficiencies – inventory costs were reduced by an average of 11%, while best-in-class manufacturers achieved reductions of up to 22%. Additionally, 86% of organizations considered accounting functionality to be a core ERP requirement, underscoring its foundational role in financial operations.

As per the latest insights from AIMultiple, the ERP software market revenue is expected to reach approximately USD 52 Billion in 2024, with an average spend per employee projected at around USD 15.0 Microsoft Dynamics holds the largest market share by user adoption, accounting for over 11% with more than 29,000 active domains globally.

Technological advancements are playing a pivotal role in shaping the ERP landscape. The integration of AI and machine learning enables predictive analytics and intelligent automation, enhancing decision-making capabilities. Cloud-based ERP solutions offer scalability and cost-effectiveness, while mobile accessibility ensures that users can interact with the system from anywhere, fostering greater collaboration and responsiveness.

The adoption of ERP systems is driven by several key reasons, including the desire to eliminate data silos, improve customer service, and achieve compliance with industry regulations. By providing a single source of truth, ERP systems enhance data accuracy and consistency, leading to better forecasting and strategic planning.

Key Takeaways

- The Enterprise Resource Planning (ERP) software Market was valued at US$ 65.2 billion in 2023.

- The Market is expected to register a Compound Annual Growth Rate (CAGR) of 11.9% between 2024 and 2033.

- By Deployment Mode, the On-Premise segment held the biggest market share of 64.8% in 2023.

- By Business Function, the Finance segment secured a major market share of 29.1% in 2023.

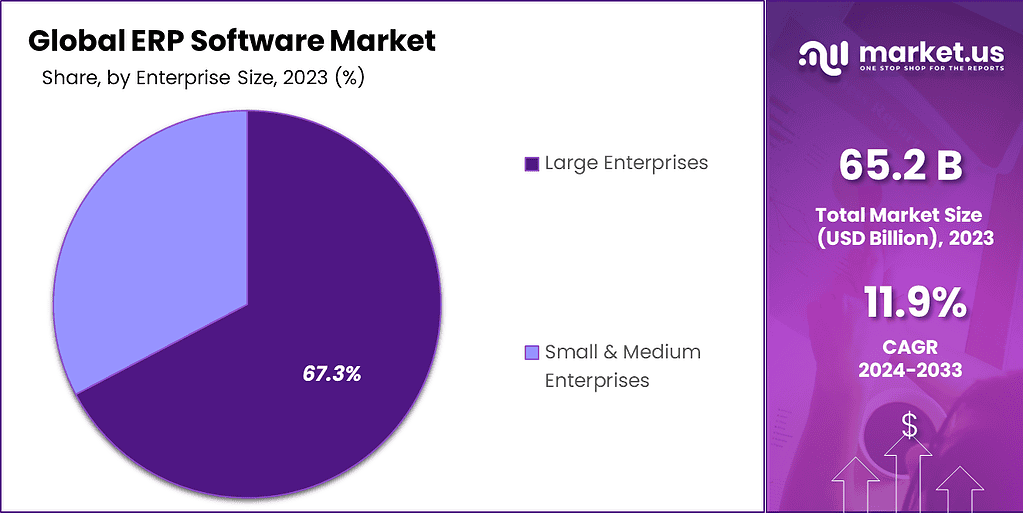

- By Enterprise Size, the Large Enterprises segment held a greater market share of 67.3% in 2023.

- By End-Use Industry, the Manufacturing segment attained a major market share of 24.5% in 2023.

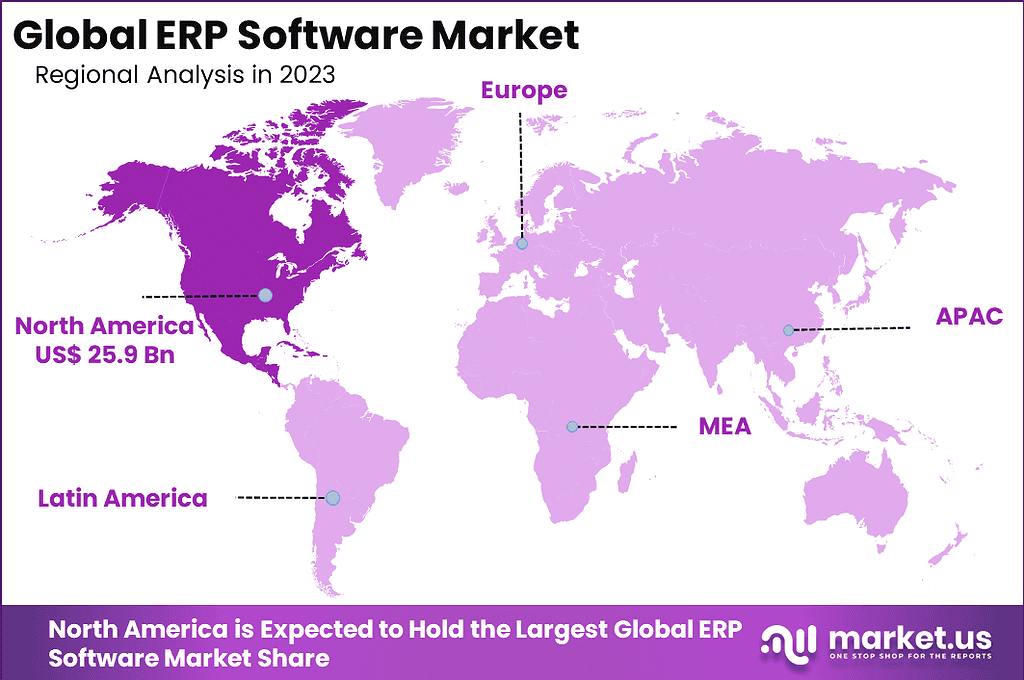

- In 2023, North America dominated the market with the biggest revenue share of 39.7%.

- Key players in the market include SAP SE, Oracle Corporation, Microsoft Corporation, and others.

Analysts’ Viewpoint

Investment opportunities in the ERP market are abundant, with vendors focusing on developing industry-specific solutions and expanding their offerings to cater to small and medium-sized enterprises (SMEs). The growing demand for ERP systems in emerging markets also presents significant potential for market expansion and revenue growth.

Businesses implementing ERP systems can expect numerous benefits, including streamlined operations, reduced operational costs, enhanced compliance, and improved agility. The ability to access real-time data empowers organizations to make informed decisions quickly, adapt to changing market conditions, and maintain a competitive edge.

The regulatory environment is increasingly influencing ERP adoption, as organizations must comply with a myriad of industry-specific regulations and data protection laws. ERP systems equipped with compliance management features help businesses monitor regulatory changes, maintain audit trails, and ensure adherence to legal requirements, thereby mitigating risks and avoiding penalties.

Deployment Mode Analysis

In 2023, the On-Premise segment held a dominant market position in the ERP software market, capturing more than a 64.8% share. This leading position can be attributed to several key factors that have favored the adoption of on-premise solutions over cloud-based alternatives. Primarily, organizations have exhibited a preference for on-premise ERP systems due to their enhanced control over enterprise resources and data.

The ability to host and manage the software within an organization’s own IT infrastructure allows for a higher degree of customization and integration with existing systems, which is particularly valuable for businesses with complex processes or those operating in industries with stringent regulatory compliance requirements.

Moreover, the on-premise deployment model offers a perceived advantage in terms of security and data sovereignty, as sensitive information remains within the physical confines of the organization, reducing the vulnerability to external breaches and cyber threats. This aspect is critically important for sectors such as finance, healthcare, and government, where data privacy and protection are paramount.

The initial higher investment and maintenance costs associated with on-premise ERP systems are often justified by these organizations through the benefits of increased security, customization, and control. Despite the growing traction of cloud-based ERP solutions, driven by their scalability, lower upfront costs, and operational flexibility, the on-premise segment continues to thrive due to these entrenched advantages.

By Business Function Analysis

By Business Function, the market is distributed into Finance, Supply Chain, Human Resource, and Other Business Functions. Among these, the Finance segment dominated the market by securing a larger revenue share of 29.1% in 2023.

The dominance of the finance segment in the market can be attributed to its central role in organizational operations and decision-making processes. Finance is an integral aspect of any business, responsible for managing financial transactions, budgeting, forecasting, and reporting.

ERP systems offer comprehensive modules tailored specifically to address the complex needs of finance departments, including general ledger, accounts payable, accounts receivable, financial reporting, and compliance management. These functionalities are critical for businesses to maintain accurate financial records, ensure regulatory compliance, and make informed strategic decisions.

Moreover, finance-related processes often involve numerous manual tasks and data entry, which can be time-consuming and prone to errors. ERP solutions streamline and automate these processes, improving efficiency, reducing costs, and minimizing the risk of inaccuracies. Given the critical importance of finance functions in driving organizational success and the benefits offered by ERP systems in this area, the finance segment dominates the Global ERP Software Market.

Enterprise Size Analysis

On the basis of Enterprise Size, the market is further separated into Small & Medium Enterprises and Large Enterprises. From these, the Large Enterprises segment held the biggest revenue share of 67.3% in 2023. The dominance of the Large Enterprises segment in the market is due to several key factors. Firstly, large enterprises usually have more extensive and complex business operations compared to small and medium-sized businesses (SMEs), necessitating robust and scalable ERP solutions to manage their diverse needs.

ERP systems offer functionalities that span across various departments and business processes, providing integrated solutions for finance, human resources, supply chain management, and more. These comprehensive capabilities align well with the requirements of large enterprises, enabling them to streamline operations, improve efficiency, and make data-driven decisions.

Additionally, large enterprises often have greater financial resources and organizational capacity to invest in ERP implementations, customization, and ongoing support, making them more inclined to adopt and leverage advanced ERP technologies. These factors collectively contribute to the dominance of the Large Enterprises segment in the Global ERP Software Market.

End-Use Industry

Based on End-Use Industry, the market is further divided into Manufacturing, IT and Telecommunications, BFSI, Retail & E-Commerce, Healthcare, Government, and Other End-Use Industries. Among these End-Use Industries, the Manufacturing segment dominated the market by obtaining a larger revenue share of 24.5% in 2023.

The Manufacturing segment dominates the market owing to several key factors. Firstly, manufacturing operations are inherently complex, involving multiple processes such as production planning, inventory management, supply chain coordination, and quality control. ERP systems offer integrated solutions that streamline these operations, improving efficiency, reducing costs, and enhancing overall productivity. Additionally, the manufacturing sector is highly competitive, with companies constantly seeking ways to optimize processes and gain a competitive edge.

ERP software provides valuable insights and analytics that enable manufacturers to make data-driven decisions, anticipate market demands, and respond swiftly to changing business conditions. Furthermore, regulatory compliance and quality management are crucial in the manufacturing industry, and ERP systems offer functionalities to ensure adherence to industry standards and regulations. Due these benefits companies in this industry prioritize the adoption of ERP solutions, contributing to the segment’s dominance in the Global ERP Software Market.

Key Market Segments

Based on Deployment Mode

- Cloud

- On-premises

Based on Business Function

- Finance

- Supply Chain

- HR

- Other Functions

Based on Enterprise Size

- Small Enterprises

- Large Enterprises

- Medium Enterprises

Based on End-Use Industry

- Retail

- Aerospace & Defense

- BFSI

- Manufacturing & Services

- Government

- Telecom

- Other Industry Verticals

Driving Factor

Shift Towards Digital Transformation

The global push towards digital transformation is a critical driver for the Global ERP Software Market. As companies strive to digitize their operations and embrace digital business models, ERP systems have become a cornerstone of their transformation strategies. These platforms facilitate the integration of digital technologies into all areas of a business, improving operational efficiency and delivering value to customers. The shift towards digital transformation has led to the adoption of ERP systems that support new business models, such as e-commerce, mobile commerce, and as-a-service offerings.

Furthermore, the integration of IoT (Internet of Things) devices with ERP systems has opened up new possibilities for automation and data analytics, enabling businesses to achieve greater insights into their operations and drive innovation. This alignment with digital transformation initiatives highlights the ERP software market’s vital role in enabling future-ready businesses.

For Instance, according to the European Union (EU), 72% of large businesses and 40% of small & medium enterprises in the European Union purchased cloud services in 2021. Moreover, in 2022, 57% of enterprises in the European Union offered remote access of enterprise resources including business software or applications, email system, and documents to their employees.

Restraining Factor

Integration Issues with Existing Systems

Integrating ERP systems with existing business applications and legacy systems presents a significant technical challenge, serving as a major restraint for the market’s growth. Many organizations rely on legacy systems that are deep-rooted in their operational processes. Achieving seamless integration between these existing systems and new ERP platforms can be a complex, time-consuming, and costly endeavor.

The necessity for uninterrupted data flow and functionality between the ERP system and other business applications often requires extensive customization and technical expertise, further escalating project costs and complexity. These integration challenges can lead to reluctance among businesses to adopt ERP solutions. The difficulty in integrating ERP systems with legacy technologies not only hinders their adoption but also restricts the ability of organizations to fully leverage the advantages of ERP solutions, thereby impeding market growth.

Growth Opportunity

Growing Demand for Cloud-Based ERP Solutions

The surge in demand for cloud-based ERP solutions presents a significant opportunity for the Global ERP Software Market. Cloud technology offers scalability, flexibility, and cost-efficiency, making ERP systems accessible to a broader range of businesses, including small and medium-sized enterprises (SMEs).The cloud deployment model reduces the need for extensive on-premise infrastructure, lowering the barriers to entry for adopting ERP solutions. Moreover, cloud-based ERP systems facilitate remote access, enabling businesses to operate and manage their processes from different locations in the world. This aspect is particularly appealing in the current global business landscape, which prioritizes mobility and flexibility.

As more organizations embark on digital transformation journeys, the shift towards cloud ERP is expected to accelerate, driving market growth. This trend also opens up avenues for ERP vendors to innovate and offer subscription-based models, making ERP solutions more adaptable to the varying needs of businesses across different industries.

Latest Trends

Adoption of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into ERP systems is an important trend shaping the Global ERP Software Market. AI and ML technologies enhance ERP functionalities, enabling advanced data analytics, predictive insights, and intelligent automation. These capabilities allow businesses to optimize operations, anticipate market trends, and make data-driven decisions with improved accuracy.

AI-enhanced ERP solutions can automate routine tasks, from inventory management to customer service, freeing up human resources for strategic planning and innovation. As AI and ML technologies continue to evolve, their incorporation into ERP systems is expected to grow, driving efficiency and innovation across industries.

This trend not only attracts businesses seeking competitive advantage through technological advancement but also opens new avenues for ERP vendors to differentiate their offerings, stimulating market growth. For Instance, In June 2023, Microsoft Corporation launched AI-powered assistance in its ERP offerings including Microsoft Dynamics 365 Supply Chain Management, Microsoft Dynamics 365 Finance, and Microsoft Dynamics 365 Project Operations.

Geopolitical and Recession Impact Analysis:

Geopolitical Impact Analysis:

Geopolitical tensions and uncertainties have a profound impact on the Global ERP Software Market. Disruptions in global trade patterns, fluctuations in currency exchange rates, and variations in regulatory environments across different regions can influence market dynamics. Companies operating in multiple countries may face challenges in maintaining streamlined operations due to differing legal and business requirements.However, this environment also presents an opportunity for ERP solutions as businesses increasingly rely on ERP systems to navigate the complexities of international operations, ensuring compliance with varied regulations and managing supply chain disruptions efficiently.

The adaptability of ERP systems to accommodate these geopolitical shifts is crucial, making them more valuable as strategic tools for global business management. The demand for ERP solutions that offer flexibility and real-time analytics to respond geopolitical changes is expected to rise, as organizations seek to mitigate risks and capitalize on emerging opportunities in a volatile global landscape.

Recession Impact Analysis:

Economic downturns and recessions pose significant challenges to the Global ERP Software Market, affecting investment decisions and priorities within organizations. During recessions, businesses often tighten budgets, avoid non-essential expenditures, and focus on cost optimization strategies. This cautious approach can lead to a slowdown in new ERP system implementations or upgrades.

However, recessions also highlight the importance of operational efficiency, cost control, and informed decision-making wherein ERP systems excel. Organizations may leverage ERP solutions to streamline processes, enhance visibility into financial and operational metrics, and identify cost-saving opportunities.

In this context, cloud-based ERP solutions, with their lower upfront costs and scalability, may see increased adoption as businesses seek to maintain agility and competitiveness with minimal investment. Thus, while recessions may initially hamper market growth, they also highlight the critical role of ERP systems in navigating economic challenges, potentially accelerating the shift towards more flexible, cost-effective ERP models.

Regional Analysis

North America Dominates the Market with a Major Revenue Share of 39.7%.

The demand for ERP Software in North America was valued at US$ 25.9 billion in 2023 and is anticipated to grow significantly in the forecast period. The dominance of the North America in the market can be attributed to several key factors. Firstly, North America particularly the United States, is home to many of the leading ERP software vendors such as Oracle and Microsoft. The proximity of these market leaders facilitates early adoption and integration of ERP solutions among local businesses.Additionally, the region exhibits a highly mature IT infrastructure, which is conducive to the deployment and efficient operation of advanced ERP systems. There’s also a strong culture of technological innovation and adoption in North America, with businesses across various sectors keen to leverage technology for operational efficiency and competitive advantage.

Moreover, the presence of a large number of multinational corporations in this region necessitates sophisticated business management tools like ERP to handle complex operations and regulatory compliance across different geographies. These factors, combined with significant investment in digital transformation initiatives, drive the high adoption rates and market dominance of ERP solutions in North America.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the Global ERP Software Market is characterized by the presence of several key players along with smaller vendors and new entrants, contributing to a dynamic and fragmented market environment. Leading companies such as SAP, Oracle, Microsoft, and Infor dominate the market, offering comprehensive ERP solutions that cater to large enterprises and SMEs.

These major players invest significantly in research and development to integrate advanced technologies like AI, ML, and cloud computing into their ERP offerings, enhancing their functionality and user experience. The market also witnesses competition from niche vendors that specialize in specific industries or functionalities, providing tailored solutions that address unique business needs.

The competitive intensity is further heightened by the increasing adoption of cloud-based ERP solutions. Collaboration and strategic partnerships are common, as companies seek to expand their product portfolios and geographic reach. The competitive landscape is evolving, with innovation and technology integration serving as key differentiators among companies.

Top Key Players in the ERP Software Market

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Sage Group plc

- Infor

- Unit4

- Epicor Software Corporation

- Workday Inc.

- Ramco Systems Limited

- Plex Systems Inc.

- IFS AB

- Other Key Players

Recent Developments

- In October 2023: Accenture plc collaborated with SAP SE to help companies accelerate ERP transformation in cloud and adopt generative AI.

- In May 2023: Fortis Payment Systems, LLC partnered with Sage Group plc to provide ERP experience along with integrated payments.

- In March 2023: SAP SE launched cloud ERP offering for medium-sized companies.

Report Scope

Report Features Description Market Value (2023) USD 65.2 Bn Forecast Revenue (2033) USD 200.7 Bn CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-Based and On-Premise), By Business Function (Finance, Supply Chain, Human Resource, and Other Business Functions), By Enterprise Size (Small & Medium Enterprises and Large Enterprises), By End-Use Industry (Manufacturing, IT and Telecommunications, BFSI, Retail & E-Commerce, Healthcare, Government, and Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape SAP SE, Oracle Corporation, Microsoft Corporation, IBM Corporation, Sage Group plc, Infor, Unit4, Epicor Software Corporation, Workday Inc., Ramco Systems Limited, Plex Systems Inc., IFS AB, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is ERP software?ERP (Enterprise Resource Planning) software is a suite of integrated applications that help businesses manage and automate various back-office functions, including accounting, human resources, supply chain management, and customer relationship management.

How big is ERP Software Market?The Global ERP Software Market size is expected to be worth around USD 200.7 Billion by 2033 from USD 65.2 Billion in 2023, growing at a CAGR of 11.9% during the forecast period 2023 to 2032.

Who are the key players in the ERP software market?Some key players operating in the ERP software market include SAP SE, Oracle Corporation, Microsoft Corporation, IBM Corporation, Sage Group plc, Infor, Unit4, Epicor Software Corporation, Workday Inc., Ramco Systems Limited, Plex Systems Inc., IFS AB, Other Key Players,

Which region has the biggest share in Enterprise Resource Planning Market?North America Dominates the Market with a Major Revenue Share of 39.7%.

What are the challenges of implementing ERP software?Some challenges of implementing ERP software include:

- High Initial Costs

- Data Migration

- Customization

- User Adoption

- Integration with Legacy Systems

- Security Concerns

-

-

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Sage Group plc

- Infor

- Unit4

- Epicor Software Corporation

- Workday Inc.

- Ramco Systems Limited

- Plex Systems Inc.

- IFS AB

- Other Key Players