Global Equestrian Equipment Market Size, Share, Growth Analysis By Product Type (Saddles, Bridles, Helmets, Riding Boots, Protective Gear, Riding Apparel, Other Accessories), By End-User (Professional Riders, Recreational Riders), By Distribution Channel (Online Retail, Sports Specialty Stores, Supermarkets, Brand Outlets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137423

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

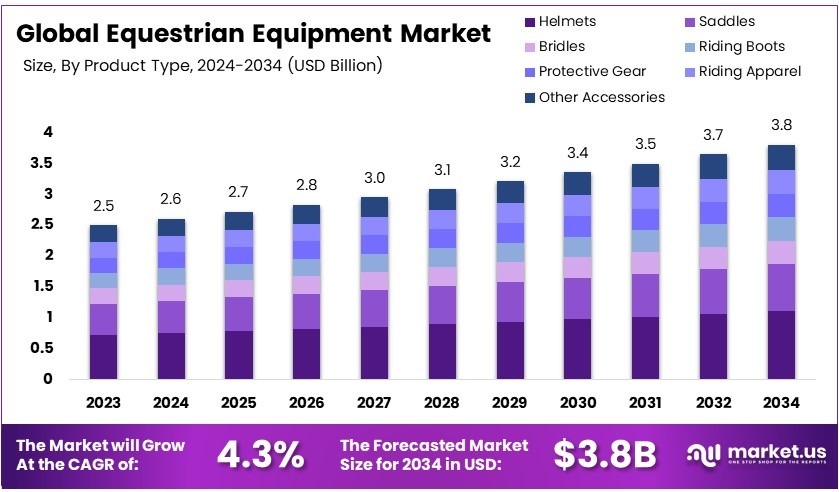

The Global Equestrian Equipment Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Equestrian equipment includes all gear used in horse riding, such as saddles, bridles, riding boots, helmets, and protective vests. This equipment is essential for the safety and performance of both the rider and the horse during various equestrian activities.

The Equestrian Equipment Market deals with the supply and sale of gear and attire for horse riding. It serves a wide range of consumers, from casual riders to competitive equestrians, offering products that enhance safety, performance, and comfort in riding disciplines.

Equestrian sports continue to grow, engaging millions worldwide. In 2023, the USEF Network’s broadcasts of 87 live events reached 246,000 unique users in 195 countries, demonstrating the sport’s global appeal and the extensive use of specialized equipment.

Growth in the equestrian market is driven by increasing participant numbers and international exposure. With 7.1 million Americans involved in various capacities, opportunities for market expansion and innovation in sports equipment continue to rise.

Globally, the market benefits from widespread participation and the affluent demographics associated with equestrian sports. Locally, communities thrive through economic activities related to equestrian events and breeding farms.

Government regulations and investments subtly shape the equestrian market, enhancing safety standards and promoting sports through supportive policies. This governmental engagement helps maintain the sport’s integrity and ensures its long-term viability.

Key Takeaways

- The Equestrian Equipment Market was valued at 2.5 Billion USD in 2024, and is expected to reach 3.8 Billion USD by 2034, with a CAGR of 4.3%.

- In 2024, Helmets dominated the product type segment with 29.1%, due to increasing focus on rider safety.

- In 2024, Professional riders dominated the end-user segment with 54.7%, reflecting a high demand from competitive equestrian sports.

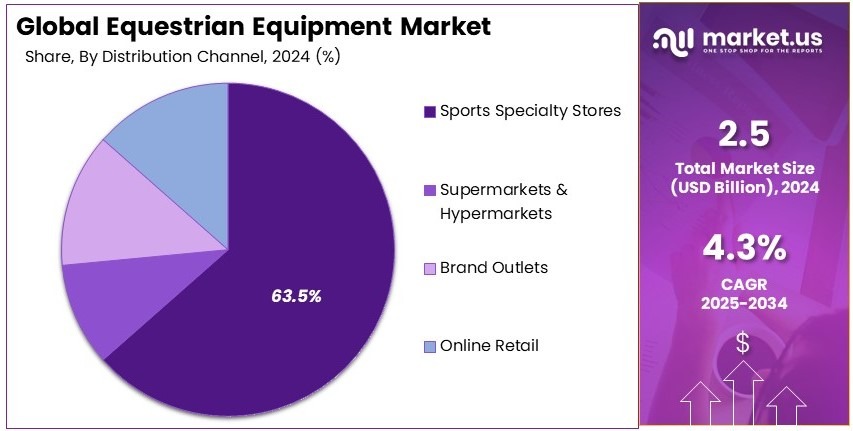

- In 2024, Sports specialty stores dominated the distribution channel with 63.5%, indicating preference for specialized retail experiences.

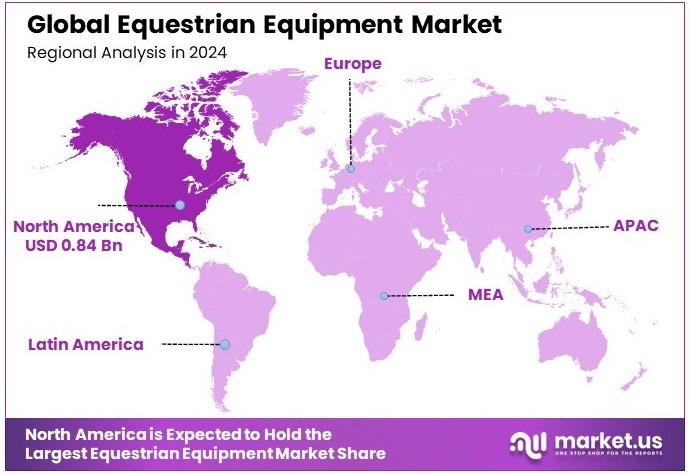

- In 2024, North America dominated the region with 33.4% share and USD 0.84 Bn revenue, demonstrating a strong regional market presence.

Product Type Analysis

Helmets dominate with 29.1% due to their critical role in rider safety and stringent safety regulations.

The Equestrian Equipment Market is segmented by product type, which includes saddles, bridles, helmets, riding boots, protective gear, riding apparel, and other accessories. Helmets are the dominant sub-segment, primarily because they are essential for rider safety.

The growth in this segment is driven by stringent safety standards and increasing awareness about concussion protocols, which encourage both casual and competitive riders to invest in high-quality helmets.

Saddles are key for both comfort and performance in riding, designed to suit various riding styles and disciplines. Their evolution is marked by innovations that enhance rider and horse comfort, making them a substantial part of the equestrian equipment market.

Bridles provide necessary control and communication with the horse, essential for all riding disciplines. Their design and material quality impact their functionality and durability, influencing market preferences.

Riding boots are designed for safety and functionality, with styles varying significantly across different equestrian disciplines. They contribute to the market by meeting specific rider needs for comfort and performance.

Protective gear, including vests and body protectors, is increasingly adopted by riders looking for additional safety measures, particularly in eventing and show jumping, where the risk of falls and injuries is higher.

Riding apparel is tailored to offer comfort and flexibility while reflecting the style and elegance of the sport. This segment includes jodhpurs, breeches, show jackets, and competition shirts, each designed to meet the practical and aesthetic demands of riders.

Other accessories, such as gloves, horse boots, and grooming tools, support the comprehensive needs of equestrian enthusiasts, filling niche markets and complementing the primary equipment segments.

End-User Analysis

Professional riders dominate with 54.7% due to their need for high-performance gear and regular participation in competitions.

The end-user segment in the Equestrian Equipment Market is categorized into professional and recreational riders. Professional riders form the largest group, driven by their frequent participation in competitions and training, which necessitates regular upgrades and purchases of high-quality equestrian gear.

Recreational riders, while forming a smaller segment, are significant for the market’s volume, driven by the growing popularity of equestrian sports among amateurs and leisure riders. This group’s needs focus more on comfort and durability, influencing product variations and marketing strategies.

Distribution Channel Analysis

Sports specialty stores dominate with 63.5% due to their targeted product offerings and expert customer service.

Distribution channels for equestrian equipment include online retail, sports specialty stores, supermarkets/hypermarkets, and brand outlets. Sports specialty stores hold the predominant share, favored by consumers for their expert advice, product range, and the ability to try products before purchasing.

This segment’s dominance is reinforced by the specialized nature of equestrian products, which benefits from knowledgeable staff and a tailored shopping experience.

Online retail, while growing, offers convenience and often competitive pricing, appealing particularly to the recreational segment of the market. This channel’s expansion is driven by the increasing comfort of consumers with online shopping and the broad availability of product reviews and comparisons.

Supermarkets/hypermarkets and brand outlets hold smaller shares, primarily serving as accessible points for entry-level and mid-range products, catering to casual buyers and those new to the sport.

Key Market Segments

By Product Type

- Saddles

- Bridles

- Helmets

- Riding Boots

- Protective Gear

- Riding Apparel

- Other Accessories

By End-User

- Professional Riders

- Recreational Riders

By Distribution Channel

- Online Retail

- Sports Specialty Stores

- Supermarkets/Hypermarkets

- Brand Outlets

Driving Factors

Global Popularity Drives Market Growth

The global popularity of equestrian sports and events influences the equipment market significantly. Increased interest in riding activities from professionals and amateurs alike adds to demand. Technological advancements enhance rider safety, which drives innovation. This promotes the development of advanced materials and designs.

Similarly, the growth of professional and amateur competitions fuels the need for better gear. For example, new safety vests and helmets designed for showjumping have become more popular. Such events also support the creation of premium products. The rising participation in recreational horse riding contributes to expanding the customer base.

As more riders seek equipment that blends style with function, manufacturers invest in quality enhancements. This shift benefits manufacturers who adapt to new safety standards and design improvements.

The market grows as innovations align with evolving consumer needs. For this reason, stakeholders see potential for steady expansion. These factors combine to create a robust foundation for sustained market growth.

Restraining Factors

High Costs Restraints Market Growth

Dependence on wealthier consumer segments also narrows the market. Limited availability in emerging regions limits expansion opportunities. Seasonal demand fluctuations add uncertainty. These factors lower overall demand and affect supply chains. For example, high-quality saddles often remain inaccessible to casual riders due to their cost. Similarly, niche markets struggle to gain traction outside affluent areas.

This restraint slows down the growth rate. Moreover, distribution challenges in new markets lead to reduced market penetration. Low production volumes result in higher costs, which affects pricing. On the flip side, manufacturers face barriers in scaling operations due to these restraints.

For instance, a small company may find it hard to distribute products in rural areas. Consequently, smaller firms may exit the market, reducing competition. The market players must navigate these obstacles by seeking cost efficiencies.

Innovative manufacturing techniques and expanded logistics can mitigate some restraints. For example, partnering with local retailers in emerging markets can help lower distribution costs. Therefore, the high costs and limited reach pose considerable restraints on market growth.

Growth Opportunities

Sustainable Opportunities Provide Opportunities

Development of sustainable and eco-friendly gear opens new opportunities in the market. Companies exploring green materials see growth potential. Customization trends allow for personalized equipment that appeals to niche groups.

Online retail expansion offers broader reach and convenience to consumers. Sustainability attracts environmentally conscious buyers. This approach enables manufacturers to tap into new consumer segments. For example, companies producing saddles from recycled materials find new customers who value green practices.

This opportunity also lies in personalized gear meeting specific rider needs, which enhances customer loyalty. Similarly, personalized bridles tailored to fit unique horse breeds gain popularity. The focus on safety innovations builds trust and market reputation.

Expansion through online channels removes geographical limitations. Retailers can reach customers in remote areas by offering virtual fittings and demonstrations. In addition, digital tools improve customer engagement and feedback.

Emerging Trends

Advanced Materials Are Latest Trending Factor

The use of advanced materials is emerging as a key trending factor. Carbon fiber and other materials enhance saddle design. These materials increase durability and reduce weight. Riders benefit from improved performance and safety. For instance, lightweight carbon fiber stirrups are now favored by professionals for better control.

Biomechanics-based equipment also trends upward. This approach optimizes rider posture and horse comfort. Gender-inclusive apparel shows a growing trend that meets diverse customer needs. For example, equestrian jackets are now designed for all body types, offering both style and comfort.

Trendy stylish and functional riding apparel gains traction. New technologies improve design features and user experience. Manufacturers invest in research to integrate these trends. The market sees a shift towards innovation and inclusivity.

Regional Analysis

North America Dominates with 33.4% Market Share

North America leads the Equestrian Equipment Market with a 33.4% share, equating to USD 0.84 billion. This prominence is driven by a strong equestrian culture and a substantial number of active participants in both recreational and competitive riding.

Key factors contributing to this high market share include the widespread presence of equestrian facilities, high levels of disposable income allowing for investment in equestrian activities, and a well-established network of suppliers and retailers specializing in high-quality equipment. The region’s affluent population provides a steady demand for premium equestrian products.

Market dynamics in North America are influenced by trends such as the increasing popularity of equestrian sports among younger demographics and the growing emphasis on animal welfare and sustainable practices in the manufacture of equestrian gear. These trends not only drive product innovation but also market growth.

The forecast for North America suggests that its market presence in the equestrian sector will continue to expand. Ongoing technological advancements in equipment, coupled with rising interest in equestrian sports as a leisure and competitive activity, are likely to further enhance the market’s growth and innovation in the coming years.

Regional Mentions:

- Europe: Europe remains a strong market for equestrian equipment, supported by its historic involvement in equestrian sports and a large number of high-profile events. The region’s focus on quality and heritage brands continues to influence its market position.

- Asia Pacific: The Asia Pacific market is growing due to increasing interest in equestrian sports, rising wealth, and investments in equestrian facilities. Countries like China and Australia are key contributors to this growth, expanding their influence in the global market.

- Middle East & Africa: In the Middle East & Africa, equestrian sports are gaining popularity, particularly in countries with a tradition of horse riding. Investments in luxury sports and recreational facilities are driving the regional market.

- Latin America: Latin America’s market is developing slowly with rising interest in equestrian activities. Economic growth and increasing disposable incomes in countries like Brazil and Argentina are likely to boost the market for equestrian equipment.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Equestrian Equipment Market is prominently driven by four main companies: Ariat International, Inc., Cavallo GmbH & Co. KG, Charles Owen & Company (Bow) Ltd., and Devoucoux. These firms are central to setting industry trends and advancing product innovation within the equestrian world.

Ariat International, Inc. stands out for its innovative approach to equestrian footwear and apparel. Known for durability and comfort, Ariat’s products are designed to meet the specific needs of equestrian sports enthusiasts. Their commitment to combining tradition with technology makes them a favorite among riders of all levels.

Cavallo GmbH & Co. KG is recognized for its high-quality riding boots and equestrian accessories. The company emphasizes craftsmanship and functional design, ensuring that each product offers both style and practicality. Cavallo’s dedication to quality has established it as a trusted brand in the competitive equestrian market.

Charles Owen & Company (Bow) Ltd. specializes in rider safety equipment, particularly helmets. With a strong focus on safety and technology, Charles Owen helmets are renowned for their rigorous testing and compliance with international safety standards, making them a top choice for competitive and recreational riders alike.

Devoucoux is known for its bespoke saddlery and leather goods. The brand’s focus on custom-fit products enhances the riding experience by ensuring comfort for both horse and rider. Devoucoux’s dedication to handcrafted quality and detail positions them as a luxury provider in the market.

These companies lead the Equestrian Equipment Market through their dedication to quality, innovation, and safety. Their commitment to developing products that enhance the comfort and performance of riders and horses alike helps them maintain a competitive edge. By focusing on customer needs and staying at the forefront of technological advancements, these key players significantly influence market dynamics and the future of equestrian sports equipment.

Major Companies in the Market

- Ariat International, Inc.

- Cavallo GmbH & Co. KG

- Charles Owen & Company (Bow) Ltd.

- Devoucoux

- Dublin Clothing

- Equine Couture

- Horseware Ireland

- WeatherBeeta

- Troxel Helmets

- Kerrits Equestrian Apparel

- Hermès International S.A.

- Weaver Leather

- HKM Sports Equipment GmbH

Recent Developments

- Hugo Boss: In August 2023, Hugo Boss announced the launch of BOSS Equestrian, a premium apparel line tailored for equestrian enthusiasts. Designed, produced, and distributed by Bold Equestrian Ltd., the collection became available worldwide in September 2023 through select partners and the official BOSS website.

- Ireland (DAFM): In December 2024, Ireland’s Department of Agriculture, Food and the Marine implemented a new equine traceability system, based on the annual equine census. This mandatory census requires all equine keepers to report the number of horses under their care, aiming to enhance industry traceability and enforce compliance.

- Horse Racing Ireland (HRI): In June 2024, Horse Racing Ireland responded to an investigative documentary exposing mistreatment within the horse racing industry. HRI pledged a €16.1 million investment in welfare and integrity services, while the Irish Minister for Agriculture announced an investigation into equine slaughter supply practices, underscoring a commitment to animal welfare.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 3.8 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Saddles, Bridles, Helmets, Riding Boots, Protective Gear, Riding Apparel, Other Accessories), By End-User (Professional Riders, Recreational Riders), By Distribution Channel (Online Retail, Sports Specialty Stores, Supermarkets/Hypermarkets, Brand Outlets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ariat International, Inc., Cavallo GmbH & Co. KG, Charles Owen & Company (Bow) Ltd., Devoucoux, Dublin Clothing, Equine Couture, Horseware Ireland, WeatherBeeta, Troxel Helmets, Kerrits Equestrian Apparel, Hermès International S.A., Weaver Leather, HKM Sports Equipment GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Equestrian Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Equestrian Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ariat International, Inc.

- Cavallo GmbH & Co. KG

- Charles Owen & Company (Bow) Ltd.

- Devoucoux

- Dublin Clothing

- Equine Couture

- Horseware Ireland

- WeatherBeeta

- Troxel Helmets

- Kerrits Equestrian Apparel

- Hermès International S.A.

- Weaver Leather

- HKM Sports Equipment GmbH