ePharmacy Market Analysis By Drug Type (Prescription Drug, Over-The-Counter Drug (Otc)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 84483

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

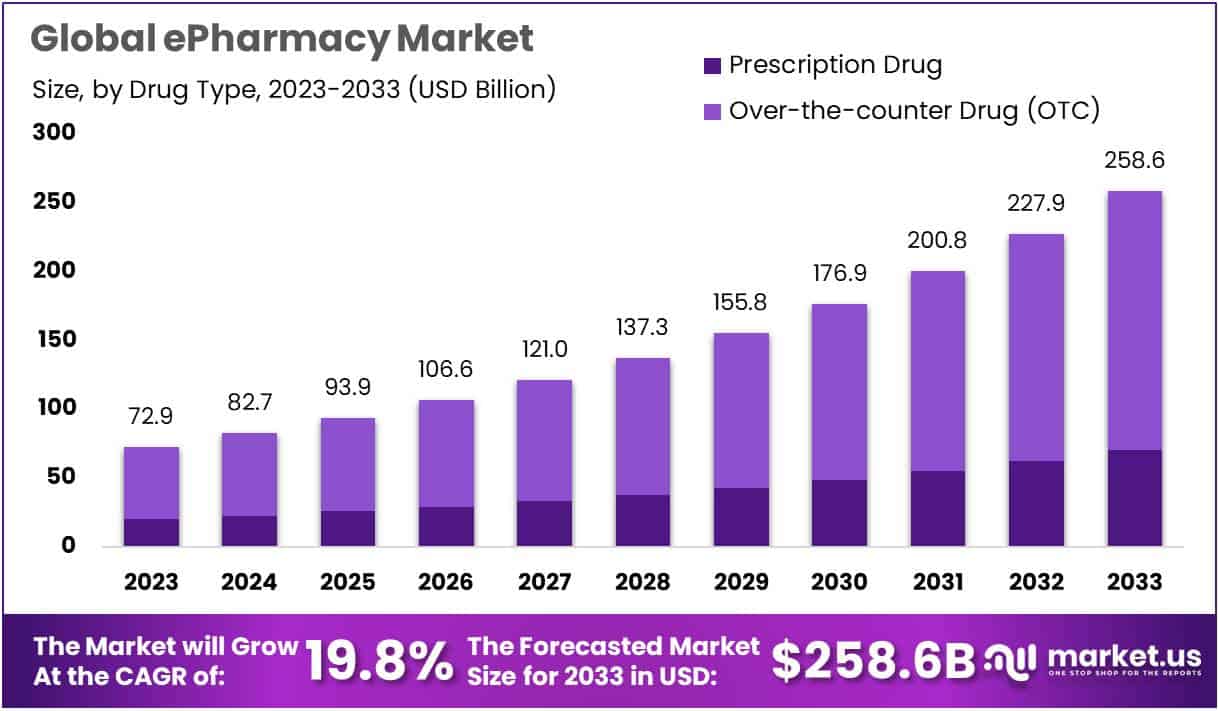

The Global ePharmacy Market size is expected to be worth around US$ 258.6 Billion by 2033, from US$ 72.9 Billion in 2023, growing at a CAGR of 19.8% during the forecast period from 2024 to 2033.

ePharmacy, commonly known as online pharmacies, represents the digital evolution of traditional brick-and-mortar pharmacies. These platforms offer a virtual space where customers can effortlessly purchase a variety of healthcare products and medications. The convenience factor is paramount, as individuals can browse extensive product ranges, add items to their digital carts, and complete purchases from the comfort of their homes.

The ePharmacy market has experienced substantial growth due to factors such as increased internet accessibility, changing consumer preferences, and technological advancements. Offering a wide range of pharmaceutical products, over-the-counter drugs, and healthcare items, ePharmacies provide unparalleled convenience, allowing consumers to order medications from their homes.

The digital shift in healthcare, including telemedicine and remote consultations, has further fueled this growth. EPharmacies are characterized by competitive pricing, discounts, and a diverse product range, making them attractive to a broad consumer base. However, challenges like regulatory compliance, data security, and concerns about counterfeit drugs highlight the need for careful industry navigation.

EPharmacies, integral to the evolving healthcare landscape, are marked by the convergence of technology and medicine. The seamless integration with telehealth platforms is a prominent trend, facilitating online consultations and prescription services. Noteworthy developments include the use of data analytics and artificial intelligence for personalized medicine recommendations, based on individual health data. To address concerns such as patient data security and the risk of counterfeit drugs, the industry is exploring technologies like blockchain for enhanced supply chain transparency.

As ePharmacies expand services beyond medication delivery to include health monitoring devices and wellness supplements, their role in the healthcare ecosystem is set to evolve, requiring a delicate balance between innovation and regulatory compliance.

Key Takeaways

- The ePharmacy market is expected to grow to USD 258.6 billion by 2033, with a CAGR of 19.8% from 2024.

- Market expansion is fueled by increased internet access and a rise in chronic diseases, with COVID-19 highlighting technology’s critical role.

- Regulatory challenges and concerns about online medication authenticity and cybersecurity are major obstacles to market growth.

- Over-the-counter drugs represent 72.7% of the market, indicating a strong consumer preference for non-prescription medications.

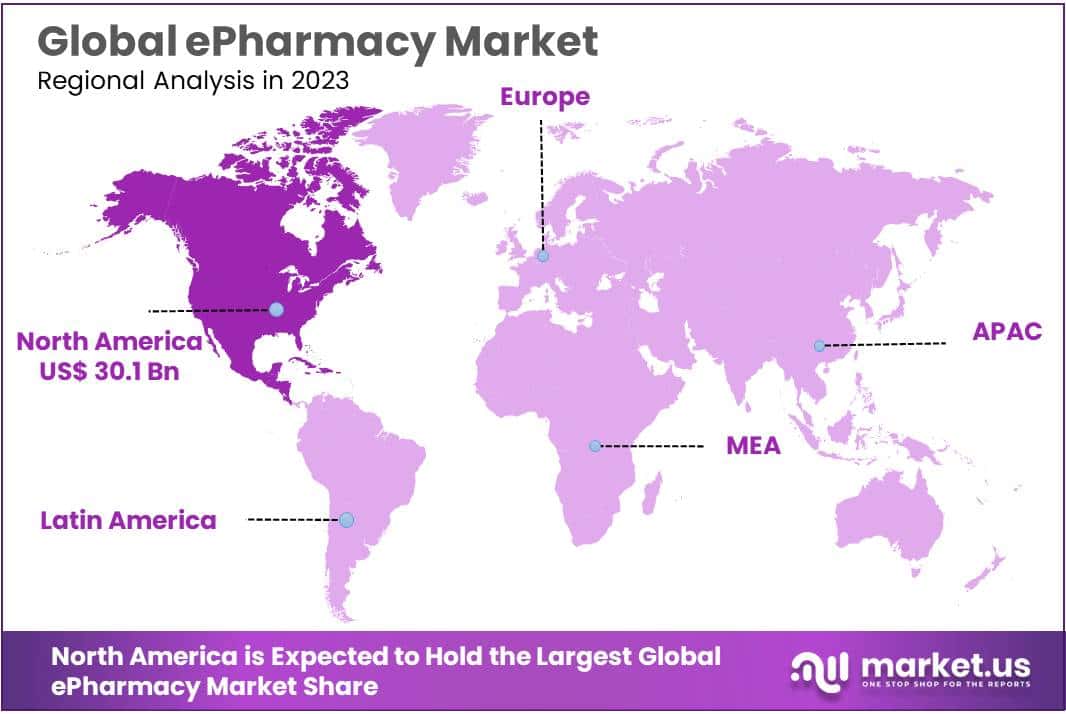

- North America leads the market, holding a 41.3% share valued at USD 30.10 billion, supported by high internet penetration and favorable regulations.

- ePharmacies have significant global expansion potential; opportunities exist in personalized medicine and partnerships with telehealth services.

- Online consultations and subscription-based models for medication refills are gaining popularity within ePharmacy platforms.

- Blockchain technology is being integrated to enhance supply chain transparency and combat counterfeit drugs, ensuring authenticity.

- Increased global internet usage is driving ePharmacy adoption, meeting consumer demands for convenient, accessible healthcare solutions.

- Innovations like mobile health apps, telemedicine, and AI in prescription systems are enhancing efficiency and patient engagement in ePharmacies.

Drug Type Analysis

In 2023, the ePharmacy market showcased a significant dominance by Over-The-Counter Drug (OTC), securing a robust 72.7% share. This indicates a noteworthy preference among consumers for readily accessible medications without the need for a prescription.

The Over-The-Counter Drug segment’s supremacy can be attributed to the ease with which consumers can obtain non-prescription medications for common ailments. This includes widely used products like pain relievers, cold and flu medications, and allergy remedies. The convenience of browsing, selecting, and purchasing these items online contributes to the strong market position of OTC drugs within the ePharmacy landscape.

Moreover, the OTC segment’s dominance underscores the growing trend of self-medication and the increasing awareness among consumers regarding their healthcare needs. The simplicity of accessing over-the-counter medications through ePharmacies aligns with the modern consumer’s preference for streamlined and user-friendly healthcare solutions.

Key Market Segments

Drug Type

- Prescription Drug

- Over-The-Counter Drug (Otc)

Drivers

Increasing Internet Penetration

As internet access expands globally, more consumers are gaining online connectivity, leading to a surge in ePharmacy usage. The convenience of ordering medications from the comfort of one’s home is a significant driving force.

Rising Chronic Diseases

The prevalence of chronic diseases is on the rise, necessitating continuous medication. ePharmacies offer a convenient solution for patients with long-term medication needs, providing automated prescription refills and timely home delivery.

Technological Advancements

Innovations such as mobile health apps, telemedicine, and artificial intelligence-driven prescription systems enhance the efficiency and accessibility of ePharmacies. These technologies improve patient engagement and streamline the entire medication procurement process.

Pandemic Impact

The COVID-19 pandemic has accelerated the adoption of ePharmacies due to lockdowns, social distancing measures, and the increased focus on minimizing in-person interactions. This shift in consumer behavior is expected to have a lasting impact on ePharmacy market growth.

Restraints

Regulatory Challenges

The ePharmacy sector faces regulatory hurdles and varying legal frameworks in different regions. Compliance issues and evolving regulations can pose challenges to market players, affecting their operational flexibility.

Concerns Regarding Medication Authenticity

Some consumers express reservations about the authenticity and quality of medications purchased online. Ensuring the safety and legitimacy of pharmaceuticals in the ePharmacy supply chain is crucial to overcoming this restraint.

Digital Divide

Despite increasing internet penetration, a digital divide still exists, with certain demographics lacking access to online platforms. This limitation hinders the potential reach of ePharmacies and can be a restraining factor in certain regions or among specific population segments.

Cybersecurity Risks

With the increasing reliance on digital platforms, the ePharmacy market is susceptible to cyber threats. Security breaches and data privacy concerns can undermine consumer trust, making cybersecurity a critical factor for sustained market growth.

Opportunities

Global Expansion

Opportunities for ePharmacies to expand globally by entering untapped markets and forming strategic partnerships with local healthcare providers. This expansion can tap into the growing demand for convenient and accessible healthcare services.

Personalized Medicine

Integrating personalized medicine into ePharmacy services presents a significant growth opportunity. Tailoring medication regimens based on individual patient characteristics and genetic profiles can enhance treatment outcomes and customer satisfaction.

Telehealth Integration

Collaborating with telehealth services to offer a seamless healthcare experience. Integration with virtual consultations and remote monitoring can create a comprehensive healthcare ecosystem and drive customer loyalty.

Evolving Healthcare Ecosystem

Collaborating with pharmaceutical manufacturers, insurance providers, and healthcare professionals to create a more integrated healthcare ecosystem. This collaboration can lead to improved patient outcomes and increased efficiency in the healthcare value chain.

Trends

Rise of Online Consultations

The integration of online doctor consultations within ePharmacy platforms is becoming a prominent trend. This enables users to receive virtual prescriptions and personalized medical advice through the same platform where they order medications.

Subscription-Based Models

The adoption of subscription-based models for medication delivery is gaining traction. EPharmacies are offering subscription services for regular medication refills, providing convenience for both consumers and the platforms.

Blockchain for Supply Chain Transparency

Implementing blockchain technology to enhance transparency and traceability in the ePharmacy supply chain. This trend aims to address concerns related to counterfeit drugs and ensure the authenticity of pharmaceutical products.

Focus on Health and Wellness

EPharmacies are expanding beyond traditional pharmaceuticals to include a broader range of health and wellness products. This trend aligns with the growing consumer interest in preventive healthcare and lifestyle-related products available through digital platforms.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 41.3% share and holding a USD 30.10 billion market value for the ePharmacy sector. This regional supremacy can be attributed to a confluence of factors that have propelled North America to the forefront of the digital pharmaceutical landscape.

One key driver of North America’s ePharmacy dominance is the widespread adoption of digital technologies and high internet penetration across the region. The tech-savvy population has readily embraced online platforms for various services, including healthcare. With a robust infrastructure and a culture of digital convenience, ePharmacy services have seamlessly integrated into the daily lives of North American consumers.

The rise of ePharmacy in North America has been significantly boosted by strong regulatory support. The existing regulatory frameworks create a favorable environment for the expansion of digital health services, ensuring that ePharmacy platforms meet stringent standards. This not only guarantees a safe and dependable alternative to traditional pharmacies but also fosters confidence among investors and promotes innovation within the sector. The clear regulatory guidelines have played a crucial role in solidifying North America’s leading position in this field.

Moreover, the prevalence of chronic diseases in the region has increased the demand for convenient and accessible healthcare solutions. ePharmacies, with their user-friendly interfaces and prompt delivery services, have emerged as a preferred choice for individuals managing chronic conditions. The ability to order medications with a few clicks and have them delivered to their doorstep aligns with the evolving healthcare preferences of North American consumers.

North America’s strong presence in the ePharmacy sector is influenced by a competitive landscape where numerous well-established platforms are actively competing for market dominance. These companies have dedicated substantial resources to marketing, technology, and logistics, aiming to improve their services and stand out in the market. This dynamic environment benefits consumers by providing a wide array of options and encouraging ongoing innovation in the industry.

Additionally, the COVID-19 pandemic accelerated the acceptance of digital health solutions, including ePharmacy services, as people sought contactless alternatives to traditional healthcare practices. The shift in consumer behavior, triggered by the pandemic, further propelled the growth of ePharmacy in North America.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The ePharmacy market is bustling with key players, each bringing its own unique strengths to the table. Among these influential companies, The Kroger Co. stands out as a major player, leveraging its extensive network of physical stores to provide customers with seamless online pharmaceutical services. This gives them a competitive edge in terms of both accessibility and customer trust.

Walgreen Co., a familiar name in the retail pharmacy landscape, is making significant strides in the ePharmacy sector. With a strong focus on digital innovation and customer convenience, Walgreen Co. is capitalizing on its well-established brand to expand its presence in the online pharmaceutical space.

Giant Eagle Inc. is carving its niche in the ePharmacy Market by combining a regional approach with a commitment to customer satisfaction. Their localized strategies cater to specific market needs, allowing them to build a loyal customer base.

Walmart Inc., a retail giant, is playing a formidable role in the ePharmacy landscape. The company’s vast resources and logistics capabilities enable it to offer a wide range of pharmaceutical products online, creating a one-stop-shop for customers seeking both health and household items.

In addition to these key players, there are several other significant contributors shaping the ePharmacy Market. These players, which may include emerging startups or established entities diversifying their portfolios, bring a dynamic element to the market. Their innovative approaches, ranging from tech-driven solutions to customer-centric services, contribute to the overall growth and evolution of the ePharmacy sector.

As the ePharmacy Market continues to evolve, the interplay of these key players will be crucial in defining the landscape. The competition fosters innovation, pushing companies to find new and improved ways to meet the evolving needs of consumers in the digital pharmaceutical space. With each player contributing its unique strengths, the ePharmacy Market is poised for sustained growth and enhanced customer experiences.

Market Key Players

- The Kroger Co.

- Walgreen Co.

- Giant Eagle Inc.

- Walmart Inc.

- Express Scripts Holding Company

- CVS Health

- Optum Rx Inc.

- Rowlands Pharmacy

- Cigna Corporation (Express Scripts Holdings)

- Amazon.com Inc.

- Axelia Solutions (Pharmeasy)

- Apex Healthcare Berhad (Apex Pharmacy)

Recent Developments

- In January 2024: At the Consumer Electronics Show (CES), Walmart revealed several technological innovations aimed at transforming customer experiences. This included a new GenAI-powered search experience for iOS users, which allows for more intuitive and comprehensive product searches. Additionally, Walmart announced the expansion of drone delivery services to 1.8 million more households in the Dallas-Fort Worth area, significantly enhancing delivery capabilities with 75% of supercenter items eligible for this service.

- In January 2024: Express Scripts is set to manage pharmacy benefits for over 20 million Centene patients, following a transition from CVS Caremark. This change is part of a broader effort to streamline pharmacy benefits management and is expected to influence service dynamics across a wide network of pharmacies that will now operate under Express Scripts’ provider contracts.

- In September 2023: GoodRx announced a significant initiative at Walgreens to reduce the prices of nearly 200 prescription medications by an average of 40%. With this new pricing structure, many commonly prescribed medications are now available for less than $15 for a 30-day supply. This initiative aims to make medications more affordable and accessible to consumers, addressing health concerns such as heart disease, mental health issues, and others not typically covered by insurance.

Report Scope

Report Features Description Market Value (2023) US$ 72.9 Bn Forecast Revenue (2033) US$ 258.6 Bn CAGR (2024-2033) 19.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Prescription Drug, Over-The-Counter Drug (Otc)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The Kroger Co., Walgreen Co., Giant Eagle Inc., Walmart Inc., Express Scripts Holding Company, CVS Health, Optum Rx Inc., Rowlands Pharmacy, Cigna Corporation (Express Scripts Holdings), Amazon.com Inc., Axelia Solutions (Pharmeasy), Apex Healthcare Berhad (Apex Pharmacy) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Kroger Co.

- Walgreen Co.

- Giant Eagle Inc.

- Walmart Inc.

- Express Scripts Holding Company

- CVS Health

- Optum Rx Inc.

- Rowlands Pharmacy

- Cigna Corporation (Express Scripts Holdings)

- Amazon.com Inc.

- Axelia Solutions (Pharmeasy)

- Apex Healthcare Berhad (Apex Pharmacy)