Global Enterprise Monitoring Market Size, Share, Industry Analysis Report By Offering (Software, Services),By Deployment Mode (On-Premises, Cloud),By Monitoring Type (Application Performance Monitoring, Infrastructure Monitoring, Network Monitoring, Log and Event Monitoring, Cloud Monitoring, Digital Experience Monitoring, Others),By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises),By End-User Industry (IT and Telecom, Banking Financial Services and Insurance, Healthcare and Life Sciences, Retail and E-Commerce, Manufacturing, Government and Public Sector, Other End-User Industry) By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Nov 2025

- Report ID: 167207

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- AI-Led Growth Outlook

- Strategic Snapshot

- Value Chain Overview

- By Offering

- By Deployment Mode

- By Monitoring Type

- By Organization Size

- By End-User Industry

- By Region

- Key Market Segments

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

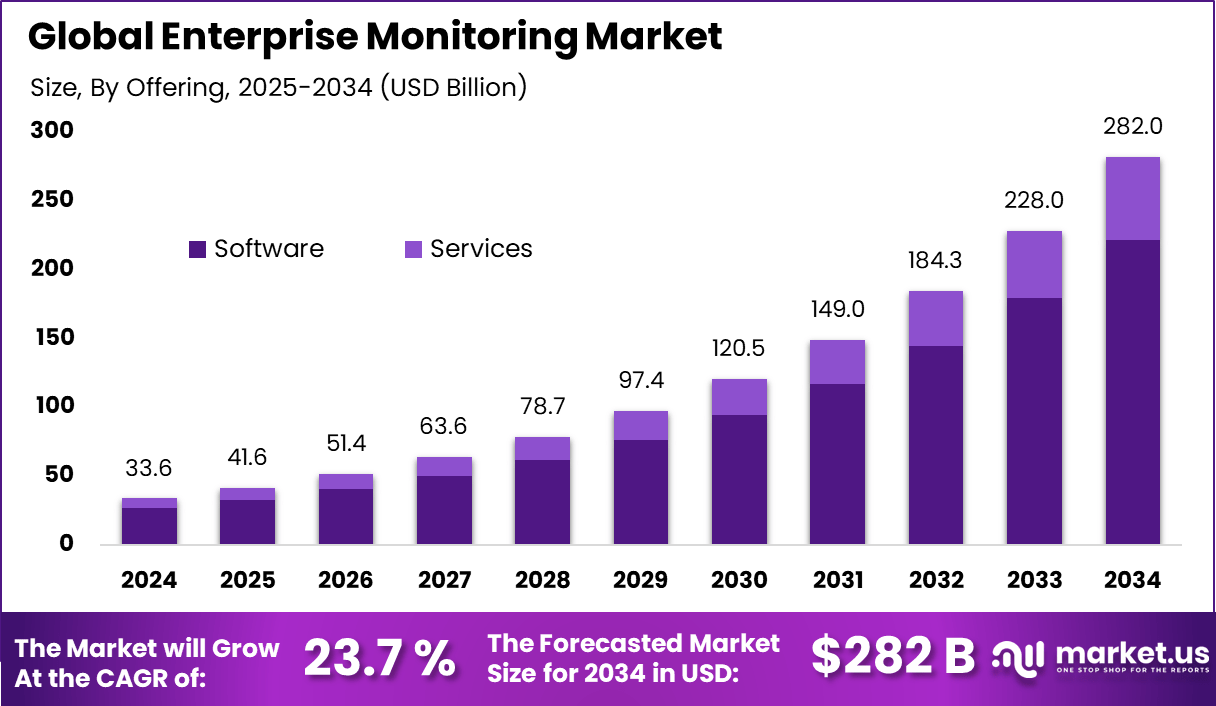

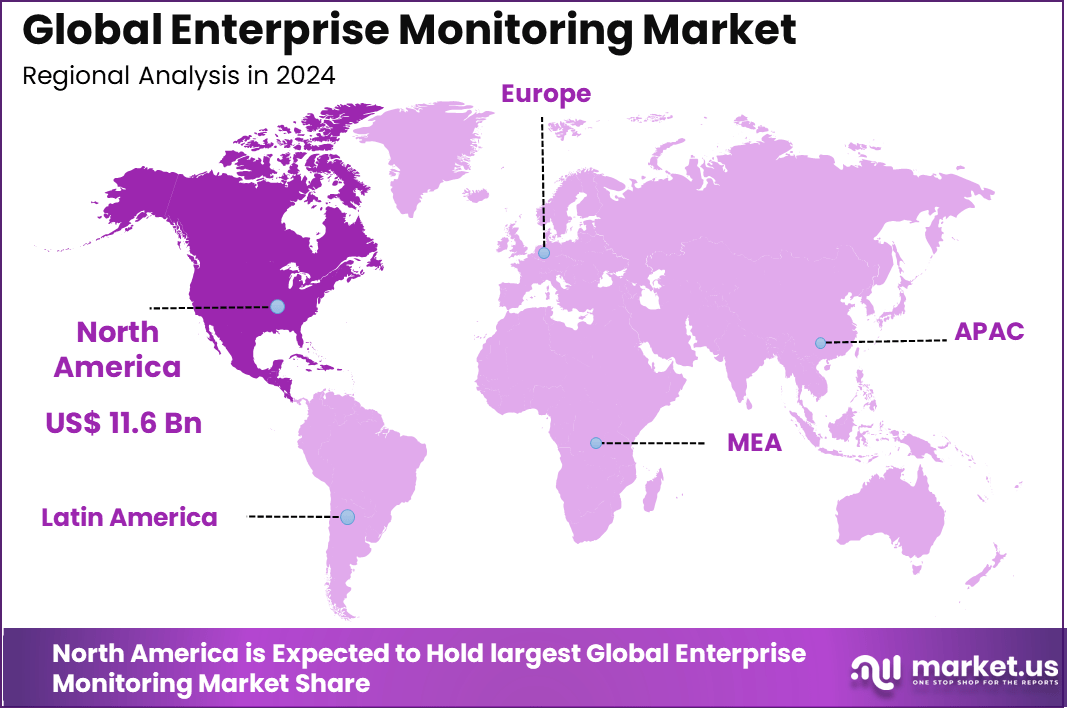

The Global Enterprise Monitoring Market generated USD 33.62 Billion in 2024 and is predicted to register growth to about USD 282 Billion by 2034, recording a CAGR of 23.70% throughout the forecast span. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 9.94 Billion revenue.

The enterprise monitoring market covers tools and systems used to observe the health, performance, and availability of applications, networks, servers, and digital infrastructure. These platforms collect data from various components of the IT environment and convert it into insights that help organizations maintain stability. As digital systems expand across cloud, on-premise, and hybrid setups, enterprise monitoring becomes essential for ensuring smooth operations.

The market is supported by the growth of distributed applications, increasing use of cloud services, and rising dependency on real-time digital operations. Organizations use monitoring solutions to detect issues early, avoid downtime, and maintain service quality for internal teams and customers. As IT environments become more complex, monitoring tools serve as a central layer for visibility and control across the entire system.

Key Takeaways

- Software solutions dominated the enterprise monitoring market with a 78.6% share, as organizations rely on advanced platforms for real-time visibility, analytics, and proactive issue resolution.

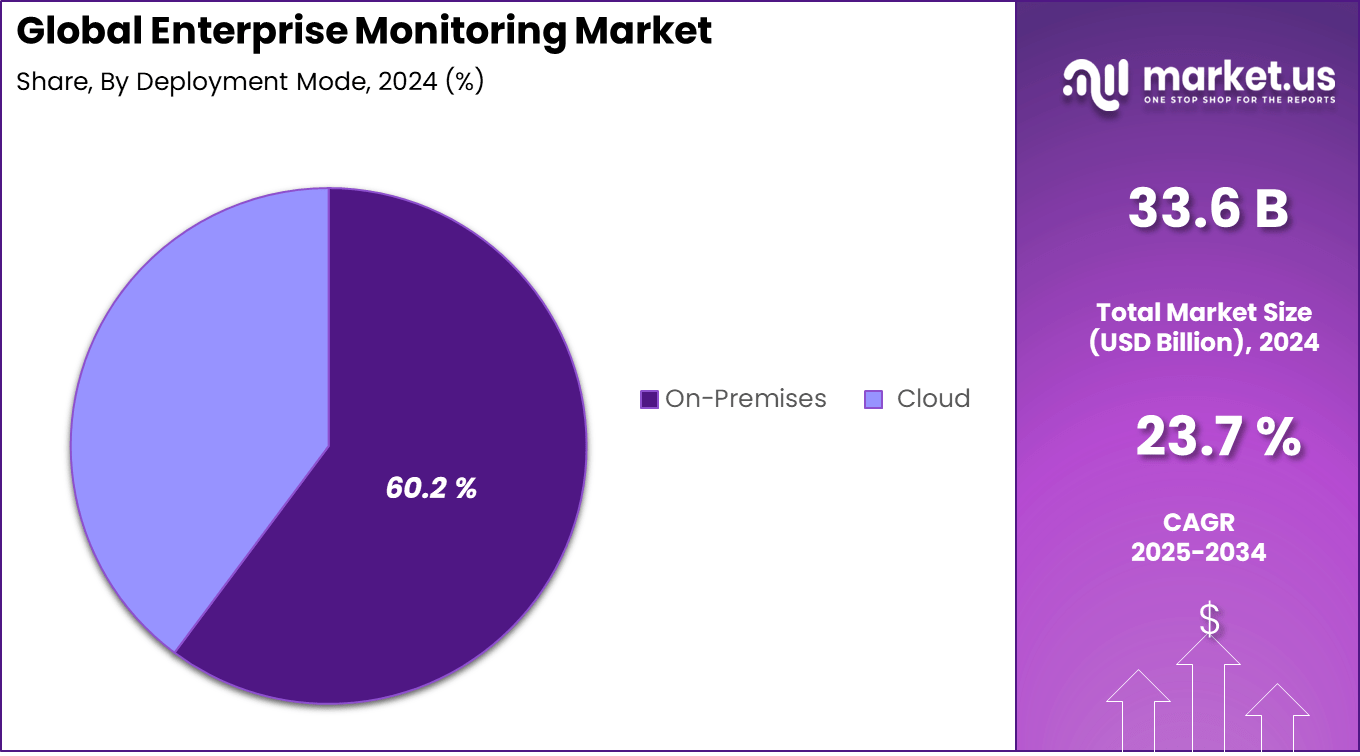

- On-premises deployment accounted for 60.2%, reflecting strong preference among enterprises for greater control, data security, and compliance with internal IT policies.

- Application Performance Monitoring led monitoring types with a 35.7% share, driven by the need to ensure consistent performance of business-critical applications.

- Large enterprises represented 70.4% of adoption, supported by complex IT environments and higher monitoring requirements across multiple systems.

- IT and telecom emerged as the leading end-user industry with 38.8%, due to continuous network operations, high service uptime expectations, and large-scale digital infrastructure.

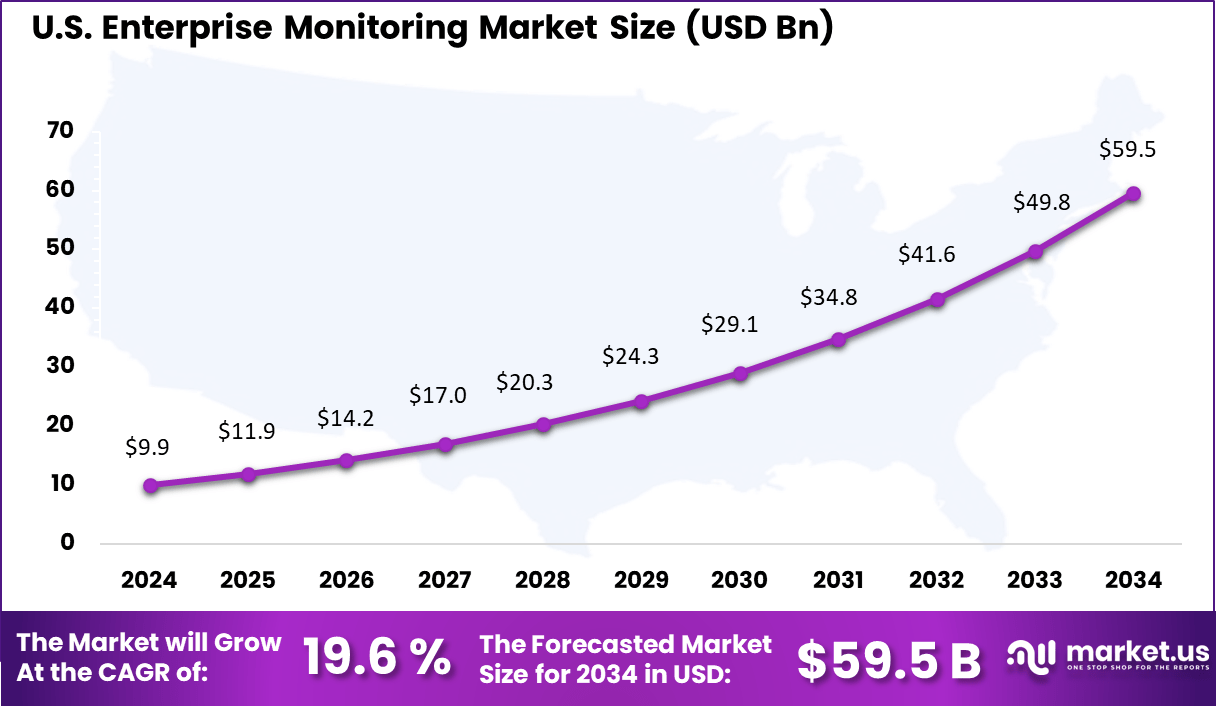

- North America held a 34.8% share, supported by early technology adoption and strong enterprise IT spending, while the U.S. market showed high growth momentum driven by digital transformation initiatives.

AI-Led Growth Outlook

AI-led advancement is shaping the next stage of enterprise monitoring. Modern monitoring platforms are adopting machine learning models to examine large volumes of logs, metrics, and traces in real time. These models support early detection of unusual patterns and give IT teams more time to react before disruptions occur. This improves system reliability and reduces unplanned outages across cloud and on-premise environments.

Another important aspect of AI-led growth is automated root cause analysis. Instead of manual investigations, AI models correlate events from different systems to identify underlying issues quickly. This reduces the workload for operations teams and improves service quality. As enterprises generate more telemetry data each year, AI-driven monitoring becomes essential for controlling complexity and maintaining operational performance.

Strategic Snapshot

The enterprise monitoring market is positioned as a foundational element within modern IT operations. Organizations depend on monitoring solutions to maintain performance across data centers, cloud platforms, and distributed applications. This central role makes monitoring a key investment area for digital transformation programs. Enterprises are increasingly integrating monitoring with IT service management and security analytics to form a unified operational strategy.

Another strategic dimension comes from the shift toward continuous modernization. As businesses adopt container platforms, microservices, and multi-cloud strategies, monitoring tools must adapt to track these environments. Vendors that support flexible deployment models and offer deep visibility across infrastructure layers maintain a competitive edge. This strategic alignment ensures long-term relevance for monitoring tools within evolving enterprise ecosystems.

Value Chain Overview

The value chain of the enterprise monitoring market begins with technology providers that develop monitoring engines, data collectors, and analytics components. These companies create the core platforms that gather performance metrics, logs, and user experience signals. Hardware suppliers, cloud providers, and integration partners support the infrastructure that enables monitoring systems to operate smoothly across hybrid environments.

The next layer consists of system integrators, managed service providers, and enterprise IT teams that deploy and configure monitoring solutions. These groups connect monitoring tools with existing applications and operational processes. The final stage of the value chain includes end users who rely on monitoring data to support decision making. Their insights help organizations maintain system stability, plan upgrades, and manage long-term performance goals.

By Offering

Software accounts for 78.6%, indicating that enterprise monitoring relies mainly on digital monitoring platforms. These software solutions track system performance, application health, and infrastructure availability across enterprise environments. Organizations depend on software tools to gain real-time visibility into complex IT systems. Centralized monitoring improves operational awareness.

The dominance of software is driven by the need for automation and continuous system oversight. Software platforms allow faster detection of performance issues and system failures. Enterprises use these tools to reduce downtime and improve service reliability. Regular updates and scalability further support adoption.

By Deployment Mode

On-premises deployment holds 60.2%, reflecting strong preference for internal control over monitoring systems. Enterprises handling sensitive data rely on local infrastructure to manage performance and security monitoring. On-site deployment supports direct access to monitoring data. This approach reduces reliance on external connectivity.

Adoption of on-premises systems is supported by compliance and data governance requirements. Organizations benefit from greater customization and system control. Integration with legacy infrastructure is easier in on-premises environments. These factors continue to support this deployment model.

By Monitoring Type

Application performance monitoring accounts for 35.7%, making it the leading monitoring type. Enterprises use these tools to track application response times, availability, and error rates. Continuous monitoring helps identify performance bottlenecks quickly. This improves overall application reliability.

Growth in this segment is driven by rising use of complex and distributed applications. Performance monitoring helps maintain consistent user experience. Enterprises rely on these insights to optimize application behavior. This supports smoother business operations.

By Organization Size

Large enterprises represent 70.4%, highlighting their strong reliance on enterprise monitoring solutions. These organizations operate complex IT environments with multiple applications and systems. Monitoring tools help manage this complexity efficiently. Centralized oversight is critical for large-scale operations.

Adoption among large enterprises is driven by higher IT budgets and operational risk management needs. Monitoring platforms support proactive issue resolution. They also improve system planning and capacity management. Long-term digital initiatives further increase adoption.

By End-User Industry

The IT and telecom sector holds 38.8%, making it the largest end-user segment. These organizations manage high volumes of network traffic and digital services. Continuous monitoring is essential to ensure service quality and uptime. System failures can directly impact customers.

Demand in this sector is driven by service-level requirements and network complexity. Monitoring tools help detect faults and performance issues early. They also support network optimization and service continuity. Reliability remains a top priority.

By Region

North America accounts for 34.8%, supported by advanced IT infrastructure and strong enterprise adoption. Organizations in the region invest heavily in monitoring tools to support digital operations. High cloud and application usage increases monitoring needs. Technology maturity supports steady demand.

The United States reached USD 9.94 Billion with a CAGR of 19.6%, reflecting strong market expansion. Growth is driven by increased application complexity and digital transformation. Enterprises continue to prioritize system reliability and performance. Monitoring solutions remain essential for operational stability.

Key Market Segments

By Offering

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Monitoring Type

- Application Performance Monitoring

- Infrastructure Monitoring

- Network Monitoring

- Log and Event Monitoring

- Cloud Monitoring

- Digital Experience Monitoring

- Others

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By End-User Industry

- IT and Telecom

- Banking, Financial Services and Insurance

- Healthcare and Life Sciences

- Retail and E-Commerce

- Manufacturing

- Government and Public Sector

- Other End-User Industry

Emerging Trends

In the enterprise monitoring market, one prominent trend is the advancement of unified observability platforms that consolidate infrastructure, application, network, and user experience data into a single analytical environment. This integration enables organisations to monitor complex IT ecosystems holistically, detect issues faster, and reduce dependency on siloed tools.

The convergence of real time telemetry with advanced dashboards supports actionable insights and improves operational responsiveness. Another emerging trend is the integration of machine learning and automation into monitoring workflows.

Predictive anomaly detection, automated alerting, and intelligent root cause analysis help enterprises manage large volumes of monitoring data without increasing manual effort. These capabilities are enhancing proactive issue resolution and reducing mean time to repair in enterprise environments where system complexity and workload volumes are rising.

Growth Factors

A key growth factor for the enterprise monitoring market is the rapid expansion of distributed and hybrid IT environments. Enterprises now operate across cloud, on premise, and edge infrastructures, increasing the need for comprehensive monitoring solutions that can span multiple environments.

Monitoring platforms that provide visibility across these diverse landscapes are essential for ensuring performance, availability, and security. Another factor fueling growth is the increasing importance of digital experiences and service continuity.

Business operations, customer interactions, and revenue generating services depend on consistently performant systems. Monitoring solutions help enterprises maintain service reliability by delivering early warnings of performance degradation, infrastructure bottlenecks, or application failures. This operational value promotes wider adoption across sectors with mission critical digital workloads.

Driver Analysis

Need for Real-Time Visibility and Faster Issue Resolution

A key driver is the demand for real-time visibility across enterprise environments. IT teams need immediate alerts when latency spikes, servers fail, or applications slow down. Monitoring systems provide continuous tracking and instant notifications that help prevent disruptions. This capability ensures reliable service levels for end users.

Another driver is the need for faster issue resolution. As applications grow more complex, diagnosing performance problems becomes more difficult. Enterprise monitoring platforms help pinpoint root causes by correlating data from different sources. This reduces investigation time and helps IT teams restore services quickly.

Restraint Analysis

Integration Complexity and High Data Volume Management

A major restraint is the complexity of integrating monitoring tools with existing systems. Enterprises often use a mix of legacy software, modern cloud platforms, and third-party applications. Connecting all these environments to a unified monitoring system requires time, configuration effort, and skilled resources. This slows adoption in organizations with limited technical capacity.

Another restraint is the challenge of managing large volumes of monitoring data. Continuous tracking generates huge amounts of logs, metrics, and traces. Storing, processing, and analyzing this data requires robust infrastructure. If not managed properly, the monitoring environment can become costly and resource intensive.

Opportunity Analysis

Expansion Into Hybrid and Multi-Cloud Environments

There is a strong opportunity in the growing use of hybrid and multi-cloud environments. Organizations that combine on-premise systems with multiple cloud platforms need monitoring tools that operate consistently across all layers. Vendors offering cross-platform visibility and simple integration can capture significant demand as enterprises expand their digital footprint.

Another opportunity lies in industry-specific monitoring use cases. Sectors such as healthcare, financial services, manufacturing, and retail rely on specialized applications with strict performance requirements. Monitoring tools tailored to these environments can help organizations meet security standards, compliance needs, and operational targets.

Challenge Analysis

Skills Gap and Complexity of Modern IT Architectures

A major challenge is the shortage of skilled professionals who can manage and interpret monitoring data. Even with user-friendly dashboards, effective monitoring requires understanding system behavior and identifying risk patterns. Without proper training, teams may miss important signals, reducing the effectiveness of monitoring efforts.

Another challenge is the complexity of modern IT architectures. Distributed applications span containers, cloud services, and microservices. Monitoring systems must collect data from many sources and present it in a coherent form. Ensuring consistent performance across such environments requires strong infrastructure planning and continuous optimization.

Key Players Analysis

Splunk, Datadog, New Relic, SolarWinds, IBM, Broadcom, Microsoft, Amazon Web Services, and Google lead the enterprise monitoring market with platforms that provide real time visibility across applications, infrastructure, and cloud environments. Their solutions help organizations detect performance issues, reduce downtime, and improve service reliability. These companies focus on scalability, AI driven insights, and unified monitoring dashboards.

Cisco Systems, Nagios Enterprises, ManageEngine, ScienceLogic, LogicMonitor, and AppDynamics strengthen the market with network monitoring, application performance management, and automated alerting capabilities. Their tools support proactive IT operations and faster root cause analysis. These providers emphasize ease of deployment, integration with IT service management, and cost efficiency.

Riverbed Technology, Micro Focus, BMC Software, Sumo Logic, Grafana Labs, and other players expand the landscape with specialized observability, log analytics, and visualization solutions. Their offerings help enterprises optimize performance and gain deeper operational insights. These companies focus on flexibility, open integration, and developer friendly tools. Increasing focus on uptime, digital experience, and operational resilience continues to drive steady growth in the enterprise monitoring market.

Top Key Players in the Market

- Splunk Inc.

- Datadog Inc.

- New Relic Inc.

- SolarWinds Corporation

- IBM Corporation

- Broadcom Inc.

- Microsoft Corporation

- Amazon Web Services Inc.

- Google LLC

- Cisco Systems Inc.

- Nagios Enterprises LLC

- ManageEngine (a division of Zoho Corporation Pvt. Ltd.)

- ScienceLogic Inc.

- LogicMonitor Inc.

- AppDynamics LLC

- Riverbed Technology LLC

- Micro Focus International plc

- BMC Software Inc.

- Sumo Logic Inc.

- Grafana Labs Inc.

- Others

Recent Developments

- Splunk Inc. (Cisco) – By August 2025, Cisco had completed its integration of Splunk with its networking portfolio, launching unified network and application observability that gives end‑to‑end views across IT infrastructure and security operation. The combined offer targets enterprises with complex hybrid architectures, positioning Splunk as the analytics and investigation layer while Cisco provides deep network and security telemetry.

- LogicMonitor Inc. – At its Elevate 2025 conference in May 2025, LogicMonitor outlined a strategy to blend hybrid observability with “Agentic AI,” embedding its Edwin AI assistant into incident response, anomaly detection and resource navigation so the platform can move from reactive monitoring to intelligent operations.

Report Scope

Report Features Description Market Value (2024) USD 33.62 Bn Forecast Revenue (2034) USD 282 Bn CAGR(2025-2034) 23.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Software, Services), By Deployment Mode (On-Premises, Cloud), By Monitoring Type (Application Performance Monitoring, Infrastructure Monitoring, Network Monitoring, Log and Event Monitoring, Cloud Monitoring, Digital Experience Monitoring, Others), By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), By End-User Industry (IT and Telecom, Banking Financial Services and Insurance, Healthcare and Life Sciences, Retail and E-Commerce, Manufacturing, Government and Public Sector, Other End-User Industry) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Splunk Inc., Datadog Inc., New Relic Inc., SolarWinds Corporation, IBM Corporation, Broadcom Inc., Microsoft Corporation, Amazon Web Services Inc., Google LLC, Cisco Systems Inc., Nagios Enterprises LLC, ManageEngine (a division of Zoho Corporation Pvt. Ltd.), ScienceLogic Inc., LogicMonitor Inc., AppDynamics LLC, Riverbed Technology LLC, Micro Focus International plc, BMC Software Inc., Sumo Logic Inc., Grafana Labs Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Monitoring MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Enterprise Monitoring MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Splunk Inc.

- Datadog Inc.

- New Relic Inc.

- SolarWinds Corporation

- IBM Corporation

- Broadcom Inc.

- Microsoft Corporation

- Amazon Web Services Inc.

- Google LLC

- Cisco Systems Inc.

- Nagios Enterprises LLC

- ManageEngine (a division of Zoho Corporation Pvt. Ltd.)

- ScienceLogic Inc.

- LogicMonitor Inc.

- AppDynamics LLC

- Riverbed Technology LLC

- Micro Focus International plc

- BMC Software Inc.

- Sumo Logic Inc.

- Grafana Labs Inc.

- Others