Global Enterprise Governance, Risk And Compliance Market Size, Share Analysis Report By Component (Software, Services, Integration, Consulting, Support), By Application (Director Board, EHS, ESG, Legal Services, Others), By Organization Size (Small & Medium Enterprise, Large Enterprise), By Vertical (BFSI, Construction & Engineering, Energy & Utilities, Government, Healthcare, Manufacturing, Retail & Consumer Goods, Telecom & IT, Transportation & Logistics, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150883

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

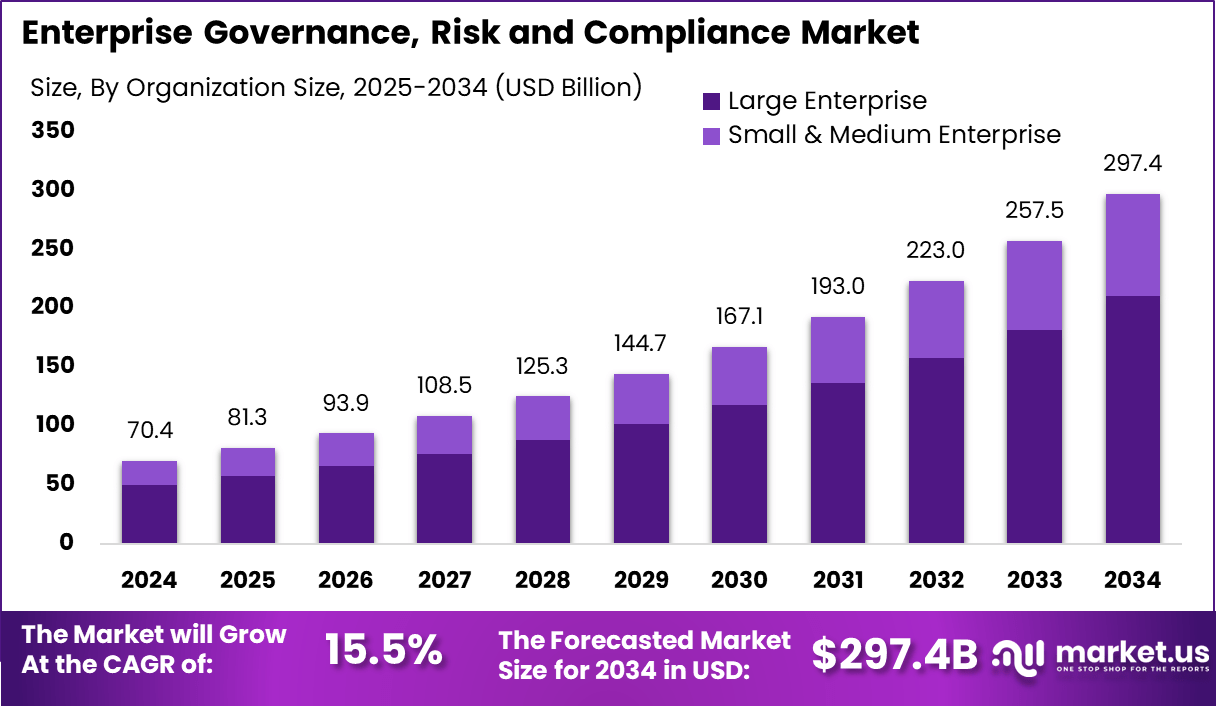

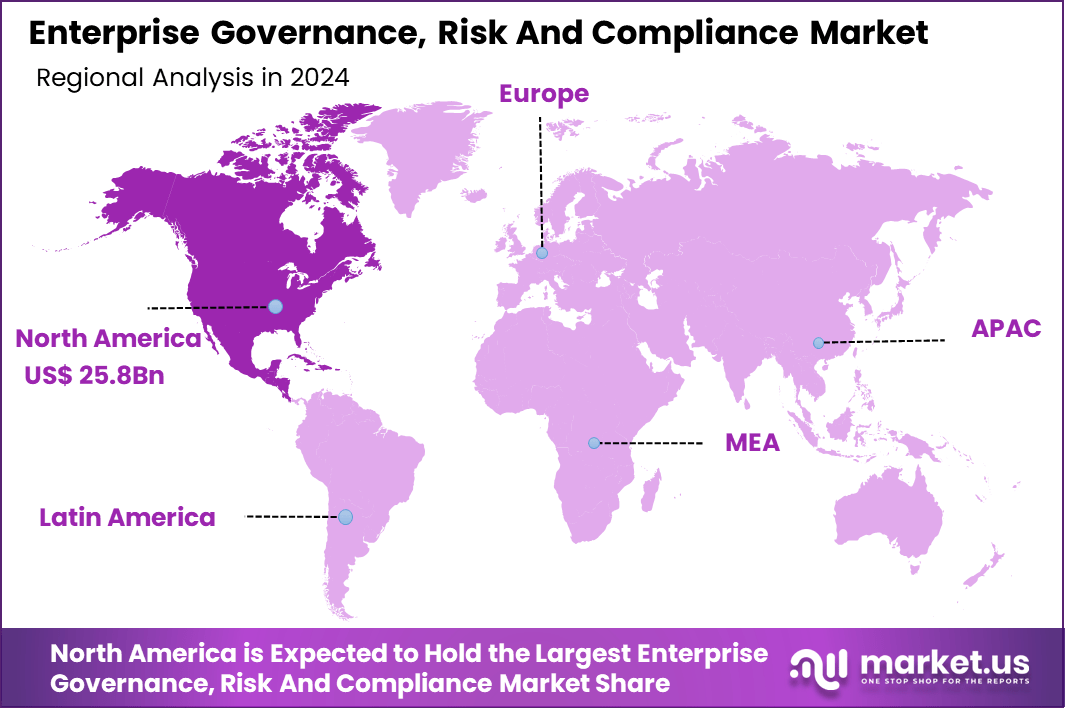

The Global Enterprise Governance, Risk And Compliance Market size is expected to be worth around USD 297.4 Billion By 2034, from USD 70.4 billion in 2024, growing at a CAGR of 15.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.7% share, holding USD 25.8 Billion revenue.

The Enterprise Governance, Risk, and Compliance (eGRC) Market is undergoing significant transformation as global business environments become increasingly complex. Comprehensive platforms are being adopted to unify governance, risk management, and compliance activities, delivering organizational stability, operational efficiency, and regulatory transparency.

The Top Driving Factor behind market expansion is the intensifying regulatory landscape worldwide. Enterprises face evolving obligations under frameworks such as GDPR, SOX, HIPAA, PCI-DSS, and regional cybersecurity mandates, which drive the adoption of automated compliance and risk management tools. Concurrently, rising complexity and frequency of cyber threats heighten the demand for real-time risk analytics and unified governance systems.

For instance, In April 2024, LogicGate, a U.S.-based risk management company, introduced its AI Governance Solution to support enterprises in managing and governing AI technologies across operations. This new solution is designed to ensure compliance, agility, and a competitive advantage, enabling businesses to adopt AI responsibly while maximizing its value. The launch reflects a growing need for secure and structured AI integration in enterprise systems.

The Investment Opportunities in eGRC lie in several emerging areas: SaaS tools for mid-sized organizations, AI-driven risk engines, blockchain-based audit trails, and GRC platforms tailored for specialized verticals like healthcare and energy. Consultants and managed service providers are entering joint ventures to deliver advisory and implementation services.

Key Takeaways

- The Global Enterprise Governance, Risk and Compliance (EGRC) Market is forecast to reach USD 297.4 billion by 2034, growing from USD 70.4 billion in 2024, at a strong CAGR of 15.5% during 2025–2034.

- In 2024, North America led globally with a 36.7% market share, generating approximately USD 25.8 billion in revenue.

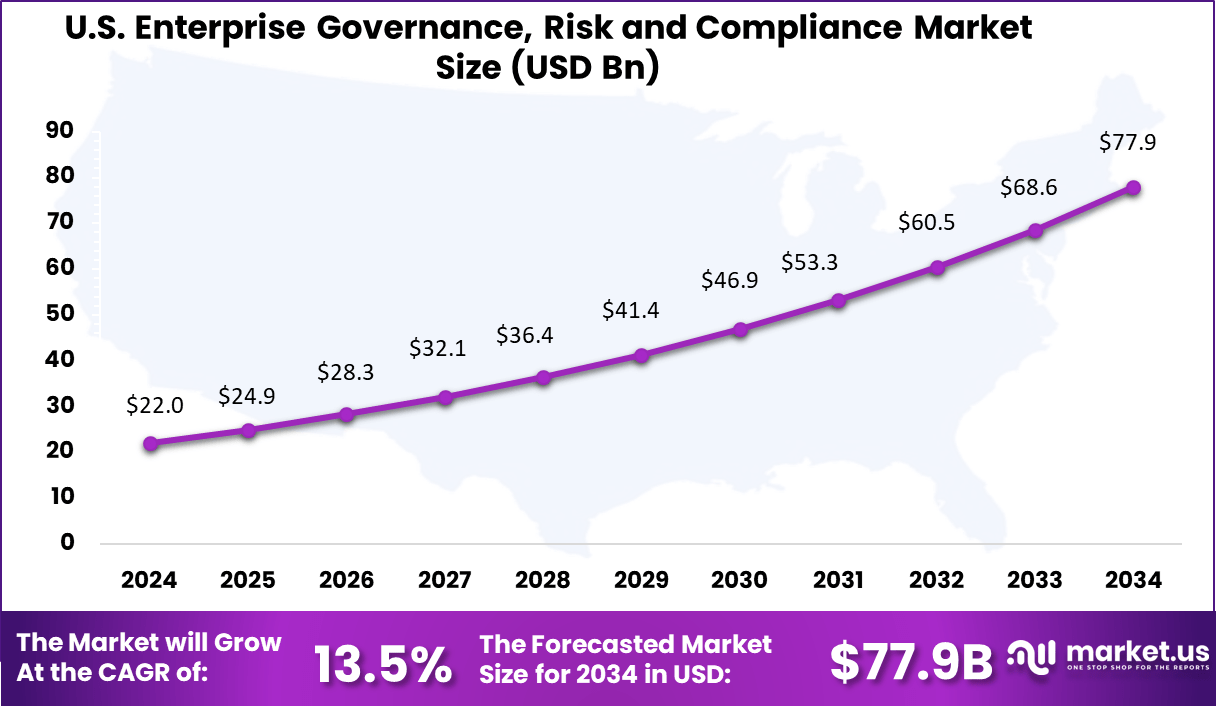

- The United States contributed USD 21.96 billion in 2024 and is expected to expand steadily at a CAGR of 13.5% through 2034.

- The Software segment dominated the market by component, accounting for 64.7%, reflecting the shift towards integrated digital compliance platforms.

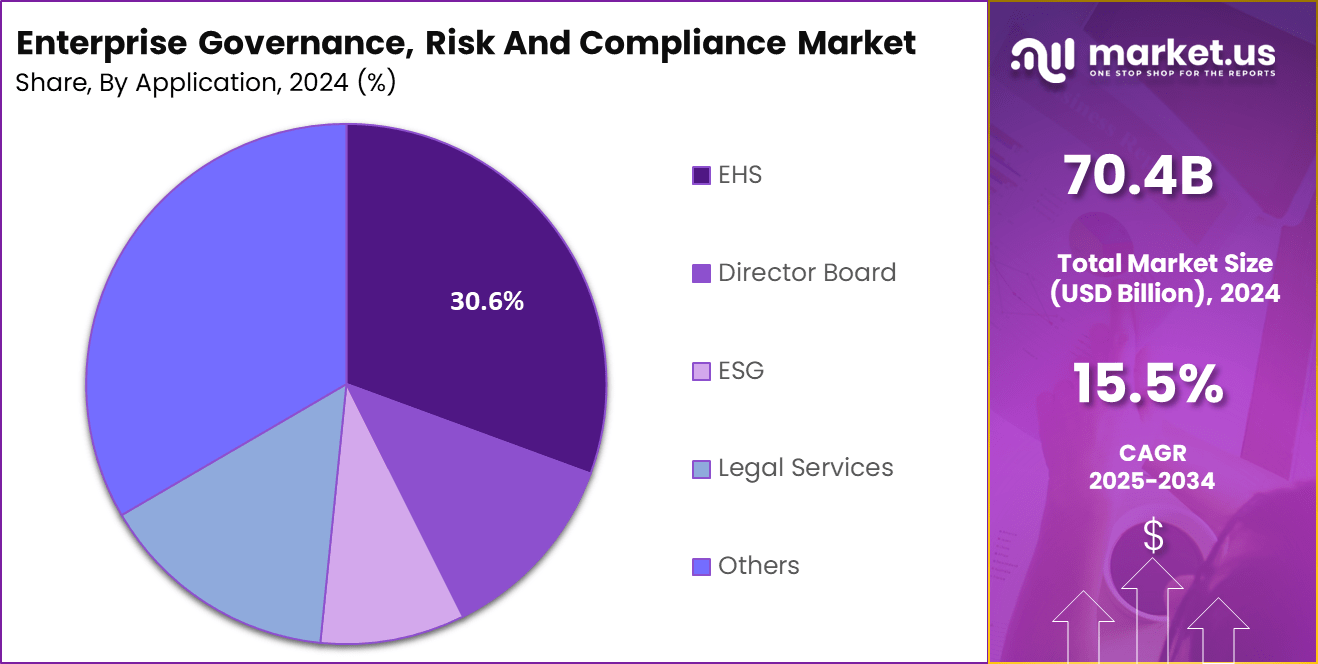

- Among applications, Environment, Health, and Safety (EHS) held a notable 30.6% share, driven by regulatory tightening and rising ESG priorities.

- By organization size, Large Enterprises remained the primary adopters, with a commanding 70.7% share in 2024, due to their complex regulatory obligations.

- Within verticals, the BFSI sector led the market with 26.9% share, supported by strict compliance frameworks and increasing risk management initiatives.

Role of AI

Artificial intelligence is playing a transformative role in the evolution of Enterprise Governance, Risk, and Compliance (eGRC) frameworks by automating risk identification, streamlining compliance processes, and enhancing decision-making across complex regulatory environments.

AI tools are increasingly being adopted to continuously monitor internal controls and detect compliance breaches in real time, significantly reducing dependence on manual audits. Machine learning algorithms can analyze vast datasets from operational systems, communications logs, and third-party platforms to identify anomalies that signal potential compliance issues or policy violations.

This shift allows enterprises to transition from reactive to predictive compliance postures, strengthening their risk mitigation strategies and regulatory responsiveness. Furthermore, natural language processing and AI-based policy engines are now being used to interpret and align business operations with continuously evolving regulatory guidelines. These systems can automatically map new regulatory changes against existing policies, highlighting gaps and recommending remediation.

In addition, AI enhances transparency and traceability through automated documentation and audit trails, which not only improve compliance reporting but also reduce the burden on legal and compliance teams. Enterprises are also leveraging AI to identify insider threats, assess third-party risks, and create dynamic risk-scoring models tailored to their operational realities.

US Market Expansion

The US Enterprise Governance, Risk And Compliance Market is valued at approximately USD 22 Billion in 2024 and is predicted to increase from USD 41.4 Billion in 2029 to approximately USD 77.9 Billion by 2034, projected at a CAGR of 13.5% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 36.7% share and generating approximately USD 25.8 billion in revenue in the Enterprise Governance, Risk, and Compliance (EGRC) market. This regional leadership is largely driven by early and widespread adoption of AI-driven compliance tools, a matured regulatory landscape, and a strong focus on cyber risk resilience.

U.S. organizations, in particular, have been proactive in deploying advanced EGRC platforms to manage complex regulatory obligations, especially in heavily regulated sectors such as finance, healthcare, and critical infrastructure. The presence of large enterprises and well-funded startups in the region has further accelerated innovation in automation, data governance, and predictive analytics.

By Component Analysis

In 2024, Software segment held a dominant market position, capturing more than a 64.7% share of the global EGRC market. This leadership is a reflection of enterprises’ strong preference for scalable, cloud-native solutions that offer real-time visibility into compliance and risk.

As organizations migrate to cloud environments, they increasingly require flexible EGRC platforms capable of seamless integration with existing systems. The inclination toward automation has elevated demand for software that supports audit, policy, incident, and compliance management in a unified environment.

The software segment’s prominence is further explained by its ability to consolidate diverse risk and compliance functions into a single pane of glass. Centralized dashboards and analytics-powered tools enable organizations to proactively monitor emerging risks, manage regulatory changes, and streamline reporting processes – capabilities that cannot be fully replicated via services alone.

Vendor consolidation in the software space has also contributed, with major platforms offering integrated modules across audit, risk, policy, incident, and compliance domains. This comprehensive coverage drives adoption among large enterprises seeking efficiency and cohesion.

Component Comparison

Component 2024 Share Key Strengths Outlook Summary Software > 64.7% Cloud scalability, AI-enabled analytics, modular risk/compliance tools Expected to maintain dominance; core driver of ~13% CAGR through 2030 Services (total) ~ 35% Integration, consulting, support services Consulting leads; strong growth in integration; support ensures system resilience By Application Analysis

In 2024, EHS segment held a dominant market position, capturing more than a 30.6% share of the global EGRC market. This strong leadership was underpinned by organizations’ increasing focus on ensuring workplace safety and managing environmental responsibilities. Industrial and manufacturing firms, in particular, faced rising pressure to comply with stricter safety policies and environmental standards.

The EHS applications segment emerged as a vital component for enterprises balancing operational efficiency with regulatory obligations, driving a surge in software solutions that automate incident reporting, safety training, hazard assessment, and emissions tracking. The momentum behind the EHS segment was further reinforced by its ability to integrate seamlessly with core risk and compliance systems.

Application Segment Overview

Application Area 2024 Share Growth Drivers Outlook Summary EHS >30.6% (dominant) Occupational safety mandates; environmental regulations; ESG alignment Expected to maintain leadership as regulatory focus and ESG pressures intensify Director Board Significant role Governance oversight; audit preparedness; policy compliance Stable growth; critical for executive-level risk management ESG Emerging rapidly Investor expectations; sustainability reporting mandates High growth potential; strong adoption trend Legal Services Moderate slice Contract risk management; legal compliance Steady expansion; supports broader risk control strategies Others Niche consolidation IT risk, third-party risk, anti-fraud, digital threats Incremental growth expected with digital adoption This integration allowed for a unified approach to governance, enabling real-time monitoring of safety metrics alongside traditional compliance and risk indicators. Given that industrial risk management is a top priority for many sectors, EHS platforms that offered predictive analytics, mobile data capture, and centralized dashboards gained a rapid edge.

By Organization Size Analysis

In 2024, Large Enterprise segment held a dominant market position, capturing more than a 70.7% share of the global EGRC market. This commanding role can be attributed to the inherent complexities faced by large organizations – operating across multiple countries, navigating diverse regulatory frameworks, and maintaining intricate supply chains.

These enterprises must invest deeply in sophisticated EGRC platforms that provide centralized control, robust analytics, and cross-jurisdiction compliance capabilities. The scale of their operations, coupled with the financial penalties and reputational risks associated with non-compliance, incentivizes substantial spending on integrated GRC software and expert services.

Furthermore, large enterprises are leading the adoption of AI-powered GRC solutions to manage automation, predictive risk analysis, and incident response. These capabilities align with the strategic priorities of enterprise boards and risk committees, elevating EGRC from a backend function to a core element of corporate governance.

Organization Size Segment Overview

Organization Size 2024 Share Key Drivers Outlook Summary Large Enterprise > 70.7% (dominant) Complex compliance needs; cross-border operations; advanced eGRC adoption Expected to maintain dominance; benefit from AI, cloud, centralized investment SMEs < 30% (smaller) Growing digital risk; affordable, modular offerings; vendor-simplified tools Anticipated accelerated growth; segment gaining traction with scalable solutions The combination of high regulatory pressure, advanced digital infrastructure, and in-house talent allows large organizations to deploy tailored EGRC systems – comprising consulting, integration, and ongoing support – designed to deliver enterprise-wide oversight and agility.

By Vertical Analysis

In 2024, BFSI segment held a dominant market position, capturing more than a 26.9% share of the global Enterprise Governance, Risk, and Compliance (EGRC) market. This leading role reflects the heightened regulatory complexity and risk exposure in the financial sector. Banks, insurance companies, and capital markets face persistent pressures from credit, market, operational, and cyber‑fraud risks.

EGRC platforms offering real‑time risk monitoring, fraud detection, and regulatory reporting have become essential tools for institutions aiming to manage these multifaceted demands efficiently. The priority placed on vendor risk, anti‑money laundering (AML), and cybersecurity compliance has driven BFSI adoption. Financial institutions operate with extensive third‑party networks and complex product portfolios, making them vulnerable to supply‑chain, transaction, and reputational risks.

EGRC solutions that integrate vendor governance, transaction monitoring, and incident response provide these organizations with a unified system to anticipate and mitigate threats – a capability that sustains the BFSI’s position at the forefront of the market. Additionally, rapid digitalization within BFSI has accelerated demand for scalable EGRC tools.

Vertical Segment Outlook

Vertical 2024 Share Key Drivers Outlook Summary BFSI > 26.9% (dominant) Regulatory complexity; fraud/cyber risk; AI analytics; global operations Expected to maintain leadership; strong catalyst for continued eGRC innovation Government Significant Public accountability; regulatory audits; data privacy mandates High adoption; steady expansion via transparency and service regulation Healthcare Robust growth HIPAA/EMR compliance; patient data security; supply chain risk management Accelerating adoption; compliance demands and digital transformation in care Manufacturing Moderate Operational & supply-chain risk; safety/quality compliance Growing steadily; integration across ERP and IoT systems Energy & Utilities Moderate Grid security; environmental regulation; critical infrastructure protection Required for resilience; stable moderate growth As banks and insurers evolve toward digital platforms, they require compliance systems capable of harmonizing with agile development cycles, cloud architectures, and evolving regulatory frameworks. The combination of technological sophistication, regulatory scrutiny, and tangible business value has secured BFSI’s dominant share. While other verticals such as IT & Telecom are emerging quickly, none yet match the scale and depth of EGRC deployment seen in the financial sector.

Key Market Segments

By Component

- Software

- Audit Management

- Compliance Management

- Risk Management

- Policy Management

- Incident Management

- Others

- Services

- Integration

- Consulting

- Support

By Application

- Director Board

- EHS

- ESG

- Legal Services

- Others

By Organization Size

- Small & Medium Enterprise

- Large Enterprise

By Vertical

- BFSI

- Construction & Engineering

- Energy & Utilities

- Government

- Healthcare

- Manufacturing

- Retail & consumer goods

- Telecom & IT

- Transportation & Logistics

- Others

Market Dynamics

Aspect Key Insight Implication Emerging Trend AI-driven, integrated eGRC platforms with predictive analytics and real-time compliance automation Enables unified oversight and reduces manual risk/compliance management Driver Escalating cybersecurity threats and regulatory mandates, especially in BFSI and healthcare sectors Drives strong demand for end-to-end eGRC adoption to ensure resilience and legal adherence Restraint High cost and complexity of integrating eGRC with legacy systems Limits adoption among SMEs and delays digital risk transformation in traditional enterprises Opportunity Scalable, modular eGRC tools tailored for SMEs with flexible deployment models Expands market base and improves accessibility for resource-constrained organizations Challenge Rapidly evolving global regulations around ESG, data privacy, and cyber reporting Creates pressure on vendors to provide adaptable, self-updating compliance platforms Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Leading participants in the Enterprise Governance, Risk, and Compliance (eGRC) market are actively pursuing strategic initiatives to strengthen their competitive position and expand their solution offerings. These strategies include the launch of innovative compliance tools, deeper integration of AI and automation, as well as cross-industry collaborations aimed at enhancing risk visibility and regulatory agility.

For instance, in recent developments, major solution providers have entered into partnerships with regional consulting firms and cloud service vendors to broaden their market access and deliver tailored compliance solutions.

Several players have also launched upgraded GRC platforms equipped with advanced risk modeling, real-time dashboards, and ESG compliance modules to meet the growing demand for digital-first governance frameworks. These moves are in line with the industry’s broader shift toward scalable, secure, and data-driven compliance ecosystems.

Top Key Players Covered

- FIS

- Genpact

- IBM

- Maclear Global

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI360 Inc.

- SAP SE

- SAS Institute Inc.

- Software GmbH

- Thomson Reuters

- Wolters Kluwer N.V.

- Others

Recent Developments

- In January 2025, IBM partnered with e&, a UAE-based technology group, to deploy a full-scale AI and Generative AI governance framework aimed at reinforcing compliance and ethical oversight. Powered by IBM’s watsonx.governance platform, this collaboration focuses on enhancing risk control and regulatory adherence across e&’s AI infrastructure.

- In October 2024, Thomson Reuters acquired Materia, a U.S.-based AI startup focused on tax and audit automation. This move was intended to deepen the company’s AI capabilities, streamline financial compliance tasks, and improve risk mitigation in regulatory reporting through intelligent workflow enhancements.

- In September 2024, Oracle launched its Financial Crime and Compliance Management (FCCM) Monitor Cloud Service, offering financial institutions a unified platform to oversee compliance. The service enables faster risk detection, supports proactive fraud prevention, and aims to reduce overall compliance costs through intelligent automation and centralized oversight.

- In March 2024, Credo AI launched its upgraded Governance, Risk, and Compliance (GRC) platform for AI, aimed at enabling the safe and ethical deployment of AI systems. The redesign includes new features tailored for AI Governance Custodians, streamlining compliance tasks and supporting responsible AI practices through an improved user interface.

- In February 2024, Swiss GRC announced its entry into the Indian market, offering both on-premise and private cloud solutions specifically customized for local BFSI institutions and government agencies. This strategic move highlights the growing demand for localized, compliant GRC solutions in emerging markets.

- Also in February 2024, iOPEX introduced a specialized compliance and governance add-on for ServiceNow’s creator workflows. This integration enhances ServiceNow’s utility by embedding risk-aware governance features, helping enterprises meet regulatory standards while maintaining operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 70.4 Bn Forecast Revenue (2034) USD 297.4 Bn CAGR (2025-2034) 15.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services, Integration, Consulting, Support), By Application (Director Board, EHS, ESG, Legal Services, Others), By Organization Size (Small & Medium Enterprise, Large Enterprise), By Vertical (BFSI, Construction & Engineering, Energy & Utilities, Government, Healthcare, Manufacturing, Retail & Consumer Goods, Telecom & IT, Transportation & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FIS, Genpact, IBM, Maclear Global, MetricStream, Microsoft, NAVEX Global, Inc., Oracle, RSA Security LLC, SAI360 Inc., SAP SE, SAS Institute Inc., Software GmbH, Thomson Reuters, Wolters Kluwer N.V., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Governance, Risk and Compliance MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Enterprise Governance, Risk and Compliance MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FIS

- Genpact

- IBM

- Maclear Global

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI360 Inc.

- SAP SE

- SAS Institute Inc.

- Software GmbH

- Thomson Reuters

- Wolters Kluwer N.V.

- Others