Global Enterprise Data Risk Management Market Size, Share, Growth Analysis By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Risk Type (Cyber and IT Risk, Operational Risk, Financial Risk, Compliance and Regulatory Risk, Third-party and Vendor Risk, Strategic Risk), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Government and Public Sector, IT and Telecommunications, Manufacturing, Energy and Utilities, Retail and Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2035

- Published date: Feb 2026

- Report ID: 178796

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Effective Takeaways

- Industry Adoption

- By Component Analysis

- By Deployment Modes

- By Organization Size

- By Risk Types

- By End-User Industry Analysis

- Key Market Segments

- Regional Analysis

- US Market Size

- Driving Factors

- Restraint factors

- Growth Opportunities

- Trending factors

- Competitive Analysis

- Future Predictions

- Recent Developments

- Report Scope

Report Overview

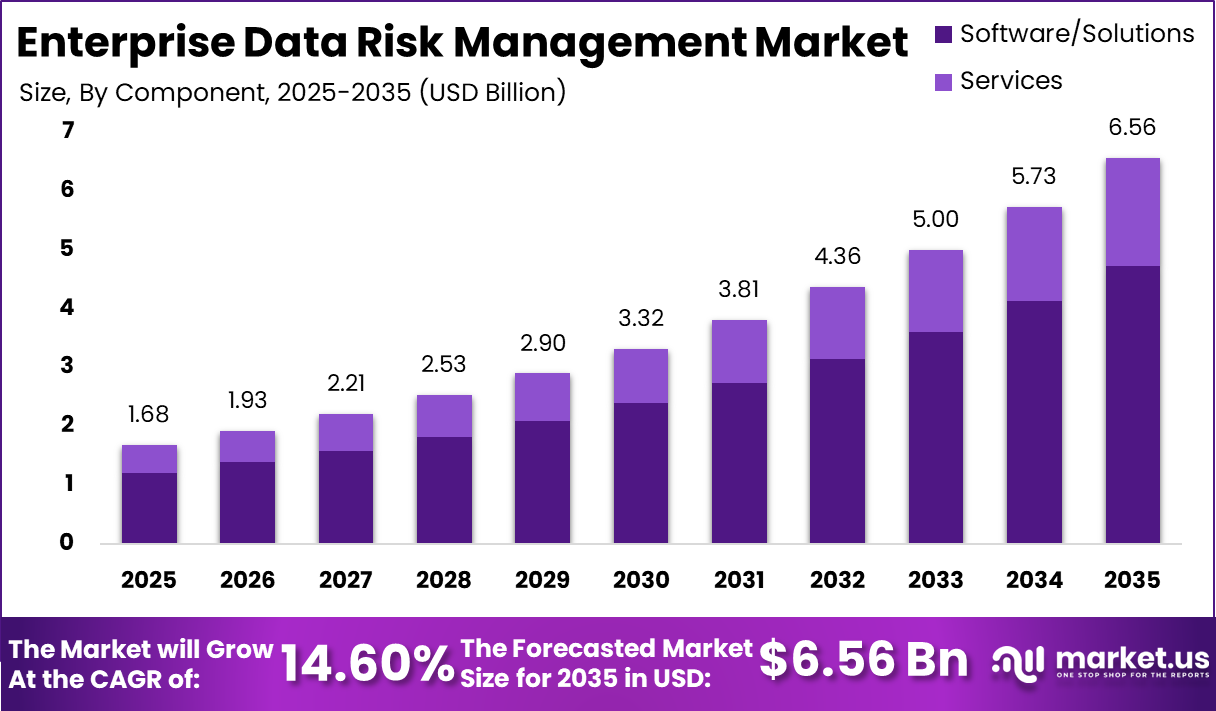

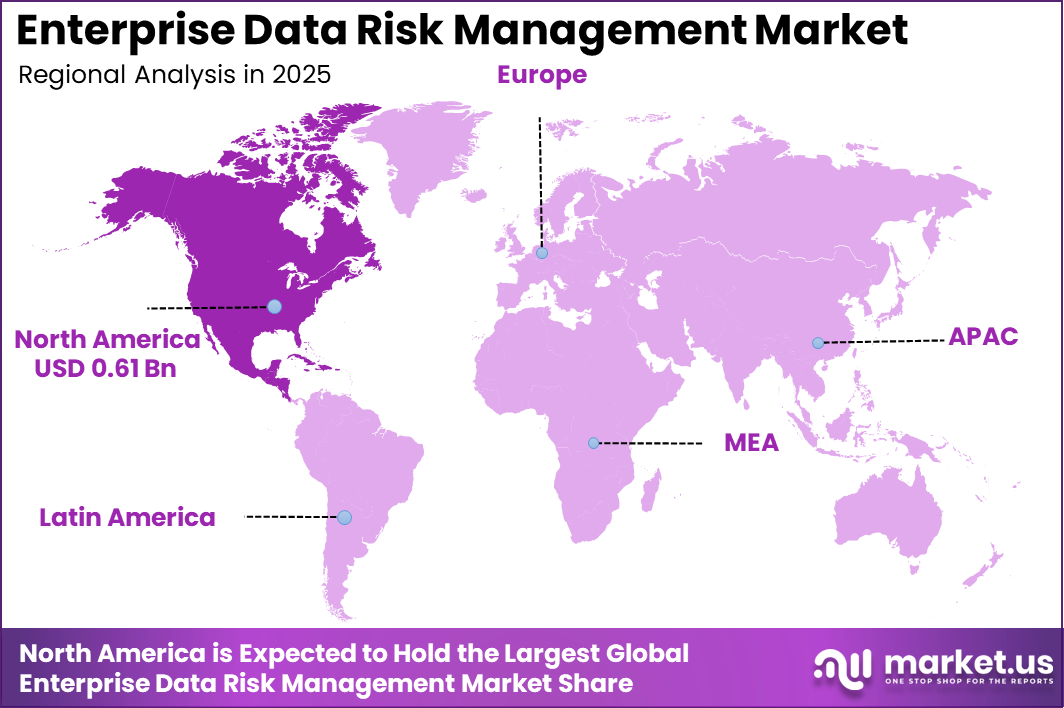

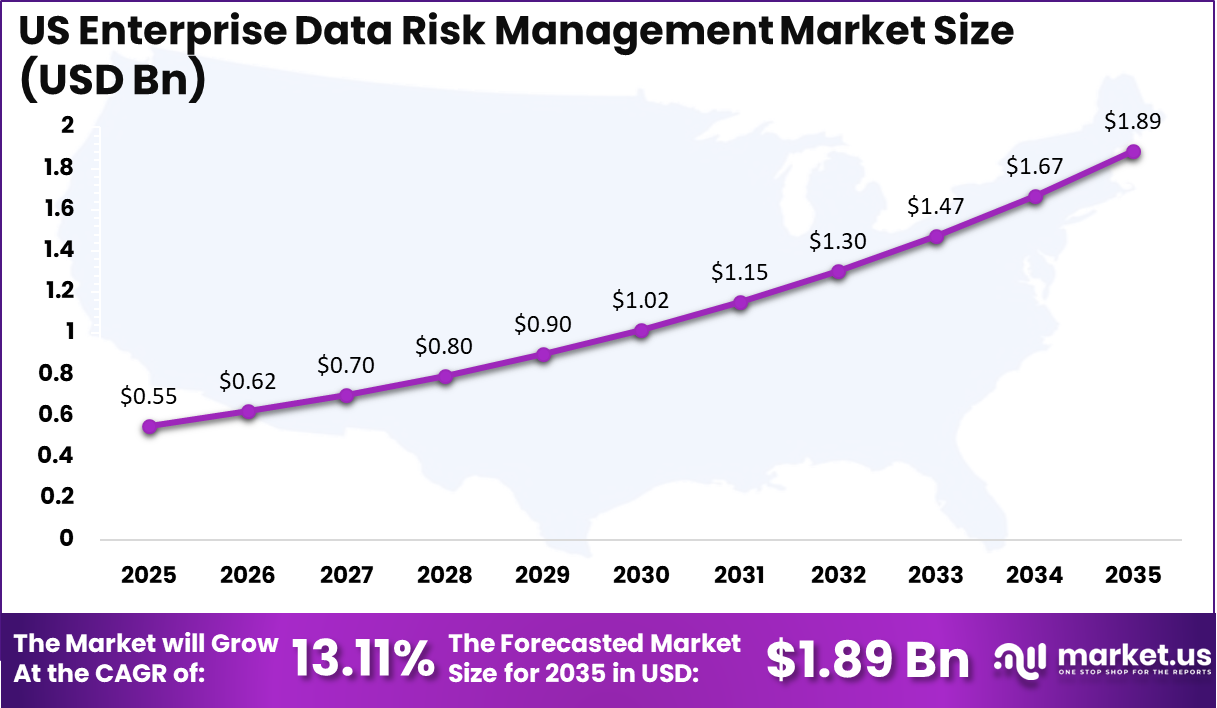

The Enterprise Data Risk Management Market is valued at USD 1.68 billion in 2025 and is projected to reach USD 6.56 billion by 2035, growing at a CAGR of 14.60%. North America holds a significant share of 36.5%, with a market size of USD 0.61 billion in 2025. Within the region, the US is expected to contribute USD 0.55 billion in 2025, growing to USD 1.89 billion by 2035, with a CAGR of 13.11%.

The market’s growth is being driven by the increasing complexity of enterprise data ecosystems, heightened regulatory scrutiny, and the rising threat of data breaches and cyberattacks. Organizations are increasingly adopting data risk management solutions to safeguard sensitive information, comply with privacy regulations, and ensure business continuity. As data becomes more distributed across cloud environments and third-party platforms, companies need integrated solutions that provide real-time risk assessment, governance, and mitigation strategies.

North America’s dominance is attributed to the region’s well-established regulatory frameworks and high adoption of advanced technologies, including AI and machine learning, to manage and mitigate data-related risks. The US, being the largest contributor in the region, is expected to continue leading the market, driven by stringent data protection laws and a growing focus on securing digital infrastructures across various industries, including finance, healthcare, and IT.

Effective Takeaways

- The Enterprise Data Risk Management Market is valued at USD 1.68 billion in 2025, with a projected value of USD 6.56 billion by 2035, reflecting a 14.60% CAGR.

- North America holds a 36.5% market share, with a 2025 size of USD 0.61 billion.

- The US market is valued at USD 0.55 billion in 2025, growing to USD 1.89 billion by 2035, at a 13.11% CAGR.

- Software/Solutions dominate the market with 72% share, highlighting strong demand for automated risk management tools.

- Cloud-based deployments represent 58% of the market, showing a preference for scalable, flexible solutions.

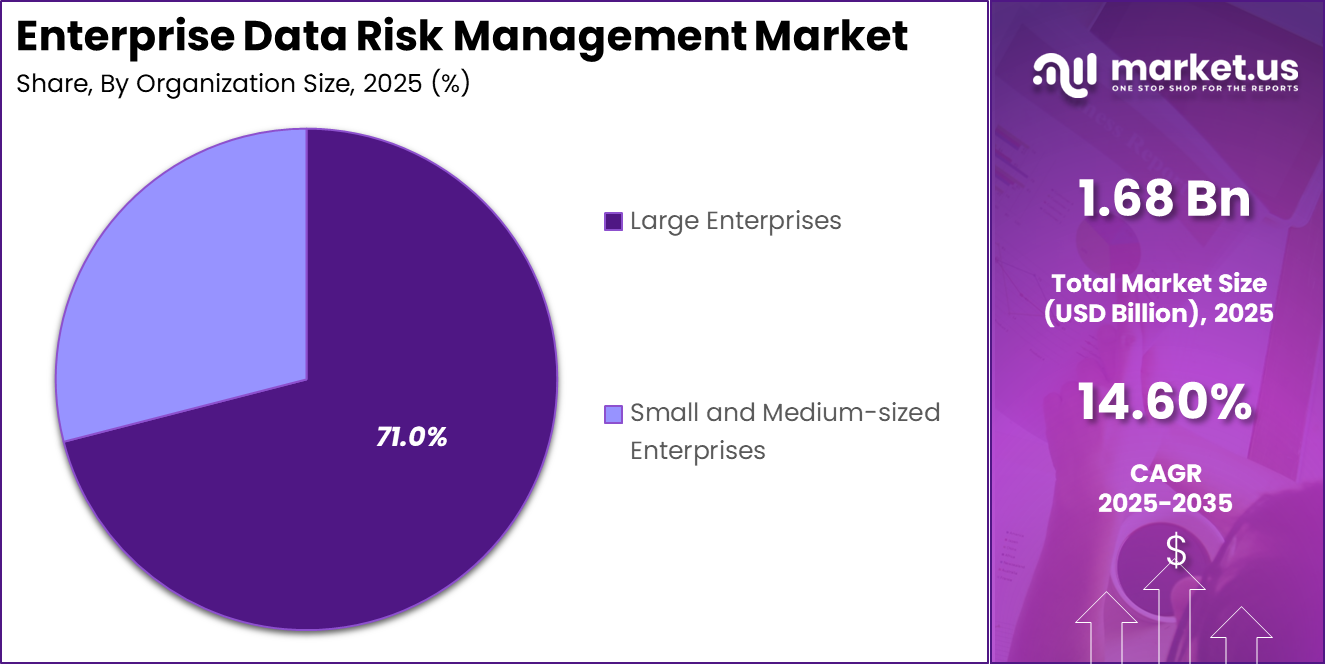

- Large enterprises account for 71% of the market, indicating that data risk management is primarily driven by complex, multi-system organizations.

- Cyber and IT risk is the largest risk type, with a 34% share, reflecting the increasing need for robust cybersecurity measures.

- The Banking, Financial Services, and Insurance sector leads adoption with 32% share, driven by stringent regulatory and compliance requirements.

Industry Adoption

Industry adoption of Enterprise Data Risk Management solutions is accelerating as organizations face increasing data complexities and regulatory requirements. As enterprises expand their data ecosystems, particularly with cloud migrations and third-party integrations, managing data risk has become more challenging.

Companies across various industries are investing in automated solutions to better manage and mitigate risks related to data security, privacy, and compliance. Financial services, particularly banking, insurance, and investment firms, are among the largest adopters due to stringent regulations like GDPR, CCPA, and the growing focus on data protection laws.

These sectors are prioritizing comprehensive data risk management systems to ensure compliance, protect sensitive customer information, and safeguard against cyber threats. Additionally, large enterprises represent a significant portion of the market, driven by their complex data operations, where managing risk across multiple systems and platforms requires advanced tools that offer visibility, control, and real-time monitoring.

As data security becomes a board-level concern, organizations are increasingly adopting cloud-based solutions for scalability and flexibility. The use of AI and machine learning is also gaining traction, enabling proactive risk detection and mitigation.

The market’s growth is further supported by industries like healthcare and IT, where data integrity, cybersecurity, and compliance are paramount. This broad industry adoption highlights the critical need for comprehensive data risk management across all sectors.

By Component Analysis

Software and solutions dominate the Enterprise Data Risk Management Market, accounting for 72% of the total share, while services make up the remaining 28%. The significant dominance of software and solutions can be attributed to the increasing need for automated, scalable, and comprehensive tools that enable organizations to manage and mitigate data risks efficiently.

These solutions offer critical functionalities such as real-time data monitoring, risk assessment, access control, compliance tracking, and incident response, which are essential for organizations to safeguard sensitive data and comply with ever-evolving regulatory requirements.

Software and solutions are particularly favored by large enterprises due to their ability to handle complex, multi-system environments. These platforms provide centralized governance, enabling businesses to manage risks across distributed data systems, cloud environments, and third-party applications. Automation is another key factor driving the adoption of software, as it reduces manual interventions, streamlines workflows, and speeds up response times to potential threats.

While services remain an important aspect, they are typically sought after for specialized needs such as implementation, customization, and change management. Many organizations use services to assist with deploying and integrating software solutions into their existing IT infrastructure, especially when dealing with complex regulatory frameworks. However, the larger share of the market is driven by software and solutions, which offer ongoing, scalable risk management capabilities for businesses aiming to stay ahead of emerging data risks.

By Deployment Modes

Cloud-based deployments account for 58% of the Enterprise Data Risk Management Market, while on-premises solutions make up the remaining 42%. The growing preference for cloud-based solutions is driven by their scalability, flexibility, and ability to support distributed and dynamic data environments.

As organizations continue to shift towards cloud infrastructures, the demand for cloud-based risk management tools has surged, enabling businesses to monitor and manage data risks in real time across multi-cloud and hybrid environments. Cloud solutions offer centralized governance, automated risk assessments, and enhanced data visibility, making them an attractive choice for organizations aiming to streamline their data risk management processes.

One of the key advantages of cloud-based platforms is their ability to scale with the growth of data. As enterprises expand their operations and data storage, cloud-based solutions allow for seamless integration of new data sources without the need for significant infrastructure upgrades. Additionally, cloud platforms offer greater flexibility in terms of remote access and collaboration, which is essential for organizations with distributed teams or global operations.

On the other hand, on-premises deployments are still preferred by organizations with strict data residency requirements or those that manage highly sensitive information, such as financial institutions or government agencies. These organizations may require more control over their data and security infrastructure, making on-premises solutions a better fit for certain use cases. However, the shift toward cloud-based solutions continues to dominate due to their cost-effectiveness and agility.

By Organization Size

Large enterprises dominate the Enterprise Data Risk Management Market, accounting for 71% of the total share, while small and medium-sized enterprises (SMEs) make up the remaining 29%. The significant adoption by large enterprises can be attributed to their complex and expansive data environments, which require robust solutions to manage and mitigate risks.

Large organizations typically operate across multiple regions, industries, and departments, often with vast amounts of sensitive data that need to be monitored, protected, and audited in real time. The growing regulatory landscape and the increased frequency of cyber threats make it essential for these enterprises to adopt comprehensive data risk management systems that can scale with their operations.

Large enterprises prioritize software solutions that provide centralized governance, real-time risk monitoring, and automated compliance tracking across distributed IT systems, cloud platforms, and third-party applications. These solutions help organizations maintain data security, ensure compliance, and reduce the risk of data breaches or non-compliance penalties.

Additionally, large enterprises often have the resources and infrastructure to invest in advanced risk management technologies, such as AI-powered analytics and machine learning, to proactively detect and mitigate emerging risks. SMEs, while adopting data risk management solutions, face challenges such as budget constraints and limited resources for implementation.

However, as data security and compliance requirements continue to grow, SMEs are gradually embracing scalable cloud-based solutions that offer cost-effective, flexible, and automated risk management capabilities.

By Risk Types

Cyber and IT risk accounts for 34% of the Enterprise Data Risk Management Market, reflecting the increasing focus on securing digital infrastructures in response to rising cybersecurity threats. With the growing frequency and sophistication of cyberattacks, organizations are prioritizing solutions that help safeguard sensitive data, maintain network integrity, and mitigate the risks associated with data breaches and unauthorized access.

Cyber and IT risk management platforms provide real-time threat detection, continuous monitoring, data encryption, and access control, enabling businesses to respond quickly to vulnerabilities and secure their IT environments. Operational risk follows as another critical category, driven by the complexity of managing day-to-day business processes across increasingly digitized and interconnected systems.

Operational risk management platforms help organizations monitor internal controls, prevent data loss, and ensure business continuity in the event of disruptions, while maintaining compliance with industry regulations. Financial risk management is also essential as companies strive to mitigate the financial impact of data security incidents, non-compliance fines, and operational failures.

With regulations like GDPR and CCPA tightening, financial risk solutions are increasingly being integrated with compliance and regulatory risk management systems. Additionally, third-party and vendor risk management is growing as businesses rely more on external partners and cloud providers.

Organizations need to ensure that their vendors meet security, compliance, and data privacy standards to prevent cascading risks across their supply chains. Strategic risk management remains essential for long-term business sustainability, helping organizations align their risk strategies with overall business goals.

By End-User Industry Analysis

Banking, financial services, and insurance (BFSI) leads the Enterprise Data Risk Management Market, accounting for 32% of the market share. This dominance is due to the highly regulated nature of the BFSI sector, where data security, compliance, and operational resilience are of paramount importance. Financial institutions must comply with stringent regulations such as GDPR, CCPA, and Basel III, while also protecting sensitive customer data from cyber threats.

As a result, the BFSI industry invests heavily in data risk management solutions to ensure compliance, reduce financial risks, and protect against potential breaches and fraud. These solutions help BFSI organizations manage data across complex systems, ensuring that both internal and external data remain secure, transparent, and compliant with regulatory requirements.

The healthcare sector also represents a significant portion of the market, driven by the increasing need to secure patient data and comply with regulations such as HIPAA. Healthcare organizations rely on data risk management tools to ensure data privacy, integrity, and availability, as well as to prevent breaches that could lead to legal liabilities and reputational damage.

Other industries, such as government and public sector, IT and telecommunications, manufacturing, energy and utilities, and retail, are also adopting data risk management solutions. These sectors face growing data protection and compliance challenges as they digitize operations, rely on cloud technologies, and handle sensitive information, further expanding the demand for effective data risk management tools across industries.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Risk Type

- Cyber and IT Risk

- Operational Risk

- Financial Risk

- Compliance and Regulatory Risk

- Third-party and Vendor Risk

- Strategic Risk

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare

- Government and Public Sector

- IT and Telecommunications

- Manufacturing

- Energy and Utilities

- Retail and Consumer Goods

- Others

Regional Analysis

North America holds a significant 36.5% share of the Enterprise Data Risk Management Market, with a market size of USD 0.61 billion in 2025. This dominance is driven by the region’s well-established regulatory frameworks, highly digitized industries, and growing concerns around data security and compliance.

The need for robust data risk management solutions is especially strong in the US and Canada, where data privacy laws such as the CCPA and GDPR-compliant regulations place high demands on organizations to protect sensitive data and ensure compliance with strict reporting requirements.

North America is home to numerous industries that handle vast amounts of sensitive information, including banking, financial services, healthcare, and technology. These sectors are increasingly adopting data risk management solutions to mitigate the risks associated with cyber threats, data breaches, regulatory fines, and operational disruptions.

In addition, businesses in the region are focused on ensuring data integrity, maintaining continuous monitoring of IT systems, and meeting the growing compliance expectations set by various governmental and international bodies.

As cloud adoption continues to rise, North American enterprises are shifting toward cloud-based data risk management solutions, which offer scalability, flexibility, and real-time risk monitoring capabilities. This trend, combined with the increasing regulatory pressures, positions North America as a major growth driver in the global Enterprise Data Risk Management Market.

US Market Size

The US market for Enterprise Data Risk Management is valued at USD 0.55 billion in 2025 and is projected to reach USD 1.89 billion by 2035, growing at a CAGR of 13.11%. This growth is driven by several factors, including increasing regulatory pressures, the rise in cyber threats, and the rapid adoption of digital transformation across industries.

As more US organizations move their operations to the cloud, the need for robust data risk management solutions has surged, with businesses looking to secure sensitive information and comply with regulations such as GDPR, CCPA, and industry-specific guidelines.

The financial services, healthcare, and technology sectors are particularly active adopters of data risk management solutions, as they are subject to stringent compliance requirements and handle large volumes of sensitive data. With the growing complexity of data systems, organizations are investing in tools that provide real-time monitoring, risk assessment, and automated compliance tracking to protect against potential data breaches, cyberattacks, and operational risks.

Additionally, as the US increasingly focuses on cybersecurity and data privacy, enterprises are looking to integrate data risk management with their broader governance, risk, and compliance (GRC) strategies. This trend is expected to drive continued growth in the market, making the US one of the leading regions in the global Enterprise Data Risk Management space.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The Enterprise Data Risk Management Market is growing rapidly due to several key driving factors. First, the increasing volume and complexity of data being generated across industries is pushing organizations to invest in solutions that can manage, protect, and secure sensitive information.

As businesses adopt cloud technologies and rely more on third-party vendors, data becomes more distributed, making it harder to manage risk effectively. This has created a need for centralized platforms that can monitor, track, and govern data in real time, ensuring it remains secure and compliant.

Second, regulatory pressures are a significant driver of growth. Data privacy laws such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and sector-specific regulations require organizations to safeguard sensitive data and maintain audit trails for compliance.

Non-compliance can result in hefty fines and reputational damage, prompting businesses to adopt data risk management solutions that streamline compliance processes and reduce risk exposure. Third, the increasing frequency of cyber threats and data breaches is accelerating the need for stronger data security measures.

With cyberattacks becoming more sophisticated, organizations are focusing on implementing proactive data risk management strategies to detect and mitigate potential risks before they escalate into serious threats. As a result, companies are prioritizing tools that provide comprehensive visibility into their data systems, automate risk assessments, and support rapid response to incidents. These factors collectively contribute to the market’s robust growth.

Restraint factors

Despite strong growth potential, the Enterprise Data Risk Management Market faces several restraining factors. One of the primary challenges is the high implementation cost associated with comprehensive data risk management platforms. Large-scale deployments often require integration with multiple legacy systems, data warehouses, cloud platforms, and third-party applications.

This integration process can be complex, time-consuming, and resource-intensive, particularly for organizations with fragmented IT environments. For small and medium-sized enterprises, upfront licensing, customization, and training costs can act as significant barriers to adoption.

Another key restraint is the shortage of skilled professionals capable of managing advanced data risk frameworks. Effective data risk management requires expertise in cybersecurity, regulatory compliance, data governance, and analytics. Many organizations struggle to find qualified personnel who can configure, interpret, and maintain sophisticated risk monitoring systems, limiting the effectiveness of deployments.

Data silos also present a structural barrier. In many enterprises, information is stored across disconnected systems, departments, and geographic locations. Without standardized data definitions and governance models, achieving a unified view of data risk becomes difficult.

Additionally, resistance to organizational change can slow adoption, as implementing enterprise-wide risk management often requires process redesign and cross-functional coordination. These factors collectively moderate the pace of market expansion despite growing awareness of data-related risks.

Growth Opportunities

The Enterprise Data Risk Management Market presents significant growth opportunities as organizations accelerate digital transformation and expand their data ecosystems. One major opportunity lies in the rising adoption of artificial intelligence and advanced analytics for risk prediction and automated decision-making.

Enterprises are increasingly seeking intelligent platforms that can analyze large datasets, detect anomalies, and provide real-time risk insights, which enhances proactive risk mitigation capabilities and operational efficiency. Another strong opportunity is the rapid expansion of cloud computing and hybrid IT environments.

According to industry cloud adoption trends, a large share of enterprise workloads is shifting to cloud platforms, creating new data governance and security challenges. This transition is encouraging organizations to invest in scalable cloud-native data risk management solutions that offer continuous monitoring, encryption controls, and automated compliance tracking across distributed infrastructures.

Additionally, the growing focus on third-party and vendor risk management is opening new avenues for market growth. Modern enterprises rely heavily on external partners, SaaS providers, and global supply chains, increasing exposure to data vulnerabilities beyond internal systems. As a result, companies are prioritizing integrated risk management frameworks that assess vendor data practices and cybersecurity posture.

Emerging regulatory frameworks across financial services, healthcare, and technology sectors also create opportunities for solution providers to develop specialized compliance-focused tools. These evolving requirements are expected to drive sustained demand for advanced, automated, and industry-specific data risk management platforms.

Trending factors

One of the most prominent trends in the Enterprise Data Risk Management Market is the increasing integration of artificial intelligence and machine learning into risk monitoring systems. Organizations are moving beyond traditional rule-based risk models and adopting AI-driven platforms that can identify anomalies, predict potential data risks, and automate mitigation actions.

This shift is improving real-time visibility into enterprise data environments and enabling faster response to emerging threats. Another key trend is the rise of integrated Governance, Risk, and Compliance (GRC) frameworks.

Enterprises are consolidating multiple risk functions into unified platforms to manage cyber risk, regulatory risk, and operational risk through a single dashboard. This approach enhances decision-making efficiency and supports enterprise-wide transparency, especially in highly regulated industries such as banking and healthcare.

The growing emphasis on data privacy and ethical data governance is also shaping market trends. With increasing enforcement of global data protection regulations and stricter audit requirements, organizations are prioritizing continuous controls, monitoring, and automated audit trails.

Additionally, zero-trust security architecture is gaining traction, where every data access request is verified regardless of user location. This trend is particularly relevant as remote work and distributed data access models continue to expand, increasing the need for dynamic and context-aware data risk management solutions.

Competitive Analysis

The competitive landscape of the Enterprise Data Risk Management market is highly driven by enterprise software leaders that provide integrated governance, risk, and compliance platforms. IBM Corporation maintains a strong position through its OpenPages platform, which enables organizations to manage operational risk, regulatory compliance, and internal audit processes within a unified system, supporting enterprise-wide risk visibility.

Oracle Corporation and SAP SE compete by embedding risk analytics and compliance monitoring into their enterprise applications, helping large organizations align data governance with regulatory frameworks and operational controls. ServiceNow, Inc. has strengthened its competitive edge through its cloud-based workflow and GRC capabilities that automate risk identification, policy lifecycle management, and continuous monitoring across business operations.

SAS Institute Inc. differentiates itself through advanced analytics and risk intelligence tools that allow enterprises to detect anomalies and evaluate complex risk datasets in real time. Meanwhile, NAVEX Global, Inc. and OneTrust, LLC focus on integrated risk and compliance platforms that centralize policy management, third-party risk, and regulatory tracking to enhance organizational transparency.

MetricStream, Inc., Diligent Corporation, and RSA Archer LLC are recognized for scalable risk management frameworks that support enterprise governance and audit readiness, while Resolver, Inc. and LogicManager, Inc. emphasize configurable risk assessment and incident management solutions. Collectively, these companies compete through AI integration, automation, and unified risk dashboards, enabling enterprises to transition from reactive risk control to predictive data risk management strategies.

Top Key Players in the Market

- IBM Corporation

- Oracle Corporation

- SAP SE

- Riskonnect, Inc.

- MetricStream, Inc.

- LogicManager, Inc.

- ServiceNow, Inc.

- SAS Institute Inc.

- Resolver, Inc.

- OneTrust, LLC

- NAVEX Global, Inc.

- Wolters Kluwer N.V.

- Diligent Corporation

- AuditBoard, Inc.

- RSA Archer LLC

- Others

Future Predictions

Enterprise data risk management is projected to become more embedded in core business operations as organizations continue to digitize sensitive workflows and expand cloud infrastructures. Studies indicate that AI-enabled risk management platforms have already recorded around 34% growth in adoption between 2022 and 2024, reflecting the shift toward predictive and automated risk monitoring across enterprises.

Additionally, cybersecurity incidents increased significantly in recent years, with some reports noting a 75% spike in cyber incidents, which is expected to push enterprises to invest more heavily in integrated risk governance systems and real-time monitoring tools. Looking ahead, enterprises are anticipated to prioritize AI-driven risk analytics, continuous controls monitoring, and unified governance dashboards to manage growing data complexity.

With over 60% of organizations already using AI in production environments and many planning to expand AI budgets, enterprise risk platforms are likely to evolve toward intelligent automation and self-learning risk models. The integration of cyber risk modules, now included in more than half of new deployments, is expected to accelerate as digital ecosystems expand.

Furthermore, identity governance and insider risk management tools are projected to gain traction due to the rising volume of machine and human identities within enterprises. As regulatory pressure intensifies globally and hybrid work environments expand, organizations are likely to adopt centralized, cloud-native risk frameworks that provide real-time visibility, faster incident response, and stronger compliance alignment across distributed data environments.

Recent Developments

- In 2025, IBM’s OpenPages platform was recognized as a Leader in the IDC MarketScape Worldwide GRC Software 2025 assessment, highlighting its expanded integration of AI-driven risk analytics and automated compliance documentation capabilities across enterprise audit and control functions.

- In 2025, IBM’s OpenPages platform was recognized as a Leader in the IDC MarketScape Worldwide GRC Software 2025 assessment, highlighting its expanded integration of AI-driven risk analytics and automated compliance documentation capabilities across enterprise audit and control functions.

- In 2025, Diligent was named a Leader in the IDC MarketScape 2025 GRC Software evaluation and continues to scale its AI-powered governance and risk platform, supporting more than 25,000 organizations with integrated audit, compliance, and risk oversight solutions.

Report Scope

Report Features Description Market Value (2025) USD 1.68 Billion Forecast Revenue (2035) USD 6.56 Billion CAGR(2025-2035) 14.60% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Risk Type (Cyber and IT Risk, Operational Risk, Financial Risk, Compliance and Regulatory Risk, Third-party and Vendor Risk, Strategic Risk), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Government and Public Sector, IT and Telecommunications, Manufacturing, Energy and Utilities, Retail and Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Oracle Corporation, SAP SE, Riskonnect, Inc., MetricStream, Inc., LogicManager, Inc., ServiceNow, Inc., SAS Institute Inc., Resolver, Inc., OneTrust, LLC, NAVEX Global, Inc., Wolters Kluwer N.V., Diligent Corporation, AuditBoard, Inc., RSA Archer LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Enterprise Data Risk Management MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Enterprise Data Risk Management MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Oracle Corporation

- SAP SE

- Riskonnect, Inc.

- MetricStream, Inc.

- LogicManager, Inc.

- ServiceNow, Inc.

- SAS Institute Inc.

- Resolver, Inc.

- OneTrust, LLC

- NAVEX Global, Inc.

- Wolters Kluwer N.V.

- Diligent Corporation

- AuditBoard, Inc.

- RSA Archer LLC

- Others