Global Enterprise Data Management Market By Component (Services [Professional Services, Managed Services] and Software), By Deployment (On-premise and Cloud), By Enterprise Size (Large Enterprise and Small & Medium Enterprise (SME)), By End-use (IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, Government, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 63894

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

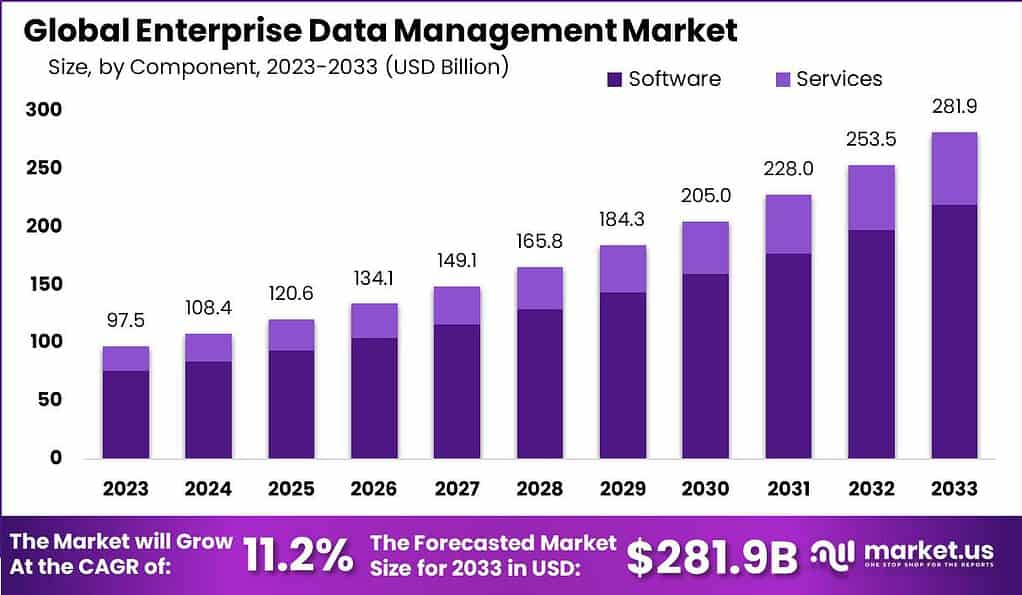

The Global Enterprise Data Management Market size was projected to be USD 97.5 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 108.4 billion. During the forecast period, the global market for enterprise data management is expected to garner a 11.2% CAGR and reach a size of USD 281.9 billion by 2033.

Enterprise Data Management (EDM) refers to the ability of an organization to precisely define, easily integrate, and effectively retrieve data for both internal applications and external communication. EDM is focused on the creation of accurate, consistent, and transparent content. It emphasizes data precision, granularity, and meaning and is concerned with how content is integrated into business applications as well as how it is passed along from one business process to another.

The Enterprise Data Management (EDM) Market is a rapidly evolving sector driven by the increasing recognition of data as a critical asset in the business world. As organizations generate and accumulate vast volumes of data, the demand for solutions that can effectively manage, integrate, and secure this data is surging. The market offers a range of tools and services designed to ensure data accuracy, consistency, and accessibility across enterprises.

Key drivers of this market include the need for regulatory compliance, the desire for better decision-making, and the growing reliance on data-intensive technologies like AI and machine learning. While the market offers substantial growth opportunities, it also faces challenges such as ensuring data privacy, integrating with legacy systems, and maintaining high-quality data.

The continuous influx of technological advancements and the increasing move towards cloud-based solutions, the EDM market is expected to keep expanding, providing businesses with the tools they need to harness the power of their data effectively. As companies continue to navigate the complexities of the digital age, the importance of robust enterprise data management has never been more pronounced, making the EDM market a critical focus for organizations across various industries.

Key Takeaways

- Market Growth Projection: The global Enterprise Data Management Market is projected to experience significant growth, with a Compound Annual Growth Rate (CAGR) of 11.2%. It is expected to reach a size of USD 281.9 billion by 2033.

- Definition of Enterprise Data Management (EDM): EDM involves collecting, storing, organizing, and managing data within an organization. It focuses on ensuring data accuracy, consistency, and transparency for both internal use and external communication.

- Market Drivers: Key drivers for the EDM market include the need for regulatory compliance, improved decision-making, and the growing reliance on data-intensive technologies such as AI and machine learning.

- Challenges: The market also faces challenges like data privacy, integration with legacy systems, and maintaining high-quality data.

- Software Dominance: In 2023, the Software Segment held a dominant market position in EDM, capturing over 77.9% share. This is attributed to the increasing demand for robust data management platforms.

- Services: EDM services are divided into Professional Services and Managed Services. Professional services involve consultancy, implementation, and support, while Managed Services offer ongoing support and maintenance.

- Deployment Modes: In 2023, the Cloud-Based Segment held a dominant market position in EDM, capturing over 58.4% share, thanks to its scalability and cost-effectiveness. On-premise solutions are still significant, especially in industries with sensitive data.

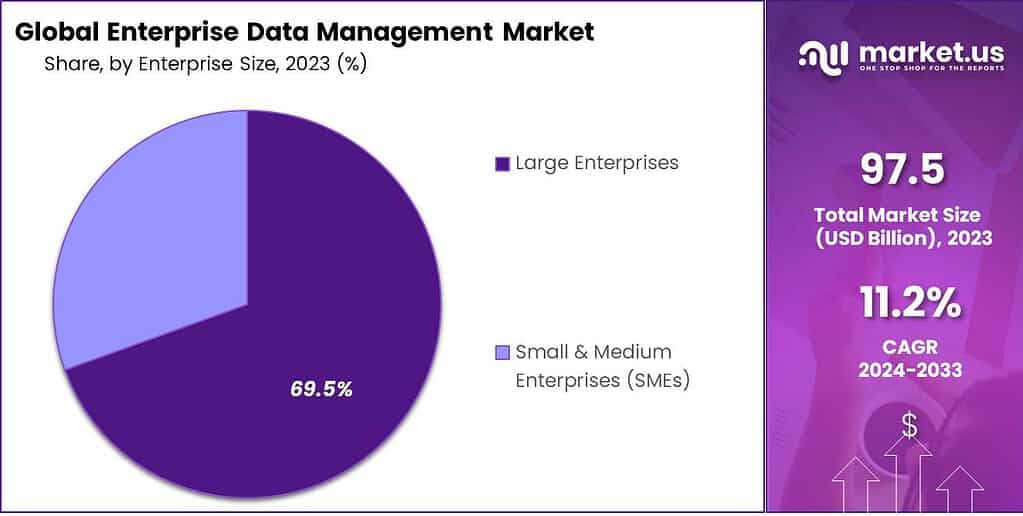

- Enterprise Size: Large Enterprises held a dominant market position in 2023, capturing over 69.5% share. However, Small & Medium Enterprises (SMEs) are rapidly adopting EDM solutions as they expand.

- End-Use Industries: Various industries, including IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, Government, and others, are adopting EDM solutions to handle vast volumes of data, ensure security, and make data-driven decisions.

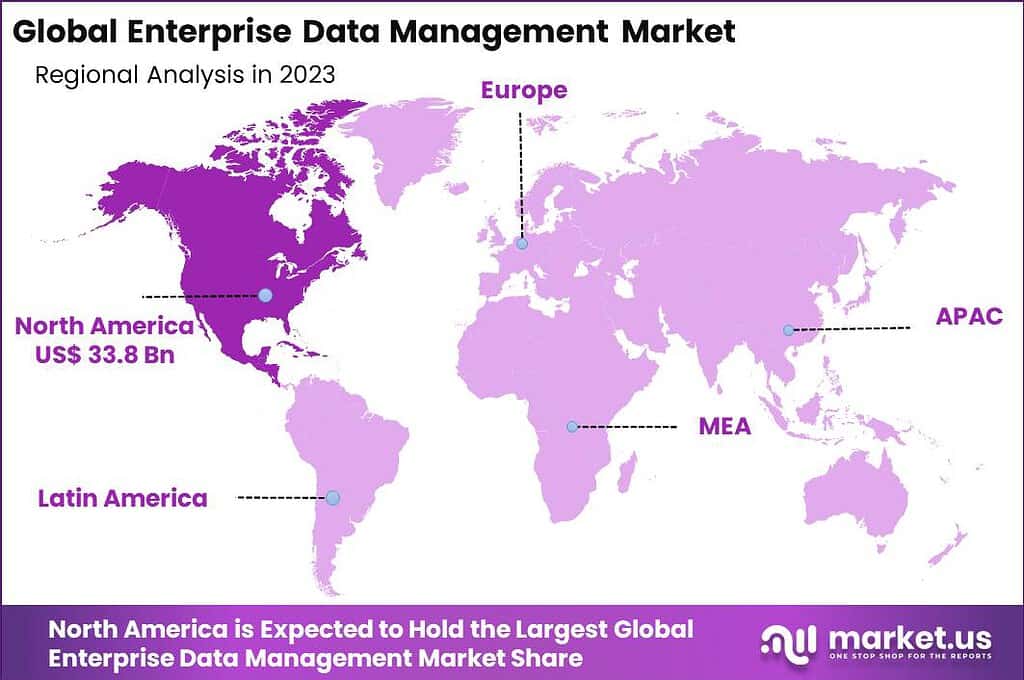

- Regional Analysis: North America dominated the EDM market in 2023, accounting for over 34.7% share, followed by Europe, the Asia-Pacific (APAC), Latin America, and the Middle East & Africa. Each region has its own drivers for EDM adoption.

- Key Players: Major industry players in the EDM market include IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., Amazon Web Services, Inc., and more.

Component Analysis

In 2023, the Software Segment held a dominant market position in the Enterprise Data Management (EDM) Market, capturing more than a 77.9% share. This significant portion is attributed to the increasing demand for robust data management platforms that can integrate, analyze, and secure vast amounts of data. Businesses are heavily investing in EDM software to gain better insights, improve operational efficiency, and ensure compliance with regulatory standards.

The software solutions range from data integration and quality tools to master data management and metadata management applications. As organizations continue to navigate the complexities of digital transformation, the reliance on comprehensive software solutions to manage and leverage data effectively is expected to maintain its upward trajectory.

On the services front, the EDM market is segmented into Professional Services and Managed Services. Professional Services involve consultancy, implementation, and support which are crucial for businesses that require tailor-made solutions and guidance in managing their data landscape. These services are particularly in demand for complex deployments where businesses seek expertise to align their data management strategies with their overall business objectives.

Managed Services, on the other hand, offer ongoing support and maintenance, allowing businesses to ensure their data management systems are running efficiently without needing to invest heavily in in-house expertise. As companies look for cost-effective ways to manage their data, the demand for Managed Services is expected to grow.

Deployment Mode Analysis

In 2023, the Cloud-Based Segment held a dominant market position in the Enterprise Data Management (EDM) Market, capturing more than a 58.4% share. This significant dominance is primarily due to the scalability, flexibility, and cost-effectiveness that cloud-based solutions offer. As businesses of all sizes continue to embrace digital transformation, the demand for cloud services that can provide real-time access, advanced analytics, and seamless integration with other applications has surged.

Moreover, the cloud model allows for easier and more efficient updates and maintenance, ensuring that businesses can stay ahead with the latest functionalities. The ability to scale resources according to demand and pay for only what is used makes the cloud-based deployment highly attractive, especially for small and medium-sized enterprises looking to leverage advanced data management capabilities without heavy upfront investments.

On the other hand, the On-premise Segment, while smaller in comparison, remains a vital part of the market. Some organizations prefer on-premise solutions due to their control over the data environment and security concerns, especially in industries dealing with highly sensitive data like finance and healthcare. On-premise systems offer a level of security and control that is crucial for businesses with stringent data governance and regulatory requirements. However, this segment faces challenges such as higher costs for installation, maintenance, and hardware, and the need for in-house expertise to manage the systems.

While the cloud-based segment is gaining traction due to its numerous advantages and is driving the evolution of the EDM market, on-premise solutions continue to hold significance for certain businesses with specific needs. As technology continues to evolve and concerns like data security in the cloud are addressed more effectively, the shift towards cloud-based EDM solutions is expected to grow even further, marking a transformative period in how businesses manage and leverage their data for strategic advantage.

Enterprise Size

In 2023, the Large Enterprises Segment held a dominant market position in the Enterprise Data Management (EDM) Market, capturing more than a 69.5% share. This substantial market share is a reflection of the extensive and complex data management needs that large enterprises face. With operations often spread across the globe, these organizations generate vast amounts of data daily.

To maintain a competitive edge, ensure compliance with international regulations, and drive strategic decision-making, large enterprises invest significantly in EDM solutions. These solutions not only help in effectively managing and securing data but also in deriving actionable insights, which are crucial for their expansive operations. The financial robustness of these organizations further facilitates the adoption of state-of-the-art EDM technologies, enabling them to lead in market share.

On the flip side, the Small & Medium Enterprise (SME) segment, while holding a smaller portion of the market, is on a trajectory of rapid growth and adoption of EDM solutions. As these businesses expand and encounter the complexities of managing larger volumes of data, the need for affordable, scalable, and efficient data management solutions becomes increasingly critical.

SMEs are turning to EDM to streamline operations, enhance decision-making, and comply with regulatory standards, all while managing costs. The rise of cloud-based EDM solutions has been a boon for SMEs, offering them the advanced capabilities traditionally enjoyed by larger counterparts without the need for hefty investments in IT infrastructure. The trend indicates a growing awareness and necessity among SMEs to leverage data as a strategic asset, driving their increased share in the EDM market.

Both large enterprises and SMEs are navigating a data-driven business landscape, with each segment showing a distinct approach and adoption rate based on their unique needs and capabilities. While large enterprises continue to lead in market share with their complex and broad-scale data strategies, SMEs are fast catching up, marking a dynamic and evolving Enterprise Data Management Market. As technology continues to advance and democratize, it’s anticipated that both segments will witness sustained growth, fueled by the universal need to harness the power of data for business success.

End-Use Industry

In 2023, the IT & Telecommunications Segment held a dominant market position in the Enterprise Data Management (EDM) Market, capturing more than a 27.2% share. This sector’s commanding presence is primarily due to the intrinsic nature of these industries, which are data-centric and require robust data management to operate effectively.

The need to handle vast volumes of data, ensure security, and leverage data for strategic decision-making drives the demand for advanced EDM solutions in this segment. As technology continues to evolve and telecommunications networks expand, the volume and complexity of data also increase, further cementing the critical role of EDM in IT & Telecommunications.

The BFSI (Banking, Financial Services, and Insurance) sector also represents a significant portion of the EDM market. In an industry where data accuracy and security are paramount, EDM solutions are vital for managing risk, complying with stringent regulations, and providing personalized customer services. The growing emphasis on data-driven strategies to enhance customer experience and operational efficiency is driving the adoption of EDM in BFSI.

Healthcare is another key segment where EDM is increasingly becoming indispensable. With the digitization of health records and the need for data integration across various healthcare providers, effective data management is critical. EDM solutions in healthcare not only help in organizing and securing patient information but also play a vital role in research, diagnosis, and personalized treatment planning.

Manufacturing industries are turning to EDM to optimize their operations and supply chains. As manufacturers embrace Industry 4.0 and IoT, they generate large amounts of data that need to be managed effectively to improve production processes, monitor equipment, and ensure quality.

The Retail & Consumer Goods sector relies on EDM for managing customer data, inventory, and supply chain logistics. In an increasingly competitive market, retailers use data to understand consumer behavior, optimize their offerings, and streamline operations.

Government agencies are also significant users of EDM. With the public sector handling vast amounts of sensitive data, there’s a growing need for EDM solutions that ensure data accuracy, security, and compliance with regulations.

Other End-Use Industries, including sectors like energy, education, and transportation, are recognizing the importance of effective data management. As these industries become more data-driven, the demand for EDM solutions tailored to their specific needs is expected to rise.

Across all these sectors, the increasing volume of data, the need for data security, and the desire to leverage data for competitive advantage are driving the adoption of EDM solutions. As businesses and industries continue to evolve and generate more data, the role of EDM in supporting strategic decision-making, operational efficiency, and regulatory compliance is set to become even more critical, shaping the future of the Enterprise Data Management Market.

Key Маrkеt Segments

Component

- Software

- Services

- Professional Services

- Managed Services

Deployment Mode

- Cloud-Based

- On-Premise

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Manufacturing

- Retail & Consumer Goods

- Government

- Other End-Use Industries

Driving Factors

- Increasing Data Volume and Complexity: The enterprise data management market is significantly influenced by the exponential growth of data volume and complexity. Businesses are generating and collecting vast amounts of data from diverse sources, including customer interactions, IoT devices, and social media. Effective data management solutions have become imperative to systematically organize, securely store, and analyze this data, enabling organizations to derive valuable insights for informed decision-making.

- Regulatory Compliance and Data Governance: The advent of strict regulations, including the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), mandates the adoption of robust data management practices by enterprises. Conforming to data protection and privacy laws, implementing effective data governance frameworks, and ensuring stringent data security measures are propelling a significant upswing in the requirement for enterprise data management solutions.

- Business Intelligence and Decision-Making: To secure a competitive advantage, businesses are placing a premium on data-driven decision-making. The recognition of the pivotal role played by data assets in extracting actionable insights is on the rise. Enterprise data management solutions serve as the cornerstone for seamless data integration, quality control, and accessibility, facilitating the generation of effective business intelligence.

- Cloud Adoption and Digital Transformation: The rising adoption of cloud computing and digital transformation initiatives is driving the market for enterprise data management solutions. Organizations, in their migration to the cloud, now seek efficient data management strategies. These strategies are essential for achieving seamless integration, data synchronization, and maintaining data security across cloud and on-premises environments.

Restraining Factors

- Lack of Data Strategy and Governance Frameworks: A significant number of organizations face difficulties in outlining a comprehensive data strategy and establishing robust data governance frameworks. In the absence of clear guidelines and defined processes for data management, enterprises may encounter challenges in guaranteeing data quality, consistency, and accessibility. These challenges can pose obstacles to the successful implementation of enterprise data management solutions.

- Budget Constraints: For smaller organizations with limited budgets, the implementation and maintenance of enterprise data management solutions can pose a considerable financial challenge. The costs associated with procuring data management tools, infrastructure, and skilled personnel may act as a constraint, especially when competing with alternative priorities for funding.

- Data Silos and Integration Challenges: Enterprises frequently encounter the hurdle of data silos, with information dispersed across various systems and departments. The integration of data from diverse sources, including legacy systems and third-party applications, can be intricate. Inadequate data integration poses a challenge to the efficacy of enterprise data management initiatives and disrupts the smooth flow of data across the organization.

- Data Security and Privacy Concerns: Enterprise data management market faces significant challenges with data breaches and privacy concerns. Organizations need to embrace robust security measures, incorporating encryption, access controls, and data anonymization, to safeguard sensitive data. Compliance with data protection regulations and addressing privacy concerns play pivotal roles in building trust and nurturing data-driven practices.

Growth Opportunities

- Adoption of Artificial Intelligence and Machine Learning: The enterprise data management market witnesses growth opportunities through the integration of artificial intelligence (AI) and machine learning (ML) technologies. The capabilities of AI and ML can enhance data analytics, automate data quality processes, and offer intelligent insights for organizations. Enterprises can exploit these technologies to streamline data management workflows and propel innovation.

- Focus on Data Governance and Data Quality: The importance of data governance and data quality management is gaining recognition among enterprises as key drivers of growth. By instituting strong data governance frameworks, organizations can secure data accuracy, consistency, and compliance. Directing investments towards data quality tools and processes allows enterprises to obtain reliable insights, elevate decision-making, and enhance overall operational efficiency.

- Cloud-Based Data Management Solutions: The growing adoption of cloud computing presents growth opportunities in the enterprise data management market. Cloud-based data management solutions offer scalability, flexibility, and cost efficiencies for enterprises. Harnessing cloud platforms allows organizations to streamline data integration, storage, and accessibility, facilitating seamless collaboration and enabling data-driven decision-making.

- Advanced Analytics and Predictive Modeling: Enterprises are increasingly adopting advanced analytics and predictive modeling to extract actionable insights from their data. The integration of enterprise data management with advanced analytics tools empowers organizations to conduct sophisticated data analysis, unveil hidden patterns, and make data-driven predictions. This integration creates growth opportunities for organizations seeking to derive high-value insights and gain a competitive advantage.

Challenges

- Data Privacy and Security Risks: Enterprises encounter ongoing challenges in the domain of data privacy and security. With the increasing sophistication of cyber threats, organizations must persistently refine their security measures to safeguard sensitive data from breaches and unauthorized access. The data management landscape is further complicated by the necessity to uphold compliance with continually evolving data protection regulations.

- Data Governance and Cultural Change: The implementation of effective data governance demands a cultural shift within organizations. Enterprises should cultivate a data-driven culture, foster collaboration between business and IT teams, and enhance data literacy among employees. Overcoming resistance to change and instilling a data governance mindset may present a considerable challenge.

- Legacy System Integration: Many organizations rely on legacy systems that may not easily integrate with modern data management solutions. The process of migrating data from these legacy systems, ensuring compatibility, and maintaining data integrity during integration can be intricate and time-consuming. The integration of legacy systems poses a challenge to achieving seamless data management, hindering the implementation of advanced data management practices.

- Data Complexity and Variety: Enterprises confront the challenge of dealing with a broad spectrum of data types, spanning structured, unstructured, and semi-structured data. Managing the complexity and variety of data sources is a task, as different data formats and structures call for specialized approaches in integration, storage, and analysis. To ensure efficient data management across the organization, enterprises must invest in tools and technologies capable of handling diverse data types.

Regional Analysis

In 2023, North America held a dominant market position in the Enterprise Data Management (EDM) Market, capturing more than a 34.7% share. This significant market presence is largely due to the region’s robust technological infrastructure, stringent regulatory compliance requirements, and a strong emphasis on data-driven business strategies. The demand for Enterprise Data Management in North America was valued at US$ 33.8 billion in 2023 and is anticipated to grow significantly in the forecast period.

The presence of key market players and a culture that readily adopts advanced technology further contribute to North America’s leading position. Industries such as IT, healthcare, and finance in this region are particularly proactive in implementing EDM solutions to ensure data accuracy, security, and effective decision-making.

Europe stands as another major player in the EDM market, driven by its strict data protection laws, such as the GDPR, which necessitate sophisticated data management solutions. The region’s advanced manufacturing, healthcare, and financial sectors are key contributors, requiring efficient data handling to maintain competitiveness and compliance. Europe’s focus on privacy and security, coupled with a strong push towards digital transformation, makes it a critical market for EDM providers.

The Asia-Pacific (APAC) region is witnessing rapid growth in the EDM market, fueled by its expanding economies, increasing digitalization, and growing recognition of data as a strategic asset. Countries like China, India, and Japan are investing heavily in technology and infrastructure, which in turn drives the demand for EDM solutions. The region’s burgeoning IT and telecommunications sectors, along with a rising number of SMEs, are significant contributors to this growth.

Latin America, though a smaller market, is on a promising growth trajectory, with an increasing number of businesses understanding the value of data management. Economic development, digital transformation, and improving regulatory frameworks are gradually paving the way for greater adoption of EDM solutions.

Finally, the Middle East and Africa are emerging markets with untapped potential. As these regions focus on economic diversification and technological adoption, industries such as oil and gas, finance, and government are beginning to invest in EDM to optimize operations and ensure regulatory compliance.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major industry players are actively investing in research and development initiatives to foster growth and optimize their internal business processes. Simultaneously, companies are exploring mergers, acquisitions, and partnerships to enhance their product portfolios, gaining a competitive advantage in the market. There is a concerted effort towards innovating new products and improving existing ones, with the goal of attracting new customers and expanding market shares.

International Business Corporation, Oracle Corporation, and SAP SE are the dominant players in this market. A notable example occurred in November 2022 when IBM Corp., a prominent software solutions provider, unveiled Business Analytics Enterprise. This comprehensive suite includes business intelligence features such as planning, forecasting, budgeting, and dashboard capabilities.

Its aim is to empower enterprises to dismantle data and analytics silos, facilitating quicker, data-driven decision-making and adept navigation through unforeseen disruptions. Additionally, the suite incorporates the IBM Analytics Content Hub, streamlining how organizations access analytics and tools from multiple service providers through a unified and personalized dashboard view.

Companies can be seen forming partnerships and mergers & acquisitions to improve their products and increase their market share. They are actively working on product development and enhancements to existing products in order to gain new customers and increase market share.

Top Company Profiles

- IBM Corporation

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- SAS Institute Inc.

- Amazon Web Services, Inc.

- Informatica

- Teradata Corporation

- Cloudera, Inc.

- Broadcom Inc.

- LTIMindtree Limited

- Solix Technologies, Inc.

- Other Key Players

Recent Developments

IBM (In 2023):

- Product Launches:

- IBM Cloud Pak for Data: IBM has introduced the IBM Cloud Pak for Data, a comprehensive suite of AI-powered data management tools designed for hybrid and multi-cloud environments. This offering aims to provide advanced solutions for effective data handling in diverse cloud setups.

- IBM Watson Knowledge Catalog: Enhanced version with improved data governance capabilities and automated data lineage tracking.

- IBM Maximo Asset Management: IBM Maximo Asset Management has been integrated with IBM Cloud Pak for Data to enhance asset data insights and enable predictive maintenance. This integration signifies a strategic move to optimize asset management processes and leverage advanced analytics for predictive maintenance.

- Acquisitions:

- Instana: Acquired a cloud-based application performance monitoring (APM) platform to strengthen IT operations management capabilities within the EDM ecosystem.

- Partnerships:

- SAP: Expanded partnership to offer joint data management solutions for hybrid cloud environments.

- Cloudera: Collaborated on developing open-source data management solutions based on Apache Hadoop and Spark.

- Financial Performance:

- Reported strong growth in its hybrid cloud data management software segment for 2023.

- Increased focus on subscriptions and recurring revenue from cloud-based offerings.

Oracle (In 2023):

- Product Launches:

- Oracle Autonomous Data Warehouse Cloud: Expanded capabilities for data virtualization and real-time analytics.

- Oracle Analytics Cloud: Enhanced self-service analytics platform with improved AI-powered insights and data visualization tools.

- Oracle Data Integrator: New features for streamlining data integration across cloud and on-premise environments.

- Acquisitions:

- DataScience.com: Acquired a cloud-based data science platform provider to boost its analytics and AI capabilities.

- Partnerships:

- Microsoft: Collaborated on offering interoperability solutions between Azure and Oracle cloud platforms for easier data migration and management.

- Salesforce: Partnered to offer joint data management solutions for customer relationship management (CRM) applications.

- Financial Performance:

- Continued strong growth in its cloud-based data management business.

- Increased focus on subscription-based revenue models.

Report Scope

Report Features Description Market Value (2023) US$ 97.5 Bn Forecast Revenue (2033) US$ 281.9 Bn CAGR (2024-2033) 11.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Services [Professional Services, Managed Services] and Software), By Deployment (On-premise and Cloud), By Enterprise Size (Large Enterprise and Small & Medium Enterprise (SME)), By End-use (IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, Government, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., Amazon Web Services, Inc., Informatica, Teradata Corporation, Cloudera, Inc., Broadcom Inc., LTIMindtree Limited, Solix Technologies, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Enterprise Data Management (EDM)?Enterprise Data Management refers to the comprehensive process of collecting, storing, organizing, and managing an organization's data throughout its lifecycle. It involves strategies and technologies to ensure data accuracy, availability, and security.

How big is the enterprise information management market?The Global Enterprise Data Management Market size was projected to be USD 97.5 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 108.4 billion. During the forecast period, the global market for enterprise data management is expected to garner a 11.2% CAGR and reach a size of USD 281.9 billion by 2033.

What does an enterprise data management do?Enterprise data management encompasses a spectrum of activities crucial for effective data handling within organizations. It involves the systematic collection, storage, organization, and maintenance of data throughout its lifecycle. The primary objectives include ensuring data accuracy, facilitating seamless access, and implementing robust security measures. Ultimately, enterprise data management serves as the backbone for informed decision-making and operational efficiency.

Is data management in high demand?The demand for data management professionals and solutions is notably high, fueled by the exponential growth of digital information. Organizations recognize the need for adept management to derive actionable insights, ensure regulatory compliance, and enhance overall operational efficiency.

Who are the key players in the enterprise data management market?Some key players operating in the enterprise data management market include IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, SAS Institute Inc., Amazon Web Services, Inc., Informatica, Teradata Corporation, Cloudera, Inc., Broadcom Inc., LTIMindtree Limited, Solix Technologies, Inc., Other Key Players

What key factors are driving the growth of the Enterprise Data Management Market?The growth of the Enterprise Data Management Market can be attributed to increasing data volumes, the need for data governance and compliance, rising demand for real-time data analytics, and the proliferation of cloud-based solutions.

Enterprise Data Management MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Enterprise Data Management MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- SAS Institute Inc.

- Amazon Web Services, Inc.

- Informatica

- Teradata Corporation

- Cloudera, Inc.

- Broadcom Inc.

- LTIMindtree Limited

- Solix Technologies, Inc.

- Other Key Players