Global Enterprise Collaboration Market Size, Share and Growth Report By Component (Software/Platforms, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Solution Type (Unified Communication & Messaging, Project & Task Management, File Sharing & Content Management, Enterprise Social Networks, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail & Consumer Goods, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171612

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption and Productivity Impact

- Key Challenges and Risks

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Solution Type Analysis

- End-User Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

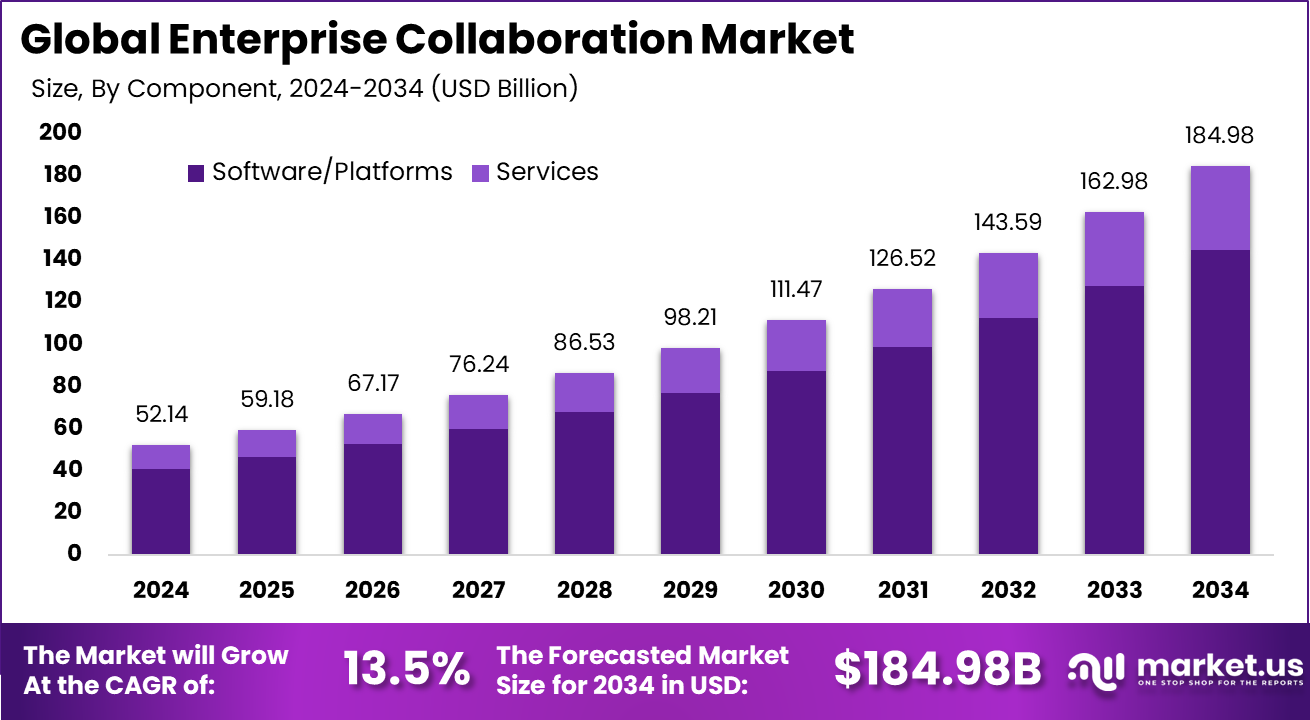

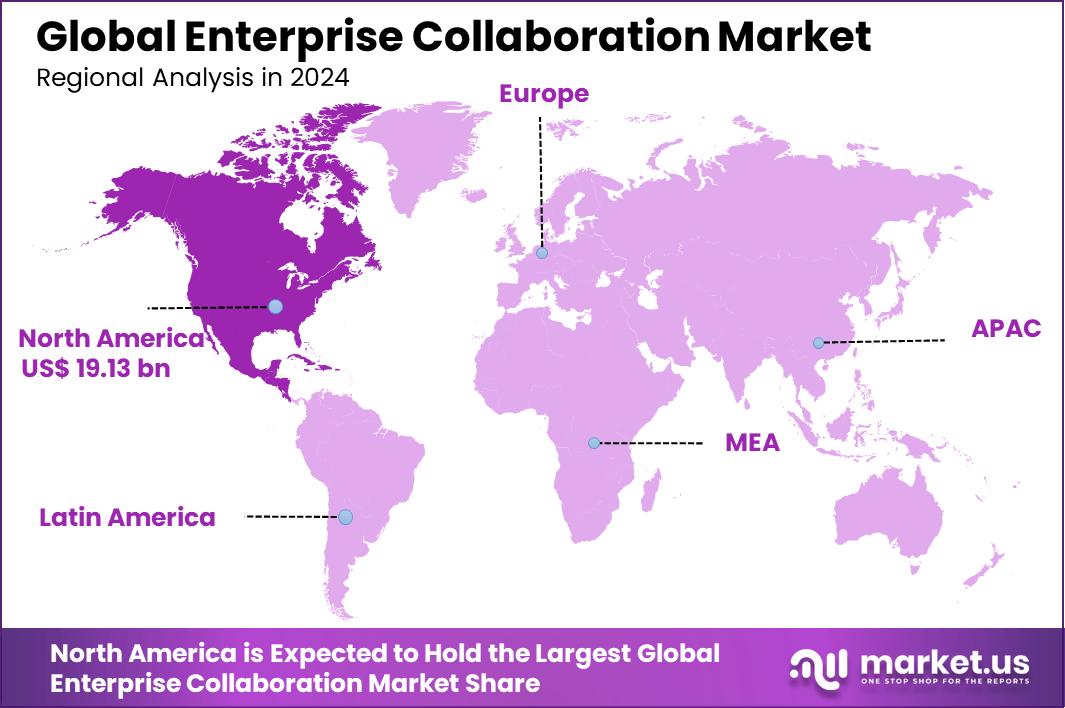

The Global Enterprise Collaboration Market size is expected to be worth around USD 184.98 billion by 2034, from USD 52.14 billion in 2024, growing at a CAGR of 13.5% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.7% share, holding USD 19.13 billion in revenue.

The enterprise collaboration market refers to software and platform solutions that enable teams within organizations to communicate, share information, and coordinate work efficiently. This market covers tools such as real-time communication systems, project management platforms, file sharing solutions, and integrated workflow applications. Adoption is driven by the need to support distributed and hybrid work models that require seamless digital interaction between employees.

The market’s growth reflects wider trends in digital transformation across industries, as organizations seek to improve productivity and reduce operational friction. The market structure includes both software solutions and associated services for deployment, integration, and support. Large enterprises often invest in comprehensive platforms that integrate messaging, conferencing, and task coordination features.

One major driving factor is the rise of remote and hybrid work models. Organizations need reliable digital platforms to connect employees across locations. Traditional communication methods are not sufficient for distributed teams. Collaboration software addresses this need by enabling real-time interaction. Another driving factor is the need to improve productivity and decision speed. Enterprises handle complex projects that require constant coordination.

For instance, in June 2025, Zoom Video Communications, Inc. introduced Real-Time Media Streams in its developer platform, delivering structured meeting data like audio, video, and transcripts for thousands of concurrent sessions. This opens doors for custom apps that make hybrid work truly interactive.

Key Takeaway

- In 2024, software and platforms dominated the enterprise collaboration market with a 78.3% share, reflecting strong demand for integrated tools that support communication, content sharing, and workflow coordination.

- Cloud-based deployment led with an 87.4% share, as organizations favored scalable, remote-ready, and centrally managed collaboration environments.

- Large enterprises accounted for 63.7% of adoption, driven by complex organizational structures and the need to support distributed teams at scale.

- Unified communication and messaging held 52.6%, highlighting continued reliance on chat, voice, and video as core collaboration functions.

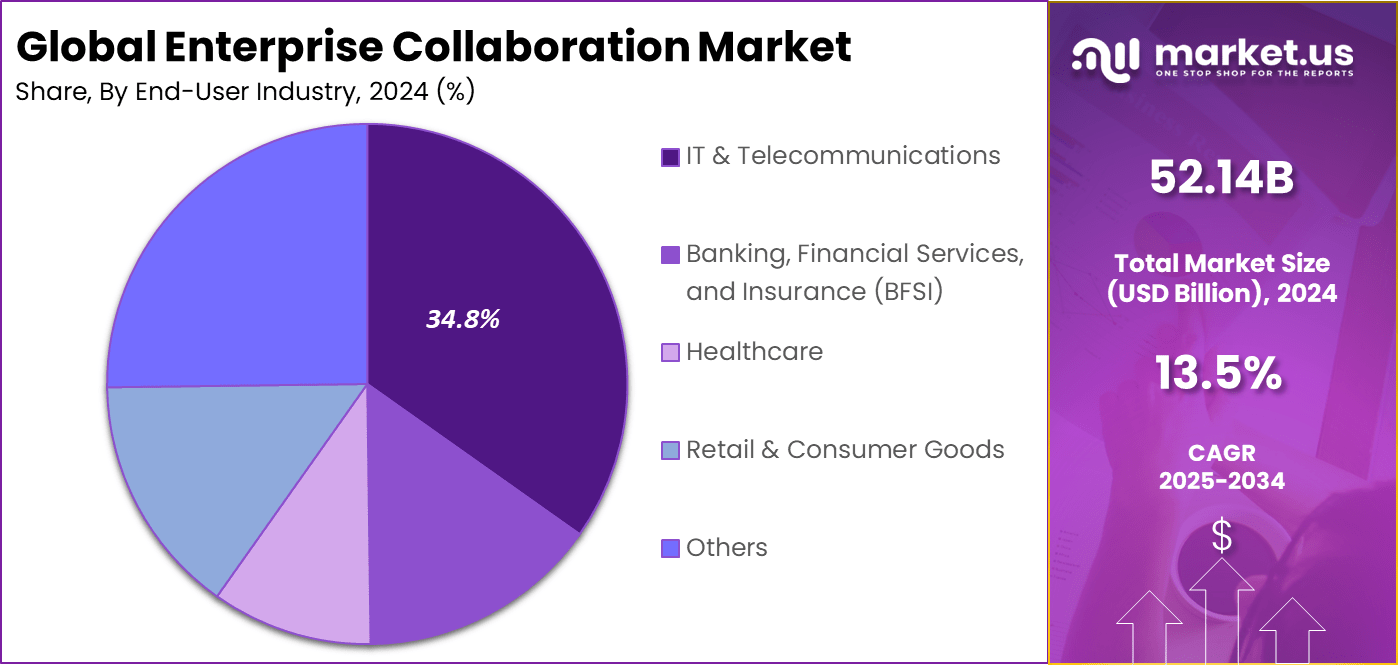

- The IT and telecommunications sector captured 34.8%, supported by high collaboration intensity and always-on operational requirements.

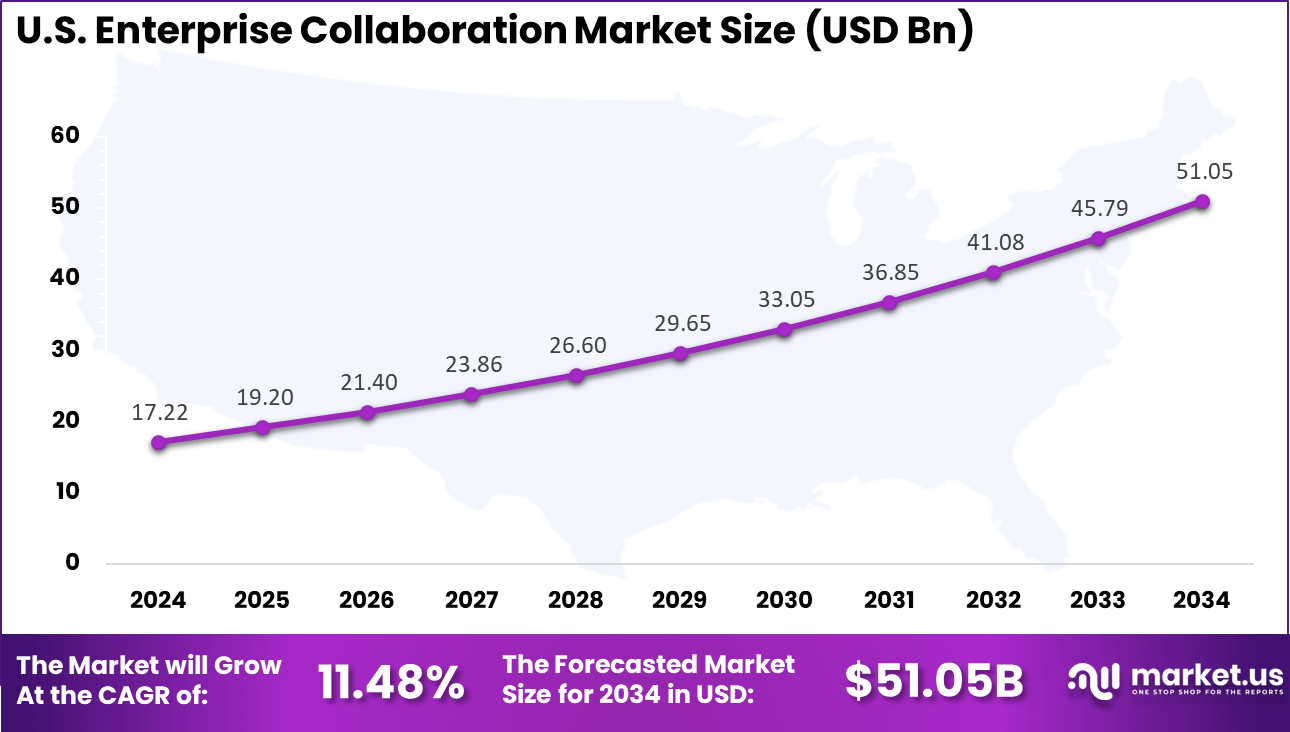

- The U.S. enterprise collaboration market reached USD 17.22 billion in 2024 and is expanding at an 11.48% CAGR, driven by hybrid work models and digital workplace investment.

- North America held over 36.7% share globally, supported by early technology adoption and mature enterprise IT infrastructure.

Adoption and Productivity Impact

- Nearly 80% of employees now rely on collaboration tools for daily work activities, reflecting their role as core workplace infrastructure.

- Organizations using AI-driven collaboration platforms report productivity gains of up to 40%, supported by automation, smarter workflows, and faster decision-making.

- Around 71% of business leaders report improved employee satisfaction due to hybrid and remote work models, while 36% of employees feel collaboration quality has declined in remote settings.

- Only 14% of employees feel fully aligned with organizational goals, pointing to gaps in communication clarity and unified collaboration practices.

Key Challenges and Risks

- Ineffective communication remains a major concern, with 86% of employees and executives linking workplace failures to poor collaboration.

- Security risks are rising, as about 45% of enterprises reported data breaches tied to cloud-based collaboration platforms in 2024.

- App overload is affecting efficiency, with 54% of employees using more than ten apps reporting communication issues, compared with 34% among those using fewer than five.

- Integration remains a challenge, as nearly 50% of organizations face compatibility issues when introducing new collaboration tools into existing systems.

U.S. Market Size

The market for Enterprise Collaboration within the U.S. is growing tremendously and is currently valued at USD 17.22 billion, the market has a projected CAGR of 11.48%. The market is growing due to rising demand for remote and hybrid work tools that connect distributed teams seamlessly. Businesses seek unified platforms for real-time chats, video calls, and file sharing to boost productivity amid flexible schedules.

For instance, in March 2025, Microsoft Corporation showcased new Teams features at Enterprise Connect 2025, including Loop workspace tabs in channels for real-time collaboration and content organization. These enhancements streamline enterprise communications while maintaining governance and compliance standards.

In 2024, North America held a dominant market position in the Global Enterprise Collaboration Market, capturing more than a 36.7% share, holding USD 19.13 billion in revenue. This dominance is due to advanced tech infrastructure that enables the fast rollout of collaboration tools across businesses.

Hybrid work models took off here, driving demand for platforms that link remote teams through chats, video, and shared files. Large enterprises in IT and telecom lead adoption, valuing scalability and security. Strong digital culture and investments in cloud setups keep the region ahead in seamless teamwork.

For instance, in June 2025, Slack Technologies introduced Simplified Layout Mode for better accessibility and removed canvas section locks to enable simultaneous editing by multiple users. Enterprise Grid customers gained advanced content moderation with Salesforce integration for bidirectional AI conversations.

Component Analysis

In 2024, The Software/Platforms segment held a dominant market position, capturing a 78.3% share of the Global Enterprise Collaboration Market. Teams depend on these tools for everyday tasks like file sharing, instant chats, and project tracking, all in one place. This leadership stems from their seamless fit into varied workflows, especially as work spreads across offices and homes.

Businesses value how these platforms reduce tool overload and boost efficiency in real time. Recent hybrid work trends have amplified their role, making coordination smoother for distributed groups. Scalability stands out as a key draw for growing organizations. These platforms expand easily without major disruptions, handling more users and data as needed.

Integration with existing systems cuts setup time and errors. Updates roll out automatically, keeping features fresh without IT headaches. This reliability drives their top position, as companies focus on productivity over maintenance. Overall, software solutions meet the core need for flexible, user-friendly collaboration in today’s fast-paced settings.

For Instance, in November 2025, Microsoft Corporation unveiled new Teams features at Ignite 2025, turning individual AI chats into group collaborations with Copilot integration. This boosts software platforms by enabling shared workflows and smarter file handling right within the app. Teams now manage projects and updates seamlessly, fitting daily needs perfectly.

Deployment Mode Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 87.4% share of the Global Enterprise Collaboration Market. They give instant access from any device or location, perfect for scattered teams. Setup costs stay low compared to old on-site systems, and updates roll out automatically without downtime.

Companies love the quick rollout during sudden changes like team growth or new projects. Security upgrades in cloud tech have built trust, pushing more firms to switch over regardless of size. Flexibility stands out as the big draw here, especially in shifting work environments.

Cloud options handle spikes in usage smoothly and cut maintenance headaches. Teams stay productive with always-on features like shared docs and calls. This dominance reflects how businesses prioritize ease and reach in their tools. As digital shifts continue, the cloud keeps pulling ahead by making collaboration simple and borderless.

For instance, in December 2025, Slack Technologies, LLC rolled out deeper Salesforce CRM integration for cloud users. Channels now link customer data directly to chats, speeding up actions without app switches. This makes cloud setups even more fluid for remote teams everywhere.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 63.7% share of the Global Enterprise Collaboration Market. These firms juggle global teams and massive data flows, needing robust tools for clear coordination. They invest heavily in secure systems that scale with complex operations and link up with existing software.

Advanced features like analytics help track progress across departments. As businesses spread out worldwide, these players drive demand for dependable tech that keeps everyone aligned. The focus on integration and security gives large firms an edge in adoption. They benefit from tools that manage high-volume interactions without breaking down.

This segment grows steadily as enterprises push for better ways to handle distributed work. Reliable platforms match their need for control and efficiency in large-scale environments. Overall, large setups shape the market by setting high standards for what collaboration tools must deliver.

For Instance, in November 2025, Zoom Video Communications, Inc. partnered with Cisco for Rooms integration. This brings native Zoom to enterprise hardware, easing hybrid meetings for thousands. Big organizations scale video without extra gear or training.

Solution Type Analysis

In 2024, the Unified Communication & Messaging segment held a dominant market position, capturing a 52.6% share of the Global Enterprise Collaboration Market. These tools blend chat, voice calls, and video into a single hub, slashing time lost on app hopping. Busy teams get a productivity boost from seamless real-time exchanges. This all-in-one approach cuts errors from mixed messages and keeps workflows tight. Remote setups have amplified the need for such integrated options to maintain strong links.

Workers in high-speed roles rely on the instant flow these solutions provide daily. A growing distance between colleagues makes unified tools essential for clear connections. They foster better teamwork by centralizing communication channels effectively. This lead comes from proven gains in speed and reduced missteps. As teams evolve, these solutions remain key to staying ahead in collaborative efforts.

For Instance, in December 2025, Microsoft Corporation added Teams Mode to Copilot at Ignite. It pulls the inbox and calendar into chats for unified messaging flows. Workers message, call, and share context in one spot, reducing email clutter.

End-User Industry Analysis

In 2024, The IT & Telecommunications segment held a dominant market position, capturing a 34.8% share of the Global Enterprise Collaboration Market. Fast digital changes in these fields call for solid tools to link teams and manage data flows nonstop. Remote models took off here first, speeding up tool use across operations. High data handling needs make collaboration platforms vital for keeping projects on schedule. Secure real-time sharing aligns perfectly with their core activities.

These industries deal with constant info streams, so effective tools prevent bottlenecks. Focus on quick exchanges supports their innovative pace and customer demands. Collaboration fits hand-in-glove with tech-driven work cultures. This strong position stems from early adoption and ongoing reliance on advanced connectivity. They continue to lead by example in leveraging these systems fully.

For Instance, in September 2025, Cisco Systems, Inc. teamed with Tata Communications on eSIM for IoT. This unifies device management in telecom networks, speeding connections for IT ops. Sectors now handle massive data links with less effort.

Emerging Trends

In the enterprise collaboration market, a prominent trend is the widespread integration of real-time communication and project coordination tools within unified platforms. Organisations are consolidating messaging, video conferencing, document sharing, and task management into single interfaces that support seamless teamwork across functions and locations.

This integration improves transparency and reduces friction in daily workflows, enabling faster decision making and more cohesive team engagement. Another emerging trend is the adoption of intelligent automation and analytics within collaboration systems.

Platforms are embedding features that automate routine tasks such as scheduling, follow-up reminders, and activity summarisation. Analytics tools that provide insights into team interaction patterns, engagement metrics, and project progress are also becoming more common. These capabilities help organisations optimise collaboration practices and identify areas for improvement in real time.

Growth Factors

A key growth factor in the enterprise collaboration market is the expanding prevalence of distributed and hybrid work environments. As organisations support workforces spread across offices, homes, and remote locations, demand for tools that enable synchronous and asynchronous collaboration increases.

Collaboration platforms provide a centralised digital environment that connects employees regardless of physical location, supporting continuity, alignment, and shared productivity. Another important growth factor is the focus on cross-functional alignment and knowledge sharing.

Modern enterprises require seamless coordination between departments such as sales, product development, customer support, and operations. Collaboration systems that enable shared documentation, cross-team communication channels, and integrated workflows help break down information silos and improve organisational responsiveness.

Key Market Segments

By Component

- Software/Platforms

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Solution Type

- Unified Communication & Messaging

- Project & Task Management

- File Sharing & Content Management

- Enterprise Social Networks

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail & Consumer Goods

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Remote Work Rise

Teams spread across locations need ways to stay connected in real time. Tools for chats and shared files help keep work flowing without office walls. This push started strong during global shifts to home setups and holds firm now. Daily tasks speed up when staff grab updates from any spot with internet. Managers find it easier to track progress across time zones. Firms with global reach gain the most from this smooth link-up.

Access to shared documents from anywhere cuts down on delays in project handoffs. Quick video calls replace long email chains, letting decisions happen faster. Workers report higher focus when they skip commutes and dive straight into core duties. Over time, these habits build stronger team bonds despite physical distance. Natural collaboration emerges as people adapt to flexible schedules.

For instance, in November 2025, Microsoft Teams rolled out external collaboration upgrades at Ignite 2025. These features ease secure connections with partners and vendors outside the organization. Teams now handle shared channels and guest access with less friction across locations. Remote workers join workflows without complex invites. Daily check-ins flow smoothly for global setups.

Restraint

Security Risks

Data leaks worry leaders when files move freely online. Strict rules on privacy add layers of checks that slow tool rollout. Breaches hit trust and lead to extra costs for fixes. Staff handle sensitive info daily yet face weak spots in shared systems. Older setups clash with new apps, raising breach odds. Many hold back on full use until safeguards tighten up.

Encryption gaps in free tools expose client details during transfers. Phishing tricks target remote users more often since home networks lack office firewalls. Recovery from incidents pulls teams away from regular work for weeks. Leaders push for audits before approving wider access. Trust rebuilds slowly after even minor slips.

For instance, in November 2025, Smartsheet launched AI-safe governance in its partner program updates. Enterprise sheets now lock sensitive fields during remote edits. Multi-national teams follow unified privacy rules. Audit trails track every change across borders. Downtime from breaches shrinks.

Opportunities

AI Features Boost

Smart tech now spots patterns in team chats to suggest next steps. Auto notes from calls, free time for real work. This opens doors for tools that learn user habits over time. Workflows get smarter with hints on tasks or team matches. Businesses test these to cut routine drags and spark ideas. Growth lies in blending AI without complex overhauls.

Predictive alerts flag delays early based on past chat tones. Matching experts to queries speeds up problem-solving across departments. Voice analysis pulls key action items from rambling discussions. Teams experiment with these in pilots to refine daily rhythms. Simple integrations make advanced help feel routine.

For instance, in September 2025, Slack AI now auto-generates huddle notes and action items. It pulls summaries from calls and sorts files into canvases. Remote teams skip manual recaps after sessions. Hints on tasks pop up in chats based on patterns. Workflows learn from daily use.

Challenges

Security Risks and Data Governance Requirements

A major challenge in the enterprise collaboration market is managing security risks associated with shared information. Collaboration systems often store sensitive business data, which must be protected from unauthorized access. Organizations must enforce strong authentication, encryption, and access policies to maintain data safety. These requirements increase complexity and require ongoing oversight.

Another challenge is data governance. As teams share files, messages, and project notes, information may proliferate in unstructured ways. Ensuring consistent naming, retention policies, and lifecycle management becomes essential to preserve compliance with industry standards and regulations. Lack of strong governance can lead to data sprawl and operational inefficiencies.

For instance, in April 2025, Atlassian tied Jira to Confluence with Rovo AI connectors. Legacy projects link across tools without data exports. Remote teams view goals and docs in one spot. Custom fields sync subtasks seamlessly. Training gaps close via unified views.

Key Players Analysis

Microsoft, Slack, Zoom, Google, and Cisco lead the enterprise collaboration market with integrated platforms for messaging, video conferencing, file sharing, and real time teamwork. Their solutions support hybrid and remote work across large organizations. These companies focus on reliability, security, and seamless user experience. Continued adoption of flexible work models continues to strengthen their market leadership.

Atlassian, Asana, Smartsheet, Citrix, Box, and Dropbox strengthen the market with collaboration tools focused on project management, document sharing, and workflow coordination. Their platforms help teams improve productivity and visibility across distributed environments. These providers emphasize ease of integration, automation, and scalability. Growing demand for structured collaboration and task transparency supports wider adoption.

Miro, Trello, Notion, and other players expand the landscape with visual collaboration, knowledge management, and lightweight productivity tools. Their offerings are popular among agile teams and creative professionals. These companies focus on simplicity, flexibility, and fast onboarding. Increasing cross functional teamwork and digital workplace transformation continue to drive steady growth in the enterprise collaboration market.

Top Key Players in the Market

- Microsoft Corporation

- Slack Technologies, LLC

- Zoom Video Communications, Inc.

- Google LLC

- Cisco Systems, Inc.

- Atlassian Corporation

- Asana, Inc.

- com, Ltd.

- Smartsheet, Inc.

- Citrix Systems, Inc.

- Box, Inc.

- Dropbox, Inc.

- Miro

- Trello

- Notion Labs, Inc.

- Others

Recent Developments

- In December 2025, at Ignite 2025, Microsoft rolled out enhanced Copilot features in Teams and Microsoft 365, including Agent Mode for smarter chat interactions and inbox insights that pull from calendars and emails. These updates make collaboration feel more intuitive, helping teams cut through the noise of daily workflows.

- In July 2025, Adidas Group went live with Dropbox Enterprise to enable seamless global collaboration across design and marketing teams. The rollout highlights Dropbox’s strength in handling massive file shares for creative enterprises without the usual headaches.

- In May 2025, Zoho Corporation introduced Vani at Zoholics USA, a visual collaboration platform designed for enterprise teams. The platform offers an infinite canvas, smart templates, and built in video conferencing to support structured collaboration in remote and hybrid work settings, reflecting Zoho’s focus on integrated and easy to use workplace tools.

Report Scope

Report Features Description Market Value (2024) USD 52.1 Bn Forecast Revenue (2034) USD 184.9 Bn CAGR(2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platforms, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Solution Type (Unified Communication & Messaging, Project & Task Management, File Sharing & Content Management, Enterprise Social Networks, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail & Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Slack Technologies, LLC, Zoom Video Communications, Inc., Google LLC, Cisco Systems, Inc., Atlassian Corporation, Asana, Inc., Monday.com, Ltd., Smartsheet, Inc., Citrix Systems, Inc., Box, Inc., Dropbox, Inc., Miro, Trello, Notion Labs, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Collaboration MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Enterprise Collaboration MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Slack Technologies, LLC

- Zoom Video Communications, Inc.

- Google LLC

- Cisco Systems, Inc.

- Atlassian Corporation

- Asana, Inc.

- com, Ltd.

- Smartsheet, Inc.

- Citrix Systems, Inc.

- Box, Inc.

- Dropbox, Inc.

- Miro

- Trello

- Notion Labs, Inc.

- Others