Enteral Feeding Devices Market By Type (Enteral Feeding Tubes, Enteral Feeding Pumps, Enteral Syringe, and Others), By Application (Gastroenterology, Oncology, Cancer, Neurological Disorder and Others), By Age Group (Adult and Pediatric), By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 49872

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

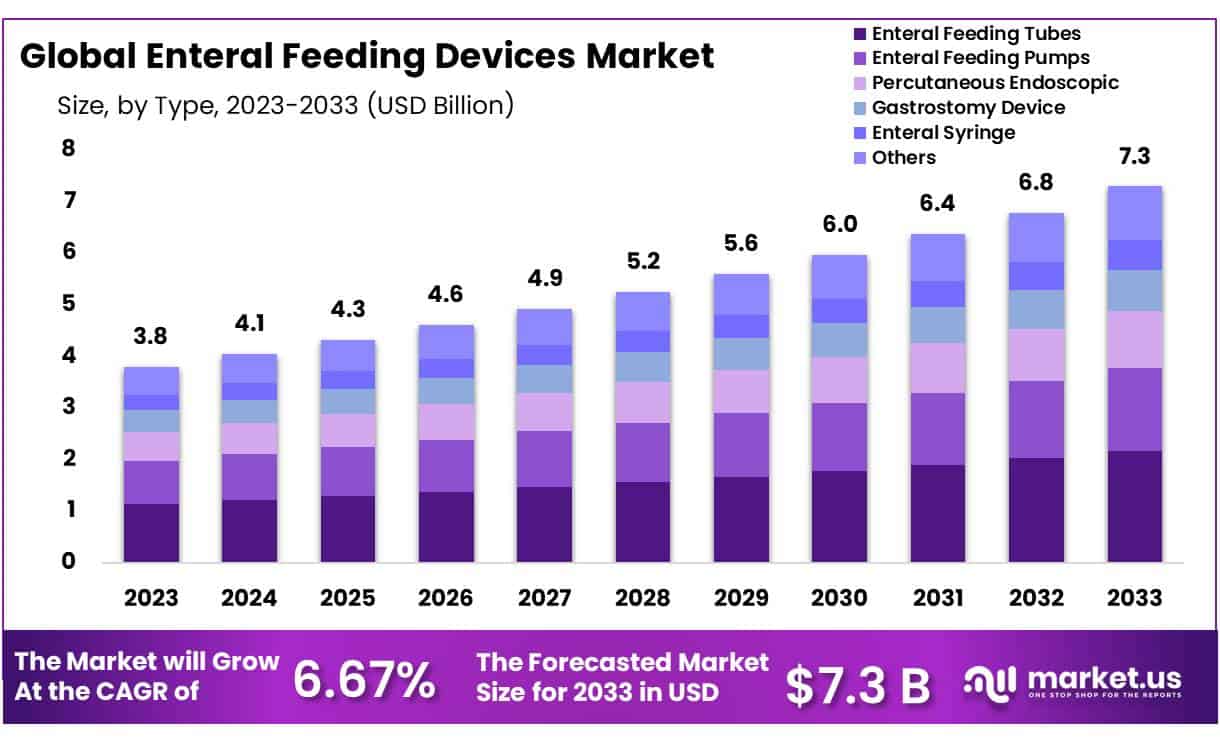

The Global Enteral Feeding Devices Market size is expected to be worth around USD 7.3 Billion by 2033 from USD 3.8 Billion in 2023, growing at a CAGR of 6.67% during the forecast period from 2024 to 2033.

An enteral feeding device is described as a medical instrument it is used to provide nutrition to patients who are unable to eat solid food by their own mouths, cannot swallow well, or require nutritional supplementation. Enteral feeding refers to the intake of food through your gastrointestinal (GI). The GI includes the mouth, stomach, and other digestive organs.

Patients with chronic diseases such as malnutrition, gastrointestinal disorders, cancer, and other conditions may require an enteral feeding device to provide drugs and nutrition. Patients can take food with the help of a tube to receive nutrition and maintain their Gastro intestinal tract function. The patient might eat enteral food to supplement their daily caloric intake. Most commonly, enteral feeding devices can be found in the activity hall (OT) and even in patients who are seriously ill at home.

Market growth is influenced by the regularity of neurological disorders and chronic diseases like cancer. The market should also grow due to the growth of the enteral nutrition market, the expansion of the geriatric population, and the overflow of malnutrition cases. Market growth is impeded by strict governmental guidelines and the unintended movement and passing of tubes, which can lead to accidental handicaps or deaths.

Key Takeaways

- The global enteral feeding devices market is projected to surge from USD 3.8 Billion in 2023 to approximately USD 7.3 billion by 2033, with a steady 6.67% CAGR during 2024-2033.

- The largest income share was held by the enteral feeding tube segment is 29.8%.

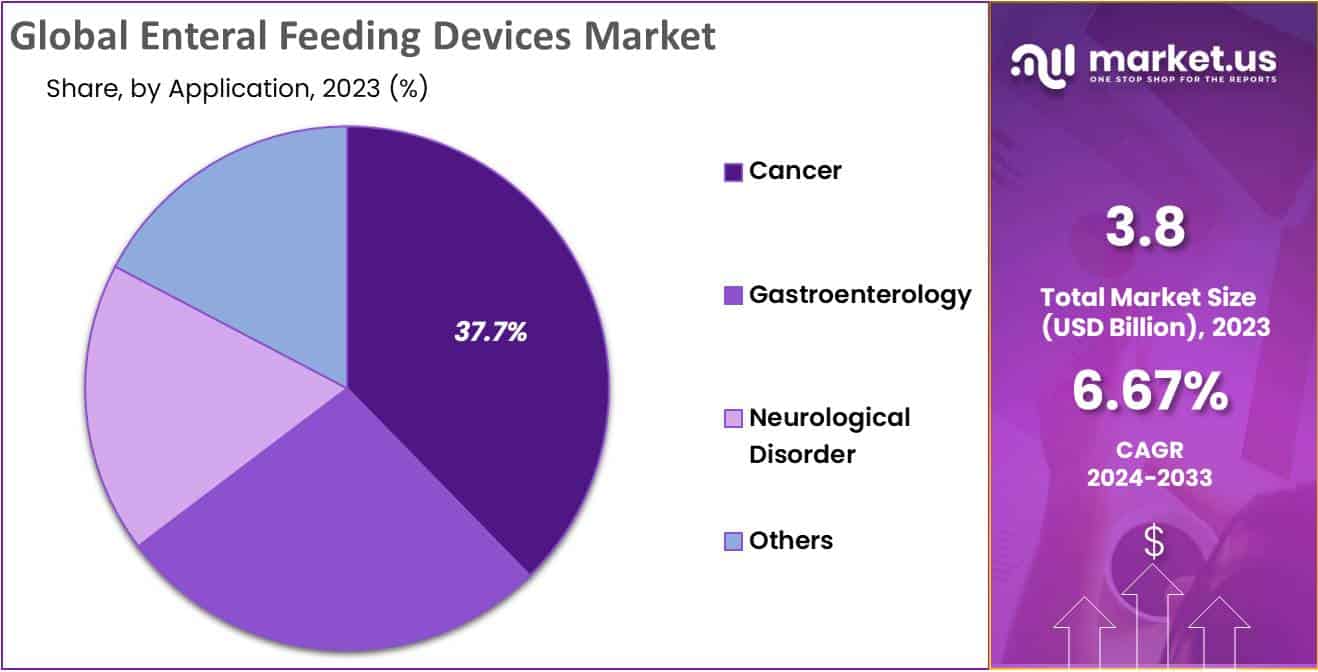

- The cancer segment held 37.7% market shares in the enteral feeding market.

- Adults constitute 81.4% of the market in 2023, while pregnant women also benefit from enteral nutrition for pregnancy risk reduction.

- global revenue share of 81.4% in 2023, the adult age group category led.

- Hospitals are the primary users due to extensive demand from various departments. Hospitals held 54.1% share in the market.

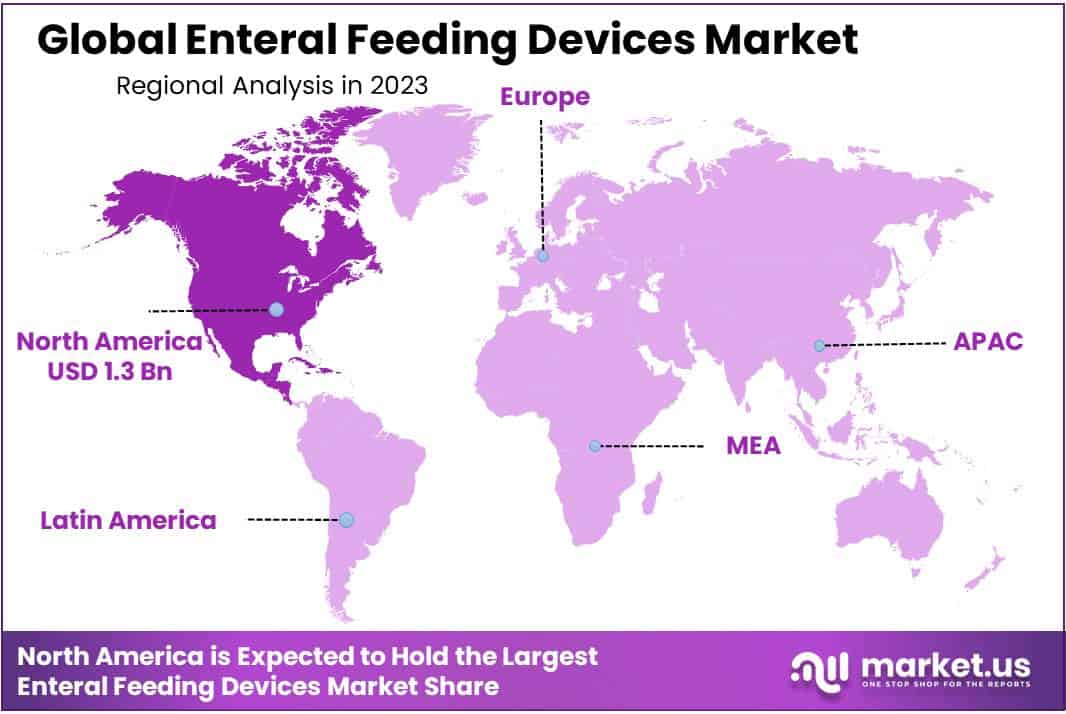

- North America, particularly the United States, holds a substantial market share, but the Asia Pacific is set to grow rapidly due to increasing disease prevalence and hospital admissions. Europe also maintains a strong market presence.

- Leading market players, such as Cardinal Health Inc., Braun Melsungen AG, Baxter International Inc., Fresenius SE & Co., Vygon SA, focus on expansion, R&D, and new product development to stay competitive.

Type Analysis

Enteral Feeding Pump Segment Holds the Largest Shares In the Market Segment

Based on Product Type, the market is segmented into Enteral Feeding Pumps and Enteral Feeding Tubes, Enteral syringes, and others. Enteral pumps are used when tube feeding must be done slowly and over a prolonged period of time. The largest income share was held by the enteral feeding tube segment is 29.8%. This tube allows liquids to be absorbed into your stomach through a tube.

For adults and children with chronic conditions, enteral-based nutrition or nutrition is a normal way to provide nutrition. This is because these conditions reduce the oral intake of nutrients. This segment’s growth can also be attributed to the increasing acceptance of these devices in home and clinic care. They are safe and provide adequate nutrition. Market growth is also facilitated by the introduction of new and improved devices.

The introduction of secure systems for pumps has reduced the risk of microbial contamination and improved the user experience. This is due to the increased adoption of low-profile devices in both the pediatric and elderly gastronomy populations. The market’s growth is due to its compact designs and attractive appearance. Gastronomy tubes with a low profile can be used to provide longer-lasting nutrition, which increases their popularity.

Application Analysis

Rising Prevalence of Cancer and Occurrence of Malnutrition Cases During Cancer Treatment will promote the Market Value

Based on the application segment, the market can be divided by Application into Cancer, Neurological Disorder, Oncology, and Gastroenterology. The cancer segment held 37.7% market shares in the enteral feeding market. Enteral tube feeding is a supportive method for providing nutrition to patients with head and neck cancer during chemotherapy and radiotherapy.

Inadequate oral intake is associated with higher rates of mortality, morbidity, and disability in patients suffering from neurological diseases. Enteral feeding is a common method of providing nutritional help for neurological patients and is essential to their nutritional management.

Age Group

The Adult Age Groups dominating This Market

With a global revenue share of 81.4% in 2023, the adult age group category led. According to a report that was published in NCBI, between 70% and 80% of pregnant women experience nausea and vomiting. Enteral nutrition is employed in these situations to prevent harmful events such as fetal intrauterine development limitation, premature newborn births, and maternal dehydration.

End-User Analysis

Growing Pressure on Hospitals and the Development of User-Friendly Enteral Feeding Devices Is Estimated to Influence the Demand

The end-user segment of the enteral feeding devices market is divided into home care settings, hospitals, and ambulatory care settings. Hospitals held 54.1% share in the market. Hospitals have different departments allotted to cardiology, dermatology, neurology, orthopedics, etc. Most of the above-mentioned departments now use an enteral feeding device.

Hospitals are increasingly using enteral feeding devices due to the high demand from many departments. The market for enteral nutrition devices is expanding to accommodate home care. The market growth would be fuelled by rising healthcare costs and the availability of new feeding equipment, as well as favorable reimbursement policies for home enteral nutrition.

Key Market Segments

By Type

- Enteral Feeding Tubes

- Enteral Feeding Pumps

- Percutaneous Endoscopic Gastrostomy Device

- Enteral Syringe

- Others

By Application

- Gastroenterology

- Cancer

- Neurological Disorder

- Others

By Age Group

- Adult

- Pediatric

By End Users

- Home Care

- Hospitals

- Ambulatory care Centers

Drivers

High Incidence of Preterm Birth and Genetic Disorders in Pediatric Patients

Due to high neonatal mortality, preterm births have become a significant health concern worldwide. To support their optimal growth, preterm infants need adequate nutrition. Preterm infants must be able to coordinate their swallowing, sucking, and breathing. This is essential for bolus delivery nutrition and human milk via enteral nutrition.

Congenital and rare genetic disorders are also present in infants. Tube feeding is also required for certain genetic disorders, such as Prader-Willi Syndrome. The market for enteral nutrition devices is seeing a rise in revenue due to the increasing demand from infants and neonates.

Restraints

Complications associated with Enteral Feeding Devices

Some of the most significant issues with the use of enteral feeding systems are initial installation challenges, mechanical complications, clinical issues, and nutritional issues. it raises the expense of healthcare. The majority of these enteral feeding-related issues are mild, but some of them are rather dangerous.

Even though they are less common and severe, enteral feeding’s metabolic complications are quite comparable to those that rise with parenteral nutrition. This issue can be diminished and prevented with careful monitoring. The mortality linked to these consequences and this worry, however, serve as a barrier to enteral feeding system adaptation.

Opportunity

Growing Healthcare Infrastructure Across the Emerging Market

The enteral feeding device market is also boosted due to growing healthcare industries in several emerging economies such as Brazil, India, South Africa, and China. The rapidly increasing geriatric population, rising per capita incomes, high patient volumes, and spiking awareness among individuals are driving the need for enhancing the healthcare industries in these nations.

Therefore, the governments in these economies are increasing their investments aimed at improving healthcare facilities & infrastructure. Owing to the high number of applications of enteral feeding devices in healthcare industries, the rising investment in this industry is slated to offer growth opportunities in the market.

Trends

Diabetes Segment Is Expected to Witness Significant Growth During the Forecast Period

The diabetes segment will experience significant growth in the forecast period, according to the application. The main factors driving the segment’s growth are the rising diabetes burden, the growing geriatric population, and the increased implementation of strategic initiatives from market players.

Globally, diabetes incidences have increased over time and are expected to rise further. By providing essential macro- and micronutrients such as energy, vitamins, minerals, and protein, enteral nutrition can help reduce the risk of malnutrition among diabetic patients. In the near future, there will be greater demand for enteral nutrition devices among diabetic patients.

Regional Analysis

North America Region Accounted Significant Share of the Global Enteral Feeding Market

The Global Enteral Feeding Devices Market can be divided into North America, Eastern Europe, Western, Asia Pacific, Latin America, and MEA. North America holds a 35.2% market share in North America for enteral feeding devices, which is made up of several countries. Due to the US’s advanced healthcare system, large market players, modern healthcare setup, rising prevalence of chronic diseases such as oral cancer, strong appropriation agreements organizations, as well as the availability of new products by which the Enteral Feeding Devices Market is expected to grow.

The Middle East, Latin America, and Africa are expected to show notable growth over the forecast period. Europe held the second highest share due to its high geriatric population, favorable reimbursement, and other factors. Asia Pacific is expected to grow at the fastest rate of CAGR, mainly due to rising incidences of cancer and other gastrointestinal diseases, high rates of preterm births, and an increasing number of hospital admissions. The forecast period has seen an increase in the demand for enteral feeding devices due to rising numbers of preterm births in China and India.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several enteral feeding devices market companies are concentrating on expanding their existing operations and R&D facilities. Furthermore, businesses in the enteral feeding device market are developing new products and portfolio expansion strategies through investments and mergers, and acquisitions.

In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

With the presence of many local and regional players, the market for enteral feeding devices is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches.

Listed below are some of the most prominent enteral Feeding device industry players.

Market Key Players

- Cardinal Health Inc.

- Braun Melsungen AG

- Baxter International Inc.

- Fresenius SE & Co.

- Vygon SA

- Abbott Nutrition

- Avanos Medical Inc.

- Amsino International Inc.

- Boston Scientific Corporation

- ALCOR Scientific Inc.

- Conmed Corporation

- Applied Medical Technology Inc.

- Other Key Players

Recent Developments

- March 2024: B. Braun Melsungen AG invested $2 million in Fidmi Medical, a company known for developing a novel low-profile percutaneous endoscopic gastrostomy (PEG) device aimed at addressing common issues like clogging and dislodgement associated with traditional enteral feeding tubes. This investment will support the completion of clinical trials and the preparation for market entry, signaling a significant commitment to improving enteral feeding solutions.

- September 2023: Cardinal Health launched the Kangaroo OMNI™ Enteral Feeding Pump in the U.S. This device is uniquely designed to handle various types of enteral feeding formulas, including thick, homogenized, and blended types. It’s distinguished by its compact size, versatility in feeding, hydrating, and flushing capabilities, and its ability to store up to a 30-day feeding history, making it an optimal solution for both hospital and home care settings.

- 2024: Vygon introduced the EasyMoov6, an innovative enteral feeding pump designed to deliver a stable weight management solution for patients, especially those suffering from chronic diseases, gastrointestinal surgeries, or localized cancers. This pump features a digital interface for precise control over food administration and is part of Vygon’s initiative to improve the quality of life for patients requiring nutritional support.

- April 2024: Abbott reported a significant increase in their overall sales, with specific growth observed in their diagnostics and medical devices segments. This uptick includes the sales of enteral feeding devices, which are part of their broad medical equipment offerings. Although exact figures for the enteral devices specifically weren’t disclosed, Abbott’s total medical devices sales for the first quarter of 2024 were reported to be $4.45 billion, marking a 14.4% increase in the U.S. market from the previous year.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 7.3 Billion CAGR (2024-2033) 6.67% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Enteral Feeding Tubes, Enteral Feeding Pumps, Enteral Syringe, and Others); By Application (Gastro intestinal, Cancer, Neurological Disorder, and Others); By Age Group (Adult and Pediatric) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cardinal Health Inc., B. Braun Melsungen AG, Baxter International Inc., Fresenius SE & Co., Vygon SA, Abbott Nutrition, Avanos Medical Inc., Amsino International Inc., Boston Scientific Corporation, ALCOR Scientific Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enteral Feeding Devices MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Enteral Feeding Devices MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cardinal Health Inc.

- Braun Melsungen AG

- Baxter International Inc.

- Fresenius SE & Co.

- Vygon SA

- Abbott Nutrition

- Avanos Medical Inc.

- Amsino International Inc.

- Boston Scientific Corporation

- ALCOR Scientific Inc.

- Conmed Corporation

- Applied Medical Technology Inc.

- Other Key Players