Global Enhanced Cloud Host Market Size, Share, Industry Analysis Report By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Hosting Type (Shared Hosting, Dedicated Hosting, Managed Hosting, Colocation Hosting), By Pricing Model (Subscription-Based, Pay-As-You-Go), By End-use Industry (IT & Telecom, Healthcare, Retail, BFSI, Government, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Oct. 2025

- Report ID: 160145

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- Financial Statistics

- U.S. Market Outlook

- Biggest Trends

- Growth Factors

- Service Type Analysis

- Enterprise Size Analysis

- Hosting Type Analysis

- Pricing Model Analysis

- End-use Industry Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

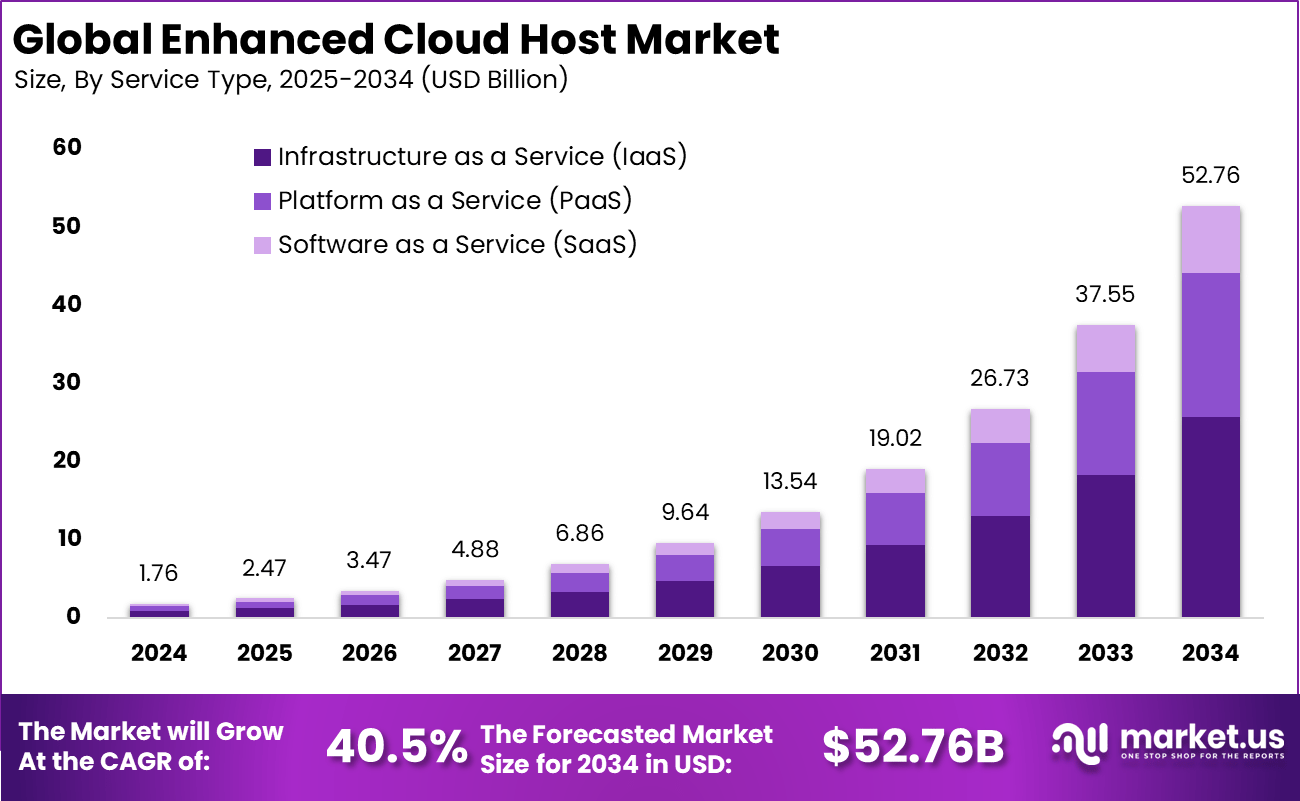

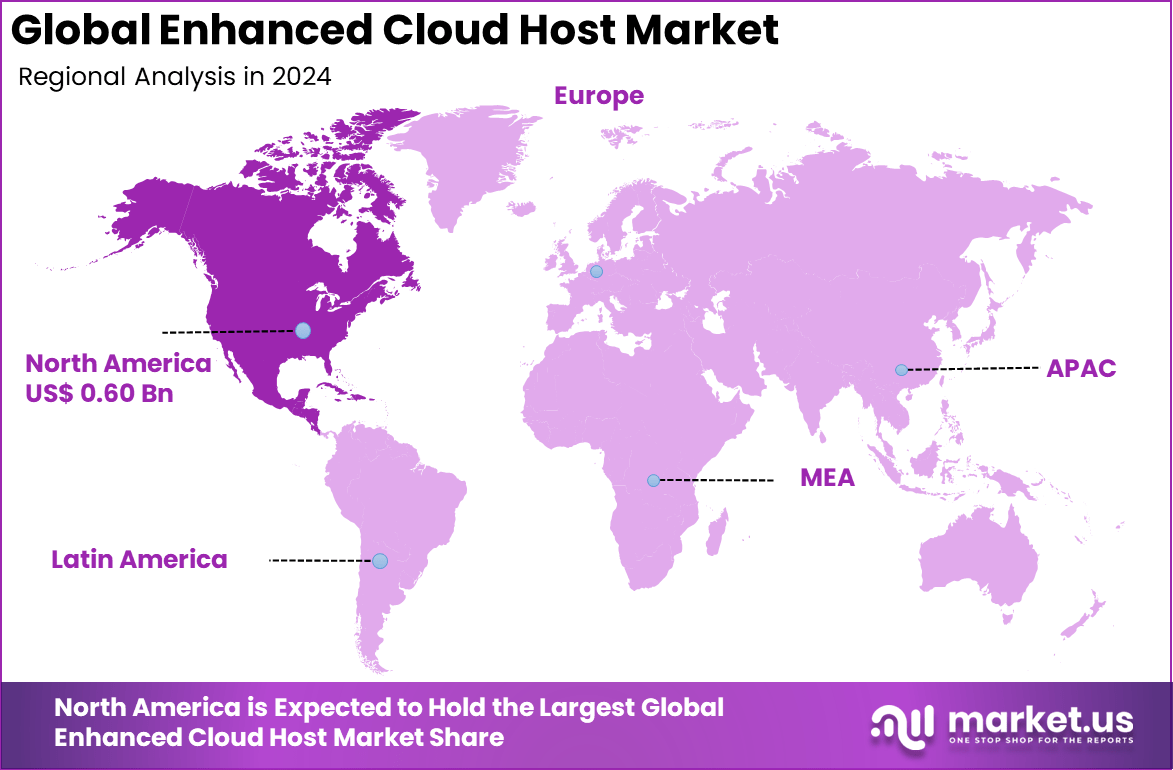

The Global Enhanced Cloud Host Market size is expected to be worth around USD 52.76 billion by 2034, from USD 1.76 billion in 2024, growing at a CAGR of 40.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.5% share, holding USD 0.60 billion in revenue.

The enhanced cloud host market is steadily transforming the way businesses manage digital infrastructure. Enhanced cloud hosting combines reliable uptime, scalable resources, automated security, and reduced manual workloads, positioning itself as the standard for organizations that want agile, always-on IT environments. The high network uptime offered by these services minimizes costly interruptions across sectors, with many providers now guaranteeing nearly 100% operational continuity.

Top driving factors in the market stem from the need for cost efficiency, flexible scaling, and business resilience. Enterprises choose cloud hosting over legacy physical servers because it typically cuts infrastructure expenses by more than 40% while allowing rapid resource scaling based on real-time needs. The digital transformation push, accelerated remote and hybrid work adoption, and the increase in connected devices are all strongly supporting long-term growth.

As of 2025, more than 86% of organizations are operating multi or hybrid cloud strategies to balance data control, compliance, and scalability. Demand for enhanced cloud hosting is being driven by businesses looking to handle the explosion of data from e-commerce, IoT, and analytics. Edge computing is seeing significant adoption, bringing data processing closer to end users and reducing latency for applications like real-time monitoring or customer profiling.

Organizations are increasingly investing in AI-powered cloud platforms, with more than 60% of cloud users now employing automation and machine learning for resource optimization, predictive maintenance, and cybersecurity improvements. The most widely adopted technologies alongside enhanced cloud hosting are edge computing, AI/ML platforms, and advanced analytics.

Many businesses report that AI-driven workload management helps them reduce cloud operational costs and downtime, with an average improvement of 25% in resource allocation efficiency. The adoption of security automation and compliance tools has also risen, helping companies face complex regulations and cyber threats confidently

For instance, in October 2024, IONOS was announced as a sponsor for the Nextcloud Enterprise Day 2024, scheduled to take place in Frankfurt. This partnership focuses on enhancing data sovereignty, security, and transparency through open-source software and open standards. IONOS, a leading digitalization partner for SMBs in Europe, supports Nextcloud hosting within secure, certified data centers.

Key Takeaway

- Infrastructure as a Service (IaaS) leads with 48.8%, reflecting strong demand for scalable computing and storage resources.

- Large enterprises dominate adoption at 70.5%, as they drive large-scale cloud transformation initiatives.

- Shared hosting holds 42.6%, supported by cost efficiency and accessibility for businesses of all sizes.

- Subscription-based pricing models account for 65.4%, showing a clear preference for predictable and flexible cloud costs.

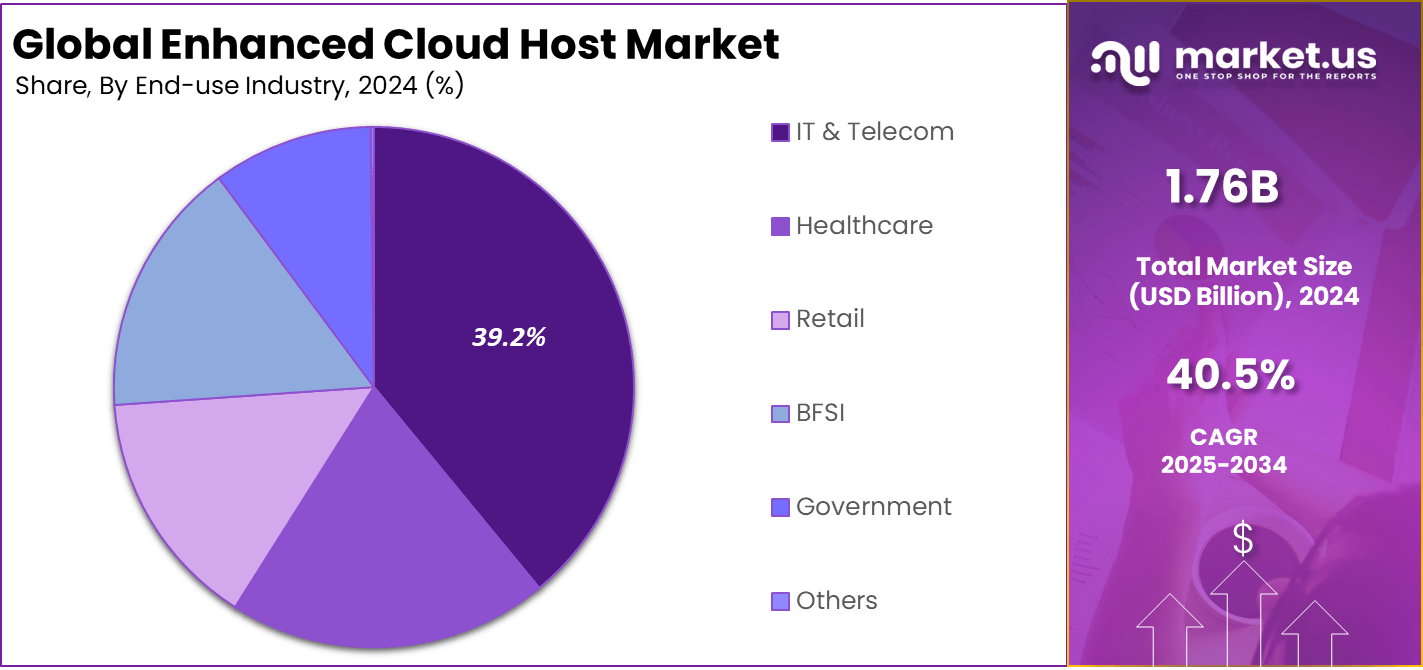

- IT & Telecom industry leads with 39.2%, leveraging cloud hosting for network operations and digital services.

- North America captures 34.5%, driven by mature cloud infrastructure and enterprise adoption.

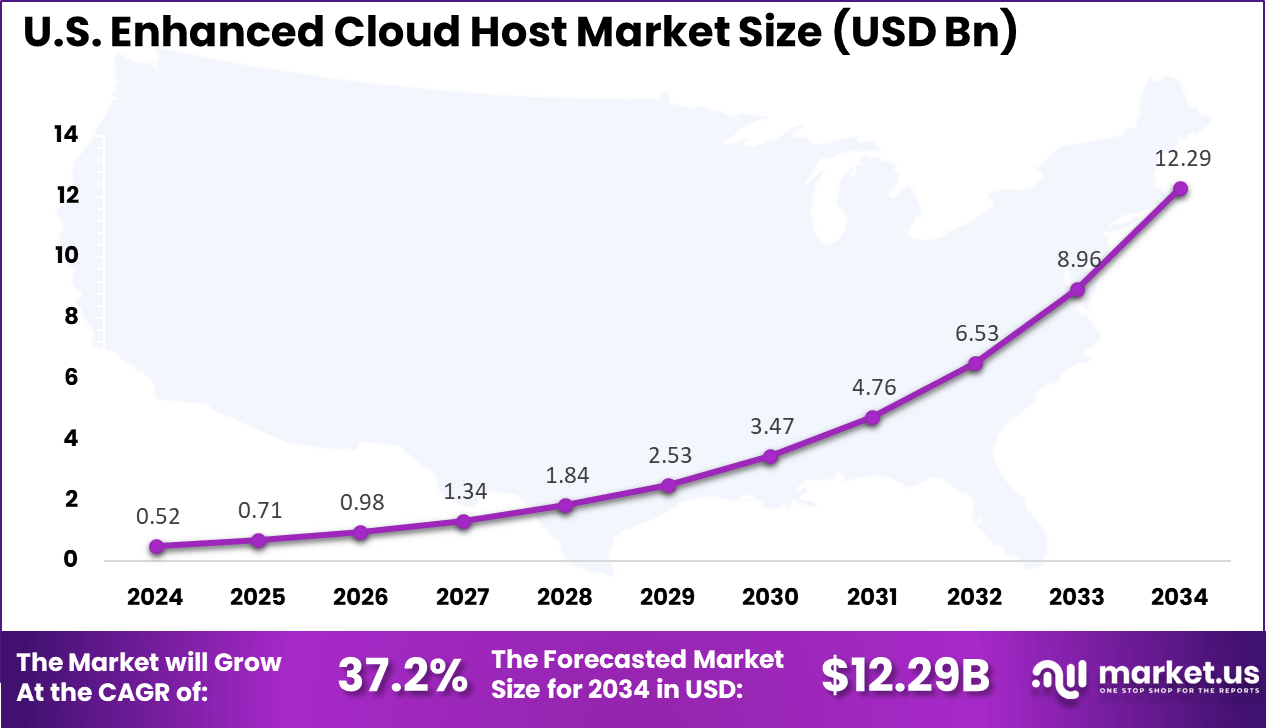

- The US market reached USD 0.52 billion and is advancing at a CAGR of 37.2%, underscoring rapid expansion in enhanced cloud hosting solutions.

Role of Generative AI

Generative AI has become a driving force in enhanced cloud hosting, not just for its ability to automate complex operations but also for transforming how organizations predict and control cloud resources. By 2025, about 85% of business leaders expect to use generative AI for low-value, routine tasks within cloud environments.

Around 77% plan to leverage it for customer service and 74% for operational optimization, showing just how mainstream AI integration has become in the infrastructure layer. A notable 65% of organizations actively report using generative AI now, nearly doubling in just one year.

This rapid adoption is changing enhanced cloud hosting from being a commodity to something uniquely adaptive, as predictive AI-driven models greatly reduce downtime, speed up incident response, and enable cloud platforms to self-optimize.

Investment and Business Benefits

Investment opportunities are especially strong in emerging markets across Asia, Latin America, and Africa, where cloud penetration is still in its early phase but accelerating. Mergers and acquisitions are rising as vendors look to integrate advanced capabilities and enter new regions, with technology innovation, sustainability initiatives, and AI-enabled services being the most sought-after areas for investors.

Business benefits are tangible and immediate: companies report cutting infrastructure costs by up to 60%, reducing carbon emissions by 65% through optimized cloud workloads, and boosting uptime close to 100%. Enhanced cloud hosting allows remote collaboration and much faster go-to-market for new products, resulting in agile operations and a substantial competitive edge.

Financial Statistics

According to cloudkeeper, Financial statistics for enhanced cloud hosting in 2025 show a continuing surge in investment and spending, fueled by broad enterprise adoption and the need for advanced, AI-driven infrastructure. Spending on cloud services has jumped 21.5% compared to the previous year, with end-user spending now topping $723 billion annually.

Public cloud hosting alone is responsible for over $980 billion in revenue in 2025, accounting for a dominant share of the global tech economy. Hybrid cloud remains the preferred model for close to 70% of organizations, mainly because it balances cost efficiency and security. Enterprises increasingly rely on multiple clouds: 81% are utilizing two or more cloud providers, driven by both flexibility and the desire to avoid vendor lock-in.

Cloud spending as a whole has seen consistent, aggressive growth rates, rising 34% year over year to reach almost $53 billion per quarter, making it the eleventh time in twelve quarters that growth rates have stayed within the 34% to 40% band. Monthly costs for a single server average $400, while a typical back-office cloud setup is billed at around $15,000 monthly, showing just how deeply cloud hosting is woven into everyday business operations.

On the infrastructure side, hyperscale providers and enterprises are projected to spend an additional $490 billion on AI and cloud infrastructure next year, which is $70 billion higher than forecasts from just a few months ago. This uptick underscores a new trend: many large tech firms are now financing cloud expansions through debt, pointing to both confidence and risk in the financial landscape of cloud hosting.

In the financial services world, 55% of banks have migrated at least 30% of their critical workloads to the cloud, and around 81% of insurance companies report improved operational efficiency after embracing cloud adoption. Over 54% of financial institutions use AI for efficiency, 51% for better decisions, and 40% report cost savings from cloud-native automation, driving continued investment in fintech cloud solutions.

U.S. Market Outlook

The market for Enhanced Cloud Host within the U.S. is growing tremendously and is currently valued at USD 0.52 billion, the market has a projected CAGR of 37.2%. The market is growing rapidly due to the country’s strong focus on technological innovation, digital transformation, and the increasing adoption of cloud-based solutions across industries.

The rise of AI, machine learning, and data analytics is driving demand for more advanced cloud services, while businesses seek cost-effective, scalable, and secure infrastructure. Additionally, remote work trends and the need for enhanced cybersecurity solutions are fueling further growth, making cloud hosting essential for U.S. companies.

For instance, in June 2024, Oracle and Google announced a groundbreaking multicloud collaboration to enhance cloud interoperability. This partnership allows customers to seamlessly integrate Google Cloud services with Oracle Cloud Infrastructure (OCI), facilitating smoother application deployments across both platforms. The new solution features a direct interconnection, optimizing performance and lowering latency.

In 2024, North America held a dominant market position in the Global Enhanced Cloud Host Market, capturing more than a 34.5% share, holding USD 0.60 billion in revenue. This dominance is due to its advanced technological infrastructure, high adoption rates of cloud services, and the presence of major cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud.

The region’s strong focus on digital transformation, innovation, and the growing demand for AI-driven cloud solutions also contributed to its market leadership. Additionally, businesses in North America prioritize scalability, data security, and cost optimization, further fueling market growth.

For instance, In June 2025, Amazon committed $10 billion to expand its AI- and cloud-focused data center infrastructure in North Carolina. The project will generate about 500 high-skilled jobs, including engineering and security roles, while also creating additional employment in construction, supply chain services, and local workforce development programs.

Biggest Trends

The biggest trends shaping enhanced cloud hosting come from hybrid and multi-cloud adoption, serverless acceleration, and the explosive growth of edge computing. As of 2025, about 87% of organizations embed AI services in their core cloud strategy, making hybrid and multi-cloud the new normal for at least 85% of enterprises.

Serverless models now see adoption rates surpassing 75%, which lets businesses deploy more applications and workloads with less operational overhead. At the same time, edge computing has reached annual global spending nearing $261 billion, driven by IoT and the need for low-latency data processing.

Growth Factors

Growth across the enhanced cloud hosting sector continues to be pushed forward by enterprise digital transformation, remote work adoption, and the rising demand for real-time analytics. Digital transformation initiatives mean most organizations are expanding cloud budgets and moving mission-critical workloads into more resilient, AI-managed environments.

The ongoing data explosion from connected devices and sensors forces cloud infrastructure to provide smarter, more scalable solutions. Around 90% of organizations now rely on cloud environments, and more than 60% say they run over half their workloads in the cloud. Sustainability is also a growth factor.

With Gen AI, cloud platforms are helping organizations optimize storage, lower energy consumption, and extend hardware lifespans to meet green computing targets. These priorities help explain why cloud hosting is central to new digital-first business strategies.

Service Type Analysis

In 2024, Infrastructure as a Service (IaaS) dominated the enhanced cloud host market with 48.8% share. Its popularity comes from the flexibility it provides to enterprises by allowing them to scale computing resources on demand without heavy investments in hardware. Organizations adopt IaaS to quickly deploy workloads, test new applications, and manage large-scale storage requirements efficiently.

The adaptability of IaaS also supports businesses that are moving toward hybrid and multi-cloud strategies. By outsourcing infrastructure management, companies reduce operational complexity while focusing more on core functions. This makes IaaS the most sought-after service type in the enhanced cloud hosting landscape.

For Instance, in May 2025, Pulsant, a prominent UK-based managed cloud services provider, launched a new Infrastructure as a Service (IaaS) offering specifically designed for Managed Service Providers (MSPs). This IaaS solution is aimed at helping MSPs scale their operations efficiently by providing customizable cloud infrastructure, enhanced security features, and improved management tools.

Enterprise Size Analysis

In 2024, Large enterprises represented 70.5% of the demand share. These organizations often require robust, secure, and highly customizable hosting solutions to manage extensive IT assets and large-scale databases. Their adoption is driven by the need to run mission-critical applications across multiple geographies with uninterrupted availability.

For large enterprises, enhanced cloud hosting also offers better compliance, backup, and security features. These capabilities ensure that businesses can safeguard sensitive information while maintaining operational efficiency. As a result, the segment continues to lead adoption over small and mid-sized enterprises.

For instance, in May 2025, Onlive Server, a leading Indian web hosting company, launched cloud servers across 30+ global locations, significantly enhancing its cloud offerings for large enterprises. This expansion allows large corporations to leverage a distributed infrastructure for application deployment, data backup, and hybrid cloud setups.

Hosting Type Analysis

In 2024, Shared hosting accounts for 42.6% of the market. This option is popular because it offers a cost-effective gateway for businesses entering cloud hosting. For small and mid-sized businesses especially, shared hosting minimizes IT overhead and avoids the need for specialized technical teams. The availability of easy-to-use tools also makes it convenient.

At the same time, shared hosting has evolved significantly in recent years. Modern enhanced hosting platforms come equipped with stronger performance optimization, including automated resource allocation, better uptime guarantees, and heightened security protocols. This has helped shared hosting overcome its earlier perception of being less secure, making it suitable even for businesses handling moderate data needs.

For Instance, in October 2024, AWS enhanced its static website hosting with AWS Amplify, simplifying deployment through Amazon S3. This integration offers seamless site hosting with a global CDN via Amazon CloudFront, supporting custom domains and SSL certificates. It provides an efficient shared hosting solution for users, minimizing setup time and improving scalability.

Pricing Model Analysis

In 2024, The subscription-based model captures 65.4% of adoption. Organizations appreciate predictable and recurring payment cycles, which makes planning IT budgets easier. Unlike one-time capital-intensive purchases, subscription-based plans allow customers to scale resources up or down without being locked into rigid structures.

This model also aligns well with the way modern services are consumed – on demand. Businesses prefer paying for what they use and upgrading as their requirements grow. Service providers, in turn, gain stability in revenue, which allows them to invest in product improvements and customer service enhancements. Subscriptions have become the cornerstone for building long-term customer relationships in cloud hosting.

For Instance, in January 2025, SAP announced the release of the S/4HANA Cloud Public Edition 2502 update, enhancing its subscription-based ERP platform with advanced AI-driven productivity tools. This update introduces Joule, SAP’s AI copilot, which offers improved decision-making, enhanced insights, and better navigation across applications.

End-use Industry Analysis

In 2024, The IT and telecom sector leads with 39.2% share. These industries require powerful hosting platforms to manage large-scale data flows, run continuous operations, and support advanced technologies like 5G, IoT, and AI-based applications. Enhanced cloud hosting provides the stability and elasticity needed for these workloads, enabling faster deployment and reliable access across global networks.

The dependence of IT and telecom companies on strong infrastructure is increasing because their services deal with millions of users simultaneously. With more telecom providers rolling out advanced mobile services and IT firms offering cloud-native products, enhanced hosting ensures seamless scalability. This segment is expected to remain the hub of innovation as IT and telecom companies continue to use hosting platforms for next-gen digital services.

For Instance, in June 2024, Oracle and Google Cloud announced a strategic multicloud partnership aimed at enhancing the IT and telecom industries. The collaboration integrates Oracle Cloud Infrastructure (OCI) database services with Google Cloud’s advanced AI tools, such as Vertex AI. This partnership allows enterprises to deploy applications seamlessly across both cloud platforms, enabling high-performance databases, robust networking, and cutting-edge AI capabilities.

Key Market Segments

By Service Type

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Hosting Type

- Shared Hosting

- Dedicated Hosting

- Managed Hosting

- Colocation Hosting

By Pricing Model

- Subscription-Based

- Pay-As-You-Go

By End-use Industry

- IT & Telecom

- Healthcare

- Retail

- BFSI

- Government

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for High-Performance Cloud Hosting

The rising shift of critical business workloads from traditional on-premises setups to cloud environments is a major driver for enhanced cloud hosting services. Organizations need hosting solutions that deliver high performance, scalability, and security to support digital transformation and hybrid work models. This demand fuels investments in advanced cloud platforms that can meet complex workload requirements efficiently.

Enterprises increasingly value cloud hosts offering automation, integrated security, and strong service-level guarantees. This helps them accelerate application deployment and ensure seamless user experiences. The push toward resilient and agile hosting infrastructure to support growing digital operations is a key growth factor driving market adoption.

For instance, in November 2024, NVIDIA launched DOCA 2.9, a major update to its cloud computing infrastructure platform, enhancing both performance and security for AI workloads. Key features include improved congestion control, a new telemetry library, and support for massive-scale AI deployments with up to 128,000 GPUs.

Restraint

Complex Regulatory and Trade Environments

Stringent regulatory frameworks, data sovereignty rules, and tariff policies pose significant challenges for enhanced cloud host providers and users. Different regions enforce privacy and operational compliance that requires localized hosting solutions, increasing complexity and cost for service providers. Moreover, trade tariffs on imported server hardware create supply chain bottlenecks and pricing uncertainties.

Such regulatory and trade hurdles make it difficult for market players to scale services quickly and economically at a global level. Organizations must continually adapt hosting strategies to evolving laws and tariffs, which can delay deployments and limit flexibility. These factors restrain smooth market growth and require careful navigation.

For instance, in July 2025, CrowdStrike introduced enhanced runtime capabilities for cloud security with its Falcon Cloud Runtime Security solution, aimed at preventing container escape attempts. The solution is designed to safeguard containerized applications in cloud environments, a critical aspect of data security and privacy in cloud hosting.

Opportunities

Expansion in Emerging Markets and Vertical Specialization

Emerging economies in Asia-Pacific and Southeast Asia present strong growth opportunities for enhanced cloud hosting. Rapid digitalization in these regions drives demand for scalable, localized cloud infrastructure. Providers investing in regional data centers can capitalize on this rising consumption and support diverse industries adopting cloud technologies.

Furthermore, vertical-specialized hosting services tailored for healthcare, finance, retail, and other sectors offer unique growth potential. By embedding compliance, security, and analytics suited to specific industry needs, providers can differentiate offerings and capture niche markets. This customization fuels ongoing innovation and market expansion.

For instance, in September 2022, DigitalOcean completed its $350 million acquisition of Cloudways, a leading provider of managed cloud hosting and SaaS solutions for small to medium-sized businesses (SMBs). This acquisition enhances DigitalOcean’s capabilities in providing easy-to-use, scalable cloud hosting solutions, particularly targeting e-commerce and small business owners.

Challenges

Skill Shortages and Talent Acquisition

The fast-paced growth of cloud technology has outstripped the availability of skilled professionals. Companies are facing intense competition for cloud experts, creating talent shortages that hinder the development and implementation of cloud solutions. This gap in skilled labor impacts businesses’ ability to fully capitalize on cloud hosting capabilities and can slow down cloud adoption or lead to higher costs for recruiting and retaining top talent in the field.

For instance, in April 2025, industry leaders expressed concern over the widening shortage of cloud security engineers, despite the increasing shift toward cloud computing. With the rise of cyber threats like ransomware, there is a critical demand for experts who can secure cloud infrastructure. However, the talent pool remains insufficient, particularly in the relatively new field of cloud security.

Key Players Analysis

The Enhanced Cloud Host Market is led by large-scale providers such as Amazon Web Services, Inc., Google LLC, and Ionos SE. These companies offer high-availability cloud infrastructure with advanced performance, scalability, and security features. Their platforms support enterprise-grade hosting, hybrid deployments, managed Kubernetes services, and global data distribution.

Mid-tier hosting providers including Bluehost Inc., DigitalOcean Holdings, Inc., DreamHost, LLC, and Hostinger serve startups, SMEs, and SaaS platforms with cost-effective hosting, managed databases, virtual machines, and developer-friendly environments. Their offerings emphasize simplified deployment, predictable pricing, and faster provisioning for e-commerce, web applications, and content-based platforms.

Specialized and emerging platforms such as Cloudways, Cloudways, LLC, xCloud Hosting LLC, and Piwik PRO contribute with tailored solutions for managed cloud hosting, data privacy compliance, and performance optimization. These providers focus on enhanced control panels, application hosting, analytics hosting, and security-enhanced environments.

Top Key Players in the Market

- Google LLC

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Hostinger

- Amazon Web Services, Inc

- Bluehost Inc.

- DigitalOcean Holdings, Inc.

- DreamHost, LLC

- Cloudways

- Ionos SE

- xCloud Hosting LLC

- Cloudways, LLC

- Piwik PRO

- Other Major Players

Note (*): Similar analysis will be provided for other companies as well.

Recent Developments

- In September 2025, Google Cloud significantly expanded its sovereign cloud capabilities in India with the launch of Google Distributed Cloud Hosted (GDCH). This solution is tailored for sectors like government, banking, and public enterprises, where stringent data security and isolation are critical.

- In September 2025, Amazon Web Services (AWS) laid the foundation for its first data center in Maharashtra, as part of an $8.4 billion investment commitment. This marks a significant milestone in AWS’s expansion across India, reinforcing its commitment to support digital transformation, STEM education, and cloud solutions for startups and MSMEs.

Report Scope

Report Features Description Market Value (2024) USD 1.76 Bn Forecast Revenue (2034) USD 52.76 Bn CAGR(2025-2034) 40.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Hosting Type (Shared Hosting, Dedicated Hosting, Managed Hosting, Colocation Hosting), By Pricing Model (Subscription-Based, Pay-As-You-Go), By End-use Industry (IT & Telecom, Healthcare, Retail, BFSI, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Hostinger, Amazon Web Services, Inc., Bluehost Inc., DigitalOcean Holdings, Inc., DreamHost, LLC, Cloudways, Ionos SE, xCloud Hosting LLC, Cloudways, LLC, Piwik PRO, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enhanced Cloud Host MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Enhanced Cloud Host MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Hostinger

- Amazon Web Services, Inc

- Bluehost Inc.

- DigitalOcean Holdings, Inc.

- DreamHost, LLC

- Cloudways

- Ionos SE

- xCloud Hosting LLC

- Cloudways, LLC

- Piwik PRO

- Other Major Players