Global Energy Management in Railway Market Size, Share, Growth Analysis By Type (Rolling Stock And System, Service, Software), By End-user (Freight Rail, Passenger Rail) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168096

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

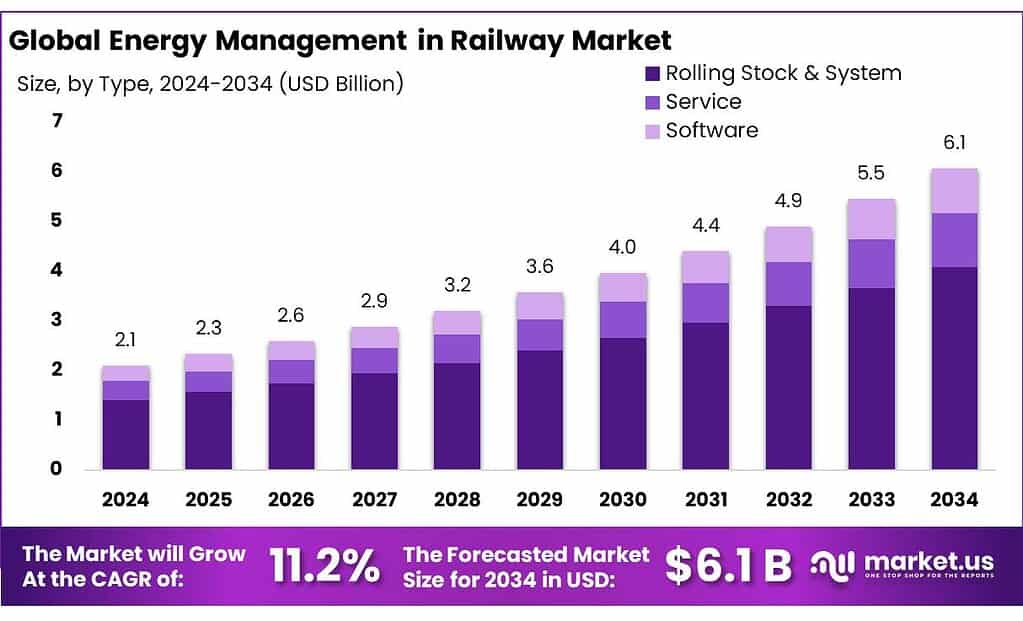

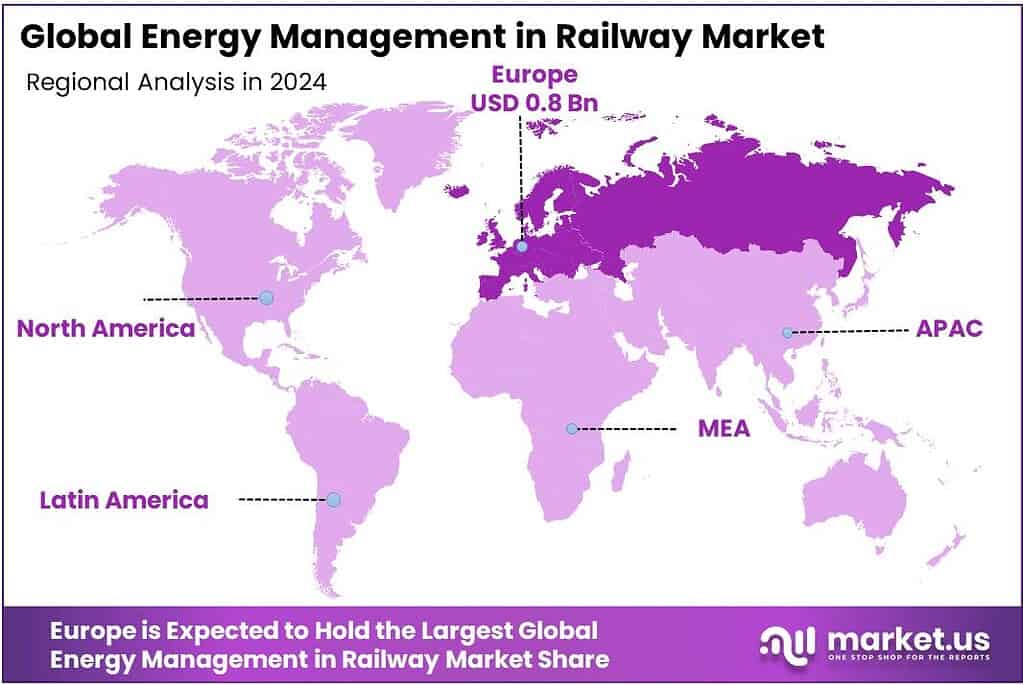

The Global Energy Management in Railway Market size is expected to be worth around USD 6.1 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024, Europe held a dominan market position, capturing more than a 42.10% share, holding USD 0.8 Billion revenue.

Energy management in railway systems is becoming central to global decarbonization strategies as governments look for low-carbon transport options. Rail already transports around 7% of global passenger-kilometres and 6% of tonne-kilometres while generating only about 1% of transport emissions, underlining its inherently efficient profile compared with other modes.

At the same time, the wider transport sector is a major energy and emissions challenge, accounting for roughly 30% of global final energy demand in 2024 and around 23% of global energy-related CO₂ emissions. This context is pushing policymakers and operators to invest in rail energy-management technologies, from efficient traction and regenerative braking to wayside storage and digital control platforms.

The industrial landscape is shaped by the high degree of rail electrification. Globally, about 35% of railway lines were electrified in 2022, with Europe at 55% and Asia-Pacific at 53%, providing a strong base for advanced energy-management solutions on power-supply and rolling-stock systems. In parallel, around three-quarters of global rail passenger movements already rely on electricity, reinforcing the relevance of grid-connected efficiency measures and renewable integration.

Government initiatives are accelerating the market. India’s “Green Railway” policy aims for net-zero emissions from Indian Railways by 2030, combining full network electrification with energy efficiency in locomotives, trains and fixed installations. The Ministry of Railways projects power demand of about 8,200 MW by 2029-30 and estimates a need for around 30,000 MW of renewable capacity to meet this in a net-zero pathway.

Concrete investments are already visible. As of early 2023, Indian Railways had commissioned roughly 147 MW of solar and 103 MW of wind, with a further 2,150 MW of renewable capacity tied up through agreements. Regional initiatives, such as full route electrification and station-level solar, are creating direct demand for energy-management systems that coordinate onboard loads, traction supply and local generation.

At corridor level, electrification and smart energy use deliver measurable savings. North Central Railway in India reports that full electrification of its 3,294 km network saved about 70 million litres of diesel and avoided roughly 500,000 tonnes of CO₂ emissions, while deployment of Head-On Generation and 12.7 MW of solar capacity generated 11.87 million units of electricity in 2024-25. These results showcase the business case for advanced monitoring and optimisation platforms.

Key Takeaways

- Energy Management in Railway Market size is expected to be worth around USD 6.1 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 11.2%.

- Rolling Stock & System held a dominant market position, capturing more than a 67.2% share in the Energy Management in Railway Market.

- Passenger Rail held a dominant market position, capturing more than a 62.3% share in the Energy Management in Railway Market.

- Europe holds a leading position in the Energy Management in Railway Market, accounting for around 42.10% of global revenue, valued at nearly USD 0.8 billion.

By Type Analysis

Rolling Stock & System dominates with 67.2% due to direct onboard energy control and efficiency gains.

In 2024, Rolling Stock & System held a dominant market position, capturing more than a 67.2% share in the Energy Management in Railway Market. This leadership comes from its direct role in managing how energy is used inside trains. Energy-efficient traction systems, onboard monitoring, regenerative braking, and smart control units help operators reduce power waste during daily operations. Most railway authorities focus first on upgrading rolling stock because it delivers fast and visible energy savings.

The System segment plays a supporting but important role by focusing on network-level energy optimization. This includes wayside energy storage, substations, power supply control, and centralized energy monitoring platforms. In 2024, system-level solutions were mainly used to balance energy demand across routes and stations rather than inside trains themselves. By 2025, interest increased as rail networks looked to integrate renewable power and manage peak electricity loads more efficiently.

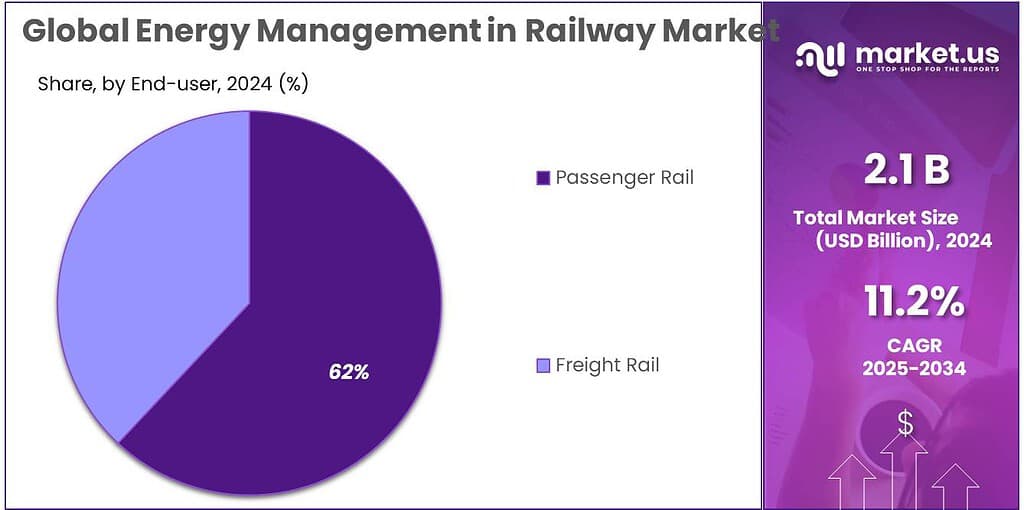

By End-user Analysis

Passenger Rail dominates with 62.3% due to high energy use in daily urban and intercity operations.

In 2024, Passenger Rail held a dominant market position, capturing more than a 62.3% share in the Energy Management in Railway Market. This dominance is mainly due to the large number of passenger trains running on fixed schedules every day. Metro systems, suburban rail, and intercity trains consume significant electricity for traction, lighting, air conditioning, and station operations.

In 2025, the focus on passenger rail energy management continued to strengthen as cities expanded public transport networks to reduce road traffic and emissions. Rail authorities increasingly adopted smart energy monitoring, regenerative braking use, and demand-based power control to manage rising passenger volumes. Passenger comfort also influenced energy decisions, as better climate control and smoother operations had to be balanced with lower power consumption.

Key Market Segments

By Type

- Rolling Stock & System

- Service

- Software

By End-user

- Freight Rail

- Passenger Rail

Emerging Trends

Data-Driven Food Logistics Are Pushing Smarter Railway Energy Management

A clear new trend in railway energy management is the way food and agrifood companies are asking rail operators for hard, verifiable energy and emissions data along their routes. Global agrifood systems emitted about 16.2 billion tonnes CO₂-equivalent in 2022, close to 30% of all human-made emissions. With that kind of number on the table, big buyers in grains, dairy, fruits and chilled foods now want transport partners who can show exactly how much energy they use, when they use it, and how much of it comes from clean power.

Inside that footprint, the food cold chain has become a priority. UNEP and FAO estimate that the food cold chain accounts for about 4% of total global greenhouse-gas emissions when you combine energy for cooling with food lost due to lack of refrigeration.

Food loss and waste add more urgency to this trend. UNFCCC highlights that food loss and waste are responsible for around 8–10% of global greenhouse-gas emissions and waste roughly USD 1 trillion of food each year. The UN also notes that about 13.2% of food is lost between harvest and retail, and a further 19% is wasted at household, food-service and retail level.

Drivers

Decarbonising Food Supply Chains as a Key Driver for Railway Energy Management

A major driving force behind energy management in railways is the pressure to cut emissions from global food and agrifood supply chains. New FAO data show that agrifood systems emitted about 16.2 billion tonnes CO₂-equivalent in 2022, accounting for roughly 30% of total human-made greenhouse gases. . A large part of this footprint lies beyond the farm, in transport, processing and cold chains. That is exactly where efficient, well-managed rail energy systems can make a difference.

The European Commission reports that “food miles” – the transport of food from field to fork – generate about 3.0 Gt CO₂-equivalent, equal to 19% of total food-system emissions. As governments and retailers face this number, they are under pressure to shift food logistics from high-emission trucks and planes to lower-carbon modes such as rail. But this shift only works at scale if railways manage their own energy use smartly – from traction power to station systems to refrigerated freight.

Food loss and waste add another powerful push. According to UNFCCC, food loss and waste are responsible for 8–10% of annual global greenhouse gas emissions and cost the world economy about USD 1 trillion every year. Part of this waste is linked to weak logistics and unreliable cold chains. When rail operators invest in advanced energy-management systems – for example, efficient traction, regenerative braking, wayside storage and digital control of onboard HVAC and reefer loads – they help food companies run stable, low-carbon cold chains with fewer temperature breaks and less spoilage.

Energy-efficient rail is already a strong climate performer. IEA estimates that rail moves around 7% of global passenger-kilometres and 6% of tonne-kilometres but produces only about 1% of transport CO₂ emissions, with electric rail already carrying over 85% of passenger activity and 55% of freight movements. Energy-management projects – such as eco-driving support, traction substation optimisation, onboard metering and integration of renewable power – are how operators keep this advantage while absorbing more food and agribulk traffic.

Restraints

Cold-Chain & Road-Dominated Food Logistics Limits Rail Energy Gains

Globally, nearly 90% of non-bulk freight moves by road, including most food and perishable shipments — leaving only a small share for rail-based transport. This heavy road-dependence means that even if a railway operator improves onboard energy efficiency or deploys regenerative braking and smart power management, the potential reduction in overall emissions stays limited because road transport remains dominant.

Studies from food-system analytics show that within “food miles,” road transport contributes the bulk of emissions, with road-based freight accounting for about 3.9 % of total food-system emissions, versus just 0.02 % from air freight and negligible share from rail or sea in many regions. That stark imbalance reveals a structural barrier: until the logistics industry — including cold-chain operators, retailers, wholesalers — shifts substantial volumes to rail, rail-energy management improvements won’t translate into large-scale environmental or cost benefits.

Another restraint is the nature of perishable-goods transportation. The global market for perishable-goods transportation was valued at USD 14.6 billion in 2024. However, much of this business is structured around short-haul, flexible, last-mile delivery — where trucks remain unmatched in speed and door-to-door reach, especially in fragmented geographies and rural regions. Rail, by contrast, works best for bulk, long-haul loads and lacks the flexibility to deliver quickly to many small end-points. That mismatch reduces incentives for food-logistics players to invest in rail-based cold-chain infrastructure or partner with rail operators.

Cold-chain requirements for perishable goods often demand investments in specialized refrigerated wagons, platform cooling at stations, and dedicated handling facilities. These raise capital and operational costs. For supply-chain managers oriented toward minimizing spoilage and ensuring freshness, time and flexibility often matter more than energy efficiency or lower emissions. As a result, even when energy-efficient rail technologies exist, they remain under-utilized because business-value calculation rarely favors them under current logistics practices.

Opportunity

Green Food Corridors as a Big Opportunity for Railway Energy Management

One of the biggest growth opportunities for energy management in railways sits inside the food system itself: building low-carbon “green food corridors” for grains, fruits, vegetables and chilled products. FAO estimates that global agrifood systems emitted about 16.2 billion tonnes CO₂-equivalent in 2022, roughly one-third of total human-made emissions.

The money on the table is huge. FAO reports that the value of global food and agricultural trade reached about USD 1.9 trillion in 2022, roughly five times its level in the mid-1990s. At the same time, agricultural products now make up about 8% of global merchandise trade value. As cross-border food flows rise, long-haul corridors become more important, and this is where electrified rail with strong energy-management systems can compete strongly with long-distance trucking.

Food waste adds another angle to this opportunity. UNFCCC notes that food loss and waste contribute 8–10% of global greenhouse-gas emissions and waste about USD 1 trillion worth of food each year. FAO’s earlier work estimated that uneaten food alone carried a carbon footprint of 3.3 Gt CO₂-equivalent. If rail operators can offer reliable, energy-efficient temperature control along entire routes, they help cut spoilage and emissions together — a very powerful story for retailers and food brands under ESG pressure.

For energy-management vendors and railway companies, the opportunity is to build platforms that track every kilowatt-hour used to move a pallet of fruit or frozen food. If a railway can show that its optimised driving, regenerative braking and substation control cut kWh per tonne-kilometre, and that much of that power comes from renewables, it suddenly becomes a preferred partner for big food exporters whose trade is now worth nearly USD 2 trillion a year.

Regional Insights

Europe Leads Energy Management in Railway Market with 42.10% Share, Valued at USD 0.8 Billion

Europe holds a leading position in the Energy Management in Railway Market, accounting for around 42.10% of global revenue, valued at nearly USD 0.8 billion. This dominance is built on a long-standing focus on electrified rail and decarbonisation. By 2022, the EU rail network reached about 202,000 km, of which nearly 57% was electrified, reflecting sustained infrastructure investment over several decades. This high level of electrification naturally supports advanced energy-management systems across traction power, substations and rolling stock.

European policy is a major driver. Under the EU Green Deal and related transport and climate packages, rail is identified as a key low-carbon mode. Rail’s share of transport energy consumption is under 2%, while its transport market share exceeds 8.5%, highlighting its superior efficiency versus other modes. At the same time, the sector’s high dependence on electricity has made energy prices a strategic issue; with around 56.9% of EU railway lines electrified, carrying roughly 80% of traffic, operators are under pressure to cut kilowatt-hours per train-km and manage peak demand more intelligently.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB’s rail energy solutions are positioned around traction electrification, onboard battery retrofits and depot/grid-interactive systems. Demonstrations have converted 44 Adelaide Metro sets to battery-hybrid operation, yielding lower emissions and quieter service for ~16 million annual passengers served on the network. Product lines include traction drives, ESS and reversible power electronics that enable regenerative energy capture and grid services; these offerings are being marketed for both new-build and retrofit programmes.

Alstom’s portfolio is focused on system-level energy management: reversible substations, regenerative braking integration and energy-efficient rolling stock. Reversible substation deployments exceed 136 units, enabling trains to act as temporary power sources and substantially reduce dissipation of braking energy. Large orders continue for electric traction supply (500 electric locomotives for Indian Railways noted in 2025), reflecting Alstom’s role in network decarbonisation and energy optimisation across metro, tram and mainline segments.

CRRC’s technology set includes regenerative braking systems, onboard energy storage (ultra-capacitors/modules) and energy recovery platforms claiming up to ≥30% recovery ratios and peak module recovery up to 800 kW for certain rapid transit products. Integrated control algorithms and depot/vehicle platforms are promoted to optimise distribution between onboard storage and the grid, supporting reduced traction consumption and lower operating costs for high-frequency urban and intercity services.

Top Key Players Outlook

- ABB Ltd.

- ALSTOM SA

- Caterpillar Inc.

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- CRRC Corp. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Ingeteam Corp. S.A.

- Knorr Bremse AG

- Mitsubishi Heavy Industries Ltd.

Recent Industry Developments

31, 2024, General Electric Company’s reported total revenue of $38,702 million (equipment revenue $10,274 million, services revenue $24,847 million), demonstrating corporate scale and service capability relevant to large infrastructure customers.

In 2024 CRRC Corporation Limited, reported operating revenue of RMB 246.457 billion and net profit attributable to shareholders of RMB 12.388 billion, indicating strong fiscal scale to fund energy-technology development.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 6.1 Bn CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rolling Stock And System, Service, Software), By End-user (Freight Rail, Passenger Rail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., ALSTOM SA, Caterpillar Inc., CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A., CRRC Corp. Ltd., General Electric Co., Hitachi Ltd., Honeywell International Inc., Ingeteam Corp. S.A., Knorr Bremse AG, Mitsubishi Heavy Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Management in Railway MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Management in Railway MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- ALSTOM SA

- Caterpillar Inc.

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- CRRC Corp. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Ingeteam Corp. S.A.

- Knorr Bremse AG

- Mitsubishi Heavy Industries Ltd.