Global Energy Gel Product Market Size, Share, And Industry Analysis Report By Nature (Conventional, Organic), By Pack Size (Single Serve, Multi Serve), By Ingredient Type (With Caffeine, Caffeine-Free), By Flavor (Fruit Flavours, Chocolate Flavour, Coffee and Espresso Flavour, Vanilla Flavour, Blended Flavours), By Sales Channel (Hypermarkets and Supermarkets, Groceries and Mass Retailers, Wholesale Club Stores, Convenience Stores, Specialty Stores, Online Retailers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171957

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

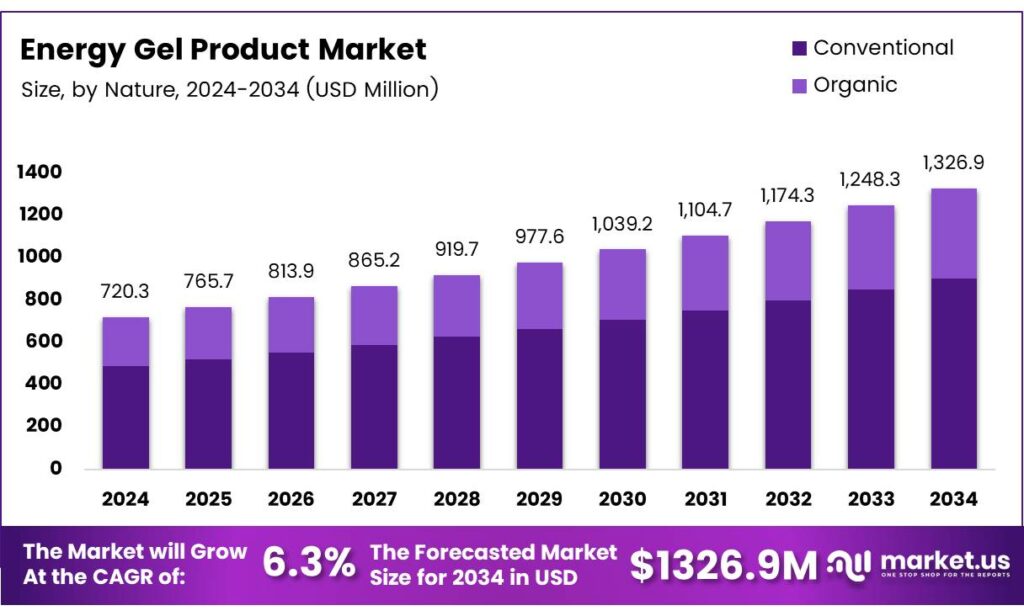

The Global Energy Gel Product Market size is expected to be worth around USD 1326.9 million by 2034, from USD 720.3 million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The energy gel product market represents the commercial ecosystem focused on concentrated carbohydrate-based nutrition designed for endurance performance support. These products deliver rapid energy absorption, digestive convenience, and portability for athletes and active consumers. As endurance sports participation expands, energy supplement demand aligns closely with performance nutrition, sports science validation, and convenience-driven consumption patterns.

The energy gel product market benefits from rising participation in cycling, running, triathlons, and recreational endurance fitness. Growing awareness of intra-workout fueling improves repeat purchases and brand loyalty. Additionally, e-commerce penetration and direct-to-consumer sports nutrition channels improve accessibility, supporting consistent category growth across developed and emerging fitness economies.

- Carbohydrate energy gel ingestion schedules strongly influence endurance performance during prolonged cycling. In trained cyclists with a mean age of 28.4 ± 3.66 years, body mass of 68.9 ± 10.63 kg, and V̇O₂max of 54.57 ± 9.45 ml·kg⁻¹·min⁻¹, consuming gels every 30 or 45 minutes during two hours of cycling at 70% V̇O₂max helped sustain higher blood glucose levels, reaching 125.5 ± 30.96 mg·dl⁻¹ and 127.6 ± 14.82 mg·dl⁻¹, compared with 102.8 ± 15.85 mg·dl⁻¹ without intake, while blood lactate remained stable.

Performance outcomes further confirmed the functional value of energy gels, as cyclists recorded longer time-trial distances with supplementation. Distances increased to 7.56 ± 0.77 km and 7.16 ± 0.92 km with gel use, versus 6.69 ± 0.74 km without gels, achieving statistical significance at p = 0.003. These results clearly link energy gel consumption to improved endurance efficiency and competitive performance benefits.

Key Takeaways

- The Global Energy Gel Product Market is projected to grow from USD 720.3 million in 2024 to USD 1326.9 million by 2034, registering a 6.3% CAGR.

- Conventional energy gels dominate the market with a leading share of 74.5% in 2024.

- Multi-serve formats hold a strong position with a market share of 63.8% due to portability and ease of use.

- Caffeinated energy gels account for a significant 68.9% share, driven by performance and alertness benefits.

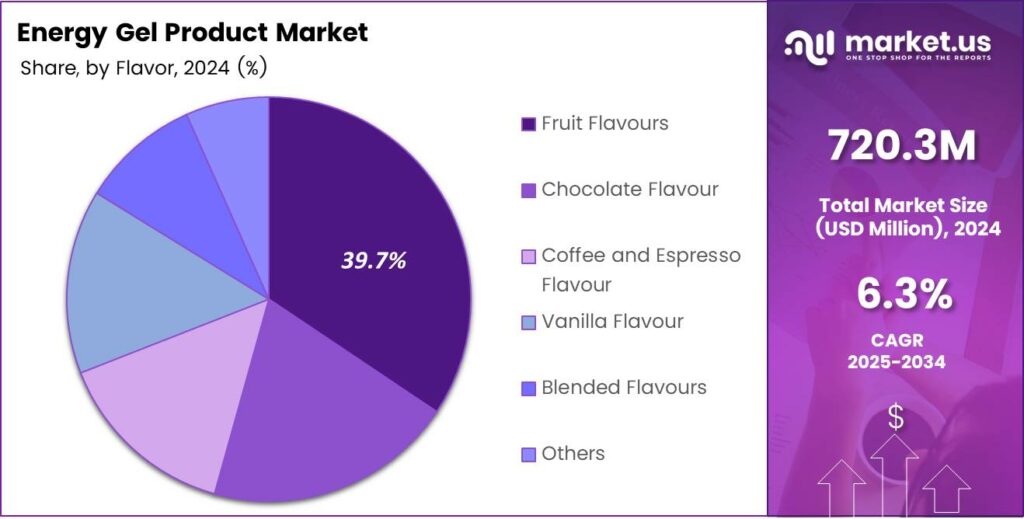

- Fruit-based energy gels lead the segment with a share of 39.7%, supported by broad consumer preference.

- Hypermarkets and Supermarkets remain the top distribution route, capturing 31.6% of total sales.

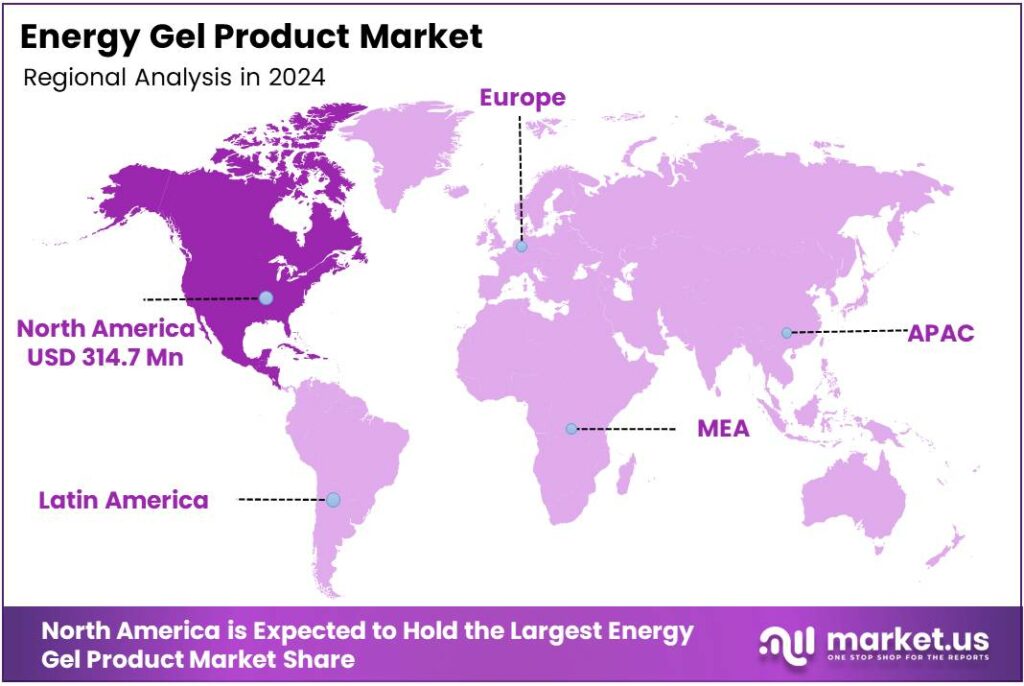

- North America dominates the global market with a share of 43.7%, valued at USD 314.7 million in 2024.

By Nature Analysis

Conventional dominates with 74.5% due to its wide acceptance, affordability, and established manufacturing base.

In 2024, Conventional held a dominant market position in the By Nature Analysis segment of the Energy Gel Product Market, with a 74.5% share. This leadership was driven by cost efficiency, stable shelf life, and strong adoption among endurance athletes. Moreover, brands relied on proven formulations to ensure consistent energy delivery during intense activities.

Organic energy gels continued to gain attention as consumers gradually shifted toward clean-label nutrition. However, higher prices and limited large-scale availability constrained faster adoption. Still, demand rose steadily among health-conscious users seeking natural sweeteners and plant-based ingredients, especially in premium sports nutrition and recreational fitness communities.

By Pack Size Analysis

Multi-serve dominates with 63.8% owing to convenience, portability, and precise portion control.

In 2024, Multi-serve held a dominant market position in the By Pack Size Analysis segment of the Energy Gel Product Market, with a 63.8% share. Athletes preferred compact sachets for easy consumption during cycling, running, and training sessions. Consequently, multi-use packs aligned well with on-the-go energy needs.

Single-serve packs supported regular users and team-based consumption patterns. These packs appealed to cost-sensitive buyers seeking value over time. Although less portable, single-serve formats gained traction among fitness enthusiasts using energy gels during planned training routines rather than competitive events.

By Ingredient Type Analysis

Caffeine dominates with 68.9% supported by performance-enhancing benefits and mental alertness.

In 2024, Caffeine held a dominant market position in the By Ingredient Type Analysis segment of the Energy Gel Product Market, with a 68.9% share. Caffeinated gels helped improve focus and delay fatigue, making them popular among endurance athletes during prolonged physical exertion.

Caffeine-free energy gels addressed the needs of sensitive consumers and beginners. These formulations emphasised carbohydrate replenishment without stimulants. As awareness grew, caffeine-free options found steady demand among recreational users, evening exercisers, and athletes managing caffeine intake carefully.

By Flavour Analysis

Fruit Flavours dominate with 39.7% due to refreshing taste and broad consumer appeal.

In 2024, Fruit Flavours held a dominant market position in the By Flavour Analysis segment of the Energy Gel Product Market, with a 39.7% share. Their light taste reduced flavour fatigue during long activities. As a result, citrus and berry variants remained widely preferred.

Chocolate flavour gels offered a richer taste profile and appealed to consumers seeking indulgence. These variants performed well in cooler conditions, where texture stability improved user experience during endurance sports. Coffee and Espresso flavour gels attracted caffeine-seeking athletes who preferred familiar beverage-inspired tastes.

Vanilla flavour maintained niche demand due to its mild and neutral profile. It often served as a base for smooth-textured gels, appealing to users sensitive to strong or acidic flavours. Blended flavours combined fruit, vanilla, or chocolate notes to enhance taste variety. This innovation helped brands differentiate offerings while reducing monotony for frequent users.

By Sales Channel Analysis

Hypermarkets and Supermarkets dominate with 31.6% supported by visibility and wide product assortment.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Sales Channel Analysis segment of the Energy Gel Product Market, with a 31.6% share. These outlets offered easy access, in-store promotions, and trusted retail environments for first-time buyers.

Groceries and Mass Retailers expanded their reach in urban and semi-urban areas. Their frequent foot traffic supported impulse purchases, especially among fitness-aware consumers integrating energy gels into daily routines. Wholesale Club Stores catered to bulk buyers and sports institutions. Although volume-driven, this channel supported cost savings for organised users and training groups.

Convenience Stores served immediate, on-the-go needs. Their proximity to gyms and transport hubs supported last-minute purchases despite limited product variety. Speciality Stores focused on performance athletes by offering expert guidance and curated selections. This channel strengthened brand credibility within serious sports communities.

Key Market Segments

By Nature

- Conventional

- Organic

By Pack Size

- Single Serve

- Multi Serve

By Ingredient Type

- With Caffeine

- Caffeine-Free

By Flavor

- Fruit Flavours

- Chocolate Flavour

- Coffee and Espresso Flavour

- Vanilla Flavour

- Blended Flavours

- Others

By Sales Channel

- Hypermarkets and Supermarkets

- Groceries and Mass Retailers

- Wholesale Club Stores

- Convenience Stores

- Specialty Stores

- Online Retailers

- Others

Emerging Trends

Flavor Innovation and Functional Ingredients Shape Market Trends

Flavor innovation is a key trending factor in the energy gel product market. Brands are introducing diverse and refreshing flavors to reduce taste fatigue. This keeps consumers engaged during long training sessions. Functional ingredients are gaining attention. Energy gels now include electrolytes, amino acids, and vitamins to support hydration and recovery.

- The World Health Organization, adults limit free sugar intake to less than 10% of daily energy, with added health benefits below 5%. This guidance has pushed energy-gel manufacturers to reformulate with precise carbohydrate blends rather than excessive sugar loads.

Environmentally conscious consumers prefer brands using recyclable or reduced-plastic packaging. This trend influences purchasing decisions, especially among younger athletes. Digital marketing also shapes the market. Online fitness communities and athlete endorsements increase product visibility. Social media plays a strong role in educating consumers and driving the trial of new energy gel products.

Drivers

Rising Participation in Endurance Sports Drives Energy Gel Demand

Growing interest in endurance sports is a key driver for the energy gel product market. More people are participating in running, cycling, triathlons, and long-distance fitness events. These activities require quick and convenient energy sources, which makes energy gels a preferred option.

- USA Track & Field, more than 17 million people participated in organized running events across the U.S. in recent years, including marathons and half-marathons. These events typically last well over 2 hours for recreational athletes, making on-the-go carbohydrate fueling essential rather than optional.

Energy gels are easy to carry, simple to consume, and provide fast carbohydrate absorption. This suits athletes who need instant energy without slowing down performance. Busy lifestyles also support demand, as many consumers prefer compact nutrition solutions during workouts.

Restraints

Digestive Concerns and Sugar Content Limit Market Expansion

Digestive discomfort remains a major restraint for the energy gel product market. Some users experience bloating, cramps, or nausea after consuming gels during physical activity. These issues discourage regular use, especially among beginners. High sugar content is another concern.

- Many consumers are becoming more health-conscious and cautious about frequent sugar intake. This perception limits adoption among casual fitness users who prefer natural or low-sugar alternatives. Gastrointestinal symptoms affect up to 30–50% of endurance athletes during long events, reducing confidence in gel usage.

Taste fatigue also affects demand. Repeated consumption of similar flavors during training can reduce product appeal. Without enough variety, users may switch to other energy sources, such as bars or drinks. Price sensitivity acts as an additional barrier. Premium energy gels often cost more than traditional snacks, which can limit use among cost-conscious consumers, especially in developing markets.

Growth Factors

Product Innovation and Clean-Label Formulas Create New Opportunities

Innovation presents strong growth opportunities in the energy gel product market. Clean-label formulations using natural ingredients attract health-focused consumers. Products with fewer additives and recognizable ingredients gain trust and acceptance. There is a rising demand for plant-based and allergen-free energy gels. These options appeal to vegan athletes and those with dietary restrictions.

- Sports-nutrition research from the American College of Sports Medicine recommends carbohydrate intake ranges of 30–60 grams per hour for endurance exercise, increasing to 90 grams for ultra-events. This wide range highlights the need for gels with different carbohydrate densities rather than one-size-fits-all products.

Energy gels designed for specific activities, durations, or intensity levels add value for serious athletes. Tailored solutions improve performance and build brand loyalty. Emerging markets also offer growth potential. Increasing fitness awareness and sports participation in developing regions support future demand. Localized flavors and affordable packaging can help companies expand their reach.

Regional Analysis

North America Dominates the Energy Gel Product Market with a Market Share of 43.7%, Valued at USD 314.7 Million

North America leads the global energy gel product market, holding a dominant share of 43.7%, with a market value of USD 314.7 million. This leadership is supported by strong participation in endurance sports, fitness activities, and organized athletic events across the region. High consumer awareness of sports nutrition and easy access to performance-focused food products continue to reinforce steady demand.

Europe represents a mature and well-structured market for energy gel products, driven by rising interest in cycling, marathon running, and outdoor endurance sports. Consumers in the region show a strong preference for scientifically formulated and clean-label nutrition products, encouraging innovation in ingredient profiles. Regulatory focus on food safety and labeling standards also supports product credibility and long-term market stability.

Asia Pacific is emerging as a high-growth region for energy gel products, supported by increasing fitness awareness and expanding participation in recreational and professional sports. Urbanization and changing lifestyles are encouraging consumers to adopt convenient energy-boosting nutrition formats. Growing e-commerce penetration and the influence of international sporting events are further accelerating market acceptance across key countries in the region.

The Middle East and Africa market is gradually developing, with demand primarily driven by the expansion of sports infrastructure and a rising interest in active lifestyles. Fitness centers, marathon events, and outdoor sports initiatives are creating new consumption opportunities. While market penetration remains moderate, improving distribution networks and increasing health awareness are expected to support steady growth over time.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Advanced Food Concepts, Inc. is typically assessed as a performance-led player that leans into endurance nutrition needs where portability and fast digestion matter. In 2024, its strength comes from staying close to athlete routines and practical use-cases, with a focus on consistent energy delivery and easy-to-use formats that fit training and race-day conditions.

Nutrition Works Ltd is often viewed as a formulation-driven brand, aiming to balance quick energy with gut comfort and repeat use. Analysts usually note its role in serving everyday endurance users who want reliable fueling without complexity, which supports steady demand in retail and team-sport ecosystems where convenience drives repeat purchases.

Boom Nutrition Inc. is positioned as an agile, marketing-forward competitor that can move quickly on flavor, texture, and pack design—small changes that influence switching behavior. In 2024, its edge is the ability to stay trend-aligned and build loyalty through community-led visibility, especially among newer athletes entering endurance and fitness events.

Clif Bar & Company is widely considered a scale-and-trust leader, benefiting from brand recognition, broad distribution, and cross-category credibility in sports nutrition. Its energy gel strategy is typically seen as portfolio-supported, using strong shelf presence and consumer familiarity to defend share while refining messaging around performance, taste, and on-the-go fueling.

Top Key Players in the Market

- Advanced Food Concepts, Inc.

- Nutrition Works Ltd.

- Boom Nutrition Inc.

- Clif Bar & Company

- Gatorade Company, Inc.

- Hammer Nutrition Ltd.

- Powerbar Inc.

- Zipvit Ltd.

- Scientific Sports Nutrition (Pty) Ltd.

Recent Developments

- In 2024, Advanced Food Concepts, GU Energy Labs launched a new line called “GU Hydration Drink Mix”, expanding from gels and chews into the powdered drink mix segment. This marks a strategic extension of their energy delivery platform. The formulation includes carbohydrates and electrolytes, emphasizing hydration + energy.

- In 2024, Clif Bar continued to emphasize its CLIF BLOKS Energy Chews and CLIF Gel products with marketing campaigns focused on Sustained Energy. They highlighted the use of organic ingredients and a caffeine-free option in their gel line, aligning with clean-label trends.

Report Scope

Report Features Description Market Value (2024) USD 720.3 Million Forecast Revenue (2034) USD 1326.9 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Pack Size (Single Serve, Multi Serve), By Ingredient Type (With Caffeine, Caffeine-Free), By Flavor (Fruit Flavours, Chocolate Flavour, Coffee and Espresso Flavour, Vanilla Flavour, Blended Flavours, Others), By Sales Channel (Hypermarkets and Supermarkets, Groceries and Mass Retailers, Wholesale Club Stores, Convenience Stores, Specialty Stores, Online Retailers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Advanced Food Concepts, Inc., Nutrition Works Ltd., Boom Nutrition Inc., Clif Bar & Company, Gatorade Company, Inc., Hammer Nutrition Ltd., Powerbar Inc., Zipvit Ltd., Scientific Sports Nutrition (Pty) Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Energy Gel Product MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Gel Product MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Food Concepts, Inc.

- Nutrition Works Ltd.

- Boom Nutrition Inc.

- Clif Bar & Company

- Gatorade Company, Inc.

- Hammer Nutrition Ltd.

- Powerbar Inc.

- Zipvit Ltd.

- Scientific Sports Nutrition (Pty) Ltd.