Global Emollients Market By Source(Botanical, Animal, Mineral, Synthetic, Others), By Type(Esters, Fatty Alcohols, Fatty Acids, Ethers, Silicones, Others), By Form(Solid, Liquid), By Application(Skin Care, Hair Care, Deodorants, Oral Care, Others), By End-use(Cosmetic and Personal Care, Pharmaceuticals, Food and Beverage, Others), By Distribution Channel(Direct Sales, Distributors), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 117845

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

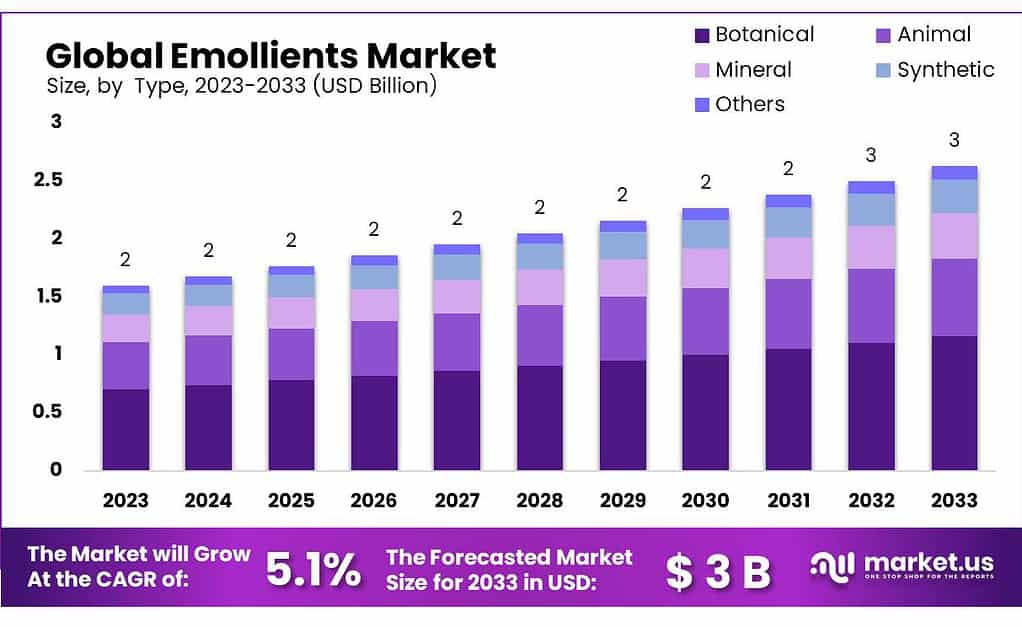

The global Emollients Market size is expected to be worth around USD 6 billion by 2033, from USD 2 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The Emollients Market refers to the industry segment that focuses on the production, distribution, and sales of emollients. Emollients are moisturizing agents used in cosmetics, skincare, and pharmaceutical products to hydrate and soften the skin. These substances work by forming a protective barrier on the skin’s surface, which helps to retain moisture, making the skin feel smooth and soft.

They are commonly found in products like lotions, creams, ointments, and balms, and are essential components in formulations designed for dry skin treatment, eczema, psoriasis, and other skin conditions.

The market for emollients encompasses a wide range of products, including natural oils (such as coconut oil, shea butter, and jojoba oil), synthetic compounds (like silicone derivatives), and complex formulations that combine multiple ingredients to achieve specific sensory and moisturizing properties. The demand in the emollients market is driven by factors such as the growing awareness of skincare health, the aging population seeking anti-aging products, and the increasing preference for natural and organic ingredients in cosmetics and personal care products.

As consumers become more knowledgeable and concerned about the ingredients in their skincare products, the emollients market has adapted by offering a broad spectrum of products tailored to diverse needs and preferences. This includes the development of non-greasy, fast-absorbing emollients and the formulation of products suitable for sensitive skin types.

The emollients market is a vital component of the broader personal care and cosmetic industries, playing a crucial role in product formulation and consumer satisfaction.

Key Takeaways

- Market Growth: The Emollients Market is projected at USD 6 billion by 2033, with 5.1% CAGR from 2023, indicating substantial growth.

- Source Diversity: Botanical sources lead with over 37.4% share, driven by demand for natural skincare.

- Type Preference: Esters dominate with over 44.2% share due to versatility and compatibility.

- Form Favoritism: Liquid emollients capture a 71.2% share, valued for quick absorption and spreadability.

- Application Focus: Skincare holds over 35.2% market share, crucial for skin hydration and health.

- Industry Dominance: Cosmetic & Personal Care sector leads with over 65.5% share, driving emollient demand.

- Distribution Channels: Distributors command a 56.8% share, crucial for efficient market access.

- Regional Leadership: Asia Pacific leads with a 34.3% market share, driven by growing demand and awareness.

- Mineral oil and petrolatum are the most commonly used emollients, accounting for over 40% of the global emollients market.

- The average water absorption capacity of emollients can range from 1 to 10% by weight.

By Source

In 2024, Botanical sources held a dominant position in the Emollients Market, capturing more than a 37.4% share. This segment’s popularity is driven by the growing consumer preference for natural and organic skincare products. Botanical emollients, derived from plants, are favored for their gentle and effective moisturizing properties, appealing to consumers seeking clean and sustainable beauty options.

Products like shea butter, jojoba oil, and coconut oil are examples of botanical emollients that have gained widespread acceptance for their nourishing benefits and compatibility with various skin types.

Animal-derived emollients also play a significant role in the market, although they cater to a niche audience due to ethical and sustainability concerns. These emollients, including lanolin and beeswax, are known for their rich moisturizing properties and effectiveness in barrier formation on the skin. Despite facing challenges from shifting consumer preferences, the animal source segment remains relevant for specific applications in skincare and pharmaceutical formulations.

Mineral-based emollients constitute another important segment, utilizing ingredients such as petroleum jelly and mineral oil. These emollients are prized for their occlusive properties, creating a barrier on the skin to prevent moisture loss. However, the demand for mineral emollients faces scrutiny over environmental concerns and skin health, prompting some consumers to explore alternative options.

Synthetic emollients have carved out a substantial market share, thanks to their ability to mimic the skin’s natural moisturizing factors and provide consistent performance across diverse product formulations. Synthetic options like silicone derivatives are engineered for specific attributes, such as non-greasy feel or rapid absorption, catering to the formulation needs of modern skincare and cosmetic products.

By Type

In 2024, esters held a dominant market position in the Emollients Market, capturing more than a 44.2% share. This segment’s popularity is largely due to esters’ versatility and efficacy as emollients in a wide range of skincare and cosmetic products.

Esters, formed from the reaction between an acid and an alcohol, are known for their smooth texture and ability to soften and condition the skin without leaving a greasy residue. Their stability and compatibility with other cosmetic ingredients make them a favorite choice for formulators aiming to create luxurious, moisturizing products.

Fatty alcohols also constitute a significant portion of the emollients market. Derived from natural fats and oils, fatty alcohols such as cetyl alcohol and stearyl alcohol are used in skincare formulations for their moisturizing properties and ability to stabilize emulsions. Their non-irritating nature and effectiveness in improving product texture cater to consumers seeking gentle, effective moisturization.

Fatty acids, including stearic acid and oleic acid, are another key type of emollients. These naturally occurring compounds are valued for their role in maintaining the skin’s barrier and hydrating properties. Fatty acids are integral to a variety of formulations, contributing not only to the product’s moisturizing effects but also to its overall sensory experience.

Ethers, though a smaller segment, play an essential role in the emollients market. These compounds are appreciated for their light texture and quick absorption, making them suitable for use in lightweight, non-greasy formulations. Ethers are particularly popular in facial skincare products, where a light feel is desired.

Silicones are a major player in the emollients market, prized for their unique set of properties that include a silky texture, excellent spreadability, and the formation of a breathable barrier on the skin. Dimethicone and cyclomethicone are examples of silicones used widely in both skincare and haircare products for their smoothing and conditioning effects.

Overall, the Emollients Market is characterized by its diversity of types, each offering unique benefits and functionalities suited to different product formulations and consumer preferences. The dominance of esters highlights their integral role in providing effective moisturization, while the presence of fatty alcohols, fatty acids, ethers, silicones, and other innovative compounds illustrates the market’s dynamic nature and ongoing evolution to meet a broad spectrum of skincare needs.

By Form

In 2024, Liquid held a dominant market position, capturing more than a 71.2% share. Liquid emollients are preferred by many because they’re easy to spread and absorb quickly into the skin, making them popular in skincare products like lotions and serums.

Solid emollients, on the other hand, accounted for the remaining market share. They’re often found in products like balms and ointments, offering longer-lasting moisturization and targeted treatment for specific skin concerns like dry patches or chapped lips.

Overall, while liquid emollients lead the market due to their versatility and ease of use, solid emollients still play a vital role in meeting diverse skincare needs, contributing to the overall richness of the emollients market segment.

By Application

In 2024, Skin Care held a dominant market position, capturing more than a 35.2% share. This indicates a strong demand for emollients in skin care products due to their moisturizing and softening properties, which help maintain healthy skin.

Hair Care followed closely, accounting for a significant portion of the market share. Emollients in hair care products contribute to smoother, shinier hair by providing moisture and reducing frizz, making them popular in conditioners and styling products.

Deodorants represented another substantial segment, leveraging emollients to offer smooth application and skin conditioning benefits alongside odor protection.

In Oral Care, emollients are utilized for their soothing properties, especially in products like lip balms and toothpaste, where they help moisturize and protect delicate oral tissues.

The remaining segment, Others, encompasses a variety of applications such as baby care products, where emollients are used to maintain the softness and suppleness of infant skin, as well as in specialty cosmetics and pharmaceuticals.

Overall, the dominance of Skin Care reflects the widespread use of emollients in daily skincare routines, while the presence of emollients across diverse applications underscores their versatility and importance in various personal care products.

By End-use

In 2024, Cosmetic & Personal Care held a dominant market position, capturing more than a 65.5% share. This highlights the widespread use of emollients in various cosmetic and personal care products, including skincare, hair care, and deodorants, to provide moisturization and enhance product texture.

Pharmaceuticals followed, representing a significant segment of the market. Emollients are utilized in pharmaceutical products such as creams, ointments, and topical treatments to soothe and hydrate the skin, making them valuable in dermatological and wound care applications.

In Food & Beverage, emollients find application as food additives and ingredients, particularly in processed foods and beverages, where they contribute to texture, mouthfeel, and shelf stability. Although this segment holds a smaller market share, emollients play a crucial role in ensuring product quality and consumer satisfaction.

The remaining segment, Others, encompasses diverse end-uses such as industrial applications, veterinary products, and agricultural formulations. Emollients serve various purposes in these sectors, including lubrication, conditioning, and protection, demonstrating their versatility beyond traditional consumer goods.

Overall, while Cosmetic & Personal Care dominate the emollients market, the presence of emollients across pharmaceuticals, food & beverage, and other industries underscores their broad applicability and significance in multiple sectors.

By Distribution Channel

In 2024, Distributors held a dominant market position, capturing more than a 56.8% share. This indicates a strong reliance on distributors for the distribution of emollients, as they play a crucial role in reaching a wide range of customers, including retailers, pharmacies, and beauty salons.

Direct Sales, although representing a smaller portion of the market share, involve manufacturers selling emollients directly to consumers through their channels, such as company-owned stores, online platforms, or sales representatives. This distribution channel offers manufacturers more control over branding and customer experience but may require significant investment in marketing and infrastructure.

Overall, the dominance of Distributors reflects the efficiency and reach they provide in distributing emollients to various retail outlets and end-users, while Direct Sales offer manufacturers an alternative strategy to engage directly with consumers and build brand loyalty.

Key Market Segments

By Source

- Botanical

- Animal

- Mineral

- Synthetic

- Others

By Type

- Esters

- Fatty Alcohols

- Fatty Acids

- Ethers

- Silicones

- Others

By Form

- Solid

- Liquid

By Application

- Skin Care

- Hair Care

- Deodorants

- Oral Care

- Others

By End-use

- Cosmetic & Personal Care

- Pharmaceuticals

- Food & Beverage

- Others

By Distribution Channel

- Direct Sales

- Distributors

Drivers

Increasing Consumer Awareness Regarding Skincare Drives Growth in Emollients Market

The burgeoning Emollients Market is predominantly driven by a surge in consumer awareness regarding skincare. Emollients, a key component in skincare formulations, are substances that soften and moisturize the skin, thereby improving its texture and appearance. As consumers become increasingly conscious of the importance of skincare routines and maintaining healthy skin, the demand for emollient-based products has witnessed a significant upsurge.

One of the primary factors fueling this trend is the growing emphasis on personal grooming and hygiene. In recent years, there has been a noticeable shift in consumer preferences towards skincare products that not only cleanse but also nourish and protect the skin.

This shift can be attributed to various factors, including changing lifestyle patterns, rising disposable incomes, and heightened awareness regarding the adverse effects of environmental pollutants on skin health. Consequently, individuals are actively seeking skincare solutions that offer long-lasting hydration and protection against external aggressors, thus driving the demand for emollient-rich formulations.

Moreover, the increasing prevalence of skin disorders and conditions such as dryness, eczema, and psoriasis has further propelled the demand for emollient-based products. Emollients play a crucial role in alleviating symptoms associated with these conditions by restoring the skin’s natural moisture barrier and preventing excessive water loss. As a result, dermatologists and healthcare professionals often recommend emollient therapy as part of the treatment regimen for various skin ailments, thereby contributing to the expansion of the emollients market.

Furthermore, the rising aging population worldwide has emerged as a significant demographic driver for the emollients market. With advancing age, the skin undergoes structural changes, leading to reduced moisture retention, increased dryness, and susceptibility to damage. As a result, older individuals are increasingly turning to emollient-based skincare products to address age-related skin concerns and maintain skin elasticity and suppleness.

Restraints

Stringent Regulatory Requirements Pose Challenges for Emollients Market Growth

Despite the promising growth trajectory of the Emollients Market, it faces significant restraints, with stringent regulatory requirements emerging as a major impediment. Regulatory bodies across the globe impose stringent guidelines and standards governing the formulation, labeling, and marketing of skincare products containing emollients.

These regulations are primarily aimed at ensuring consumer safety, product efficacy, and adherence to quality standards. While well-intentioned, compliance with these regulations poses several challenges for manufacturers and stakeholders in the emollients market.

One of the primary restraints stems from the complex and evolving nature of regulatory frameworks governing skincare products. Regulatory requirements vary significantly between different regions and jurisdictions, with each market characterized by its own set of rules, standards, and procedures.

Navigating this intricate regulatory landscape requires substantial investments of time, resources, and expertise, particularly for companies operating on a global scale. Ensuring compliance with diverse regulatory requirements often entails extensive documentation, product testing, and regulatory submissions, leading to delays in product development and market entry.

Moreover, the stringent safety and efficacy standards set forth by regulatory authorities necessitate rigorous testing and evaluation of emollient-based skincare products. Manufacturers are required to conduct comprehensive preclinical and clinical studies to assess the safety profile, skin compatibility, and therapeutic efficacy of their formulations.

These studies involve a series of tests, including skin irritation tests, sensitization studies, and stability assessments, among others, to demonstrate the safety and efficacy of the product. However, conducting such studies incurs substantial costs and can significantly extend the product development timeline, thereby impeding market access and competitiveness.

Furthermore, the regulatory landscape surrounding cosmetic ingredients, including emollients, is subject to continuous evolution in response to scientific advancements and emerging safety concerns. Regulatory authorities frequently update and revise existing regulations, introducing new requirements, restrictions, and labeling provisions for skincare products.

Compliance with these evolving regulations necessitates ongoing monitoring, adaptation, and reformulation of product formulations to align with the latest regulatory standards. Failure to comply with regulatory requirements can result in product recalls, regulatory sanctions, and reputational damage, posing significant risks to manufacturers and deterring investment in the emollients market.

Opportunity

Rising Demand for Natural and Organic Emollients Presents Lucrative Opportunity for Market Expansion

Amidst the evolving landscape of the Emollients Market, a significant opportunity emerges in the form of the escalating demand for natural and organic emollients. Consumer preferences are increasingly shifting towards sustainable, eco-friendly, and ethically sourced skincare products, driven by growing awareness regarding environmental conservation, health consciousness, and concerns over the adverse effects of synthetic chemicals on skin health. This paradigm shift in consumer behavior creates a fertile ground for manufacturers to capitalize on the burgeoning market for natural and organic emollients.

One of the key drivers fueling the demand for natural emollients is the growing mistrust and skepticism towards conventional skincare products formulated with synthetic ingredients. Consumers are becoming more discerning and proactive in scrutinizing product labels, seeking transparency regarding ingredient sourcing, manufacturing processes, and environmental impact.

As a result, there is a burgeoning demand for skincare formulations that harness the power of natural botanical extracts, plant-based oils, and organic emollients, perceived as safer, gentler, and more compatible with the skin.

Furthermore, the proliferation of clean beauty movements, wellness trends, and holistic approaches to skincare has propelled the popularity of natural and organic emollients. Conscious consumers are gravitating towards products that align with their values of sustainability, purity, and cruelty-free practices, driving demand for emollient-rich formulations derived from renewable, plant-based sources.

Manufacturers have an opportunity to tap into this growing segment of the market by offering a diverse range of natural emollients, such as shea butter, coconut oil, jojoba oil, and avocado oil, renowned for their moisturizing, nourishing, and skin-soothing properties.

Moreover, the advent of green chemistry and biotechnology has paved the way for innovation in the development of novel, eco-friendly emollients derived from renewable resources. Advances in extraction techniques, formulation technologies, and ingredient bioprocessing enable the production of natural emollients with enhanced efficacy, stability, and sensory attributes, meeting the evolving needs and preferences of consumers.

Market players can leverage these technological advancements to expand their product portfolios, differentiate their offerings, and gain a competitive edge in the burgeoning market for natural and organic emollients.

Trends

Rise in Demand for Multifunctional Emollients Reflects Key Trend in Skincare Industry

A prominent trend shaping the Emollients Market is the increasing demand for multifunctional emollients, driven by evolving consumer preferences and industry innovation. Multifunctional emollients, also known as performance-driven emollients, are characterized by their ability to offer a wide range of benefits beyond basic moisturization, including skin conditioning, protection, and enhancement.

This trend underscores a fundamental shift in consumer expectations towards skincare products that deliver comprehensive solutions to address diverse skin concerns and cater to individualized skincare needs.

One of the primary drivers fueling the demand for multifunctional emollients is the growing convergence of skincare and cosmeceutical concepts, blurring the lines between traditional skincare and therapeutic formulations.

Consumers are increasingly seeking skincare products that not only hydrate and soften the skin but also target specific skin concerns such as aging, hyperpigmentation, and environmental damage. As a result, there is a rising demand for emollients enriched with active ingredients, antioxidants, vitamins, and botanical extracts, known for their skin-rejuvenating, anti-aging, and protective properties.

Furthermore, the advent of advanced formulation technologies and ingredient innovations has enabled the development of multifunctional emollients with enhanced efficacy, stability, and sensory attributes. Manufacturers are leveraging encapsulation techniques, nanotechnology, and delivery systems to enhance the bioavailability and penetration of active ingredients, ensuring targeted delivery and optimal skin benefits.

Additionally, the incorporation of emollients into multifunctional formulations such as serums, creams, lotions, and masks allows for synergistic interactions between emollients and other skincare actives, maximizing overall product performance.

Moreover, the rise of personalized skincare solutions and bespoke beauty trends has fueled the demand for customizable emollients tailored to individual skin types, concerns, and preferences. Consumers seek skincare formulations that offer versatility, adaptability, and flexibility to address their unique skincare needs, whether it be hydration, anti-aging, or soothing properties.

As a result, there is a growing market for customizable emollient blends that allow consumers to mix and match ingredients, textures, and fragrances to create personalized skincare rituals and experiences.

Regional Analysis

The Asia Pacific region is poised to lead the global Emollients Market, capturing a significant market share of 34.3%. This robust growth is primarily driven by the increasing demand for emollients in crucial applications such as skincare, personal care products, and pharmaceuticals, among others.

The surge in emollient production in countries like China, India, and various Southeast Asian nations, including Korea, Thailand, Malaysia, and Vietnam, is expected to drive market expansion across the region during the forecast period. This growth trajectory is supported by the region’s expanding beauty and personal care industry, rising disposable incomes, and growing consumer awareness regarding skincare and wellness.

In North America, economic prosperity, coupled with the growth of industries that rely on emollients for skincare formulations, is anticipated to boost the demand for emollients. The region’s focus on product innovation, coupled with the increasing emphasis on natural and organic skincare ingredients, further propels this demand, positioning North America as a pivotal market for emollients.

Europe is also projected to witness substantial growth in the Emollients Market. This growth is driven by the growing consumer preference for skin care products that offer hydration, nourishment, and protection, as well as the increasing demand from the cosmetics, pharmaceuticals, and personal care sectors. Europe’s stringent regulations regarding product safety and efficacy contribute to the rising adoption of emollients in skincare formulations.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Emollients Market boasts a diverse landscape with several key players driving innovation, product development, and market growth. These key players play a crucial role in shaping the competitive dynamics of the industry and are instrumental in meeting the evolving needs and preferences of consumers worldwide.

Market Key Players

- Ashland Inc.

- BASF SE

- Clariant

- Covestro AG

- Croda International PLC

- Eastman Chemical Company

- Evonik Industries AG

- Hallstar

- Lonza

- Oleon Health and Beauty

- Sasol

- Solvay

- Stepan Company

- The Lubrizol Corporation

- Vantage Speciality Chemicals

Recent Development

- In February 2024, BASF announced a partnership with a biotechnology company to develop sustainable bio-based feedstocks for various products, potentially including ingredients for emollients.

- Covestro: Announced their commitment to increasing the use of recycled materials in their production processes in March 2024. While not directly related to emollients, it reflects their focus on sustainability, which could extend to developing more eco-friendly emollient solutions.

Report Scope

Report Features Description Market Value (2023) USD 2 Bn Forecast Revenue (2033) USD 6 Bn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source(Botanical, Animal, Mineral, Synthetic, Others), By Type(Esters, Fatty Alcohols, Fatty Acids, Ethers, Silicones, Others), By Form(Solid, Liquid), By Application(Skin Care, Hair Care, Deodorants, Oral Care, Others), By End-use(Cosmetic and Personal Care, Pharmaceuticals, Food and Beverage, Others), By Distribution Channel(Direct Sales, Distributors) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Ashland Inc., BASF SE, Clariant, Covestro AG, Croda International PLC, Eastman Chemical Company, Evonik Industries AG, Hallstar, Lonza, Oleon Health and Beauty, Sasol, Solvay, Stepan Company, The Lubrizol Corporation, Vantage Speciality ChemicalsAshland Inc., BASF SE, Clariant, Covestro AG, Croda International PLC, Eastman Chemical Company, Evonik Industries AG, Hallstar, Lonza, Oleon Health and Beauty, Sasol, Solvay, Stepan Company, The Lubrizol Corporation, Vantage Speciality Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Emollients Market?Emollients Market size is expected to be worth around USD 6 billion by 2033, from USD 2 billion in 2023.

What CAGR is projected for the Emollients Market?The Emollients Market is expected to grow at 5.10% CAGR (2024-2033).Name the major industry players in the Emollients Market?Ashland Inc., BASF SE, Clariant, Covestro AG, Croda International PLC, Eastman Chemical Company, Evonik Industries AG, Hallstar, Lonza, Oleon Health and Beauty, Sasol, Solvay, Stepan Company, The Lubrizol Corporation, Vantage Speciality Chemicals

-

-

- Ashland Inc.

- BASF SE

- Clariant

- Covestro AG

- Croda International PLC

- Eastman Chemical Company

- Evonik Industries AG

- Hallstar

- Lonza

- Oleon Health and Beauty

- Sasol

- Solvay

- Stepan Company

- The Lubrizol Corporation

- Vantage Speciality Chemicals