Emergency Medical Services Billing Software Market By Product Type (In-house and Outsourced), By Application (Land Ambulance Services, Water Ambulance Services, and Air Ambulance Services), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152994

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

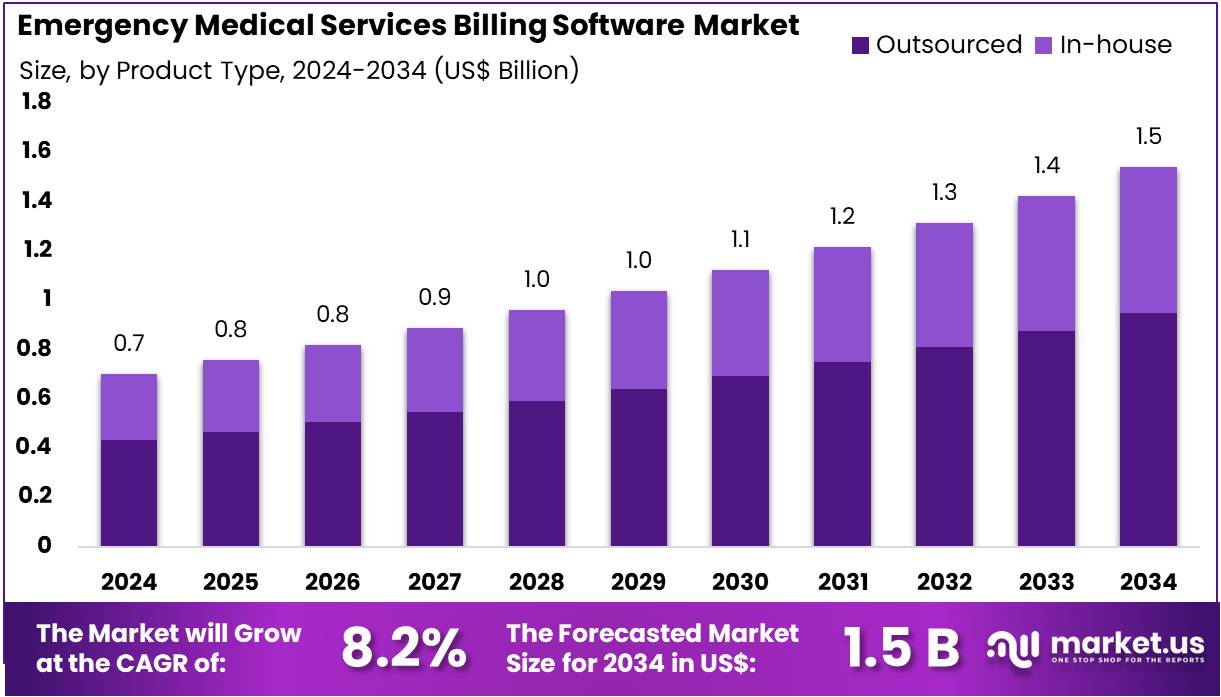

The Emergency Medical Services Billing Software Market Size is expected to be worth around US$ 1.5 billion by 2034 from US$ 0.7 billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034.

Increasing demand for streamlined operations and better financial management in emergency medical services (EMS) is driving the growth of the EMS billing software market. EMS providers face numerous challenges, including complex billing processes, insurance claims, and compliance with ever-evolving regulations. To address these issues, EMS billing software offers advanced features that automate billing, improve claim accuracy, and reduce errors, ultimately ensuring faster reimbursements and reducing administrative costs.

The rising prevalence of injuries and trauma is also contributing to the market’s expansion, with growing numbers of patients requiring emergency care. In the “Injury and Trauma Emergency Department Hospitalization Statistics, 2020-2021” report by the Canadian Institute of Health Information, it was noted that 301,347 females and 249,872 males were admitted to emergency departments across Canada due to unintentional falls during this period. These figures highlight the continuous need for efficient EMS services and, consequently, the demand for integrated billing software solutions to handle large volumes of emergency cases.

Recent trends in the market show a shift towards cloud-based EMS billing software, providing scalability, real-time updates, and easier integration with other healthcare systems. Additionally, the adoption of artificial intelligence (AI) and machine learning (ML) to analyze billing data and predict payment trends presents significant opportunities for enhanced revenue cycle management. As healthcare systems focus on improving efficiency and reducing operational costs, EMS billing software continues to evolve, offering new functionalities and improvements to better meet the needs of EMS providers. With the increasing demand for cost-effective, efficient billing solutions, the market is poised for continued growth.

Key Takeaways

- In 2024, the market for emergency medical services billing software generated a revenue of US$ 0.7 billion, with a CAGR of 8.2%, and is expected to reach US$ 1.5 billion by the year 2034.

- The product type segment is divided into in-house and outsourced, with outsourced taking the lead in 2023 with a market share of 61.6%.

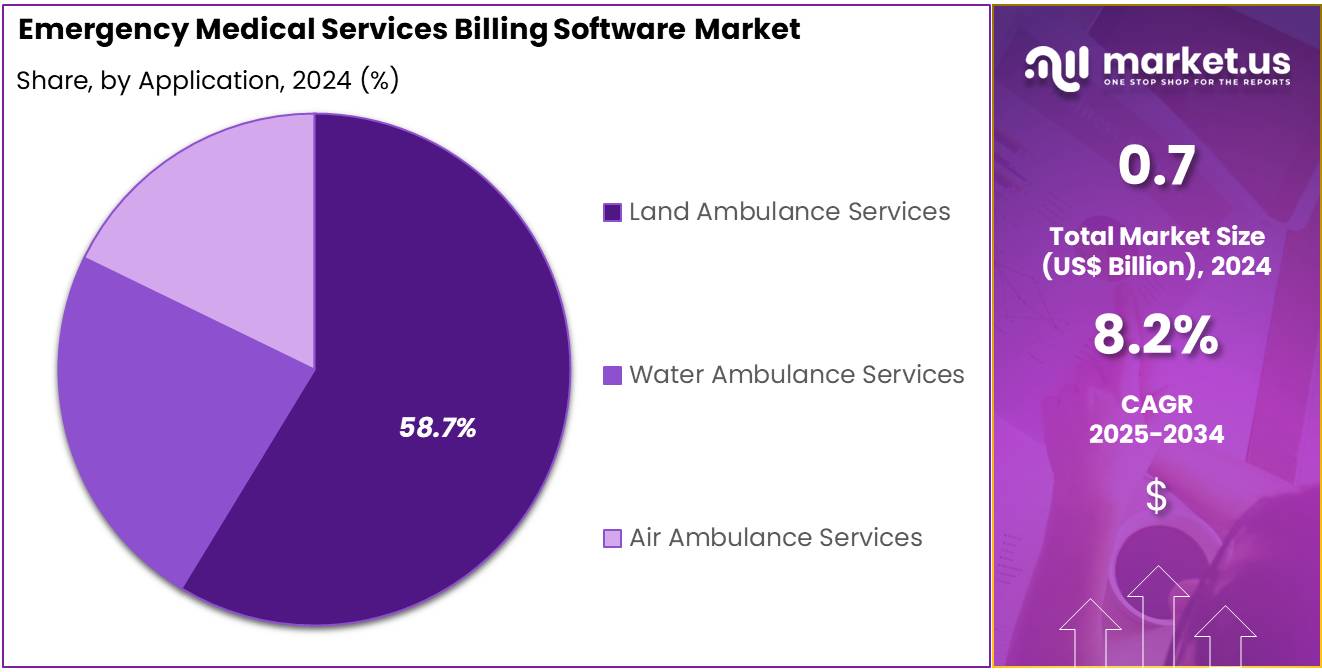

- Considering application, the market is divided into land ambulance services, water ambulance services, and air ambulance services. Among these, land ambulance services held a significant share of 58.7%.

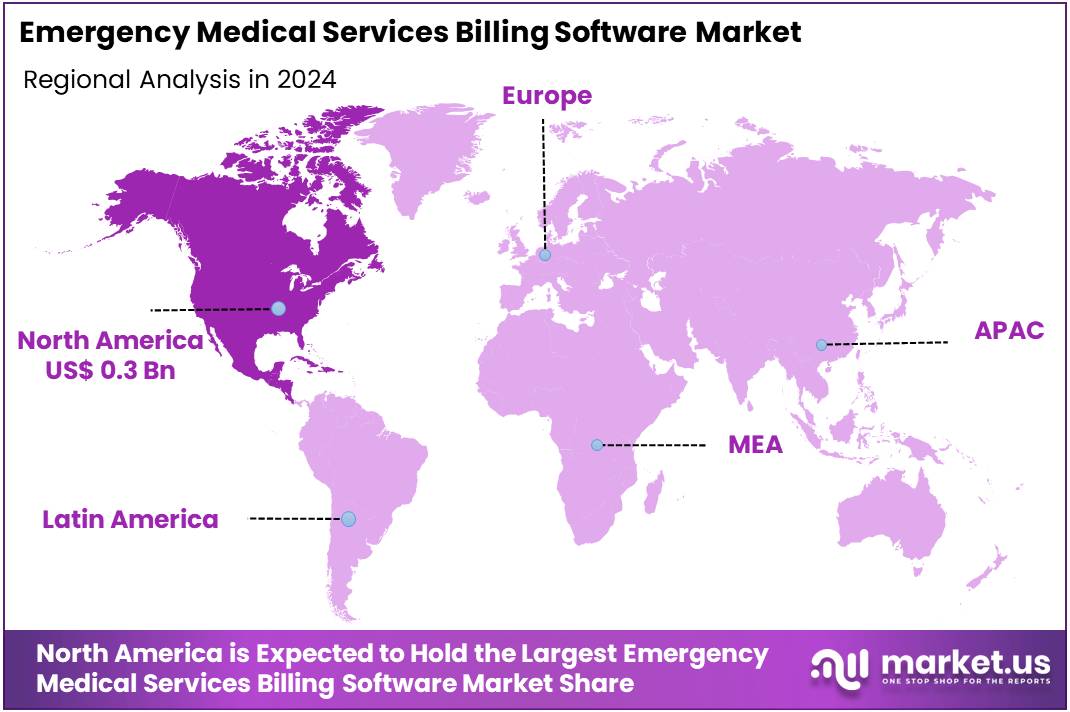

- North America led the market by securing a market share of 42.8% in 2023.

Product Type Analysis

The outsourced segment dominates the emergency medical services (EMS) billing software market, holding 61.6% of the market share. This growth is expected to continue as more EMS providers opt for outsourcing their billing functions to specialized service providers, allowing them to focus on core operations. Outsourcing offers EMS companies access to expertise in billing and coding, along with the ability to streamline their revenue cycle management.

The increasing complexity of medical billing regulations and the need for compliance with evolving healthcare policies are projected to drive more EMS providers toward outsourced solutions. Outsourced billing services provide enhanced efficiency, reduce administrative costs, and improve the accuracy of claims submissions, which are likely to contribute to the continued growth of this segment.

Furthermore, as EMS providers expand their services across different regions, outsourcing their billing needs to specialized companies will become a preferred strategy to ensure timely reimbursements and better financial management. The growing demand for cloud-based outsourced billing services, which offer scalability and data security, is expected to further accelerate growth in this segment.

Application Analysis

Land ambulance services hold a dominant share of 58.7% in the EMS billing software market. This segment’s growth is expected to be driven by the increasing demand for emergency medical services on land, especially in urban areas where accidents and medical emergencies are frequent. The growing population, along with the rise in lifestyle diseases such as heart attacks and strokes, is projected to increase the number of land ambulance calls. As a result, the need for efficient billing software to manage these services is expected to grow significantly.

Additionally, the adoption of advanced technologies, including GPS tracking and telemedicine integration, in land ambulance services is likely to improve the efficiency of these operations and further boost demand for EMS billing software tailored to these needs. Land ambulance providers are also anticipated to increase their focus on improving revenue cycle management and reducing billing errors, which will drive the adoption of specialized EMS billing software.

As governments invest in improving healthcare infrastructure, the demand for land ambulance services and associated software solutions is projected to continue growing in both developed and emerging markets. Furthermore, as reimbursement policies evolve, the need for accurate billing and coding solutions for land ambulance services is expected to enhance the market’s expansion.

Key Market Segments

By Product Type

- In-house

- Outsourced

By Application

- Land Ambulance Services

- Water Ambulance Services

- Air Ambulance Services

Drivers

Increasing Complexity of Reimbursement Regulations and Documentation Requirements is Driving the Market

The escalating complexity of healthcare reimbursement regulations and the ever-growing demands for precise documentation are a significant driver propelling the emergency medical services (EMS) billing software market. EMS agencies operate within a highly intricate regulatory environment, governed by federal, state, and local mandates concerning patient transport, treatment, and billing.

Each payor, including Medicare, Medicaid, and commercial insurers, has distinct coding, submission, and compliance requirements, which are frequently updated. This necessitates specialized software solutions capable of navigating these complexities to ensure accurate claim submission, minimize denials, and optimize revenue cycles. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) routinely updates its fee schedules and coding guidelines.

A February 2025 report prepared for CMS by the RAND Corporation, based on data from 3,694 ambulance agencies for 2022 and 2023, highlighted the substantial gap between EMS expenses and revenues, implicitly underscoring the critical need for efficient billing to maximize reimbursement. Errors in coding or incomplete documentation can lead to claim rejections, delays in payment, and even penalties, creating a strong impetus for EMS providers to adopt sophisticated billing software that automates and streamlines these convoluted processes, thereby driving market growth.

Restraints

Challenges in Data Interoperability and Integration with Legacy Systems are Restraining the Market

Significant challenges related to data interoperability and the integration of new emergency medical services billing software with existing legacy systems are a considerable restraint on market growth. Many EMS agencies and healthcare providers still rely on older, siloed data management systems that were not designed to seamlessly communicate with modern billing platforms. This lack of interoperability can lead to manual data entry, duplicate records, and inconsistencies, which in turn increase the risk of billing errors and inefficiencies.

Integrating new billing software with electronic health records (EHRs), patient management systems, and hospital information systems often proves to be a complex, time-consuming, and expensive endeavor. A May 2025 article on healthcare data integration challenges noted that many healthcare organizations still use decades-old systems that lack interoperability, leading to critical data being locked in silos.

Furthermore, the absence of universal data standards across different EMS and healthcare platforms complicates data exchange and validation. These integration hurdles deter some EMS agencies, particularly smaller ones with limited IT resources, from upgrading to advanced billing software, thereby restraining the market’s full potential and hindering the adoption of more efficient revenue cycle management solutions.

Opportunities

Growing Adoption of Cloud-Based Solutions and Artificial Intelligence (AI) for Revenue Cycle Management is Creating Growth Opportunities

The increasing adoption of cloud-based solutions and the burgeoning integration of artificial intelligence (AI) for revenue cycle management (RCM) are creating significant growth opportunities in the emergency medical services billing software market. Cloud-based platforms offer numerous advantages, including enhanced accessibility, scalability, reduced upfront IT infrastructure costs, and improved data security through robust cloud provider frameworks. This makes advanced billing software more attainable for EMS agencies of all sizes.

Concurrently, the application of AI and machine learning algorithms is revolutionizing billing processes by automating tasks such as coding, claim submission, and denial management, while also identifying patterns for fraud detection and predicting potential denials. For instance, a June 2025 report discussing AI in medical billing highlighted that solutions are automating repetitive tasks, streamlining workflows, and improving accuracy across billing and claims processing.

The report also identified AI-powered revenue cycle automation as a top healthcare AI trend for 2025. These AI-driven capabilities not only increase efficiency and accuracy in billing but also free up EMS personnel to focus on patient care rather than administrative burdens. This dual shift towards flexible cloud deployments and intelligent automation is rapidly expanding the capabilities and appeal of EMS billing software, driving substantial market growth.

Impact of Macroeconomic / Geopolitical Factors

Global economic pressures, including persistent inflation and fluctuating national healthcare budgets, significantly influence the emergency medical services billing software market by affecting operational costs for software providers and IT investment capabilities of EMS agencies. The development and maintenance of sophisticated billing software require substantial investments in skilled labor, cloud infrastructure, and cybersecurity measures, all of which are subject to inflationary pressures.

For example, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for Medical Care Services increased by 3.6% from May 2023 to May 2024, reflecting broad inflationary trends that filter into healthcare IT costs. Economic downturns or fiscal tightening by governments can lead to reduced funding for public EMS agencies, impacting their ability to invest in new technologies or upgrade existing billing systems.

Furthermore, shifts in national healthcare funding models, such as moves towards value-based care or new reimbursement mechanisms, necessitate continuous updates and adaptations in billing software, adding to development costs for vendors. However, these challenges also compel EMS providers to seek more efficient and cost-effective solutions for revenue management, driving demand for robust billing software that can mitigate financial strain and optimize reimbursement, ultimately contributing to market innovation and resilience.

Evolving US trade policies, including tariffs and regulations on technology imports, are indirectly shaping the emergency medical services billing software market by influencing the cost of IT infrastructure and cybersecurity measures. While billing software itself is largely a service or intellectual property, the hardware components, cloud computing services, and specialized cybersecurity tools that underpin these platforms often rely on globally sourced inputs.

Tariffs on imported servers, networking equipment, or even certain advanced microchips can increase the operational costs for software developers and cloud service providers that host EMS billing platforms. For example, a June 2025 report by TeckPath on the impact of U.S. tariff policies on the tech sector noted that increased import duties on components like semiconductors and specialized equipment have raised costs across the industry. This rise in input costs for IT infrastructure can translate into higher subscription fees or initial implementation costs for EMS agencies.

Conversely, US trade policies and a heightened national focus on cybersecurity for critical infrastructure, including healthcare data, are driving investments in domestic IT security solutions and data residency. This emphasis on securing sensitive patient billing information encourages software developers to build more robust, compliant, and domestically hosted platforms, fostering greater trust and leading to a more secure and resilient ecosystem for EMS billing.

Latest Trends

Enhanced Emphasis on Real-Time Data Analytics and Performance Metrics is a Recent Trend

A prominent recent trend significantly impacting the emergency medical services billing software market in 2024 and continuing into 2025 is the enhanced emphasis on real-time data analytics and performance metrics. EMS agencies are increasingly recognizing the critical importance of leveraging data insights to optimize their billing processes, identify areas of revenue leakage, and improve overall operational efficiency.

Modern billing software is evolving to incorporate sophisticated analytics dashboards that provide immediate visibility into key performance indicators (KPIs) such as claim submission rates, denial rates, average reimbursement times, and collection effectiveness. This capability allows EMS leadership to make data-driven decisions to refine their billing strategies, negotiate better contracts with payers, and allocate resources more effectively.

For example, the U.S. Centers for Medicare & Medicaid Services (CMS) continues to push for greater data transparency and accountability in healthcare. While not a direct statistic on EMS software usage, CMS’s ongoing initiatives, such as the Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) Payment System proposed rules for 2025, consistently emphasize quality data reporting and performance measurement. This growing demand for actionable insights from billing data, rather than just processing claims, is pushing software providers to integrate more advanced analytical tools and reporting features, making data-driven revenue cycle management a defining trend in the emergency medical services billing software market.

Regional Analysis

North America is leading the Emergency Medical Services Billing Software Market

North America dominated the market with the highest revenue share of 42.8% owing to increasing emergency call volumes, a persistent need for operational efficiency, and ongoing regulatory changes that necessitate sophisticated billing solutions. EMS calls constitute the leading incident type for U.S. fire departments, accounting for 65.2% of responses in 2023, underscoring the high demand for emergency services.

In Canada, provinces like Grey County reported responding to a record 15,796 total calls in 2024, with paramedic services seeing a 29.72% increase in patient call volume over the past five years, averaging 5.94% annually. This rising workload places immense pressure on EMS agencies to streamline their administrative processes, making specialized billing software indispensable.

Such software automates complex coding, submission, and reimbursement workflows, ensuring compliance with evolving healthcare regulations and maximizing revenue capture. While specific revenue figures for EMS billing software from individual companies are often integrated into broader financial reports, major players continue to innovate.

For example, ImageTrend, a prominent provider of EMS data and software solutions, celebrated 25 years in business in 2023 and achieved NEMSIS V3.5 compliance for its Elite platform, demonstrating continuous adaptation to industry standards. ZOLL Medical Corporation, which also offers EMS software solutions, reported an estimated annual revenue of US$2 billion, reflecting its significant presence in the broader emergency medical device and software market. These factors collectively indicate a robust and expanding market for EMS billing software in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rapid modernization of healthcare infrastructure, increasing emergency service utilization, and a strong push towards digital transformation within the healthcare sector across the region. Countries like China are seeing a significant rise in emergency outpatient visits, with data reporting 9,088.000 million visits in 2023, an increase from 7,980.000 million in 2022, indicating a growing demand for emergency care that necessitates efficient billing systems.

Governments in Asia Pacific are actively investing in enhancing their emergency medical services and promoting digitalization. For instance, the Chinese government has invested over US$1.2 billion to enhance communication systems in ambulances, and initiatives like India’s Ayushman Bharat Digital Mission (ABDM) are creating a nationwide digital health ecosystem, including incentives for healthcare providers to adopt digital health solutions. This widespread digitalization in healthcare directly supports the adoption of advanced billing software.

Global players with a presence in the region are likely to benefit from these trends. The World Health Organization (WHO) actively promotes digital health initiatives across its South-East Asia Region, with recent updates in 2024 focusing on digital health transformation. These governmental efforts and the increasing volume of emergency medical interactions are projected to significantly accelerate the adoption and growth of these essential software solutions across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the emergency medical services billing software market utilize various strategies to drive growth. They focus on enhancing software functionality by integrating advanced features such as real-time data analytics, automated billing, and compliance management to streamline operations for EMS providers. Companies also prioritize scalability, offering solutions that cater to both small and large organizations.

Strategic partnerships with healthcare institutions and technology providers enable these firms to enhance their service offerings and expand market reach. Additionally, they invest in user training and support to improve customer retention. Geographical expansion and targeted marketing efforts further strengthen their position in both developed and emerging markets.

One key player, TriTech Software Systems, provides comprehensive software solutions to the EMS industry. The company offers billing software that simplifies compliance and payment processes, improving operational efficiency for emergency medical service providers. TriTech continues to innovate by integrating cutting-edge technologies such as cloud computing and mobile applications into its offerings. With a strong focus on customer service and user-friendly interfaces, TriTech remains a key player in the EMS billing software market, enhancing the billing process for EMS organizations worldwide.

Top Key Players in the Emergency Medical Services Billing Software Market

- MEDAPOINT

- Lexipol (EMS1)

- iTech Workshop Pvt Ltd

- Isalus Healthcare

- Health iPASS

- Change Healthcare

- Ambubill – Ambulance Billing Service

- AIM EMS SOFTWARE & SERVICES

Recent Developments

- In June 2022: A strategic collaboration was established between Health iPASS, a division of Sphere, and Atlus Neighbors Emergency Centers (NEC), a network of urgent care facilities linked to hospitals in the Houston, Texas area. This partnership centers on the deployment of Health iPASS’s Advanced eBilling solution, aiming to streamline and improve the efficiency of billing operations across NEC facilities.

- In March 2022: Tampa Fire Rescue implemented a new EMS billing platform developed by Digitech. The system offers a secure and user-friendly interface, enabling patients to make payments conveniently through mobile devices. The integration of automated features and encrypted payment options enhances both accessibility and transaction security.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 billion Forecast Revenue (2034) US$ 1.5 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (In-house and Outsourced), By Application (Land Ambulance Services, Water Ambulance Services, and Air Ambulance Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MEDAPOINT, Lexipol (EMS1), iTech Workshop Pvt Ltd, Isalus Healthcare, Health iPASS, Change Healthcare, Ambubill – Ambulance Billing Service, AIM EMS SOFTWARE & SERVICES. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Emergency Medical Services Billing Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Emergency Medical Services Billing Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- MEDAPOINT

- Lexipol (EMS1)

- iTech Workshop Pvt Ltd

- Isalus Healthcare

- Health iPASS

- Change Healthcare

- Ambubill - Ambulance Billing Service

- AIM EMS SOFTWARE & SERVICES