Global Embedded FPGA Market Size Analysis, Decision-Making Report By Technology (EEPROM, Antifuse, SRAM, Flash, Others), By Application (Data Processing, Consumer Electronics, Industrial, Military and Aerospace, Automotive, IT & Telecom, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149603

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

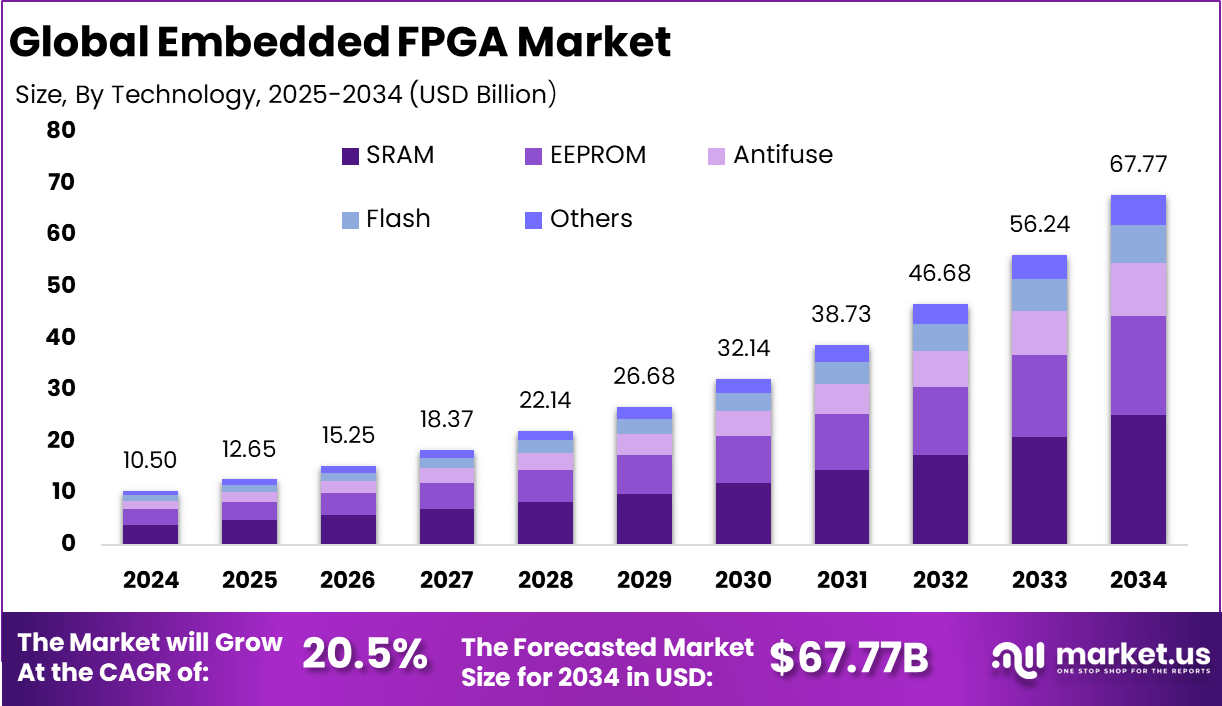

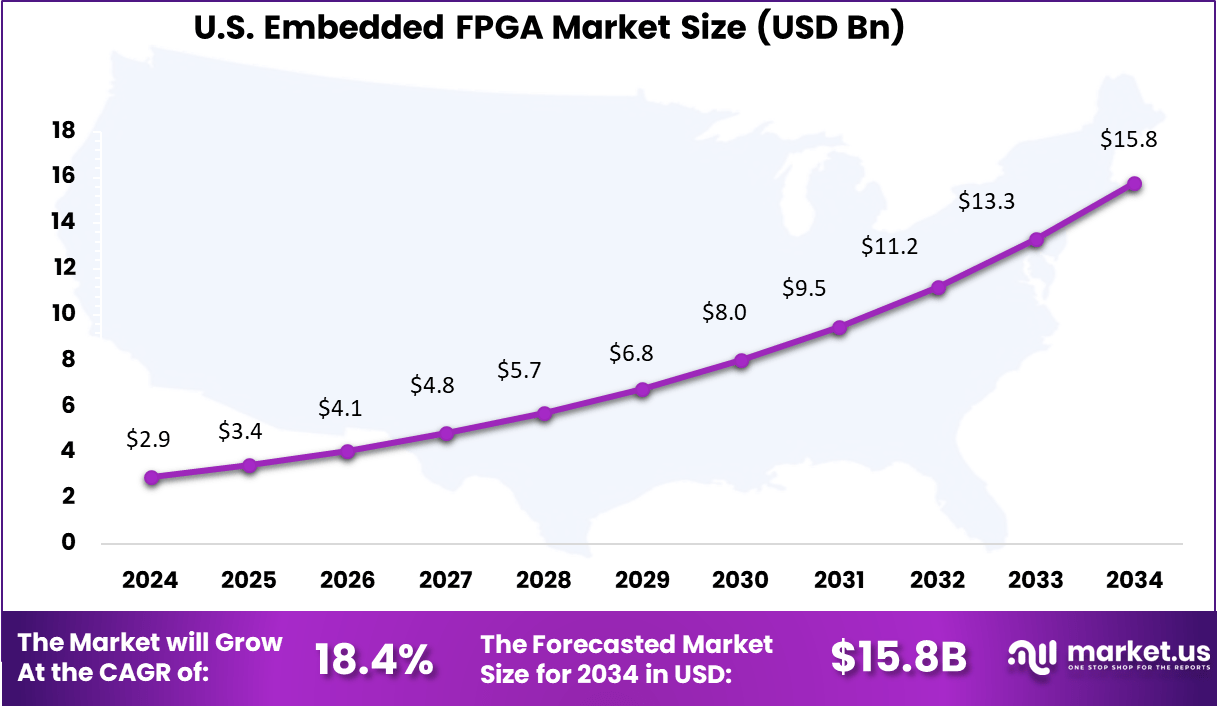

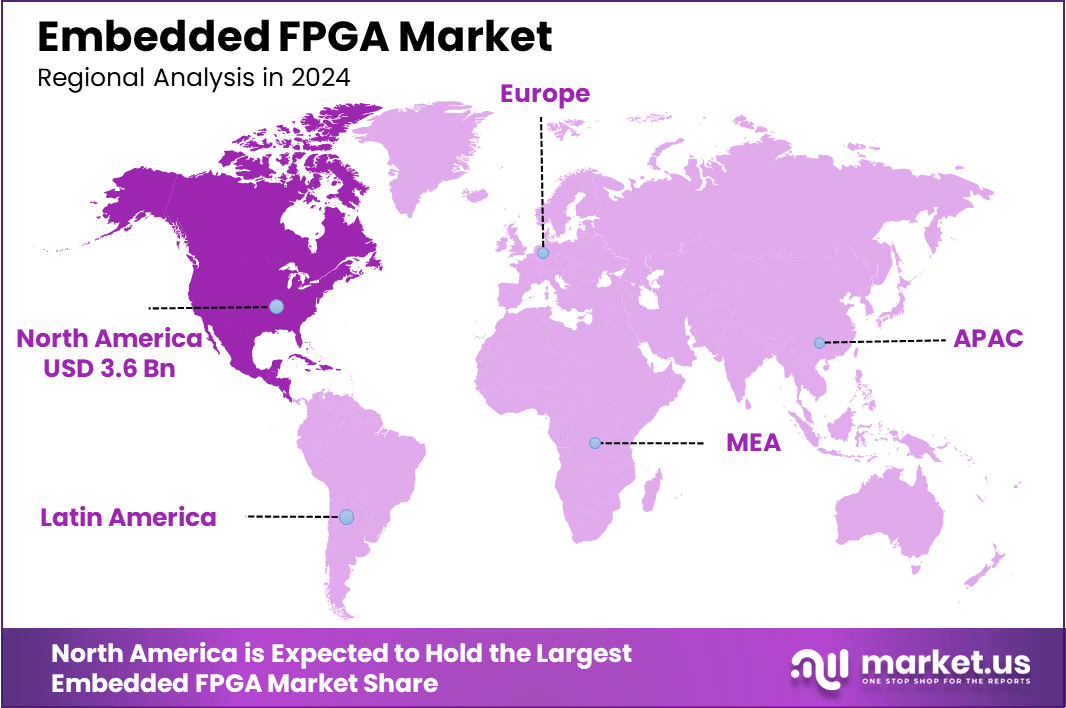

The Global Embedded FPGA Market size is expected to be worth around USD 67.77 Billion By 2034, from USD 10.5 billion in 2024, growing at a CAGR of 20.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.7% share, holding USD 3.6 Billion revenue. Driven by advanced applications, the U.S. embedded FPGA market has surged to USD 2.91 billion, growing at 18.4% CAGR.

The global embedded FPGA market is experiencing significant growth, driven by the increasing demand for customizable and energy-efficient computing solutions across various industries. Key factors propelling the embedded FPGA market include the demand for low-power and cost-effective solutions, the need for hardware reconfigurability, and the increasing complexity of semiconductor designs.

eFPGAs enable designers to implement updates and enhancements post-deployment, reducing time-to-market and allowing for rapid adaptation to evolving technological requirements. Additionally, the integration of eFPGAs into SoCs facilitates higher system-level integration, leading to improved performance and reduced overall system costs.

According to market.us, The Global Field-Programmable Gate Array (FPGA) Market is projected to reach USD 39.0 billion by 2033, up from USD 10.9 billion in 2023, expanding at a robust CAGR of 13.6% from 2024 to 2033 – driven by rising demand for reconfigurable computing in AI, 5G, and automotive applications.

The demand for embedded FPGAs is escalating in industries that require real-time data processing and adaptability. In telecommunications, eFPGAs are utilized to manage dynamic network protocols and standards. The automotive industry leverages eFPGAs for advanced driver-assistance systems (ADAS) and autonomous driving technologies, which necessitate high computational power and flexibility.

Key Takeaways

- The Global Embedded FPGA Market is projected to grow from USD 10.5 Billion in 2024 to approximately USD 67.77 Billion by 2034, reflecting a compelling CAGR of 20.5% during 2025–2034.

- In 2024, North America led the global market, accounting for over 34.7% share, generating nearly USD 3.6 Billion in revenue, supported by strong R&D and tech-driven industries.

- The U.S. embedded FPGA market alone reached around USD 2.91 Billion in 2024 and is forecasted to grow steadily at a CAGR of 18.4%, driven by its integration in next-gen communication and defense systems.

- Among technologies, SRAM-based embedded FPGA held the largest share at 37.2%, favored for its speed, flexibility, and compatibility with standard CMOS processes.

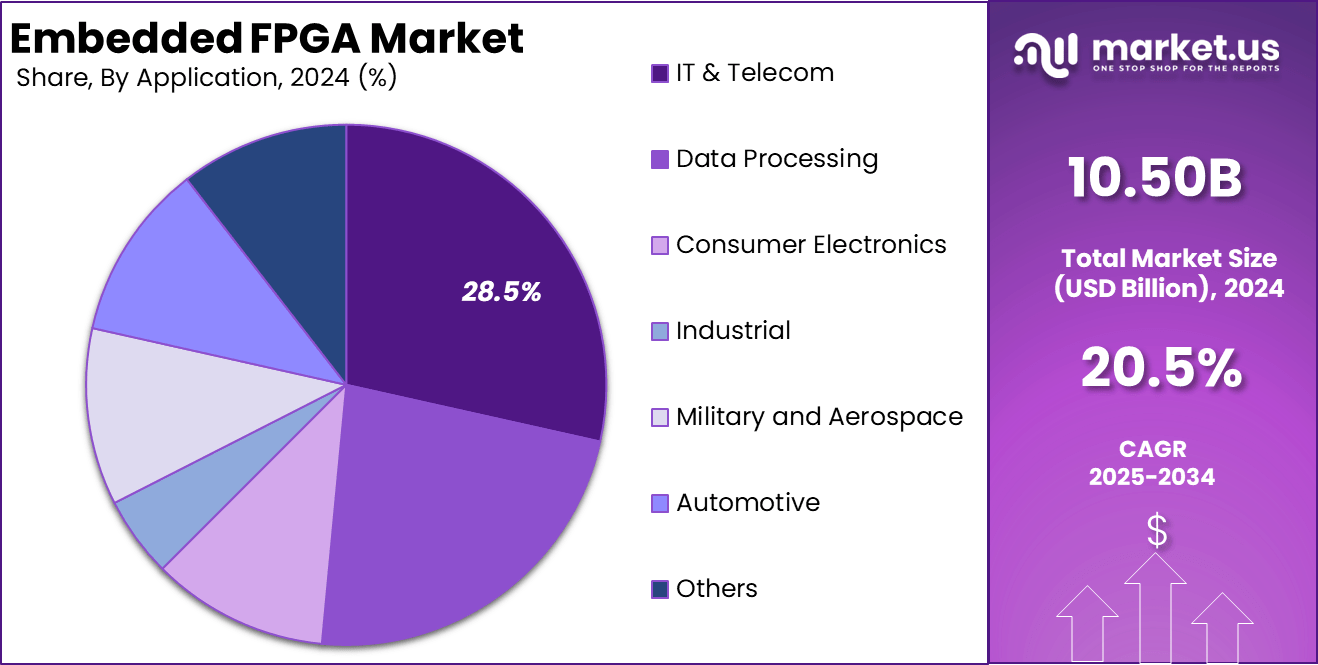

- By application, the IT & Telecom sector dominated in 2024 with a 28.5% market share, due to the rapid deployment of 5G infrastructure and the demand for programmable solutions in networking equipment.

Analysts’ Viewpoint

Investment opportunities in the embedded FPGA market are substantial, given the technology’s applicability across multiple high-growth sectors. Companies investing in eFPGA development and integration can capitalize on the demand for customizable and energy-efficient hardware solutions.

Organizations are adopting embedded FPGAs to achieve greater design flexibility, reduce development cycles, and enhance product longevity. The ability to update hardware functionalities post-deployment allows companies to respond swiftly to market changes and technological advancements, ensuring their products remain competitive and up-to-date.

The regulatory environment for embedded FPGAs is influenced by industry-specific standards and compliance requirements, particularly in sectors such as automotive, aerospace, and healthcare. Manufacturers must ensure that eFPGA-integrated systems meet relevant safety, security, and performance standards. As eFPGAs become more prevalent in critical applications, adherence to stringent regulatory frameworks will be essential to ensure product reliability and market acceptance.

US Market Expansion

The US Embedded FPGA Market is valued at approximately USD 2.9 Billion in 2024 and is predicted to increase from USD 6.8 Billion in 2029 to approximately USD 15.8 Billion by 2034, projected at a CAGR of 18.4% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant position in the embedded FPGA market, capturing over 34.7% of the global share, with revenue reaching approximately USD 3.6 billion. This leadership is attributed to the region’s advanced semiconductor infrastructure, significant investments in research and development, and the presence of key industry players such as Intel, AMD, and NVIDIA.

By Technology Analysis

In 2024, Static Random-Access Memory (SRAM) technology led the eFPGA market, accounting for approximately 37.2% of the market share. SRAM-based eFPGAs are favored for their reprogrammability, allowing designers to update logic functions post-manufacturing. This flexibility is crucial in applications requiring frequent updates or iterative development cycles.

Additionally, SRAM eFPGAs offer faster design cycles and support for in-system programming, streamlining the development process. These advantages make SRAM the preferred choice for industries demanding high adaptability and performance.

By Application Analysis

In 2024, the IT & Telecom sector emerged as the leading application segment for eFPGAs, capturing about 28.5% of the market share. The proliferation of 5G networks and the increasing demand for high-speed data processing have driven the adoption of eFPGAs in this sector.

Their ability to handle complex signal processing tasks and adapt to evolving communication standards makes them ideal for telecom infrastructure. Furthermore, the integration of eFPGAs in data centers enhances computational efficiency, supporting the growing needs of cloud services and network operations.

Key Market Segments

By Technology

- EEPROM

- Antifuse

- SRAM

- Flash

- Others

By Application

- Data Processing

- Consumer Electronics

- Industrial

- Military and Aerospace

- Automotive

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Low Power Consumption and Flexibility

Embedded FPGAs (eFPGAs) are increasingly favored in modern electronics due to their low power consumption and reconfigurability. These characteristics make them ideal for applications in IoT devices, wearables, and edge computing, where energy efficiency and adaptability are paramount.

The ability to reprogram eFPGAs post-deployment allows for updates and modifications without the need for hardware changes, offering significant cost and time savings. This flexibility is particularly beneficial in rapidly evolving technological landscapes, enabling devices to adapt to new standards and protocols as they emerge.

Moreover, the integration of eFPGAs into System-on-Chip (SoC) designs enhances system performance while maintaining low power profiles. This integration supports the development of compact, efficient, and versatile electronic systems.

Restraint

High Development Costs and Complexity

Despite their advantages, the adoption of eFPGAs is hindered by high development costs and design complexity. The initial investment required for eFPGA integration, including licensing fees and specialized design tools, can be substantial.

Additionally, the design process demands a high level of expertise, as it involves intricate planning and verification to ensure functionality and performance. These factors can be prohibitive, especially for small and medium-sized enterprises with limited resources.

The complexity of eFPGA design also extends to the verification and testing phases, where ensuring reliability and performance under various conditions can be challenging. This complexity may lead to longer development cycles and increased time-to-market, potentially offsetting the benefits of flexibility and reconfigurability.

Opportunity

Integration in Edge AI Applications

The rise of edge computing and artificial intelligence (AI) presents significant opportunities for eFPGAs. Their ability to process data locally reduces latency and bandwidth usage, which is crucial for real-time AI applications such as autonomous vehicles, industrial automation, and smart devices.

eFPGAs can be tailored to specific AI workloads, offering a balance between performance and power efficiency that is difficult to achieve with traditional processors. Furthermore, the reconfigurability of eFPGAs allows for updates and optimizations of AI algorithms without hardware changes, facilitating continuous improvement and adaptation to new requirements.

Challenge

Integration with Existing Systems

Integrating eFPGAs into existing systems poses significant challenges, particularly concerning compatibility and design complexity. Legacy systems may not be designed to accommodate the flexible and reconfigurable nature of eFPGAs, leading to potential issues with interfacing and communication.

Additionally, the integration process often requires substantial modifications to existing hardware and software architectures, which can be time-consuming and costly. Moreover, the lack of standardized tools and methodologies for eFPGA integration can complicate the design process.

Engineers must often rely on proprietary solutions, which may not be compatible with all systems or may require specialized knowledge to implement effectively. These challenges can deter organizations from adopting eFPGAs, despite their potential benefits, highlighting the need for more accessible integration solutions and standardized practices within the industry.

Emerging Trends

Embedded FPGAs (eFPGAs) are witnessing significant advancements, particularly in their integration with artificial intelligence (AI) and edge computing applications. The adaptability of eFPGAs makes them well-suited for real-time data processing tasks, which are essential in AI-driven applications.

Their reconfigurable nature allows for on-the-fly updates and optimizations, enabling devices to handle evolving AI algorithms without the need for hardware modifications. This flexibility is crucial in sectors like autonomous vehicles and industrial automation, where rapid adaptation to new data is necessary.

Another notable trend is the increasing adoption of open-source FPGA development tools. Traditionally, FPGA development relied heavily on proprietary tools, which could be costly and limit customization. The emergence of open-source platforms democratizes access to FPGA development, allowing a broader range of developers to experiment and innovate.

Business Benefits

The integration of eFPGAs into system-on-chip (SoC) designs offers substantial business advantages, particularly in terms of product longevity and adaptability. By embedding reconfigurable logic within SoCs, companies can extend the functional lifespan of their products.

This is especially beneficial in industries where devices are expected to operate over extended periods, such as automotive and industrial sectors. The ability to update and modify functionalities post-deployment without physical alterations reduces the need for frequent hardware replacements, leading to cost savings and improved return on investment.

In addition to enhancing product longevity, eFPGAs contribute to faster time-to-market for new products. Their programmable nature allows for rapid prototyping and iterative development, enabling companies to test and refine their designs efficiently. This agility is crucial in sectors where technological advancements occur rapidly, and the ability to launch products swiftly can be a significant competitive advantage.

Key Player Analysis

In 2025, Achronix Semiconductor Corporation strengthened its embedded FPGA (eFPGA) leadership by launching the VectorPath® 815 PCIe accelerator card powered by Speedster®7t1500, addressing AI and data center needs. In parallel, it collaborated with Primemas to embed Speedcore™ eFPGA IP in chiplet architectures, enhancing integration flexibility.

Flex Logix Technologies Inc., a key innovator in reconfigurable logic, was acquired by Analog Devices in late 2024 to enhance digital signal processing systems. This move expanded Flex Logix’s access to diverse end markets and embedded eFPGA design opportunities.

Meanwhile, Advanced Micro Devices Inc. (AMD) extended its FPGA reach through the introduction of the Versal adaptive SoC Gen 2 in 2024, aimed at edge AI and automotive markets. The acquisition of Enosemi in May 2025 added advanced photonic integration to AMD’s embedded solutions, showing a strategic focus on energy-efficient data processing.

Intel Corporation, via its FPGA business unit Altera, re-emerged as a standalone entity in early 2024 and then sold a majority stake to Silver Lake in 2025, signaling a renewed strategic pivot towards core computing markets and streamlining of FPGA-focused innovations.

Top Key Players Covered

- Achronix Semiconductor Corporation

- Adicsys

- Advanced Micro Devices Inc

- Efinix Inc

- Flex Logix Technologies Inc.

- Intel Corporation

- Lattice Semiconductor Corporation

- Menta S.A.S

- Microchip Technology Inc

- Quick Logic Corporation

- Others

Recent Developments

- Achronix Semiconductor Corporation, In May 2025 – Launched the VectorPath® 815 PCIe accelerator card, powered by the Speedster® 7t1500 FPGA, targeting AI and high-performance computing applications.

- Efinix Inc., March 2025 – Announced a line of FPGA solutions designed specifically for the automotive industry, focusing on low power and high performance.

- Flex Logix Technologies Inc., November 2024 – Acquired by Analog Devices Inc. (ADI) to bolster digital capabilities, particularly in integrating FPGA fabric into SoCs and ASICs.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Bn Forecast Revenue (2034) USD 50.8 Bn CAGR (2025-2034) 25.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (EEPROM, Antifuse, SRAM, Flash, Others), By Application (Data Processing, Consumer Electronics, Industrial, Military and Aerospace, Automotive, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Achronix Semiconductor Corporation, Adicsys, Advanced Micro Devices Inc, Efinix Inc, Flex Logix Technologies Inc., Intel Corporation, Lattice Semiconductor Corporation, Menta S.A.S, Microchip Technology Inc, Quick Logic Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Achronix Semiconductor Corporation

- Adicsys

- Advanced Micro Devices Inc

- Efinix Inc

- Flex Logix Technologies Inc.

- Intel Corporation

- Lattice Semiconductor Corporation

- Menta S.A.S

- Microchip Technology Inc

- Quick Logic Corporation

- Others