Global Electronic Wearable Market Size, Share, Industry Analysis Report By Product (Wrist-Wear, Eyewear & Headwear, Footwear, Neckwear, Body-wear, Others), By Application (Consumer Electronics, Healthcare, Enterprise & Industrial Applications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159665

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

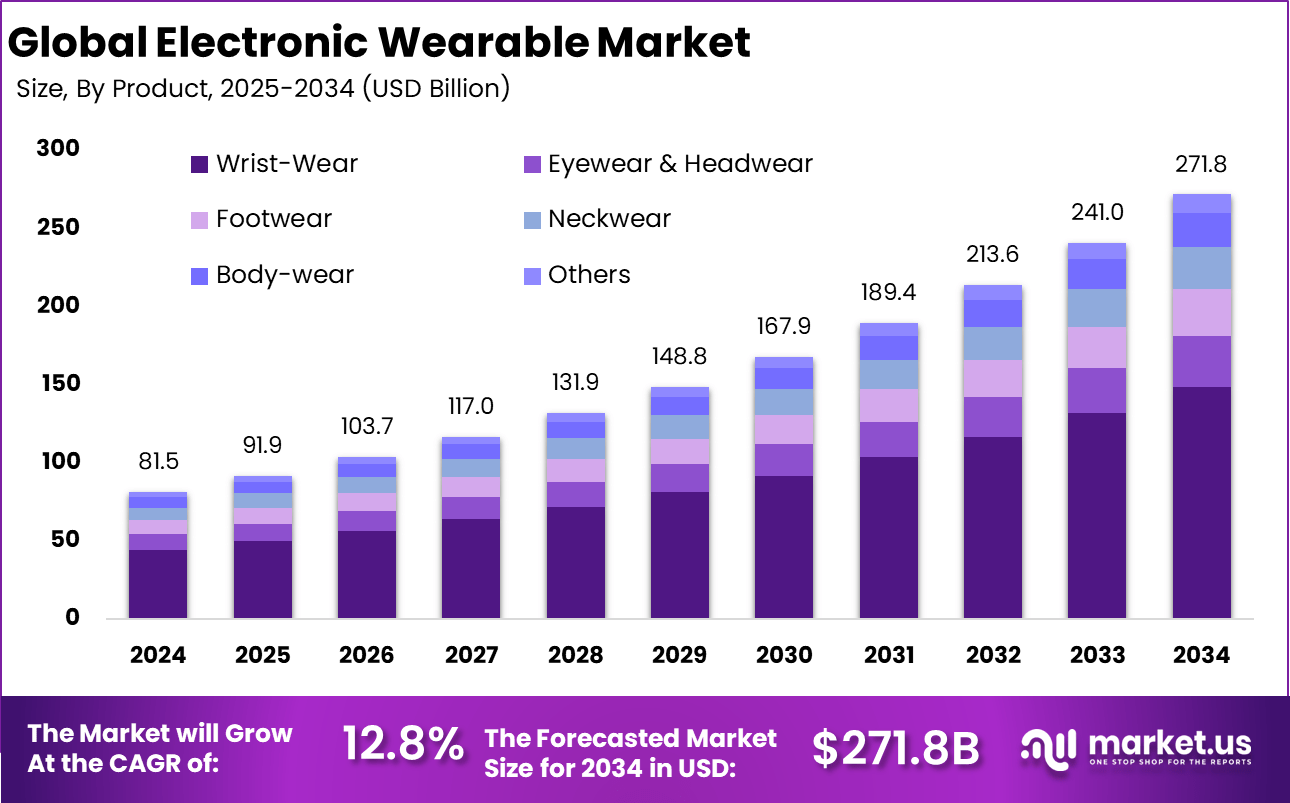

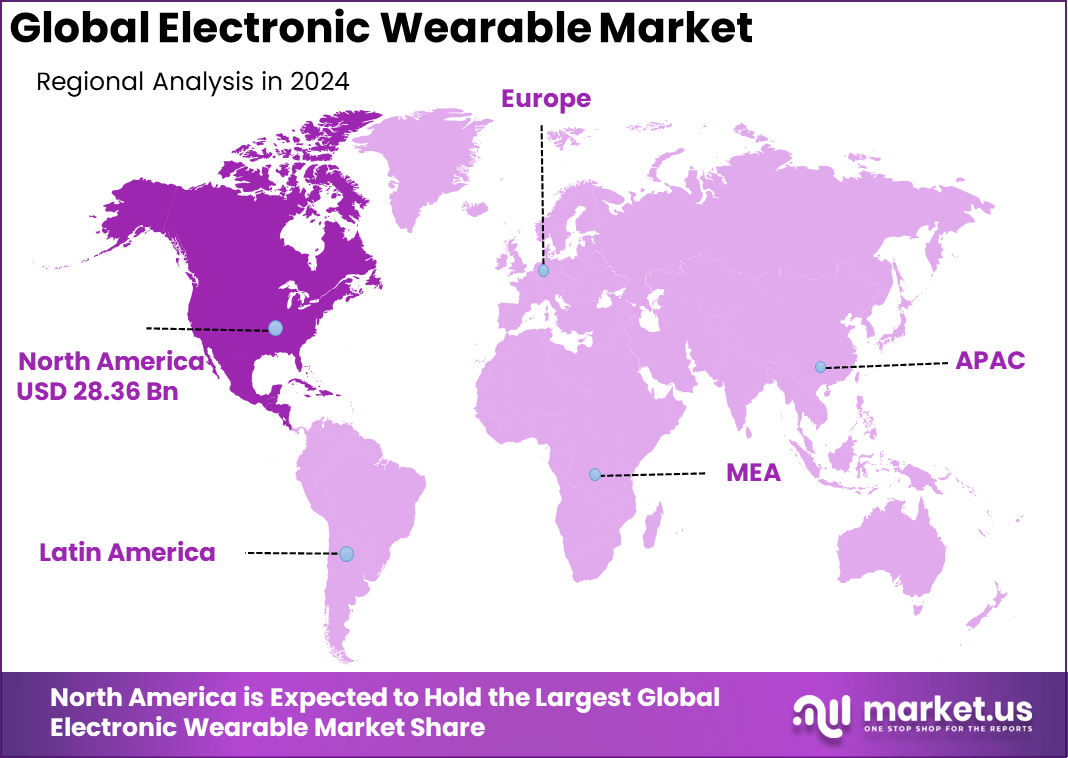

The Global Electronic Wearable Market size is expected to be worth around USD 271.8 billion by 2034, from USD 81.5 billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 28.36 billion in revenue.

The electronic wearable market comprises devices that users can wear on their body or embed in clothing, which include sensors, connectivity, data processing, and sometimes actuation. These wearables include smartwatches, fitness bands, hearables (smart earbuds), smart glasses, smart clothing, smart rings, and health monitoring patches. They collect data, monitor health or environment, deliver notifications, or assist with augmented reality.

One strong driver is the growing consumer interest in health and wellness tracking, such as heart rate, sleep monitoring, step counting, and stress management. Another is improvements in miniaturized sensors, low-power electronics, wireless connectivity, and battery technology, which make wearables more practical.

According to Market.us, The global wearable technology market was valued at USD 70 billion in 2023 and is projected to reach about USD 231 billion by 2032, growing at a CAGR of 14.60%. Growth is driven by rising demand for health monitoring, fitness tracking, and connected devices, supported by continuous advances in sensors and connectivity.

The rise of Internet of Things ecosystems, where wearables interoperate with phones, smart home systems, and cloud platforms, also supports growth. Finally, demand from enterprise, healthcare, and industrial applications for monitoring, safety, and productivity boosts market expansion.

For instance, in September 2025, Huawei launched the Watch GT 6, a new smartwatch designed to compete with Apple’s latest offerings. The Watch GT 6 boasts impressive features, including advanced health tracking capabilities and a remarkable 21-day battery life, positioning it as a strong competitor in the smartwatch market.

Key Takeaway

- By product, Wrist-Wear dominated with 54.7%, highlighting strong consumer preference for smartwatches and fitness trackers.

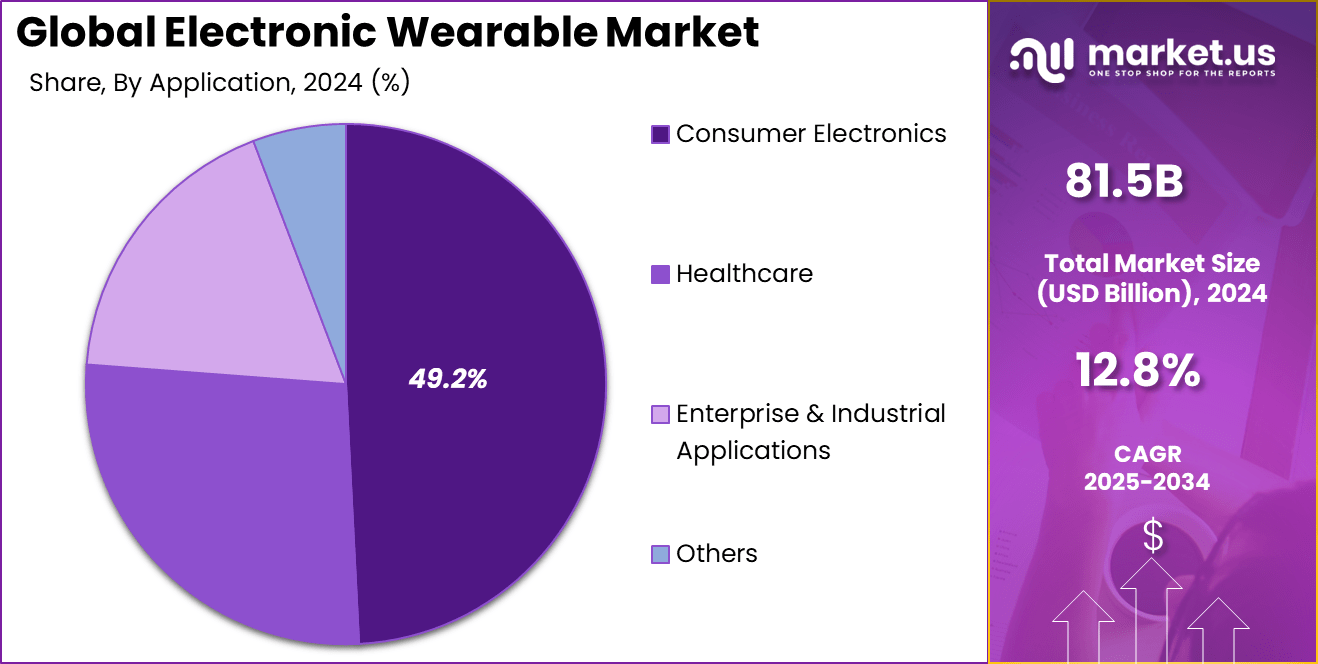

- By application, Consumer Electronics led with 49.2%, reflecting the widespread adoption of wearable devices for personal and lifestyle use.

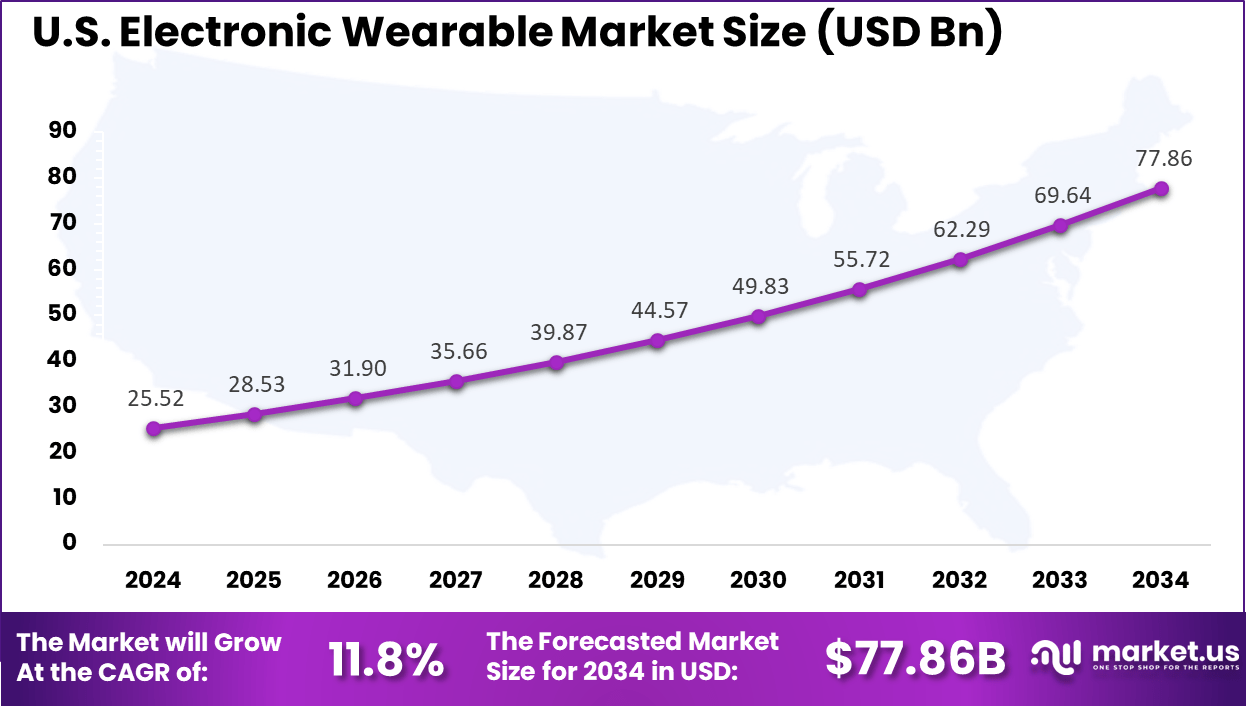

- Regionally, North America held 34.8% of the market, with the U.S. generating about USD 25.52 billion and expanding at a CAGR of 11.8%, driven by high consumer spending and rapid technology upgrades.

Role of Generative AI

Generative AI is playing a significant role in transforming electronic wearables in 2025. It has shifted these devices from simple data trackers to intelligent assistants that offer personalized health recommendations, conversational support, and real-time insights. Currently, generative AI is responsible for about 10% of all data generated, a sharp rise from less than 1% in 2021.

In wearable technology, AI enables advanced features like health scoring and predictive analytics, making the devices deeply integrated into daily wellness management. Around 35% of companies have adopted AI to improve productivity, signaling a strong trend towards AI-driven wearable technology enhancements.

Investment and Business Benefits

Investment opportunities in the wearable market are abundant as companies expand portfolios and enter emerging regional markets. Asia-Pacific, Latin America, and parts of Europe show promising growth due to rising incomes and increasing health consciousness.

Investors find value in sectors like smart clothing, medical wearables, and AR/VR devices that are pushing technological boundaries. Mergers and acquisitions remain active, with established firms acquiring startups to gain competitive edges through innovative technologies.

The business benefits of wearables are clear and multifaceted. Wearable devices boost employee productivity by enabling real-time alerts and reducing non-essential activities. They improve workplace safety by monitoring physical conditions and environmental risks, preventing accidents in high-risk sectors.

On the customer front, wearables provide valuable data insights improving service personalization and enhancing customer experiences. Businesses embracing wearable tech also gain a reputation for innovation, staying ahead in competitive markets through enhanced operational efficiency and customer engagement.

U.S. Market Size

The market for Electronic wearables within the U.S. is growing tremendously and is currently valued at USD 25.52 billion, the market has a projected CAGR of 11.8%. The market is growing tremendously due to increasing health consciousness, rising demand for fitness tracking, and advancements in technology.

With more consumers focusing on personal wellness, wearables offer convenient solutions for monitoring heart rate, sleep patterns, and physical activity. Additionally, the integration of AI and improved sensors has enhanced the functionality of wearables, attracting tech-savvy consumers. The widespread use of smartphones and growing healthcare applications further drives the adoption of wearable devices across the country.

For instance, in June 2025, the U.S. Health Secretary Xavier Becerra announced a campaign led by the Department of Health and Human Services (HHS) to encourage the use of wearable devices for health monitoring across the country. This initiative aims to promote the adoption of wearables to track vital signs, improve chronic disease management, and encourage healthier lifestyles.

In 2024, North America held a dominant market position in the Global Electronic Wearable Market, capturing more than a 34.8% share, holding USD 28.36 billion in revenue. This dominance is due to high consumer demand for advanced health and fitness tracking devices, widespread technology adoption, and strong brand presence.

The region benefits from a tech-savvy population, significant disposable income, and a growing focus on health and wellness. Additionally, the integration of wearables with smartphones, AI, and healthcare systems, along with strong retail and e-commerce platforms, further contributed to the market.

For instance, in February 2022, Motorola and Verizon announced a collaboration to deliver the next generation of wearable technology. This partnership focuses on integrating 5G capabilities into wearable devices, enhancing performance and connectivity for consumers in North America.

Product Analysis

In 2024, Wrist-worn devices dominated the electronic wearable market with 54.7% share. These include smartwatches and fitness trackers that have become part of everyday lifestyle for health monitoring, notifications, and connectivity. The ease of use and compact design make wrist-wear the most convenient form factor for mass adoption.

The segment continues to gain ground as consumers increasingly rely on these devices for activity tracking, heart rate monitoring, and even payment services. Ongoing innovations, such as integration with healthcare platforms and improved battery performance, are further strengthening the position of wrist-wear products in the market.

For Instance, in September 2024, Apple launched the Apple Watch Ultra 3, a new wristwear packed with advanced features like satellite SOS, a 42-hour battery life, and enhanced health tools. This model focuses on providing users with more robust health and safety features, such as real-time heart rate monitoring, ECG, and enhanced fitness tracking.

Application Analysis

In 2024, Consumer electronics made up 49.2% of the application share. Wearable devices in this space are increasingly viewed as personal companions that offer entertainment, fitness tracking, and connected experiences. Their seamless integration with smartphones and wireless ecosystems has helped drive consistent demand.

The segment remains driven by a growing appetite for multifunctional gadgets. As consumers look for devices that combine convenience with style, wearables have evolved from being fitness-only accessories to versatile tech companions that support broader lifestyle needs.

For instance, in May 2025, Google expanded its Gemini AI platform beyond smartphones to include smartwatches, cars, TVs, and XR devices. This move marks a significant shift towards integrating advanced AI capabilities into a broader range of consumer electronics and wearable devices.

Latest Trends

Emerging trends in electronic wearables highlight the growing adoption of augmented reality (AR) and virtual reality (VR) devices alongside traditional wristwear. Smartwatches continue dominating the market with improvements in health monitoring and connectivity. There is also a noticeable rise in smart rings, smart glasses, and digital therapeutics software designed for medical conditions, like Parkinson’s disease.

The market is moving toward more immersive and context-aware experiences, with head-mounted displays becoming common for training and communication purposes. This trend reflects a shift from hardware-only products to solutions that blend real and virtual experiences for users.

Growth Factors

Several growth factors are driving the wearable market, including increasing consumer focus on proactive health management and prevention. Real-time monitoring of vital signs such as heart rate, blood oxygen, and glucose levels is becoming mainstream. Advancements in AI, low-power sensors, and IoT connectivity enhance the wearables’ capabilities and user experience.

Governments and health agencies actively promote wearable adoption for preventive healthcare, contributing to demand. The integration of AR/VR and AI-powered analytics also opens new functional opportunities beyond traditional fitness uses. The global wearable electronics market is growing at an annual rate above 15%, reflecting strong consumer and industrial interest.

Key Market Segments

By Product

- Wrist-Wear

- Eyewear & Headwear

- Footwear

- Neckwear

- Body-wear

- Others

By Application

- Consumer Electronics

- Healthcare

- Enterprise & Industrial Applications

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Growing Demand for Health and Fitness Monitoring

One of the strongest drivers fueling the electronic wearable market is the rising global demand for health and fitness monitoring devices. Consumers today are increasingly health-conscious and prefer wearables that can track vital signs such as heart rate, blood oxygen levels, sleep quality, and physical activity.

This demand is further bolstered by the shift toward preventive healthcare practices, where continuous monitoring helps in early detection of health issues. For instance, the popularity of fitness bands and smartwatches demonstrates the consumer focus on real-time health data, enabling improved lifestyle decisions and fitness goals.

For instance, in August 2024, Huawei introduced its new TruSense System, a cutting-edge health and fitness platform designed to meet the growing demand for advanced fitness tracking in wearables. This system uses advanced sensors and AI to provide more accurate and personalized insights into users’ health, helping individuals track their fitness progress, monitor vital signs, and optimize their workout routines.

Restraint

Battery Life Limitations

One of the biggest challenges for wearable devices is their limited battery life. As manufacturers add more advanced features like GPS, continuous heart rate monitoring, or real-time data tracking, power consumption increases.

For users who rely on wearables for extended periods, the need for frequent charging can be inconvenient. This limitation often affects the overall user experience, particularly for high-performance devices, making longer-lasting battery technology a crucial area for improvement in the wearable market.

For instance, In April 2025, researchers introduced fluid flexible batteries to tackle battery life limitations in wearables. The technology is lightweight, durable, and flexible, offering longer power capacity for devices such as smartwatches and fitness trackers.

Opportunities

Expansion in Emerging Markets

Emerging markets present a notable opportunity for growth in the electronic wearable sector. Regions like India and China are witnessing rapid rises in disposable income along with increasing smartphone penetration and health awareness.

Furthermore, government initiatives supporting digital health, fitness, and telemedicine fuels demand, creating fertile ground for wearable manufacturers to expand. This growing consumer base combined with expanding e-commerce channels means that wearable electronics can reach more users efficiently.

For instance, in July 2024, Samsung expanded its wearables portfolio by introducing a range of new devices aimed at unlocking intelligent health experiences for users. The new products include advanced smartwatches and fitness trackers designed to enhance personal wellness through innovative health monitoring features.

Challenges

Balancing Cost and Ease of Use

One of the biggest challenges for the electronic wearable market is creating devices that offer meaningful value while remaining easy to use and affordable. Consumers often face high costs when purchasing advanced wearables, which limits their accessibility especially in price-sensitive markets.

While premium smartwatches deliver many functions, their elevated price may deter broader adoption among everyday users. Additionally, usability is crucial since wearables target a diverse group that includes less tech-savvy individuals. Simplifying device interfaces and ensuring seamless integration with other technology ecosystems is vital for user acceptance.

For instance, in August 2025, HTC and Google, in partnership with Quanta, launched a new line of AI-powered smart glasses, marking a key milestone in wearable technology. However, with many companies entering the market and offering similar products, increasing saturation is making it harder for new devices to stand out.

Key Players Analysis

The Electronic Wearable Market is led by global technology giants such as Apple Inc., Samsung, Google, and Huawei Technologies. These companies dominate the smartwatch and fitness tracker segments by integrating health monitoring, AI features, and seamless smartphone connectivity.

Consumer electronics brands like Sony, HTC, Xiaomi, LG Electronics, and Motorola Solutions continue to expand their presence with competitive pricing and region-specific product lines. Their devices focus on affordability, battery life, and multi-device compatibility.

Specialized fitness and health monitoring companies including Garmin Ltd., Polar Electro, Withings, CASIO COMPUTER CO., LTD., and TomTom International BV cater to professional athletes and healthcare users. These players offer precision tracking for heart rate, GPS, sleep, and training analytics. ASUSTeK Computer Inc. also contributes through smart accessories focused on connectivity.

Top Key Players in the Market

- SAMSUNG

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- HTC Corporation

- Xiaomi

- ADIDAS AG

- Nike, Inc.

- LG Electronics

- Motorola Solutions, Inc.

- Fossil Group

- Polar Electro

- Withings

- Michael Kors

- CASIO COMPUTER CO., LTD.

- TomTom International BV

- ASUSTeK Computer Inc.

- Others

Note (*): Similar analysis will be provided for other companies as well.

Recent Developments

- May 2025, Huawei launched a new line of wearables emphasizing health and fashion, including the HUAWEI WATCH 5 with enhanced interaction via TruSense system and Multi-sensing X-TAP tech, housed in premium materials for durability and style.

- July 2025, Garmin further expanded by acquiring MYLAPS, a sports timing and performance tracking technology provider. This acquisition complements Garmin’s focus on sports and outdoor wearables by adding integrated timing and analytics tools.

- August 2025, HTC entered the smart glasses market with the VIVE Eagle, a lightweight AI-assisted wearable focused on media capture and assistance without a screen. This marks HTC’s strategic move into AI-powered glasses as part of its broader XR and AI ecosystem.

- September 2025, Huawei secured the top spot in the global wearable market for the second consecutive quarter with a 20.2% share, driven by models like WATCH FIT 4 Series, WATCH GT 5 Series with TruSense, and the WATCH 5 series with advanced battery modes.

Report Scope

Report Features Description Market Value (2024) USD 81.5 Bn Forecast Revenue (2034) USD 271.8 Bn CAGR(2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Wrist-Wear, Eyewear & Headwear, Footwear, Neckwear, Body-wear, Others), By Application (Consumer Electronics, Healthcare, Enterprise & Industrial Applications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAMSUNG, Garmin Ltd., Huawei Technologies Co., Ltd., Apple Inc., Sony Group Corporation, HTC Corporation, Google, Xiaomi, ADIDAS AG, Nike, Inc., LG Electronics, Motorola Solutions, Inc., Fossil Group, Polar Electro, Withings, Michael Kors, CASIO COMPUTER CO., LTD., TomTom International BV, ASUSTeK Computer Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Wearable MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Electronic Wearable MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SAMSUNG

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- HTC Corporation

- Xiaomi

- ADIDAS AG

- Nike, Inc.

- LG Electronics

- Motorola Solutions, Inc.

- Fossil Group

- Polar Electro

- Withings

- Michael Kors

- CASIO COMPUTER CO., LTD.

- TomTom International BV

- ASUSTeK Computer Inc.

- Others