Electronic Skin Patch Market By Product Type (Monitoring & Diagnostic and Therapeutic), By Wireless Connectivity (Connected and Non-connected), By Application (Diabetes Management, Cardiovascular Monitoring, Temperature Sensing, Electrical Stimulation, Motion Sensing, and Patient Monitoring), By End-User (Healthcare Professionals, Consumers, and Athletes and Fitness Enthusiasts), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158202

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

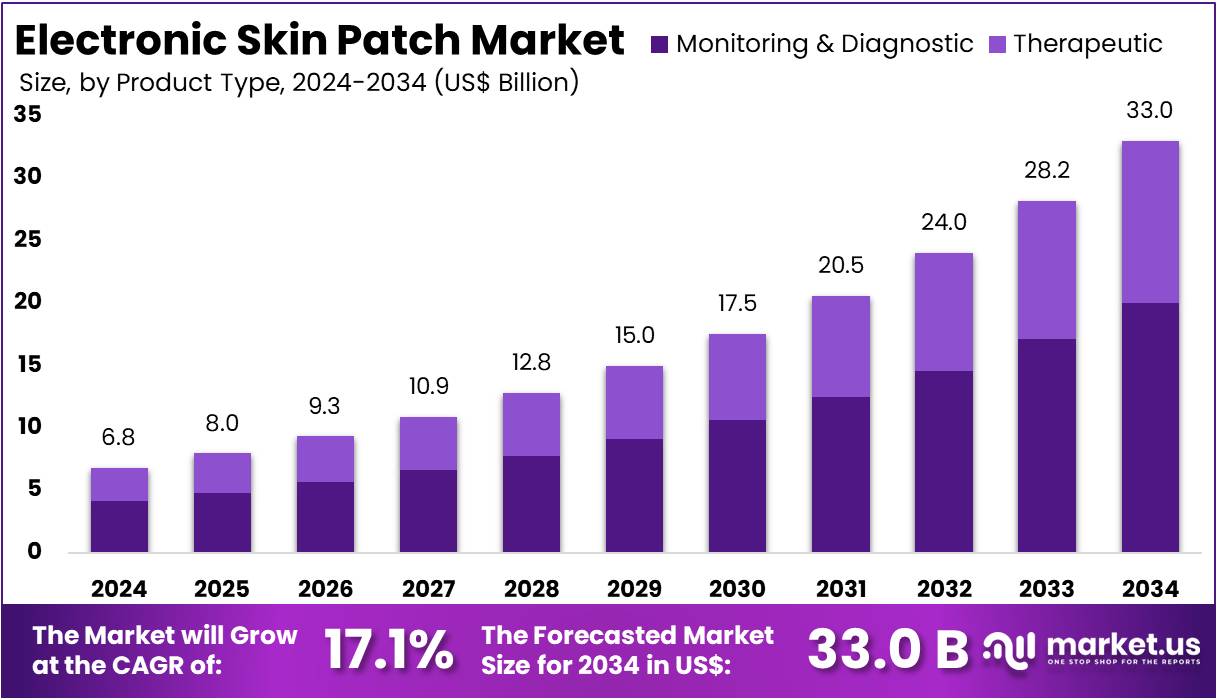

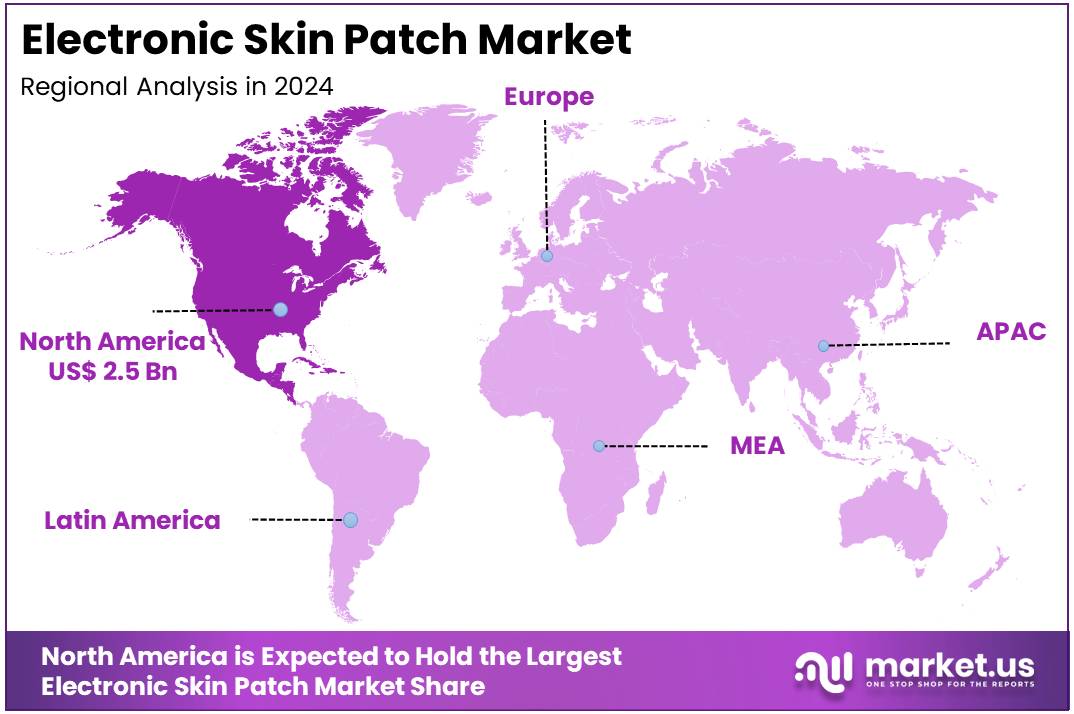

The Electronic Skin Patch Market size is expected to be worth around US$ 33.0 billion by 2034 from US$ 6.8 billion in 2024, growing at a CAGR of 17.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 36.9% share and holds US$ 2.5 Billion market value for the year.

Rising patient demand for convenient and continuous health monitoring is a primary driver of the electronic skin patch market. These flexible, adhesive devices offer a less invasive and more comfortable alternative to traditional monitoring equipment for a range of applications, including vital signs tracking, drug delivery, and pain management. The increasing burden of chronic diseases has further fueled this demand; for instance, the CDC reports that over 59% of adult emergency department visits between 2017 and 2019 were made by individuals with at least one chronic condition, a reality that necessitates better remote management solutions.

Growing collaborations and a focus on advanced materials are key trends shaping the market. Companies are increasingly partnering to integrate new technologies that enhance the functionality and wearability of these patches. For example, in November 2024, Henkel and Linxens announced a collaboration that resulted in a proof of concept for a self-regulating heating element within a skin patch, aimed at improving patient comfort for applications like pain relief and temperature-controlled drug delivery. This development, showcased at the MEDICA trade show, demonstrates the industry’s commitment to creating sophisticated, multi-functional patches that offer both therapeutic benefits and user comfort.

Increasing investment in digital health and the push for regulatory approval are creating significant opportunities for market expansion. The FDA’s Digital Health Center of Excellence is actively advancing the review of new medical devices that incorporate sensor-based technology, including electronic patches. This regulatory support is crucial for building consumer and physician confidence.

As of August 2024, the FDA had authorized over 950 medical devices with AI or machine learning features, many of which are wearables designed for remote patient monitoring. This rapid pace of innovation is enabling the use of electronic skin patches for proactive, predictive health analytics, empowering clinicians to make more informed decisions and paving the way for a new era of personalized medicine.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.8 billion, with a CAGR of 17.1%, and is expected to reach US$ 33.0 billion by the year 2034.

- The product type segment is divided into monitoring & diagnostic and therapeutic, with monitoring & diagnostic taking the lead in 2023 with a market share of 60.7%.

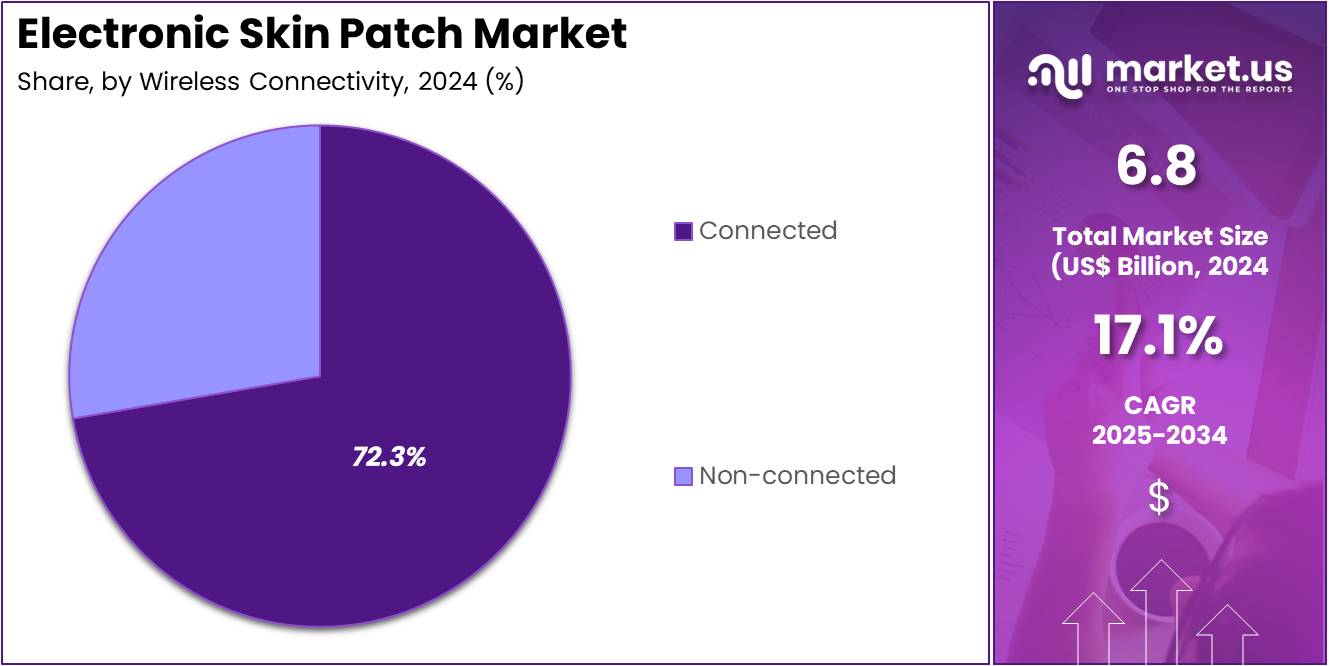

- Considering wireless connectivity, the market is divided into connected and non-connected. Among these, connected held a significant share of 72.3%.

- Furthermore, concerning the application segment, the market is segregated into diabetes management, cardiovascular monitoring, temperature sensing, electrical stimulation, motion sensing, and patient monitoring. The diabetes management sector stands out as the dominant player, holding the largest revenue share of 34.1% in the market.

- The end-user segment is segregated into healthcare professionals, consumers, and athletes and fitness enthusiasts, with the healthcare professionals segment leading the market, holding a revenue share of 50.3%.

- North America led the market by securing a market share of 36.9% in 2023.

Product Type Analysis

Monitoring & diagnostic electronic skin patches hold the largest share of 60.7% in the market. The growth of this segment is expected to continue due to the increasing adoption of wearable healthcare devices for continuous monitoring of vital health metrics. With advancements in sensor technologies, monitoring & diagnostic patches are expected to provide real-time, accurate data for chronic conditions such as diabetes and cardiovascular diseases.

As consumers and healthcare providers increasingly rely on non-invasive and continuous monitoring solutions, the demand for electronic skin patches is likely to rise. In addition, their role in early disease detection and personalized health management is anticipated to drive this segment’s growth. The expanding use of these patches in hospital and home care settings is expected to further fuel their adoption.

Wireless Connectivity Analysis

The connected segment dominates the wireless connectivity category, holding 72.3% of the market. This growth is attributed to the increasing integration of advanced connectivity features, such as Bluetooth and Wi-Fi, into electronic skin patches. These features enable seamless data transmission to mobile devices, health apps, and cloud-based platforms, providing real-time updates on a patient’s health status.

The demand for connected patches is expected to rise as healthcare systems and patients prioritize remote monitoring, especially in managing chronic conditions. The continuous advancements in wireless communication technologies, coupled with the increasing adoption of telemedicine, are projected to further drive the growth of connected electronic skin patches. Their ability to integrate with health management systems makes them a valuable tool for personalized and proactive healthcare.

Application Analysis

Diabetes management is the leading application in the electronic skin patch market, accounting for 34.1% of the segment. This segment’s growth is expected to be driven by the increasing prevalence of diabetes worldwide and the need for continuous glucose monitoring.

Electronic skin patches are anticipated to play a crucial role in diabetes management by providing real-time monitoring of glucose levels, enabling patients to manage their condition more effectively. With the growing shift towards at-home health management, these patches are expected to become an integral part of personalized diabetes care.

Furthermore, the integration of insulin delivery mechanisms in patches, along with continuous glucose monitoring, is expected to boost demand in this segment. As healthcare providers emphasize the importance of proactive diabetes care, the market for electronic skin patches in diabetes management is expected to grow rapidly.

End-User Analysis

Healthcare professionals account for 50.3% of the end-user segment in the electronic skin patch market. This significant share is driven by the increasing use of electronic skin patches in clinical settings for monitoring and diagnosing a range of medical conditions. These patches offer healthcare professionals valuable tools for continuous, non-invasive monitoring of patients, which is expected to improve patient outcomes and reduce healthcare costs.

The ability to remotely track patients’ health status, particularly in chronic disease management, is expected to make these patches indispensable in hospitals and clinics. The growing shift towards patient-centered care, coupled with advancements in telemedicine and wearable health technology, is projected to expand the adoption of electronic skin patches among healthcare professionals. These professionals are likely to play a key role in driving the integration of these devices into routine healthcare practices.

Key Market Segments

By Product Type

- Monitoring & Diagnostic

- Therapeutic

By Wireless Connectivity

- Connected

- Non-connected

By Application

- Diabetes Management

- Cardiovascular Monitoring

- Temperature Sensing

- Electrical Stimulation

- Motion Sensing

- Patient Monitoring

By End-User

- Healthcare Professionals

- Consumers

- Athletes and Fitness Enthusiasts

Drivers

The rising prevalence of chronic diseases is driving the market

The market for electronic skin patches is experiencing significant growth, primarily driven by the increasing global prevalence of chronic diseases, such as diabetes and cardiovascular conditions, that require continuous, long-term monitoring. Traditional methods of monitoring, such as manual blood glucose checks or periodic blood pressure measurements, can be cumbersome, invasive, and may not provide a complete picture of a patient’s health over time.

Electronic skin patches offer a convenient and discreet solution for continuous data collection, enabling more precise and proactive management of these conditions. According to the Centers for Disease Control and Prevention (CDC), in 2021, an estimated 38.4 million Americans, or 11.6% of the total population, had diabetes, with an additional 97.6 million adults having prediabetes. This massive and growing patient population represents a strong and consistent demand for the continuous glucose monitoring (CGM) patches and other wearable biosensors that are becoming a standard of care.

Restraints

Data privacy and cybersecurity risks are restraining the market

A significant restraint on the electronic skin patch market is the serious threat of cybersecurity breaches and the associated data privacy concerns. These devices collect and transmit highly sensitive personal health information, making them prime targets for cybercriminals. A single breach can expose millions of patient records, leading to severe financial penalties for companies and a catastrophic loss of patient trust.

Manufacturers must invest heavily in robust encryption and security protocols to meet stringent regulatory requirements. The scale of this challenge is significant. According to a report by the US Department of Health and Human Services (HHS) Office for Civil Rights (OCR), in 2023, there were 725 large healthcare data breaches that impacted over 133 million individuals.

The vast majority of these breaches were due to hacking incidents. This demonstrates a major vulnerability in the digital healthcare ecosystem and creates a significant headwind for the market, as providers and patients are hesitant to adopt connected medical devices without absolute assurance of data security.

Opportunities

The shift toward remote patient monitoring is creating growth opportunities

A key growth opportunity for electronic skin patches lies in the broader industry shift toward remote patient monitoring (RPM) and home-based healthcare. The increasing focus on value-based care models, which prioritize patient outcomes and cost-effectiveness, has made RPM a cornerstone of modern medicine. By enabling continuous data collection from a patient’s home, electronic skin patches reduce the need for frequent in-person visits and allow healthcare providers to intervene proactively. This is especially beneficial for managing chronic conditions and post-operative care.

The Centers for Medicare & Medicaid Services (CMS) has expanded reimbursement for RPM services, signaling strong institutional support for this care model. A 2024 report by the US Department of Health and Human Services (HHS) Office of Inspector General (OIG) highlighted that Medicare and Medicare Advantage payments for RPM services totaled more than US$300 million in 2022, a dramatic increase from US$15 million in 2019. This growing financial and regulatory support validates the business case for electronic skin patches within the broader RPM ecosystem.

Impact of Macroeconomic / Geopolitical Factors

The electronic skin patch market is significantly influenced by macroeconomic and geopolitical factors. The high prevalence of chronic diseases and the growing demand for continuous health monitoring solutions are major drivers, as electronic skin patches offer a non-invasive and cost-effective alternative to traditional clinical visits. However, economic downturns and high inflation can hinder this growth by reducing consumer purchasing power and leading to budget constraints in healthcare systems, which may delay the adoption of new technologies.

Geopolitical tensions, particularly involving key manufacturing regions, can disrupt the complex global supply chains for the industry. For instance, recent US trade policies imposed steep tariffs on many Indian goods, with a 50% duty taking effect in late August on items such as apparel and jewelry, though key electronic and pharmaceutical products were granted a temporary exemption. These duties on other sectors increase the cost of components and final products for some manufacturers, potentially impacting the market’s growth trajectory and altering supply chain strategies.

Latest Trends

The development of multi-sensor patches for comprehensive data collection is a recent trend

A defining trend in 2024 is the accelerated development and commercialization of multi-sensor electronic skin patches. While early devices often focused on a single parameter, such as heart rate or glucose levels, the newest generation of patches integrates multiple sensors to collect a more comprehensive set of physiological data. For example, a single patch might now measure heart rate, body temperature, respiratory rate, and oxygen saturation simultaneously, providing a more holistic view of a patient’s health.

This ability to monitor multiple vital signs with a single, convenient device is streamlining patient care and providing physicians with richer data for diagnostics and treatment planning. This trend is strongly supported by patent activity. A search of the US Patent and Trademark Office (USPTO) database for 2024 reveals a growing number of patents related to multi-sensor wearable patches. For example, a patent granted in January 2024 to Alfred E. Mann Foundation for Scientific Research covers a “skin patch for sensing or affecting a body parameter,” showcasing the active innovation in creating these integrated, multi-functional devices.

Regional Analysis

North America is leading the Electronic Skin Patch Market

During 2024, the electronic skin patch market experienced substantial growth in North America, which commanded an approximate 36.9% revenue share of the global market. The regional growth stemmed from increasing adoption of remote patient monitoring solutions, a growing geriatric population, and a rising prevalence of chronic conditions like diabetes and cardiovascular disease.

Key players Dexcom and Abbott Laboratories drove significant expansion, for example, Dexcom generated $4.033 billion in revenue during 2024, an 11% increase over 2023, while launching new products like the Dexcom ONE+ CGM system. Favorable regulatory actions by the US Food and Drug Administration also accelerated market expansion; the FDA cleared 235 AI-enabled medical devices in 2024, representing a substantial increase over the 226 devices cleared in 2023. Additionally, the Centers for Disease Control and Prevention documented that cardiovascular disease caused one-third of all deaths in the US in 2023, totaling 919,032 deaths, thus fueling demand for non-invasive monitoring technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The electronic skin patch market is anticipated to grow significantly in the Asia Pacific region during the forecast period. Market expansion is estimated due to a large and aging population, rapid technological advancements in digital healthcare, and a rising prevalence of chronic diseases. The region is also likely to benefit from favorable government policies and increased investment in healthcare infrastructure.

For instance, China’s “Healthy China 2030” initiative reflects a national commitment to enhancing healthcare, including digital health solutions. The International Diabetes Federation also projects a substantial increase in diabetes cases in the region, with the number of adults in the IDF South-East Asia region with diabetes expected to rise from 90 million in 2021 to 151 million by 2045. Similarly, growing awareness and the adoption of advanced wearable solutions, like continuous glucose monitors, are further accelerating market growth throughout the Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

To secure growth in the competitive electronic skin patch market, key players implement a multi-pronged strategy encompassing technological innovation, strategic partnerships, and focused application development. Leading firms invest heavily in research and development to create more advanced, comfortable, and accurate wearable sensors, often integrating AI and flexible electronics to enhance functionality and data analytics.

Companies also establish collaborations with healthcare providers, research institutions, and technology firms to expand market reach and accelerate commercialization. Furthermore, they target specific, high-growth application segments such as continuous glucose monitoring for diabetes management, remote cardiovascular monitoring, and performance tracking for the sports and fitness industry.

Dexcom, Inc. is a global leader in diabetes care technology, specifically for continuous glucose monitoring (CGM) systems. The company designs, develops, and commercializes wearable patches that measure glucose levels in real-time for individuals managing diabetes. Dexcom’s core mission focuses on delivering advanced, user-friendly solutions that provide actionable insights, helping patients and healthcare professionals make informed decisions.

The firm competes with other established medical device companies but maintains a strong market position through continuous product innovation, evidenced by the development of its G6 and G7 CGM systems. Dexcom also strategically partners with insulin pump manufacturers and other technology companies to expand its ecosystem and market penetration.

Top Key Players in the Electronic Skin Patch Market

- VitalConnect

- Medtronic, Inc

- Intelesens Ltd

- Insulet Corporation

- GENTAG, Inc

- Feeligreen

- Epicore Biosystems

- Dexcom, Inc

- Boston Scientific Corporation

- Biolinq Incorporated

- Abbott

- 3M

Recent Developments

- In August 2025: Epicore Biosystems, a developer of sweat-sensing wearables, announced a new partnership with REUS Cares. The partnership involves the deployment of Epicore’s Connected Hydration Armband to combat heat stress among agricultural workers in Latin America. The armband monitors sweat, electrolytes, and fluid losses, providing real-time, personalized hydration guidance. This development shows a key trend of electronic skin patches moving beyond clinical settings to address specific occupational health and safety needs.

- In April 2025: Phantom Neuro, a neuroprosthetics company, announced a US$19 million Series A funding round led by Ottobock. This funding is aimed at advancing the company’s muscle-implant technology for prosthetic limbs. While not a skin patch, this development is highly relevant to the market as it represents a significant investment in a technology that works in conjunction with wearable devices. The technology aims to provide more natural control of robotic systems, which could be integrated with future electronic skin patches for a more complete human-machine interface.

Report Scope

Report Features Description Market Value (2024) US$ 6.8 billion Forecast Revenue (2034) US$ 33.0 billion CAGR (2025-2034) 17.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monitoring & Diagnostic, and Therapeutic), By Wireless Connectivity (Connected, and Non-connected), By Application (Diabetes Management, Cardiovascular Monitoring, Temperature Sensing, Electrical Stimulation, Motion Sensing, and Patient Monitoring), By End-User (Healthcare Professionals, Consumers, and Athletes and Fitness Enthusiasts) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape VitalConnect, Medtronic, Inc, Intelesens Ltd, Insulet Corporation, GENTAG, Inc, Feeligreen, Epicore Biosystems, Dexcom, Inc, Boston Scientific Corporation, Biolinq Incorporated, Abbott, 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Skin Patch MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Electronic Skin Patch MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- VitalConnect

- Medtronic, Inc

- Intelesens Ltd

- Insulet Corporation

- GENTAG, Inc

- Feeligreen

- Epicore Biosystems

- Dexcom, Inc

- Boston Scientific Corporation

- Biolinq Incorporated

- Abbott

- 3M