Global Electronic Filtration Market Size, Share, And Industry Analysis Report By Product Type (Air Filters, Liquid Filters, Gas Filters), By Filtration Technologies (Mechanical Filtration, Adsorption Filtration, Membrane Filtration, Electrostatic Filtration), By Filter Material (Glass Fiber, PP, PTFE, Nylon, PES, Cellulose, Stainless Steel), By End-use (Semiconductor, Consumer Electronics, Industrial Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175488

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

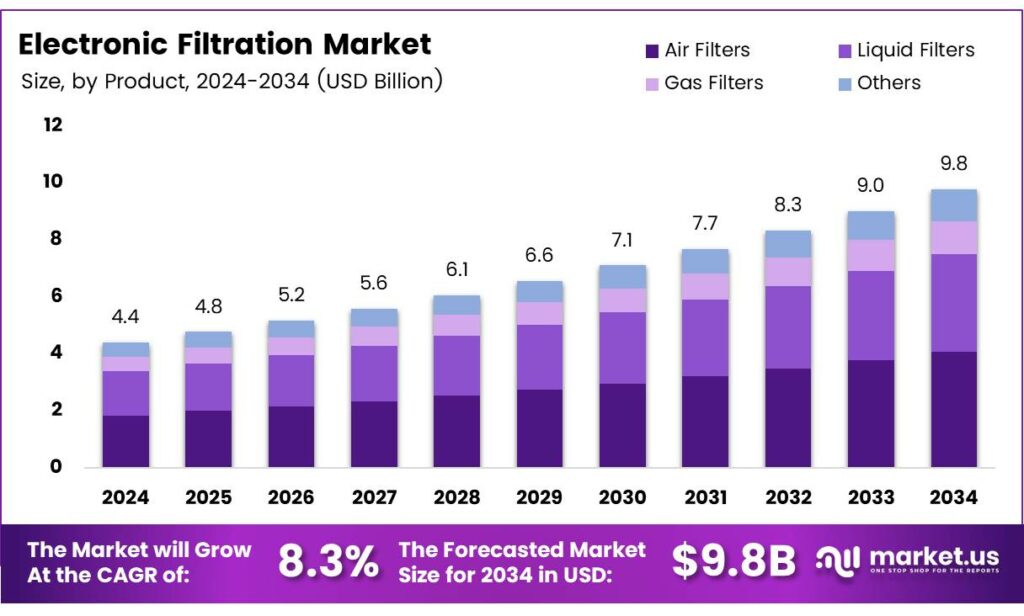

The Global Electronic Filtration Market size is expected to be worth around USD 9.8 billion by 2034, from USD 4.4 billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The Electronic Filtration Market includes advanced systems that use electrostatic, membrane, nanofiber, or hybrid technologies to remove contaminants from air, water, and industrial fluids. These solutions enhance HVAC efficiency, support cleaner manufacturing, and improve precision in laboratory workflows. In labs, membrane filters remain vital for water testing, air sampling, and sterilization, with common pore sizes of 0.2 µm and 0.45 µm and diameters such as 13 mm, 25 mm, 47 mm, and 90 mm to fit modern filtration setups.

The Electronic Filtration Market continues to expand as industries prioritize cleaner environments, efficient purification, and safer workspaces. Growing pollution levels and global health standards push demand for high-efficiency air and water filtration technologies. Additionally, digital monitoring and sensor-enabled filtration are accelerating market modernization.

- Material-engineered membranes also excel in fine-particle capture. PVC/PU membranes achieved over 99.5% efficiency for PM 0.3–0.5 µm, while sericin-coated polyester filters reached ≈56% PM2.5 and PM10 removal. Nanostructured ZIF8–SiO₂ membranes exceeded 99.9% soft-smoke particulate removal, and polypropylene-DMAEMA systems delivered efficiencies between 65% and 76.4%.

Despite strong lab performance, real-world results vary across electronic filtration technologies. An ion-spray carbon-fiber device that reached 47.8% efficiency in laboratory tests decreased to 39.8% in chamber evaluations, and a corona-discharge precipitator showed 67.7% removal for 0.3–0.5 µm particles, 40.6% for 1 µm, and 14.5% for 3 µm at 120 m³/h airflow.

Advanced sensor-integrated filtration systems enhance accuracy by allowing real-time pressure monitoring, with sensors measuring 0–200 Pa and delivering ±0.03 Pa repeatability for reliable digital control. High-performance multilayer media also demonstrate strong filtration potential, with MERV 16-equivalent filters removing 88% of black carbon, 86% of ultrafine particles, and 91% of 0.3–2.5 µm particles, while portable gas-phase units achieve 90–94% efficiency across similar particle ranges.

Key Takeaways

- The Global Electronic Filtration Market is projected to grow from USD 4.4 billion in 2024 to USD 9.8 billion by 2034 at a CAGR of 8.3%.

- Air Filters lead the product segment in 2025 with a 39.9% market share.

- Mechanical Filtration dominates filtration technologies in 2025 with a 34.7% share.

- Glass Fiber is the top filter material in 2025, capturing 29.4% of the market.

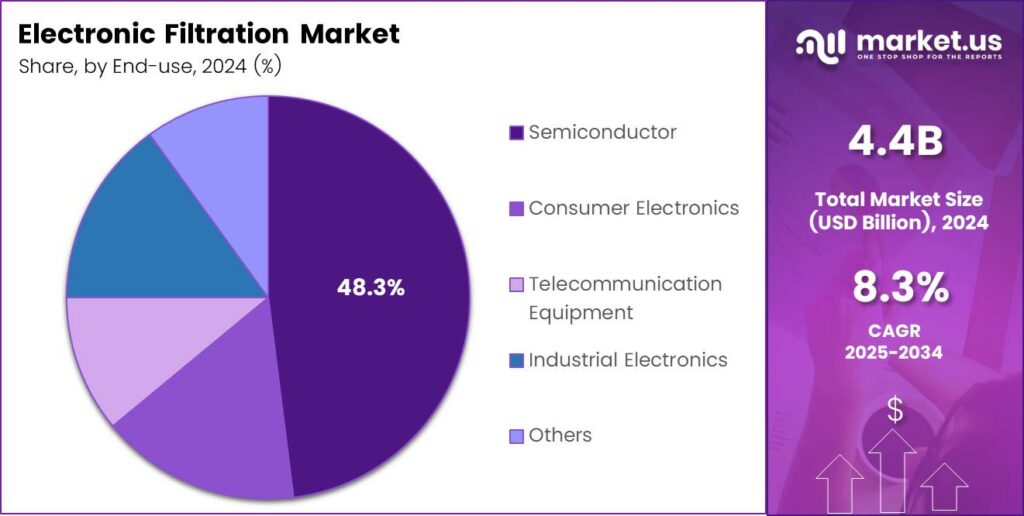

- The Semiconductor segment leads end-use applications in 2025 with a 48.3% share.

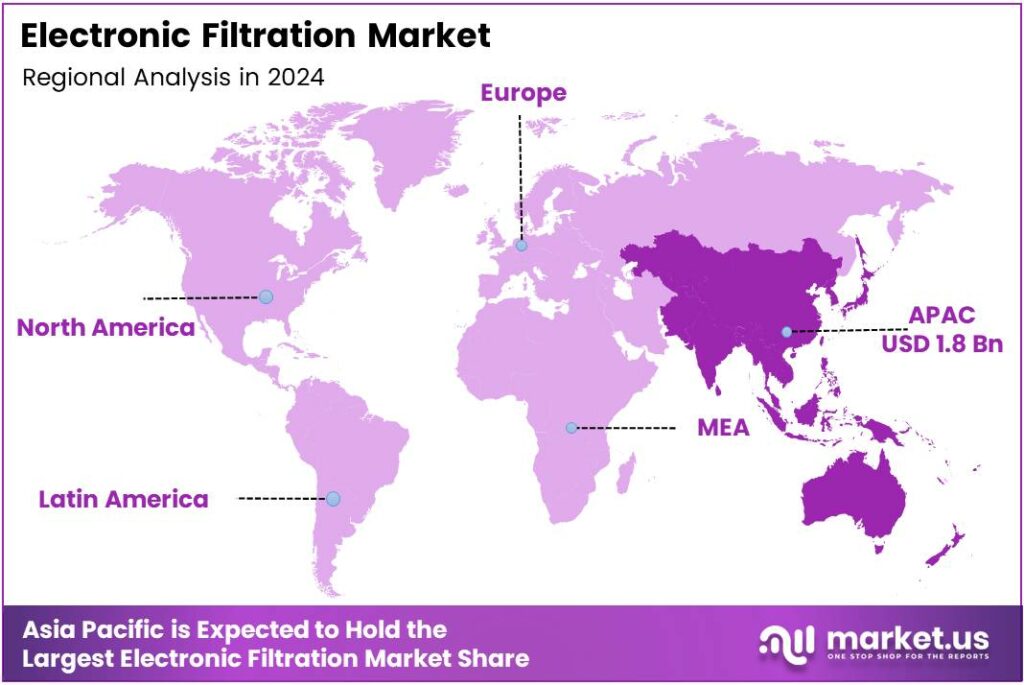

- Asia Pacific is the leading regional market with a 41.2% share valued at USD 1.8 billion.

By Product Type Analysis

Air Filters dominate the Electronic Filtration Market in 2025 with a 39.9% share due to widespread use across semiconductor and electronics applications.

In 2025, Air Filters held a dominant market position in the By Product Type Analysis segment of the Electronic Filtration Market, with a 39.9% share. Their strong adoption stems from rising cleanroom installations, stricter particle-control requirements, and growth in microelectronics production. They continue gaining traction due to efficiency, long service cycles, and regulatory compliance.

Liquid Filters benefited from expanding demand in precision cleaning, cooling systems, and chemical processing used in semiconductor fabrication. Their ability to maintain fluid purity and safeguard sensitive components strengthens their relevance. Growing investment in chip manufacturing and advanced packaging further supports their long-term adoption across global electronic production networks.

Gas Filters witnessed consistent uptake as industries required higher purity levels for process gases like nitrogen, argon, and hydrogen. Their relevance increased with the expansion of controlled-atmosphere environments. Advanced filter media supporting stable process parameters continue driving this segment’s utilization across technology manufacturing clusters worldwide.

Others include specialty filtration types designed for niche operational environments. These solutions support emerging electronic applications needing tailored contamination-control approaches. Their growth is steady as manufacturers invest in customized technologies to align with evolving electronic system requirements and new material innovations across industrial ecosystems.

By Filtration Technologies Analysis

Mechanical Filtration leads the market in 2025 with a 34.7% share due to reliability and broad compatibility.

In 2025, Mechanical Filtration held a dominant market position in the By Filtration Technologies Analysis segment of the Electronic Filtration Market, with a 34.7% share. It remains widely adopted for its cost-effectiveness, simple design, and dependable removal of particulates across electronics manufacturing and cleanroom operations.

Adsorption Filtration continued gaining traction as industries sought solutions that target odors, vapors, and molecular contaminants. Activated carbon and advanced adsorbent media enabled stable and precise filtration performance. Demand increased in semiconductor, display, and component assembly environments requiring enhanced gas-phase contamination control.

Depth Filtration found strong usage in processes requiring multilayer contaminant removal. Its efficiency in trapping fine particles throughout the filter structure makes it suitable for liquid and gas purification used in wafer fabrication and sensitive electronic manufacturing. It remains valued for durability and adaptability across operational conditions.

Membrane Filtration experienced notable adoption due to its ability to achieve extremely fine filtration levels. Microfiltration and ultrafiltration membranes support chemical processing, ultrapure water production, and precision cleaning stages. Increasing miniaturization in electronics continues to reinforce its long-term relevance.

By Filter Material Analysis

Glass Fiber dominates the market in 2025 with a 29.4% share due to high filtration efficiency and thermal stability.

In 2025, Glass Fiber held a dominant market position in the By Filter Material Analysis segment of the Electronic Filtration Market, with a 29.4% share. Its high-temperature resistance, strong particulate capture efficiency, and reliability in semiconductor filtration make it a preferred choice in critical environments.

PP (Polypropylene) filters advanced steadily due to their chemical resistance, affordability, and suitability for liquid filtration applications. They are widely used in cooling systems, chemical baths, and cleaning processes. Growing demand for cost-effective filtration solutions supports this material’s adoption.

PTFE filters gained traction owing to their superior chemical compatibility and excellent durability. They are used extensively in aggressive chemical handling, etching environments, and high-purity applications. Their ability to maintain filtration performance under challenging conditions ensures consistent usage.

Nylon filters remained relevant thanks to their mechanical strength and versatility in both liquid and air filtration processes. They are used in electronics assembly, coating operations, and precision cleaning tasks, supporting stable process outcomes and contamination control.

By End-use Analysis

Semiconductor applications dominate the market in 2025 with a 48.3% share, driven by cleanroom expansion and advanced chip manufacturing.

In 2025, Semiconductor held a dominant market position in the By End-use Analysis segment of the Electronic Filtration Market, with a 48.3% share. Strict purity standards, rising wafer production, and advanced process technologies sustain strong demand for high-performance electronic filtration solutions.

Consumer Electronics applications continued expanding as devices required higher precision and cleaner component processing. Filtration systems support stable manufacturing outcomes across smartphones, wearables, and personal electronics. Growing assembly operations reinforce the segment’s advancement.

Telecommunication Equipment benefited from global 5G infrastructure upgrades. Precision filtration supports the production of optical components, transmitters, and electronic modules. Clean manufacturing processes enable better equipment reliability and improved signal performance.

Industrial Electronics maintained consistent adoption as industrial automation, control systems, and power electronics required reliable filtration support. These applications rely on stable contamination control to preserve product quality, durability, and long-term system performance.

Key Market Segments

By Product Type

- Air Filters

- Liquid Filters

- Gas Filters

- Others

By Filtration Technologies

- Mechanical Filtration

- Adsorption Filtration

- Depth Filtration

- Membrane Filtration

- Electrostatic Filtration

- Others

By Filter Material

- Glass Fiber

- PP

- PTFE

- Nylon

- PES

- Cellulose

- Stainless Steel

- Others

By End-use

- Semiconductor

- Consumer Electronics

- Telecommunication Equipment

- Industrial Electronics

- Others

Emerging Trends

Growing Use of Smart and Energy-Efficient Filtration Technologies Shapes Market Trends

A major trend shaping the electronic filtration market is the increasing use of smart filtration systems. These advanced units come with sensors, IoT connectivity, and real-time monitoring features that help industries track contamination levels and optimize filter performance automatically.

- Miniaturization in electronics manufacturing is also driving demand for high-precision microfiltration technologies. As chips and circuits become smaller and more advanced, industries need ultra-clean production environments to maintain quality. The industry expects 18 new semiconductor fab construction projects to start in 2025 (including 15 new 300mm facilities).

The growth of cleanrooms across semiconductor, biotechnology, aerospace, and EV sectors is further influencing filtration trends. Companies are upgrading to advanced HEPA and ULPA filters to meet strict purity standards. Automation and robotics in factories are also increasing filtration requirements. Clean air and liquid systems help machines operate smoothly and reduce downtime.

Drivers

Rising Need for Clean Air and Contaminant-Free Electronics Drives Market Growth

Electronic filtration systems are gaining strong demand as modern electronic devices require dust-free and particle-free environments to function reliably. With increasing production of semiconductors, PCBs, and sensitive chips, industries are investing heavily in filtration systems that keep contaminants away from manufacturing lines.

The rapid growth of data centers and cloud infrastructure. These facilities generate high heat and require clean airflow to protect servers and prevent operational downtime. As the global digital ecosystem grows, so does the need for air and liquid filtration technologies.

The rise of electric vehicles (EVs) and battery manufacturing is also pushing the market forward. EV components like lithium-ion batteries and power electronics demand highly controlled filtration during production to maintain efficiency and safety standards.

Furthermore, strict government regulations regarding industrial air quality, emissions, and workplace safety are encouraging manufacturers to adopt advanced filtration solutions. These rules help reduce pollutants, protect workers, and improve energy efficiency.

Restraints

High Installation and Maintenance Costs Limit Market Expansion

A major restraint for the electronic filtration market is the high upfront investment required for advanced filtration systems. Industries that use high-precision equipment must install costly air and liquid filtration units, which may not be affordable for small and medium manufacturers.

- In the U.S., a recent CHIPS-for-America update stated that CHIPS for America had awarded approximately $6.72 billion and allocated over $36 billion in proposed funding across 20 states, and that semiconductor and electronics companies have announced over $450 billion in private investments.

Technical complexity also creates limitations. Advanced filtration systems require skilled technicians to operate and maintain them. Many developing regions face a shortage of trained professionals, delaying the adoption of modern filtration technologies.

Growth Factors

Increasing Adoption of Clean Manufacturing Technologies Creates New Growth Opportunities

The electronic filtration market is witnessing strong opportunities as more industries shift to cleanroom manufacturing. Sectors like semiconductors, EV batteries, and medical electronics are expanding rapidly, creating a large need for precision filtration systems that maintain ultra-clean environments.

Another major opportunity lies in the explosive growth of data centers worldwide. As governments and companies invest in cloud services, cybersecurity, and AI infrastructure, the demand for efficient air filtration to protect high-value IT assets is increasing significantly.

Emerging markets such as India, Southeast Asia, and Latin America are also building new electronics manufacturing facilities. These regions are adopting modern filtration technologies to meet global quality standards, providing suppliers with large expansion potential.

Regional Analysis

Asia Pacific Dominates the Electronic Filtration Market with a Market Share of 41.2%, Valued at USD 1.8 Billion

The Asia Pacific region leads the global Electronic Filtration Market, accounting for a significant 41.2% share and reaching USD 1.8 billion in value due to rapid industrialization, strong electronics manufacturing hubs, and increasing cleanroom adoption across China, Japan, and South Korea. Expanding semiconductor production and government support for high-tech manufacturing further strengthen the region’s dominance.

North America maintains a strong position supported by its mature semiconductor sector, stringent contamination control standards, and rising adoption of high-performance filtration systems in data centers and precision manufacturing facilities. The U.S. plays a leading role in driving innovation, particularly in microelectronics and aerospace. Growing cleanroom expansions and the surge in chip fabrication projects add steady momentum to the market.

Europe shows stable market growth driven by its expanding electronics manufacturing base, strong emphasis on environmental compliance, and rising demand for filtration within automotive electronics and industrial automation. Countries such as Germany and France focus on high-efficiency filtration technologies to ensure quality production.

The Middle East & Africa region is emerging gradually, supported by industrial diversification initiatives and rising investments in high-tech infrastructure. Growth in sectors like telecommunications, clean energy, and precision manufacturing is creating new needs for electronic filtration. While still developing, the region benefits from government-backed technology adoption in countries such as the UAE and Saudi Arabia.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Entegris, Inc. remains one of the most influential players in electronic filtration in 2025 because its portfolio is built around contamination control for advanced semiconductor manufacturing, where yield losses are expensive, and tolerances keep shrinking. From an analyst lens, its strength is the ability to support both leading-edge fabs and mature nodes with filtration solutions that fit tightly into process workflows, helping customers reduce defect risk while keeping uptime stable.

Mott Corporation stands out for engineered porous media and precision filtration components that suit harsh chemical handling and high-purity process environments commonly seen in electronics production. In 2025, the company’s positioning benefits from demand for durable, repeatable filtration performance in critical tools and sub-systems, especially where reliability and long service life can lower the total cost of ownership for manufacturers.

Porvair Filtration Group continues to gain relevance in 2025 by serving multiple electronic manufacturing needs, from high-efficiency filtration to specialized materials and assemblies used in controlled environments. Its competitive edge is flexibility—supporting a wide set of applications linked to cleanroom operations and process protection—making it a practical supplier choice for customers balancing performance requirements with procurement continuity.

Cobetter Filtration is increasingly visible in 2025 due to its focus on high-purity filtration products that align well with electronics and semiconductor supply chains looking for scalable sourcing. From a market standpoint, the company benefits when buyers diversify vendors and expand capacity, and its growth potential is strongest where consistent quality, validation support, and fast fulfillment directly influence production stability.

Top Key Players in the Market

- Entegris, Inc.

- Mott Corporation

- Porvair Filtration Group

- Cobetter Filtration

- Graver Technologies

- Pall Corporation

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- Clean Rooms International

- Honeywell

Recent Developments

- In 2025, Entegris focus on advancing contamination control technologies in liquid and gas filtration for semiconductor and microelectronics manufacturing. Launch of the Azora Photochemical Bulk Filter, featuring groundbreaking filtration media designed to enhance performance in bulk chemical and point-of-use filtration applications for critical photochemical processes.

- In 2025, Mott Corporation has emphasized innovations in high-purity filtration for semiconductor and related high-tech sectors, alongside expansions in clean energy and defense applications that intersect with electronic filtration needs. Unveiled the GasShield HiFlow Sandwich Filter, engineered for next-generation semiconductor fabrication with high particle retention (over 9 LRV at 1.5 nm) and improved flow rates to address increasing demands in fab environments.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 9.8 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Air Filters, Liquid Filters, Gas Filters, Others), By Filtration Technologies (Mechanical Filtration, Adsorption Filtration, Depth Filtration, Membrane Filtration, Electrostatic Filtration, Others), By Filter Material (Glass Fiber, PP, PTFE, Nylon, PES, Cellulose, Stainless Steel, Others), By End-use (Semiconductor, Consumer Electronics, Telecommunication Equipment, Industrial Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Entegris, Inc., Mott Corporation, Porvair Filtration Group, Cobetter Filtration, Graver Technologies, Pall Corporation, Donaldson Company, Inc., Parker Hannifin Corporation, Clean Rooms International, Honeywell Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Electronic Filtration MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Electronic Filtration MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Entegris, Inc.

- Mott Corporation

- Porvair Filtration Group

- Cobetter Filtration

- Graver Technologies

- Pall Corporation

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- Clean Rooms International

- Honeywell