Global Electromagnetic Therapy Device Market Analysis By Power (Low Frequency, High Frequency), By Application (Pain management, Bone Growth, Others), By End-use (Hospitals, Home Care Settings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 18600

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

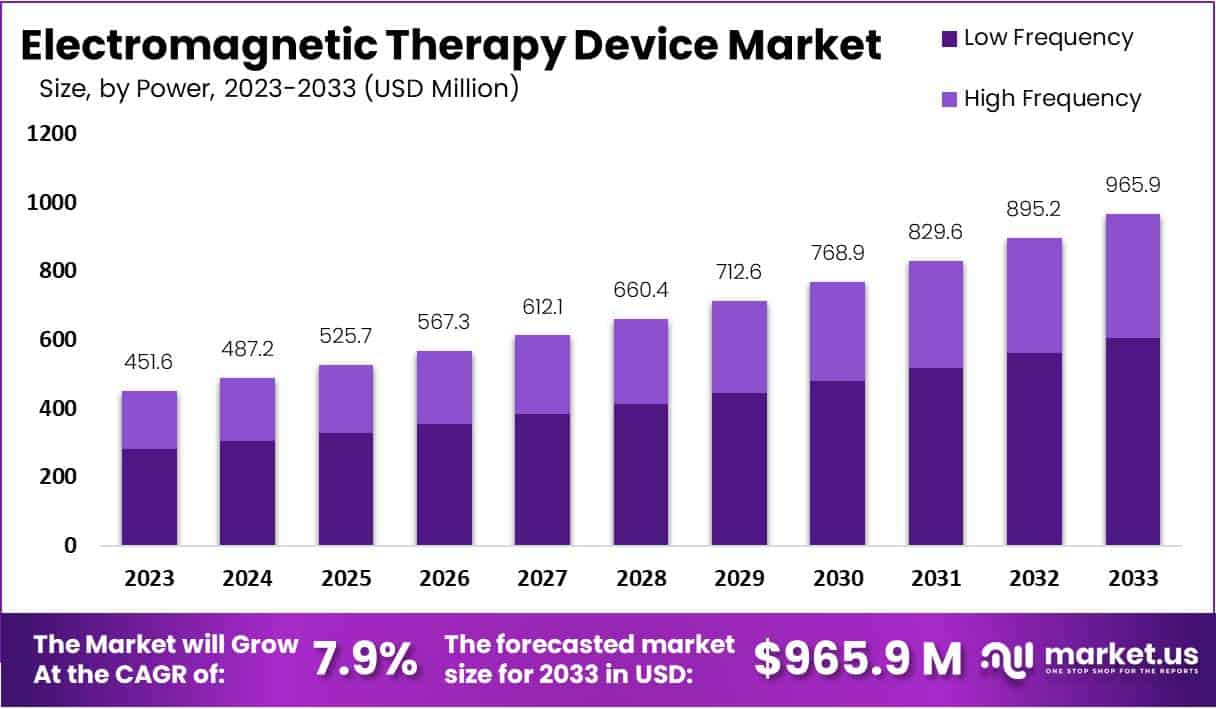

The Electromagnetic Therapy Device Market Size is projected to reach approximately USD 965.9 million by 2033, showing a significant increase from the 2023 figure of USD 451.6 million. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 7.9% during the forecast period spanning from 2024 to 2033.

Electromagnetic devices are medical devices that use electromagnetic pulses in electromagnetic therapy. Electromagnetic therapy is a somehow pseudoscientific form of alternative medicine that claims to treat disease by applying electromagnetic radiation to the body. Magnetic energy exists in our body and it controls the heartbeats, stimulates muscles, and more.

Each molecule in the human body contains a small amount of magnetic energy. Electromagnetic Therapy Devices are commonly used in Bone Growth, Pain Relief, and other fields. The assumption is that imbalance due to electromagnetic frequencies causing illness in the body can be corrected by electromagnetic therapy.

Electromagnetic therapy is also known as bioelectricity, magneto biology, magnetic field therapy, and magnetic healing. Applications like instant pain relief, bone growth, etc are expected to grow this market. The use of Devices is supplementary to surgery this could anticipate driving the market. US food and drug Administration (FDA) has approved some instruments this could help to boost the market.

Key Takeaways

- Market Growth: Projected market size of USD 965.9 million by 2033, with a 7.9% CAGR from 2024 to 2033, a significant increase from the 2023 figure of USD 451.6 million.

- By Power: Low Frequency devices hold 62.5% market share in 2023, preferred for safety and efficacy, reflecting nuanced consumer preference.

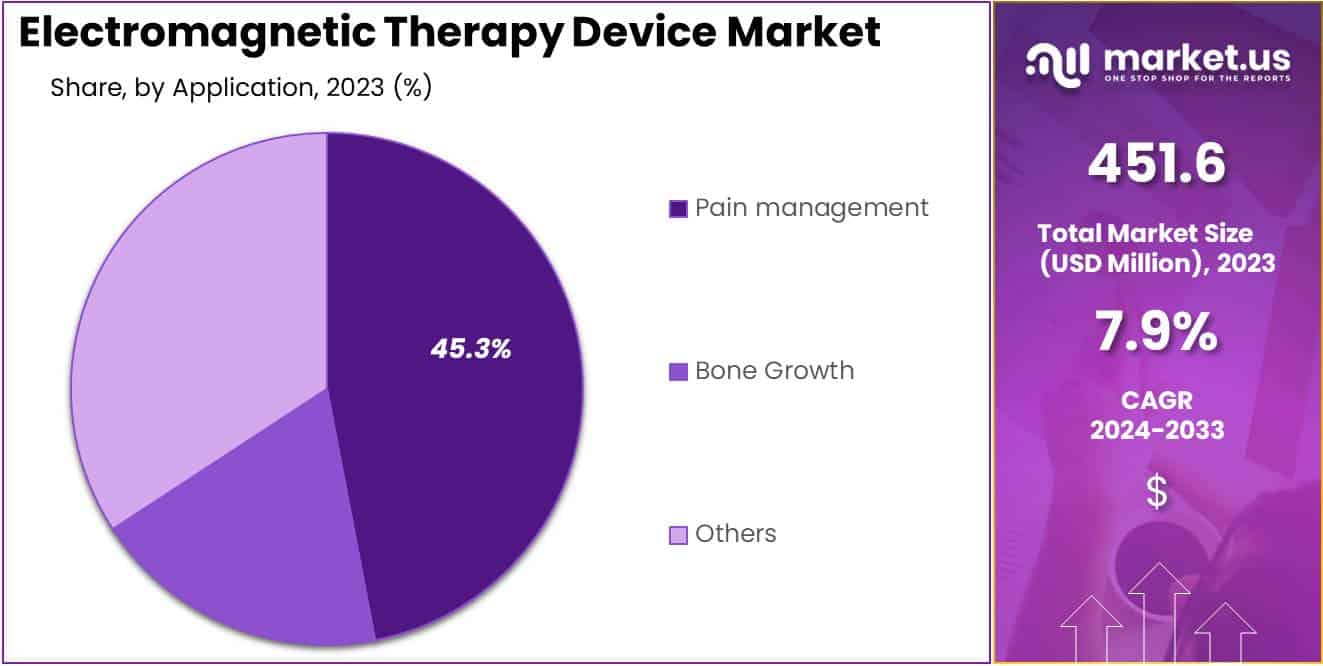

- Application Leadership: Pain management leads with 45.3% market share in 2023, followed by Bone Growth and a diverse Others category.

- End-use Dynamics: Hospitals dominate with 51.8% market share in 2023, while home care settings gain traction due to portability and ease of use.

- Drivers: Advancements in wearable electromagnetic therapy devices for injury recovery and growing clinical studies supporting therapy benefits.

- Restraints: High costs of advanced devices hinder widespread adoption, coupled with perceived lack of robust clinical evidence on long-term safety and efficacy.

- Opportunities: Integration of electromagnetic therapy with IoT and AI for personalized solutions, expanding application scope to new therapeutic areas.

- Trends: Pulsed Electromagnetic Field (PEMF) technology gaining acceptance, rising demand for wearable devices, and development of affordable Over-the-Counter (OTC) products.

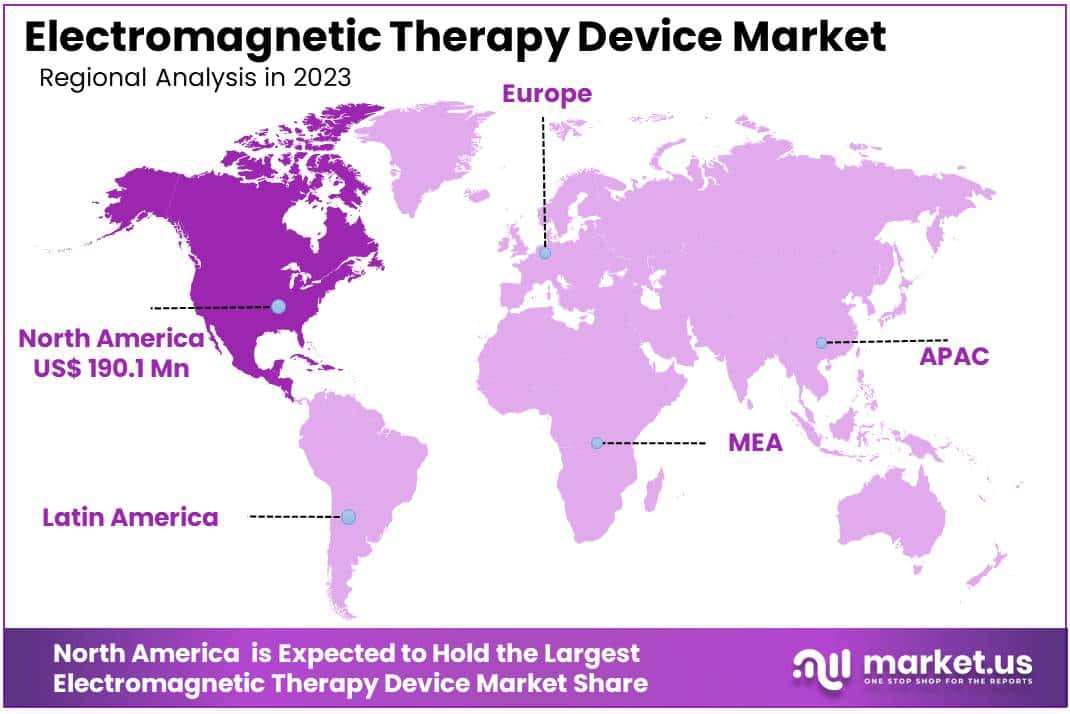

- Regional Insights: North America dominates with 42.1% market share and USD 190.1 million in 2023, while Asia Pacific anticipates the fastest CAGR, driven by supportive policies and rising healthcare awareness.

Power Analysis

In 2023, the Electromagnetic Therapy Device market showcased a noteworthy dominance in the Low Frequency segment, securing a substantial market share of over 62.5%. This indicates a prevailing preference among consumers for devices operating at lower frequencies.

Low Frequency devices, characterized by their gentle yet effective electromagnetic waves, have garnered significant popularity due to their perceived safety and efficacy. The majority share held by this segment can be attributed to the growing awareness and acceptance of these devices for various therapeutic applications.

Conversely, the High Frequency electromagnetic therapy devices, known for their targeted and intense approach, appeal to a specific set of users seeking more concentrated therapeutic benefits.

The market dynamics suggest a nuanced consumer preference, with a substantial inclination towards the gentler effects of Low Frequency devices. This trend may stem from a heightened emphasis on user comfort and safety in the ever-evolving landscape of health and wellness. As the market continues to evolve, monitoring shifts in consumer preferences within these distinct segments will be crucial for stakeholders aiming to capitalize on emerging opportunities.

Application Analysis

In 2023, the Pain management segment emerged as a dominating posiotin in the Electromagnetic Therapy Device Market, commanding a substantial market share of over 45.3%. This segment’s dominance can be attributed to the growing demand for non-invasive solutions in addressing pain-related issues. The user-friendly and effective nature of electromagnetic therapy devices for pain management has garnered widespread acceptance among both healthcare professionals and patients.

Additionally, the Bone Growth application segment showcased significant traction in the market, securing a notable position. With a clear focus on aiding bone regeneration and healing processes, electromagnetic therapy devices have become pivotal in orthopedic treatments. This segment’s adoption is fueled by the increasing incidence of bone-related disorders and the desire for advanced, efficient therapeutic options.

Furthermore, the market witnessed notable contributions from the Others category, encompassing various applications beyond pain management and bone growth. This diverse segment includes applications in areas such as wound healing, neurological disorders, and inflammation reduction. The versatility of electromagnetic therapy devices in addressing a spectrum of health concerns positions this segment as an exciting and evolving space within the market.

End-use Analysis

In 2023, the electromagnetic therapy device market witnessed a significant presence in various end-use segments, with hospitals emerging as the dominant players. Securing a commanding market share of over 51.8%, hospitals exhibited a robust demand for these therapeutic devices, reflecting the growing adoption of electromagnetic therapy within clinical settings.

Hospitals, being key healthcare facilities, showcased a strong inclination towards integrating electromagnetic therapy devices into their treatment protocols. The reliability and efficacy of these devices contributed to their widespread use in hospitals, where healthcare professionals leverage their benefits for diverse medical applications.

The home care settings also demonstrated noteworthy traction, comprising a substantial portion of the market. With a discernible market share, individuals increasingly embraced electromagnetic therapy within the comfort of their homes. The ease of use and portability of these devices played a pivotal role in their popularity in home care settings, offering patients a convenient and accessible means of incorporating electromagnetic therapy into their wellness routines.

Beyond hospitals and home care, the market extended its reach to other segments, displaying a dynamic landscape. Various healthcare facilities and wellness centers contributed to the broader adoption of electromagnetic therapy devices, albeit with a comparatively smaller market share. These segments leveraged the versatility of these devices to address specific health concerns and promote overall well-being.

Key Market Segments

Power

- Low Frequency

- High Frequency

Application

- Pain management

- Bone Growth

- Others

End-use

- Hospitals

- Home Care Settings

- Others

Drivers

Advancements in electromagnetic therapy technology such as wearable devices for injury recovery

The world of electromagnetic therapy is undergoing rapid advancements, particularly in the realm of wearable devices. These innovative technologies are reshaping the landscape of injury recovery. Wearable electromagnetic therapy devices offer the convenience of on-the-go treatment, allowing individuals to seamlessly incorporate healing into their daily lives. These technological strides not only enhance the effectiveness of therapy but also cater to the contemporary lifestyle preferences of users.Increasing proof from clinical studies validating the benefits and efficacy of electromagnetic therapy

The credibility of electromagnetic therapy is receiving a substantial boost with a growing body of evidence from rigorous clinical studies. The scientific community is increasingly validating the tangible benefits and efficacy of electromagnetic therapy. This robust empirical support is instilling confidence among healthcare practitioners and consumers alike, fostering a more widespread acceptance of electromagnetic therapy devices as reliable tools for various health concerns.Restraints

High costs of the latest electromagnetic therapy devices making it difficult for widespread adoption

The cutting-edge electromagnetic therapy devices come with a hefty price tag, posing a significant barrier to their widespread adoption. Think of it as a high entry fee – not everyone can afford the latest and most advanced devices. This financial hurdle limits the accessibility of these devices, potentially preventing many individuals and healthcare institutions from embracing this technology.

Perceived lack of strong clinical evidence by critics on long-term safety and efficacy

Critics in the field express concerns about the long-term safety and efficacy of electromagnetic therapy devices, creating a perception that there isn’t sufficient solid clinical evidence supporting their use. It’s akin to skepticism – even if the devices show promise, doubts linger about their long-term impact. This skepticism can deter potential users, including healthcare professionals, from embracing the technology until more robust evidence is available to address these concerns.

Opportunities

Combining Electromagnetic Therapy with Latest Technologies (IoT, AI, etc.)

Integrating electromagnetic therapy with cutting-edge technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) can enhance the effectiveness of treatments. This can enable personalized solutions by adapting therapy parameters based on real-time data and individual responses.

Smart and connected electromagnetic therapy devices can provide more accurate and tailored treatments, optimizing outcomes for users. Additionally, the integration of AI can lead to continuous improvements and advancements in therapy protocols based on data analysis and machine learning.

Expanding Application Scope to New Therapeutic Areas

Further research and development can expand the application of electromagnetic therapy beyond its current uses. Exploring therapeutic areas like wound healing, tissue regeneration, and other emerging fields present opportunities for market growth.

Diversifying the application scope opens up new markets and allows electromagnetic therapy devices to address a broader range of health conditions. This expansion can also lead to partnerships with healthcare professionals and institutions for clinical applications.

Growth Opportunities in Developing Regions with Traditional Medicine

In regions where traditional medicine is still widely practiced, there is potential to integrate electromagnetic therapy into existing healthcare practices. This can be done by showcasing the complementary nature of electromagnetic therapy alongside traditional treatments.

This approach allows companies to tap into markets with established healthcare practices, providing an additional and modern therapeutic option. Collaboration with local healthcare providers and adapting products to suit cultural preferences can enhance acceptance and adoption in these regions.

Trends

Devices with Pulsed Electromagnetic Field (PEMF) Technology

Pulsed electromagnetic field (PEMF) technology is increasingly finding acceptance in clinical settings, thanks to its promising therapeutic benefits. The growing body of clinical studies and research supporting the effectiveness of PEMF for a range of health conditions is playing a key role in this acceptance.

The market for devices integrating PEMF technology is experiencing robust growth, reflecting a rising preference among healthcare professionals and patients for this type of electromagnetic therapy. The pulsating nature of electromagnetic fields is thought to offer positive effects on tissue repair and pain management, contributing to the popularity of PEMF in the healthcare field.

Wearable Electromagnetic Therapy Devices

The demand for wearable electromagnetic therapy devices is on the rise, driven by the growing need for convenient and continuous support in injury recovery. These devices are gaining popularity, especially among athletes and those with active lifestyles, as they allow individuals to undergo electromagnetic therapy while going about their daily activities.

The appeal lies in the convenience and mobility offered by these wearables, allowing users to apply therapy directly to the affected area. This trend signifies a shift towards healthcare solutions that prioritize consumer needs and a preference for non-invasive, on-the-go treatment options.

Affordable Over-the-Counter (OTC) Products

Companies in the electromagnetic therapy device market are working towards creating and launching cost-effective over-the-counter products. The goal is to make electromagnetic therapy more easily available to a larger audience, enabling people to buy and utilize these devices without requiring a prescription.

By concentrating on the retail sector, businesses aim to reach a wider market, connecting with consumers who are keen on self-care and home-based therapy. This shift aligns with the increasing inclination of consumers to actively participate in maintaining their health and well-being.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 42.1% share and holds USD 190.1 million market value for the year. North America’s large share can be attributed to the high adoption of advanced electromagnetic therapy devices, a strong presence of key manufacturers, and a well-established healthcare infrastructure.

The United States is the major contributor to the North American electromagnetic therapy device market owing to the rising geriatric population, increasing incidence of chronic pain, and a growing preference for non-invasive treatment options. Moreover, supportive government initiatives to promote the development and adoption of advanced medical devices are facilitating market growth.

The Asia Pacific electromagnetic therapy device market is anticipated to expand at the fastest CAGR over the forecast period. Supportive government policies, rising healthcare expenditure, and increasing consumer awareness regarding advanced therapeutic options are prime factors driving regional growth. Emerging markets such as China, India, and South Korea are expected to contribute substantially owing to improving healthcare access and infrastructure.

Europe accounts for the second largest share of the global electromagnetic therapy devices industry. High adoption of technologically advanced products, developed healthcare infrastructure, and presence of key players are favoring regional growth. Germany, France, Italy, Spain, and the UK are major revenue contributors. The rising burden of musculoskeletal disorders coupled with growing geriatric population is spurring the adoption.

The Latin America and Middle East & Africa markets are projected to exhibit moderate growth over the forecast timeline. Developing healthcare infrastructure, rising medical tourism, and improving reimbursement scenario are favoring the adoption of electromagnetic therapy devices.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Electromagnetic Therapy Device Market is characterized by a diverse array of key players, each making significant contributions to the industry. Bedfont Scientific, Orthofix Holdings, I-Tech Medical Division, and other key players collectively drive innovation, quality, and accessibility in electromagnetic therapy devices, shaping a market that is responsive to evolving healthcare needs.

Bedfont Scientific, distinguishes itself with its innovative solutions. Known for its commitment to advancing healthcare technology, Bedfont Scientific consistently introduces cutting-edge electromagnetic therapy devices that cater to diverse medical needs. The company’s emphasis on research and development positions it as a frontrunner, ensuring a steady flow of novel products to meet evolving market demands.

Orthofix Holdings, brings a wealth of experience and expertise to the Electromagnetic Therapy Device landscape. Renowned for its comprehensive portfolio of orthopedic solutions, Orthofix has successfully extended its reach into electromagnetic therapy device market. The company’s strong focus on quality and patient outcomes underscores its significance in the market, contributing to the overall growth and competitiveness of the industry.

The I-Tech Medical Division introduces devices that merge technological innovation with healthcare efficacy. The division’s strategic approach to addressing specific medical challenges ensures its devices are well-received, providing healthcare professionals with reliable tools for electromagnetic therapy.

In addition to these major players, there are other key contributors shaping the Electromagnetic Therapy Device Market. These players, though diverse in their offerings, collectively enhance the market landscape. Their unique perspectives and product offerings contribute to the overall competitiveness and dynamism of the market, ensuring a broad spectrum of choices for healthcare providers and patients alike.

Electromagnetic Therapy Device Market Key Players are

- Bedfont Scientific

- Orthofix Holdings

- I-Tech Medical Division

- OSKA

- Medithera

- NiuDeSai

- Nuage Health

- Oxford Medical Instruments Health

- Bemer

Recent Developments

- In October 2023, Boston Scientific acquired ElMind Therapeutics for $165 million, marking a strategic move to enhance its neuromodulation portfolio. With ElMind’s non-invasive transcranial magnetic stimulation (TMS) therapy devices designed for treating depression and various neurological conditions, Boston Scientific aims to broaden its impact on patient care. The acquisition is expected to expedite ElMind’s commercialization efforts, extending the reach of its innovative technology to a more extensive patient population.

- In September 2023, BTL Industries introduced the EmSculpt Neo Body Sculpting System, an upgraded version of its well-received EmSculpt device. This advanced system combines high-intensity focused electromagnetic (HIFEM) and radiofrequency (RF) energy simultaneously, promising faster and more effective results in muscle building and fat reduction. The EmSculpt Neo is set to make waves in the aesthetic medical devices market.

- In June 2023, Hyperice launched the Vyper GO 2.0 Percussion Massage Gun, adding to its line of innovative recovery technologies. This portable and powerful massage gun boasts improved ergonomics, quieter operation, and an extended battery life, catering to the needs of athletes and fitness enthusiasts who are always on the move. The Vyper GO 2.0 is designed to provide effective and convenient percussion massage therapy.

Report Scope

Report Features Description Market Value (2023) USD 451.6 Mn Forecast Revenue (2033) USD 965.9 Mn CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Power (Low Frequency, High Frequency), By Application (Pain management, Bone Growth, Others), By End-use (Hospitals, Home Care Settings, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bedfont Scientific, Orthofix Holdings, I-Tech Medical Division, OSKA, Medithera, NiuDeSai, Nuage Health, Oxford Medical Instruments Health, Bemer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electromagnetic Therapy Device MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Electromagnetic Therapy Device MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Bedfont Scientific

- Orthofix Holdings

- I-Tech Medical Division

- OSKA

- Medithera

- NiuDeSai

- Nuage Health

- Oxford Medical Instruments Health

- Bemer