Global Electric SUV Market Size, Share, Growth Analysis By Vehicle Type (Compact, Mid-size, Full-size), By Propulsion Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Hybrid Electric Vehicles), By Vehicle Range (Up to 250 km, 250-500 Km, Above 500 Km), By Drive Type (FWD, RWD, AWD), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157081

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

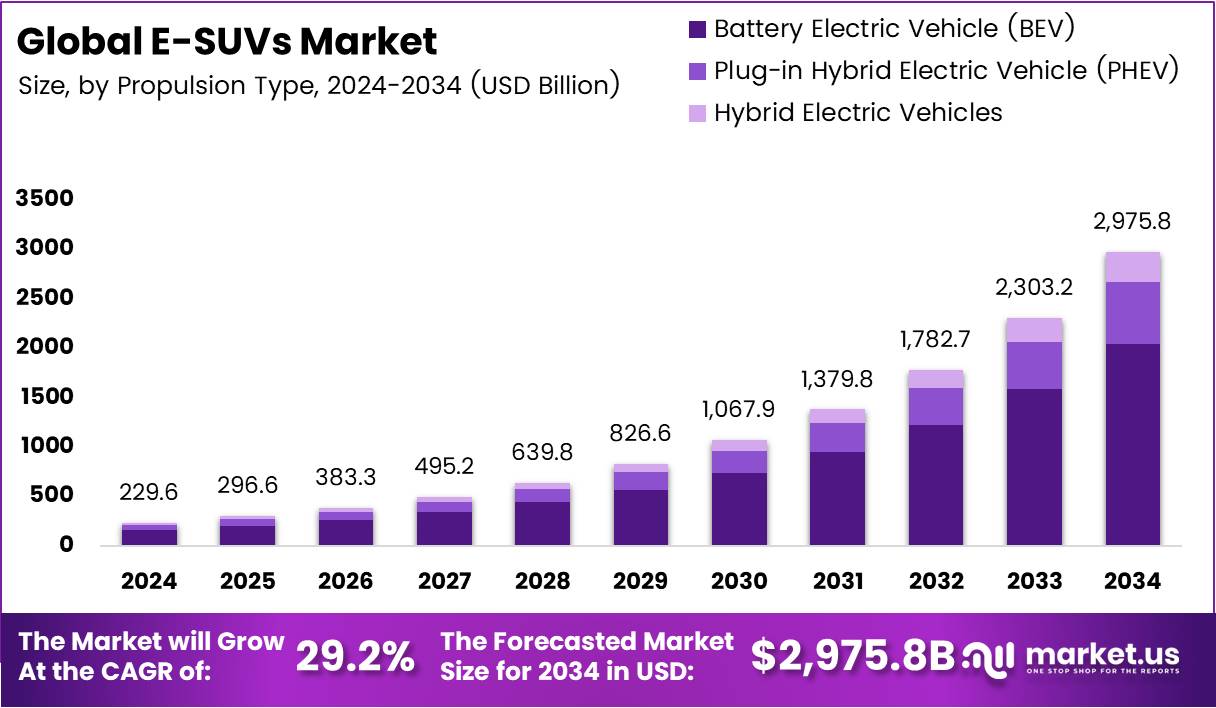

The Global Electric SUV Market size is expected to be worth around USD 29.2 by 2034, from USD 229.6 Billion in 2024, growing at a CAGR of 29.2% during the forecast period from 2025 to 2034.

The Electric SUV market is experiencing a significant transformation as consumers increasingly shift towards eco-friendly transportation solutions. With advancements in battery technology and growing environmental awareness, electric SUVs have gained momentum. The market is anticipated to grow rapidly, driven by consumer demand for energy-efficient vehicles, and enhanced driving experiences with advanced features.

Government policies and regulations play a pivotal role in driving this market’s growth. Incentives such as tax credits and rebates for electric vehicle (EV) purchases are encouraging consumer adoption. Additionally, regulations targeting emissions reductions are compelling automakers to invest in electric mobility. Such initiatives create a favorable environment for the expansion of the Electric SUV market.

The increasing adoption of electric SUVs is also bolstered by improvements in battery technology. Enhanced driving ranges and faster charging capabilities are addressing the common pain points faced by early adopters of electric vehicles. Consequently, consumers are becoming more confident in their transition to electric mobility, especially for SUVs, which traditionally have been associated with high fuel consumption.

Electric SUVs represent a substantial opportunity for automakers. They provide an avenue for companies to tap into the growing demand for sustainable vehicles while capitalizing on the shift away from traditional gasoline-powered SUVs. The market is expected to expand as a result of innovation in design, features, and vehicle performance tailored to meet consumer needs.

According to AutoInsurance, 95% of EV and hybrid car owners were satisfied with their current vehicles. This statistic highlights the increasing satisfaction rates among consumers, further reinforcing the growing interest in electric SUVs. Additionally, between 2011 and 2023, total EV sales in the U.S. increased from 17,763 to 1,456,484 vehicles, with an average year-over-year growth of 53%, according to AutoInsurance.

Key Takeaways

- The Global Electric SUV Market is expected to be worth around USD 29.2 Billion by 2034, from USD 229.6 Billion in 2024, growing at a CAGR of 29.2% during 2025 to 2034.

- In 2024, Compact vehicles held a dominant market position in By Vehicle Type Analysis segment, with a 39.3% share.

- In 2024, Battery Electric Vehicle (BEV) led the By Propulsion Type Analysis segment with a 68.7% share.

- In 2024, the 250-500 Km range held a dominant market position in the By Vehicle Range Analysis segment with a 57.1% share.

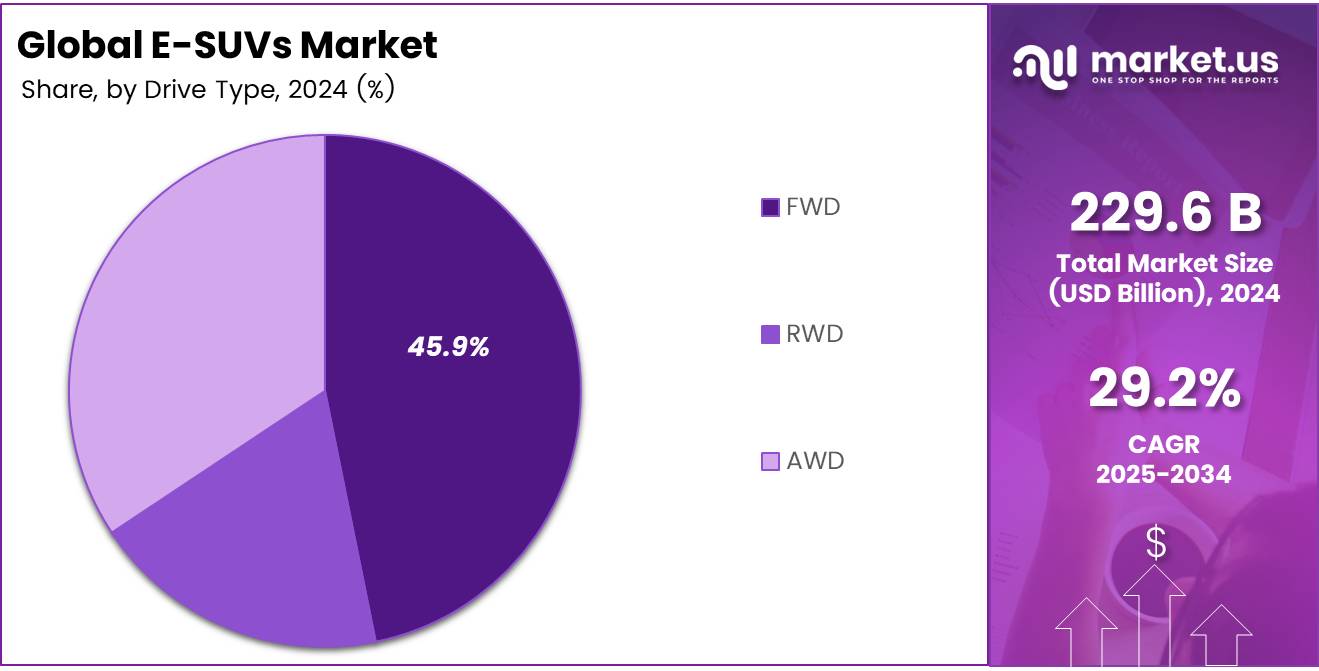

- In 2024, FWD dominated the By Drive Type Analysis segment with a 45.9% share.

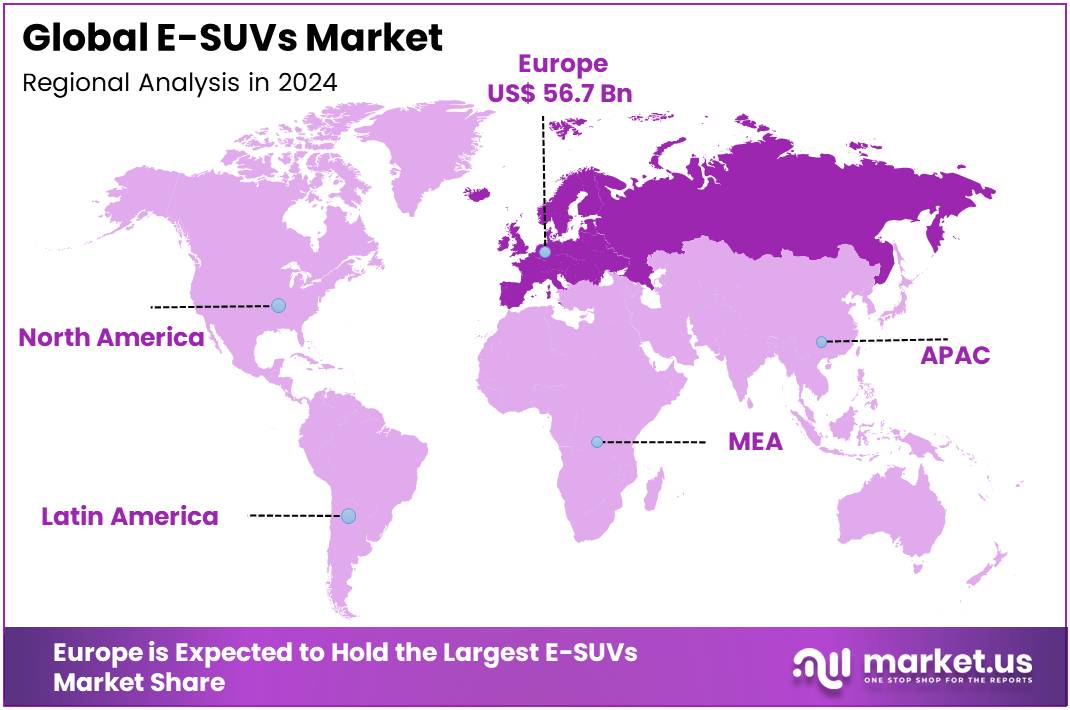

- Europe is the dominant region, holding 43.8% of the market share, valued at USD 56.7 Billion.

Vehicle Type Analysis

Compact dominates with 39.3% due to its optimal balance of affordability and urban practicality.

In 2024, Compact held a dominant market position in By Vehicle Type Analysis segment of Electric SUV Market, with a 39.3% share. This segment’s leadership reflects consumer preference for vehicles that offer the versatility of an SUV while maintaining maneuverability in urban environments and competitive pricing.

Mid-size electric SUVs represent a significant portion of the market, appealing to families seeking more interior space and cargo capacity without compromising on electric efficiency. These vehicles strike an ideal balance between practicality and performance, making them attractive to mainstream consumers transitioning from conventional vehicles.

Full-size electric SUVs cater to premium buyers and those requiring maximum space and towing capabilities. Despite representing a smaller market share, this segment commands higher profit margins and demonstrates the technological advancement of electric powertrains in larger vehicle applications. The segment continues to grow as charging infrastructure improves and range anxiety decreases among consumers considering larger electric vehicles.

Propulsion Type Analysis

Battery Electric Vehicle (BEV) dominates with 68.7% due to its zero-emission operation and advancing battery technology.

In 2024, Battery Electric Vehicle (BEV) held a dominant market position in By Propulsion Type Analysis segment of Electric SUV Market, with a 68.7% share. This commanding presence demonstrates consumer confidence in pure electric technology and the maturation of charging infrastructure supporting long-distance travel.

Plug-in Hybrid Electric Vehicle (PHEV) serves as a transitional technology for consumers seeking electric driving benefits while maintaining the security of conventional fuel backup. This segment appeals to buyers with longer commutes or limited access to charging infrastructure, offering flexibility in various driving scenarios.

Hybrid Electric Vehicles represent the entry point for consumers exploring electrification without full commitment to plug-in technology. These vehicles provide improved fuel efficiency and reduced emissions compared to conventional SUVs while requiring no changes to existing refueling habits. The segment continues to attract price-conscious consumers and those in regions with developing electric infrastructure, serving as a bridge toward full electrification adoption.

Vehicle Range Analysis

250-500 Km dominates with 57.1% due to its practical balance between daily usability and charging frequency.

In 2024, 250-500 Km held a dominant market position in By Vehicle Range Analysis segment of Electric SUV Market, with a 57.1% share. This range category perfectly addresses the needs of most consumers, providing sufficient capacity for daily commuting, weekend trips, and occasional longer journeys without frequent charging stops.

Up to 250 km range vehicles typically represent more affordable options, appealing to urban consumers with shorter daily driving requirements and reliable access to home or workplace charging. These vehicles often feature smaller battery packs, resulting in lower purchase prices and making electric SUVs accessible to a broader consumer base.

Above 500 Km range vehicles cater to premium buyers and those requiring extended driving capabilities without charging interruptions. This segment demonstrates the technological advancement of battery technology and appeals to consumers with long commutes or frequent intercity travel requirements. While representing a smaller market share, these vehicles command premium pricing and showcase the potential of electric SUV technology for all driving scenarios.

Drive Type Analysis

FWD dominates with 45.9% due to its cost-effectiveness and sufficient performance for most driving conditions.

In 2024, FWD held a dominant market position in By Drive Type Analysis segment of Electric SUV Market, with a 45.9% share. Front-wheel drive systems offer manufacturers cost advantages while providing adequate traction and performance for typical SUV usage, making electric SUVs more accessible to mainstream consumers.

RWD configurations appeal to performance-oriented buyers seeking enhanced driving dynamics and weight distribution benefits. This drivetrain choice often accompanies premium electric SUV models, offering superior acceleration and handling characteristics that showcase the instant torque advantages of electric powertrains.

AWD systems target consumers prioritizing all-weather capability and maximum traction control. This configuration proves particularly attractive in regions with challenging weather conditions or for buyers requiring enhanced off-road capabilities. While adding complexity and cost, AWD systems demonstrate the versatility of electric powertrains in delivering power to multiple wheels with precise control, enhancing both safety and performance in various driving conditions.

Key Market Segments

By Vehicle Type

- Compact

- Mid-size

- Full-size

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicles

By Vehicle Range

- Up to 250 km

- 250-500 Km

- Above 500 Km

By Drive Type

- FWD

- RWD

- AWD

Drivers

Government Support and Enhanced Infrastructure Accelerate Electric SUV Adoption

Government subsidies and tax breaks are making electric SUVs more affordable for everyday families. These financial incentives help reduce the high upfront costs that often discourage buyers from switching to electric vehicles. Urban and suburban households are particularly benefiting from these programs, leading to faster adoption rates.

The global expansion of fast-charging networks specifically designed for electric SUVs is removing range anxiety concerns. These charging stations can power up large electric vehicles quickly, making long-distance travel more practical. As more charging points become available, consumers feel more confident about purchasing electric SUVs.

Consumer preferences are shifting toward premium SUVs that produce zero emissions. Buyers want the space and comfort of traditional SUVs but with environmental benefits. This trend is driving automakers to focus more resources on developing high-end electric SUV models.

Battery technology continues to improve significantly. New lithium-ion and solid-state batteries are becoming more efficient and can store more energy in larger vehicles like SUVs. These improvements mean electric SUVs can travel longer distances on a single charge, making them more appealing to consumers who need reliable transportation for daily commutes and family trips.

Restraints

Limited Infrastructure and Performance Concerns Slow Electric SUV Market Growth

The biggest challenge facing electric SUV adoption is the lack of charging infrastructure in rural and semi-urban areas. While cities have many charging stations, smaller towns and countryside locations often have few or no options. This creates problems for people who live outside major metropolitan areas or those who frequently travel to remote locations.

Many potential buyers worry about electric SUVs’ ability to tow heavy loads like boats, trailers, or campers. Traditional gas-powered SUVs are known for their strong towing capacity, but electric versions may struggle with the same tasks. This concern is particularly important for families and businesses that regularly haul equipment or recreational vehicles.

Performance in extreme weather conditions remains another significant concern. Cold temperatures can reduce battery efficiency, limiting how far electric SUVs can travel. Hot weather can also affect battery performance and charging speeds. These issues make some consumers hesitant to rely on electric SUVs as their primary vehicle, especially in regions with harsh seasonal weather patterns that could leave them stranded.

Growth Factors

Advanced Technology Integration Creates New Growth Opportunities for Electric SUVs

Vehicle-to-grid technology represents a major opportunity for electric SUV growth. This system allows electric SUVs to send stored energy back to the power grid during peak demand periods. Owners can earn money by selling excess battery power, making electric SUVs not just transportation but also energy storage investments that benefit both consumers and utility companies.

Luxury and performance electric SUV models are targeting wealthy consumers who want both environmental responsibility and premium features. These high-end vehicles offer superior technology, comfort, and performance while maintaining zero emissions. This market segment is willing to pay premium prices for advanced electric SUVs with cutting-edge features.

Partnerships between car manufacturers and renewable energy companies are creating sustainable charging solutions. These collaborations develop charging stations powered by solar or wind energy, making electric SUVs truly environmentally friendly from energy source to wheels. Such initiatives appeal to environmentally conscious consumers.

Fleet and ride-sharing services in major cities are increasingly adopting electric SUVs. These businesses benefit from lower operating costs and positive environmental branding. As more commercial operators choose electric SUVs, it demonstrates their reliability and cost-effectiveness to individual consumers.

Emerging Trends

Smart Technology and Material Innovation Shape Electric SUV Market Trends

Artificial intelligence is transforming electric SUV interiors with advanced infotainment systems and self-driving capabilities. These AI features provide personalized driving experiences, improved safety, and enhanced connectivity. Consumers increasingly expect their vehicles to offer smartphone-like functionality and autonomous driving assistance, making these technologies essential for market competitiveness.

Automakers are using lightweight composite materials to improve electric SUV efficiency. These advanced materials reduce vehicle weight without compromising safety or durability. Lighter vehicles require less energy to operate, extending battery range and improving overall performance. This trend helps address consumer concerns about electric SUV limitations.

Over-the-air software updates are becoming standard in electric SUVs. These wireless updates can improve vehicle performance, add new features, and fix problems without requiring dealership visits. This technology keeps vehicles current and can even enhance battery efficiency or add entertainment options long after purchase.

Adventure-focused consumers are driving demand for rugged electric SUVs designed for off-road use. These specialized vehicles combine environmental benefits with outdoor capability, appealing to consumers who want to explore nature responsibly. Manufacturers are developing electric SUVs specifically for camping, hiking, and other outdoor activities.

Regional Analysis

Europe Dominates the Electric SUV Market with a Market Share of 43.8%, Valued at USD 56.7 Billion

Europe is the dominant region in the electric SUV market, accounting for 43.8% of the total market share, valued at USD 56.7 billion. This strong position is driven by robust government incentives for electric vehicles, growing environmental concerns, and increasing consumer demand for green alternatives. Additionally, the presence of several established automotive manufacturers in the region contributes to the market’s growth.

Asia Pacific Electric SUV Market Trends

Asia Pacific is witnessing significant growth in the electric SUV market, supported by strong consumer demand and advancements in electric vehicle technology. The region’s growth is fueled by major investments in electric mobility infrastructure and incentives for sustainable transportation, particularly in countries like China and Japan. Although the region does not hold the leading share, its market potential is substantial.

North America Electric SUV Market Insights

North America holds a noteworthy position in the electric SUV market, bolstered by rapid technological advancements and strong consumer interest in eco-friendly vehicles. The U.S., in particular, benefits from government policies and growing investments in charging infrastructure. The market is expected to continue growing as electric vehicle adoption increases across the region.

Middle East and Africa Electric SUV Market Trends

The Middle East and Africa region is experiencing gradual growth in the electric SUV market, driven by increased awareness of environmental concerns and a shift toward sustainable transportation. While the market share remains smaller compared to other regions, growing interest in electric vehicles is expected to lead to steady expansion in the coming years.

Latin America Electric SUV Market Trends

Latin America’s electric SUV market is still in the early stages but is expected to grow due to increasing environmental awareness and favorable government policies. The market share remains limited compared to other regions, but emerging economies and government support are gradually encouraging the adoption of electric vehicles across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric SUV Company Insights

In 2024, Tesla Inc. holds a prominent position in the global Electric SUV market, benefiting from its strong brand presence and innovative technology. Tesla’s commitment to electric vehicles (EVs) and continuous advancements in battery technology position it as a leading player, contributing significantly to market growth.

BYD Company Ltd. has made impressive strides in the Electric SUV market, particularly in China, with a broad range of EV offerings. The company’s competitive pricing strategy and strong local manufacturing capabilities have fueled its market share growth, particularly in emerging markets, making it a formidable contender in the global electric vehicle segment.

Hyundai Motor Company continues to expand its footprint in the Electric SUV market with its diverse lineup of electric vehicles, including the Ioniq 5 and Kona Electric. Hyundai’s commitment to sustainable mobility and rapid adoption of electric powertrains has allowed it to capture significant market share, with strong demand across both developed and developing markets.

Toyota Motor Corporation has been a key player in the automotive industry, and although it has been relatively cautious in fully embracing electric vehicles, its investments in hybrid technologies and upcoming EV models like the bZ4X demonstrate its readiness to ramp up production. Toyota’s strong reputation for reliability and innovative hybrid solutions positions it well for future success in the growing electric SUV market.

Top Key Players in the Market

- Tesla Inc.

- BYD Company Ltd.

- Hyundai Motor Company

- Toyota Motor Corporation

- Nissan Motor Corporation

- Kia Corporation

- Ford Motor Company

- Volkswagen AG

- AB Volvo

- Honda Motor Co., Ltd.

- Chevrolet

Recent Developments

- In August 2025, electric cars eligible for a £3,750 discount were announced, aiming to make EVs more affordable for a broader range of consumers and accelerate adoption. This initiative is part of the UK government’s strategy to meet its carbon reduction goals and promote sustainable transportation.

- In August 2025, Macquarie Asset Management raised $405 million for Vertelo, a fleet electrification firm, to support its efforts in transforming traditional vehicle fleets into electric ones. This investment highlights the growing momentum in the market for electrifying commercial fleets to reduce carbon footprints.

- In August 2024, Lucid secured up to $1.5 billion in funding to support the rollout of its electric SUVs, marking a significant milestone as the company expands its product line and aims to capture a larger share of the growing EV market. The funding will be crucial in enhancing production capabilities and scaling up their operations.

Report Scope

Report Features Description Market Value (2024) USD 229.6 Billion Forecast Revenue (2034) USD 29.2 CAGR (2025-2034) 29.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Compact, Mid-size, Full-size), By Propulsion Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Hybrid Electric Vehicles), By Vehicle Range (Up to 250 km, 250-500 Km, Above 500 Km), By Drive Type (FWD, RWD, AWD) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tesla Inc., BYD Company Ltd., Hyundai Motor Company, Toyota Motor Corporation, Nissan Motor Corporation, Kia Corporation, Ford Motor Company, Volkswagen AG, AB Volvo, Honda Motor Co., Ltd., Chevrolet Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tesla Inc.

- BYD Company Ltd.

- Hyundai Motor Company

- Toyota Motor Corporation

- Nissan Motor Corporation

- Kia Corporation

- Ford Motor Company

- Volkswagen AG

- AB Volvo

- Honda Motor Co., Ltd.

- Chevrolet