Global Electric Box Truck Market Market Size, Share, Growth Analysis By Product Type (Light-Duty (Class 3-5), Medium-Duty (Class 6-7), Heavy-Duty (Class 8)), By Application (Urban Logistics and Express Delivery, Cold Chain Transportation, Municipal and Public Services, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166572

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

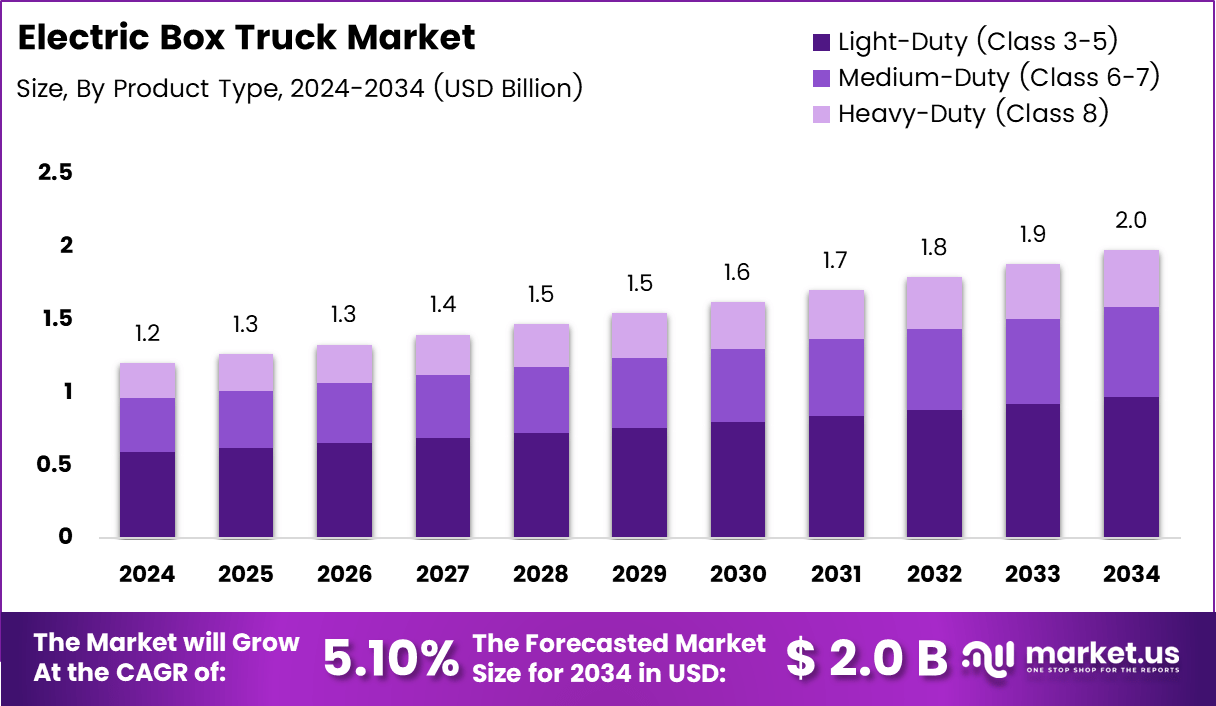

The Global Electric Box Truck Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The Electric Box Truck Market represents a rapidly expanding segment within commercial transportation. It focuses on zero-emission vehicles equipped with box-style cargo bodies suitable for logistics, retail distribution, parcel movement, and urban delivery. These vehicles support sustainability goals and provide operators with lower operating costs, reduced noise, and greater compliance with tightening environmental rules.

Transitioning further, this market gains momentum as logistics companies prioritize efficiency during last-mile delivery. Fleet operators increasingly evaluate electric box truck options to strengthen delivery consistency and reduce fuel exposure. Growing e-commerce activity reinforces the need for dependable electric platforms that handle diverse cargo demands while maintaining predictable energy use across daily routes.

Moreover, government investments accelerate adoption by offering subsidies, tax credits, and charging-infrastructure funding. Policies in major economies encourage businesses to replace older diesel fleets with electric box trucks to meet strict emissions standards. These incentives reduce upfront cost barriers and improve long-term financial visibility for fleet managers evaluating electrified transportation assets.

Additionally, rising regulatory pressure strengthens market direction as cities introduce low-emission zones and impose restrictions on combustion-engine freight vehicles. These regulations push operators toward electric alternatives that deliver compliance and operational efficiency. Businesses adopting electric box trucks gain reputational benefits and demonstrate commitment to sustainability targets established in corporate ESG frameworks.

Expanding opportunities emerge as charging networks scale and battery technologies improve. Logistics operators explore route optimization, energy-management software, and depot-charging systems that enhance fleet productivity. These improvements enable consistent charging cycles, higher uptime, and predictable cost structures that support long-term operational planning within freight ecosystems.

In the broader context, fleet-owner sentiment further reinforces the electric transition. According Survey, 87% of fleet owners stated they expect to add electric vehicles within the next five years. This growing inclination signals strong acceptance of electric box trucks as feasible long-term assets for commercial delivery operations.

Similarly, electrification efforts remain underway across existing fleets. According survey, 64% of fleet professionals already operate electric vehicles, while 36% expect 20–50% of their fleets to become electric by 2025. These measurable shifts indicate rising confidence in electric box truck performance, reliability, and total-cost advantages across logistics-focused businesses.

Key Takeaways

- The Global Electric Box Truck Market is projected to reach USD 2.0 Billion by 2034, rising from USD 1.2 Billion in 2024.

- The market is expanding at a stable growth pace with a projected CAGR of 5.1% from 2025 to 2034.

- The Light-Duty (Class 3–5) segment leads the Product Type category with a dominant 49.3% share.

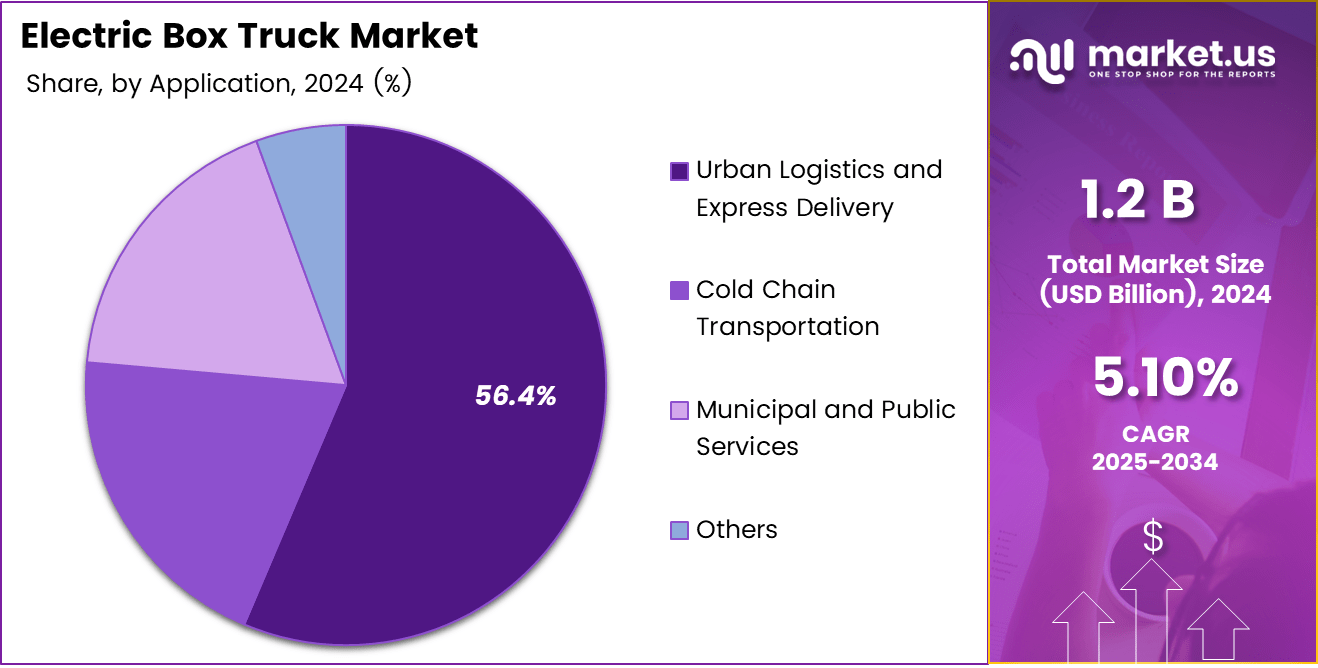

- Urban Logistics and Express Delivery remains the top Application segment with a commanding 56.4% share.

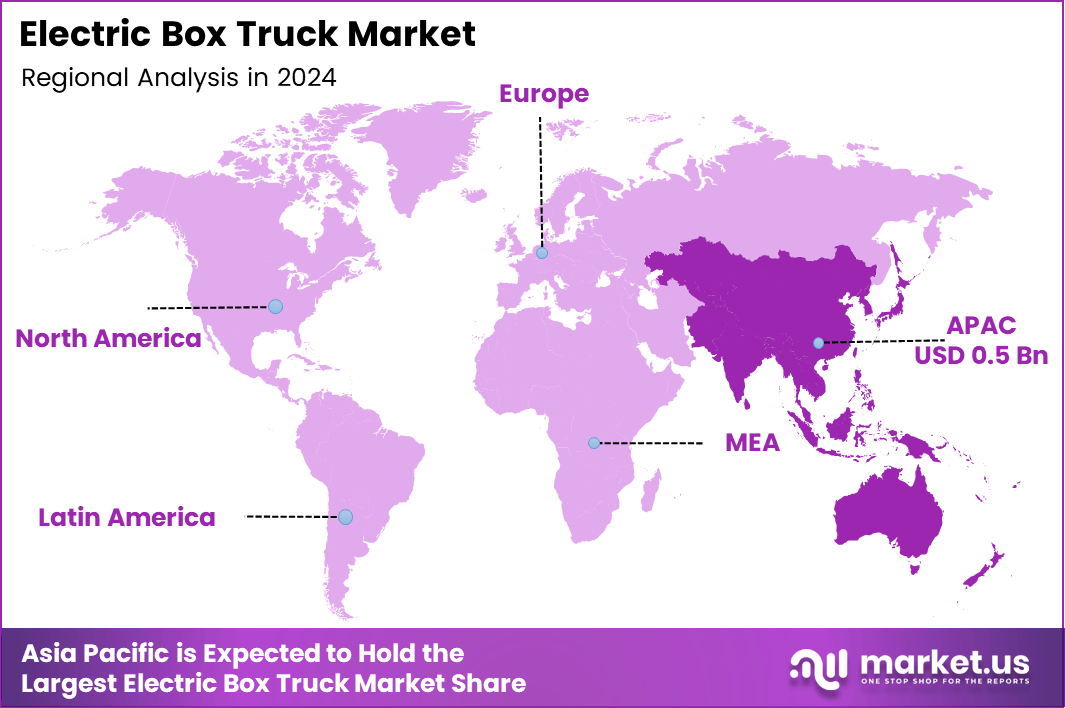

- Asia Pacific stands as the leading region with a 45.2% market share valued at USD 0.5 Billion.

By Product Type Analysis

Light-Duty (Class 3-5) dominates with 49.3% due to high adoption in short-route commercial operations.

In 2024, Light-Duty (Class 3-5) held a dominant market position in the ‘By Product Type’ Analysis segment of the Electric Box Truck Market, with a 49.3% share. This segment gains traction because operators favor compact, energy-efficient electric trucks for frequent urban deliveries. Their lower operating costs and easier charging integration strengthen adoption across last-mile distribution environments.

Medium-Duty (Class 6-7) electric box trucks expand steadily as logistics networks diversify payload needs. These vehicles support larger route density and moderate cargo volumes, making them suitable for regional transport frameworks. Fleet managers select this category to balance increased payload capacity with efficient electric powertrains that reduce fuel dependency across daily operational cycles.

Heavy-Duty (Class 8) trucks advance gradually as manufacturers scale battery capacity and charging infrastructure. These trucks address long-haul applications requiring higher torque and substantial cargo weights. Transitioning into this segment becomes feasible as governments support heavy-duty electrification programs and operators evaluate long-term cost predictability associated with reduced maintenance and emissions compliance requirements.

By Application Analysis

Urban Logistics and Express Delivery dominate with 56.4% driven by rising last-mile delivery needs.

In 2024, ‘Urban Logistics and Express Delivery’ held a dominant market position in the ‘By Application’ Analysis segment of the Electric Box Truck Market, with a 56.4% share. Rapid e-commerce expansion strengthens demand for electric box trucks in dense cities. Businesses prefer zero-emission fleets to meet sustainability goals and navigate regulatory restrictions on combustion vehicles.

Cold Chain Transportation grows steadily as battery systems optimize temperature-controlled delivery. Operators explore electric box trucks for refrigerated goods, pharmaceuticals, and perishable shipments. Advancements in thermal insulation and energy-efficient cooling technologies improve route viability. This segment benefits from increasing safety standards and expanding demand for low-emission cold supply chain networks.

Municipal and Public Services adopt electric box trucks to support waste collection, utility work, and maintenance operations. Government agencies prioritize emissions reduction and shift toward electrified service fleets. The segment gains momentum as municipalities integrate sustainability commitments into procurement plans and upgrade traditional fleets with reliable and quieter electric alternatives across daily operational cycles.

Others include specialty-use cases such as event logistics, rental fleets, and customized commercial applications. Businesses integrate electric box trucks for flexible transportation needs that align with environmental priorities. This group represents emerging opportunities as diverse industries experiment with electrified vehicle formats to enhance operational efficiency and reduce long-term energy expenditures.

Key Market Segments

By Product Type

- Light-Duty (Class 3-5)

- Medium-Duty (Class 6-7)

- Heavy-Duty (Class 8)

By Application

- Urban Logistics and Express Delivery

- Cold Chain Transportation

- Municipal and Public Services

- Others

Drivers

Rising Fleet Electrification Commitments Accelerate Market Expansion

Logistics companies increase their interest in electric box trucks as they set stronger fleet electrification targets. Many operators shift to cleaner vehicles to reduce long-term fuel expenses and comply with urban emission rules. These commitments create steady demand for electric box trucks across short-haul, mid-mile, and last-mile delivery networks.

E-commerce platforms strengthen adoption as their delivery volumes rise each year. These businesses explore electric box trucks to improve operational efficiency and reduce carbon footprints. The growth of online shopping makes fast, affordable, and sustainable transportation a priority, encouraging greater investment in reliable electric truck fleets within dense distribution regions.

Government-backed EV charging corridors expand across key transport routes, making electric trucks easier to deploy. Public investment supports high-power chargers at logistics hubs, highways, and urban centers. Better access to charging reduces range concerns and enables fleet planners to schedule predictable charging cycles that align with existing delivery operations.

Corporate demand for zero-emission last-mile delivery solutions increases as companies respond to environmental expectations from consumers and regulators. Businesses use electric box trucks to meet emissions standards while improving brand responsibility. This shift encourages long-term fleet transition strategies that support cleaner transportation ecosystems and strengthen market confidence in electrified commercial vehicles.

Restraints

Limited Charging Infrastructure Slows Market Advancement

The Electric Box Truck Market faces challenges as the availability of high-capacity commercial fast-charging stations remains limited. Many logistics operators struggle to plan long delivery routes due to inconsistent charging coverage. These gaps slow adoption because fleet managers prefer predictable charging access that supports reliable scheduling and minimizes operational delays.

Urban areas improve charging networks faster than regional or highway corridors, creating an uneven infrastructure landscape. This imbalance restricts fleet expansion and makes long-distance electric trucking difficult. Companies require dependable charging points for continuous operations, but current deployment rates do not fully match the rising demand for commercial EV usage.

Higher upfront procurement costs also restrain market growth. Electric box trucks generally cost more than diesel trucks, making initial investment a key concern for small and mid-sized businesses. Even though electric trucks reduce fuel and maintenance expenses over time, many operators hesitate due to the high entry cost of vehicle acquisition.

Financing programs and government incentives soften these financial barriers, but the gap remains significant. Businesses carefully evaluate total cost of ownership before transitioning fleets. Without stronger subsidies and lower battery costs, many operators delay electrification, slowing the overall market expansion despite growing interest in sustainable commercial transportation.

Growth Factors

Integration of Solar-Assisted Charging Creates New Market Opportunities

Solar-assisted charging systems present a promising opportunity for electric box truck fleets. Fleet depots can integrate rooftop solar arrays to reduce electricity costs and improve energy independence. This setup allows operators to generate clean power on-site, lowering long-term operating expenses while supporting sustainability goals across delivery and logistics operations.

Telematics and energy optimization software also enhance market potential. Fleet managers use digital tools to monitor battery health, track route efficiency, and optimize charging cycles. These technologies help reduce downtime and improve energy planning, making electric box trucks more reliable for daily commercial use. Better insights encourage faster fleet expansion.

Advanced software platforms further support predictive maintenance, which extends vehicle lifespan and reduces unexpected repair costs. Real-time performance data allows businesses to adjust operations quickly. As these digital capabilities grow, fleet operators gain stronger confidence in managing electric assets, strengthening the appeal of transitioning from diesel models to electric fleets.

Fleet replacement programs focused on aging diesel delivery trucks offer additional growth opportunities. Governments and businesses target old, high-emission vehicles for retirement, creating openings for electric alternatives. Incentives, scrappage programs, and sustainability commitments drive faster adoption. These replacement cycles help accelerate the shift toward cleaner transportation and expand electric box truck demand.

Emerging Trends

Surge in Demand for Autonomous-Ready Platforms Shapes Market Trends

The Electric Box Truck Market experiences strong momentum as companies show rising interest in autonomous-ready electric platforms. Businesses explore vehicles built with sensor mounts, ADAS compatibility, and future automation upgrades. These features help fleet operators prepare for next-generation logistics models while improving safety, route planning, and long-term operational efficiency.

Autonomous-ready designs also attract attention because they support smoother integration of upcoming self-driving technologies. Logistics networks increasingly evaluate automation to reduce driver shortages and lower labor-related costs. Electric box trucks designed with automation-friendly architecture become more appealing as companies plan future delivery strategies centered around continuous and reliable vehicle performance.

Battery-swapping solutions emerge as another significant trend, particularly for operations requiring nonstop vehicle availability. Swapping stations reduces downtime by allowing trucks to exchange depleted batteries for fully charged ones within minutes. This approach supports intense logistics cycles where traditional charging schedules may slow delivery workflows or limit operational flexibility.

Growing interest in battery-swapping also reflects the need for predictable energy management across large fleets. Operators prefer fast-turnaround solutions that maintain delivery continuity without adjusting route schedules. As more companies pilot or test swapping models, the trend gains visibility and strengthens the market’s transition toward efficient and uninterrupted electric fleet operations.

Regional Analysis

Asia Pacific Dominates the Electric Box Truck Market with a Market Share of 45.2%, Valued at USD 0.5 Billion

Asia Pacific leads the Electric Box Truck Market due to rapid urbanization, strong e-commerce expansion, and government incentives supporting fleet electrification. The region’s dominance, with a substantial 45.2% share valued at USD 0.5 billion, reflects rising adoption across China, Japan, and South Korea. Growing investments in charging corridors and logistics modernization further reinforce market strength.

North America Electric Box Truck Market Trends

North America shows steady growth supported by clean-transportation policies, state-level electrification mandates, and expanding last-mile delivery needs. The region benefits from advanced charging infrastructure and strong commercial adoption backed by sustainability targets. Increasing integration of electric fleets in logistics and retail distribution accelerates market penetration across major metropolitan hubs.

Europe Electric Box Truck Market Trends

Europe advances quickly as strict carbon-emission standards push operators toward zero-emission delivery trucks. Governments provide subsidies, tax relief, and low-emission-zone regulations that encourage electric fleet expansion. Strong logistics networks and urban freight strategies drive uptake, especially in Western Europe, where cities prioritize clean transportation and support wider fleet replacement programs.

Middle East & Africa Electric Box Truck Market Trends

The Middle East & Africa region experiences early-stage but rising interest, driven by government diversification strategies and sustainability investments. Gulf countries expand EV infrastructure to support logistics modernization. Although adoption remains gradual, commercial operators explore electric box trucks for controlled urban routes and future emission-reduction commitments within growing transport hubs.

Latin America Electric Box Truck Market Trends

Latin America witnesses emerging adoption supported by urban delivery growth and municipal interest in cleaner transportation. Countries focus on reducing diesel dependence and improving air quality in major cities. Infrastructure limitations slow expansion, but growing pilot programs and supportive public policies encourage long-term opportunities in commercial fleet electrification.

United States Electric Box Truck Market Trends

The United States moves rapidly toward fleet electrification as logistics operators respond to sustainability goals and state regulations. Investments in nationwide charging corridors strengthen operational feasibility for electric box trucks. Rising e-commerce demand and supportive federal incentives drive broader use across urban, regional, and last-mile delivery operations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric Box Truck Market Company Insights

The global Electric Box Truck Market in 2024 gains strength as major commercial vehicle manufacturers advance electrification strategies to meet rising logistics demand and regulatory pressure. These companies shape market direction by improving battery systems, production scalability, charging compatibility, and operational reliability across diverse delivery environments.

BYD maintains strong influence through its large-scale EV production capabilities and integrated battery technologies. Its focus on cost-efficient platforms and high-capacity battery systems supports widespread deployment of electric box trucks in both urban and intercity logistics, reinforcing market confidence and accelerating fleet transitions.

Hyundai expands its strategic commitment to electric commercial mobility by developing robust EV architectures designed for mid-range delivery operations. Its emphasis on energy efficiency, performance stability, and safety-enhancing systems helps logistics operators adopt electrified fleets with predictable operating patterns and lower long-term maintenance requirements.

Ford contributes notable momentum as it integrates practical cargo design, enhanced telematics, and fleet-ready charging support into its electric truck offerings. Its approach focuses on improving commercial usability, enabling operators to shift from diesel vehicles to electric box trucks without compromising payload capacity or route flexibility.

Daimler strengthens the market landscape through advancements in heavy-duty and medium-duty electric truck engineering. Its work on battery durability, high-efficiency electric drivetrains, and intelligent energy-management systems provides logistics businesses with dependable platforms capable of addressing demanding delivery cycles and sustainability targets.

Together, these manufacturers support global momentum toward cleaner commercial transportation by enhancing reliability, lowering operational emissions, and offering fleet operators scalable electrification pathways.

Top Key Players in the Market

- BYD

- Hyundai

- Ford

- Daimler

- Volvo Group

- Renault

- Sany

- JMEV

- XCMG

- Dongfeng Motor Group

- SUNLONG BUS

Recent Developments

- In February 2024, Capital One announced its acquisition of Discover Financial Services for USD 35.3 billion, marking one of the largest financial sector consolidations of the decade. This move aimed to expand Capital One’s payment ecosystem and strengthen its competitive position across credit, banking, and digital payment networks.

- In June 2024, SAP acquired the digital adoption platform WalkMe for USD 1.5 billion, reinforcing its commitment to improving enterprise software usability .The acquisition helped SAP enhance workflow guidance, automation, and user productivity across complex enterprise systems.

- In January 2025, Blackstone and Vista Equity Partners completed the take-private acquisition of Smartsheet for $8.4 billion, strengthening their portfolio in digital work-management solutions. This deal supported Smartsheet’s expansion into enterprise-grade productivity tools with greater operational flexibility under private ownership.

- In February 2025, Google acquired cloud security company Wiz for USD 32 billion, marking a significant investment in next-generation cloud and AI security capabilities. The acquisition accelerated Google’s security modernization strategy, enabling stronger protection for cloud-native workloads across global enterprises.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Light-Duty (Class 3-5), Medium-Duty (Class 6-7), Heavy-Duty (Class 8)), By Application (Urban Logistics and Express Delivery, Cold Chain Transportation, Municipal and Public Services, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BYD, Hyundai, Ford, Daimler, Volvo Group, Renault, Sany, JMEV, XCMG, Dongfeng Motor Group, SUNLONG BUS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-